Hello Steemians,

Welcome to Steem Crypto Academy Season 2 Week 1.

I will be Comparing EOS AND NEO in my homework task

EOS

The blockchain platform EOS was developed by Block.one after an ICO that lasted a whole year (from June 2017 to June 2018) with a resounding success. The new cryptocurrency caused a stir among investors, as demand was constantly fueled by numerous marketing activities. Excessive financing of a project often attracts criticism from specialists and ordinary users. The capitalization of EOS today is almost $ 2 billion, and the team seems to be making every effort to meet the expectations of investors.

However, the platform is still far from perfect. Until now, there are no official graphical programs for managing nodes - all tools are aimed at developers.

The architecture of the EOS network itself has also been criticized. As with other similar platforms, the Delegated Proof of Stake (DPoS) consensus is designed to deliver the stated transaction processing speed, sacrificing the principles of decentralization. In EOS, all network participants automatically select a small group of high-performance nodes every day to create blocks. These nodes are called validators - there are currently 21. After 24 hours, these powers are transferred to the next group. In this way, the network constantly optimizes the speed of transaction processing. EOS Boasts 4000 TPS Peak Performance Based on Load Test Results... Moreover, this record was achieved at the stage of launching the network in 2018, and at the time of this writing, the load on the network can be described as low.

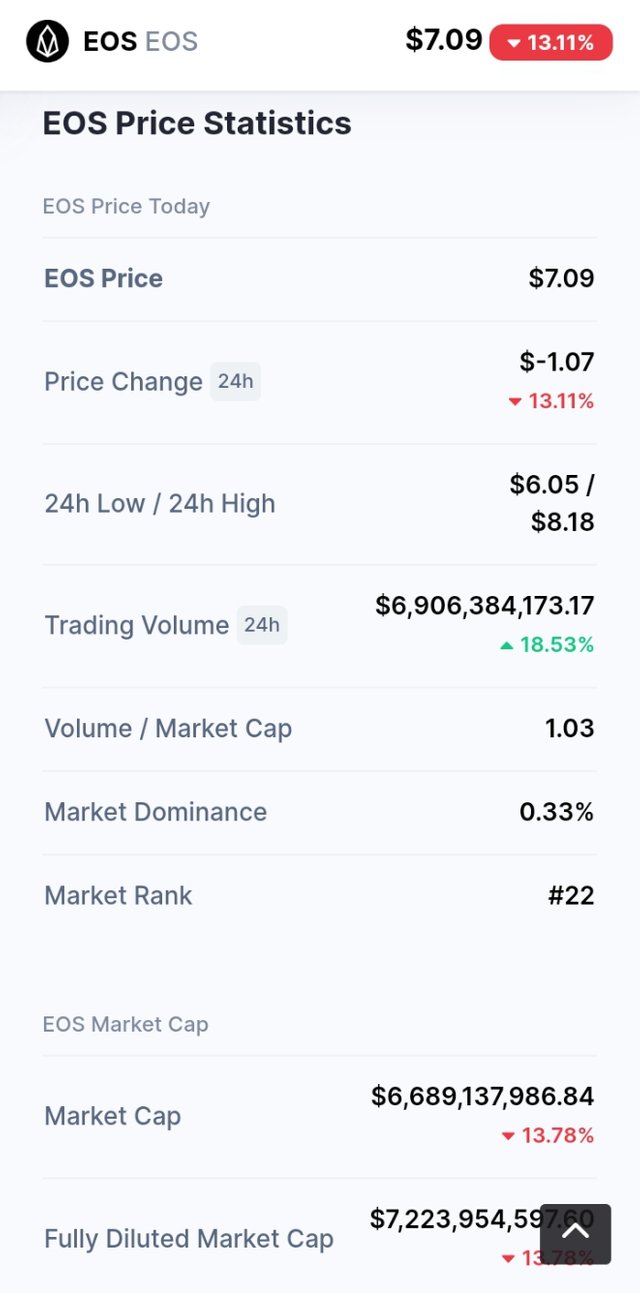

More than 90% of the one billion EOS is already in circulation. The cost of the coin is about $ 2, it rises and falls after bitcoin and is generally of interest, mainly for believers in the project.

NEO

According to BitcoinWiki, the project started in 2014 in China, when it became clear that Bitcoin and Ethereum were experiencing scaling problems. Neo is a decentralized and at the same time fast enough digital asset management protocol for its time. It provides registration, storage, transfer, trading, clearing and settlement through a peer-to-peer network.

Neo uses the Delegated Byzantine Fault Tolerance (dBFT) consensus. In principle, it is similar to the DPoS algorithms described above and differs only in the conditions for voting participants and nodes that are selected to generate blocks.

Released in June 2019, dBFT 2.0 enables the Neo public network, where block generation takes no more than 15 seconds. If a transaction is confirmed by delegates and is included in a block, then it is considered complete and irreversible.

Neo is often referred to as "Chinese Ethereum", apparently due to its ability to issue its tokens and conduct ICOs. NEO smart contracts can be written in any programming language, since access to network resources is carried out via API. Consensus algorithms, properties of cryptocurrencies of projects and principles of their distribution differ.

There are two basic tokens in the Neo public network: NEO and GAS. They have different properties, different purposes and different emission volumes.

NEO is positioned as a cryptocurrency to represent the value of the project itself. The smallest unit is 1 NEO. No fractional parts. Within the network, NEO can be used as a basis for voting on the future of the blockchain, as well as for receiving GAS for generating new blocks or for maintaining the network.

GAS are more like money. They serve to support the functioning of the network and pay commissions. Unlike NEO, GAS can be split. The emission volume is also 100 million, but it is generated gradually. Initially, when adding each new block, 8 GAS is created, but the production speed decreases by 1 token for every 2 million blocks generated.

Comparison between EOS and NEO

i.) NEO is compatible with government regulations; while EOS focus on scaling.

ii.) NEO is developed for the future; while EOS, so far nothing concrete, but this is a "project under development", which may no longer be of interest to investors.

iii.) NEO cooperation with OnChain - great potential for NEO; while EOS creates greater convenience for developers, allowing them to create applications.

iv.) NEO speed: 10,000 transactions per second, while EOS does not require computing power.

v.) In NEO The presence of two tokens (NEO + GAS) is a great advantage when using the Proof-of-Stake protocol; while EOS has ease of implementation (in theory).

vi.) In NEO lack of anonymity (a necessary evil for government regulation); while EOS has no restrictions on fundraising, and therefore the project can be greatly overestimated.

vii.) NEO technology was quite disruptive for 2014, but in terms of transaction confirmation speed and performance, this platform is inferior to EOS which demonstrate excellent performance.

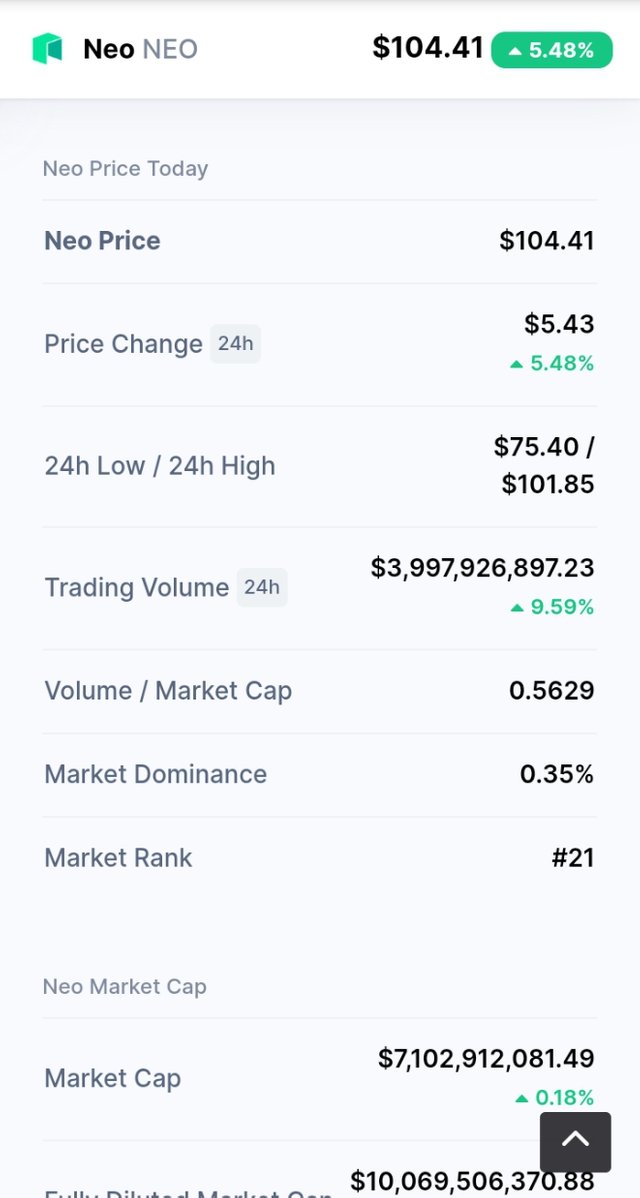

viii.) NEO is currently ranked 21; while EOS is ranked 22 base on market capitalization.

Thanks for reading my post.

Special thanks to Prof @alphafx for this week lecture.

Scoring

Thanks for participating.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit