Greetings and welcome to my homework post in the crypto academy which is based on Stability in Digital coins organized by Professor @awesononso.

1. Explain why stability is important in Digital Currencies.

Most Crypto currencies are used under a decentralized system which takes away the stability of the digital currency. They take away the stability because, under the decentralized system, every user is in control of the currency’s price movement. When a user buys the currency, there is a rise in the price of the currency from an increase in the use of the currency and its demand. While when a user sells the currency, the price of the digital currency will fall from the fall in the demand.

This movements cause the digital currency to be very unstable and thus lose its store of value.

Stability in digital currencies is necessary to create a Store of Value. This store of value characteristic is necessary because a user should be able to put in an amount in the currency and that amount should have the same value as at when it was stored and when it is withdrawn.

This characteristic of store of value is very absent in crypto currencies due to their decentralization and instability. But it has been made a reality through rebase coins, stable coins and Central Bank Digital Currencies(CBDCs).

Other reasons of having stability in digital currencies include:

- Stable digital coins are more tradeable and cost less than fiat coins during transfers of the coin.

- Stable coins can easily be used to enter trades.

2. Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Central Bank Digital Currencies a.k.a. CBDCs refer to a country’s currency’s digital representation as a digital currency. These CBDCs possess the same value as the country’s currency in real-time.

CBDCs would have a great impact in the digital lives of the users and we will see in the table below some of the effects of the CBDCs on its customers.

| 1. CBDCs will reduce the need of having a bank account which limits many customers. This feature will eliminate the need for a customer to go to the physical bank to do his transactions because this will be now possible through the wallets on the mobile phone. | 1. With the use CBDCs, wallets on mobile phones will now be used for transactions unlike the physical bank but this is blocked by the availability of mobile phones to the residents of the country. Such technological barriers will reduce the use of CBDCs by the country’s population. |

| 2. CBDCs are issued by the Central government of the country, thus giving the currency legal backing as a medium of exchange of the country. | 2. Since CBDCs are issued by the central authority of the country, there is the absence of privacy as all transactions are being seen and monitored by the central authority. This is a serious drawback. |

| 3. CBDCs are centralized digital currencies and this will eliminate the instability which is present in decentralized Digital currencies. | 3. Due to the fact that the digital currency is centralized, The central authority has all control over the system and the bad policies issued by the central government can cause drastic price fluctuations, inflation and even devaluation of the currency. |

3. Explain in your own words how Rebase Tokens work. Give an illustration.

Rebase tokens are a type of digital currency that have similarities to stable coins as they have a table price but they function using the price mechanism and adjust according to the supply of the tokens.

With the rebase tokens, it retakes the stable price no matter how the price fluctuates.

When price rises, this indicates a rise in demand. An increase in the price of the currency will in turn cause a rise in the supply. But an increase in supply will lead to a fall in price as stated by the laws of demand and supply which states that, “An increase in supply will lead to a fall in the price”. And when this happens, the price will fall until reach its original stable price.

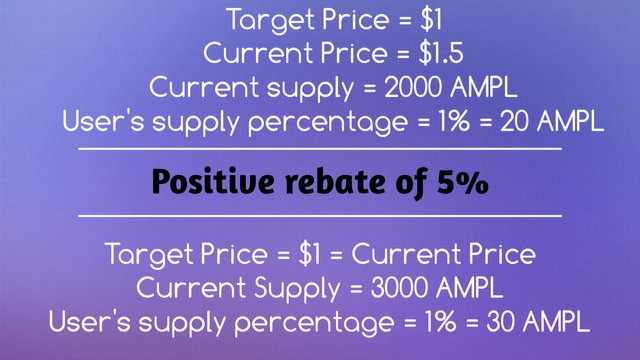

For example, if the target price of 1 AMPL is $1 and the price increases to a value of $1.5, there will be the occurrence of a positive rebase and the supply of AMPL will rise and lead to a fall in the price of AMPL until it reaches its targeted price and this will be the end of the rebase period.

Also, if the price falls from a fall in demand, this will cause the supply of the token to experience a drop. And a fall in supply will therefore lead to a rise in the price of the token caused by the forces of demand and supply. The price will keep rising till it meets its objective price where it will stop.

For example, if the target price of 1 AMPL is $2 and the price falls to a price of $1.5, there will be a negative rebase where the supply will drop and after the rebase period, the price will retake its position at $2.

After the movement of price(whether upwards or downwards) and the rebase(whether positive or negative), the supply of the token will fluctuate and this will change the amount of tokens which a holder will possess in his wallet. But with this in mind, the holder’s percentage owned in the network supply will remain unchanged despite the change in the number of tokens possessed after the rebase.

For example, if a user has 20 AMPL which is equivalent to 1% of the AMPL supply network of 2000 AMPL, and the price changes from the target price of $1 to $1.5, there will be a positive rebase and the supply will rise to 3000 AMPL and later on, price restored back to $1. After this happens, the amount of tokens increase to 30 AMPL and this still amounts to 1% of the supply which is 3000 AMPL.

4. Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

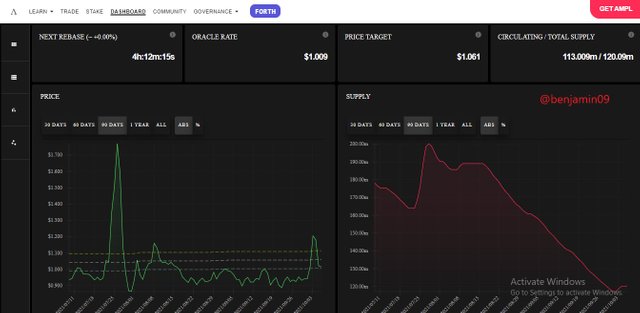

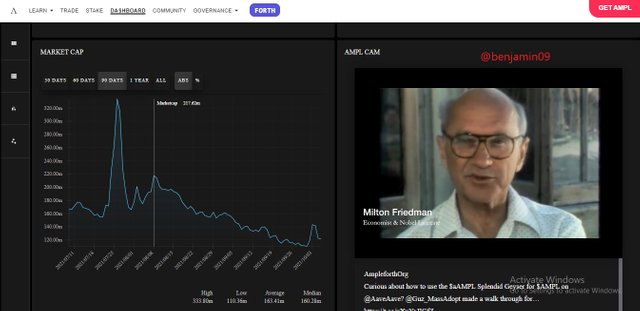

From the above screenshot, we have:

Oracle rate=1.009

Price target=1.061

Rebase %= {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

Rebase %={[(1.009-1.061)/1.061]100}/10

Rebase %={-0.049100}/10

Rebase %=-4.901/10

Therefore, Rebase %=-0.490

On this dashboard page of Ampleforth, not only are there the target price, Next Rebase, oracle rate, circulating rate, the price graph and the supply graph, there is also the market cap graph and a tutorial video about AMPL.

5. Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

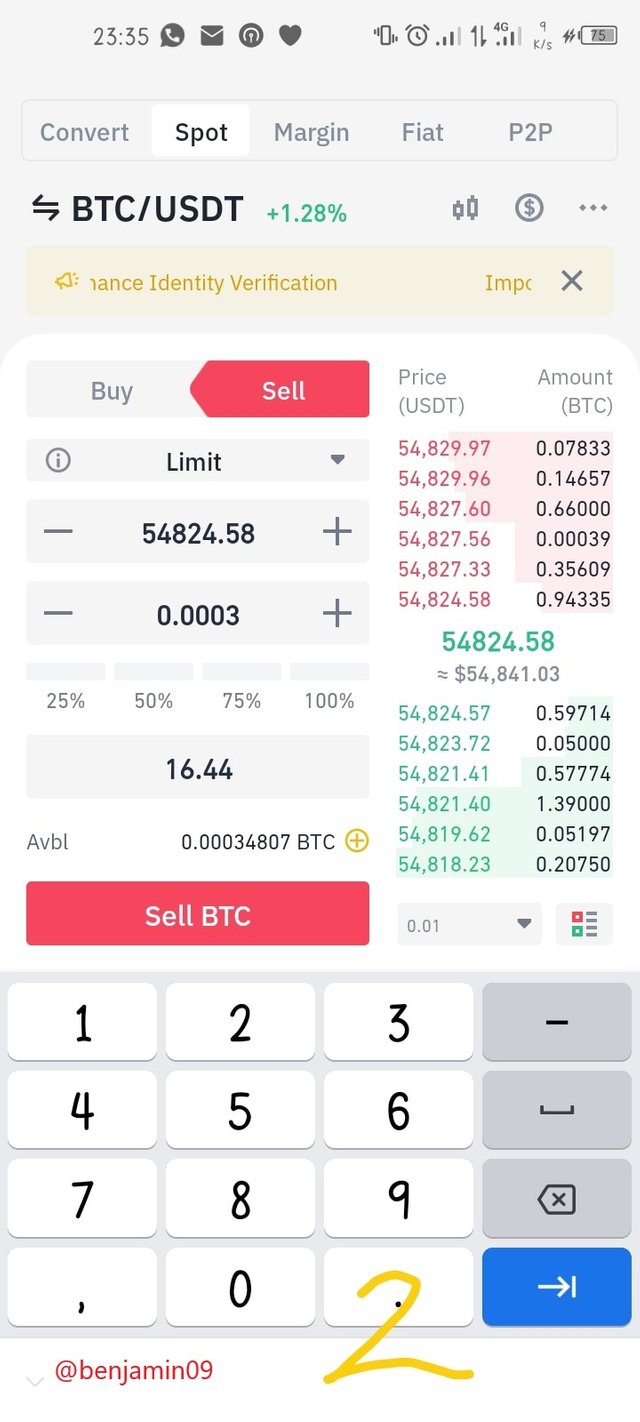

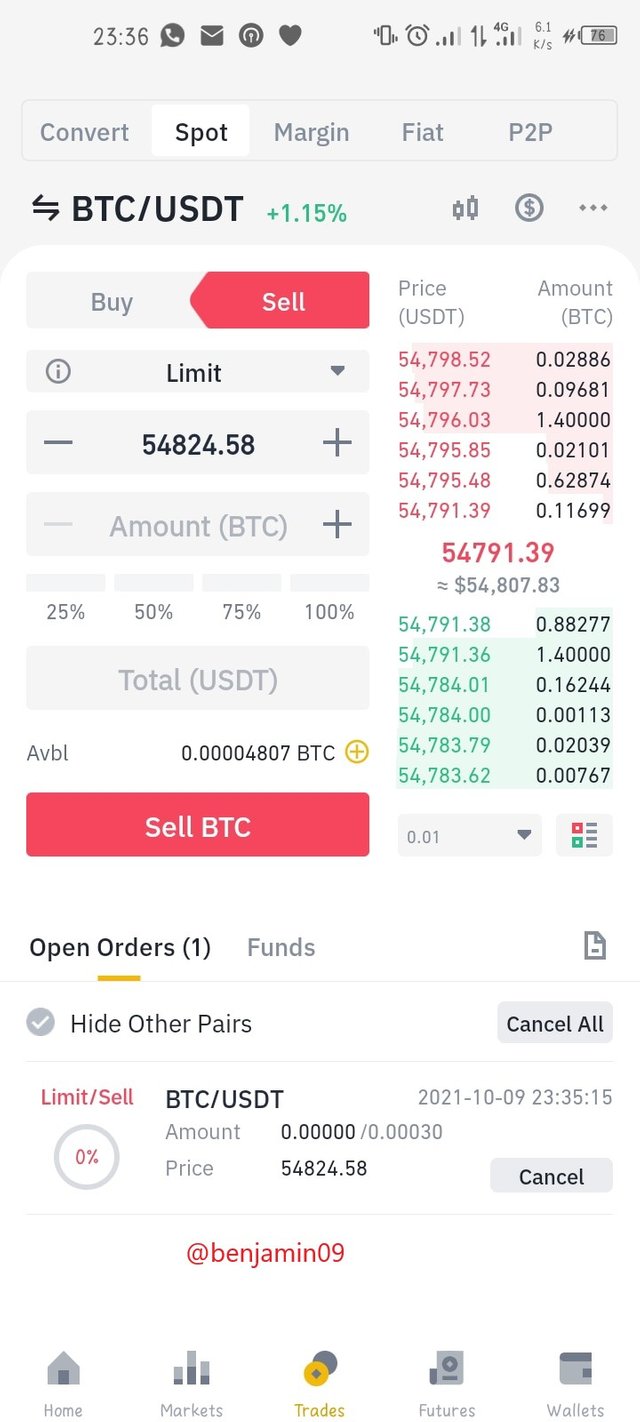

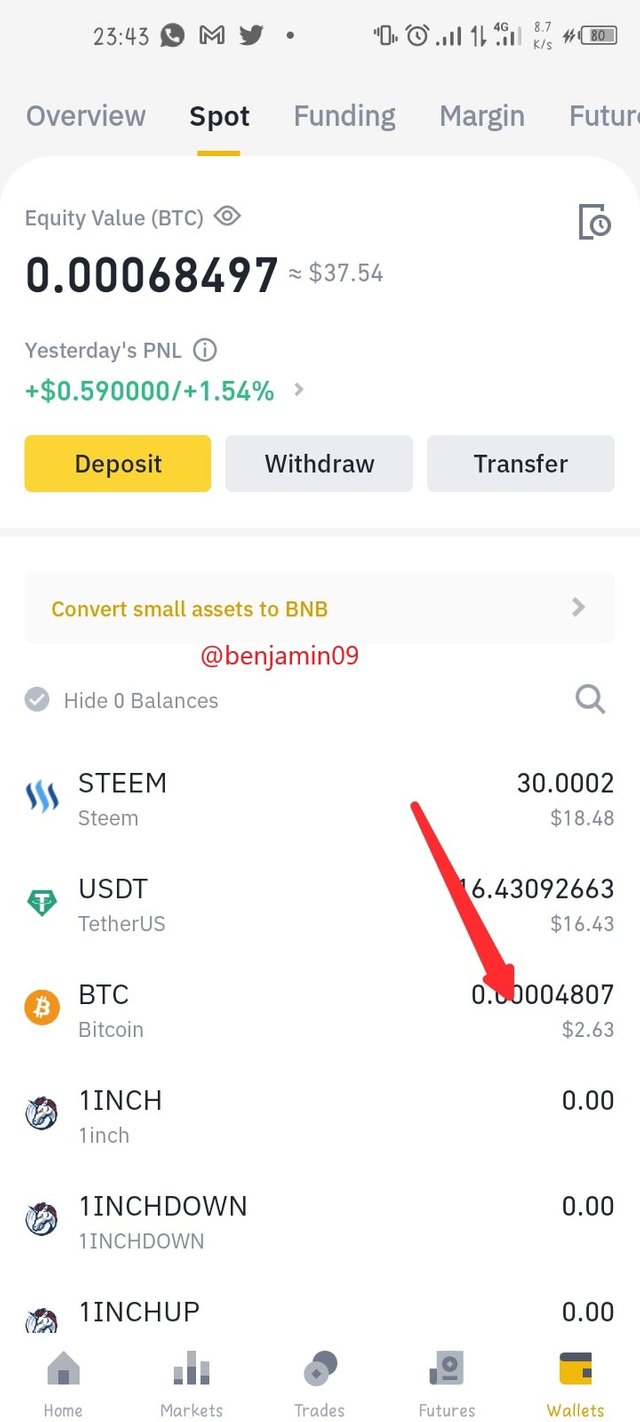

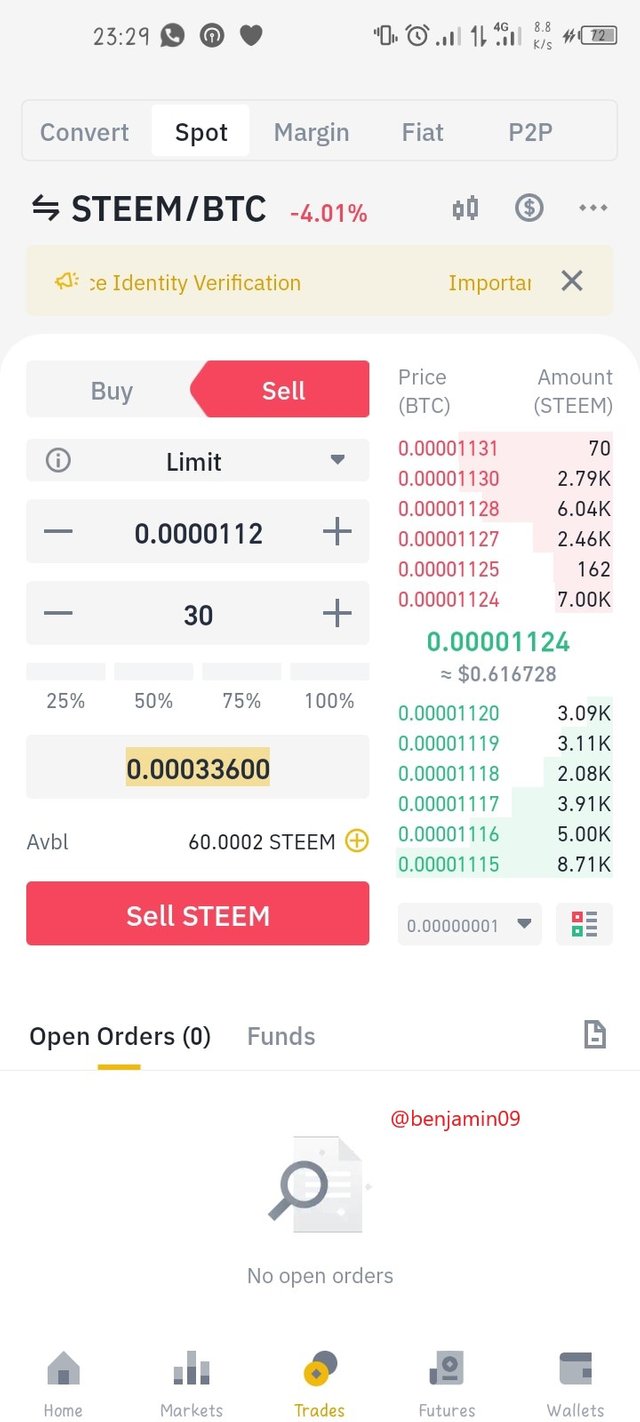

Firstly, I have to trade my Steem to BTC before using my obtained BTC to trade to USDT.

I now trade $16.44 worth of my BTC to USDT.

After the trade is complete, I have a total of $16.44 USDT in my account obtained from trading my BTC.

6. Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

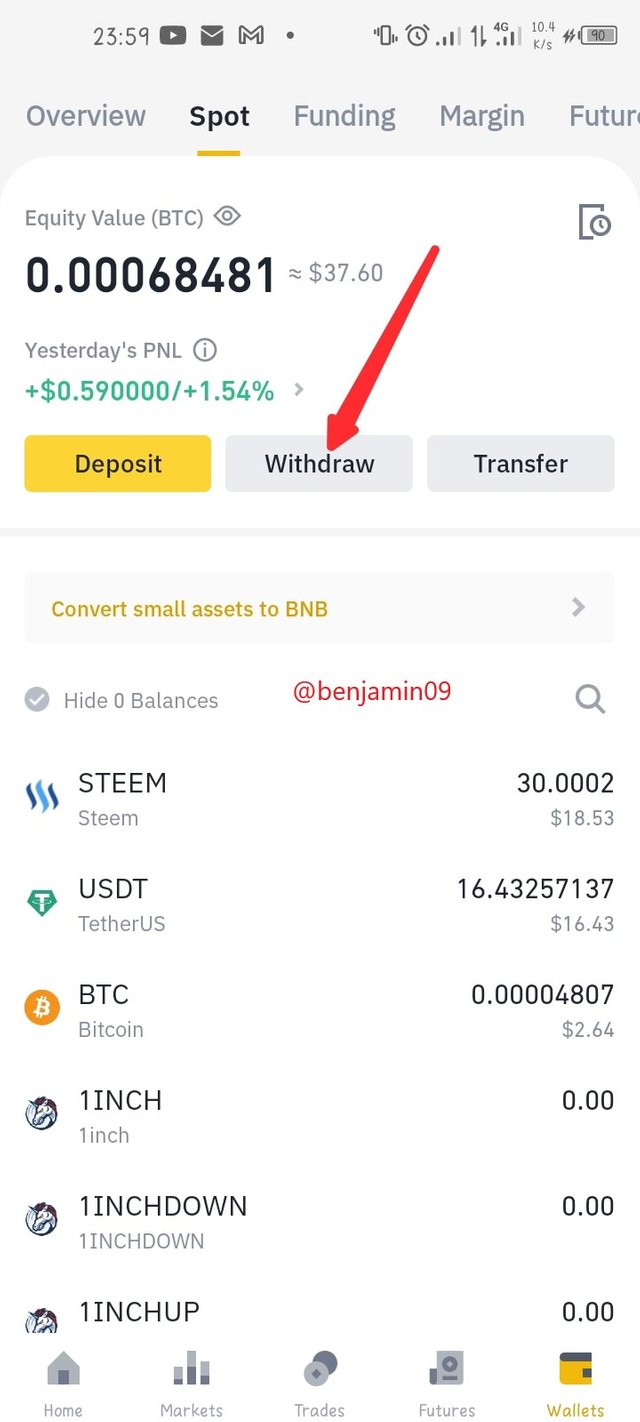

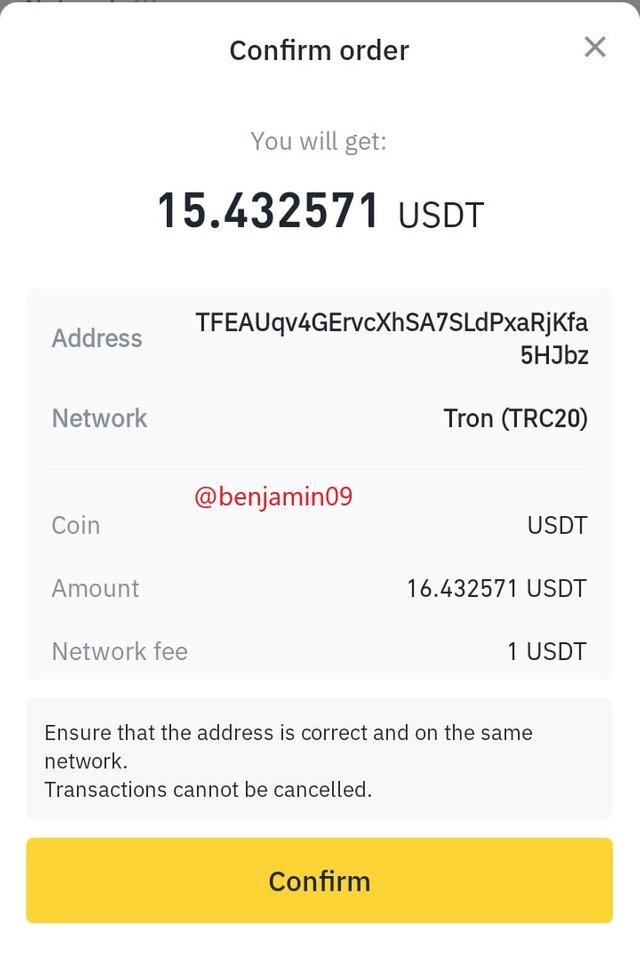

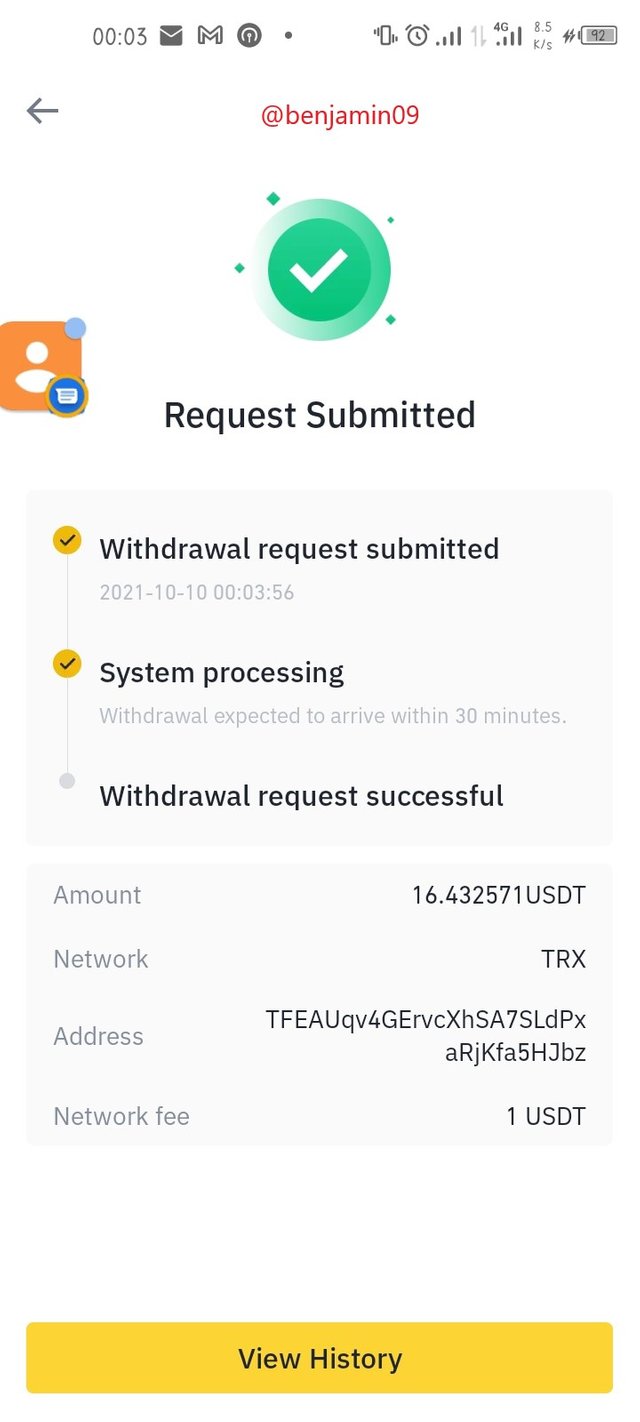

To begin, I click on the withdraw sign to withdraw my USDT to my TRON wallet.

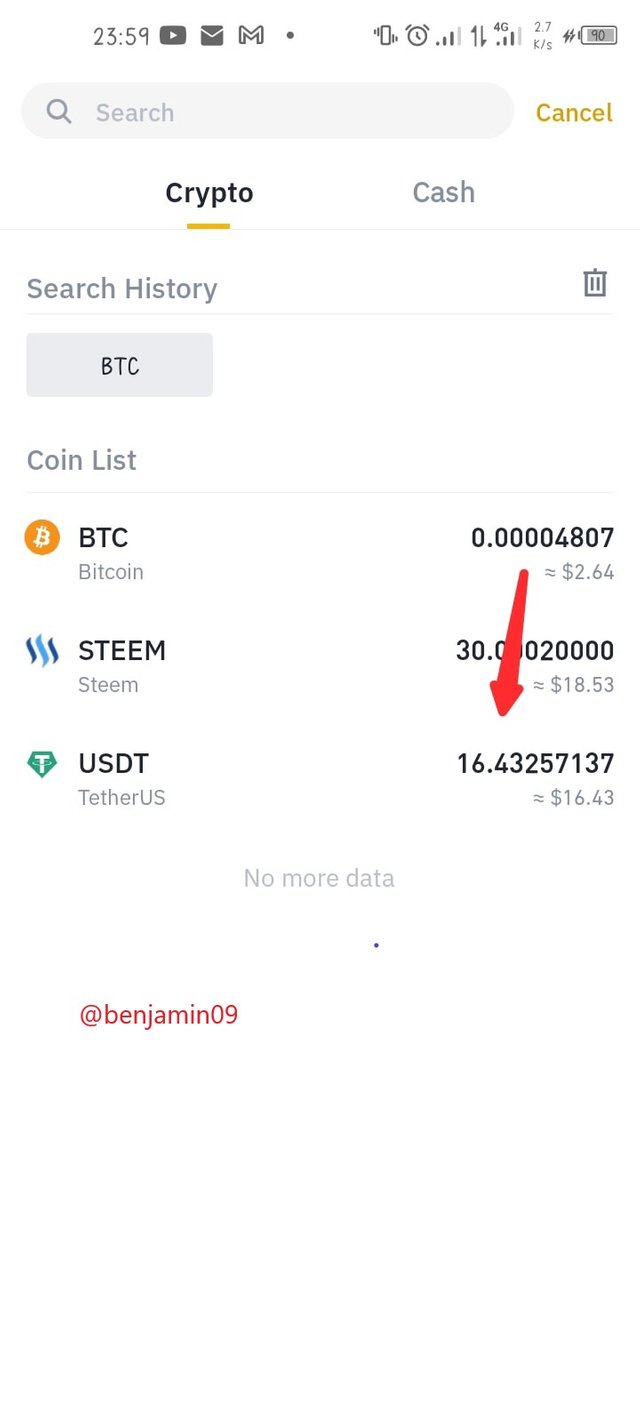

After that, I select USDT as the currency I want to withdraw.

[Screenshot source](https://www.tronlinkwallet.com

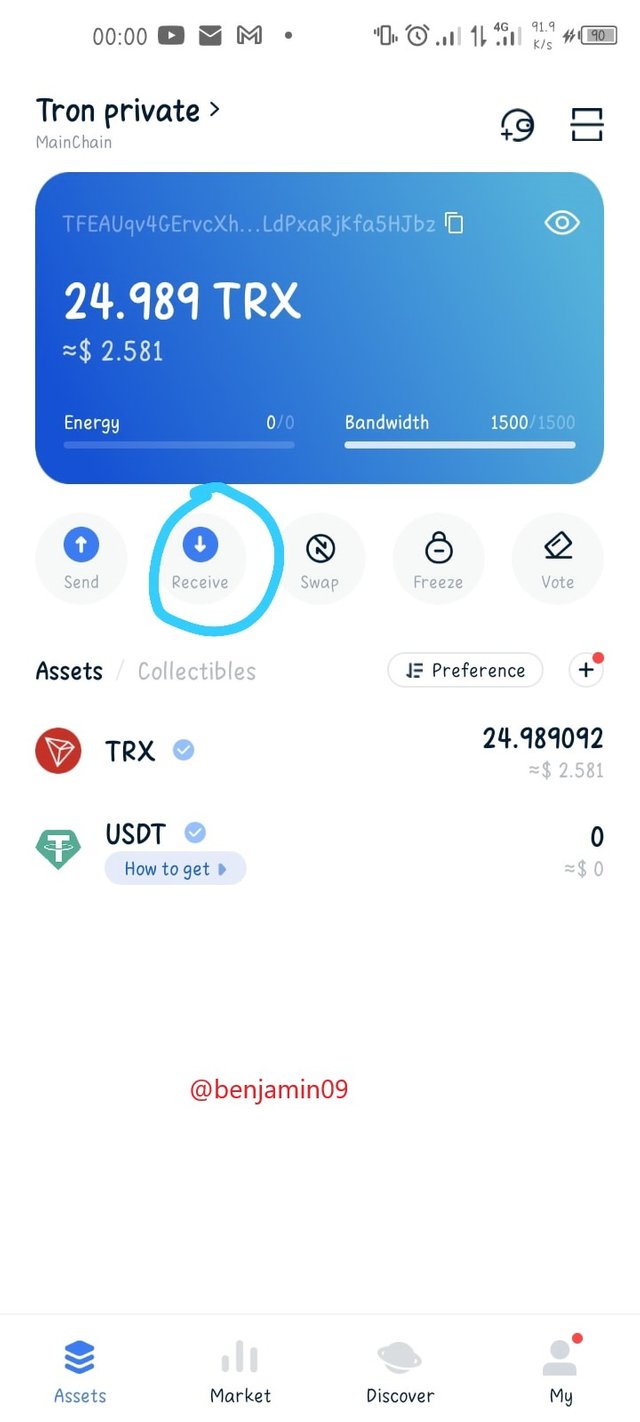

I now go to my TRONlink wallet and click on receive and obtain my wallet address.

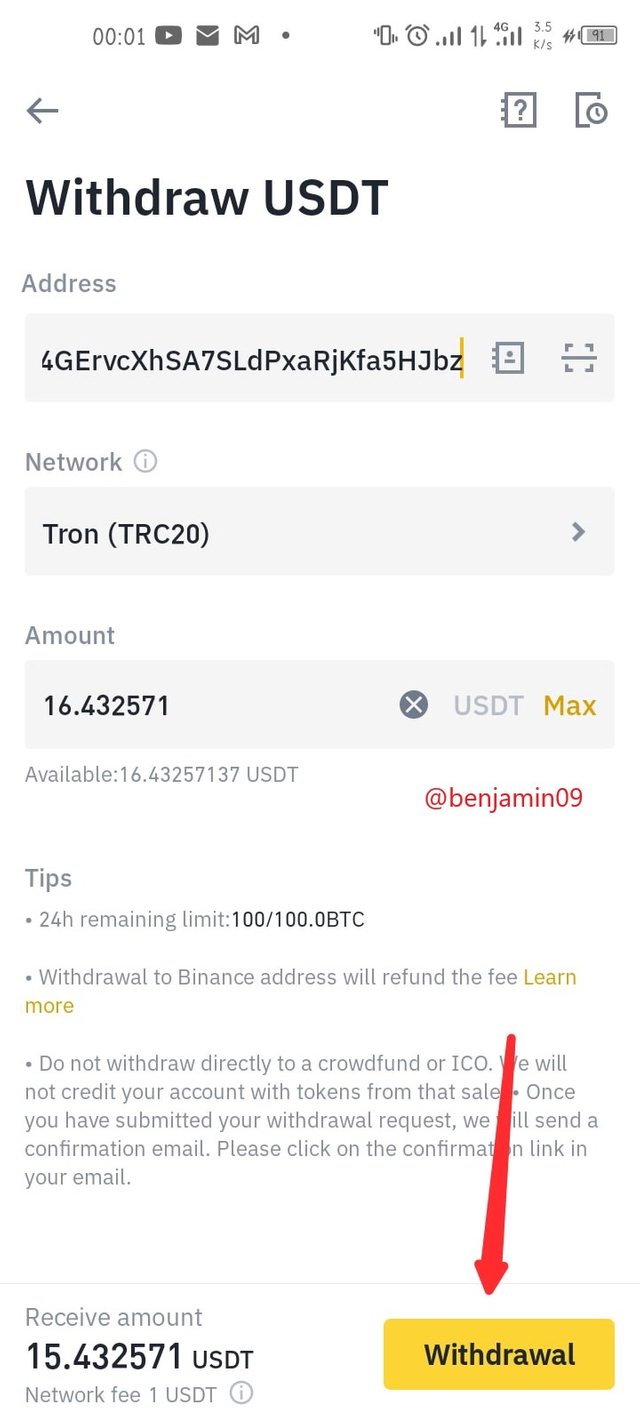

I input my wallet address and select my network as TRON (TRC20), input my amount and click on withdrawal.

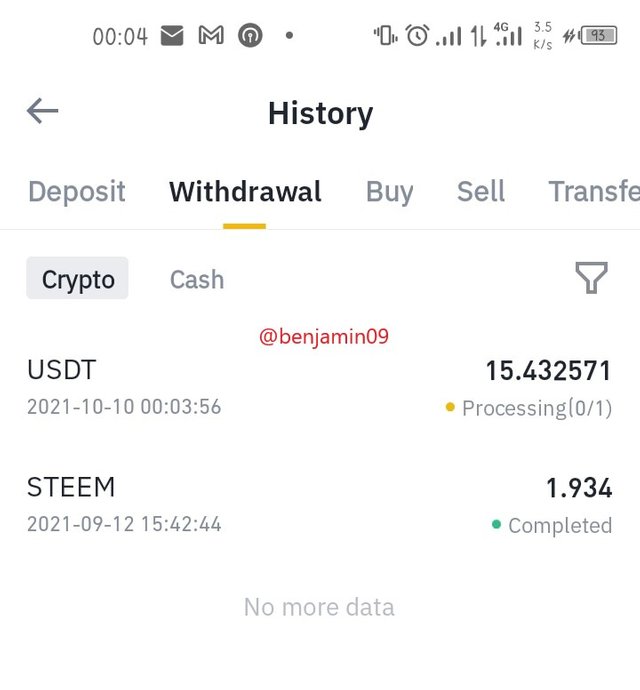

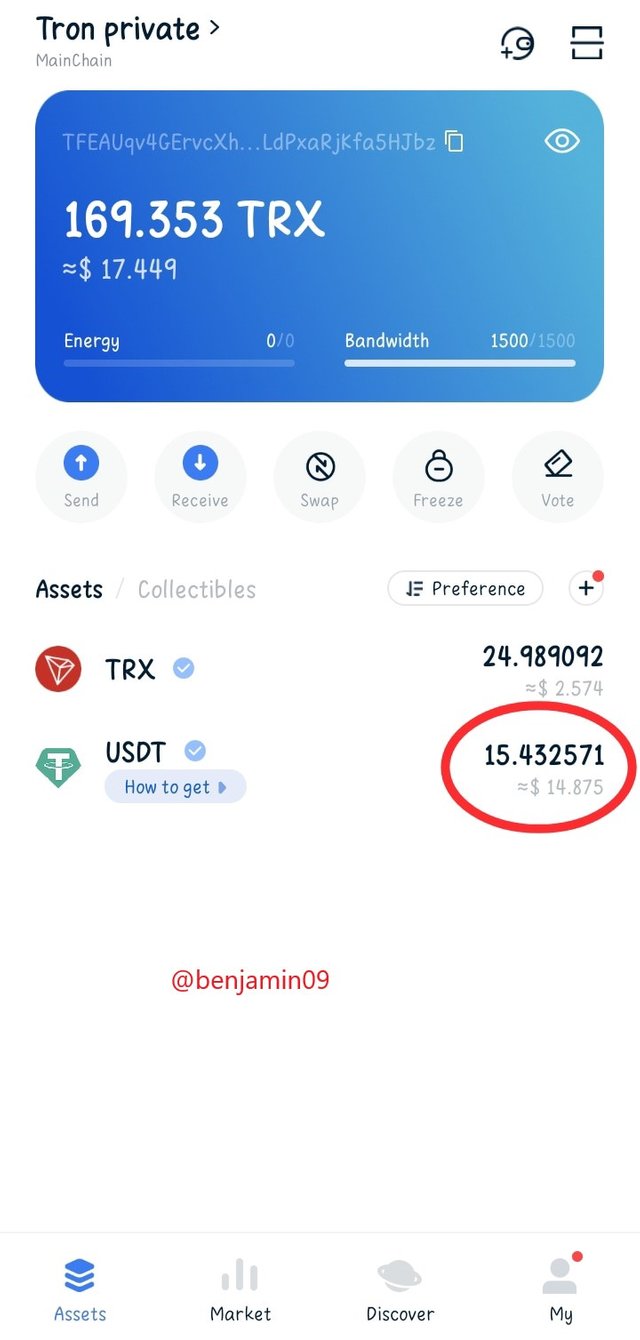

At the end of it all, I have as USDT balance in my TRONlink wallet as $15.4.

Advantages of Stablecoin over Fiat currency.

Some of the advantages include:

- Transactions with stablecoin have no need for a third party that should involve themselve in the transaction.

- The transactions with stablecoin take a shorter duration of time as compared with the fiat currencies.

- The withdrawal charges are better in stablecoin especially as the rates remain stagnant despite the market stance.

- There is no central authority monitoring the transaction in stablecoin as opposed to fiat currencies where there is a central authority overseeing the transactions.

Conclusion.

After the completion of this homework post, I know about the various types of digital currencies and the necessity of stability in digital coins. Also, how to trade coins and the advantages of stable digital coins over fiat money currencies.

Thank you for reading.