![AddText_10-28-12.20.38[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmX4XgPRnCQtvZZBobRvUwDC2twjZQGVKsdtRYUxqE24td/AddText_10-28-12.20.38[1].jpg)

Define and Explain in detail in your own words, what is a "Trading Plan"?

From the words forming the term TRADING PLAN we can conclude that it has something to do with planning in your trades. In my own understanding TRADING PLAN refers to the laid down principles or conditions put together by a trader in order to have full control over his actions in the market as to whether to buy or to sell. When these laid down conditions are met by the market behavior the trader then triggers the necessary action. In other words Trading plan is a set of rules or regulations that you set for yourself to serve as a guideline to you in performing your trades. Trading plan includes a variety of factors one of which is the capital available to used fir the trade and when to enter or exit a trade.

Explain in your own words why it is essential in this profession to have a "Trading Plan"?

Being a trader in cryptocurrencies means will require that you have a well versed plan in order to be a successful trader as the saying goes: He who fails to plan, plans to fail. Cryptocurrencies are very volatile and hence can make you rich within a second and at the same time can also make you bankrupt with a second. You need a trading plan because it will help you know what type of a trader you are and what type of trades you should enter. It helps you maintain focus on your trading objectives. Having a trading plan makes you trade consistently without putting in emotions which will certainly make you earn some profit. With a trading plan with a proper risk management losses can be managed hence we stop losses at the time we will not loss every investment. With a good trading plan you may decide to develop a portfolio of different assets which will make it very difficult for you to loss all investment. In short with a good trading plan losses are mitigated and profits are made which is the aim of every trader, and that is what makes trading plan essential to traders.

Explain and define in detail each of the fundamental elements of a "Trading Plan"

Capital management refers to the practice of critically analyzing the amount of money you are using in the trade and setting out percentages of that said amount you are willing to lose in that trade. I will personally be willing to lose a maximum of 1% of my initial capital this will mean that the moment I enter a trade with say $ 20 the minimum maximum loss I will be willing to take is $2 so immediately the price of the asset I invested in drops to that point I will initiate a sell order. In capital management we also set for ourselves the maximum profit we expect to make from an entry. The percentage of interest we normally set for ourselves is always more than the percentage we are willing to lose. We also set aside the days we are willing to be in active trade as part of the capital management.

Crypto trading is a very risky business to do so you need to have a way to manage your risk. You manage your risk by setting for yourself the number of losses you are ready to accept in a day so that in a case where you reach that number of losses in a day no matter the time of the day I quit trading for the day. That is if I choose to take 3 losses a day and in a day I encounter 3 losses during my first 3 entries I will have to stop and continue the next day.

This refers to the commitment w make to our already laid down rules and regulations. We need to stay disciplined once we enter the crypto market. We shouldn’t allow emotions to take over our judgments in the crypto market. Have a positive psychology in trading is very key to be successful. You need to to stay by your rules under risk management and capital management. When you get you targeted percentage profit you don’t become too complacent and decide to still hold on but you withdraw and the vice versa.

This refers to the practice of planning how much you will be willing to invest after every successful entry in order to maximize your interest. This is where you strategize how to reinvest whether you reinvest the initial capital together with the interest or not. You may plan to carry out the compound interest strategy also known as roll over where every profit together with the initial capital is reinvested to make more profit.

PRACTICAL

- Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of ‘

“Binance”, taking into account that the minimum amount of exchange or investment is $ 10.

Lets assume I want to start trading on Binance with $50

CAPITAL MANAGEMENT

As indicated above I will be will be entering the market with $50 with an allowed percentage loss of 1% which will translate to $0.5 this will mean that with any trade I open with $50 I will be willing to loss a maximum of $0.5 and my percentage profit for my endeavor will be set at 3% this will mean that I will be ready to accept a profit of $1.5 per each entry I make with $50. My capital management ratio will be 1: 3 in this case.

I will be running my trade from Monday to Friday which makes it 5 days in a week.

RISK MANAGEMENT

I have a total of $50 ready to be used to trade. I will be opening 5 trades in a day each at $10. With my risk management plan I will risk to loss 2 trades. So in a day where I lose up to 2 trades I will close for the day. This will management the risk of losing all my money.

TRADING PSYCHOLOGY

Going into this trade I my psychology is to remain consistent and focused on my goal. Being consistent will mean that I will stick to the routine I will design for myself.

I will not enter a trade against my conscience, this means that if I’m not sure about a trade I will not open it.

I will at least make a full comprehensive fundamental and technical analysis of an asset before I enter into a trade.

I will stick to my capital management plans that is exit a trade when I’m losing 1% of initial capital and also taking profit when I have gotten a 3% profit margin without being complacent.

PLANNING MY ACCOUNT.

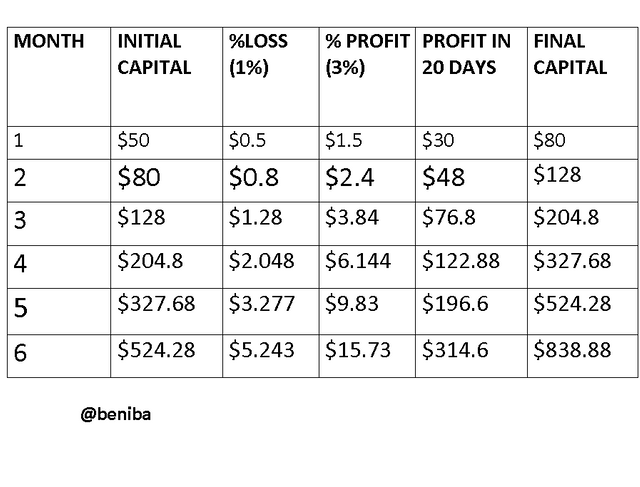

I have decided to start my trade in the first month with $50 and then practice the compound interest model of trading where all the profit made during the month is added to my initial capital in the following month. At the end of the 6 month spell with my initial capital of $50 I will be expecting to have $838.88 at the end of my 6 months trade.

CONCLUSION

Being a good trader will demand that you develop a very good trading plan and remaining very commited to your plan. Developing a trading plan you need to understand all the components of a trading plan which are:

Risk management.

Capital management

Trading psychology

Controlling of account.

A trading plan that has all these components fully laid out means a commitment to be succesfull. Thanks to professor @lenonmn21 for this great lecture.