Theory.

1. Define and Explain in detail in your own words, what is a "Trading Plan"?

A trading plan refers to the set of guidelines or instructions which we as traders give ourselves to be able to control our capital, and implement our trading strategies in the market that will further lead to an increase in our capital and success in trading. A trading plan is a very useful and important guide that most successful traders have and implement and this is what makes it very important in trading. A trading plan is needed to be able to be successful in trading and implementing the market strategies which are already known.

Before an operation or trade order is placed, the trader will have to make sure that all the requirements or conditions of the trading plan are fulfilled or executed. This means that, before a buy or sell order is placed in the market, the trader will have to make sure that all the events in the trading plan have been met. This will ensure all trades to follow the trading plan and thus, be successful.

2. Explain in your own words why it is essential in this profession to have a "Trading Plan"?

In order to be a successful trader, one will need to have a trading plan. The reason why a trading plan is very essential is because of the following points.

- A trading plan helps traders to manage risk and create a balance between profits and losses with profits always more than losses. This makes the level of risk smaller than the level of gains.

- Another reason why a trading plan is very essential is because, it helps a trader to manage his capital, preventing him from blowing his account. This is probably the most important reason why a trading plan is being used. A trader has to ensure that all conditions on the trading plan are met, before an order (whether buy or sell) is placed in the market. Thus helping the trader to manage his capital wisely and also, grow his capital in order to have bigger profit levels in the future.

- A trading plan is also very essential because, it helps us keep our emotions intact or in place.

- A trading plan helps us to multiply our capital over time and thus bring us lots of money. The trading plan when used with the right trading strategies, can lead to an increase in trading capital over time.

3. Explain and define in detail each of the fundamental elements of a "Trading Plan".

A trading plan has 4 fundamental elements which are going to be defined and explained below.

- Risk Management.

Risk management refers to that part of the trading plan which is used to ensure capital growth and reduce risk by taking into account the number of successful trades either won, or lost. This means that, the trader who is looking for profits, will create a balance between the number of trades won and the number of trades lost. The balance will be in creating an imbalance with the number of trades won and lost, making the number of trades won to be more than the number of trades lost. This is the way to reduce risk in trading.

This means that, if a trader places 5 trades per day, he may decide to stop his trading for that day, if he reaches his maximum of 2 lost trades or his maximum of 5 won trades. This creates a balance that puts the trader in a win-win situation.

- Capital Management.

Capital management refers to an essential part of the trading plan which helps the user manage his capital by defining the percentage of the capital which he is willing to risk when placing a trade whether buying or selling. By setting a certain percentage of the capital to stake while trading, in case of losses, there will be minimal loss on investment capital depending on the percentage of the capital that is staked.

With capital management, the trader will have to place the following percentages.

Percentage of Loss. The percentage of loss is the percentage of the capital that the trader is willing to lose. For example, if the percentage of loss could be at 2% of the capital then in case of loss, he will lose 2% of his capital investment.

Percentage of profit. The percentage of profit refers to that percentage that the trader will be willing to take in case of profits and close the trade. Also, the level of profits should be more than the percentage of loss. So, if the percentage of loss is 2%, therefore the profits percentage will be at least 4%, making a 2:1 ratio for profits:losses.

Days of operation. The trader needs to determine the days which he will be trading and actively monitoring the markets. Once he choses his days of operation, he can now manage his capital in a way that will last and bring profits as the days go by.

- Trading Psychology.

Trading psychology is very essential in a trading plan because, when a trader is trading with his real account and live assets in the market, he has to be very emotionally balance to be able to make the right calls of trading while taking into consideration our risk management and also, capital management. The trader has to be in the right state of mind so as to place an order whether sell or buy, using technical analysis and after checking every condition of the risk and capital management.

This means that, the trader should close the trades no matter what happens or how the markets look as long as he already obtained his objectives from risk management and capital management. From the previous examples, if 5 trades gain profits for that day, the trader should close them and stop trading for the day. And if 2 trades are lost that day, the trader should close the trades and stop trading for the day.

Also, with trading psychology, a list should be made that takes into consideration external factors that may influence the trader emotionally or psychologically. This list should be made and only after it is checked, before the trader can enter the market and carry out his transactions.

- Planning and Control.

Planning and control is an essential part of the trading plan which helps the trader to manage his income in a way that will increase and multiply his capital monthly thus bringing him long term profits. With this, the trader can control and organize his trading schedule monthly following his risk and capital management in a way that will cause his monthly capital to increase in a compounded manner.

An application, most preferably Microsoft Excel can be used to organize an plan the monthly goals and objectives. This will be good for the capital as it will be bound to increase over time.

Practicals.

Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

Your own Risk Management

In creating my trading plan, I will have to create a risk management strategy that will be best appropriate for me given the case that I have as investment capital, $50.

My risk management, will be to make a maximum of 5 entries in a day.

Out of these 5 entries, I will have as maximum losses to be 2 entries for the day and maximum profits will be 5 profitable trades.

As soon as any one of these 2 conditions are met, I will close trading for the day. This will reduce the risk of trading with my investment capital.

Your own Capital Management

My capital management on $50 will be the following.

- Percentage losses.

My percentage losses will be 2% of my investment capital of $50 which will be $1. This will reduce the loss on my account capital in case of loss during trading. - Percentage profits.

The percentage of profits will be set to 2x the percentage loss. This will be 4% of trading capital of $50 per trade. This will give profits of $2 per successful trade. - Days of operation.

The number of days which I will be trading will be 5days minimum a week and this will give a total of 20days a month.

Say in detail, what are the rules or Psychology that you yourself would use to fully comply with said plan and be able to operate the cryptocurrency market

The rules I will give myself will be the following.

- Always respect the risk management as well as the capital management part of the trading plan.

- Never enter a trade during examination periods.

- Never enter a trade when emotionally unstable or distressed.'

- Never enter a trade when preoccupied with other engagements.

- Operate the market only during morning and night periods.

Finally, make a table with the strategic planning of your capital, covering at least 6 months.

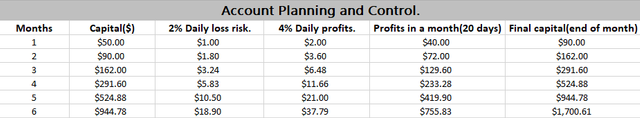

This is my account planning and control table which was made using Microsoft Excel by me.

Conclusion.

Capital management is very important for any trader who intends to be successful in the trading world. It is created by the trader to his preference and capital and with this, he will control how he trades in the market and thus, increase his investment capital to such a point when he can start withdrawing from all the profits made in the platform.

Thank you for reading.

CC: @lenonmc21

club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit