Hello, crypto lovers. This is my entry for the homework given by Professor @reminisence01.

✓Spot Trading

Spot trading is the fundamental or basic investment that happens in the crypto market. Spot Trading is buying Cryptocurrencies when the monetary value is low and storing or saving for a period of time until the monetary value of that cryptocurrency increases then selling it, hereby making profit.

Cryptocurrencies are bought and sold at the price called spot price, doing this, the investor or trader has ownership of the Cryptocurrency. The spot price is the present/current price of Cryptocurrency.

A personal example to illustrate spot trading

In March- July 2021, most cryptocurrencies dropped drastically including steem. Steem dropped from 540 Naira to 140 naira. I saw the advantage, bought about 500 steem and stored in my steemit wallet, October 2021, steem has increased to 350 Naira, that is more than twice the price I bought it for and before the year runs out, steem might get back to 540 Naira.

Advantage of Spot Trading

• The trader in the spot Market can decide not to trade their cryptocurrency if the monetary value is not favourable to them, they can decide to hold the coins until the value appreciates

• Transparency of the Cryptocurrency is another advantage because the spot prices are public information to be view of both buyers and sellers

• The quick transaction of spot trading is an advantage as trading is done at a spot

• Spot Trading does not require a master or advance knowing in Cryptocurrency, it just requires him to know when a cryptocurrency is low and taking that advantage

Disadvantages of spot Trading

•It might take a lot of patience and endurance before the Cryptocurrency grows and increases to the point of more profit.

•Ignorant traders might buy the Cryptocurrency when the monetary value is high, this can cause the trader to have very little or no gain at all. The trader might eventually make a loss.

✓Margin Trading

Margin Trading refers to the process by which traders purchase more cryptocurrency than their current capital can afford. They do this by borrowing Cryptocurrencies from other traders and Exchange platforms.

This means that the trader's trading power is higher than his/her initial trading capital can carry them.

Advantages of Margin Trading

• By borrowing Cryptocurrencies from follow traders and Exchanges, the trader can make so much profit from his initial capital which was little. This mean with the help of Margin Trading, a trader's purchasing power increases.

• It can cause more profit

Disadvantages of Margin Trading

• Margin Trading is a NO for beginning traders. It requires a very high level of advancement and professionalism.

• Margin Traders suffer more risk than spot traders. This risk can result to a total loss in their capital and even the borrowed fund

•Every loan must be returned to the lender with an interest.

✓ Future Trading

This type of trading requires high level of professionalism, so it is not starter's friendly. In future trading, investors take note of historical prices of the Cryptocurrency and make prediction of the future price.

In future market, Cryptocurrencies are bought or sold at an agreed fixed price by the buyer and seller and a date for the execution of the trade is also fixed. The future market helps traders take advantage of the unstableness (Volatility) of the coins in the Crypto market. If the investor predicts wrongly, he will make a loss.

Advantages of Future Trading

• In future trading, if the investor predicts accurately,it means more profit.

• Future Trading is very much profitable than the spot trading if there is accuracy prediction.

• Future Trading has the hedging advantage. Hedging in Cryptocurrency is a means or strategy of reducing and managing risk, example of hedging is using offset positions.

• The trading commission paid in future trading is usually less than other trading

• It has a high efficiency level and are fair unlike spot Market

• The future trading has longer trading hours, it exceeds the traditional market hours, some future market even operators over the night, 24 hours services.

• High liquidity is also an added advantage as investor can exit or enter a market at will.

Disadvantages of Future Trading

• This type of trade is unsuitable for traders who are still learning trading of Cryptocurrencies,this is due to it's high technicality

• If a trader make a wrong prediction, it will lead to an irresistible loss

• Future Market comes with high leverage issues. This is as a result of the unstableness of the future prices, this leads to loss

2a.. Explain the different types of orders in trading

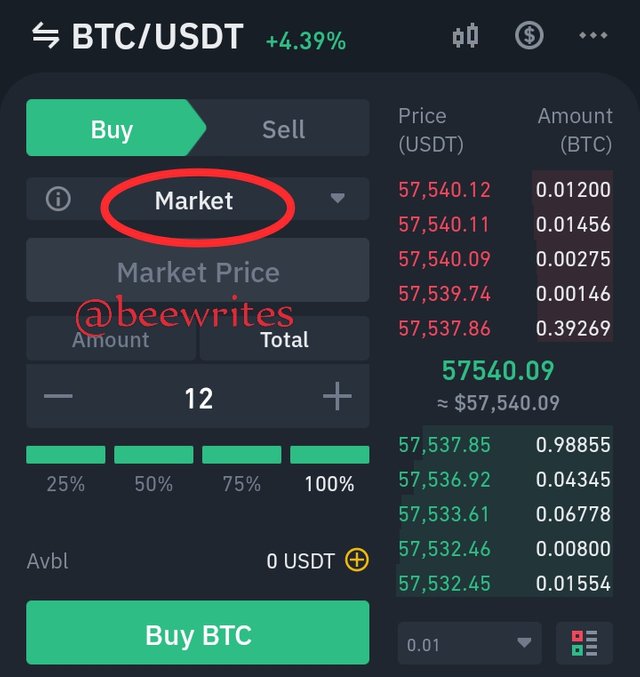

✓ Market Order

Market order is an order to buy or sell a cryptocurrency with immediacy. In market orders, negotiation is not done as the trader trades at the current price from the order Book, because of this reason, time and energy is saved . The market order is the commonest type of order in the Crypto world, as a matter of fact, it is the default setting in most stock brokers. It is the role of the market markers to create market order.

.

.

This is the buy Market order of Bitcoin/ USDollar.

Having the bid price and ask price of $57.537.85 and $57.540.12 respectively

✓Pending Order

Pending orders are orders or instructions the investor gives to either buy or sell an asset when it gets to a specific price. It is carried out when the current price isn't alright by the trader and he wants his specified price.

Pending other are divided into 3

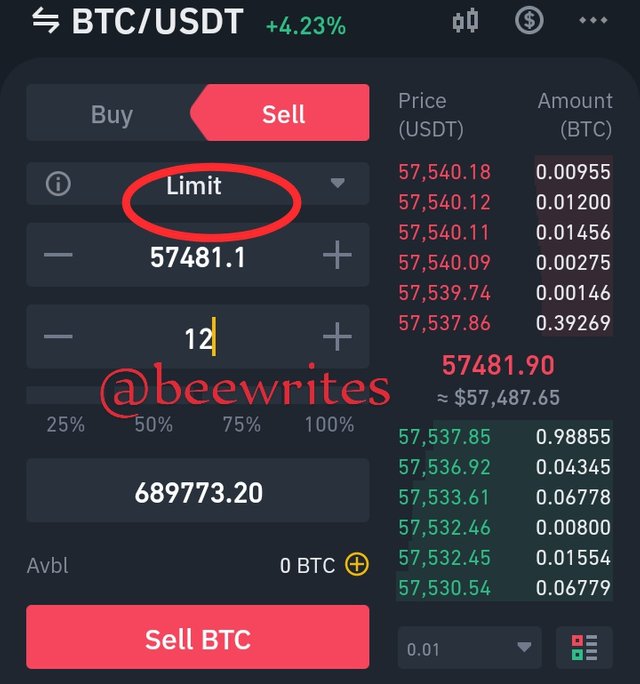

i.. Limit order

Limit order are orders made by the investor to sell or buy an asset at a certain price indicated by him (the investor)

Limit order can be a sell limit order or a buy limit order.

A sell limit order is an instruction to sell a cryptocurrency higher than the current price or even higher than the investor's ideal price

A buy limit order is an order to buy a cryptocurrency at a price lesser than the current price or even lesser than the investor's ideal price

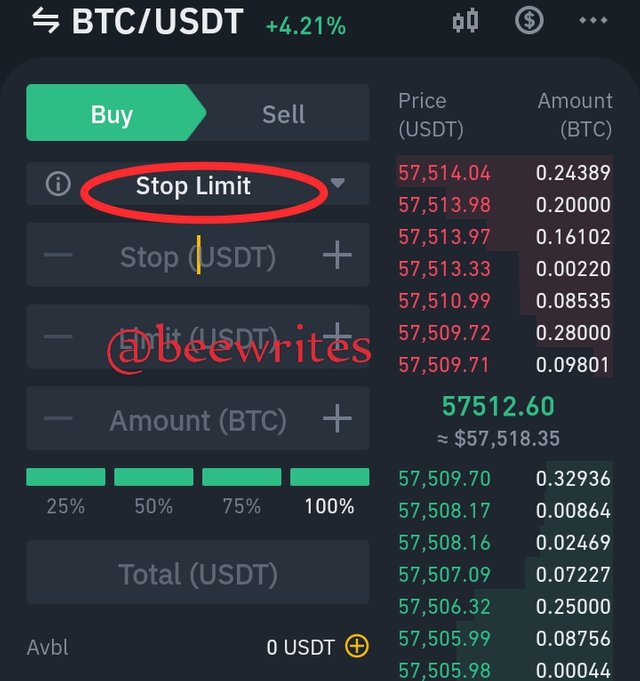

ii.. Stop Orders

This is another category of pending order. The stop order will enable traders to place a limit order when the stop Price has been met or executed. Stop limit order combines the characteristics of stop loss with limit order to curtail risk. When stop Price is executed, it turns into a limit order

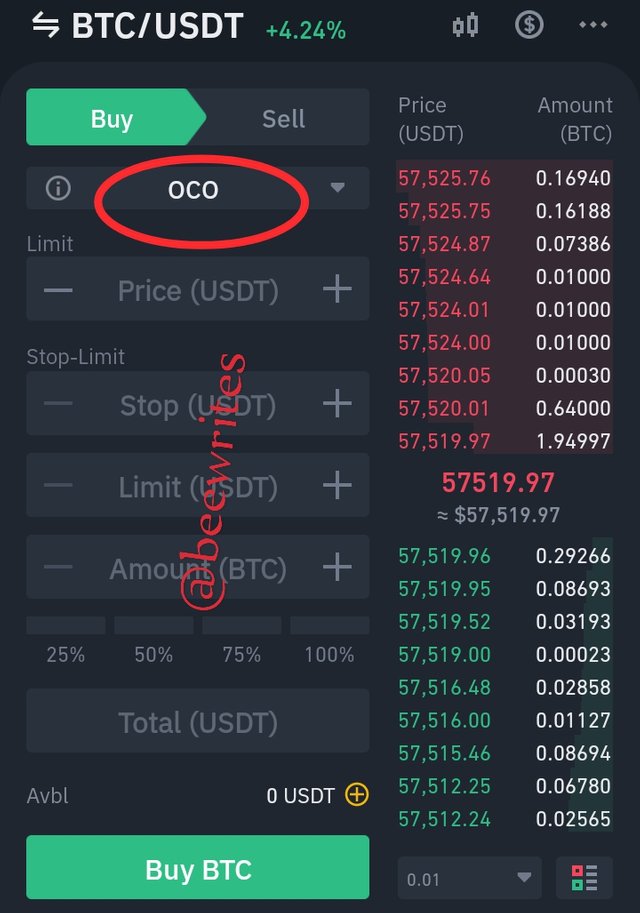

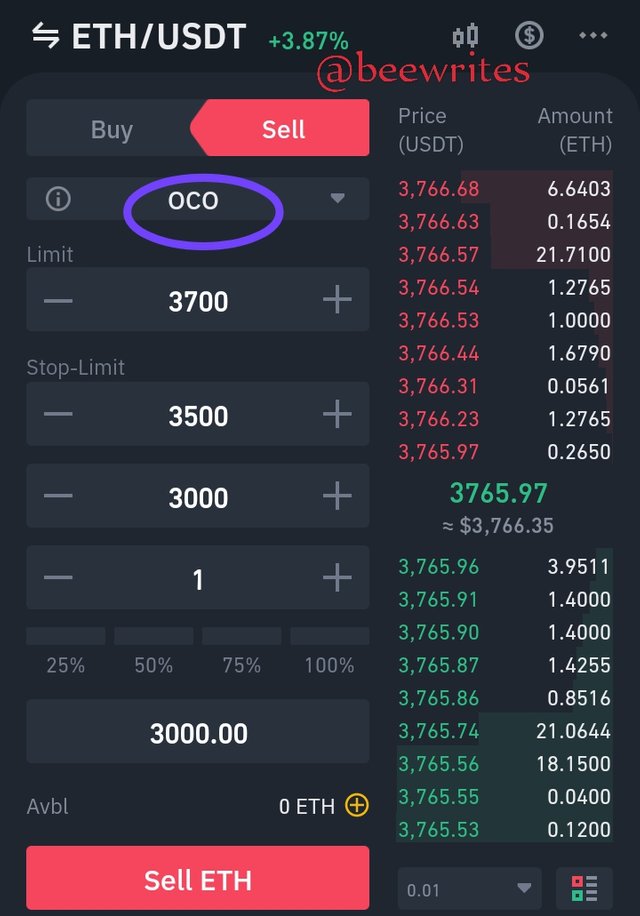

iii.. OCO Order

This is an acronym for One Cancel the Other. This is a conditional order that if one order is met or executed, the other order is cancelled. This can only happen if two orders are placed. This is an automatic order that causes an order to cancel automatically when the other order is met. The two orders placed are limit order and a stop limit order, only one will be executed and the other will be cancelled. Other types of automatically cancelling orders are Fill or Kill (FOK) or Immediate or Cancel (IOC)

✓ Exit Order

The exit order are further grouped into 2

i.. Stop Loss Order

Stop Loss Order are automatic order given by the investor to stop or close an order if the market is not going as expected or predicted. It is the stop loss order that cancels or exit an order plan if it is not going in favour of the investor's plan or prediction. This is a risk management order.

ii. Take Profit Order

A take profit order is an automatic order set by the investor to close a trade or sell a security when it gets to a specific price or higher. This ensures maximum profit. Take profit order are super helpful for short term traders or day traders that will want to make quick profit from the sharp increase in crypto prices.

2b... How can a trader can manage risk using an OCO order( technical example needed)

The OCO is grouped under the pending order. It is a key role of the OCO order to limit and manage risk. It functions by allowing two trades to be placed at a goal, if one other is closed or executed, the other order cancels automatically

(

Giving a clear picture to this study using the ETH/USD cryptocurrency.

A trader that is not sure of the next movement of the Cryptocurrency can place a sell limit order of $3700 and a stop limit order of$3500.

This means that if the price if ETH/USD gets to $3700, the sell limit will be executed and the stop order will be cancelled or aborted, but if the price drops to $3500 due to factor like volatility, the stop order is executed and the sell limit order is aborted

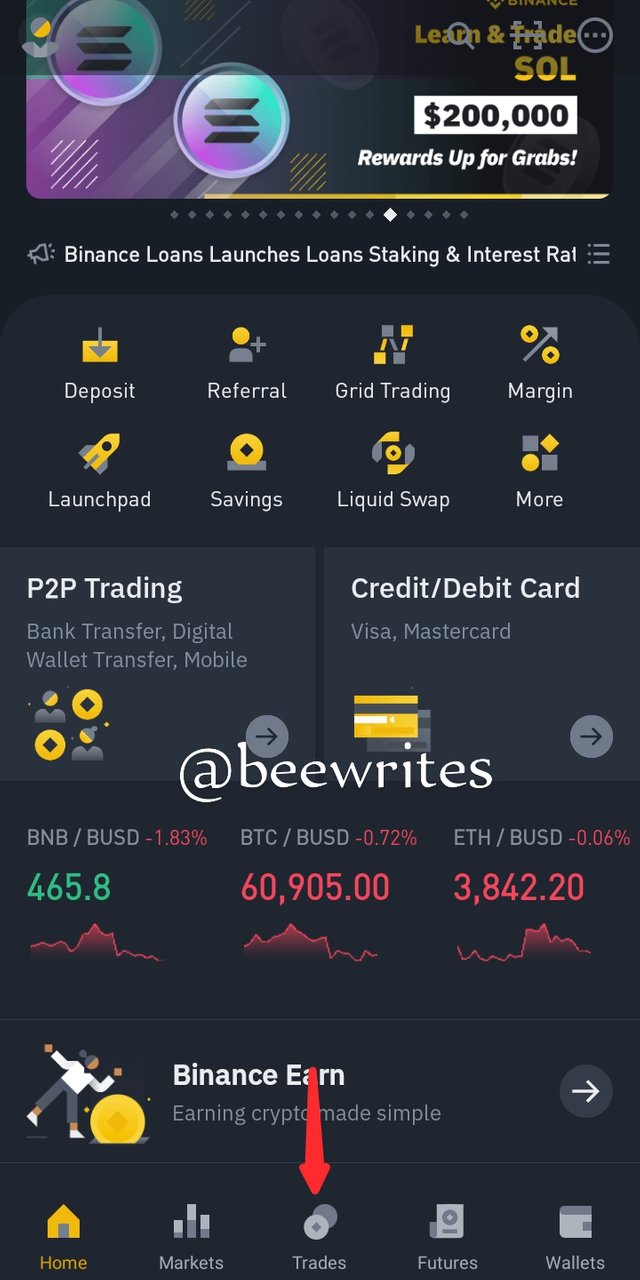

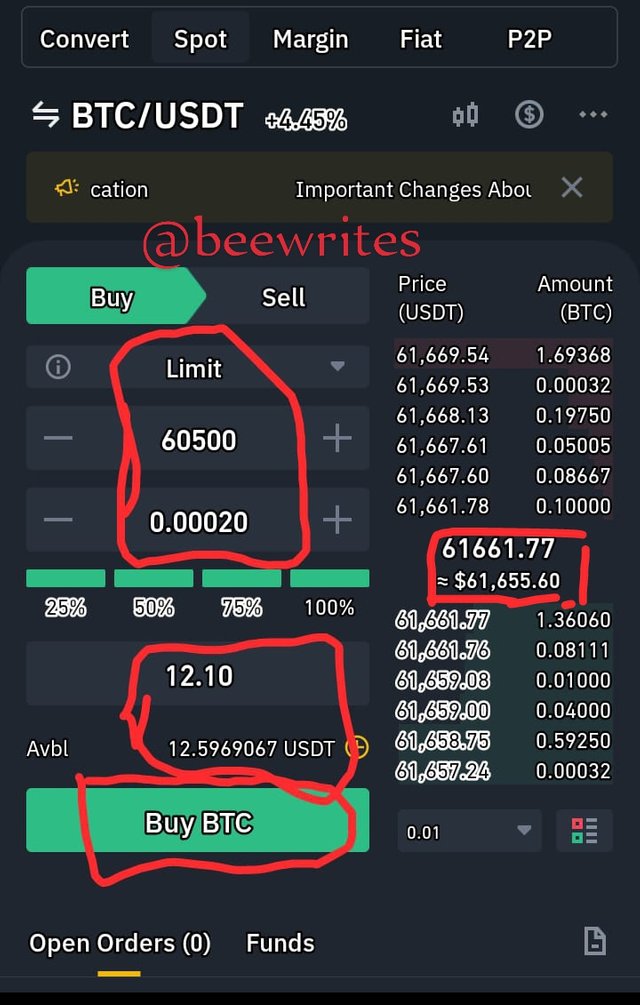

3.. Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed (screenshot needed from any cryptocurrency exchange)

To answer this question, I'll be using the Binance exchange. I'll also be using the BTC/USDT Crypto asset to make my trade.

Here are the steps to follow

• I logged into my binance wallet and clicked on the trade icon

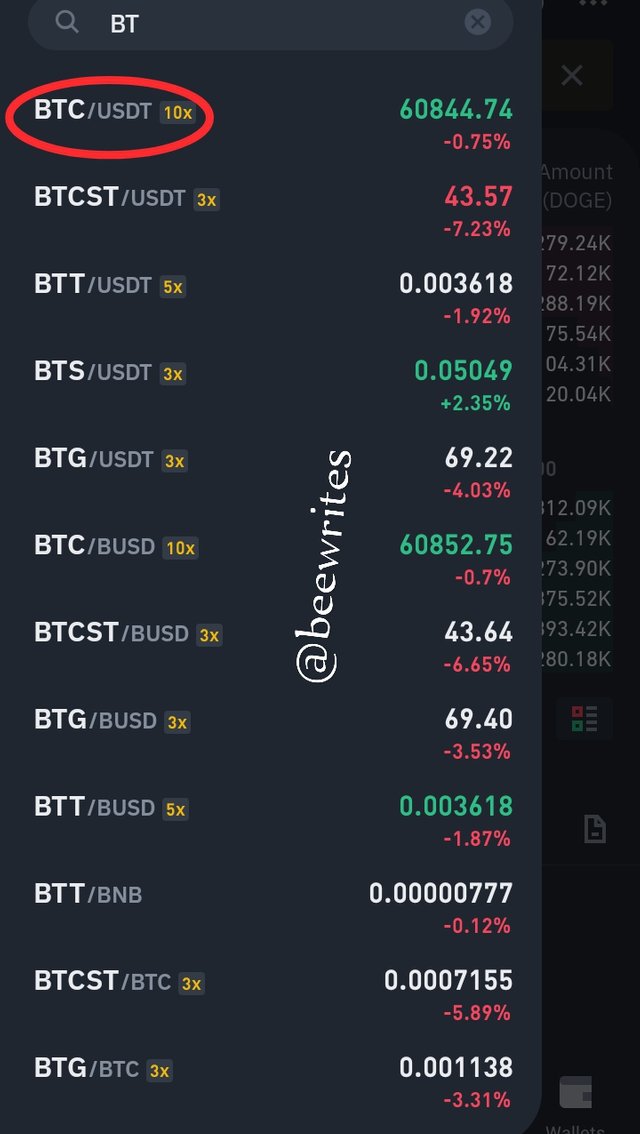

•Then I searched the Cryptocurrency I'll like to use

I will be using BTC/USDT

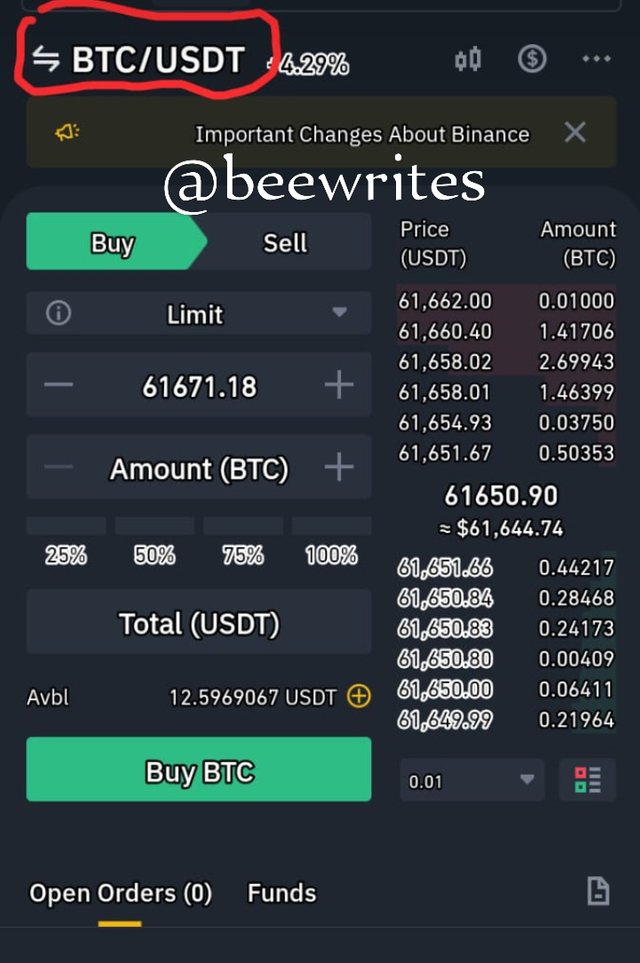

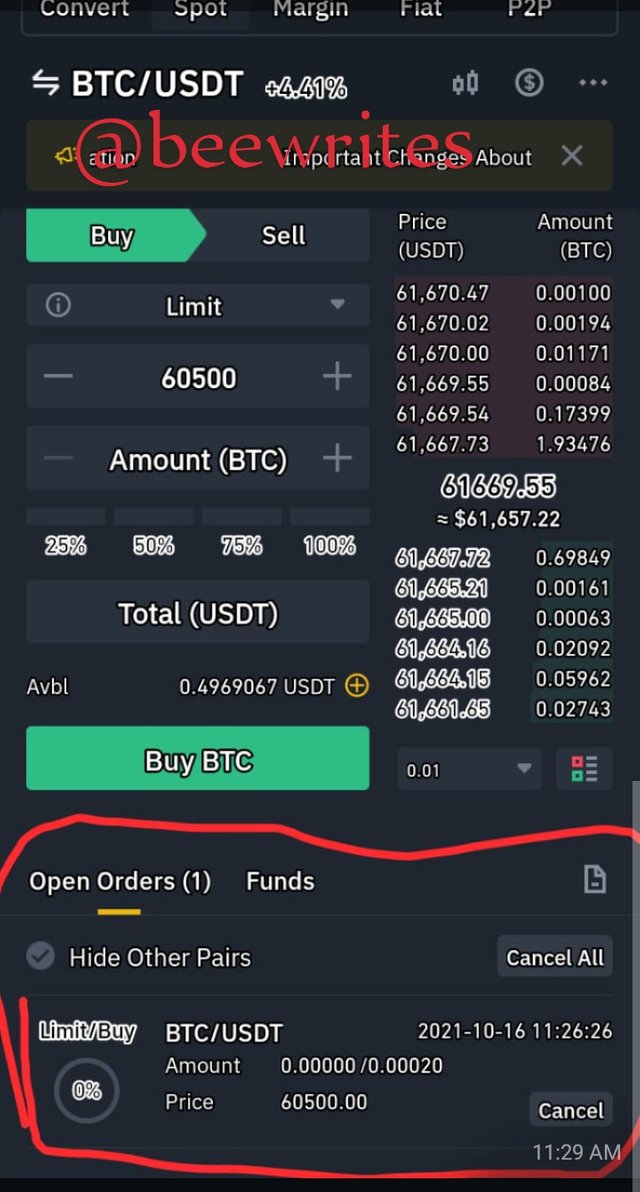

• I reset my trade from the market order to the limit order. I will be trading with the buy limit order because I intend making a buy order

• I will reset the price to the price suitable for me. I want to buy less than the current market price of $61661.79. I placede a buy limit order of $60.500

•The buy limit order has been placed successfully. The trade won't be met until the market price tallies with the buy limit price and even lesser

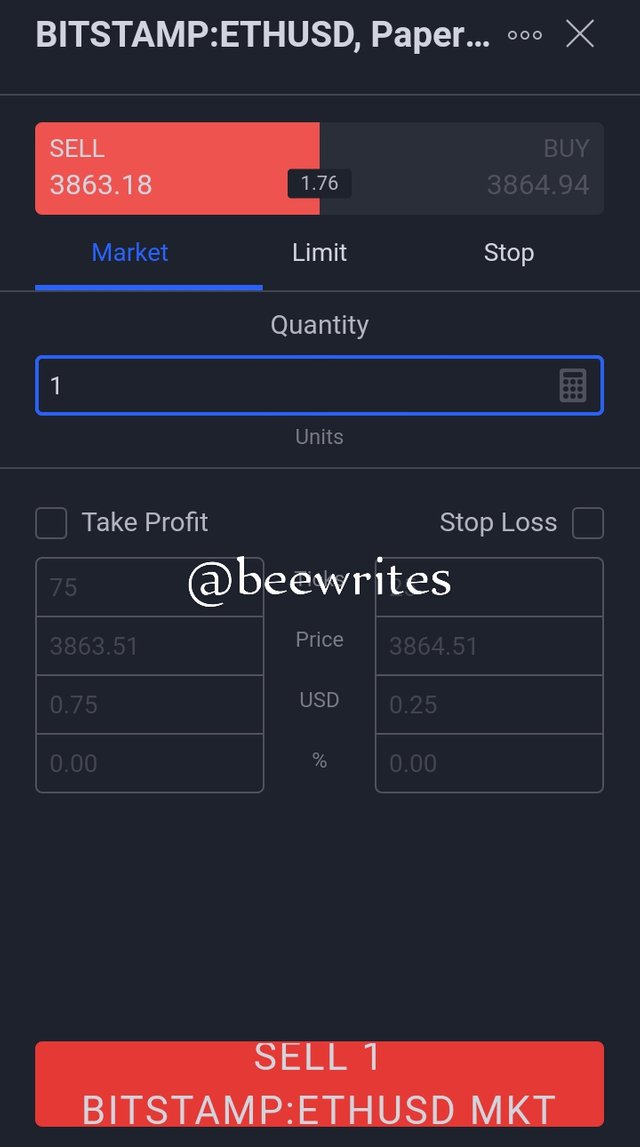

4.. Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected

i.. Why you chose the Crypto asset

I will be using tradingview.com to give answers to this question.

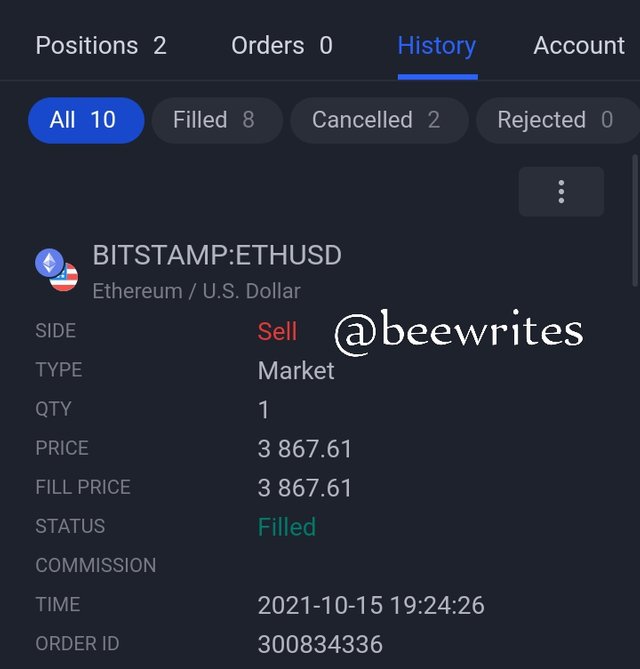

A sell order has been placed for 1 ETH for $3867.61

I am using Ethereum for the reason being that the Cryptocurrency is very popular, infact, it is the second most popular cryptocurrency after Bitcoin. Also, the versatility of Ethereum is another advantage. Ethereum is very broad and vase, it has a token called Ether and also smart contracts and Decentralized Application (Dapps). To deepen further into this, Ethereum has proven to be one of the fastest growing Cryptocurrencies, it started in 2015 with as low as $1 and some cents, but as of 2021, Ethereum has risen to $3700. That's by far a huge growth

ii. Why you chose the indicator and how it suits your trading styles

I used the Bollinger Band Indicator

The Bollinger Band Indicator is a Volatility Based indicator. Since Cryptocurrencies are known for it's high volatility and unstableness in market prices per time, this Indicator is helpful in the management of such occurance.

The Bollinger Band Indicator tells you the movement of the market, when the market is loud or quiet(down or up) so as to guide the trader to trade profitably. It gives the trader a better insight on when to enter a trade or exit a trade.

The Bollinger Band Indicator is made of 3 lines, the middle is the simple Moving Average, while the top and bottom lines are the upper and lower Bolling lines respectively

iii. Indicate the exit orders (screenshot required)

The exit orders

✓Conclusion

Trading Cryptocurrencies are no new word in the Crypto world. However, it is worthy of note that trading done ignorantly can lead to a severe loss, therefore it is adviced to get a level of knowledge before trading. A demo account can be used to practice everything you have learnt.

Thank you Professor @reminiscence01 for this teaching

Hello @beewrites, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Professor @reminiscence01.

The grade made me smile.

I will keep putting more efforts

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit