Hello, welcome to Steemit Crypto Academy Season 5, Week 7.

It is another great chance to learn. Thanks to Prof @sapwood

Discuss the various features of Curve Finance? What are the different types of pools available in Curve Finance? What are the major DeFi protocols Curve is integrated with? How does Curve Finance improve the second layer utility of a token of a different protocol?

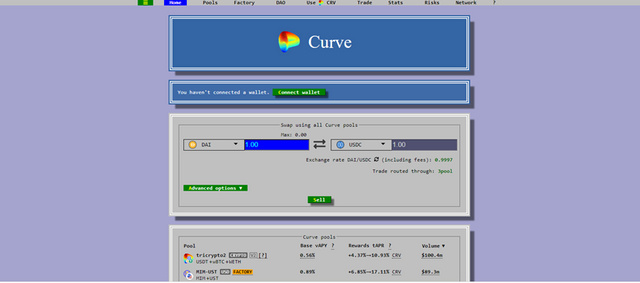

The Curve finance is similar to the uniswap, it is a Decentralized exchange that is used for trading cryptocurrency assets in the market. The important features of Curve Finance include the liquidity pools and its interface, which is used for trading which includes lending and exchanging of cryptocurrency assets.

We can know about the features by going to its official website at Curve Finance

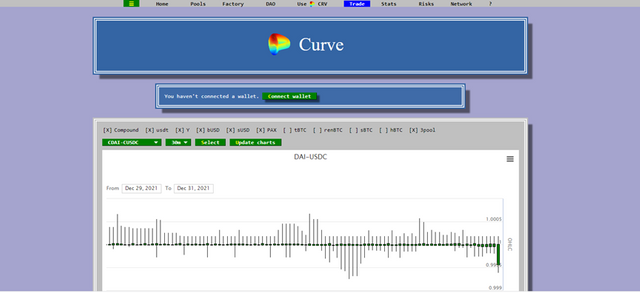

This is the interface of the Curve Finance stablecoin. The interface is made up of many features such as the CRV, Trade, Factory, pools Stats, Risks, Network, and some other. The trading platform can be seen below and its features

The trading platform on the Curve Finance is used for trading which includes buying and selling cryptocurrency assets, it is made up of different cryptocurrency pairs and even time frames, which you can adjust to suit you.. it is like the other trading platform with some difference. It has this graphical appearance, you can look from the chart above.

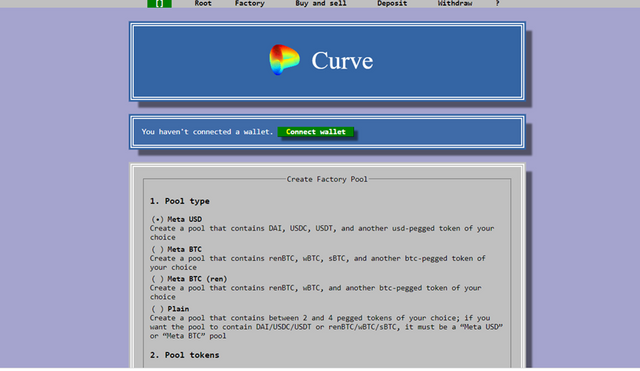

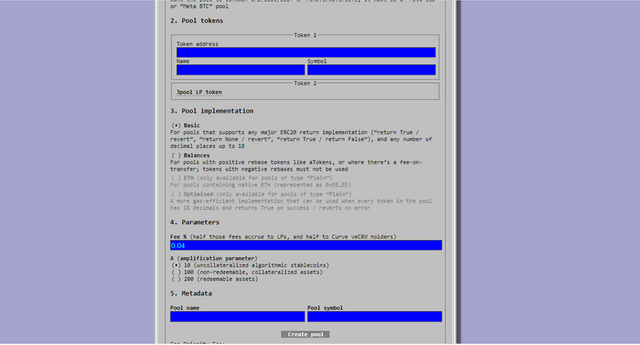

Another Feature I earlier mentioned is the Factory feature, it is a very important feature in the Curve Finance platform.

The factory feature is made up of pools and how to create and start your own liquidity pool. It has different sections like the pool type, pool token, pool implementation, parameter, and metadata.

The types of pools include

Tricrypto2, ren, 1usd, sbtc, CRVETH, 3POOL, STETH, UST, EURTUSD,LINK, FRAX etc

The pools are being categorized in the platform and these are some categories below

- TriPool: The Tripool is mainly known for its main stablecoins which are the USDT, DAI, and the USDC. The Tripool is also known as Plain Pools and it is the largest curve pool because of the list of stablecoin it has.

- Bitcoin Pools: This pool is mainly used to tokenize the Bitcoin and some pools on it include the wBTC, renBTC, sBTC, and hBTC.

- Lending Pools: These pools are used for lending and there is interest that is added for lending your crypto. Some of the lending pools include PAX, Y, BUSD, and compound

What are the major DeFi protocols Curve is integrated with?

Some major DeFi protocols that are integrated with curve include AAVE, Compound Yearn Finance, and Synthetix, and they are done in a way that if liquidity is being deposited, it can supply more liquidity to the liquid provider.

The pools are interconnected to others and this is possible due to the help of the Wrapped token pools. But if a problem happens in one it will affect others.

How does Curve Finance improve the second layer utility of a token of a different protocol?

This is done by the way the curve is being integrated with other major external DeFi protocols and transactions can be done across the different Dei Protocol which makes the Curve to be a single point DeFi that is used by the users.

This further gives you the opportunity to work with more than one platform. For instance, you can use the Compound platform for your lending and you can be given a DAI token which is not the native token of the compound platform. And there are many ways the curves have improved the second layer token. It all the platform to become one, and they all work in harmony.

What is impermanent loss? Explain with examples? How does Curve Finance mitigate this loss?

Impermanent loss is a special risk that consists of a liquidity provider that provides liquidity to 2 asset pools in DeFi protocol, in this situation, the difference is in value between the two depositing cryptocurrency assets that is done using the Automated Market maker Liquidity pool or it can also be done by holding them in your wallet. The Market-making algorithm is XY=K, which the X has to be equal with the Y.

For Example,

Let say that 1 Dot is equivalent to SOL in Uniswap, and I stake 10 DOT, in the Uniswap it will be 10 DOT-SOL in the exchange pair.

As time goes by the DOT is now 5500 SOL, that is the both of them are equal

Let say the X side is 1 DOT, then the Y side will be 5500 SOL

Let say in 29 days the DOT increase to 6000

But we should not forget XY=K where the X and the Y has to equal or evenly balance,

So the asset worth of the DOT will be 6000 + 1000 = 7000

What is the difference between constant product invariant and constant sum invariant? How does Curve Finance accommodate these two to offer a wider zone of INPUT/OUTPUT balance? How does it lower the slippage?

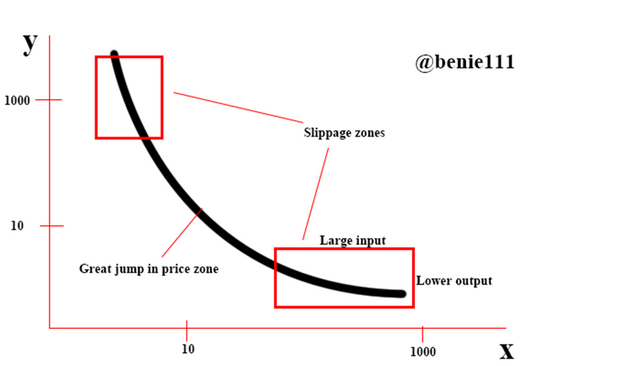

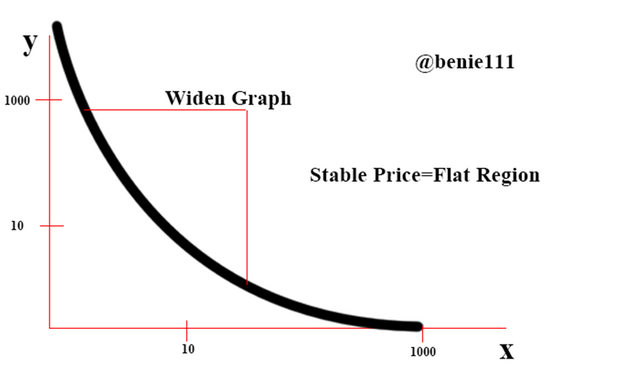

I said earlier that the Automated Market maker-based algorithm is XY=K where the K is a constant value. In the graph, it can be seen as this below.

From the chart above we observed that when the slippage zone is accessed, this normally leads to a very low output which is gotten through a very high cost.

They are slippage when we convert like $5000 USDT to BNB, there is usually some slippage.

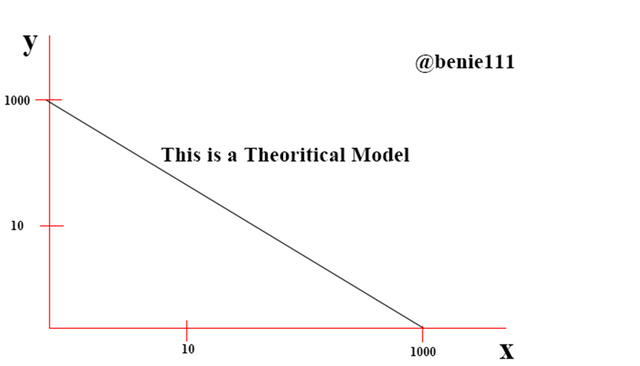

This formula X+Y =K is described with a very straight line and this is called a constant sum invariant which is mostly used by curve finance

When there is zero slippage and infinite liquidity, this is normally a theoretical model and the graph can be seen above. Most theories like this one do not apply in reality.

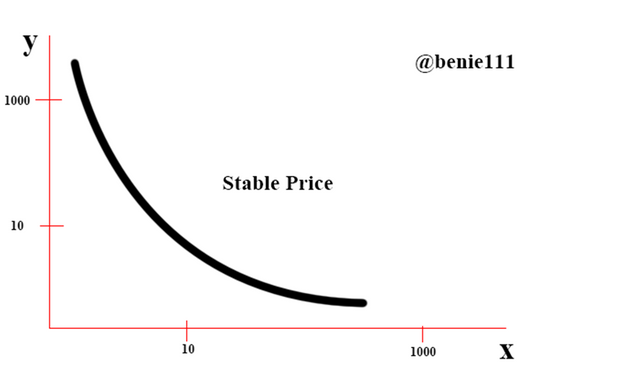

The Curve Finance made the real application by combining both theories together and it resulted in having a special graph that indicates a very smooth curve line which indicates a stable price. There is a fluctuation in the X and Y axis which further justifies the stable price of the token.

How does it lower the slippage?

This can be achieved by further widening the curve on the graph and if this is done properly then slippage will be drastically decreased.

What is veCRV? What are the benefits of holding veCRV token?

The veCRV is an abbreviation that means vote-escrowed CRV, this is a period where the CRV is been locked and as you lock the CRV , you will get more veCRV as reward.

The CRV is the native token of Curve Finance. You can lock the CRV from one to four years, and the more you lock the CRV then the more your veCRV will be

The benefits of The veCRV token can be seen below.

- You will get rewarded for locking your CRV

- You have voting power in DAO proposal and pool parameter

- Liquidity providers usually get rewarded for providing liquidity

- The more you lock your CRV, the more your reward becomes

- For liquidity providers who have more than 2.5 veCRV have the opportunity to create an official DAO vote

Perform a stablecoin swap using Curve Finance using a suitable network of your choice? Include the transaction hash? Indicate the total fees incurred during the entire process? State your observation?Screenshot/Transaction Hash required?

(Hint- You may use Polygon Network, I have provided the RPC details to add Polygon Network in your Metamask wallet, should you need this.)

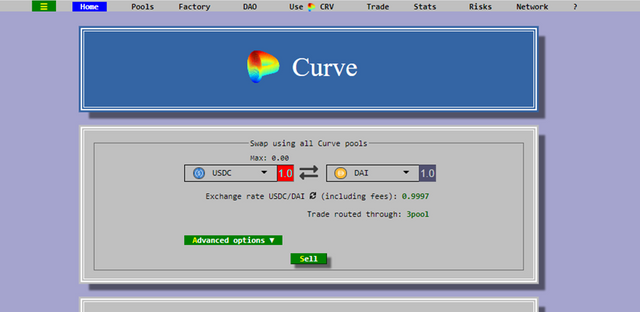

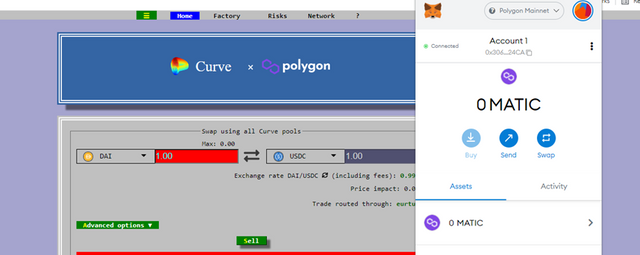

In this question, I will use the USDC and DAI pair to do the swap and I will be using the Polygon network.

So let start

Gently, click the Sell button, then the metamask window will pop out and then you can confirm your transaction,

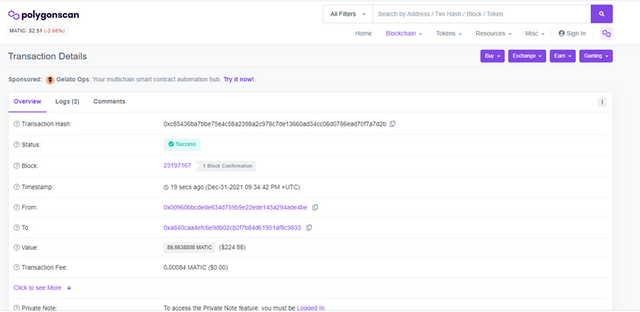

Then you can also see and click the transaction using the polygons can, the other details are also in the Polygonscan too like the Hash of the transaction, the transaction fee, and so many others.

CONCLUSION

Honestly, I have learned a lot about Curve Finance, it took a lot of research, and today I know it is a Defi Exchange platform. I also understand the impact of slippage in price and how it can be reduced and took out to look at the graphs carefully and understand them too. And also the benefit of locking CRV and getting rewarded with veCRV and also the benefits of CRV.

I want to especially thank the professor for the interesting topic, though it was challenging, however, all glory to be God for a successful conclusion.