Hello everyone, I welcome you all to another great week in the Steemit Crypto Academy. I thank the Professors for making their lessons informative and educative enough for some of us who have no knowledge of cryptocurrency.

Today's lesson was delivered by crypto professor @gbenga on Decentralized Finance (DeFi) and Yield Farming. This post is all about my homework task on the topic.

Decentralized Finance

DeFi is a fast-growing ecosystem in the cryptocurrency industry that at providing financial services like the traditional method of finance but in a decentralised manner. The blockchain-based ecosystem has made it possible for users to gain financial services without relying on traditional banks and financial institutions that deal with third parties and central bodies making it difficult to access financial services.

With DeFi, anyone from any class can access financial services of lending, borrowing and insurances while having full control of their assets. DeFi uses the distributed ledger technology to keep transactions in an indiscriminate and transparent format making it impossible for crimes and financial fraud that exist frequently in traditional finance.

Most DeFi protocols are built on smart contracts which automate financial transactions in a faster and efficient manner. Similarly, the cost of transactions is reduced and financial services are made accessible to everyone. The importance of DeFi in today's finance cannot be overestimated.

Features of Decentralized Finance (DeFi)

Permissionless: DeFi allows transactions to be carried out by anyone without the approval and control of central bodies, unlike traditional financial systems where transactions need to be accessed and approved before they can be executed. The permissionless feature of DeFi makes it possible for anyone to access financial services anytime without considering the size of your funds. Lending, borrowing and staking programs are accessed easily by users, unlike the traditional method where a user needs to have a relationship and a certain amount of funds with the bank before he/she can access these services.

Decentralization: No central body or authority is needed to carry out transactions as transactions are stored in different nodes in the network. This makes transactions transparent and open to everyone. With DeFi, fraud and financial crimes will be reduced as records of transactions cannot be tempered by anyone because every made public in the blockchain smart Contracts: Most DeFi protocols makes use of smart contracts to automate transactions making it faster, safer and more efficient than the traditional finances where financial services and transactions a lot of time before it can be processed.

Stable Coin

Stable coins are digital assets pegged with other assets with a stable value. Most stable coins are pegged 1:1 with the US dollar. Stable coins are coins with very low or zero volatility. The low volatility in stable coins is achieved by pegging them to a conventional asset like gold or fiat currencies. These coins serve as a haven for investors to protect their funds against the high volatility of the cryptocurrency industry and market crashes. Stable coins came into adoption in 2018 after the market bleed which made investors lose almost 75% of their assets. For example, Bitcoin reached its all-time high of $19000 in 2017, after that, there was a bear market that took BTC down to as low as $4000. This scenario made investors lose their funds and seek stable currencies to protect them against situations like this.

Benefits of Stable Coins

Little or No Volatility: Cryptocurrency is a very high digital asset that can make a price change of 20% in hours. This example is seen in BTC in 2017 when it hit an all-time high of $19000, after that, there was a corresponding pullback of almost 70% within a couple of weeks. The volatile nature of cryptocurrency made stable coins a haven for investors due to their price stability. With stable coins, investors can easily convert and save their funds to protect them against these market crashes.

Global Payment and Remittances: Stable coins have been widely accepted by most financial institutions like JP Morgan as an efficient means of settling international payments. Most stable coins are built on smart contracts in a Decentralized Finance ecosystem, this makes transactions carried out faster, safer, more efficient and less costly than the traditional means of payment which restricts some region from carrying out International transfers. A good example is my country Nigeria where Paypal is restricted making it difficult for users to carry out international transactions.

Tokenization: Stable coins are pegged to conventional assets like gold and fiat currencies which are stored in the reserves (Banks and financial institutions). This makes digital assets redeemable to conventional assets and gives investors confidence that their digital assets can be redeemed for either gold or US dollar. With tokenization, the liquidity of stable coins is increased and transactions are carried out faster at a reduced cost.

There are so many stablecoins in the Cryptocurrency industry. Examples are:

- USD Tether (USDT)

- USD Coin (USDC)

- DAI (DAI)

- Binance USD (BUSD)

- Paxos Standard (PAX)

- True USD (TUSD)

- Gemini Dollar (GUSD)

Etc.

Gemini Dollar (GUSD)

Gemini dollar is a digital stable coin created by Gemini exchange which was founded in 2014 by two brothers Cameron and Tyler Winklevoss. GUSD is an ERC-20 token built on Ethereum blockchain with its smart contract being regularly audited by Trail of Bits Inc. Gemini received approval from the New York Department of Financial Services(NYDFS) to launch Gemini Dollar. A stable coin pegged 1:1 to the US dollar invented to link the traditional finance industry and the cryptocurrency industry.

GUSD is monitored and regulated by the New York Department of Financial Services(NYDFS) to ensure that its reserve policy is kept as stated. Gemini Trust Company LLC issues GUSD to users and keeps a corresponding deposit of US dollar of any GUSD issued out in the reserve. This deposit is held in the bank and the currency is incurred through the Federal Deposit Insurance Corporation(FDIC) insurance program. GUSD isn't mineable or was sold during the presale, the token is issued out anytime there is demand for it. The total number of GUSD circulating in the market is being deposited in the bank in US dollar value.

Features of Gemini Dollar

Stable and fully backed: GUSD is fully backed 1:1 to USD and the coin is redeemable to a stable value of $1.

Regulated and Insured: GUSD reserves are deposited in the bank with a USD value of every GUSD issued out. This deposit is being regulated and insured by Federal Deposit Insurance Corporation(FDIC) for the insurance program. This gives users confidence that they can redeem the token for the US dollar.

Transparently Audited: USD reserves of GUSD issued out is being audited monthly by top registered financial institutions, BPM LLP, and its Ethereum smart contract is being audited by Trail of Bits which is a top information security research and development firm.

Zero Fees: There is no transaction cost when creating or redeeming GUSD through Gemini.

Programmable Money: GUSD is an ERC-20 token built on Ethereum blockchain, this makes it fully programmable and useful in smart contract development.

Use Cases of Gemini Dollar(GUSD)

Facilitate transactions: GUSD is used to carry out transactions across exchanges. Similarly, the token can be used for international transactions for US dollars. GUSD still maintains its stable value of $1 across exchanges.

Provides liquidity: GUSD provides liquidity for Decentralized exchanges(DEX) and Decentralised Finance (DeFi) for automated market makers and other liquidity pools.

Financial Services: GUSD can be lent out or staked to earn passive income. DeFi protocols like Compound, Fulcrum, bZx, AAVE, block to are decentralised platforms where GUSD can be lent out for profits.

For payment purposes: GUSD can be sent across borders within a short time and can also be used to purchase items at the store using Gemini Pay.

Serves as a Haven: GUSD serves as a haven to traders to protect them against market crashes and high liquidity of the cryptocurrency market. Traders move their funds to GUSD which still maintains its stable of $1 even during market crashes.

Technical Overview of GUSD

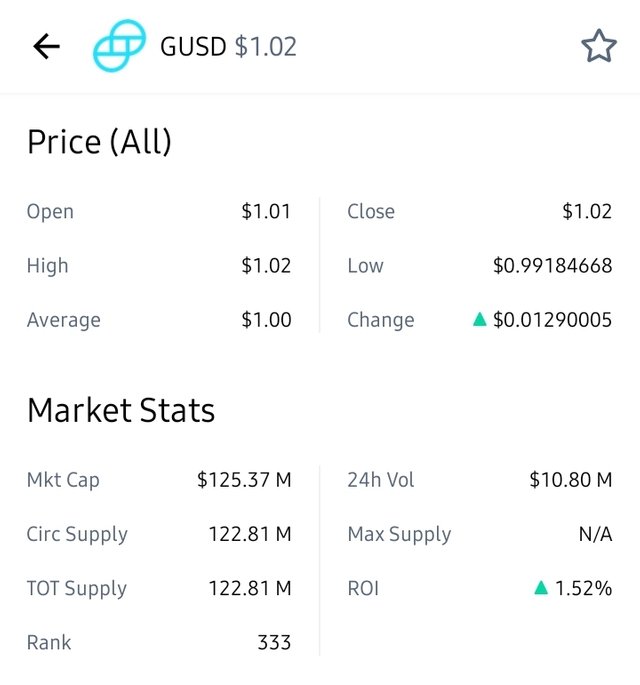

GUSD is ranked 333 with a market capital of $125.37 million and a circulating supply of 122.81 million. This means that an equivalent of $122.81 million is in deposit in the bank to be redeemed for US dollar. GUSD have reached an all-time high of $1.02 and an all-time low of $0.99 since its invention. The stability of the coin can be seen in the price change which is $0.0129 making GUSD a very low volatile coin. This can also be seen in the chart below.

Contract information of GUSD can be found on Etherscan

Exchanges where GUSD can be bought

GUSD has a 24hr trading volume of $10.8 million across exchanges. This high trading volume makes GUSD a liquid coin that can be traded easily in exchanges. The picture below shows the list of exchanges where GUSD can be traded, sold and purchased. FatBtc has the highest trading volume GUSD with a trading volume of $3.55 million. Further information GUSD market can be found on CoinmarketCap

Gemini Dollar Wallet

GUSD is an ERC-20 token. This means that it can be stored in any wallet that supports Ethereum tokens. Example of wallets that support GUSD is Myether wallet, Trust wallet, Metamask wallet, Atomic wallet, Exodus wallet etc.

Conclusion

The impact of Decentralized Finance on today's financial system cannot be overemphasized. Seamless and transparent financial services are the pitfalls of traditional finance which have been solved through DeFi. Stable coins are a great ecosystem in the DeFi community which aim at protecting users against the high volatility of the crypto market. Similarly, stable coins are pegged to conventional assets thereby bridging the division between Blockchain and traditional finance. GUSD is a stable coin pegged 1:1 to the US dollar. GUSD is being regulated by the New York Department of Financial Services (NYDFS) and Federal Deposit Insurance Corporation(FDIC) which makes investors feel confident with the cryptocurrency. There are still other top competitors GUSD like USDT, USDC, BUSD, PAX, DAI etc. The currency has a bright future and might be adopted by major markets in the future.

Thank you all for reading. My sincere thanks to professor @gbenga for making this lesson easily understandable.

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Remark

When I saw your post, I didn't anything less, I know you to be a good writer, hope to see you more in the academy.

Rating 8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://twitter.com/BeckyOgoke/status/1376139819307433985?s=19

❤️❤️❤️❤️

Becky.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations!!!! You have been upvoted by @ngoenyi and I’m voting with the Steemalive Community Curator @steemalive account to support our community members. Keep on making great content and always stay active in the community to recieve further support

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit