Question 1

What is Zethyr Finance?

Zethyr Finance

Zethyr Finance is a decentralized finance protocol built on the Tron blockchain. The Zethyr ecosystem is comprised of other DeFi Tron-based projects like Zethyr exchange, Zethyr Finance, and Zethyr governance. Zethyr Finance is a decentralized protocol that allows nodes to lend and borrow Tron blockchain tokens like TRX, USDT, WIN, and BTT.

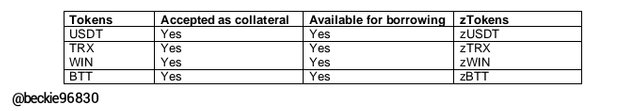

The lending process is referred to as Supply, where nodes deposit TRC-20 tokens to the supply pool, which involves freezing the deposited token for a stipulated period to earn interest in form of annual percentage yield (APY). The lender nodes earn rewards in form of Minted zTokens (zUSDT, zTRX, zWIN, zBTT), as a reward for providing assets for borrowers. The zTokens are pegged in an equivalent ratio of 1:1 to the deposited token, such that the value of the deposited token is reversed.

Zethyr Finance provides nodes within the Tron ecosystem with borrowing opportunities, where nodes can borrow TRC-20 tokens and pay interest. The incurred interest is calculated in the ratio of the token borrowed on a daily basis, which is the interest distributed to the lenders that provide the supply pool liquidity.

The Zethyr decentralized exchange allows nodes to exchange TRC-20 tokens with the Tron ecosystem, which makes it easy for nodes to provide supply and cash in on the interest earned. The Zethyr DEX utilizes an aggregating Protocol to offer the best prices for exchange activities, by comparing the price of the TRC-20 token with the list price on various exchanges.

Zethyr ecosystem has a native token called ZTR, which is used for its governance within the DApp.

Question 2

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr Finance Features

To ascertain the features of Zethyr Finance, visit its official website. On the main page, the Zethyr Finance platform has six (6) key features which include Markets, V1, ZToken, Swap, Stable, and Blog.

I will explain the functions of each zethyr finance feature below:

1- Markets Feature

The market feature of zethyr finance shows the total amount of TRC-20 tokens supplied and borrowed, with the corresponding annual returns (APY). This metric helps investors to understand the nature of the Zethyr supply pool, as the assets with the highest supply are shown (in this instance is TRX, which has about 86.50% of the supply pool). The estimated APY reward for supplying TRC-20 tokens to the supply pool is shown as well, where TRX has a supply APY of $4.55%, and USDT has a supply APY of 26.15%, this implies that supply USDT token yields more interest compared to TRX.

2- V1 Feature

The V1 is the previous Mainnet version of the Zethyr Finance software, which is linked compatibly to version 2 of the DApp. Some of the features of version 1 (V1) include markets, calculator, DEX, swap, stable, and blog. Though it is best advised to utilize the services of the newer version, which is version 2.

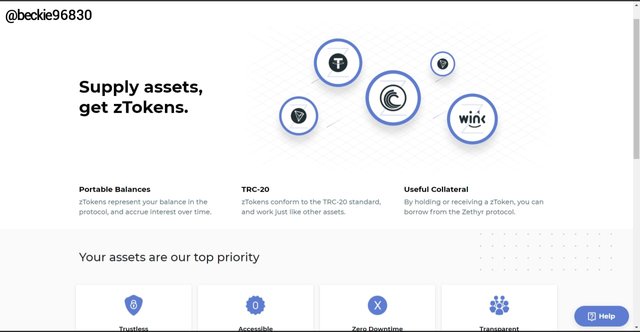

3- ZToken Feature

The zToken is a token created within the Zethyr finance ecosystem which is pegged at a 1:1 value ratio to the deposited token. Ideally, lenders that supply tokens to the supply pool deposit TRC-20 tokens, then the zethyr finance platform mints the equivalent of the deposited token and credits it to the lender's portfolio. This helps maintain portable balance and management of the collaterals.

Lenders earn interests in ZToken, which must be the same as the token deposited. i.e if a lender supplied UDST tokens to the supply pool, the lender must earn the direct equivalent of the zToken in USDT which is zUSDT.

4- Swap Feature

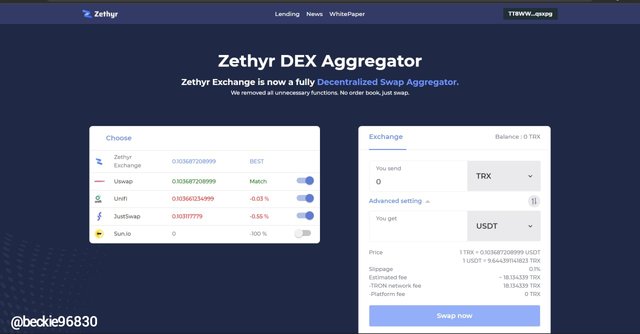

The swap feature of zethyr finance allows nodes to exchange their TRC-20 tokens with other TRC-20 tokens like USDT, BTC, ETH, SUN, etc. The Zethyr finance DEX uses an aggregated compilation of pricing, where the price of the asset is compared to the exchange activities of other Tron-based DEX like JustSwap and Uswap to ensure a better exchange price.

From the illustration above, the price offered by Uswap matched best with the exchange pricing of the Zethyr finance, when exchanging TRX to USDT. This aggregator function is very helpful as it helps increase potential gains from swapping activities.

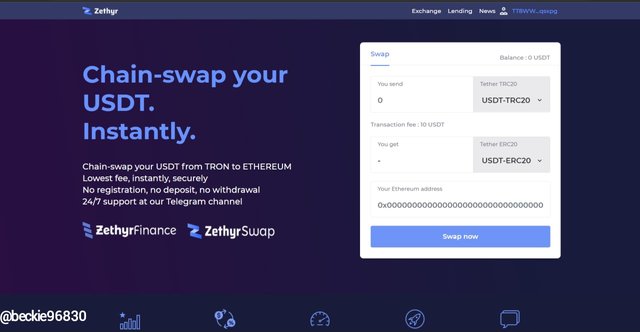

5- Stable Feature

The stable feature of the Zethyr finance platform is one of its most useful functions. The stable swap allows nodes to swap their ERC-20 based USDT to TRC-20 USDT, and vise versa.

Ideally, this swap function involves cross-chain transactions which can help nodes to reduce transaction costs (gas fees) associated with the Ethereum blockchain. The Zethyr stable swap is instant and requires no additional deposit as a direct swap can be done using the Ethereum address.

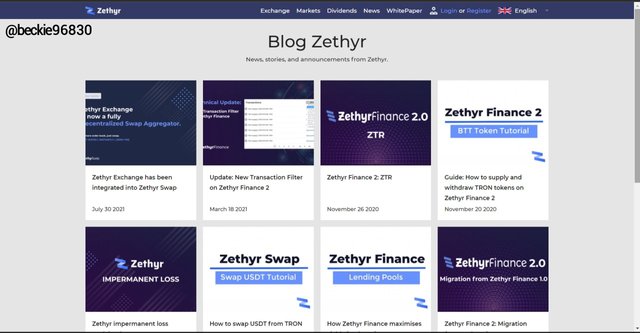

6- Blog Feature

The blog feature of the Zethyr is where important updates and information about the finance DApp is released. This helps the DApp users stay connected and in tune with the current changes or new implementations of the platform.

DEX Aggregator

DEX aggregators are Blockchain-based services that use algorithms to source the price and liquidity of an asset from different exchanges to offer the user better pricing at any given interval. This helps traders to ascertain the best possible price at a given time to swap tokens of choice from a wide range of exchanges available to the DEX aggregator.

From the above illustration of Zethyr, the aggregator search through 3 exchanges to order better token swap prices. The exchanges used above are JustSwap, Uswap, and Zethyr exchange.

Question 3

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

Zethyr Market

The zethyr finance market offers an investor the opportunity to lend or borrow, when the lender deposits their TRC-20 token to the supply pool, aiming to earn interest from borrowers. The borrowers can borrow TRC-20 tokens and pay interests on a daily basis till the borrowed fund is repaid.

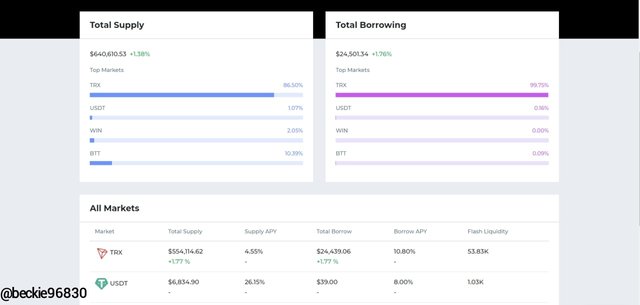

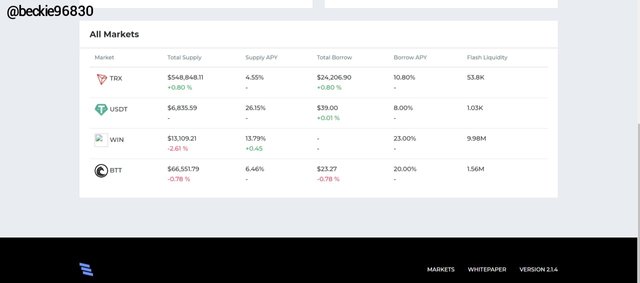

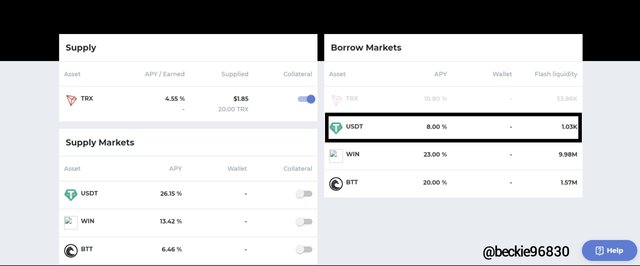

The different TRC-20 token listed on Zethyr Finance platform has different interest rates for borrowing and supplying. Consider the image below:

From the above image, the various markets from supply and borrowing TRC-20 token offer different interest rates. The rates are as follows:

TRX Market- the TRX market has a total supply of $548,848.11, a supply APY of 4.55%, a total of $24,206 has been borrowed, with a borrow interest rate of 10.08% and flash liquidity of 53.8k.

USDT Market- the USDT market has a total supply of $6,835.59, a supply APY of 26.15%, a total of $39.00 has been borrowed, with a borrow interest rate of 8.00% and flash liquidity of 1.03k.

WIN Market- the WIN market has a total supply of $13,109.21, a supply APY of 13.79%, a total of $24,206 has been borrowed, with a borrow interest rate of 23.00% and flash liquidity of 9.98M.

BTT Market- the BTT market has a total supply of $65,962.99, a supply APY of 6.46%, a total of $23.06 has been borrowed, with a borrow interest rate of 20.00% and flash liquidity of 1.56M.

From the above market data, the most profitable market is the USDT market because it has a high supply APY of 26.15%.

Question 4

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

Linking TronLink to Zethyr

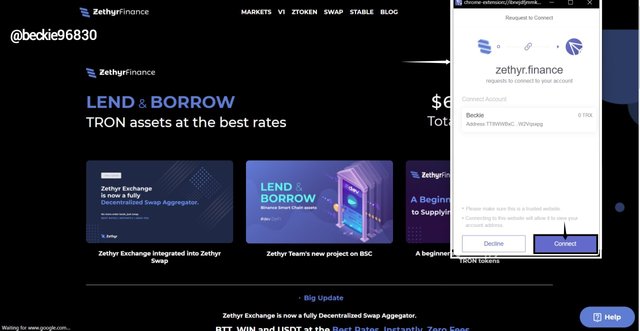

To link TronLink wallet to Zethyr finance, first visit Zethyr Finance official website and click on My Portfolio

Next, TronLink will require the connection to be authorized. A TronLink dialogue box will pop up, click on Connect to authorize the connection.

The TronLink wallet will be linked to the Zethyr finance platform.

Question 5

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

zTokens

As previously explained, zToken is a token created within the Zethyr finance ecosystem which is pegged at a 1:1 value ratio to the deposited token. Ideally, lenders that supply tokens to the supply pool deposit TRC-20 tokens (TRX, WIN, USDT, etc), then the zethyr finance platform mints the equivalent of the deposited token in ZToken, and credit it to the lender's portfolio. This helps maintain portable balance and management of the collaterals.

Lenders earn interests in zToken, which must be the same as the token deposited. i.e if a lender supplied UDST tokens to the supply pool, the lender must earn the direct equivalent of the zToken in USDT which is zUSDT.

Similarly, borrowers deposit their collateral as TRC-20 tokens and get the zToken equivalent of the borrowed token applied for. the borrower pays interest on a daily basis to avoid the accumulation of interest via compounding.

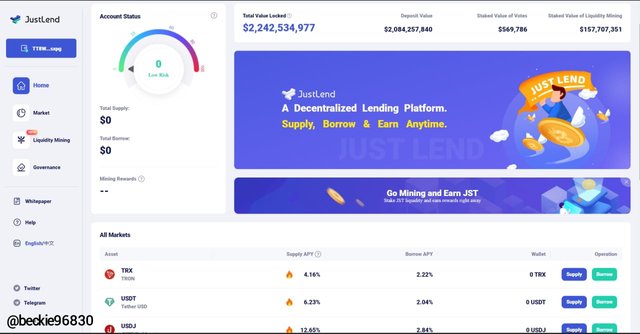

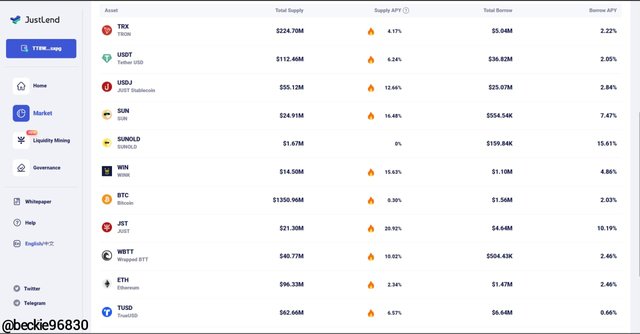

JustLend Finance

JustLend Finance is a decentralized finance protocol built on the Tron blockchain that allows nodes to supply and borrow TRC-20 tokens like TRX, USDT, WIN, BTT, etc, similar to zethyr finance.

JustLend offers up to 12.00% APY as an interest rate for lending. The JustLend protocol accepts deposits of TRC-20 tokens and assigns an equivalent of the deposited token in jToken to the depositor. The jTokens are created within the JustLend finance ecosystem, pegged at a 1:1 value ratio to the deposited token. Ideally, lenders supply tokens to the supply pool through depositing TRC-20 tokens, then the JustLend platform mints the equivalent of the deposited token in jToken and credits it to the lender.

Lenders earn interests in jToken, which must be the same as the token deposited. i.e if a lender supplied TRX tokens to the supply pool, the lender must earn the direct equivalent of the jToken in TRX which is jTRX.

Similar to Zethyr finance, JustLend has a market section where the total amount of TRC-20 tokens supplied and borrowed, with the corresponding annual returns (APY).

This metric helps investors to understand the nature of the JustLend supply pool, as the assets with the highest supply are shown (in this instance is BTC, which has about $1.35B liquid supply). The estimated APY reward for supplying TRC-20 tokens to the supply pool is shown as well, where JST has a supply APY of 20.91%, and BTC has a supply APY of 0.30%, this implies that supply JST token yields more interest compared to BTC.

Question 6

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

Supplying on Zethyr Finance

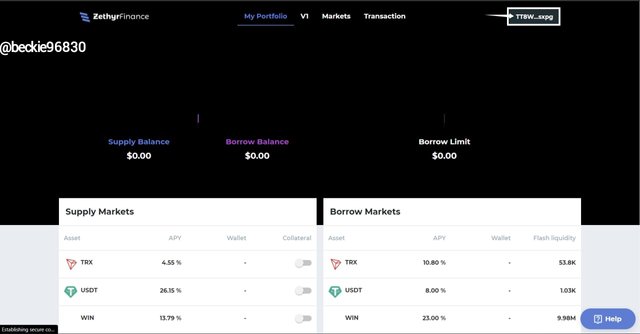

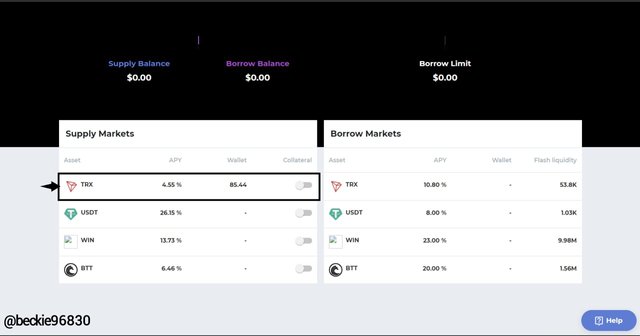

To supply on Zethyr finance supply pool first visit the platform official website and link your TronLink wallet. Then click on My portfolio to access the available supply markets.

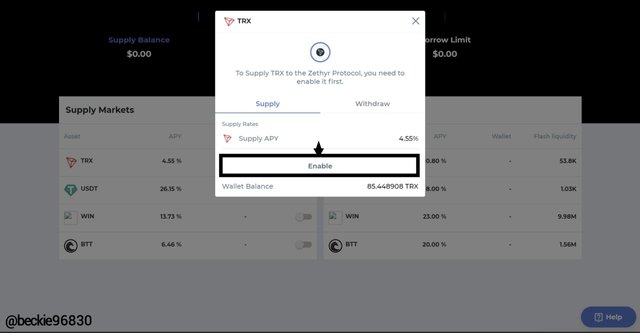

For this illustration, I chose to supply to the TRX market with a supply APY of 4.55%. click on the market of choice to proceed.

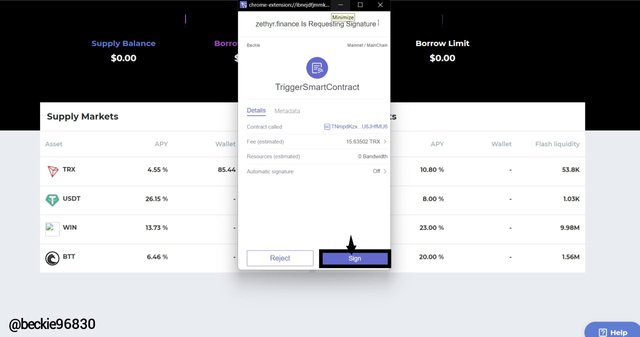

Next click on Enable to enable the TRX market supply.

TronLink wallet will require the enable transaction to be signed. Click on Sign from the TronLink wallet popup

From the above transaction, a fee of 15 TRX was charged to enable the TRX supply market.

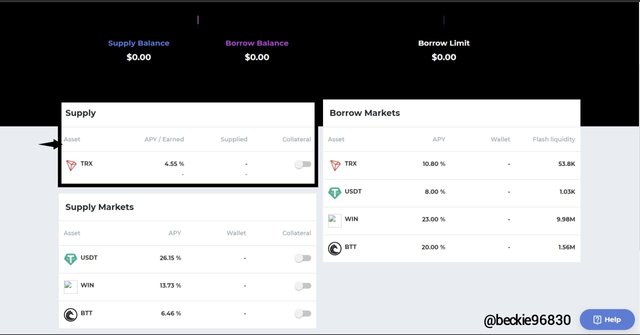

The TRX supply market will be created, now the supply can be done on the Zethyr finance.

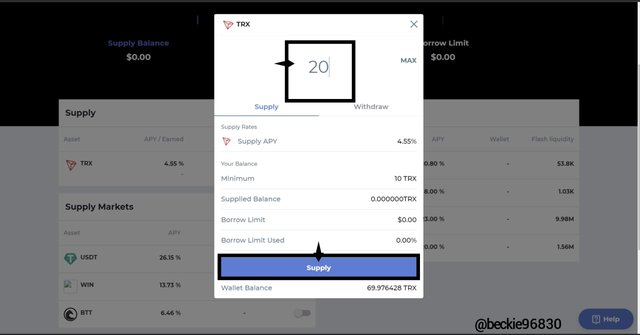

To supply to the TRX supply pool, click on the TRX supply market and enter the amount of TRX to be supplied from the TronLink wallet balance. For this illustration, I chose to supply 20 TRX, which is equivalent to $2.06

Then click Supply

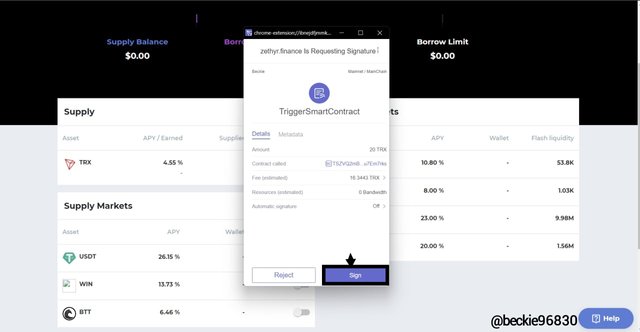

TronLink wallet will require the enable transaction to be signed. Click on Sign from the TronLink wallet popup

The 20 TRX will be supplied and added to the supply pool.

Question 7

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

Borrowing on Zethyr Finance

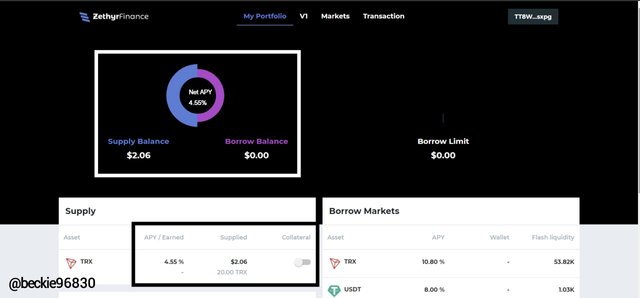

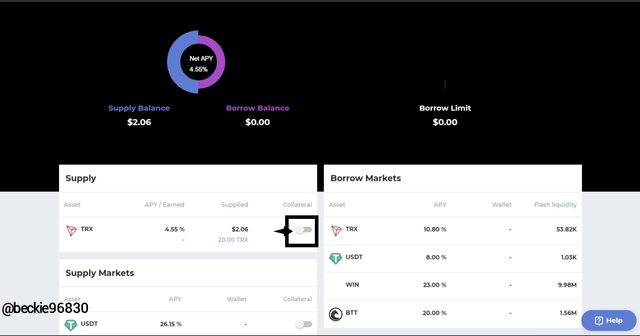

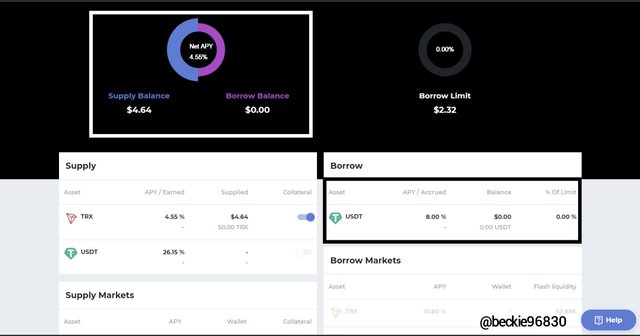

To borrow on Zethyr finance, collateral is required as an initial deposit. But in this instance, the supplied TRX (zTRX) can be used as collateral. To do this, click on the toggle button on the TRX supply market.

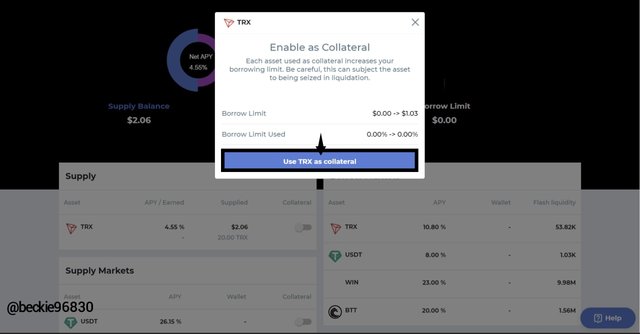

Next, choose to use TRX as Collateral by clicking on Use TRX as Collateral

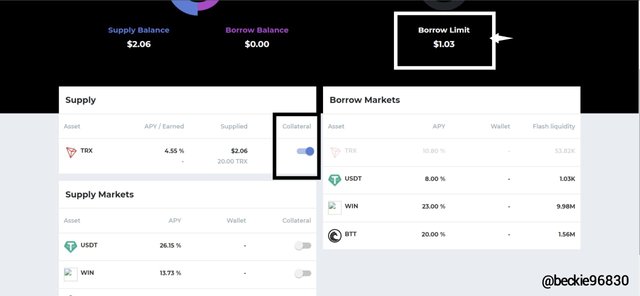

The TRX token has been collateralized, and a borrowing limit of $1.03 was granted as it is 50% of the $2.06 worth of TRX supplied to the supply pool.

Next, on the Borrow market, choose the asset to choose to borrow and click on it. For this illustration, I chose to borrow USDT.

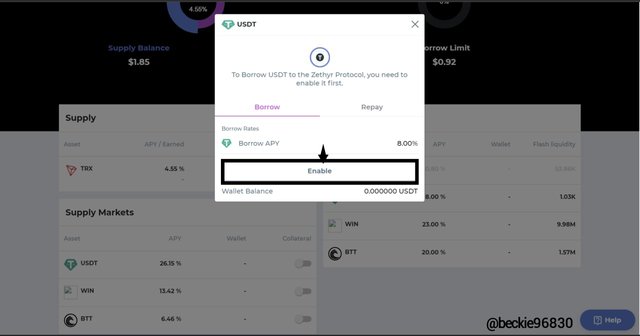

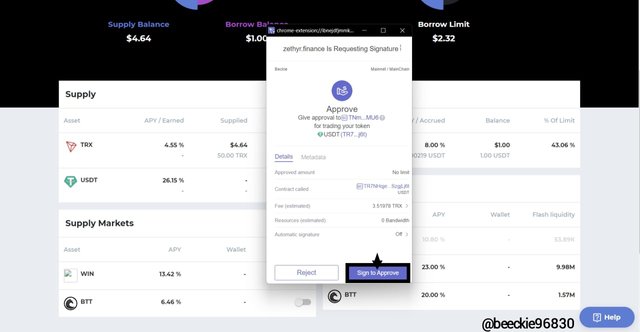

The USDT borrow market is required to be enabled. To enable the USDT borrow market, click on the market and click on Enable

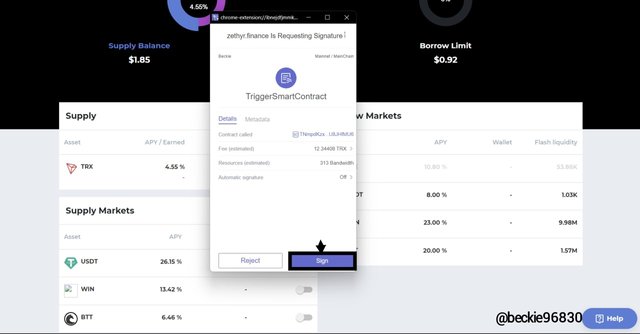

TronLink wallet will require the enable transaction to be signed. Click on Sign from the TronLink wallet popup

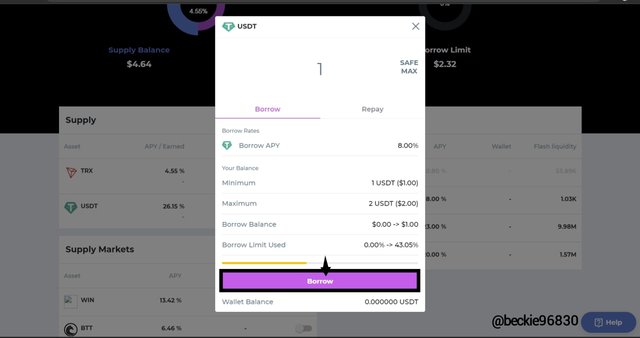

Now, the USDT borrow market has been enabled, click on the market and enter the amount of USDT to be borrowed. For this illustration, I chose to borrow 1 USDT.

Next, click on Borrow

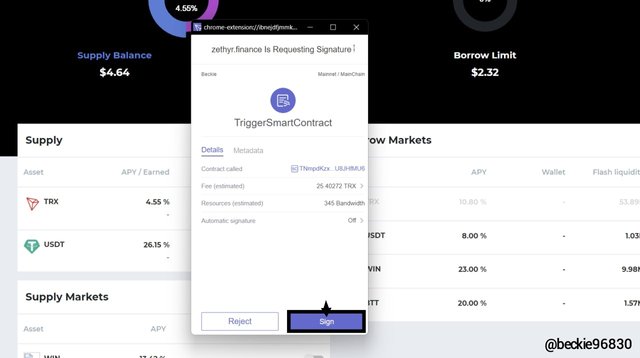

TronLink wallet will require the enable transaction to be signed. Click on Sign from the TronLink wallet popup

From the above transaction, a fee of 25.7477 TRX was charged to enable the TRX transaction.

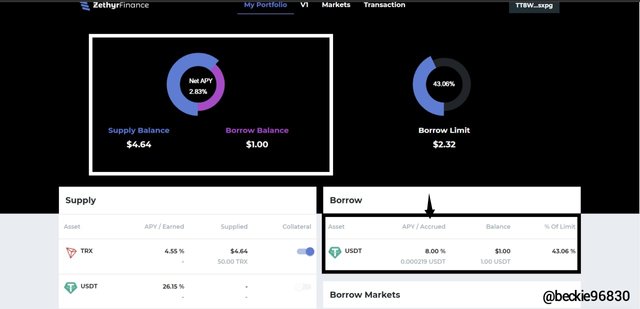

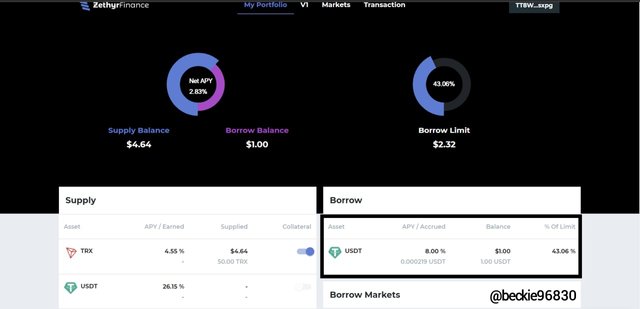

I successfully borrowed 1 USDT which is equivalent to $1 for a borrowing APY of 8.00%

Repaying A Borrowed Token

To repay the borrowed USDT token, click on the USDT borrow market

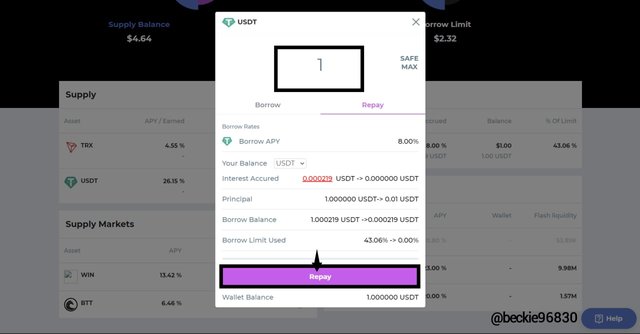

Next, select the repay option and enter the amount to be repaid. Then click Repay

An interest of 0.000219 USDT was incurred

TronLink wallet will require the enable transaction to be approved. Click on Approve from the TronLink wallet popup

From the above transaction, a fee of 3.51978 TRX was charged to approve the TRX transaction.

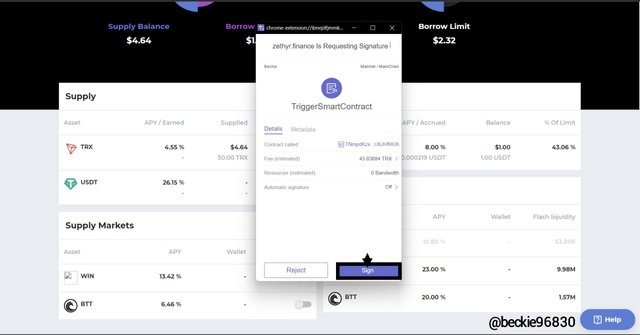

Next, the TronLink wallet will require the enabled transaction to be signed. Click on Sign from the TronLink wallet popup

From the above transaction, a fee of 43.83684 TRX was charged to approve the TRX transaction.

The borrowed USDT has been paid backed, with an interest of 0.000219 USDT incurred for borrowing the USDT token.

Question 8

What do you think of Zethyr Finance? Is it great or not? State your reasons.

Zethyr Finance Pros

In my opinion, the opportunities offered by Zethyr finance to the investor is great, with high-interest rate yields for lenders (suppliers) in various supply pool. For instance, in the illustration used above, the USDT supply market has a supply APY of 26.15%, which is considered a good return on investment.

Zethyr finance has systemic safety investment strategies put in place to protect the investor's funds like not borrowing more than 50% of the supplied token. This helps the platform checkmate liquidation of an invested asset as the crypto market is in continuous movement (bullish and bearish seasons).

Another standout feature of the Zethyr platform is the integration of swap (exchange) services to the platform. This helps investors to easily swap between their TRC-20 tokens at aggregated prices, which is arguably the best price when compared to a wider range of other exchanges.

Zethyr Finance Cons

A major downside of Zethyr finance is the charges incurred during the smart contract signing. For instance, it cost about 43.83684 TRX to sign the repayment transaction, which is equivalent to $4.

Conclusion

The Zethyr Finance is a decentralized finance protocol built on the Tron blockchain. The Zethyr ecosystem is comprised of other DeFi Tron-based projects like Zethyr exchange, Zethyr Finance, and Zethyr governance. The Zethyr decentralized exchange allows nodes to exchange TRC-20 tokens with the Tron ecosystem, which makes it easy for nodes to provide supply and cash in on the interest earned.

Zethyr finance offers great opportunities to investors, with the high-interest rate yields for lenders (suppliers) in various supply pools, though the transaction fees are ridiculously high.

Thank you professor @fredquantum for this educative and insightful lesson