Hello, welcome to Steemit Crypto Academy Season 5, Week 8.

It is another great chance to learn. Thanks to Prof @fredquantum.

Discuss Dark Pools in Cryptocurrency in your own words. How does the dark pool works?

Dark Pools has been in existence before the creation of the cryptocurrency. The dark pool was used even as far back as the 1980s. A dark pool is simply a private place where financial exchanges are being done that is different from the general public. It stayed a very long time before it was introduced to the crypto world because of its privacy.

It was later introduced in the crypto world, so in the crypto world Dark pools are also private platforms that the crypto traders normally used, which is used to trade an asset at a chosen price, which is chosen by the traders and this will not be affected by any form of slippage as a result of Volatility of the crypto asset and other factors.

In the Dark pools, which is a totally different platform that is mostly private, traders usually place huge crypto orders, and it is usually unknown by the public.

How Crypto Dark Pools Work

This normally works as a result of traders placing some limits orders, usually a large amount. Limit orders include the likes of sell stop, buy stop, buy limit, sell limit, and others. These orders are placed by the traders in view that the orders will be executed once the price gets to the place. The above-mentioned limit order is mostly seen in the public order book. In dark pools, you can not see the limit orders on its public order book. In dark pools, the order is mostly invisible and on its own.

When large orders are being placed by a trader, they are matched to order with that same price. There is a concept called BLOCK TRADING, this is where the placing and the matching of the orders are being met. This happens because of the big amount of assets that is been transacted. In Dark Pools, one of its advantages is that Slippage is normally avoided. And the Dark pools also create a room for privacy that allows the traders to only see what they are trading.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

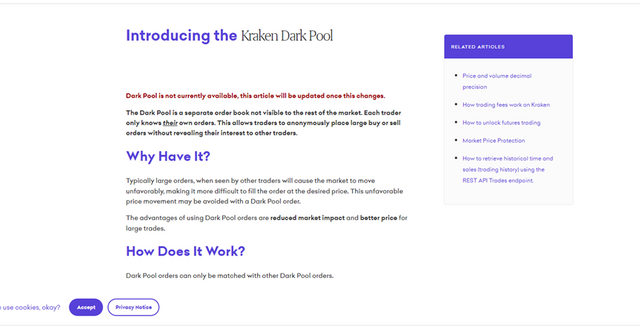

In this particular question, I will be discussing the Kraken. The Kraken was been ran by a US-based crypto exchange and it was founded by Jesse Powell in 2011. The Kraken exchange offered the Dark pool service in 2016, this made it the first platform to run Dark pool. The Dark pool has a list of 95 cryptocurrencies, for now, that are available for trading. Though the Dark pool began with Ethereum and bitcoin was introduced in 2021.

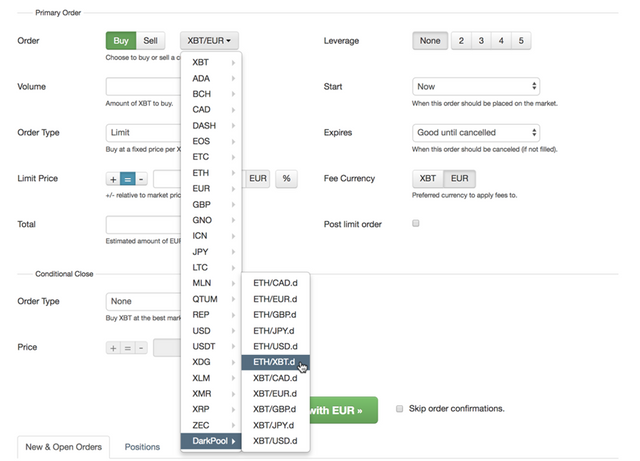

For users to place orders using Kraken’s Dark pool. There is a list of conditions that must be correctly followed. Failure to accurately follow the Kraken’s Dark pool condition that you can not place any limit order. But if you follow the conditions properly, then you can place your limit orders in the Kraken Dark pool. When the limit orders are placed, it automatically matches the order, with other orders and at the same price level.

Due to the fact that there are the same trading fees, you can hardly know if it's a Market maker.

The dark pools is unavailable at this time

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

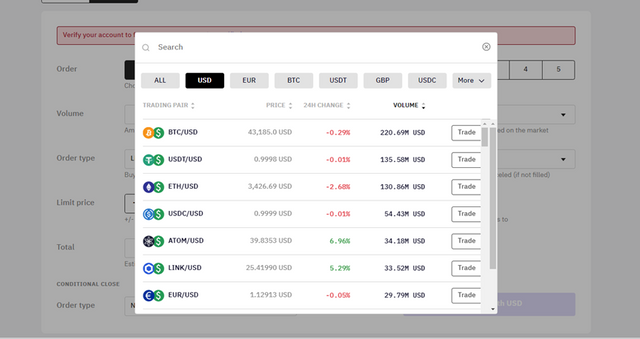

The assets that are supported on the Kraken Dark pool includes Bitcoin and the Ethereum

Ethereum pairs:

ETH/CAD

ETH/EUR

ETH/GBP

ETH/JPY

ETH/USD

Bitcoin pairs:

BTC/CAD

BTC/EUR

BTC/GBP

BTC/JPY

BTC/USD

What are the requirements for getting involved in dark pool trading on the platform?

From the official website of the Kraken, the requirements are as follows.

- The first requirement is for you as a client or user to be verified to the Pro Level.

- $100,000 USD is the minimum order size for the Bitcoin

- $50,000 USD is the minimum order size for the Ethereum

- Market orders are only the limit orders in the Kraken service.

Fees Attracted in Kraken's Dark Pool

Users have a 30-day trading volume, this affects the fees you will be paying. In the Kraken exchange, the more clients make trades on the platform, the lesser the chat will be. In Kraken, the fees fall between 0.20% to 0.36%

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

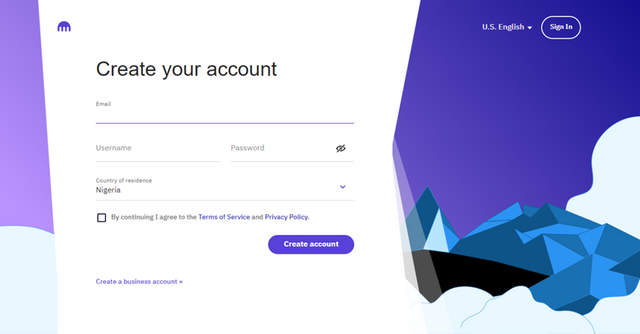

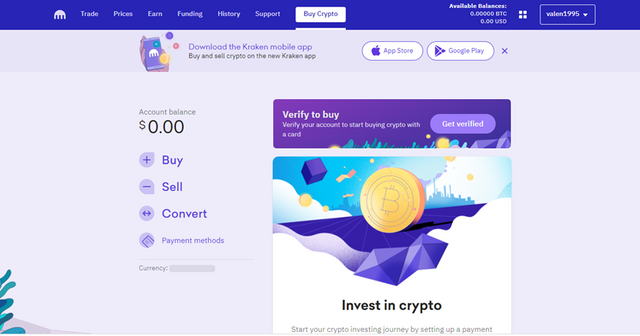

- For you to perform block trading, the initial thing you will do is to have an account with them by creating an account.

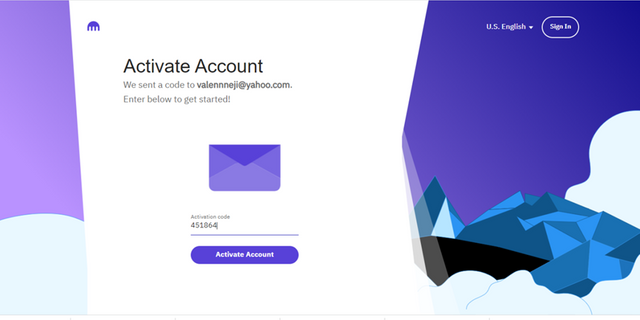

- Put in all the required details, then feel in the code sent to your email to activate it.

- The Kraken exchange platform that just opened completely.

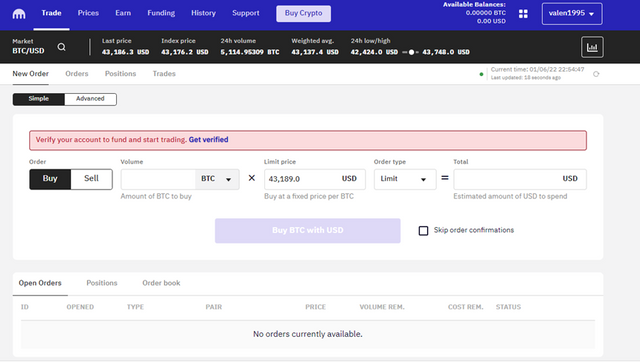

- Go to trade and click new trade.

- These are the lists of the cryptocurrency present at the Kraken.

Due to the unavailability of the Dark pools, there is a screenshot of how it looks that is on their website, and below is the image

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

A decentralized Dark pool is simply when the block trading is been done on the decentralized exchange that hides all the presence of any other party or even the third party in all your transactions that is been done in the dark pool, which improves how secured the dark pools is being decentralized as compared to the centralized exchange.

In a Decentralized Dark pool, the identity of the user is being hidden, so there is no KYC verification for the user in the platform, you did not need to bring your personal information of any kind. In the Decentralized Dark pool, traders do their transactions in large amounts and there is no third-party monitoring their activities. With The Decentralized Dark pool, Dark pools become more private.

In the Decentralized dark pool, trades are not carried out on the liquidity pools, but it depends on the Atomic swaps that is peer-to-peer transaction that is done across blockchain.

IN decentralized dark pools, when a large order is placed, it is normally split into smaller pieces so that it can easily get matched. The Node in the blockchain will receive the smaller piece and there will be a competition among the nodes for who to match them.

What do you understand by Zero-Knowledge Proofs?

In 1985, Shafi Goldwasser, Charles Rackoff, and Silvio Micali were the first people to explain the Zero-Knowledge Proofs, which is also known as the Zero-knowledge Protocol or the ZKP. The ZKP is simply used to check the genuinity or the authenticity of any transaction that is being done on the dark pools.

In the Zero Knowledge Proof, there is a prover and the Verifiers. The Prover needs to be proven but he has the information while the Verifier verifies or check the authenticity of the prover.

What made the Zero-knowledge proof more unique can be summarized with these three characteristics

- The Prover does not provide any personal information about himself.

- The prover should be able and willing to persuade the verifier about the information he has provider

- Failure for the prover to persuade the verifier about his information then his transaction will remain pending.

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

We will be discussing the Ren protocol, which initially was the Republic protocol and later renamed the Ren Protocol. Loong Wan and Taiyang Zhang formed the Ren Protocol in the year 2017.

The Ren Protocol is one of the Decentralized dark pool projects, that used the Atomic swap in the concept of Dark pool. The Ren Protocol uses a special tool called The Shamir secret sharing, to break down the order that is being placed and it further distributes it to a different network that has Dark nodes. Then the Registrar and the Judge will then be sent by the Ethereum smart contract to process the transaction.

Immediately the breaking down and the sharing of the order is completed by the dark nodes, the proper arranging of the nodes will be carried out by the registrar. The shared order will now be matched with the help of nodes with another order.

The duty of the judge is to check the authenticity of the order by the use of Zero-Knowledge proof. The Atomic swap will be introduced into the crypto assets after the completion by the judge.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

I will be comparing the Kraken exchange which is a centralized exchange dark pool with the Ren protocol which is a Decentralized exchange dark pool.

- In Kraken exchange the identity of the user is been known and submitted by the use of KYC while in Ren Protocol, your personal information is not needed, that is why it is decentralized.

- In Kraken exchange, no nodes are needed but in the Ren Protocol nodes have a lot of important functions.

- In Kraken exchange, there is nothing as Atomic swap, because in a centralized dark pool orders are being crossed while in the Ren protocol, the bond between the traders is being done by the Atomic swap.

- Kraken exchange can view the orders of the traders while in the Ren Protocol, nobody can view the trader's orders.

- In Kraken exchange, the orders are not broken down into smaller pieces but in the case of the Ren protocol, the orders are broken down for the purpose of matchmaking.

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales??

On the 20th of July 2021, bitcoin sold a very large quantity, you can see it from the chart at Tradingview.com. The Bitcoin fall from $60,000 to $29192.59 in a space of 3 months.

For me, a market order was placed by the whale investor, he might have seen that the traders have seen a particular limit order that is on the order book and he knew that they would not sell off and surely, no execution of trade for him. The fall started from May 2021 until the month of July and it began to rise. Huge sale truly affects the market, Million dollars are lost and most investors will begin to remove their funds, and this in return will cause a further fall of the price even more.

The whale investors could have used the dark pool to do a proper transaction. The dark pool could have helped the whale to place a proper limit order in the right place.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

When the buy is very large, traders tend to put their money on that particular asset, and in turn, the market cap will be increased and the price will also further go higher.

When also there is a very large sell order, traders tend to withdraw their money from that particular asset and there will be a reduction in the market cap of that asset and the price will definitely go down, making the value of the asset reduce further. This shows that the principle of demand and supply also exists in the crypto world. Where there is a higher demand for that assets, this will definitely make the price go higher and in turn, if there is a higher supply, the price of that asset will begin to fall down.

Knowing the fact that dark pools make our trade invisible in the order book. The makes the traders blinded to the large trades. Knowing this fact, no change will occur in the price of the asset because traders will not behave exaggeratedly because the supply and demand will be equal.

Normally, we know that the trades carried on the dark pool are usually large, which will affect the price of that asset. If a whale investor sells off 10000 BTC, it will greatly affect the smaller orders on the order books exchange, and due to this action, the supply will be greater than the demand leading to a further reduction in the value of the asset.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages

- With the Dark pool, slippage is prevented due to orders being placed at a convenient price associated with the limit orders

- There is a very high level of security and privacy if you use the Dark pools

- The mind of the whale investors are unknown by the general public.

Disadvantages

- The liquidity of the normal market is being reduced, when the whale investors use the dark pool

- The rate of transparency is very low, due to the order book not being visible

- Dark pool is mainly for traders with a huge amount of funds and if you have a small fund, it is not a place for you.

CONCLUSION

A dark pool is a really wonderful place to place your trade in anticipation that the price will reach there. You can place your trade which will be invisible to the order with the limit orders place alongside the trades, but trades are placed with a huge amount of money: mostly whale investors find their way there.

It was a really wonderful topic, I have learned a lot from it and I must thank professor

@fredquantum for the interesting topic. Expecting more from you.