Question 1

Introduce Leverage Trading in your own words.

Leverage Trading

The term Leverage trader refers to trading the financial markets with money borrowed from exchange firms, brokers, etc, this allows traders to commit multiple times (2X, 5X, 10X, etc) worth of their trading capital in a trade with the sole purpose of making more profit. Ideally, leveraging gives the trader access to more purchasing power, which should be higher than the trader's invested capital.

Though, leveraging works well when the trader maintains a positive portfolio balance (profits), it also has the ability to liquidate the trader's invested capital when the trade forecast goes against the intended direction. This implies that's leveraged trading liquidates trading capital faster than non-leveraged trading.

There's no doubt that leverage trading is of great benefit to traders with both huge capital-based and small capital-based traders, it's important to highlight that leverage trading is very risky, thus making it difficult for less-experienced traders to utilize. Leveraging should only be used by experienced traders who can manage risk properly, thus avoiding the liquidation of invested capital.

Question 2

What are the benefits of Leverage Trading?

Benefits of Leverage Trading

Leveraged trading has notable benefits in trading cryptocurrencies, some of which includes the following:

Increased Leverage

Leverage trading gives traders access to more purchasing power, which is usually greater than their invested capital. The leverages can be 2X, 5X, or even up to 50X of the invested capital. This increases the chances of the trader making more profits with correct price predictions.Portfolio Diversification

Leverage trading gives the traders the ability to diversify their crypto portfolio, such that traders can open multiple trade positions on a different crypto asset with percentages of the leveraged account. This reduces the risk associated with investing in one crypto asset because of a lack of funds, thus protecting the account from nonprofitable trades.Securing Positions

Leverage trading allows traders to reduced risk exposure by securing partial profit when the price prediction is correct, or partial loss when the price prediction is wrong. This ensures that the trading account is operated with minimal risk at any given interval.Short Term Trading

Leveraged trading is ideal for short-term trading, where traders aim to make more profit within a short span of time. This reduces the risk associated with a long-term forecast of a price movement while considering the unpredictable nature of the market.Increased Profit

With leveraged trading, traders aim to make huge profits with small investment capital. Ideally, when a trader analyzes the market correctly, adopting leverage trading can greatly increase the profit percentage of the trade. For instance trading, a leverage of 20X can make 20 times the risk amount in one trade.

Question 3

What are the disadvantages of Leverage Trading?

Disadvantages of Leverage Trading

Leveraged trading has various notable disadvantages in trading, and include the following:

High Risk

Leveraged trading is associated with high risk which can result in the liquidation of the trader's account. Wrongly predicting the movement of the price using a high leveraged account can wipe the entire account. For instance, trading with 100X leverage will instantly liquidate the trading account once the prediction is wrong.Requires Experience

Leveraged trading requires a high level of trading experience in other to fully maximize the potential of leveraging with reduced risk. This ensures that the trader's account is protected from liquidation at all times while risking moderately.Trading Fees

Unlike spot trading, leverage trading attracts fees for holding trade position for days, this is as a result of the borrowed fund and the exchange holding the position into a new trading day. This adds to the loss incurred if the trade goes wrong.

Question 4

What are the Basic Indicators that we can use for Leverage Trading? (Need brief details for any essential Indicators and their purposes)

Basic Leverage Trading Indicators

To effectively trade using leverage, the trader should have a proper understanding of price movement, and also be able to combine multiple indicators to build up solid confirmations on a possible intraday trade setup. For this illustration, I will elaborate on the combination of multiple indicators below:

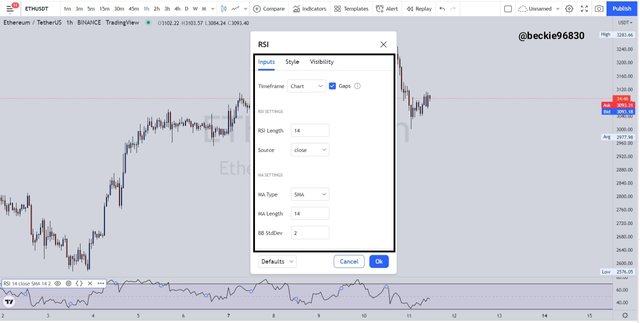

RSI Indicator

The RSI is an indicator that indicates the condition of a given market in terms of overbought, oversold, or balanced market. This is done with the RSI levels of 30 and 70. Ideally, when the price moves below the 30 RSI level, it's considered that the market is in an oversold state and a possible bullish reversal signal. While a move above the 70 RSI level indicates that the market is in an overbought state and a possible bearish reversal signal.

The RSI can be combined with other technical indicators to fully grasp the development of price and possible reversal points.

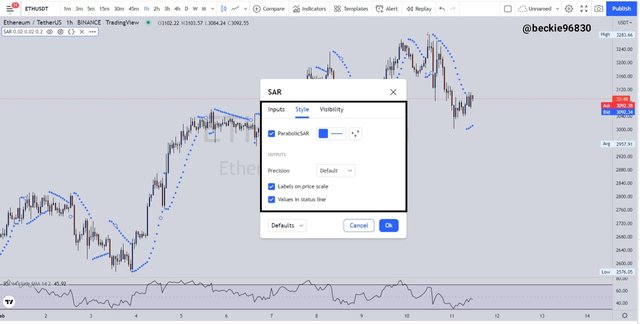

The Parabolic SAR

The parabolic SAR is a near-complete indicator that indicates the directional bias of a market, the entry and exit points, and the possible change in direction of price movement within a given timeframe. The parabolic SAR is represented on a price chart as dotted lines that appears above or below price candles. The Parabolic SAR represent trending market condition as such: when the dotted lines appear above the price movement, it indicates that the sellers are in control of the market, similarly, when the dotted lines appear below price movements, it indicates that buyers are in control of market price movement.

The parabolic SAR also indicates trend reversal through discontinuation of the dotted lines in one direction and continuation in the other direction. For instance, A bullish trend reversal can be represented by the discontinuation of the parabolic SAR dotted lines above price movement and continuation below price movements.

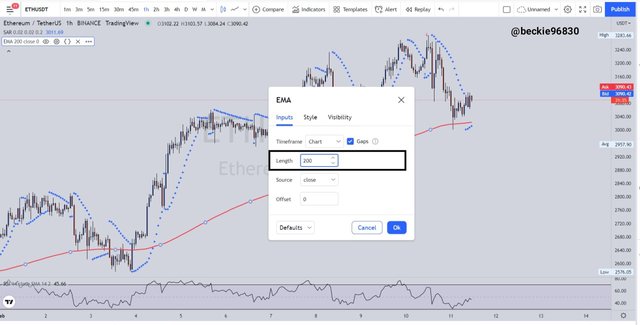

Exponential Moving Average

The exponential moving average is a trend indicator used by investors in technical analysis to determine the movement of price and areas of support and resistance. It is very similar to the Simple moving average, the only difference is in how it is calculated. Exponential moving average follows price movement closely and is calculated from the most recent price movement data, its fast reaction to price movement and indication of a trend change is why most traders prefer it to the simple moving average.

Ideally, when price breaks and stays above the moving average, price is considered to be in an uptrend movement, similarly, when price breaks and stays below the exponential moving average, price is considered to be in a downtrend.

To effectively use EMAs, the period setting should depend on the type of trader and the trading system used. Swing traders will use EMA settings with higher periods like 50, 100, 200 EMAs, while Scalper and Intra-day trades will you EMA setting with smaller periods like 8, 18, 21 EMAs. But for this type of trading, the 200 period is used.

Question 5

How to perform Leverage Trading using special trading strategies (Trading Practice using relevant indicators and strategies, Screenshots required)

Leverage Trading Strategy

To effectively trade using leverage, a combination of indicators is used with the Heikin Ashi Chart. The Heikin-Ashi Technique is a form of price representation chart that uses price data (opening, closing, high, and low) of a previous candle to create future price representations, creating a smoothened price chart.

Buy Position Leverage trading

For buying opportunities, price must be moving in an uptrend, forming consistent higher Highs and Higher Lows. Following the combined indicators, the first to be observed is the EMA. price should be above the EMA, which indicates a long-term uptrend movement of price, next the parabolic SAR Dots should switch from appearing above price to below price, indicating a trend reversal from bearish to bullish.

The last confirmation is the RSI. ideally, the RSI movement should be below the 50 level, which is the midpoint. But if the RSI moves lower to around the 20 level, which signifies an oversold condition, this further confirms that a bullish trend reversal should be anticipated, further strengthening the bullish trend confirmation.

It's important to note that all the following indicator conditions must be satisfied before a buying opportunity can be confirmed.

Consider the chart below:

Observing the chart, the exponential moving average and the parabolic SAR Dots indicated buying signals as the 200 EMA and the parabolic SAR Dots are below the price. Looking at the RSI, a clear indication of bullish price movement is observed as the RSI tick is below the 20 level, further confirming the bullish reversal of price. Stoploss is placed below the recent low while the take profit price is targeting the nearest high points.

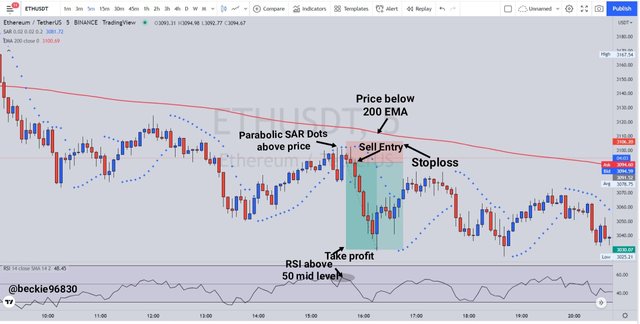

Sell Position Leverage Trading

For selling opportunities, price must be moving in a downtrend, forming consistent lower highs and Lower Lows. Following the combined indicators, the first to be observed is the EMA. price should be below the EMA, which indicates a long-term downtrend movement of price, next the parabolic SAR Dots should switch from appearing below the price to above price, indicating a trend reversal from bullish to bearish.

The last confirmation is the RSI. ideally, the RSI movement should be above the 50 level, which is the midpoint. But if the RSI moves higher to around the 70 level, which signifies an overbought condition, this further confirms that a bearish trend reversal should be anticipated, further strengthening the bearish trend confirmation.

It's important to note that all the following indicator conditions must be satisfied before a selling opportunity can be confirmed.

Consider the chart below:

Observing the chart, the exponential moving average and the parabolic SAR Dots indicated selling signals as the 200 EMA and the parabolic SAR Dots are above price. Looking at the RSI, a clear indication of bearish price movement is observed as the RSI tick is above the 50 level, further confirming a possible bearish reversal of price. Stoploss is placed above the recent high while the take profit price is targeting the nearest low points.

Question 6

Do a better Technical Analysis considering the above-explained trading strategy and make a real buy long or sell short position at a suitable entry point in any desired exchange platform. Then close that buy or sell position after appearing trend reversal signal from the Parabolic SAR indicator. Here you can also close your Buy or Sell position using any other desired Trading Method in addition to the signal coming from the Parabolic SAR indicator. However, here you must prove that trading method as a reason for closing your position. (Usually, You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines, or any other trading pattern. Use at least 2X leverage and no more than 10X )

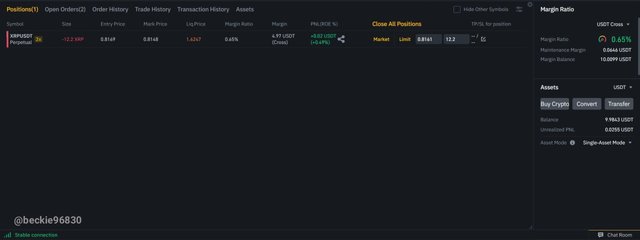

For this demonstration, I used tradingview for chart analysis and Binance exchange for real transaction execution.

Sell Trade XRPUSDT (5 MINS)

Observing the XRPUSDT chart, I noticed that price was trading below the 200 EMA, which indicated that the current trend is bearish. Following the principle of combining multiple indicators, the RSI was above the 50 Mid-level which further confirmed the bearish sentiment I had for the trade. Lastly, I waited for the parabolic SAR Dots to appear above price movement, which further confirmed the bearish trend. I executed a sell trade order using the leverage of 2X on my Binance exchange account.

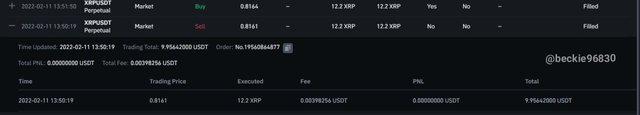

The trade was executed at $0.8169 with stoploss placed at $0.8212 and take profit at $0.8101. The risk to reward on the trade is targeted at 1:1.5.

I exited the sell trade after I noticed that price failed to move bearishly strong. As observed on the price chart, multiple indecisive candles were printed which indicated that the market sentiment is indecisive, and the current bearish momentum is not strong enough to push the price lower.

The exchanged exit order

Conclusion

Leverage trader refers to trading the financial markets with money borrowed from exchange firms, brokers, etc, this allows traders to commit multiple times (2X, 5X, 10X, etc) worth of their trading capital in a trade with the sole purpose of making more profit. Leverage trading gives the traders the ability to diversify their crypto portfolio, such that traders can open multiple trade positions on a different crypto asset with percentages of the leveraged account, Leverage trading requires a high level of trading experience in other to fully maximize the potential of leveraging with reduced risk.

Thank you professor @reddileep for this educative and insightful lesson.