Hello, welcome to Steemit Crypto Academy Season 5, Week 2.

It is another great chance to learn. Thanks to Prof @fredquantum.

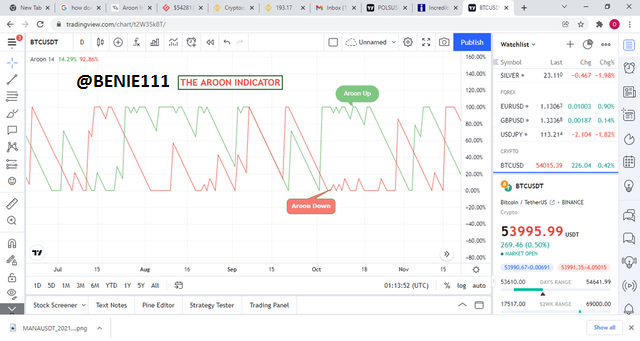

WHAT IS AROON INDICATOR? WHAT ARE AROON UP AND AROON DOWN?

Aroon Indicator is a technical analysis tool that was introduced or developed in the mid-90s specifically in 1995 by Tushar Chande. The Aroon Indicator is also known as a trend indicator based on the function and activities it is used for. The Aroon Indicator is used to identify or detect changes in trends of a market or a financial asset e.g. BTC, ETH, etc... i.e. it is used to figure out early trends and to anticipate the earliest change in trend and as well to determine the strength of a trend for a financial asset. The Aroon indicator is also used to identify important levels and also a situation where the market is currently at a halt or consolidation phase. Indeed, the Aroon Indicator is an important Indicator that does all of these amazing things mentioned, The Aroon indicator moves within a range of 0 to 100, and when it’s found above 50, it indicates a peak of either a high or a low depending on the line that crossed it and the number of periods it calculated for... and when it’s found below 50, it indicates that the high or low was experienced within that number of period, so in nutshell, the Aroon indicator is an important technical analysis tool which is used to study the trend behavioral pattern of a financial asset.

An illustration of what the Aroon Indicator looks like is shown in the screenshot below;

Image source

Image sourceWHAT ARE AROON UP AND AROON DOWN

I believe by now we already know what the Aroon Indicator is, however, the Aroon Indicator is made up of two different lines which are used to identify these trends and change in trends, and they are;

i. Aroon Up

ii. Aroon Down

WHAT ARE AROON UP?

Aroon Up is a type of Aroon Indicator line that is used to determine or identify the strength of an upward trend and it is also used in measuring the price movement of a financial asset in an uptrend.

A screenshot is shown below to illustrate this

Image source

Image sourceWHAT ARE AROON DOWN?

Aroon Down is the second type of Aroon indicator line that we have, it serves the purpose of illustrating to us the price movement of a financial asset in a downtrend and is also used to determine or measure the strength of a downtrend.

A screenshot is shown below to illustrate this

Image source

Image source

HOW IS AROON UP AND AROON DOWN CALCULATED?

In the calculation of either Aroon up or Aroon down, it is necessary and important to consider the number of periods as this would be a major factor to helping us determine the result, so basically we are calculating the prices of the highs and lows over this number of period, the number of period can be any length of day you want to calculate over. However, the default period is usually 25, but in this case we will be using 14.

The steps include;

- Noting the prices of the highs and lows it touches or gets to in the last 14day period.

- Also note the price of the last high and low over same 14day period.

- Input the figures gotten from the above mentioned into the Aroon formula for Aroon and Aroon down.

Now in calculating “Aroon Up”, the formula is;

Aroon Up = (No of Period-No of periods since the recent period High/No of period)x 100

Remember in this case the number of period is 14

And the recent high within the period is $330 for a financial asset

Equation:

Aroon Up = {(14-330)/14}x 100

In calculating for “Aroon Down”

Aroon Down = (No of Period-No of periods since the recent period Low/No of period)x 100

Remember in this case the number of period is 14, and the recent low is $200 for a financial asset.

EQUATION:

From the formula stated above;

Aroon Down = {(14-200)/14}x 100

SHOW THE STEPS INVOLVED IN THE SETTING UP AROON INDICATOR ON THE CHART AND SHOW DIFFERENT SETTINGS.

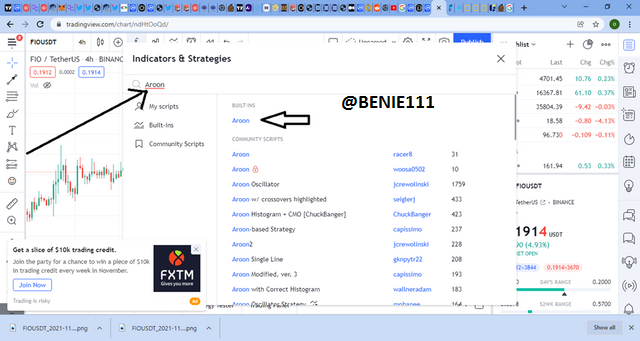

We are already aware of what the Aroon Indicator is all about and its importance, so now we are talking about how to make use of this amazing technical analysis tool, and right now I will be talking about the steps involved in setting up the Aroon Indicator on the chart, join me as we move into this.

STEPS:

I. Find a way to get yourself into the chart, it could be the chart tool for Binance, TradingView, MT4 etc. However, for this, we will be using TradingView.

II. Once you’re in, click on the Fx prompt shown in the screenshot below, this ‘Fx’ prompt indicates where you can find different indicators and you can pick your most preferred.

Image source

Image sourceIII. Once the Fx option has been clicked, it takes you to the option where you can search the name of the indicator you want to add. A screenshot is shown below to illustrate this

Image source

Image sourceIV. I have searched the name of the indicator on the search bar and it brought it, and it also suggested other indicators that as same name. I will be picking the Aroon under built in as that’s the indicator I want to make use of, by clicking on it.

A screenshot is shown below to illustrate this;

Image source

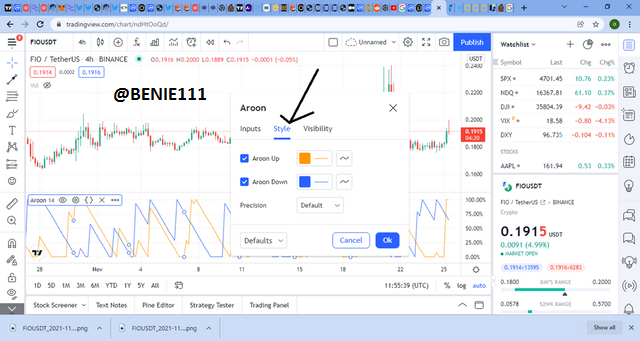

Image sourceV. From the screenshot above, we can see the Aroon Indicator has been added. However, it comes with a default setting, so we need to adjust it to fit in our most preferred number of period or other coordinates. So you click on the setting option which can be found in the screenshot below;

Image source

Image sourceVI. Once the setting is clicked, it brings to you the interface you can see above which contains “Inputs, Style, Visibility”. On the Inputs you will find Timeframe and length. On the timeframe you can input in your most preferred timeframe, for the purpose of this class I want same timeframe as the one on the chart, which is the reason its saying Same as chart. Now the Length option is where you can input the period. However, this came with 14 as default and 14-day period is actually the period we want to use, so we will leave it as it is.

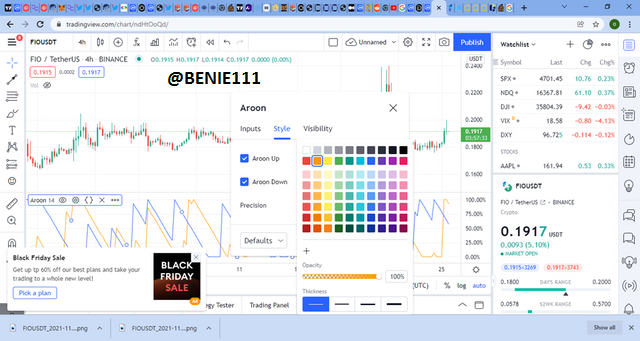

VII. For the style option, click on it, it then takes you to the interface you will find below;

Image source

Image sourceFrom the screenshot above we can see the style involves choosing or picking a color we would like the different Aroon Indicator lines to show for us. If we are fine by the colors above all we need to do is click Ok and it’s all set, if we are not fine by the colors all we need to do is click on either of the colors to take us to where we can pick a different one. Screenshot is shown below to illustrate this;

Image source

Image source

WHAT IS YOUR UNDERSTANDING OF THE AROON OSCILLATOR? HOW DOES IT WORK?

My understanding of the Aroon oscillator is based off the fact the at the Aroon oscillator is also a trend indicator just as the Aroon Indicator, the Aroon oscillator identifies and determines the strength of a trend by making use of the Aroon Indicator lines, and also checking the likelihood of its continuation. The Aroon oscillator moves within the range of -100 to 100. The Aroon up and Aroon down serves as an important tool in the definition of the Aroon oscillator, this is simply because the Aroon oscillator are strictly based off the Aroon Indicator’s up and down lines. Whenever the Aroon oscillator crosses or go above the line zero to become positive, it is based off the fact the at Aroon up has moved above Aroon down, and when the Aroon oscillator crosses or goes below zero to become negative, it is based off the fact that Aroon down has moved above the Aroon up.

The Aroon Oscillator uses Aroon Up and Aroon Down to create the oscillator. Aroon Up and Aroon Down measure the number of periods since the last 14day-period high and low.

The Aroon Oscillator crosses above the zero line when Aroon Up moves above Aroon Down. The oscillator drops below the zero line when the Aroon Down moves above the Aroon Up.

HOW TO CALCULATE THE AROON OSCILLATOR?

The Aroon oscillator is calculated by subtracting the Aroon up from the Aroon down i.e.

Aroon oscillator =Aroon Up-Aroon down.

I have stated the method in calculating the Aroon up and Aroon down in the previous section above, so I expect that the Aroon Up and Aron down.

HOW DOES THE AROON OSCILLATOR WORKS?

The Aroon Oscillator uses the Aroon up and the Aroon down to make meaning for its oscillation, so in this case trading bias is based off the Aroon up and Aroon down movement. When the Aroon oscillator crosses to move above the zero line from under to above it is because the Aroon up has crossed the Aroon down to move above and this insinuates a bullish pressure, so we would be looking for an opportunity to take a bullish entry for this while when the Aroon oscillator crosses to move below the zero line from above to below, this insinuates a bearish momentum, so we would be looking for an opportunity to take a bearish entry for this.

An illustration is shown in the screenshot below

Image source

Image source

CONSIDER AN AROON INDICATOR WITH A SINGLE OSCILLATING LINE, WHAT DOES THE MEASUREMENT OF THE TREND AT +50 AND -50 SIGNIFY?

Image source

Image source Image source

Image sourceIn the illustration found above we can see that when the Aroon oscillator was at +50, Aroon up was also at +50 and was in a strong uptrend and the Aroon down was literally down around the 0 range, and also while the Aroon oscillator was at -50 the Aroon down was at +50, while the Aroon up was around -0 which implies that the market was currently experiencing a strong downward movement.

So in conclusion the Aroon oscillator is driven by the Aroon up and Aroon down, so when the Aroon up is at +50 and the Aroon down is at 0, the Aroon oscillator is at +50, and this it indicates a strong uptrend however when the Aroon up is at 0 and the Aroon down is at +50, the Aroon oscillator equals -50, this indicates a strong bearish movement.

EXPLAIN AROON INDICATOR MOVEMENT IN RANGE MARKETS.

So the Aroon Indicator is best known as a trend indicator, which implies it works best within a trending market. However, it can as well be used in a trading range.

SO HOW DO WE IDENTIFY TRADING RANGE WITH THE USE OF THE AROON INDICATOR?

The trading range is identified when the Aroon up and Aroon down keep close tabs with themselves and it’s hard for you to differentiate what’s happening in the market as shown in the screenshot below;

Image source

Image sourcebut most importantly the best way to identify the range is when both the Aroon up and Aroon down are below the 50-mark range, or both are moving on a parallel line at same time, and new highs and lows are not being created.

To trade this you want to watch out for a break out in conjunction with an Aroon up or down crossing over the positive marks, so here you will identify which of the Aroon lines are crossing over for you to pick a bias just as shown in the screenshot below.

Image source

Image source

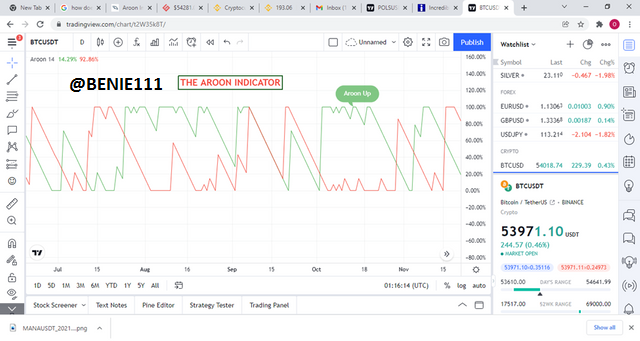

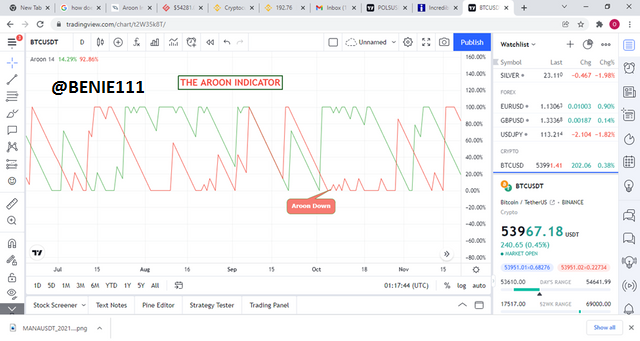

DOES AROON INDICATOR GIVE FALSE AND LATE SIGNALS? EXPLAIN. SHOW FALSE AND LATE SIGNALS OF THE AROON INDICATOR ON THE CHART. COMBINE AN INDICATOR (OTHER THAN RSI) WITH THE AROON INDICATOR TO FILTER LATE AND FALSE SIGNALS.

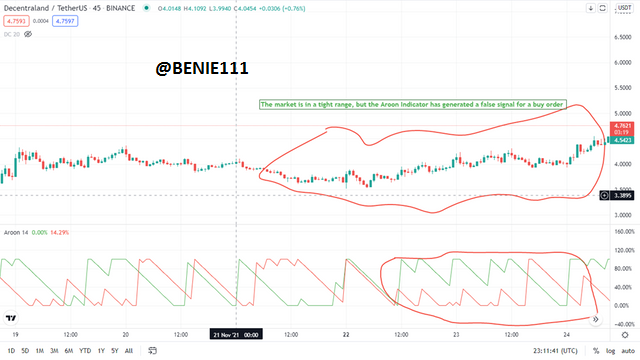

Yes, the Aroon indicator gives false signals, most especially in a market that is choppy, ranging and consolidating. In such a market it tells you the market is currently experiencing an uptrend for instance, and just in few minutes the market price which was in an uptrend before has rapidly switched back to being bearish. In this type of market situation, it affects your mind and leads to confusion.

Also, sometimes it gives a valid signal, but because of the type of market condition which usually is a range, would allow you miss out on an entry simply because of the rise and decrease in price per minute.

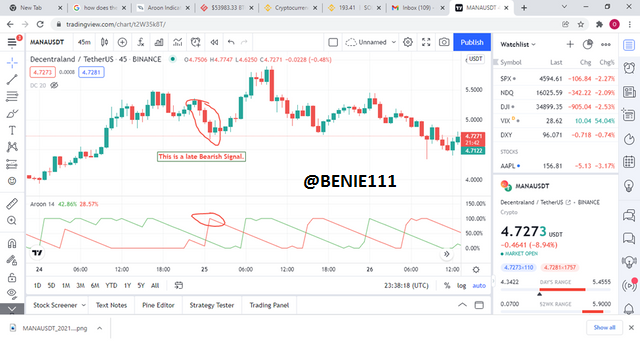

An illustration is shown below to illustrate a false signal;

Image source

Image sourceIn the screenshot seen above, we can see the Aroon Indicator giving a false signal for a long entry above the +50 range. This further proved that we should always combine the Aroon Indicator with another indicator.

Image source

Image sourceIn the screenshot above, we can see that the time it took the Aroon indicator late to notify us of the bearish signal, so if anyone entered the bearish signal they would have been confused as the bearish trade call given by the Aroon Indicator has elapsed and the market is currently elapse the sell signal and bullish momentum is experienced in a short while.

COMBINE AN INDICATOR (OTHER THAN RSI) WITH THE AROON INDICATOR TO FILTER LATE AND FALSE SIGNALS.

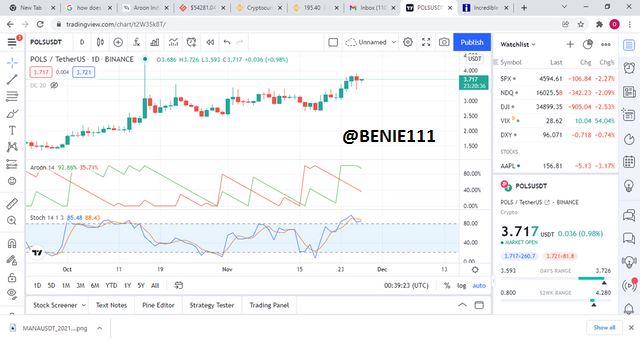

In the course of this, I will be combining the Aroon Indicator with Stochastic oscillator. This is so as to filter late and false signals... so I will be adding the Aroon Indicator and the stochastic indicator to my chart, after adding them I can make use of them.

An important thing to note is that the stochastic oscillator was added in other to help further confirm the trend and as well help filter noises or false signals

A screenshot is shown below to illustrate this;

Image source

Image sourceAs we can see from the above screenshot, the stochastic oscillator is notifying us that the market is currently in an overbought region and a likely reversal is imminent, so we can keep tabs on the chart to enter a sell trade when the red stochastic oscillator line crosses the blue stochastic oscillator line.

However, from the Aroon Indicator, it is currently notifying us of a strong upward trend currently going on. From this, we can see the stochastic oscillator also notified us of the same thing, but this time with a warning signal, which is that… the current uptrend is currently moving into an overbought region and a reversal is imminent. So we should be planning to lock in profits and be prepared for a change in trend.

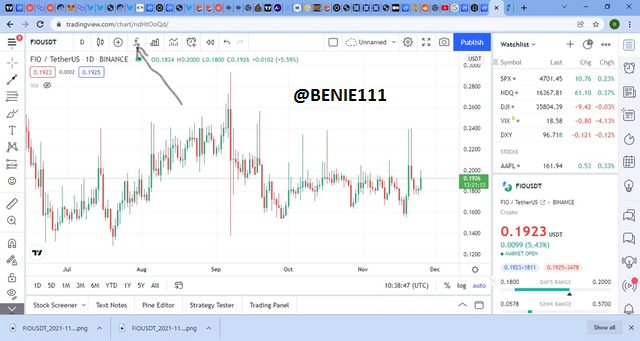

PLACE AT LEAST ONE BUY AND SELL TRADE USING THE AROON INDICATOR WITH THE HELP OF THE INDICATOR COMBINED IN (7) ABOVE.

So from the question, it is stated that I need to take a buy and sell order while using the indicator I suggested in question 7. Well the indicator mentioned is known as Stochastic Indicator, so basically what the stochastic indicator does has been explained in the question answered above. So I would go straightforward to answering the question asked.

BUY ENTRY:

In the course of carrying this out, I used EURUSD currency pair, and I will be explaining it below, but first a screenshot of the currency pair and trade is below;

Image source

Image sourceWe can find both the Aroon Indicator and the Stochastic Indicator on the chart within a 15minute timeframe, the Aroon indicator is indicating a strong bullish trend while the stochastic indicator is illustrating more of an instantaneous market condition, which ideally is a bearish retracement, and also it is almost getting to the oversold region and we are expected to continue the bullish momentum, so in this type of market I will be setting a pending order for a buy limit at $1.12960 which will be my entry, while my stop loss would be a few pips below the last low which is $1.12894, my take profit level would be at $1.13600 to give a good risk to reward of 1:5.. so should incase my trade gets violated I wouldn’t expose much of my portfolio, and in the case my take profit hits, I would have made more by risking very little.

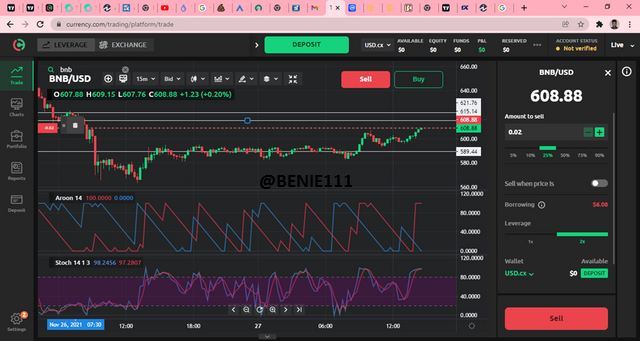

SELL ENTRY:

As you can see from the chart below, currently market is in a bullish state, but the stochastic indicator has illustrated that market is currently at an overbought region and a sell reversal imminent. Remember the Aroon indicator doesn’t tell you or give predictive scenario rather it tells you the strength of the current trend, and that’s the reason we are using a stochastic indicator, so it can help us determine entry and exit price level and at the same time give a warning signal of probable situation likely to take place. However, it is important to note that this analysis is based on a 15minute timeframe as you can see on the hart.

Image source

Image sourceFrom the screenshot above, I will be taking a sell entry at $615, while maintaining a good risk to reward of 1:4, and my take profit will be at $589, while my stop loss will just be few pips above the last high, which is $621.76. the reason for this has been stated above and it is simply because the stochastic indicator has warned us prior to the reversal in trend take effect.

STATE THE MERITS AND DEMERITS OF AROON INDICATOR.

As we all know that the Aroon Indicator is a good indicator to use so does it have its limitations also, and that’s the reason it should always be combined it with another indicator to further confirm the trend. The advantages and disadvantages of the Aroon indicator is stated in the paragraph below;

MERITS OF AROON INDICATOR

- The Aroon indicator is best used to confirm the strength of a trend; so this implies that you can use the Aroon Indicator to confirm if a trend is strong or not, a strong trend will give you a strong confirmation for an entry.

- The Aroon indicator, consist of two lines; and these lines gives you signal to pick an entry

- The Aroon indicator is used to pick an exit price level.

DEMERITS AND DISADVANTAGES OF AROON INDICATOR

- Aroon Indicator may give false signals

- The signals drawn from the Aroon Indicator may sometimes come late, most especially when the trend has faded, and a reversal is about to take place.

- The model adopted by the Aroon indicator is one that isn’t really predictive as it looks back in time to calculate the number of days to which a high or low has occurred.

CONCLUSION

The Aroon Indicator is a rare and unusual type of indicator. The Aroon Indicator is a good indicator which is best used to identify, determine and measure the strength of a trend. It is best said that despite the fact that the Aroon Indicator is a great tool for measuring the strength of a trend, it is advisable to be used in conjunction with other indicator to best determine entry and exit price levels.