Hello fellow steemians. it is good again to be back in this week crypto academy. I am writing on @kouba01 with the topic Cryptocurrency trading with RSI.

What is the Relative Strength Index - RSI and How is it Calculated?

Relative Strength Index is one of the technical tools used in trading. It is among the oscillator indicators that are used to determine the point of entry and exit for a trader. This particular tool was developed by Willis Wilder.

This tool is used to measure when a particular crypto asset is in an overbought or oversold position thereby allowing the trader to spot and verify buying and selling signals.

An RSI value that is above 50 indicates a bullish divergence, while the RSI with a value below 50 indicates a bearish divergence.

it is also good to know that when the RSI is from 70 and above, the asset is in an overbought zone. On the other hand. when the RSI is from 30 and below, the asset is in an oversold condition, thereby every trader, will be looking out for reversal signals on the other side if noticed. This is signal is usually shown below the chart of a particular crypto asset.

How To Calculate RSI

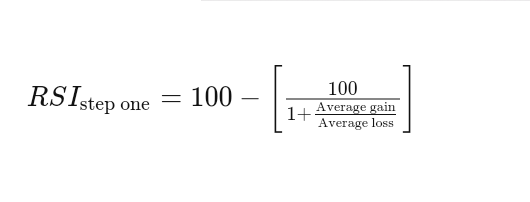

The RSI is calculated using the formula as shown below.

So we can say that

RSI = 100 - [100/(1+ (the average of upward price change/Average of downward price change))]

source

For example an asset have the following percentage gains and losses during a 14 day period = +1, +2,+1.5,-1,-1,-0.5, -2, +1, -1, +2, -0.5, +1, +0.5, -2.

the asset's percentage gains for 7 days which is equal to 9.5%

so the average price gain is = 9.5/7 = 1.35%

the asset's percentage loss which is also for 7 days = 8.5%

so the average price loss is = 8.5/7 = 1.21

therefore the RSI = 100 - [100(1+(1.35/1.21))]

RSI = 100 - [100/(1+1.12)]

RSI = 100 - [100/2.12]

RSI = 100 - 47.17

RSI = 52.83.

So from the above illustration. the RSI is bullish divergence.

So we can say that the RSI will still main its value of above 50 as far as the average gain of the asset remains positive within the period used for calculation while it will fall, when its average is in loss or negative position.

source

Can we trust the RSI on cryptocurrency trading and why?

Just like there is no 100% percent guarantee in anything we see, the same is applicable to this indicator. in as much as it is used to determine signals on long-term basis. However there is need to recognize that sometimes it gives a false signal alert. Technical indicators only indicate and not predict due to the dynamic nature of the market. So when using RSI, it is always good to use it along with other indicator as well as the technical analysis of the assets you want to trade.

So it is not 100% reliable.

How do you configure the RSI indicator on the chart and what does the length parameter mean? Why is it equal to 14 by default? Can we change it? (Screen capture required)

I am using the asset pair of EOS/USDT

the asset pair

screenshot

I am changing it to a day chart.

changing to 1D chart

screenshot

To go to where you add the RSI indicator click on the Fx sign on the menu bar

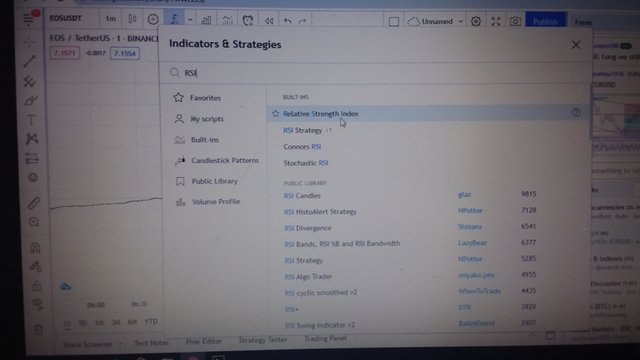

type in RSI to search for it on the search bar

screenshot

Click on Relative Strength Index as is pointed by my cursor on the screenshot

screenshot

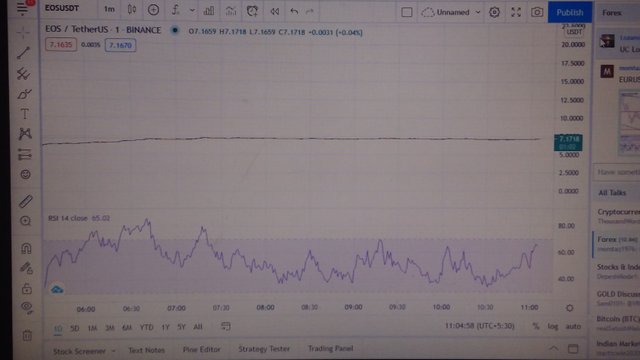

The indicator now appears on your chart automatically

screenshot

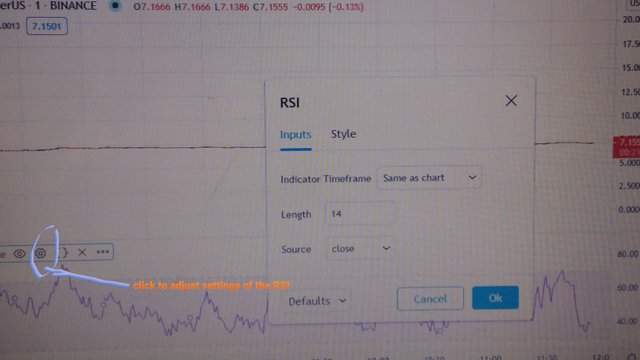

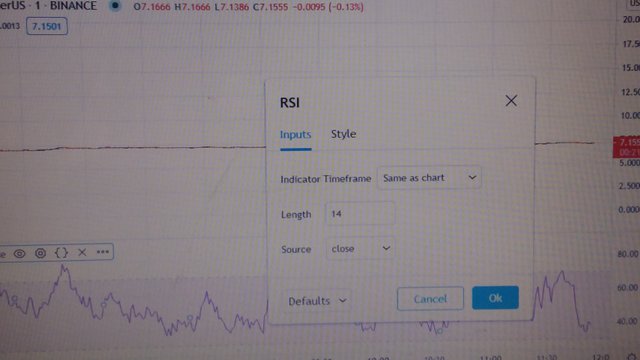

what does the length parameter mean

This is a key factor in RSI determination. the length on the chart above is 14 units by default. Since my chart is a 1D chart, it simply means that the RSI is formed in 14 days.

It is 14 by default as that is the standard default. this because, when the length is lesser, RSI finds it easy to attain to extremes values in the chart like getting to 80 or 20 and below, this makes the market look volatile and unstable. however, the length 14 appears to make the market more stable, thus providing a better and more accurate signal for the traders.

the choice of the length or period to use is dependent on the traders style and purpose for using it.

source

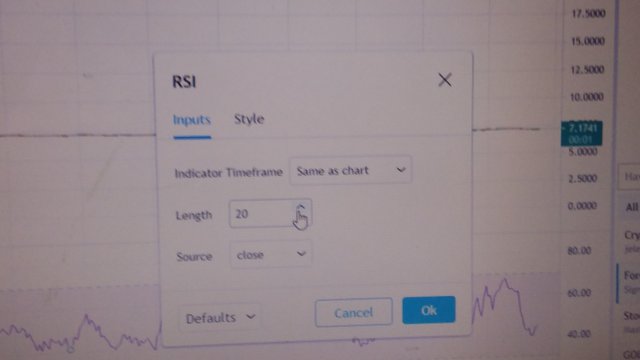

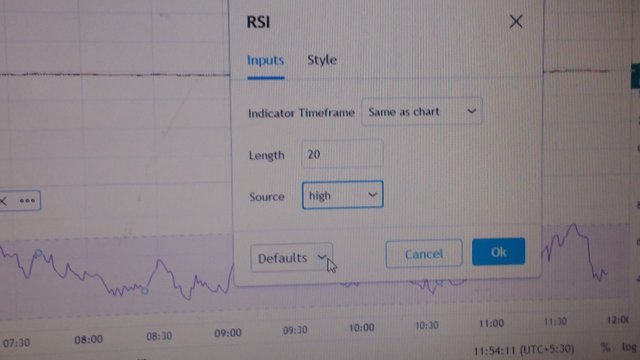

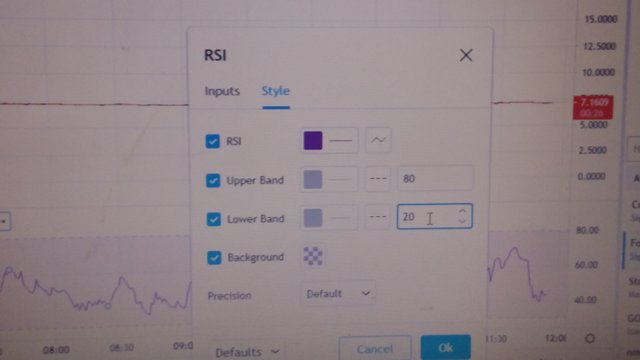

However, it could also be changed based on traders discretion.

The screenshots below shows that.

click to adjust settings of RSI

screenshot

This is the adjusted RSI on the screen now.

screenshot

How do you interpret the overbought and oversold signals when trading cryptocurrencies? (Screen capture required)

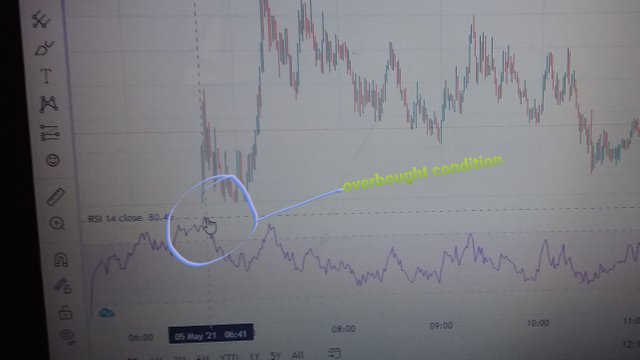

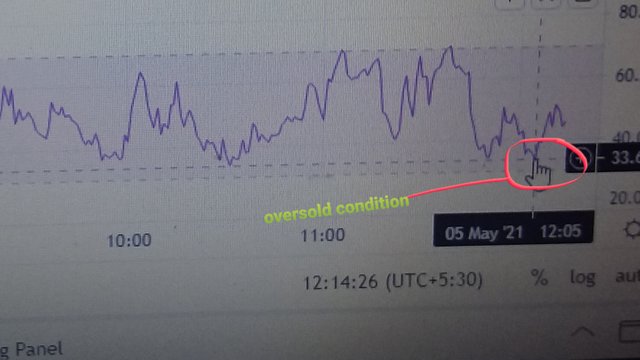

like I have earlier mentioned, when the RSI is 70 and above, the pair is overbought but when it is 30 and below, it is oversold.

overbought condition

screenshot

oversold condition

screenshot

How do we filter RSI signals to distinguish and recognize true signals from false signals. (Screen capture required)

A bearish divergence is certified when the price of an asset increases, but the RSI indicator shows a decrease in price rather than an increase.

A bullish divergence is confirmed when the price of an asset drops in price, but the price on the RSI indicator is increased or higher than that shown on the chart.

the screenshot below explains that.

from the screenshot above, the bullish divergence can be seen, shown in pink colour, as the price of the asset was falling on the chart, we notice that RSI price never went below the higher low even though it went below it on the chart. Once this pattern is noticed, it is time to go long. this is known as bullish divergence.

Also we can notice the bearish divergence in green colour lines, circled as well and arrowed. Even though the price went up as is shown on the chart, on the RSI it never moved beyond the lower high, this is an indication of a bearish reversal.

Like i earlier showed on the adjustment that could be done on the RSI settings, I normally use 20 as my period, since i have noticed that the error rate is reduced, by that I mean providing you with a more accurate signal of either to buy or sell.

Review the chart of any pair (eg TRX / USD) and present the various signals from the RSI. (Screen capture required)

the chart below is a screenshot taken from tradingview.com showing the signals both for buy and sell. this is illustrated on the screenshot.

screenshot

All the pictures are taken online real time from tradingview.com charts.

Conclusion :

RSI as indicator can help traders who can interpret very well to maximize their profit and minimize losses. it also affords them the opportunity of having reduced stop losses since they can enter the market early in any trend.

However traders needs to display caution in their use of it, and try to validate whatever signal given by it with other indicators or any other technical analysis.

Hello @benton3,

Thank you for participating in the 4th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 3/10 rating, according to the following scale:

My review :

An article with weak content in which you did not succeed in answering the questions due to the confusion of concepts you have. Try to take the time to understand the lesson and research before writing.

You may have a confused understanding of the divergences in the RSI.

In theory, the RSI is supposed to follow the same movements as the price, however sometimes the curves do not represent the same shape, we speak of divergences.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit