Question 1

Define in your own words what a contractile diagonal is and why it is important to study it. Explain what happens in the market for this chart pattern to occur. (screenshot required / Bitcoin not allowed)

The Contractile Diagonal

The contractile diagonal is a trend reversal phenomenon that occurs in a traded markets (crypto, indices, futures, etc.), In which the movement of price tends to reduce and converge at a near point before reversing in the opposite direction. The contractile diagonal setup must satisfy certain conditions before it can be considered a good trade setup.

The convergence of price indicates a reduction in the control of price by one side of the market participants (buyers or sellers), such that the buying or selling pressure keeps reducing before a complete shift of sentiment will occur. This compression of price indicates possible early trend reversals.

The contractile diagonal comprises two lines drawn diagonally, such that one of the lines is converging. Ideally, the contractile diagonal is similar to Elliott wave, where price formation is represented with wave 1,2,3,4,5. The wave points 1,3,5 are characterized with impulsive moves(trend moves) that correspond with the current trend, while the wave points 2,4 are characterized with corrective moves (pullbacks) that move in the opposite direction.

In a bullish trend, the contractile diagonal waves form, such that point 1,3,5 are impulsive moves (bullish), with point 1 extending more than point 3, also point 3 extending more than point 5. Similarly, points 2,4 are corrective moves (bearish), with point 2 extending more than point 4. This creates a compressing price formation with each bullish wave getting smaller before a bearish breakout below the lower diagonal line.

In a bearish trend, the contractile diagonal waves form, such that points 1,3,5 are impulsive moves (bearish), with point 1 extending more than point 3, also point 3 extending more than point 5. Similarly, points 2,4 are corrective moves (bullish), with point 2 extending more than wave 3. This creates a compressing price formation with each bearish wave getting smaller, before a bullish breakout above the upper diagonal line.

Question 2

Give an example of a Contractile Diagonal that meets the criteria of operability and an example of a Contractile Diagonal that does NOT meet the criteria. (screenshot required / Bitcoin not allowed)

Operability of Contractile Diagonal

The Operability of a contractile diagonal refers to the pre-identified criteria that the price formation of contractile diagonal must satisfy before it can be considered a valid contractile diagonal.

Please Note: a contractile diagonal may not necessarily satisfy the required criteria but the trend reversal will occur

The required criteria for a valid contractile diagonal are as follows:

1)- Point 1,3,5 must be an impulsive wave, while points 2,4 must be corrective waves

2)- Point 1 must extend more than point 3

3)- point 3 must extend more than point 5

4)- point 2 must extend more than point 4

5)- The diagonal line of points 1,3,5 must be converging with the diagonal line of points 2,4.

6)- The trace of point 1 to point 3 must join, while the trace of point 2 to point 4 must join

Operable Contractile Diagonal

The Operable contractile diagonal are formations that satisfy all the above-listed criteria. To illustrate this, observe the chart below:

From the above chart, the contractile diagonal satisfied all the required criteria. Point 1, is extended more than point 3, while point 3 is extended more than point 5. Similarly, point 2 is extended more than point 4.

The diagonal line trace between point 1 and point 3 is perfectly joined, while the line trace between point 2, and point 4 is nicely joined as well. Lastly, the point 1,3,5 and point 2,4 are converging upwards, this shows the compressing formation of price indicate the reducing strength of buyers in the market.

Non-Operable Contractile Diagonal

The Non-Operable contractile diagonal are formations that do not necessarily satisfy all the above-listed criteria. To illustrate this, observe the chart below:

From the above chart, it is clear that point 1 is shorter than point 3, which invalidates the fulfillment of the criteria required of a contractile diagonal.

As observed, the trend reversal after the formation of the contractile diagonal played out as expected, but the criteria were not fully met. This factors in the unpredictable nature of price, and the inefficient seen in price movement.

Question 3

Through your Verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Your purchase data must match your analysis data: such as cryptocurrency and entry price.

Contractile Diagonal Buy Setup

For this demonstration, I choose to use tradingview platform for analysis and binance for exchange trade execution.

Tradingview Analysis

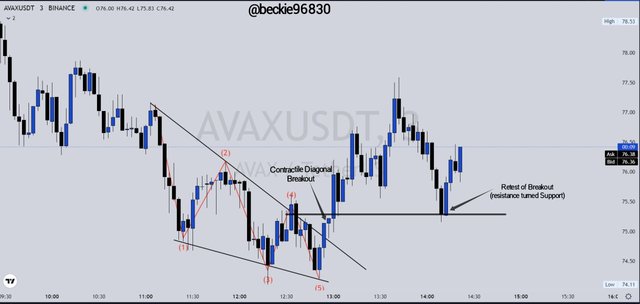

First, visit Tradingview's official website and access the chart section. I noticed a buy trade setup on AVAXUSDT, on the 3 minutes chart.

AVAXUSDT - 3 minutes

On the chart above, I noticed the formation of the contractile diagonal, which satisfied the requirements for a valid contractile diagonal, where point 1 was extended more than point 3, and point 3 was extended more than point 5, and also point 2 is extended more than point 4. The diagonal traces joined perfectly. A breakout from the bearish move created a new trend (bullish).

The setup was base on the break and retest strategy. Which required a retest of the breakout zone, it also corresponds to the area of previous resistance, now turned support. The break and retest strategy is used by conservative traders to confirm the continuation of the newly established trend.

Binance Trade Execution

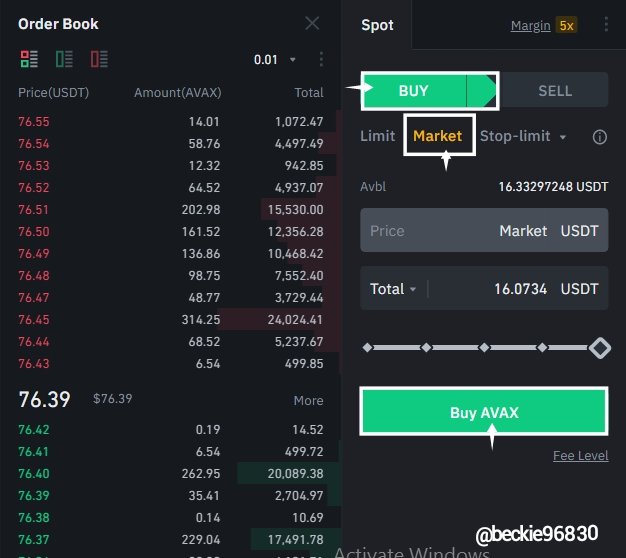

First, visit Binance official website and log in. Click on trade to access the listed assets.

Next, search for AVAXUSDT and choose the pair.

Next, choose the appropriate transaction details, transaction type -buy, choose trade execution type market, Enter the amount of AVAX to be purchased in USDT from the available balance, the click on Buy AVAX.

The buy trade was executed at $76.39 per AVAX. A fee of 0.00021000 AVAX was charged.

Question 4

Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

Contractile Diagonal Sell Setup

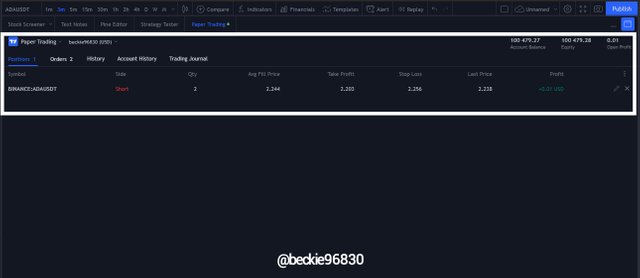

For this demonstration, I choose to use tradingview platform for analysis and trade execution. First, visit Tradingview's official website and access the chart section.

ADAUSDT - 3 Minutes

On the chart above, I noticed the formation of bullish contractile diagonal setup, with point 1 extending more than point 3, and point 3 extending more than point 5, where points 1,3,5 are impulsive bullish moves. Similarly, point 2 extended more than point 4, where points 2,4 are corrective bearish moves.

With the compression of price upwards, the bullish move got exhausted and the bearish breakout occurred. I executed the sell trade order after the close of the bearish breakout candle.

The sell order was executed at $2.244, with Stoploss placed at $2.256 and the take-profit placed at $2.203. Stoploss and take profit was set a 1: 3 risk to reward ratio, risking 1% to gain about 3%.

After about 30 minutes, the trade setup played out as expected with the sellers taking over control after the buying pressure was exhausted.

Question 5

Explain and develop why not all contractile diagonals are operative from a practical point of view. (screenshot required / Bitcoin not allowed)

Contractile Diagonal Operability

As previously explained, the operability of a contractile diagonal is based on if it satisfied the required criteria, but in certain instances, the criteria are met, but other factors contribute to making the setup inoperable. To illustrate this, observe the following scenarios below:

Scenario 1- BNBUSD

From the chart image, the formation of the contractile diagonal criteria was satisfied, as points, 1,3,5 are impulsive bearish moves, while points 2,4 are corrective bullish moves. The diagonal traces of points 1,3 and point 2,4 are joined, and one endpoint of the diagonal lines is converging.

Although the required criteria were met, the setup is considered inoperable, because the breakout did not occur after the formation of point 5. The breakout was rejected with the formation of a bearish candle instead of a bullish breakout, this prevented having a trade confirmation because the contractile diagonal 2,4 line was not broken above.

Scenario 2- DOGEUSDT

Another strong reason that invalidates a contractile diagonal set is if the required criteria are not properly satisfied. The above chart shows a contractile diagonal that played out as expected, but failed to satisfy the point 1 extending more than point 3 criteria, and the point 1 diagonal trace must join point 3 trace.

With the requirements partially satisfied, the above contractile diagonal is considered inoperable.

Conclusion

The contractile diagonal is a trend reversal pattern that uses wave points (1,2,3,4,5) similar to the Elliott wave pattern, with each wave point reduction (price compression) indicating the exhaustion of buying or selling pressure in a traded market. The contractile diagonal is very useful because of its ability to indicate early trend reversal in form of breakouts around areas of resistance or support depending on the trend.

Using the contractile diagonal requires some level of trading experience to identify the pattern and capitalize on the opportunity and avoiding late trade executions.

Thank you professor@allbert for this insightful and educative lesson.