Question 1.

Describe the differences between Staking and Yield Farming.

Staking refers to a process whereby a user keeps some part of their assets closed off and inaccessible for a period of time in order to earn some rewards and interests on them.

On the other hand, yield farming is the process whereby a user sends some assets into a pool in order to provide liquidity for that asset.. And by doing this, the person who is now termed a liquidity provider receives rewards for doing so.

These two terms sound like the same thing but what makes them different?

| Yield Farming | Staking |

|---|---|

| It is involved with every normal transaction that is initiated | It is involved with validating and verifying transactions |

| Rewards are gotten from gas fees and charges for each transaction carried out | Rewards are gotten from mining blocks |

| Locked assets are used to provide liquidity | Locked assets are used to promote governance of the project |

| The mechanism here is linked to the automated market maker | The mechanism here is linked to the consensus mechanism |

| You can do it for as long as you want | You can only do it for specific periods of time |

Question 2.

Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Show screenshots.

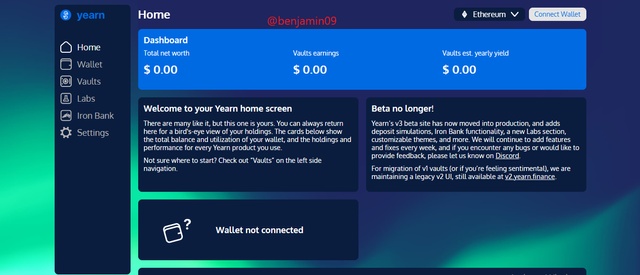

Firstly, go to https://yearn.finance/

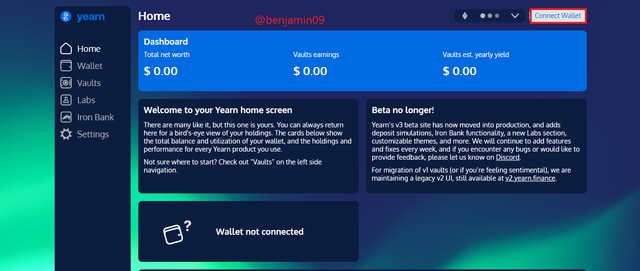

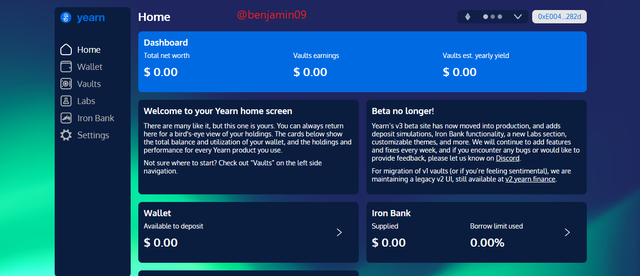

This is the homepage.

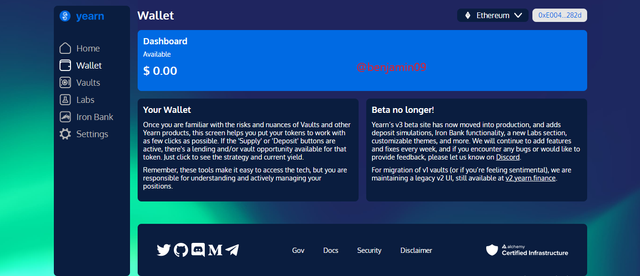

This is the wallet page.

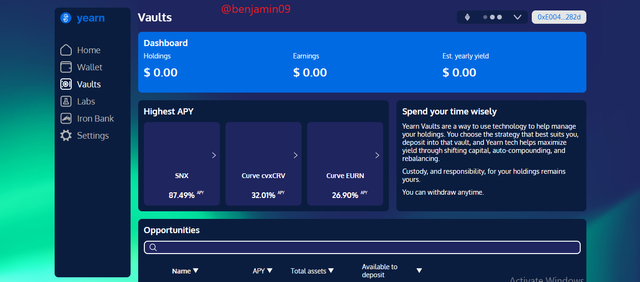

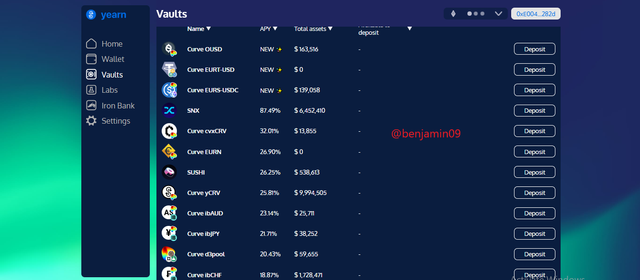

This is the vault page.

This is the Labs page.

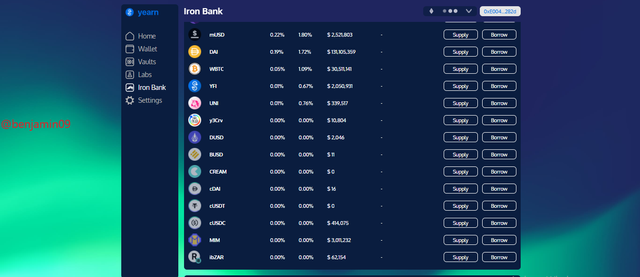

This is the Iron Bank page.

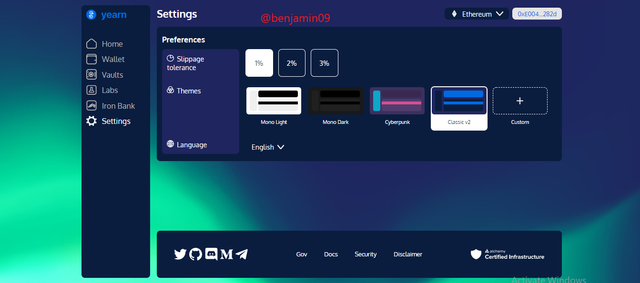

This is the Setting Page.

In the Vaults page you can add funds by clicking Deposit in the chosen field.

This is how to connect the wallet.

Wallet is connected.

Question 3.

What is collateralization in Yield Farming? What is function?

In Yield Farming, collateralisation refers to the process whereby a user is asked to deposit assets as a safeguard measure before collecting a loan from a lending platform.

It is not uncommon that people borrow money from others but are unable to pay when the time comes. Is it their fault. Of course not. But does the lender have to pay for them? It's not fair.

The money that is used by lending platforms to lend out is provided by liquidity providers. It'll be a shame that you give your money to somebody to use for a while but when you come to take, the person tells you they don't have it. It's even embarrassing.

And it is even more than embarrassing to not be able to repay the loan. Hence, characterisation came into play. It has some functions like;

- It motivates those borrowing to pay back on time. This is because the amount kept as collateral is usually greater in ratio comparison to what is borrowed. Thus, the persons will do everything within their power to not lose a higher amount.

- It also serves as a warning. With it's presence, people have to think carefully and weigh their options before stepping in to take a loan.

- It serves as compensation. Let's say that someone comes and borrows money now, gives a collateral but is unable to pay back on time. This would waste the lenders time and profits as that money could have been in the pool generating the liquidity provider profit. So the collateral will be used to pay of the debt and to compensate

Question 4.

At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

The YFI token, is it overvalued or undervalued? State the reasons.

Question 5.

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

Question 6.

In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

Where there is profit, there is risk. As amazing as Yield Faming is, we should not get too excited and forget that there are risks that accompany it as well. Some of these risks include the following.

- Risk of manipulation

When there are some people who own very large volumes of what is held in the liquidity pool, their every decision is going to affect every other person using that network. - Risk of Coding errors

They run the risk of making some errors in their code which can go as far as to leafing to the token losing it's market value. - Risk of Volatility

The value of the token will keep going back and forth at random unpredictable moments since it is a crypto currency. So you are at a risk of incurring losses.

Conclusion.

Yield farming has come with the tidal have of the crypto world, bringing DeFi to higher heights. It is a very profitable source if profits for the big players who know how to play the game.

But those who cannot deal with this should rather engage in the more stable one, staking. Without these people giving up their money for us to use, you might want to perform a transaction and you are told that there are insufficient funds.

So it is befitting that they get rewards for their sacrifice.

Thank you for reading.

CC: @imagen