Source

✓ What is Terra Station? Explore Terra Station on the web, Download the wallet and connect the wallet to Terra station. Screenshots required

Terra station is the real/official mobile wallet of the Terra cryptocurrency through there, users can manage their accounts. The terra station allows users to get access into the deentralised application of the Terra cryptocurrency blockchain. it holds the native cryptocurrency of the terra blockchain which is LUNA. It can be simply said that the Terra blockchain is a wallet for storing LUNA cryptocurrency. The terra station offers services like

•Helping to hold the LUNA cryptocurrency

•Create a new terra wallet or recover the former.

•Manage minored token

•Display historical transactions

•Swap cryptocurrency

•Staking of LUNA cryptocurrency

One very interesting and unique thing about the transaction is that cryptocurrency can be staked using the Proof of Stake consensus mechanism and through this they get rewarded for Staking their coins.

The LUNA cryptocurrency are of great function

- Stability

Terra brings stability to the cryptocurrency, the Terra coin (LUNA) is a stable coin that tries to maintains price regardless of the volatility of the Crypto market. - Staking

Staking in cryptocurrency is another way of getting more coins. Stake your coins for a number of time and get rewarded when the fixed time elapses. When the LUNA is staked, it becomes bonded coins and cannot be used until the due time.

3 Savings

Whenever the native coin of terra is minted, a percentage automatically goes into the Treasury of the blockchain. This is user to facilitate the smooth running of the blockchain.

CONNECTING THE TERRA STATION

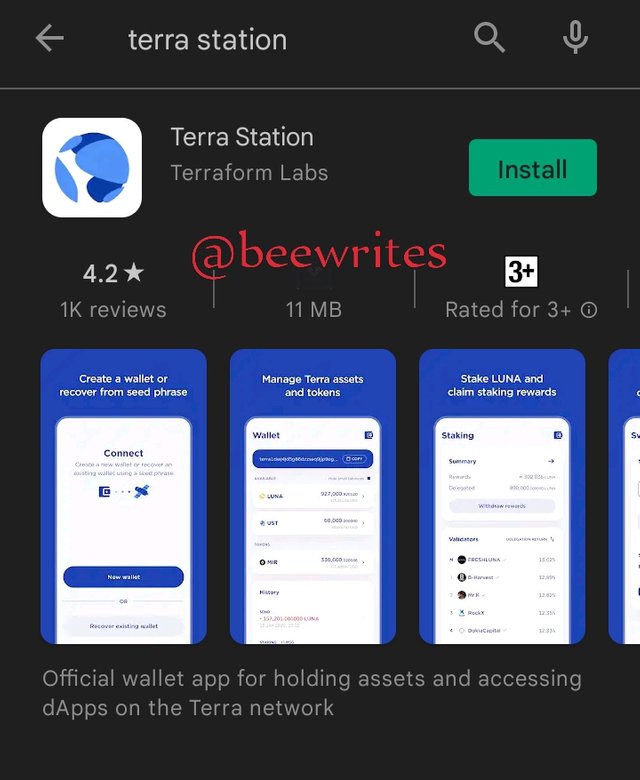

•To begin my connection, I will go to my Google playstore to download the app and install

•When fully installed, I will open the installers application

•Then pop up immediately is get started. The features handles in the Terra features starts displaying, manage assets, trace, swap and stake assets of the Terra blockchain.

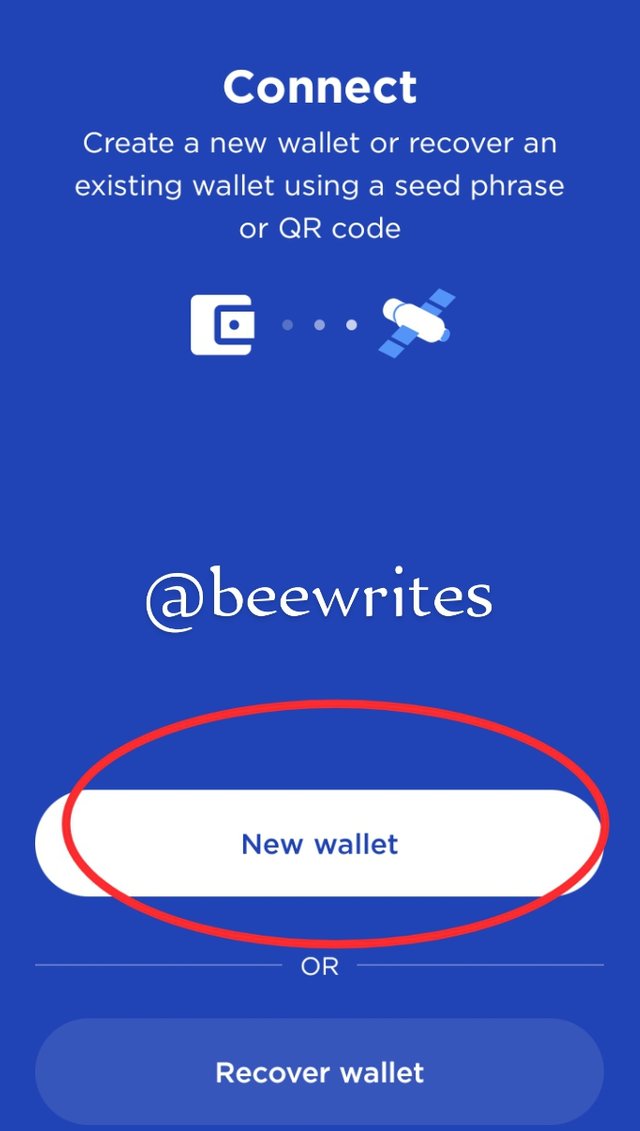

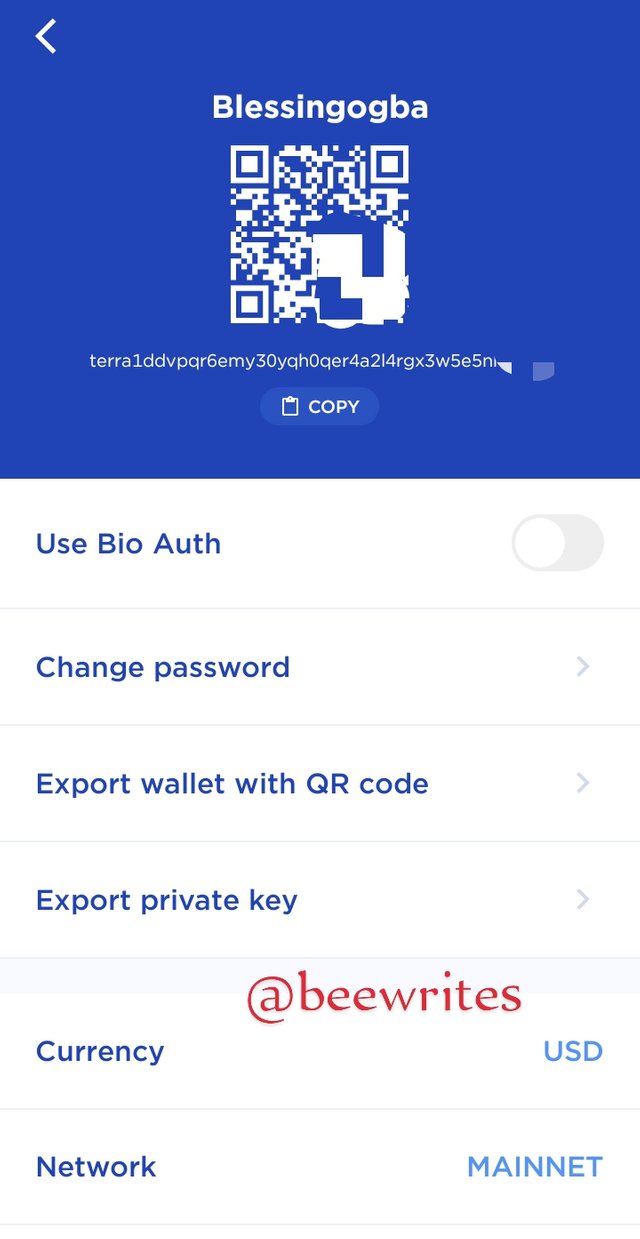

• The next phase is the site for connection. You either recover your wallet if you already have an existing Terra wallet or click new wallet to create new account

• Input your wallet and your password, then repeat your password for confirmation

•You'll be advised to write down your seed keys. Note that these Keys cannot be recovered if lost.

•Finally, your wallet is created.

EXPLORING THE TERRA STATION

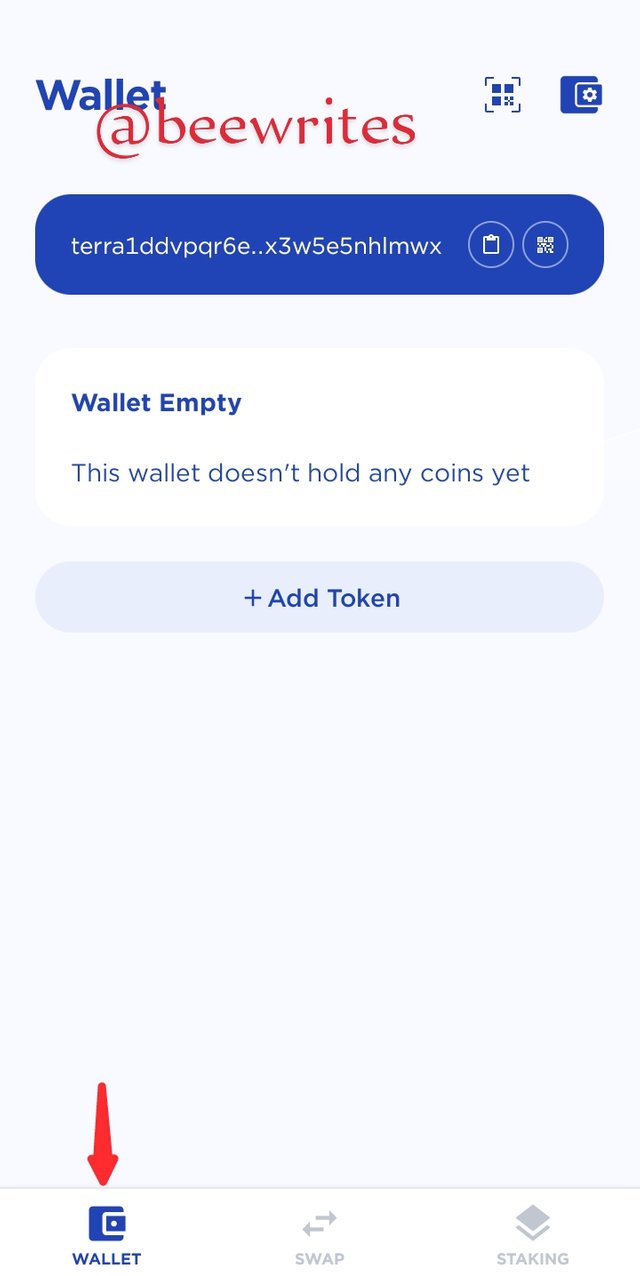

The first feature is the wallet itself. My account shows #0.00 because I don't have a token yet and hope to get some after this.

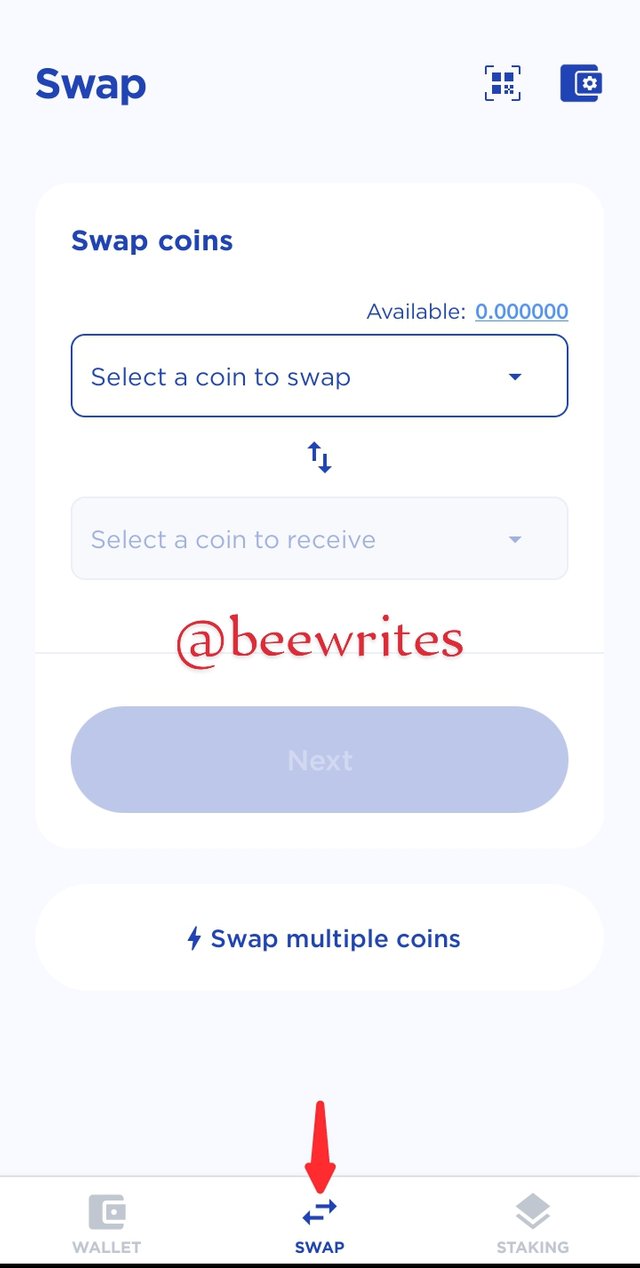

Swap feature

This feature enables the users to convert/ exchange the LUNA token into other tokens.

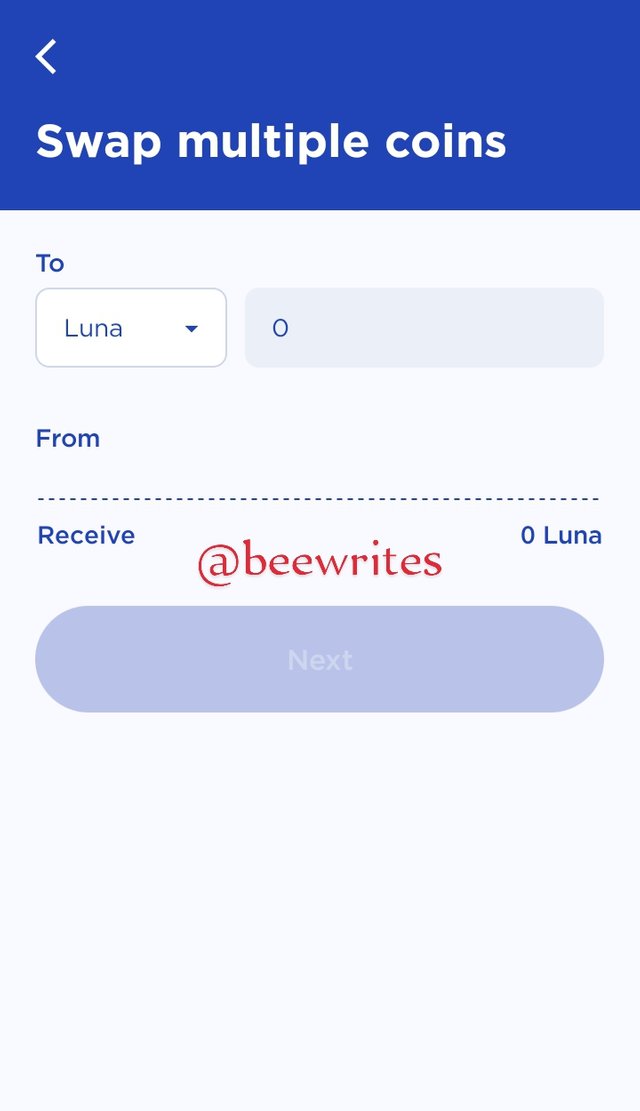

•I will go ahead to check out the swap multiple coin to see what it entails. It shows swap to which coin, swap from which coin, receive.

• You can decide on which coin you choose to swap to

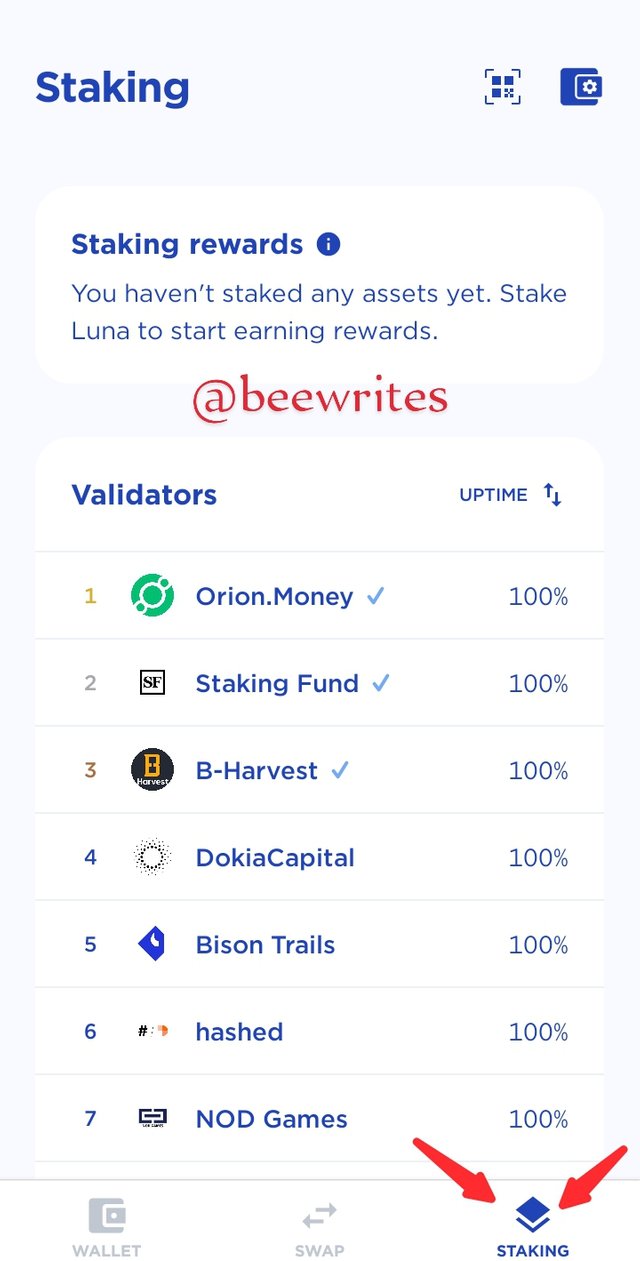

Staking feature

This is the third feature. Staking feature on the proof of stake mechanism is where the investor/validator delegates their coins to the blockchain for a fixed period of time and get rewarded by doing that.

•There are numerous validators listed on the terra station with their up time ranking from highest to lowest

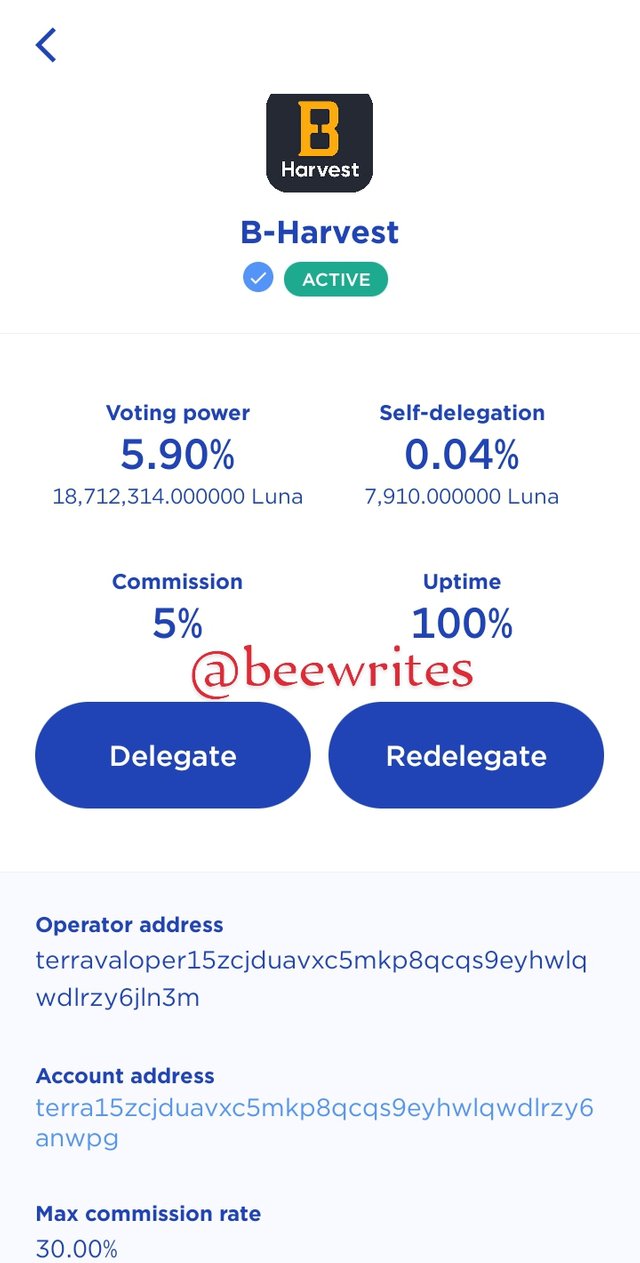

•let's explore one of the validators; b-harvest. b-harvest have voting power of 5.90%, self delegation of 0.04%, commission of 5% etc

•Click on delegate if you want to delegate your coins. click on redelegates if you have ones delegated your coins, but still want to delegate again.

✓ Explain anchor protocol, explain the app and connect to terra station wallet. show screenshot

The anchor protocol of the terra block chain is an open and permissionless protocol for savings. The anchor protocol is being run by the proof of stake consensus mechanism, this is a reason the coin is a stablecoin despite market tide and liquidity.

The anchor protocol connect the lender who is looking for means to earn by staking his coin and a borrower who is looking for staked coin to borrow. The borrower gives collateral by locking up his bonded asset(b-assets)and cannot borrow exceeding the protocol definite loan-to-value ratio

In anchor protocol, the staker enjoys high and stable Crypto rewards, immediate withdrawal of his earnings and extra protection of his lended/ staked coin.

In the anchor protocol, 5 set of users exist.

- Depositors

The depositor is the lender of the LUNA stablecoin, he lends it to the borrower and get rewarded for the services. When a depositor or lender gets rewarded it is done in form of Anchor terra(aTerra) - Borrower

The borrower borrows the stablecoin from The terra Anchor Money Market uses his bonded asset as a collateral for the coins borrowed. - Liquidators

The liquidators oversees the loan process, monitoring if the loan-to-value ratio is stepping above the value. The liquidators also have the power to confiscate the bonded asset of the borrower if he doesn't pay back in due time. - ANC liquidity providers

The ANC liquidity providers are decentralized institution that sponsors the liquidation pool so the block chain will not run into liquidity. The liquidity providers are rewarded as to the ratio of the liquidity they can provide.

EXPLORING THE ANCHOR PROTOCOL

These are steps to follow to explore the anchor protocol

•Go on their official website Link

•When the site opens, click on the icon by the top right if the page

• A page will be displayed containing dashboard, developer web app click on dashboard.

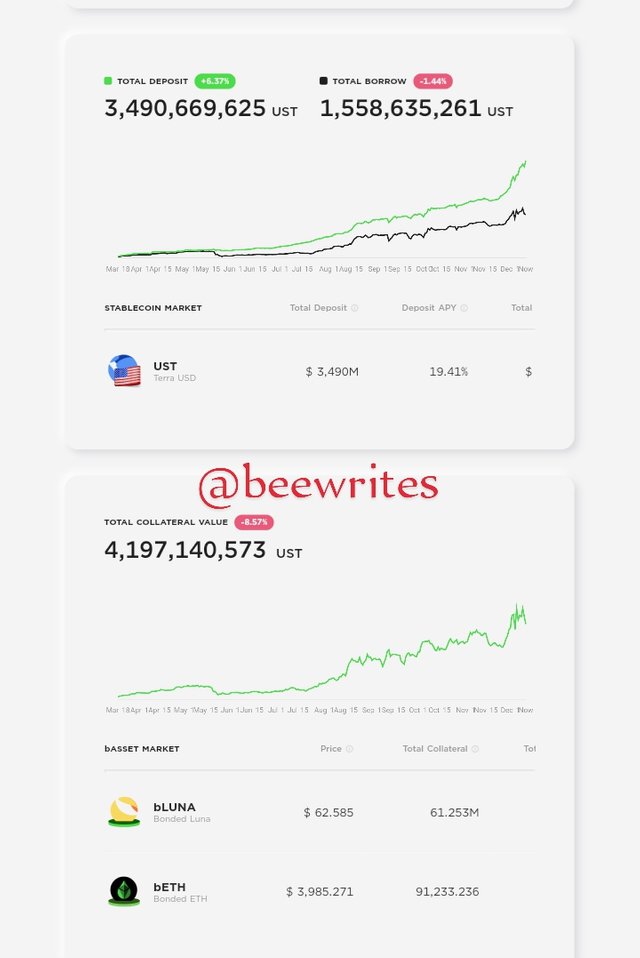

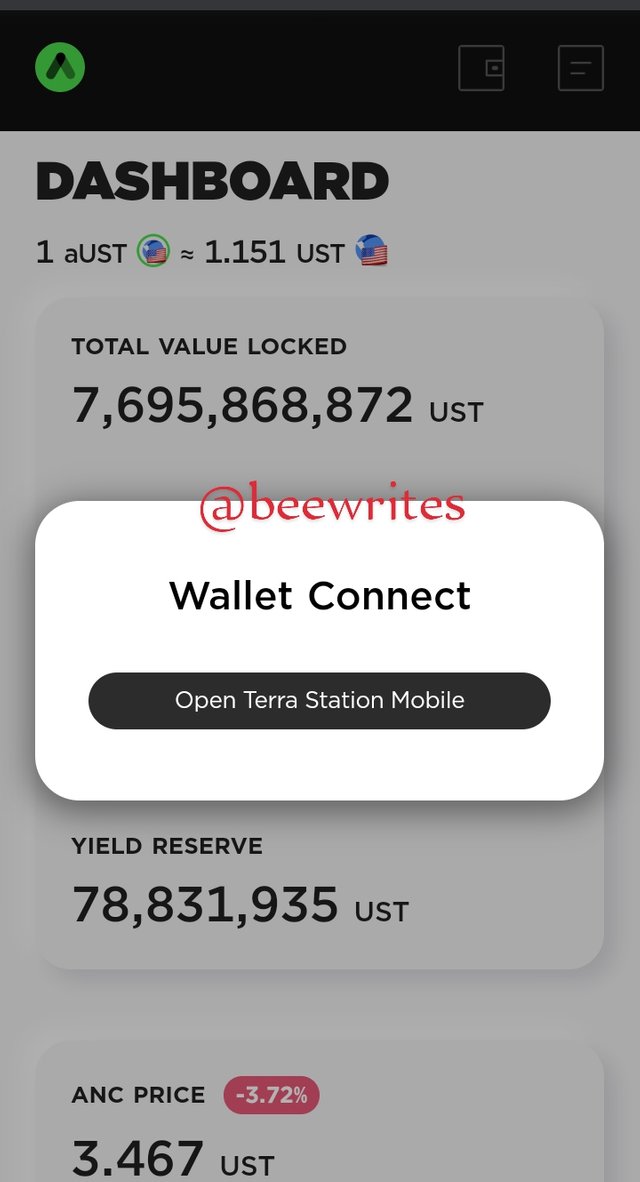

DASHBOARD

the dashboard shows in just one page the value of

TVL $7,687,810,198 UST

Yield Reserve $78,831,935 UST

Current Price 3.465

And many more

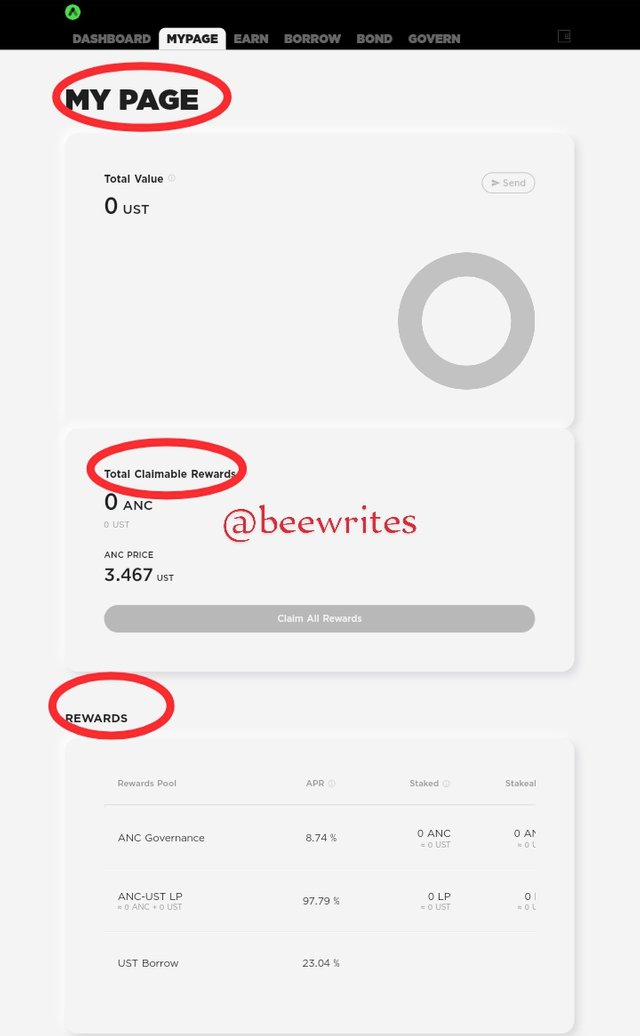

MY PAGE

"My Page" is the terra user's personal account. It displays the total value, total claimable reward, reward borrow, govern and transaction history

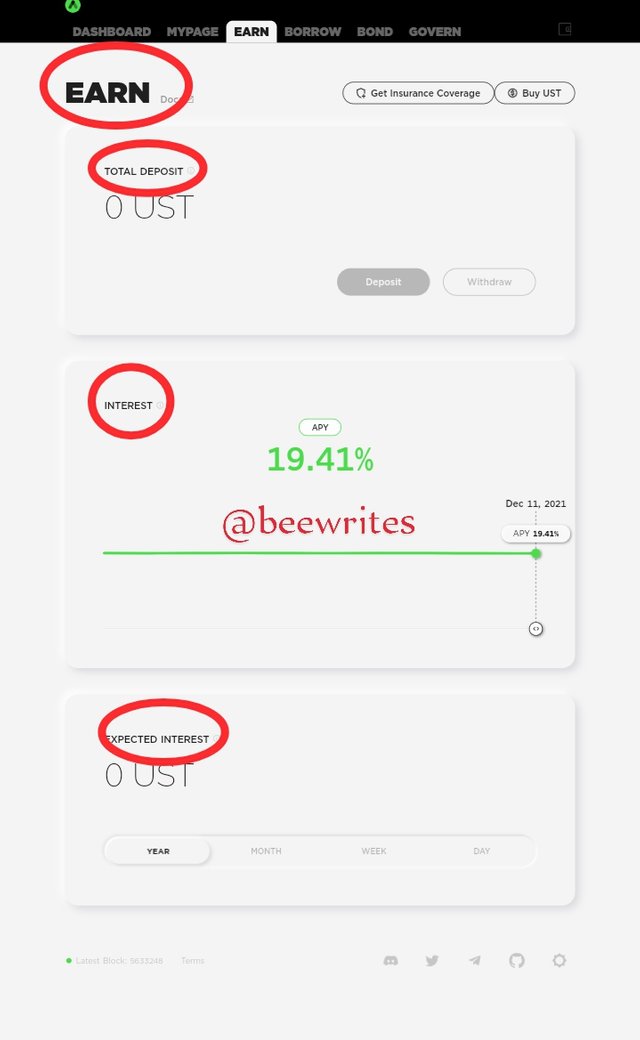

EARN

The earn feature displays your total deposit, interest gotten and expected

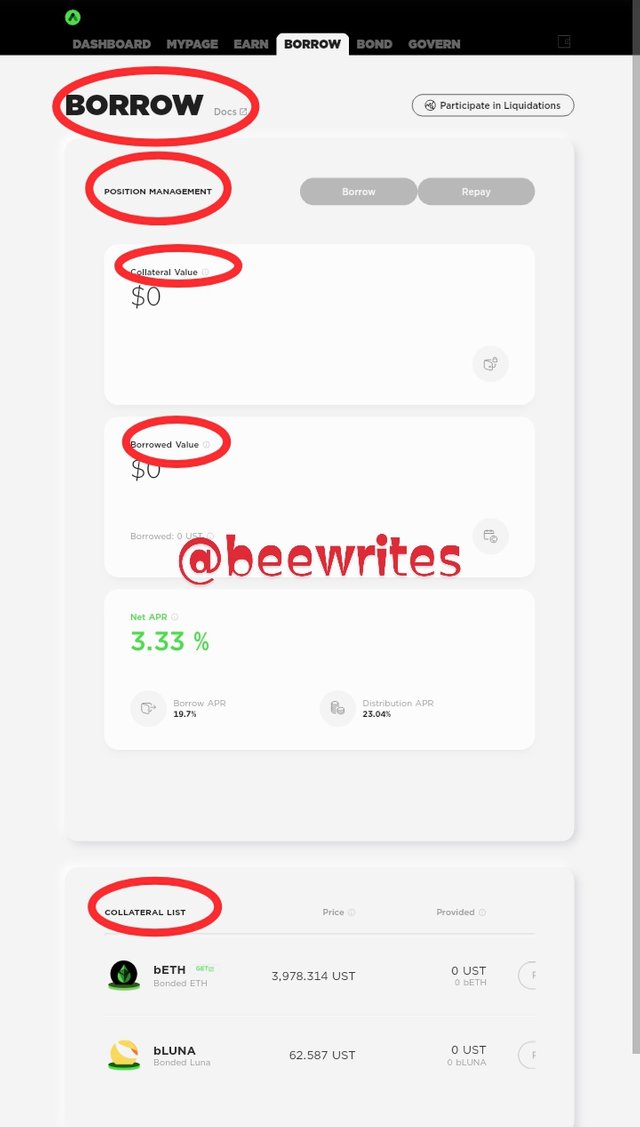

BORROW

This is where you can borrow or repay a loan, it displays position management of either borrow or repay. The collateral value, the borrowed value, the NCT APR combining of the borrowed and distribution and collateral list

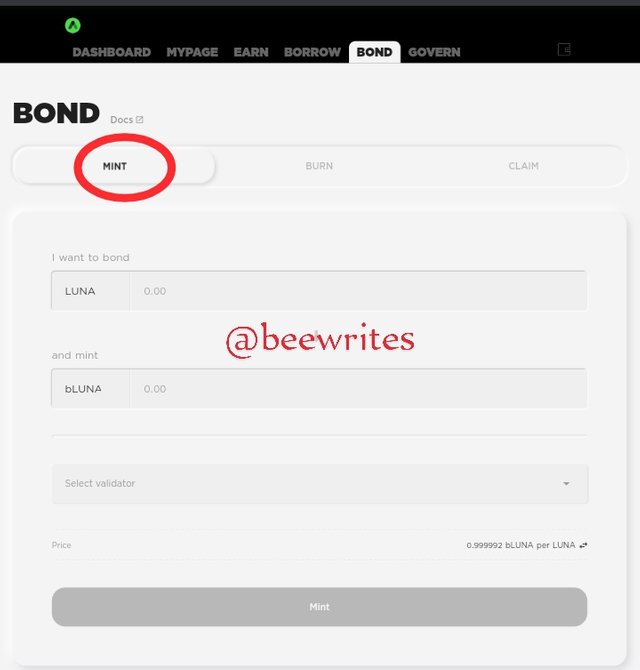

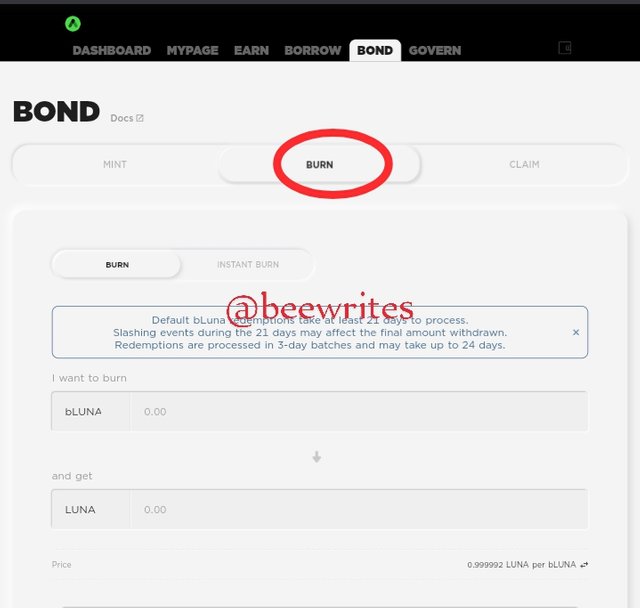

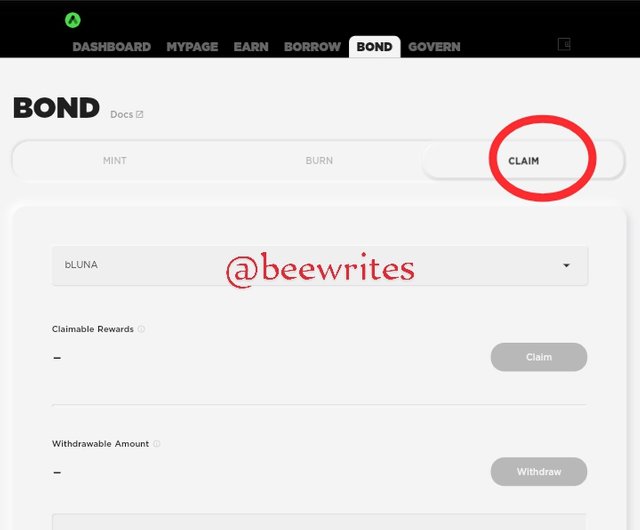

BOND

The bond has 3 features

•Mint

•Burn

•Claim

GOVERNANCE

It shows the ANC price , total Staked price and a position where you can either trade ANC or stake

CONNECTING TO THE TERRA STATION

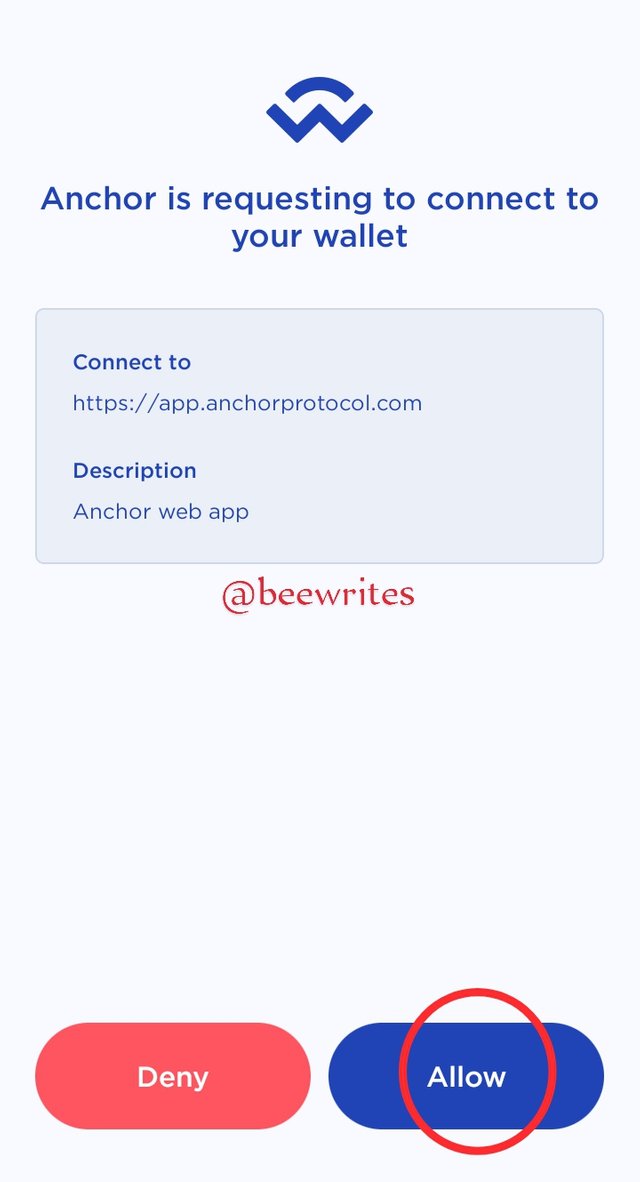

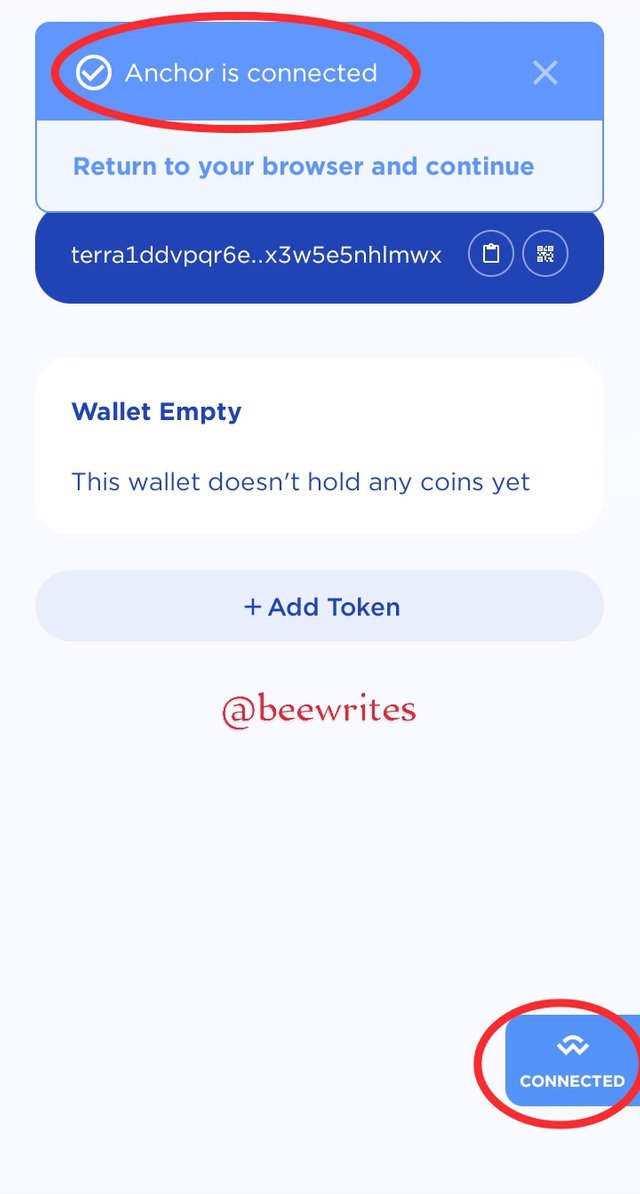

•First, go on the dashboard of the site. Click on the anchor top right

•Click in open station mobile

•Click allow

•You are now connected

✓ Explain mirror protocol, connect Terra station and explore the mirror protocol app show screenshots

The mirror protocol is a sector of the defi finance that allows the account owner to establish synthesis asset and be able to trace their assets. This synthetic asset that you create with mirror protocol is called mirrored asset(m-Assets). It shows the real life value/ price of an asset, it is this feature that will enable users be on the market for a long period of time and for easy accessibility.

EXPLORING THE MIRROR PROTOCOL

•log into the mirror protocol link choose any link from the two links display

TRADE

In this page are different places to trade and their terra swap prices

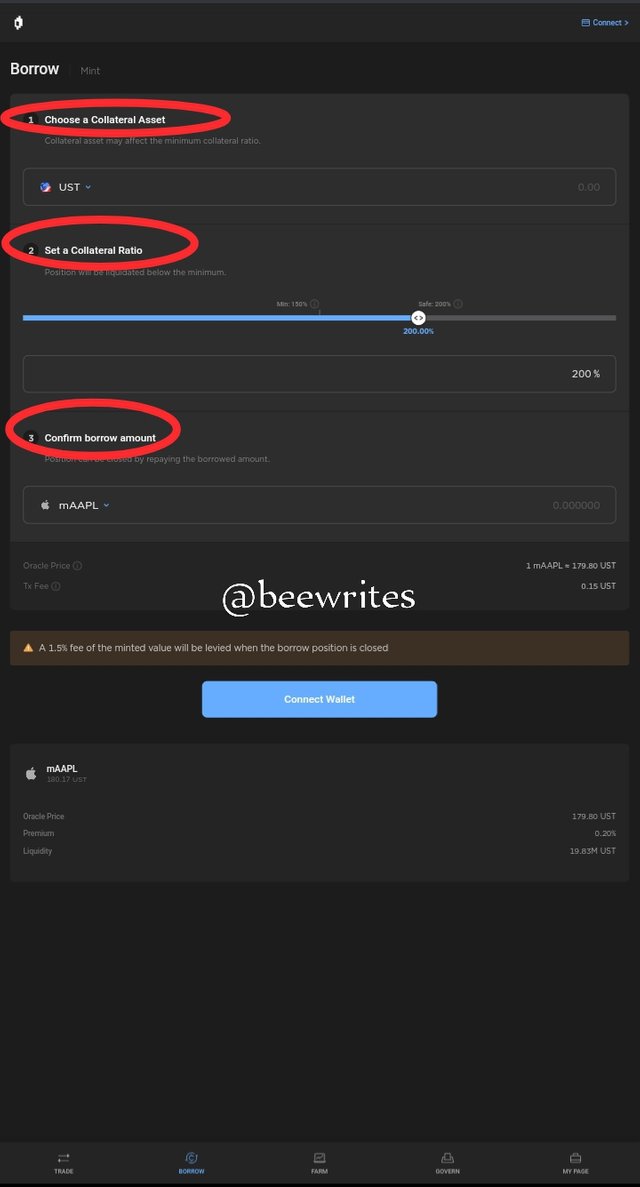

BORROW

The borrow feature is a place where you borrow asset.

Let's Click on one of the tokens to see what it displays

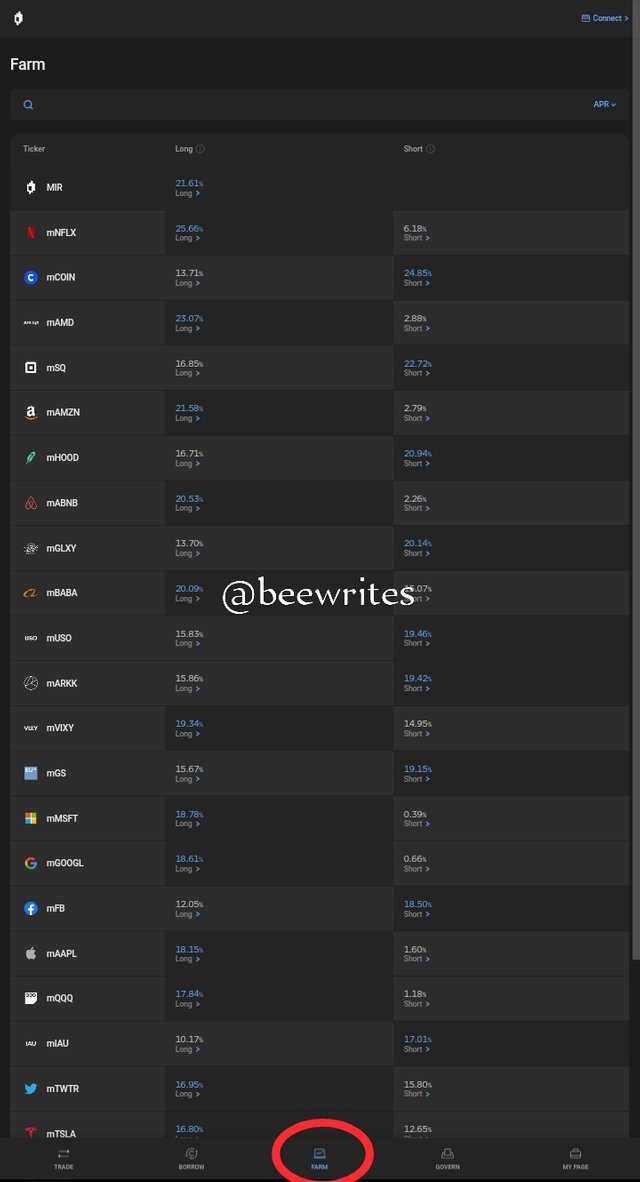

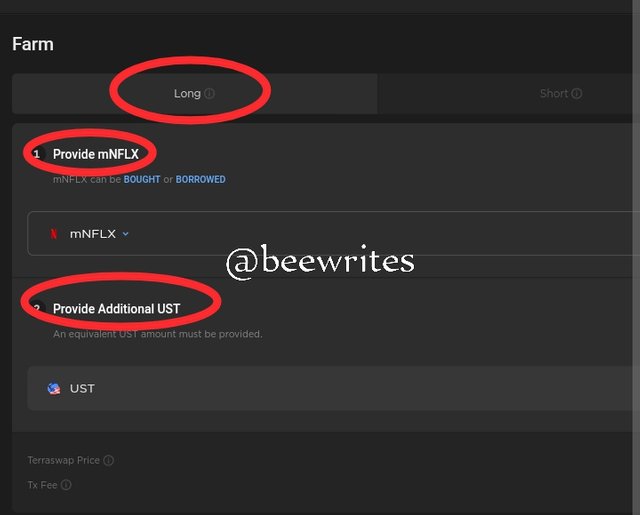

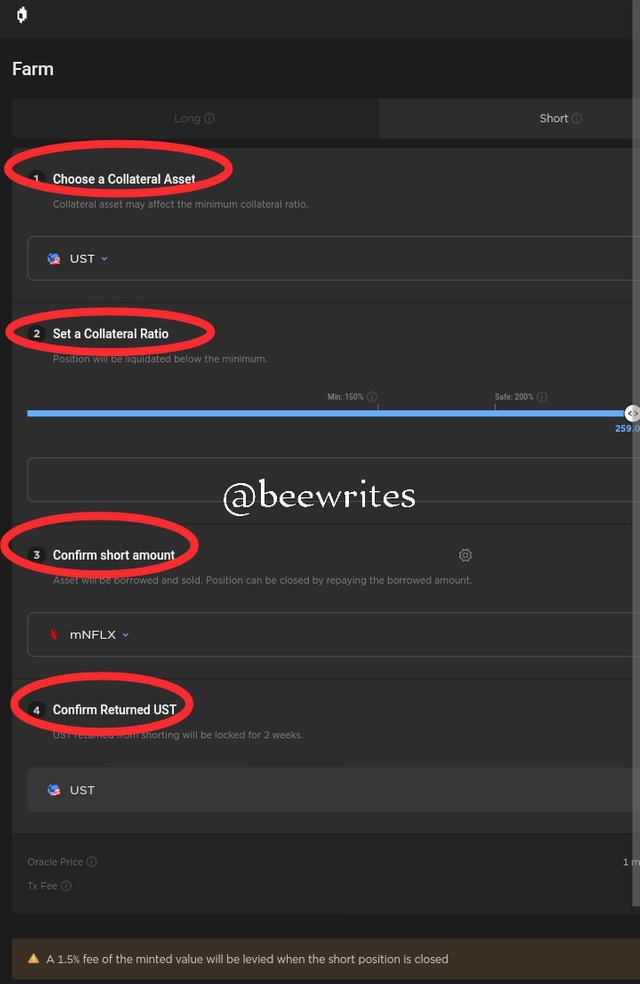

FARM

The farm feature comprises of ticker,

long and short and your different percentage.

Long

Short

GOVERN

It entails community pool 58.85m

Total staked 38.90m

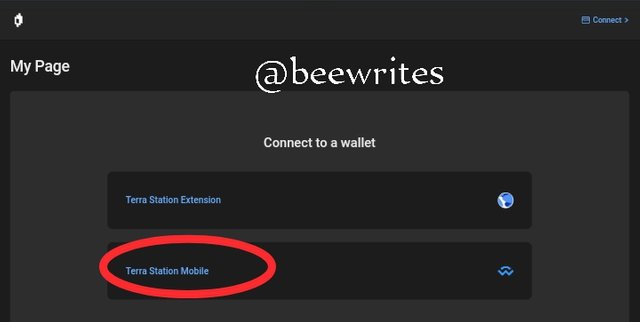

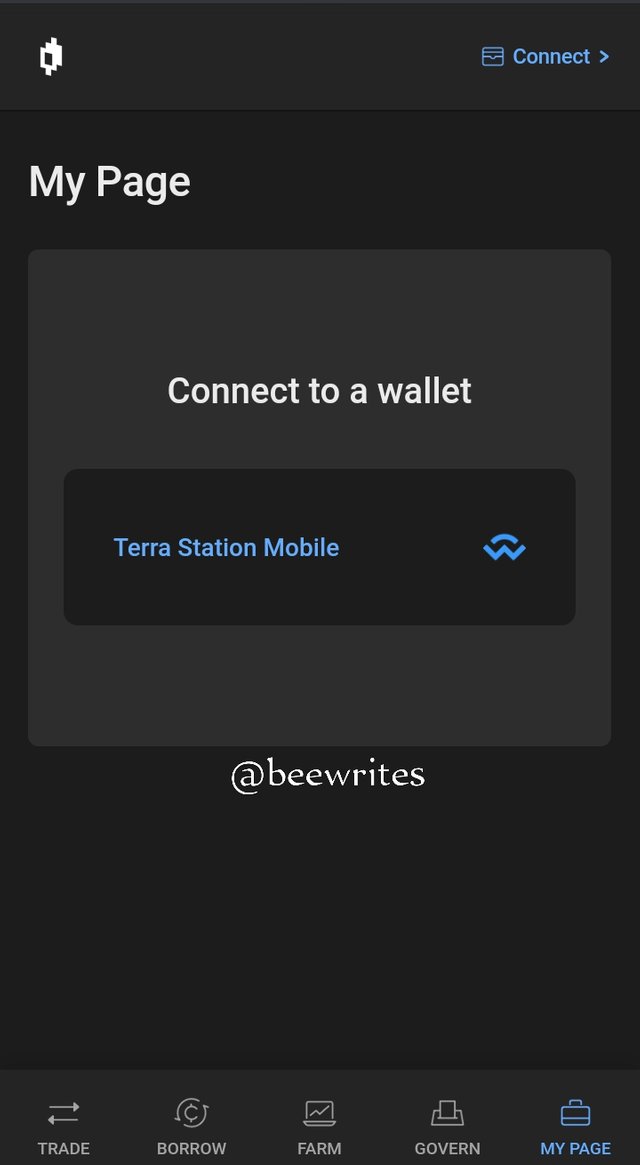

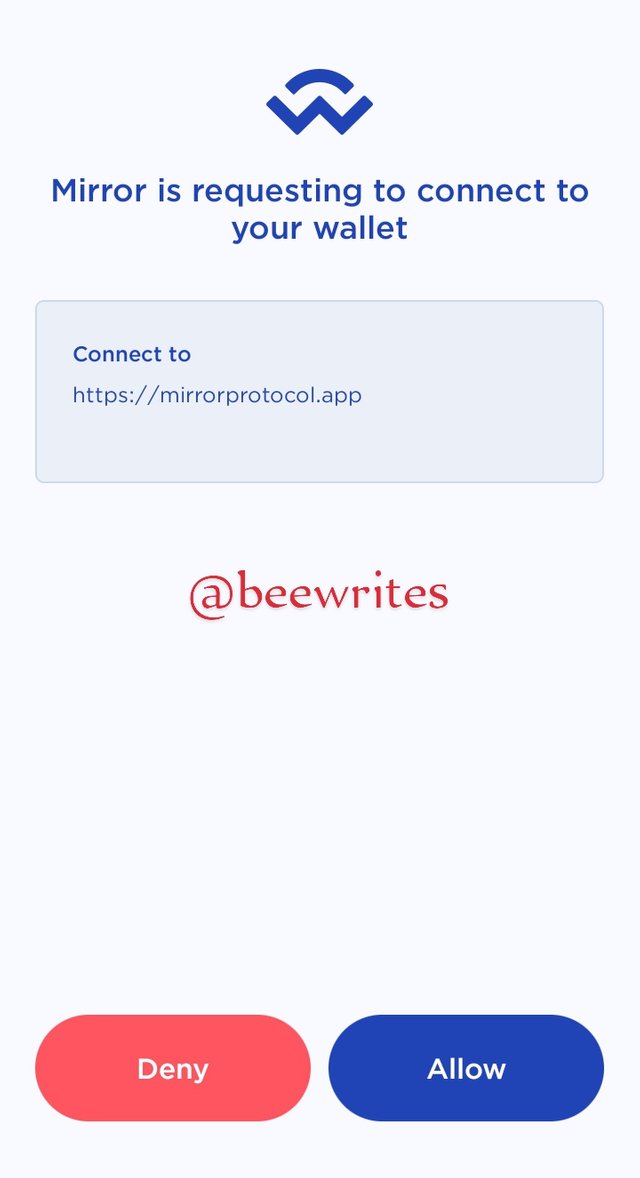

CONNECTING TO MIRROR PROTOCOL

•Go to my page and click on Terra station wallet

•click on the open terra station mobile station

•accept the process by clicking allow

•You are connected

✓ Explain how it works and what is Terra stablecoin

The Terra bridge is aimed at setting up a structure for easy and permissionless transfer of assets

What are Terra stablecoin

The crypto market is always in motion, getting rising and falling, this is called Volatility. Terra stablecoins were designed to minimise the effect of volatility on cryptocurrency. The main cryptocurrency of terra is called LUNA

. The terra USD called UST is a terra stablecoin. The coins were made for the aim of maintaining stability of prices by the use of alogarithm, it was also designed for very low fee transaction and very fast swap transaction between one cryptocurrency and the other.

Some Terra ststablecoins are

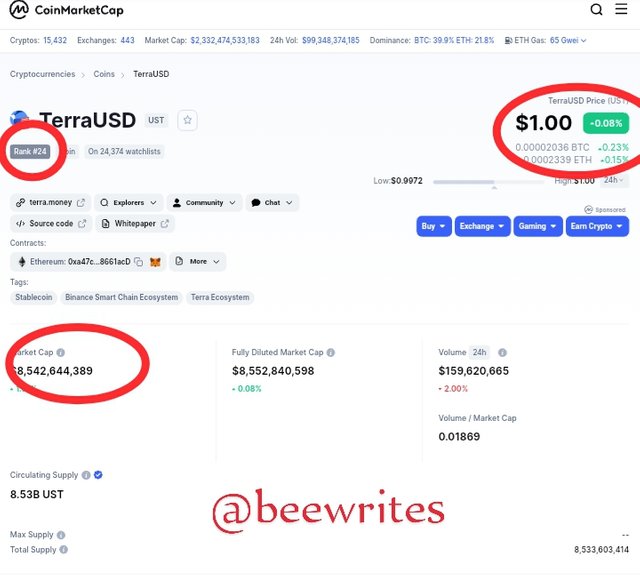

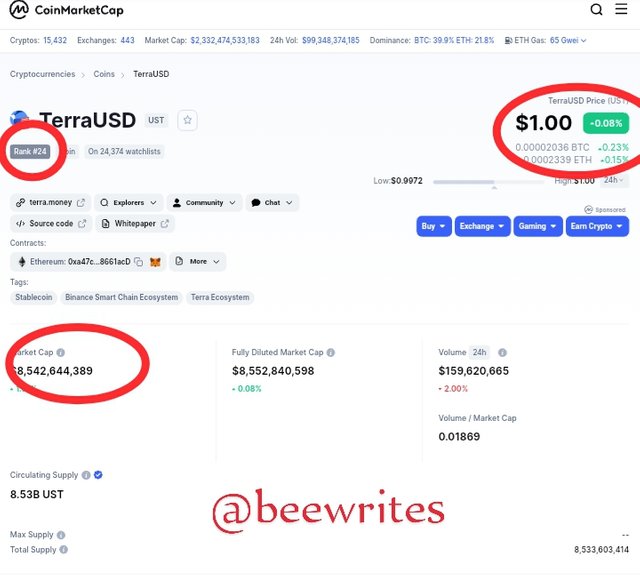

USD(UST)

Rank 24

Price $1.00

Marketcap 8,542,644,389

Circulating supply 8.533.

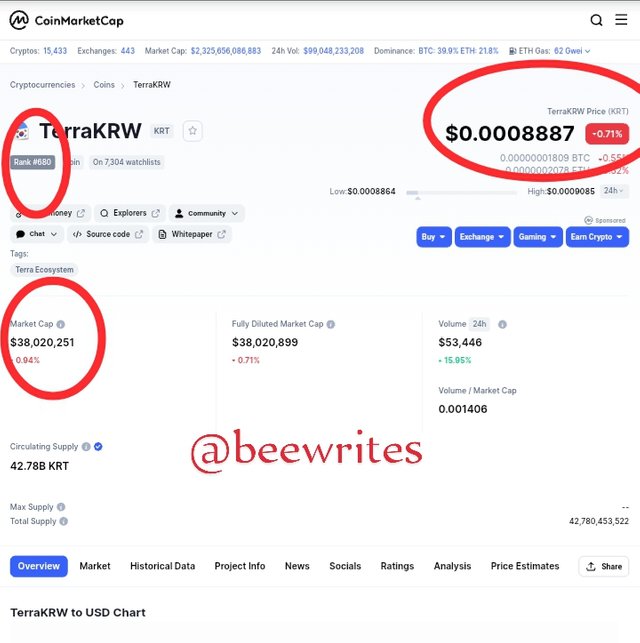

TerraKRW(KRT)

Rank 680

Price $0.00008891

Marketcap $38,037,24

Circulating supply 342.773KRT

Others are

TerraJPY, TerraCNY, TerraEUR, TerraGBP etc.

You have 1500USD and you want to transform it into UST. Explain in details and take the price of the updated LUNA token

From the screenshot above, it displays that the price of TerraUSD (UST) is $1.00

1USD=1UST

This automatically means that

1500USD=1500UST

Lets go over Terra LUNA

The price = $71.14

If 1UST=$71.14LUNA

then, 1500UST = 1500÷71.14

=$21.09

This is to firmly say at the time of my assignment, 1500USD is equivalent to 21.09LUNA

✓ Now you have those 1500 USD and you want to make profit since 1UST=1.07USD, explain in details and take price of updated LUNA token

Since 1UST = 1.07USD

1500USD = 1500×1.07

=1605

To get the profit we will be subtracting the invested USD from the new gotten USD

1605-1500 = 105USD

Let's convert USD into LUNA

Remember, 1LUNA = $71.14

Therefore, to get the amount of LUNA for 1605USD, divide 1605USD by the current price of LUNA

1605USD÷ 71.14

=22.56LUNA

This means that if 1UST = 1.07USD, then 1605USD is equivalent to 22.56LUNA

Thank you Professor @pelon53 for this interesting lecture