In your own words, explain the psychology behind the formation of the following candlestick patterns.

• Bullish engulfing Candlestick pattern

• Doji Candlestick pattern

• The Hammer candlestick pattern

• The morning star candlestick pattern

• The evening star candlestick pattern.

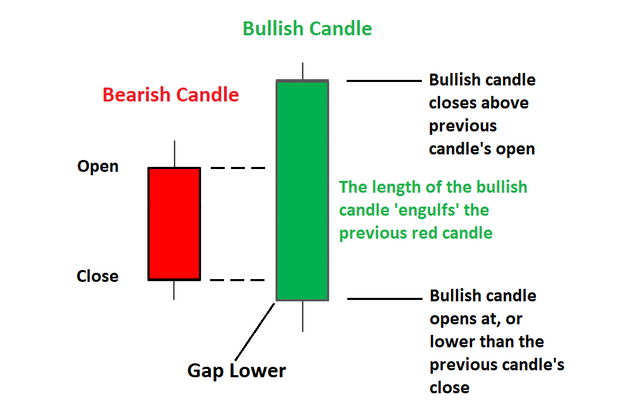

BULLISH ENGULFING CANDLESTICK

This is a type of pattern that occurs between two candlesticks with the second completely overshadowing the first. It occurs when the second candlesticks closes at a price that is higher than the opening price of the previous candlestick. This pattern. In most cases this pattern always causes a reversal in the trend. As it name suggest it always triggers a reversal of a downtrend to form an uptrend. This signals that buyers have set into the market hence causing the price to rise. When a bullish engulfing pattern occurs in the middle of an uptrend it suggest that there will be a strong continuation of the uptrend. The shows that buyers have now taken control over the market.

DOJI CANDLESTICK PATTERN.

This is a type of candlestick pattern that suggest that there was an instance of indecision between both buyers and sellers hence making the opening price and closing price virtually the same. It is derived from the japanse word “doji” which means mistake. A doji may be referred to as a reversal trend if it occurs at either a resistance or support level.

• When a doji pattern occurs in a resistance level area it will cause a reversal of trend that is the uptrend will be reversed and a downtrend will be experienced. This type of doji pattern is call GRAVESTONE DOJI CANDLESTICK.

• When a doji pattern occurs in support areas it will cause a reversal of trend too, the downtrend will be reversed and an uptrend will now be experienced. This is also called DRAGONFLY DOJI CANDLESTICK.

HAMMER CANDLESTICK PATTERN.

This is a type of candlestick in which the opening and closing price is almost equal. They can be very instrumental in technical analysis especially when it occurs at the support and resistance levels. Examining the structure of a hammer candlestick you will notice that it consist of a small body because of the small price difference between the opening and closing price and a very long wick which shows that at there was a price rejection by buyers. It often triggers a reversal especially when it occurs in the support areas.

Some times to a hammer can be formed in an opposite direct where the low, opening and closing price are just around a certain figure. This usually occurs in the resistance level and triggers a reversal from an uptrend to a downtrend. This type of hammer is called an INVERTED HAMMER.

THE MORNING STAR

This is a type of bullish reversal pattern. It is made up of a bearish candle which suggest that the market is being controlled by the sellers. The second candlestick is a Doji which exposes the indecision of buyers and sellers and suggest that a reversal is about to occur. The last component of a morning star is a bullish candlestick which engulfs the doji stick and this tells us that buyers have set into the market and are pushing the price up.

This means that there is going to be a trend reversal where the buyers will take over from the sellers and cause an uptrend to occur.

THE EVENING STAR

This somehow opposite to the morning star pattern.it is a strong bearish reversal pattern. The evening star pattern begins with a bullish candlestick which indicates buyers having control over the market of a given asset the next candlestick is the Doji candlestick which shows the inability of both buyers and sellers to control the price of the asset then finally a bearish candlestick appears and engulfs the doji candlestick which indicates that sellers have gained dominance over the buyers in the market. The evening star normally occurs at the resistance levels and causes a reversal of trend. This brings about the formation of a downtrend.

Identify these candlestick patterns listed in question one on any cryptocurrency pair chart and explain how price reacted after the formation. (Screenshot your own chart for this exercise)

BULLISH ENGULFING CANDLESTICK PATTERN

From the chart displayed above a bullish engulfing candlestick was formed after a downtrend was experience but after the formation of it the price experienced an uptrend till it reached the resistance level the dropped again

DOJI CANDLESTICK PATTERN

Viewing from the chart above I noticed that the doji candlestick formed at the support level after which the priced bounced back and saw a rise.

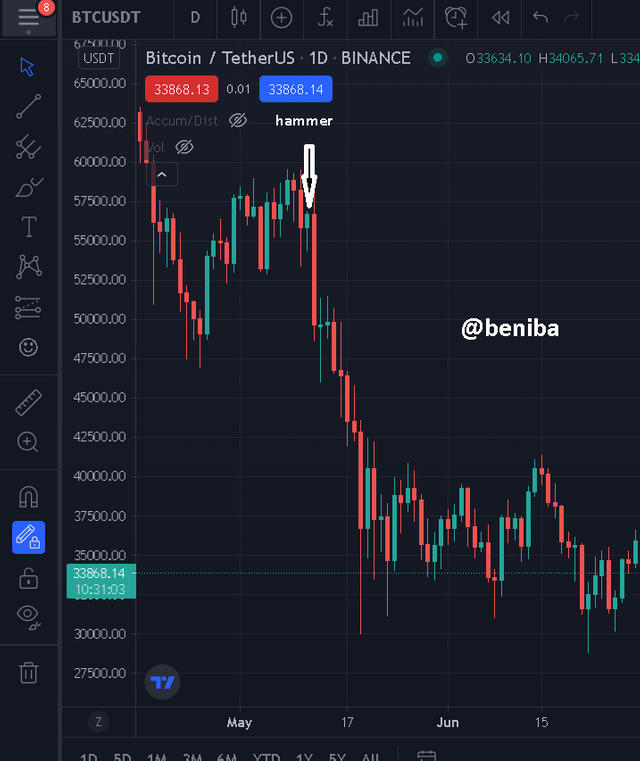

HAMMER

In the chart above the hammer was formed which showed a struggle for a control but there was so much pressure from sellers so the price dropped and formed a downtrend.

MORNING STAR PATTERN

From the chart above a morning star pattern was formed around the support level and then the buyers took over the market so the price saw a rise which caused an uptrend to be formed.

EVENING STAR PATTERN

From the chart above it is seen the an evening star pattern was formed after an uptrend which showed the takeover of the market which saw a downtrend formed as a result.

Using a demo account, open a trade using any of the Candlestick pattern on any cryptocurrency pair. You can use a lower timeframe for this exercise.(Screenshot your own chart for this exercise).

For the purpose of this assignment i used trade view. the place i marked with the rectangle showed a morning star so i will start my trade after that pattern and take profit after the price hits the resistance area.

The lecture has really being very helpful because i know that when a doji appears in the resistance or support areas a reversal of trend is expected. i also know know that morning star pattern shows a transition from sellers dominance to buyer dominance. thanks to professor @reminiscence01.

Hello @beniba,I’m glad you participated in the 4th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

Please remove all images with watermark. Always use images with copyright free sources.

Recommendation / Feedback:

Thank you for completing this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for review will be removing them shortly

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit