The crypto academy community wants participants to discuss and explain their understanding of Initial Coin Offerings in the Crypto Ecosystem, I will be responding to the assignment given.

Question

Share in detail your understanding of the Initial Coin Offering (ICO) and the purpose of the event in the crypto ecosystem.

Initial Coin Offering (ICO)

Since the conception of cryptocurrency in 2009, many projects have been launched within the crypto ecosystem to solve different underlying problems, and this has contributed greatly to the massive growth of the ecosystem while also stirring up the interests of high capital-based investors. As it's known, crypto-based projects require funding, and in an attempt to raise funds, the project incorporates a native token that derives its value in accordance with the value and funding raised by the project.

For investors to buy into a project, an ICO is offered by the project developers. An ICO also known as an initial coin offering is the first token offering done by the project developers in an attempt to raise money from investors. This is usually done through exchanges (CEX or DEX), launchpads, or in the form of retroactive Airdrops.

During an ICO, a percentage of the overall token supply is mapped out and allocated to interested investors at a given price which is usually discounted (cheap). Most projects tend to use major cryptocurrencies like BTC or ETH as a swap medium such that they offer their token in exchange for ETH or BTC based on the agreed price. Some newer projects have opted to use Stable tokens like USDT or USDC which are pegged equivalent to the US Dollar.

While ICO raises money for a project, it also builds liquidity for the project before it's listed as a tradable asset on exchanges. ICO also gives an early investing opportunity to investors who tend to buy a large volume of an asset for a cheap price before a massive reaction in the price of the asset (either up or down).

Question

Discuss your understanding of the Initial Exchange Offering (IEO) and Initial DEX Offering (IDO). What platform is utilized for IEO? Give an example of a platform and how it works for the coin offering.

Initial Exchange Offering (IEO)

An IEO is a form of token sale that is done on platforms that are backed or affiliated with centralized exchanges, these platforms are usually launchpads owned by the exchanges. The exchange platform is charged with the responsibility of overseeing the token sale activities and the funding processes. Ideally, the primary aim of conducting IEO is to leverage the larger user base of the exchanges that put their money in the trust of these exchanges.

Before an IEO can be conducted, there are a series of evaluations to be done by the exchange platform to determine if the project is worthy to be promoted on their exchange platform. In the first stage, the project developer will pitch the project idea to the exchange, and in this phase, the exchange tends to investigate if the project is real or a pump-and-dump scheme. During the second stage, the exchange investigates the risk tolerance of the token in line with the proposed solutions to problems assumed by the project. This is done by vetting their paperwork, product ideas, and feasible solutions and visions to problems.

In summary, IEO leverage the host exchange's influence to conduct successful initial offerings for new projects. As opposed to the normal methods of ICO, the IEO only require investors to have an account with the host exchange and funds to be able to access the coin offering on their platform. This makes the process smooth for both the investors and the project owners.

Initial DEX Offering (IDO)

The IDO is a decentralized form of coin offering that is hosted on decentralized exchanges using liquidity pools. In this type of coin offering, no central entity is required, the project developers create a liquidity pool that allows investors to interact with the pools, such that they can exchange their major tokens for the project's native token. Just like DEX, the IDO is considered to be permissionless and fair as it gives opportunity or everyone once the pool is created without giving leverage to anyone.

During an IDO liquidity pools are created either in crosses of the native token or in crosses of major coins. For instance, let's say a project has a native token "XYZ", and a liquidity pool of "XYZ/USDT" can be created to enable investors to swap their USDT tokens for the XYZ token. Since IDOs are permissionless, the swap orders are executed using smart contracts on the decentralized exchange hosting the token sale.

In summary, IDOs are hosted on decentralized exchange platforms through liquidity pools that investors can interact with. This makes this type of token sale decentralized as no permission or mediator is required.

Platforms Utilized in IEOs

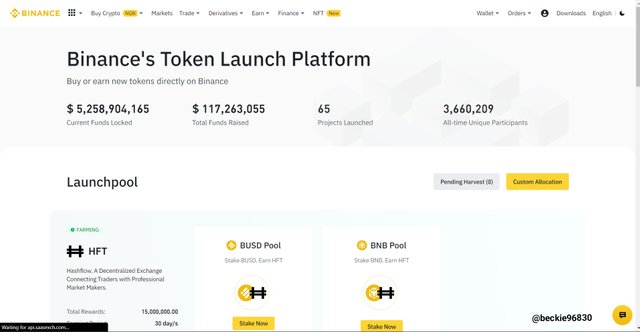

As previously explained, IEO is hosted on platforms affiliated with centralized exchanges. These platforms are usually in form of launchpads owned by these exchanges. An example of this is the Binance launchpad.

Binance Launchpad

Binance Launchpad is a service offered under Binance exchange that helps new projects to facilitate their launch whilst hosting IEO for the token on their exchange.

As previously explained, before an IEO can be conducted, there are a series of evaluations to be done by the exchange platform to determine if the project is worthy to be promoted on their exchange platform. In the first stage, the project developer will pitch the project idea to the exchange, and in this phase, the exchange tends to investigate if the project is real or a pump-and-dump scheme.

Next, in the second stage, the exchange investigates the risk tolerance of the token in line with the proposed solutions to problems assumed by the project. This is done by vetting their paperwork, product ideas, and feasible solutions and visions to problems.

Question

Have you participated in ICO/IEO/IDO before? If yes, what's your experience? Discuss a project that has performed a successful ICO before and the result of the event.

Participating In ICO/IEO/IDO

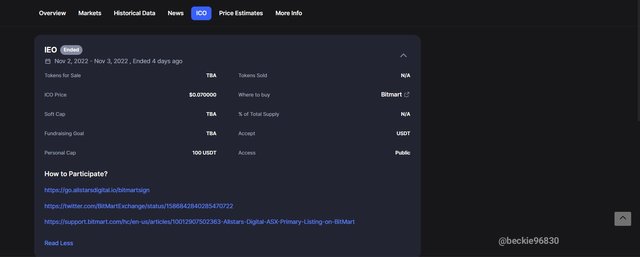

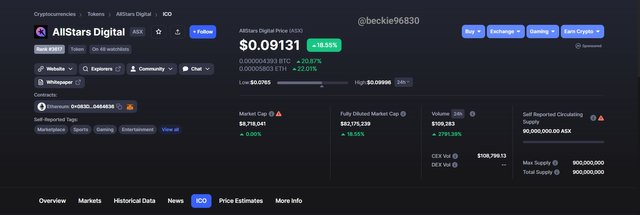

I haven't participated in any coin offering sale before but for the purpose of this assignment, I investigated a recently concluded coin sale via coinmarketcap's website. The project is called Allstars Digital which has a token called ASX. Allstar Digital is a betting solution-driven project that seeks to improve Web3 betting to accommodate real data deployment.

The project listed its IEO via the Bitmart platform, where the exchange platform created liquidity for the token sale. Following their token metrics on coinmarketcap, the sale was hosted for a day, it started on Nov 2nd and ended on Nov 3rd 2022.

As seen above, the personal cap on individual purchases was pegged at 100USDT (This implied that a user can only purchase 100USDT worth of ASX). The price of ASX was offered at $0.070000 and the token accepted was USDT. Since the sale was done through IEO, I believe the Bitmart exchange created a liquidity pool of ASX/USDT, where investors with a USDT token balance can swap their USDT token for the ASX token.

Following the end of the token sale, the price of ASX in the open market as of the time of the research is trading at $0.09131 which has yielded a positive return on investment for investors who bought at the IEO offer price in less than a week.

According to coinmarketcap's data, The ASX token has a 24hr volume of $109k, and a market capitalization of $8.7M. And the trading price is at $0.09131

In summary, coin offerings have proven to be a valid way of earning in cryptocurrency. Projects with good problem solutions are seeking investors. The coin offering provides an avenue for investors to partake early in this project to earn from the pricing of the token in the open market.

Question

What are the merits and demerits of Initial Coin Offering?

Merit of ICO

There are some notable benefits of participating in ICO, some of which include the following:

1) Project Fundraising

Initial coin offering serves as an avenue for project developers to raise funds to support their project, and in exchange for this, they offer shares of the product to investors at a discounted price before the project is launched in the open market. Doing this give investors early access to the project and its benefits like better pricing.

2) Investor's Interest

Hosting an initial coin offering is a way of getting investors' interest in projects being built. This creates a decent amount of hype around the project and by so doing is setting up the project for a good launch, as speculating secondary buyers would be interested in the project token launch as well.

3) Global Access

One of the primary benefits of hosting coin offerings in cryptocurrency is its ability to be accessed from anywhere. Since everything about Cryptocurrency is based online, this eliminates the constraints of geographical location for interested investors while prioritizing anonymity.

4) Possibility of High Return on Investment

Tokens are offered to investors for a cheap price during ICO, this makes it possible for investors to potentially earn in high percentages for the project as early believers and adopted of the project.

Demerits of ICO

There are notable disadvantages to doing ICOs, some of which include the following:

1) Cash Grab Schemes

Many new crypto projects created by scammers are a ploy to lure investors to buy into the project. This traps the investor's money as the project and its proposed solution are all based on a lie. Since the token is advertised at a cheap price many investors will show interest by committing their funds.

2) Devaluation

Since the value and pricing of a project's token in an open market correlate with the value of the project, a failed project will always result in the devaluation of its native token, which yields a negative return on investment for investors who bought into the project.

3) No Regulatory Sanctions

Cryptocurrency's primary aim is to maintain the anonymity of its users. This creates a problem for activities like coin offering sales as there are little to no regulations protecting investors from hard crashes or fraudulent activities.

Conclusion

In summary, an initial coin offering is an essential part of token growth as it provides opportunities for investors to buy into a project and creates an avenue for the project developers to raise funds to support the further development of their project. It best serves in the interest of the investor to carry out a detailed analysis of the project before investing as many cash Grab schemes promise good projects with worthy solutions but turn out to be false and scams.

Your post has been supported by @simonnwigwe from team 2 of the Community Curation Program, at 40%. We invite you to continue sharing quality content on the platform, and continue to enjoy support, and also a likely spot in our weekly top 7.

Voting date: 08/11/2022

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@becky96830 You really explained the above concept in details. I enjoyed studying your work. I hope to read more creative contents in your subsequent cryptoacademy presentations

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I must first commend the effort you put into this work for making it this detailed and comprehensive.

Just like myself, I have not also participated in an ICO but with what I have read so far from your entry, I have no doubt that you understand this topic and would not fall victim of those who come up with fake ICO to scam investors.

Thanks for sharing. #steem-on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's very true about using ICO to build liquidity for the project, a proportion of the funds received in the ICO is added to the liquidity pool to ensure easy exchange of the token when listed.

This is one of the most relevant disadvantages of ICO because some of them have no good intentions rather than to steal investors funds and since there is no regulation, it leads to loss for the investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @beckie96830

Good point, certainly the "main goal of doing IEO is to tap into the larger user base of exchanges that put their money in the trust of these exchanges", in a way it is a token sale overseen by a reputable cryptocurrency exchange. Excellent way you have developed the explanations.

Upvote on the way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I really love the way you present your article, keep it up dear friend. Initial coin offerings have been the primary method of raising funds for cryptocurrency projects and companies. IEO and IDO have equally helped in raising not less than $1 Billion for cryptocurrency projects across the world.

Thanks for sharing friend, and goodluck in this contest. #steem-on.

I will appreciate if you equally engage on Mine

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This point is very true my friend @beckie96830, ICO plays quite an important role when it comes to building or further development of project because during the ICO fund raising is done to fund and develop more on the said project. I wish you success in this contest my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey friend,

Yea you are really smart friend, I love how you really composed and nicely wrote the post. Whenever a token fails or turns out to be a scam the project value and price tends to fall because the become a high sell pressure and the coins lose investors who had large amount of asset in stalk

Thank you very much for sharing, please you can check my own entry here

wishing you success

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit