Hello my wonderful friends in steemit. Hope we are all doing good. I am excited to continue on my participation in crypto academy. This time, I would be writing on the homework task of the course presented by @cryptokraze with the topic - Market Structure Break (MSB) Strategy to Trade Reversals.

What do you understand about Market Structure?

Market structure can be defined as the formation of resistance and supports on my assets chart which is referred to as swing highs and lows. It is the pattern created due to the movement of price of an asset.

In a market, prices are not constant, the price can either go up or down. This up and down movement of prices creates what we know as market structure.

In the world of cryptocurrency trading, it is always important to watch the pattern created by price so as to determine the next price movement of the asset.

The market can move in three differrent directions. The patterns are

Uptrend pattern

Downtrend pattern

Sideways pattern.

● Uptrend pattern

During an uptrend pattern, the price of an asset moves in ascending wavelike form, causing what we refer to as swing highs and lows. As this pattern forms, you will notice that the present high and low is always higher than the previous ones.

Just like I mentioned earlier, a pattern is not constant. This movement will continue for a while until the market changes direction.

It is good to note that those lows are caused as a result of little dip in price during the uptrend, but never lower than the previous low.

HH - Higher High

GL - Higher Low

Example of an uptrend from my Binance account.

● Downtrend

A downtrend occurs when the price of an asset is decreasing, as if you are descending a hill. The decrease in price forms a wavelike pattern with lower highs and lower lows. Unlike in an uptrend, the current lower high and lower lows are lower than the previous ones.

It is worthy of note that the lower high are caused as a result of temporary increase in price during the downtrend, but never higher than the previous one.

Example of a downtrend from my Binance account.

LH - Lower High

LL - Lower Low.

● Sideways.

This pattern can also be referred to as ranging pattern. In this case the price of an asset are just within a particular price range. It is not going beyond the range. At this point, it looks as if the price is stable. This only indicates the struggle between the buyers and seller on which direction the market should take.

From my Binance account

What do you understand about Lower High and Higher Low? Give Chart Examples from Crypto Assets.

Lower High

This is the point at which the high formed will not be higher than the previous high. It fails to surpass the price of the previous swing high. This is always an indication that there is going to be reversal of an uptrend. The formation of this lower high, informs a trader that the market is about to go in the opposite direction during an uptrend.

It will be wise for us to note that it is not the only factor to be considered when checking for a trend reversal. These will be looked into later in the assignment.

Higher Low

This is the low which is caused as a result of dip in price during an uptrend. It is normally higher than the previous one and sandwiched between two higher highs. During an uptrend, a scalper can identify this higher low, enter the trade and zoom off immediately with small profit at the next higher high.

From my binance account.

Screenshot from my Binance account.

We should also note that a higher Low can formed at the end of a downtrend, signaling a change in market direction.

How will you identify Trend Reversal early using Market Structure Break? (Screenshots Needed)

This is an important part of trading every trader should learn very well. Identifying trend reversal can help a trader make as much profit as possible. Entering a market early brings about a good risk-reward ratio.

There are three things that requires our consideration to help us identify reversal for both an uptrend and downtrend early .

♤ Uptrend Reversal

For an uptrend reversal, we need to identify the

□ Formation of the Lower higher at the top of an uptrend

□ Draw the Neckline of the market structure

□ Wait for a clear breakout from the neckline.

Screenshot from my binance account.

From my screenshot, you can see the three conditions to be met clearly stated their. We all can also see what happened once those conditions were fulfilled. There was a serious downtrend pattern that followed the breakout. So if a trader, used this strategy and entered this trade early, we can imagine the profit he can rake in.

♤ Downtrend Reversal

There are 3 conditions to be met before we can of sure of a downtrend reversal. These are

◇ There will be a formation of a higher low at the bottom of a the downtrend.

◇ We need to mark the neckline of the market structure.

◇ Then sit and wait for the breakout to occur.

From the screenshot above, we also observed that the breakout occured, fulfilling our three criteria for breakout of market structure. The reversal took place and the market changed direction.

Explain Trade Entry and Exit Criteria on any Crypto Asset using any time frame of your choice (Screenshots Needed)

Determination of when to enter a buy trade using MSB.

It is bad to enter a buy trade when the trend is already in motion, unless the trader is very good with scalping. So it always best to take the following measures before entering a buy position.

There is need to ensure that the market is already on a downtrend. the lenth or duration of the downtrend is dependent on the time frame that I am using.

I need to be certain there are some lower highs(LH) and lower low(LL).

Once I observe that the higher low has been formed,, I should draw a neckline. Patience is needed as i wait for the breakout to occur. The breakout will be a very strong candlestick closing very much above the neckline.

Enter the buy position above the neckline.

This is illustrated further in the screenshot.

Determining When to enter a sell position using MSB.

To enter a sell position, we also need to confirm some key factors before entering a selling trade.

○ we need to make sure the market is currently in an uptrend pattern. The duration is dependent on the timeframe of the chart, we are making using of.

○ identify the pattern associated with an uptrend, that is the higher highs and higher lows

○ Draw the neckline once you observe the lower high has been formed. The neckline has been explained in the previous question above.

○ Sit and wait to observe when a bearish candle will cross the neckline, closing above it.

○ Enter your sell position just above the breakout candle.

The screenshot below explains the above.

How to exit a trade using the MSB

Exiting a trade can be in two ways

- When the take profit is hit, that means the trade went in your favour.

- When your stoploss is hit, which means the trade is against you.

For every trade taken, these two are very important. For a trader to be successful, he needs to have his target in every trade he takes. Knowing his target, will enable him calculate his profit and set it on the trading app by setting his take profit. The least takeprofit should be on the reward ratio of 1:1. However, if trades are entered at the right moment, a trade can enjoy a reward ratio of 1:3. This means that for every $1 you risking you will be making $3.

Once the takeprofit is hit, the trade automatically stops and profit is taken.

For a buy takeprofit, you set it depending on your profit target, using resistance line. It could be the first resistance line or the second as the case may be.

For a sell takeprofit, you set it depending on your profit target too. It could be the first support or the second as the case maybe.

Another way of exiting a trade is the use of stoploss. A stoploss is provided to ensure we dont lose more funds than is necessary when a trade goes against us. This stoploss set is usually a percentage of the trading funds available, while considering the risk reward ratio.

For a buy trade, The stoploss is set just below the last higher low

Buy setup, entry, takeprofit and stoploss.

For the sell trade, the stoploss is set just above the higher high.

Sell setup, entry, take profit and stoploss positions.

Place 2 demo trades on crypto assets using Market Structure Break Strategy. You can use lower timeframe for these demo trades (Screenshots Needed)

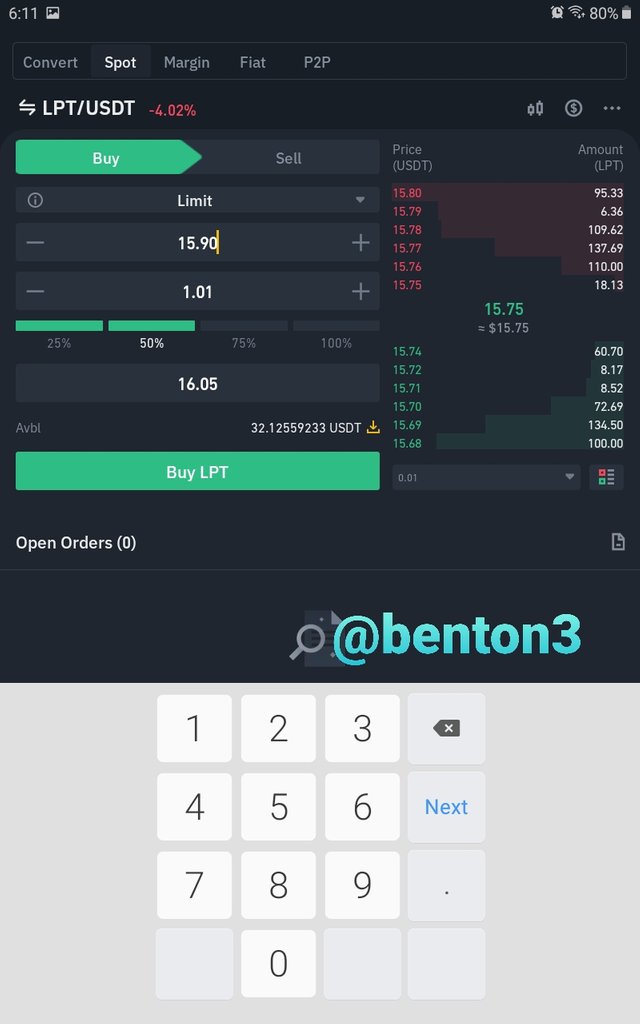

I am going to place a trade but in a real account not demo. I am using the 5mins timeframe to that. I am using the asset pair of LPT/USDT.

The screenshots below shows the Buy entry taken, but placed on buy limit trade options. The trade will only trigger off when there is a clear breakout of the neckline and the buy limit price is triggered.

The buy entry is set on buy limit options.

Stoploss and takeprofit targets to be set once the trade triggers off.

I normally use limit option for most trades I enter. I dont chase the market, the market comes and meet me. That is the beauty of the market break structure.

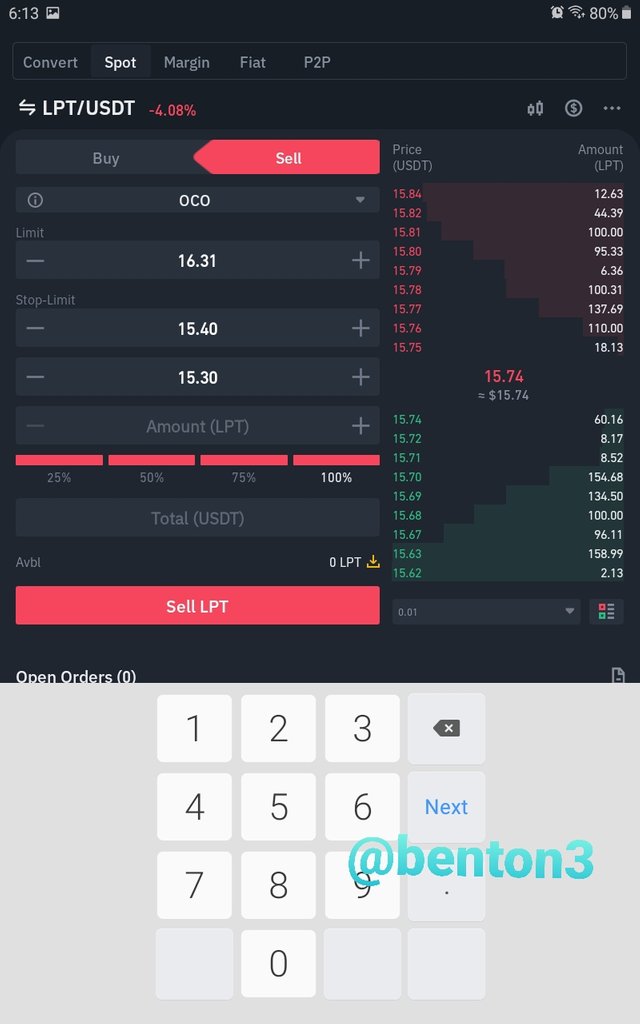

Now for the demo on sell trade,

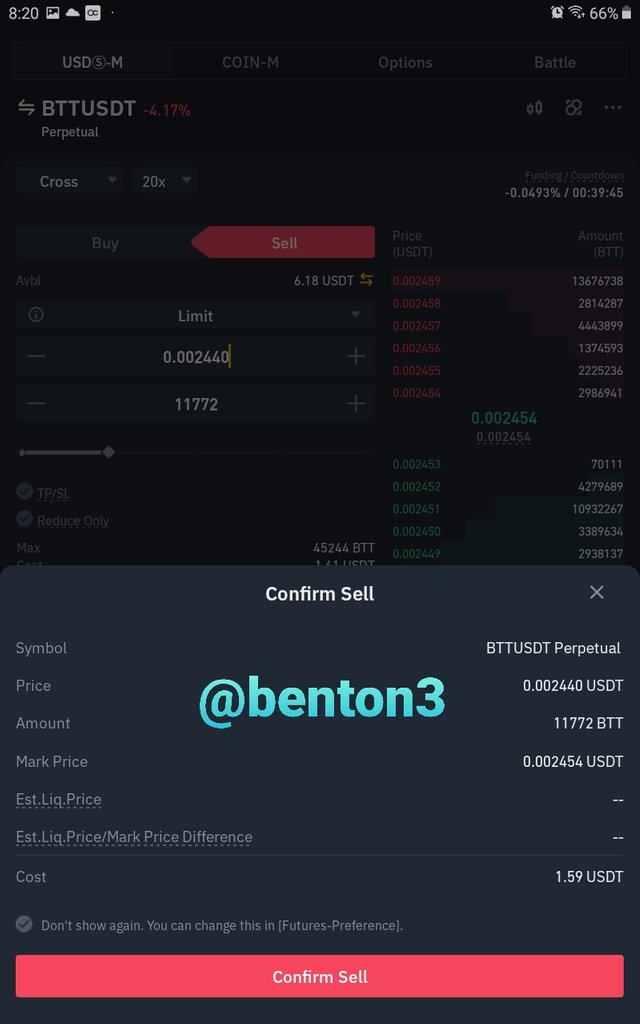

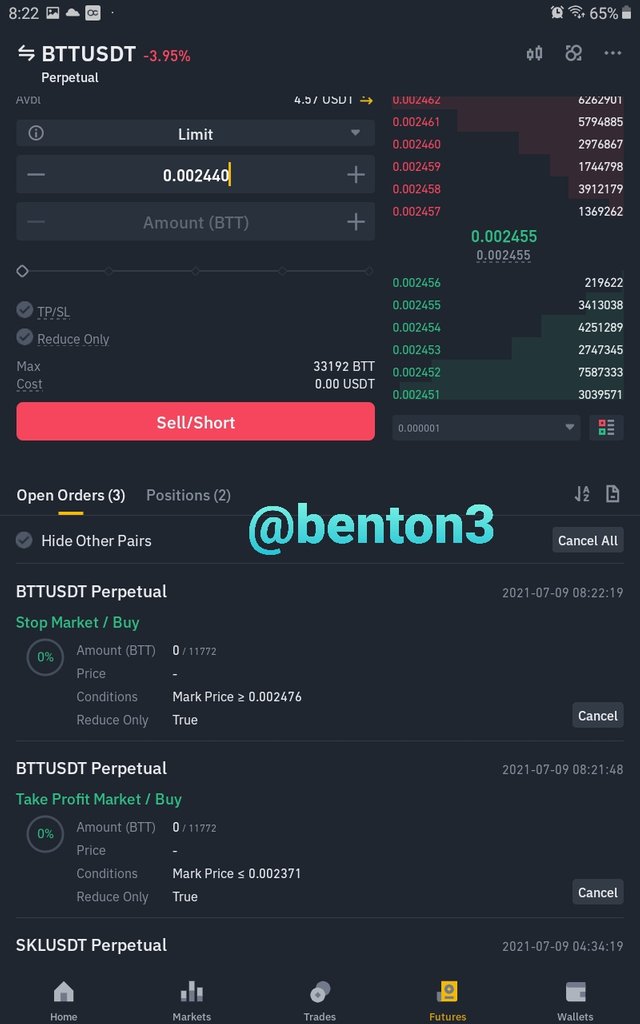

For the sell trade entry, I am using the pair of BTT/USDT. I am doing the trade on a 15mins timeframe.

Kindly see the screenshot of the analysis below.

I still entered the trade with a sell limit order.

Below you can also see my stoploss and take profit set as well.

This trade have already been triggered and is currently running.

Conclusion

I so much appreciate this wonderful lecture by professor @cryptokraze. I have really learnt a lot from it. Before now, I had an idea of market structure breakout, but can not apply it in my trades, since i did not fully understand it. Thanks to prof, I am now applying it in my real trades as you saw in question 5, just to tell you the confidence I have now.

Thanks you so much for contributing positively to my knowledge through this academy.