My Season 5 assignment post for Prof. @reminiscence01 was reviewed and scored but not curated.

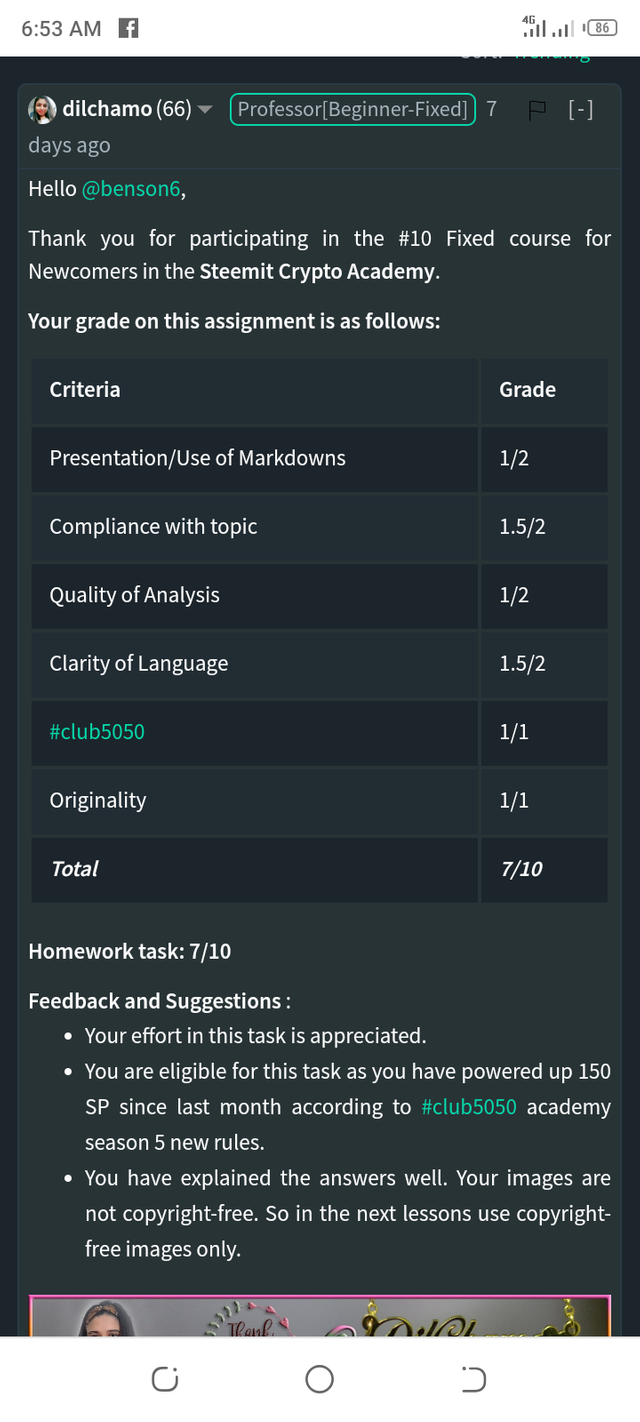

Below is the score sheet

Here is the post link for the home work task

https://steemit.com/hive-108451/@benson6/candlestick-patterns-steemit-crypto-academy-season-4-homework-post-for-reminiscence01-task-10

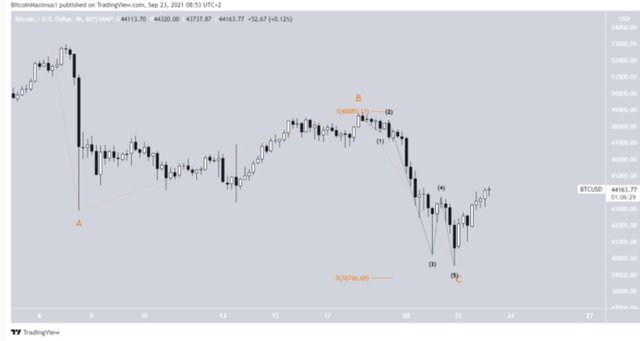

1A. EXPLAIN THE JAPANESE CANDLESTICK CHART? (ORIGINAL SCREENSHOT REQUIRED)

B. IN YOUR OWN WORDS, EXPLAIN WHY THE JAPANESE CANDLESTICK CHART IS THE MOST USED IN THE FINANCIAL MARKET.

C. DESCRIBE A BULLISH AND A BEARISH CANDLE. ALSO, EXPLAIN ITS ANATOMY.

1A. EXPLAIN THE JAPANESE CANDLESTICK CHART ? (ORIGINAL SCREENSHOT REQUIRED)

B. IN YOUR OWN WORDS, EXPLAIN WHY THE JAPANESE CANDLESTICK CHART IS THE MOST USED IN THE FINANCIAL MARKET.

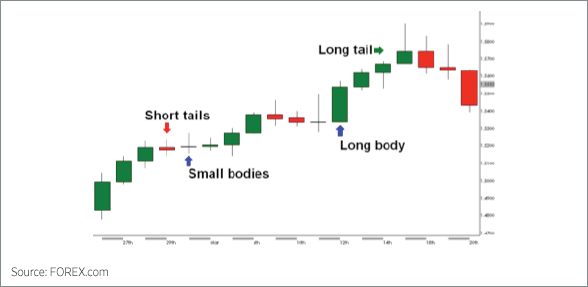

Through time, the use of the Japanese candlestick has become more well-known and famous among many money market traders. This is a result of many components which I will be examining here.

- EASY TO UNDERSTAND

The Japanese candlestick is simple to comprehend provided that they are impressive to make use of because of the use of customer-able colors and the unsophistication of the candlestick.

- INDICATORS

Indicators are influential trading tools and software that can be possibly be utilized alongside the Japanese candlestick to make better trading decisions and identify good market patterns in real-time by the traders.

- INTERACTION

This is another implication of the Japanese candlestick, it assists to exhibit the interchange between the forces of demand and supply in the market, and also between the buyers and the sellers as well.

All The listed reasons above are what makes most traders love and use the Japanese candlestick.

- MARKET PSYCHOLOGY

With the use of Japanese candlestick, sometimes at a glance, the traders can skillfully tell who is in the custody of a market, this is also known as market belief or trading psychology and the various candlestick pattern like the shooting star enables the quick decision-making of the analysis.

- ACCURACY AND DETAILS

When it gets to accuracy and circumstances, the Japanese candlestick has that, the candlestick provides detailed graphics about the recent market trend and occurrences in clear pictures and images on the different time frames, hence as a result of this, dealers get more valid results.

C. DESCRIBE A BULLISH AND A BEARISH CANDLE. ALSO, EXPLAIN ITS ANATOMY (ORIGINAL SCREENSHOT REQUIRED)

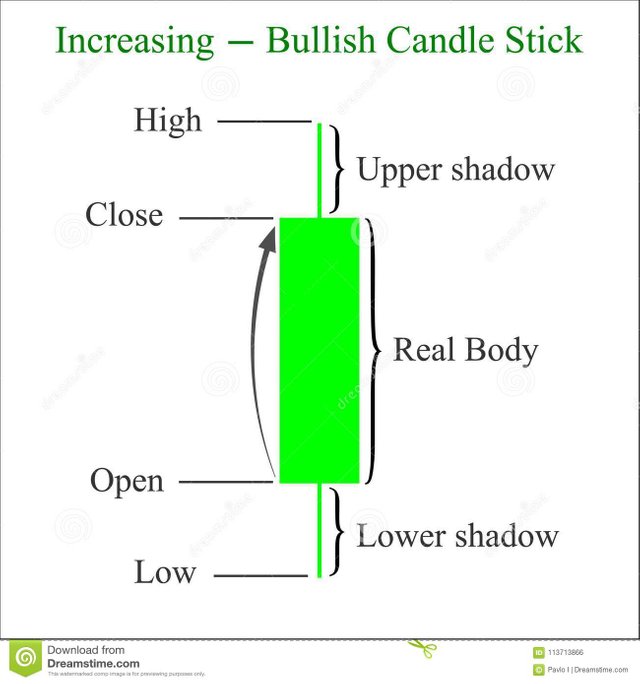

The Japanese candlestick is basically in two aspects which are the Bullish candle and the Bearish candle. I will be examining them one after the other involving their anatomy.

BULLISH CANDLESTICK

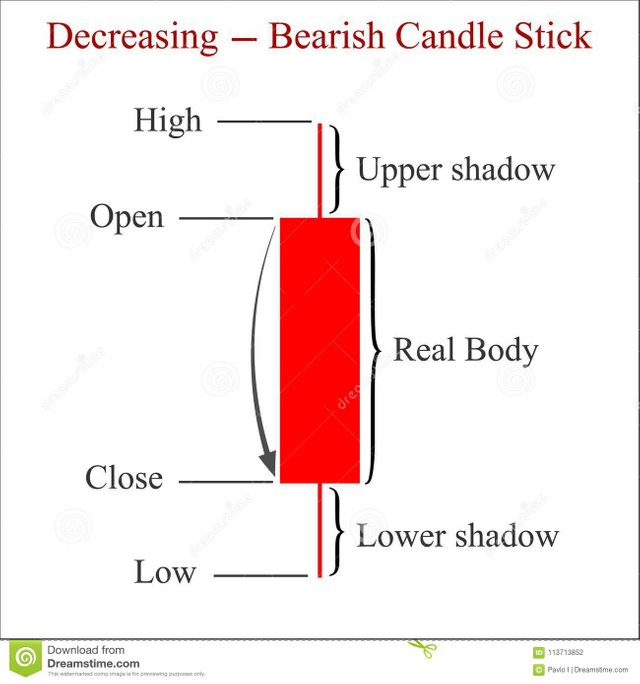

BEARISH CANDLESTICK

ANATOMY OF THE BULLISH CANDLESTICK

HIGH: It symbolizes the highest degree a special asset has reached within a time frame.

LOW:It also implies the deepest part a unique asset has achieved within a period.

OPEN: It is also understood as the opening price, this connotes the opening of price action within a period. For a bearish candle, the opening price can be organized at the top of the candle.

CLOSE: Also realized as the closing price, for a bearish candle, the closing price is constantly at the underside of the candlestick and the closing price commonly falls below the opening price for a bearish candle.

NOTE

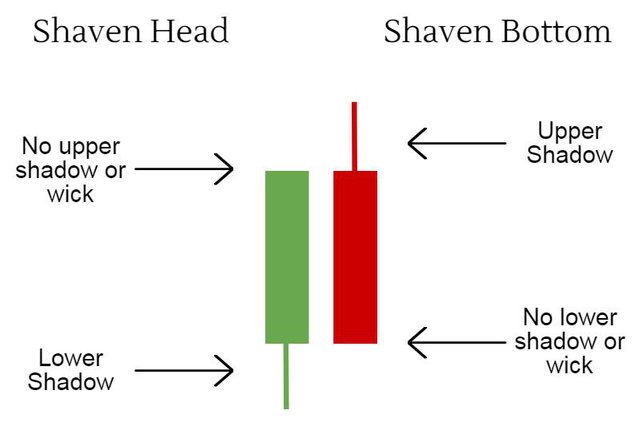

There are some outstanding cases whereby some candles occur to have no wick either on the upper shadow or lower shadow. The candle stick having no upper shadow is commonly cited as 'shaven head' while the candlestick with no lower shadow is naturally cited as 'shaven bottom'. This can be seen in the picture I uploaded.

The Japanese candle stick is a valuable trading tool for financial market traders. Its implication cannot be overemphasized as it has renovated the technique of trading. However, this course has encouraged me to privately know more about candle sticks and I will proceed to more research about them and know how to effectively relate them to get reasonable outcomes.