Hello friends, I feel great to be back for another homework task. This time I am writing on the homework task of professor @yousafharoonkhan on the topic - Exchange order book and its use and How to place different orders?

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

Just as the name implies, it is a book that is used to record transactions of a commodity whether buy or sell. In this book, the record of various rates used during the selling or purchase of an item is clearly written down in the order book. the order book comprises of not just an individual transactions, but also that of others who also engages in the buying and selling of that commodity.

For example, we can look at it as a complete statistical information of the market situation( buy and sell) of a particular commodity which also includes the prices they are bought or sold for as well as the the time the transactions were made. For the purpose of this assignment that commodity is the pair of assets being traded in an exchange platform. so we can say that an exchange order book refers to that book which contains all the records of activities whether buy or sell of a unique asset pair.

From the above, we can notice that, when it comes to the order book of crypto, unlike a commodity, two forms of currencies are involved. Also in commodity market, like when I was still working as sales person, the price is clearly determined by the forces of demand and supply, but in the crypto world, there are several drivers of price.

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

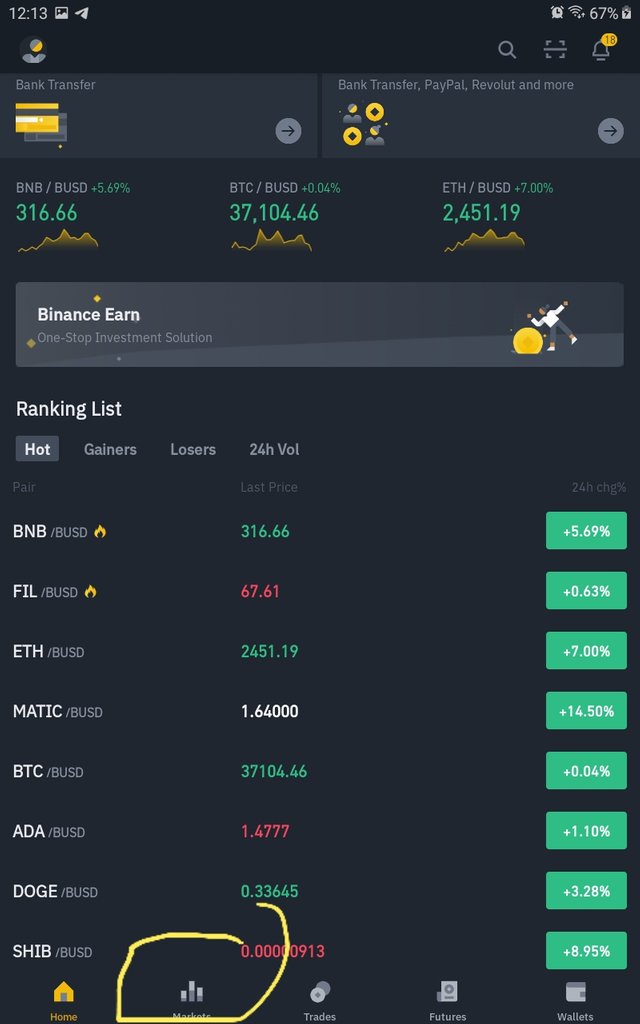

To locate the exchange order book. I will open open the Binance App, on the homepage screen, select markets,

select market

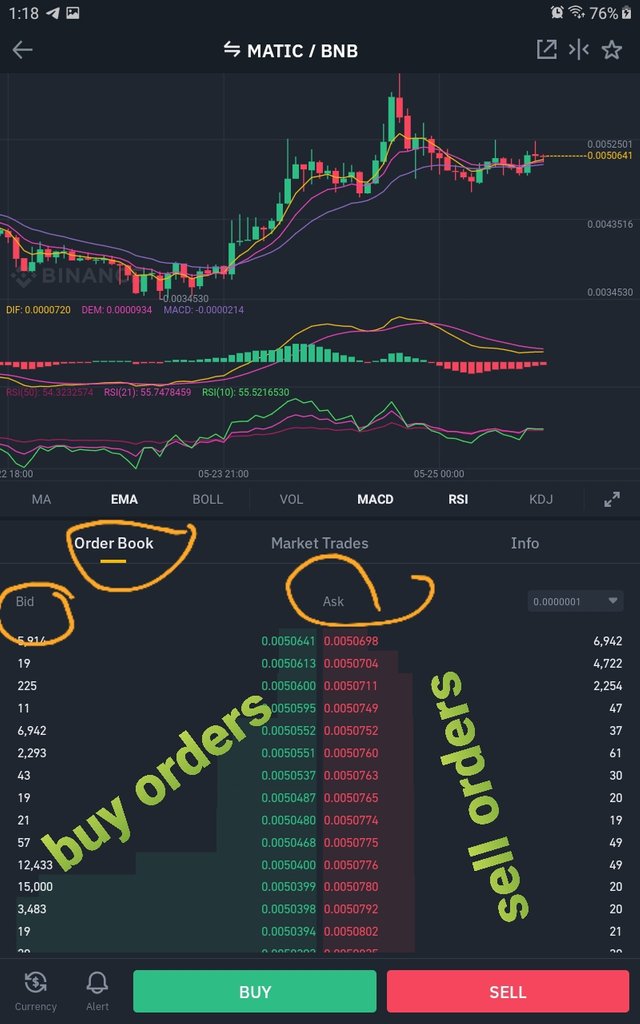

I want to use the pair of Matic/BNB to bring out the order book.

We can see the order book highlighted on the screenshot below.

order book

Pairs

Support and Resistance

Limit Order

market order

Pairs

Trading pair can be explained as two assets or cryptocurrencies that are paired together to be traded on an exchange. An example of this is Doge/USDT. What this simply means is that we can use one to buy the other, or sell one to get the other. it goes either way,. It is just like during the time of trade by barter, i now say i want chicken for my yam. this means that I can only give out my Yam in exchange for chicken, YAM/CHICKEN.

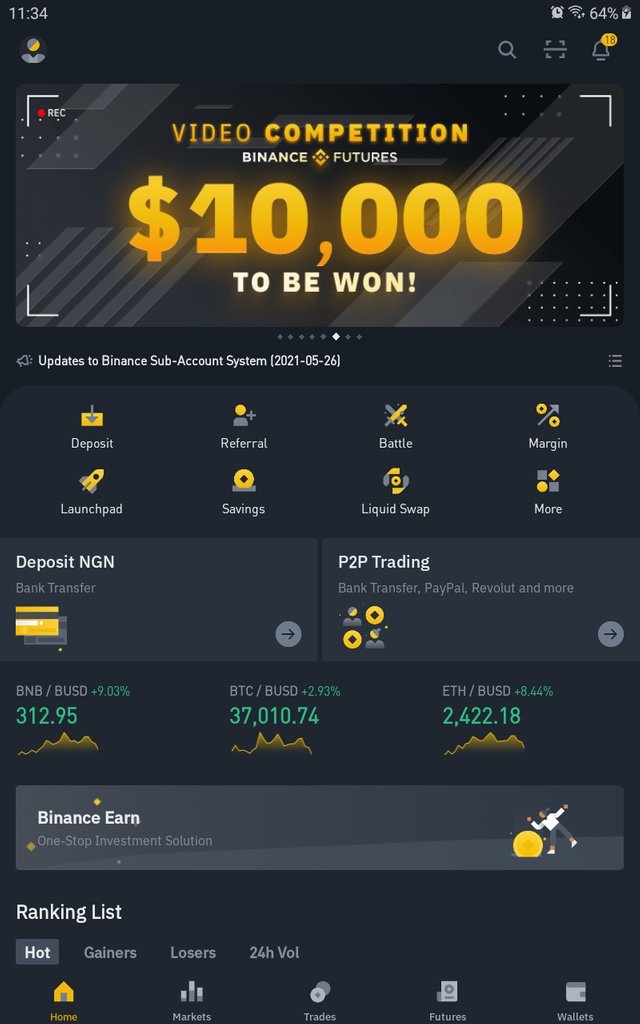

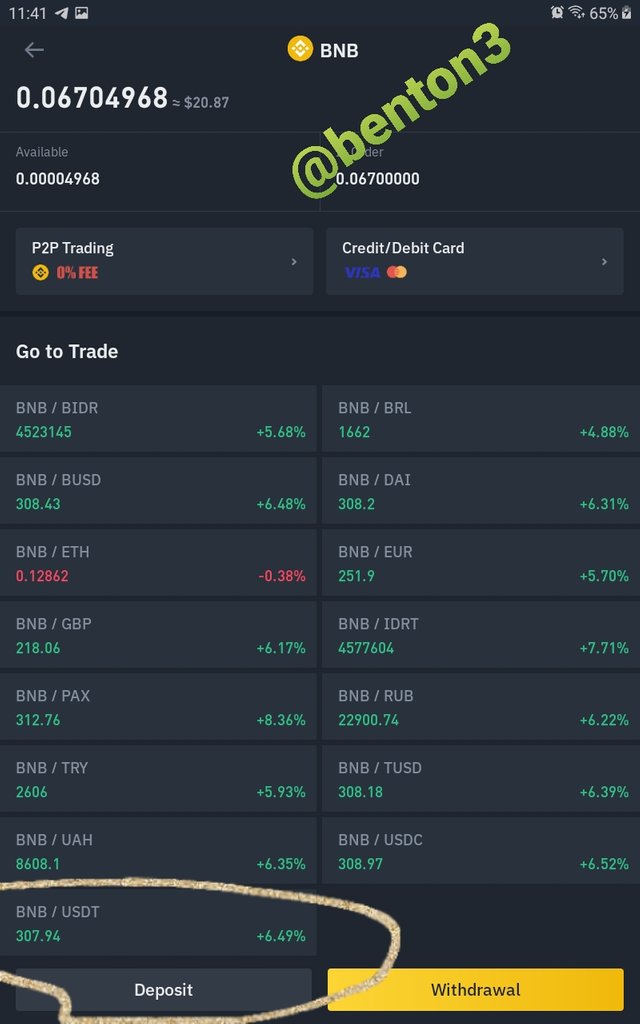

To find pairs of asset in an exchange, I Normally use Binance, just started using it since late Dec 2020.

For me, my binance account is on my tablet. so I am always automatically logged on. When you open the app, the home screen appears as shown below.

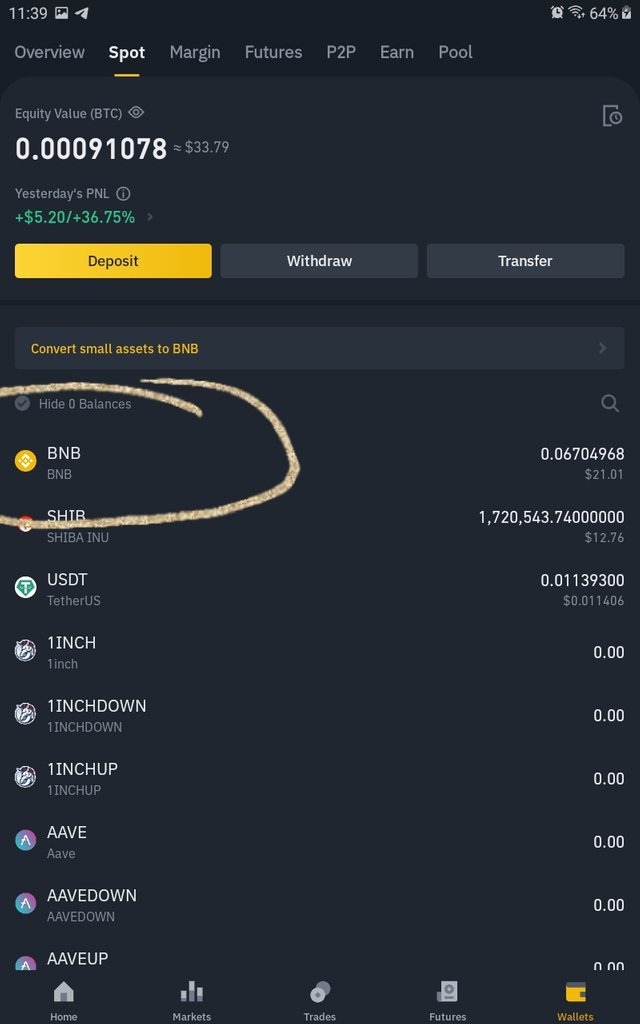

below the homepage screen, click on wallets, the screen below will show, with spot highlighted.

Any crypto selected here, brings out its subsequent pairs. for example, I want to find the pair of BNB/USDT. i click on BNB.

BNB selected

The following screen below shows, listing all the possible BNB pairs which can be traded, and right down there, you can see the pair of BNB/USDT.

BNB/USDT pair

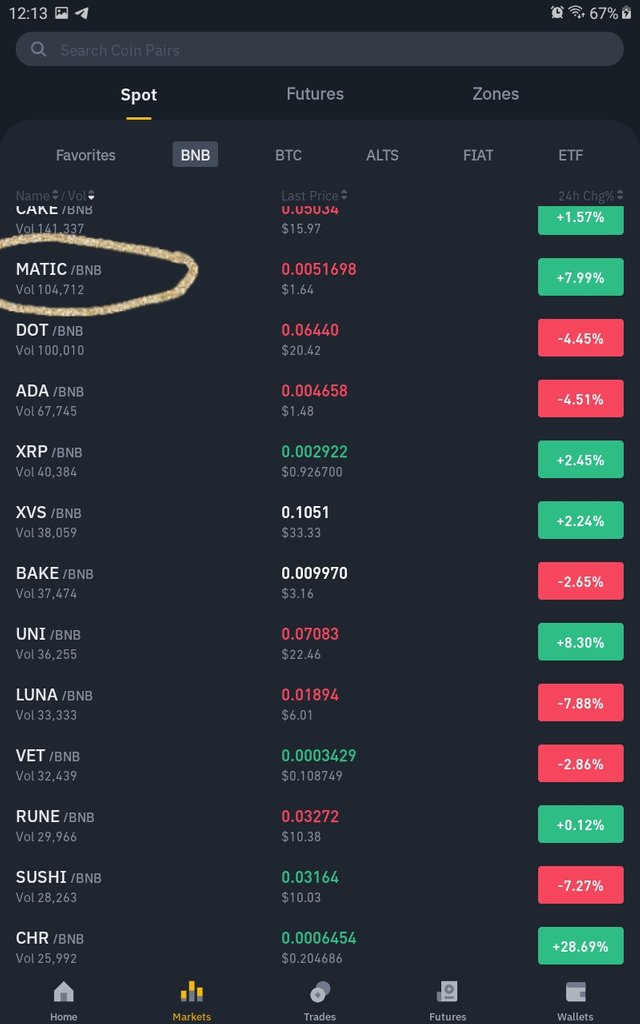

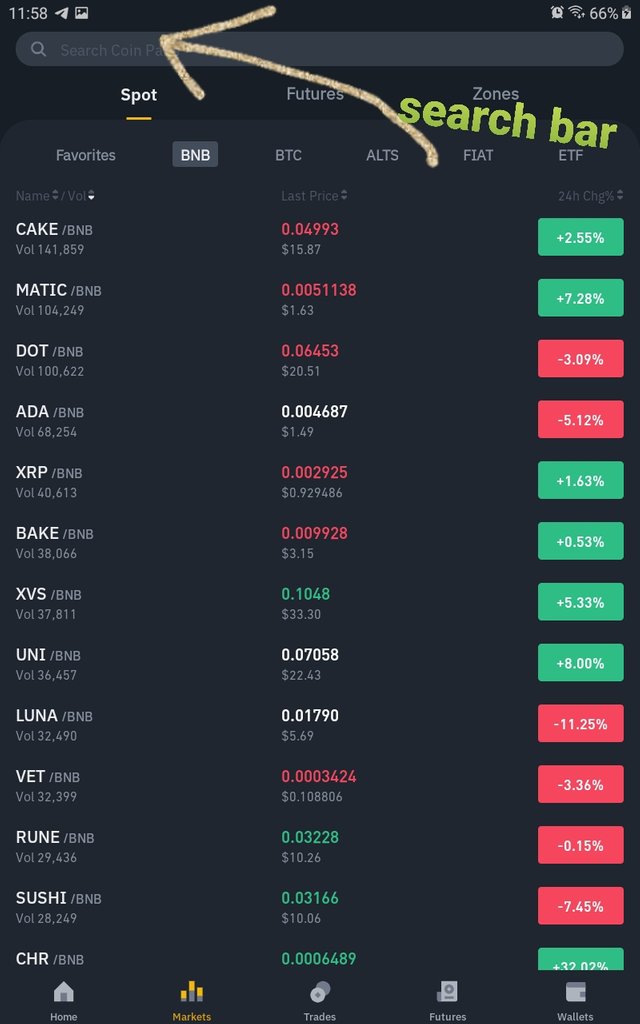

Another way it could be done is by clicking on market on the homepage, it brings out the screen below.

then on the search bar, type in the coin you want its pair.

search bar

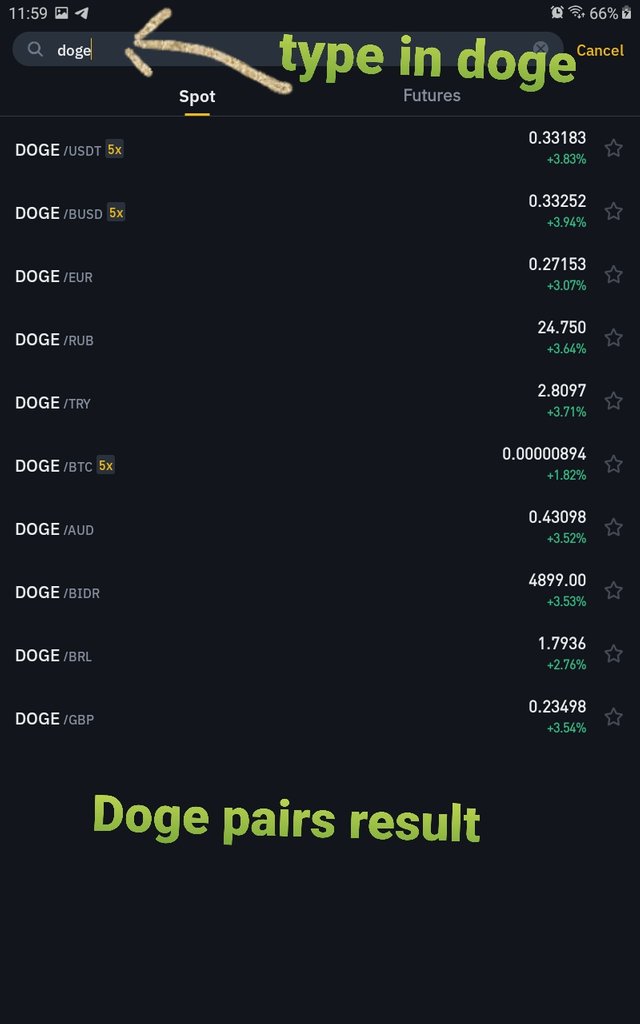

I am searching for doge pairs, so i type it in on the search bar.

doge pairs result

you can see the Doge pair as its shown above.

Support and Resistance

A support is defined as that price level at which the price of an asset is expected to hold on without going down further. this normally happen during a downtrend. At this price level, a trader assumes, that the downtrend will not continue therefore, trend reversal is upcoming, presenting an opportunity for the trader to either go long. or scalp.

This support line can be gotten from previous resistance levels on the charts.

A resistance level is defined as that level during an uptrend that prevents the price from pushing upwards, if not permanently but temporarily. just like the support level, it signals an impending reversal in the upward trend, if not permanently but temporarily. so the trader can decide to place a sell trade at this point.

Matic/BNB pair

from the screenshot above, we can see the chart forming tops, those triple tops forms a strong resistance, preventing the price from pushing upwards. however the support, can also be seen, as the price hits this point 3 times, before moving upwards.

Limit Order

The Limit order is an order I place at a price different from the prevailing market price or spot price. That is to say that, using Doge as an example, the spot price of Doge is 0.66, and i feel the price is still high, and i want to buy at 0.35, Using the limit order function, i will place an order to buy when the price is 0.35. thus whenever, the price comes down to 0.35, is when that buy order will be triggered and executed.

Market Order

Market order is that type of order at which I buy or sell at the prevailing market price. This is also referred to as spot price. In this case, the buyer or seller does not need to wait as he is willing to trade at the current price. Using the example above, i dont need to wait until the price reaches 0.35, rather I buy immediately at 0.66.

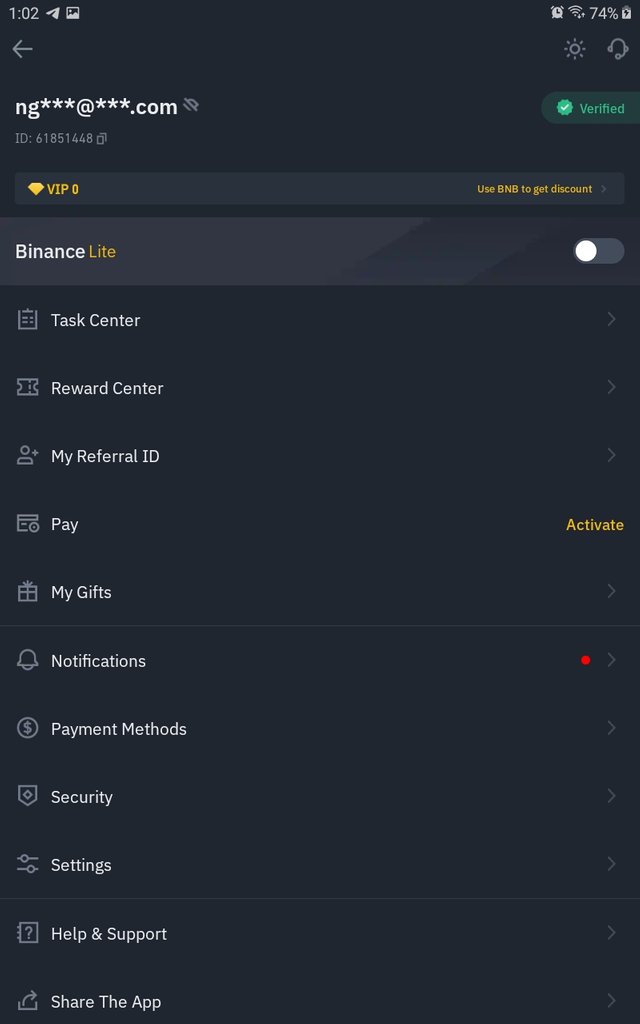

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

![Screenshot_20210525-130230_Binance.jpg];;;;;;( )

)

screenshot of my verified account

The features of the Order book

in my earlier explanation of an order book, i said. that it is a book that contains a record of buy and sell of a pair of crypto assets. This order book contains the various transactions being done the particular asset pair, you have the bid, which means buy and the Ask, which is for selling. the buying orders in indicated in green color which the selling orders are shown in red colors. the market constantly and simultaneously executes the buy and sell orders.

There are other features besides the order book. you have market trade and Info, where you can get comprehensive information about the crypto in question.

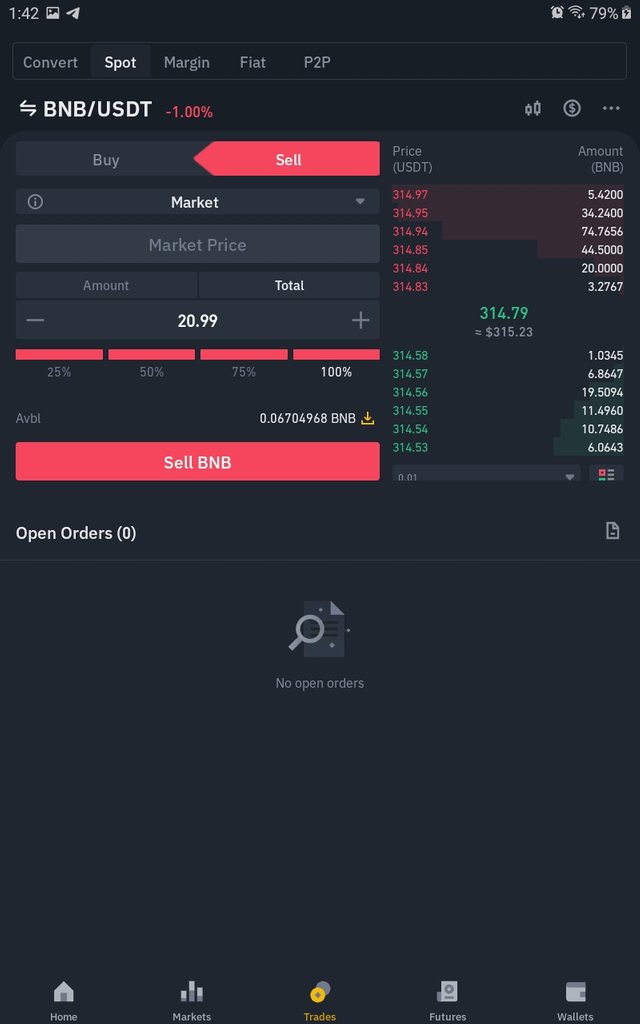

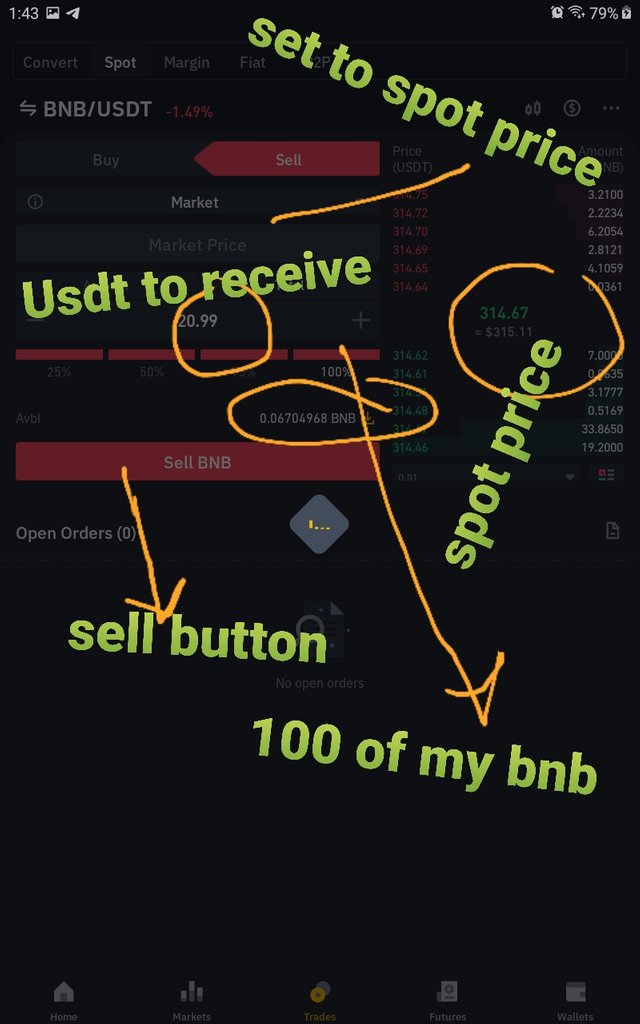

Sell Order

To place a sell order simply means to exchange a crypto that i have in my wallet for another one that I would like to make use for. In my Binance account, I already have some BNB, so I would like to sell it for USDT. To do so, I would select the BNB/USDT pair

then click on sell

fill in the details like the amount of BNB that I want to sell, or i can select 100% since I want to sell all. Change the type of sell order to market, implying that I want to sell at market price, if I sell, I would be having 20.99USDT, having sold 0.06704 BNB. then click on sell BNB to consummate the transaction.

nothing is left in bnb wallet.

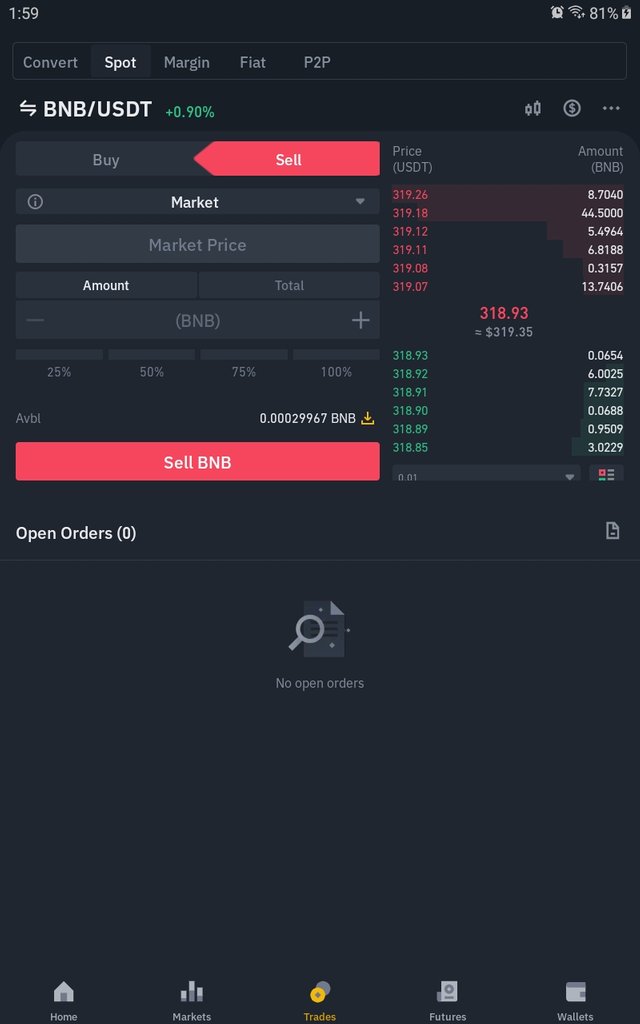

Buy order

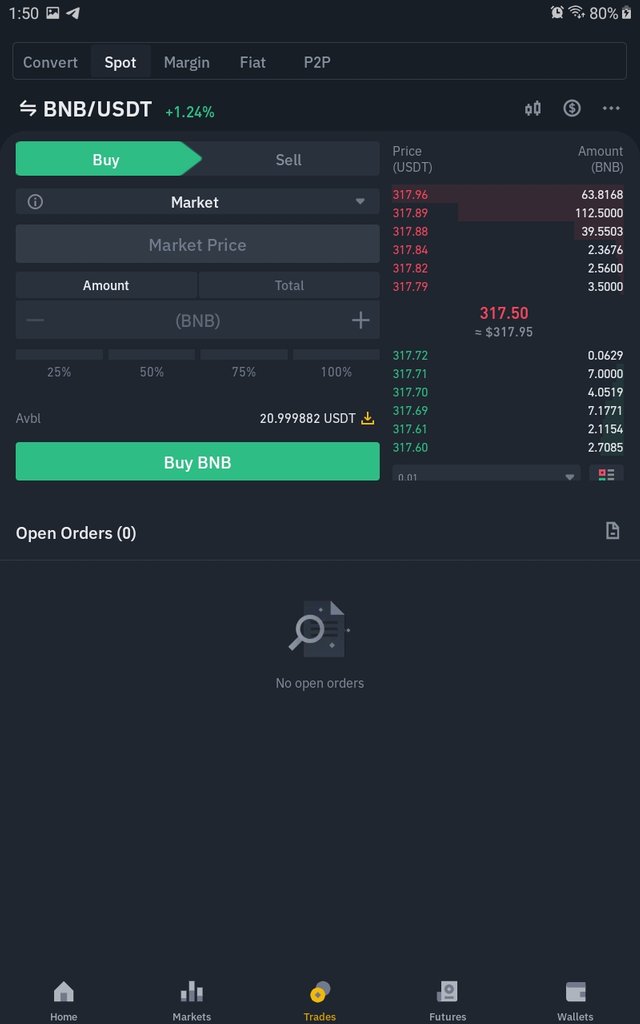

I want to buy back my BNB, exchanging my USDT to get BNB, this is what I have in my USDT wallet below.

before the buy order

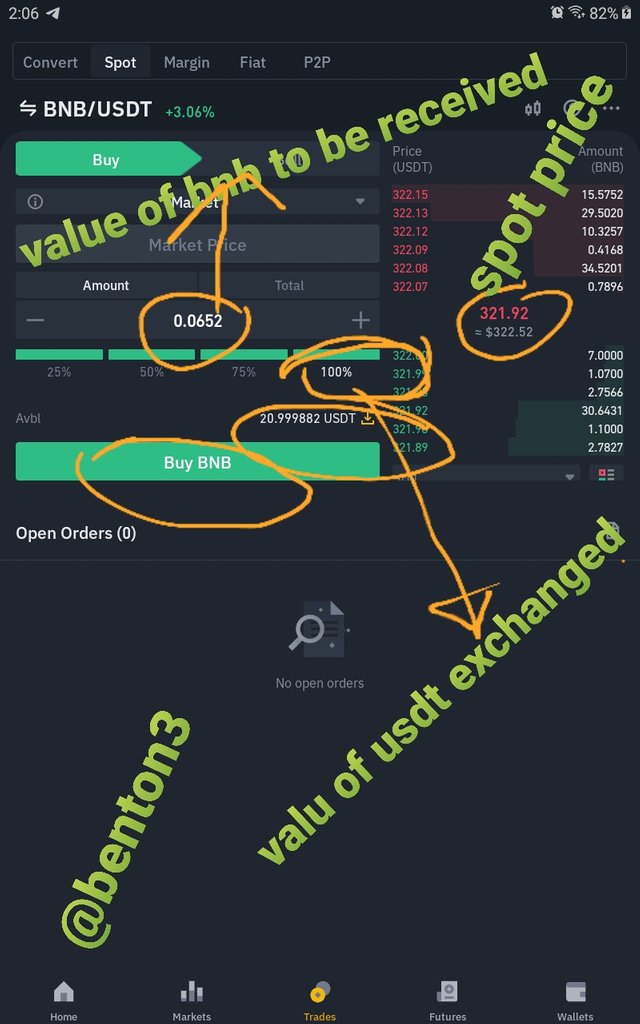

I will select buy, still select market, since i want to buy at spot price(market price), select 100% since I want to exchange all and then hit the buy button below.

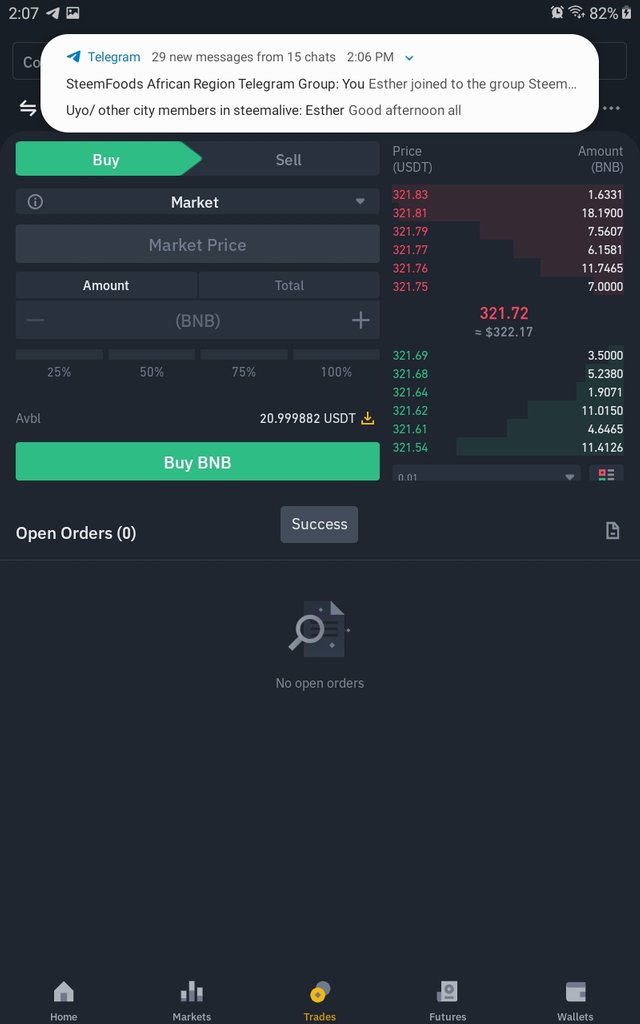

the order is quickly executed.

the process of setting up the buy order

the buy order was a success

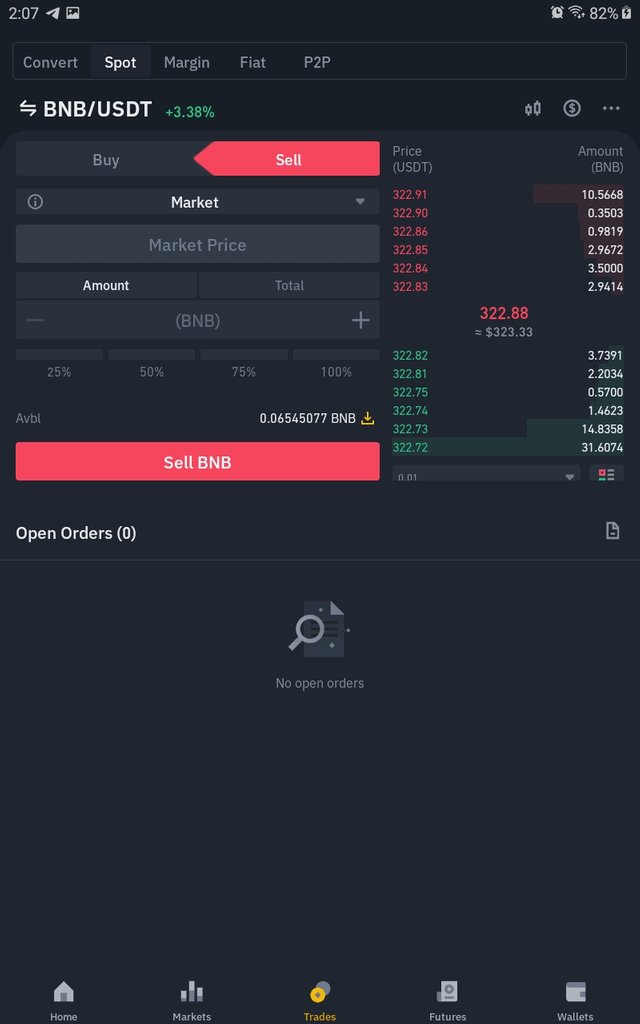

you can see in the screenshot below that my BNB is back.

the BNB is back, even though is reduced due to fluctuating prices.

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

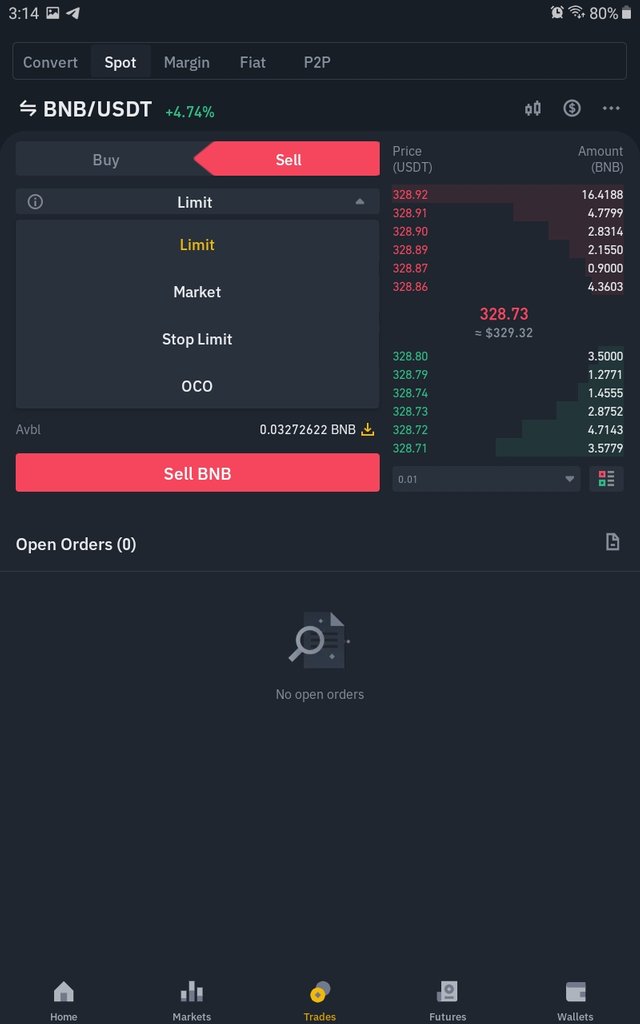

using the pair of BNB/USDT, i will illustrate how to set a sell limit order.

open the trading pair, click on the drop down menu besides limit.

select the stop limit function from the menu.

input the stop price and the limit price.

![Screenshot_20210525-153232_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmNfdDUtV6YH9Zm5Z9KJMTQo9R5wuPMMwzkxqScDfAFc3s/Screenshot_20210525-153232_Binance[1].jpg)

![Screenshot_20210525-153239_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmQZsqieinAk6XRpCpi77tNyPure6ruBtWzhwEeFsE2yZt/Screenshot_20210525-153239_Binance[1].jpg)

![Screenshot_20210525-153436_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmRo5szxpFg2Y4TNjM4E9ybU8ZHedrjXd9JGrFGgWdobVi/Screenshot_20210525-153436_Binance[1].jpg)

the sell stop limit order was success.

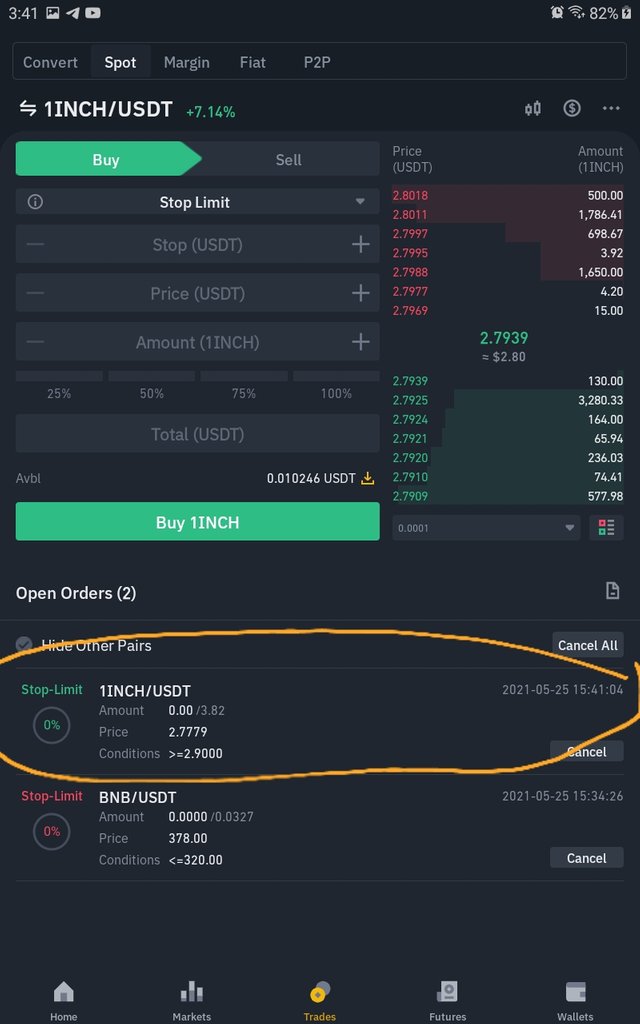

Buy stop limit order

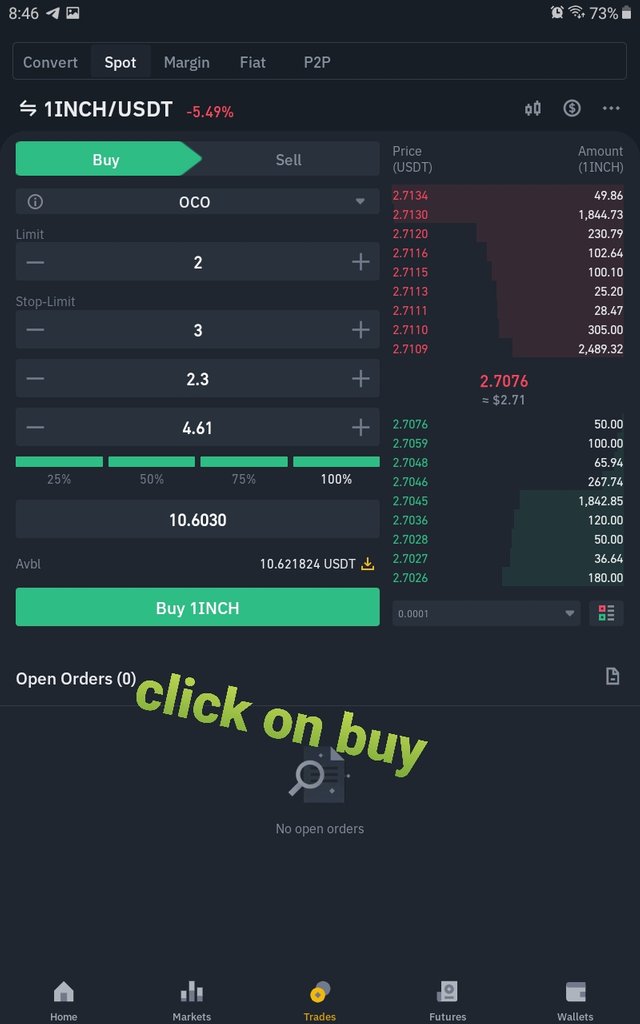

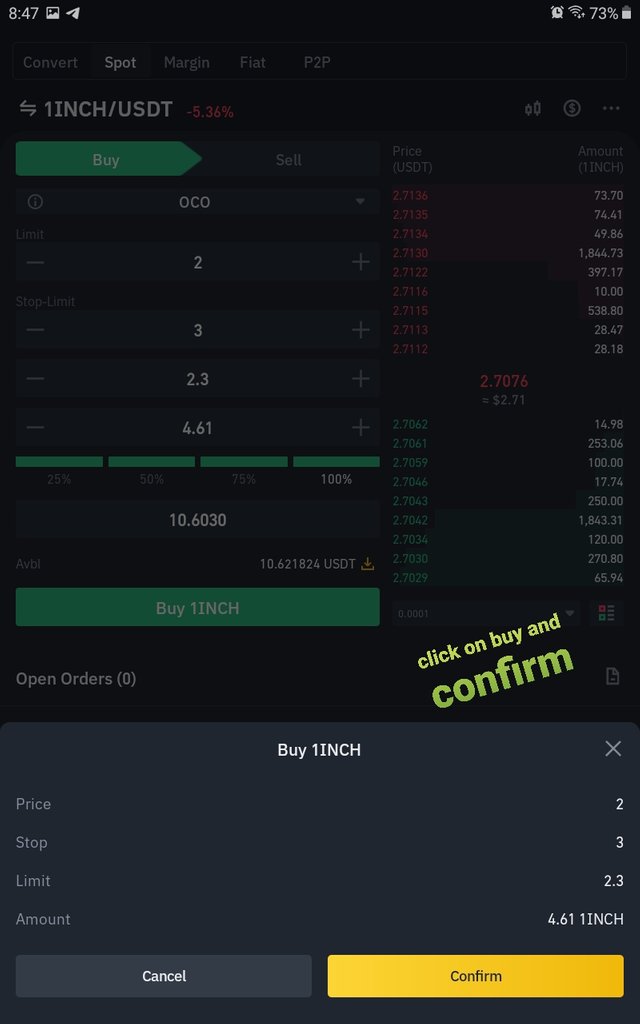

This time. I am using the pair of INCH/USDT to set the buy stop limit order. follow the same process we used in selecting the stop limit as above, but this time we are setting a buying order.

![Screenshot_20210525-154047_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmPwsStUFuFAdvmG5vtTaWBo6hfLFeQdbFtin66b3dPm4Y/Screenshot_20210525-154047_Binance[1].jpg)

![Screenshot_20210525-154101_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmTJf4Dy67oVwm2twRoduESpJcQbELSvBXBEEs24LRH2zk/Screenshot_20210525-154101_Binance[1].jpg)

Successfully done the buy stop limit order

To place sell order in OCO

OCO which means " one cancels the other order" is a type of order where several pairs are brought together and executed as one. by this I mean that where one of the orders of the pairs are executed, the rest is canceled.

to show how this is done, we will be the using the pair of BNB/USDT, I will be selling my BNB for USDT.

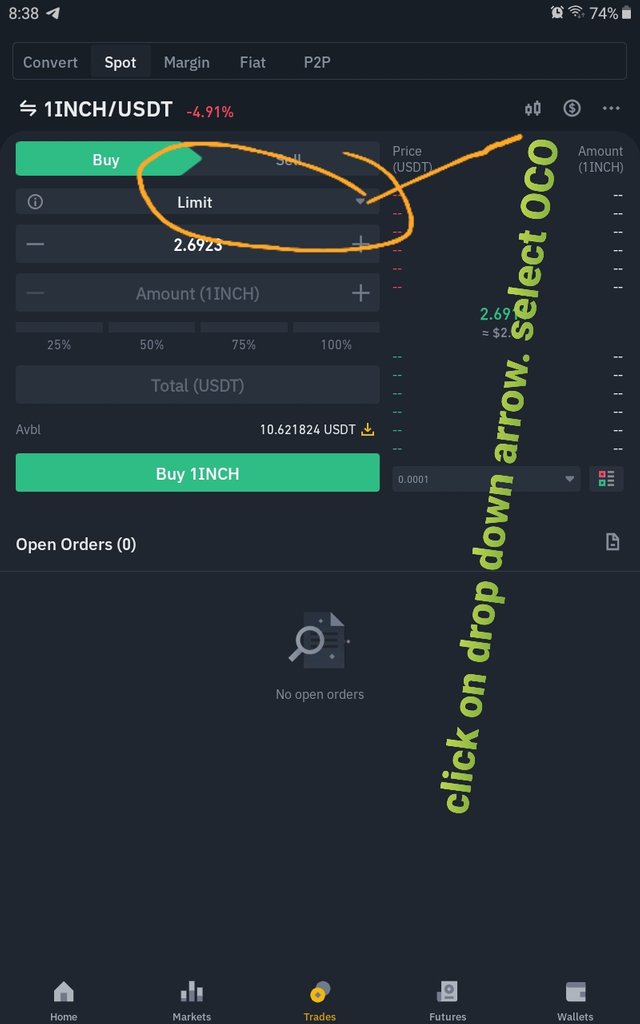

once more, we select the pair.

click on drop down arrow besides Limit.

![Screenshot_20210525-162210_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmfGXLFHdCYrRbASdkhUPrpRyqc9wVmoFABVgc5ozHUQbn/Screenshot_20210525-162210_Binance[1].jpg)

![Screenshot_20210525-162214_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQma52xPfoumMR6sxtf5pmMsS3JBxEKRDW3ZBZV9d3MuMcw/Screenshot_20210525-162214_Binance[1].jpg)

Select OCO

![Screenshot_20210525-162217_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmQ4dYrZ8iQYqXnXJAKhrBWrHcQe7UG17kxsr5cTtJkywY/Screenshot_20210525-162217_Binance[1].jpg)

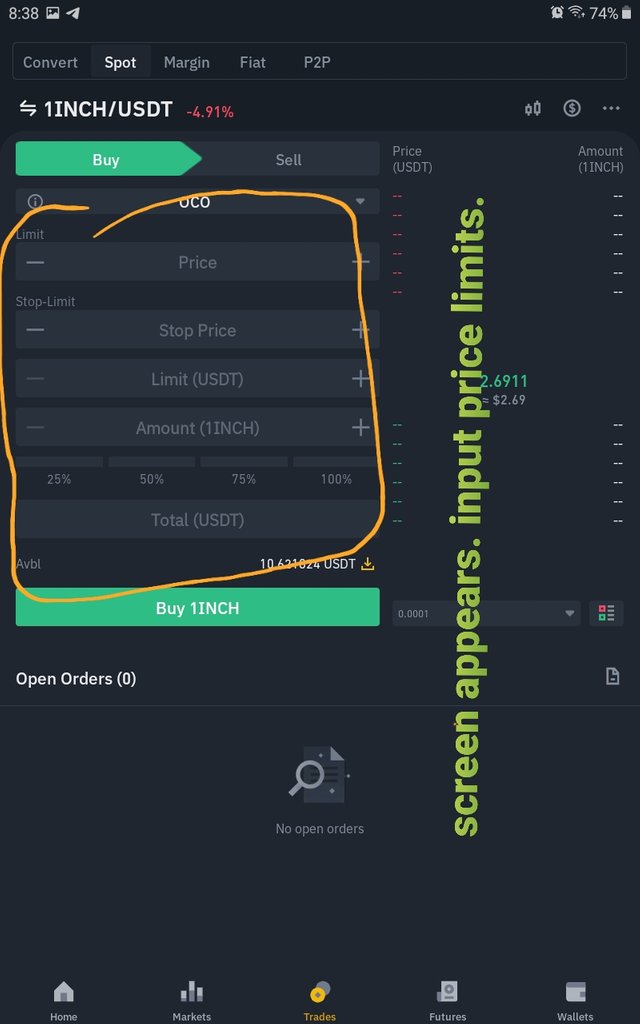

then input your limit price, stop limit prices and the limit price of the stop limit order.

![Screenshot_20210525-162807_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmeuzNgxYvxMvJKkkV2hqdHosCJKooYqbXEx7tpbJRcqRi/Screenshot_20210525-162807_Binance[1].jpg)

click on sell BNB

![Screenshot_20210525-162818_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmUBE4Ge6TnmnChNZxWmNneVr3VrTaxq99yH4FcAzEf9qS/Screenshot_20210525-162818_Binance[1].jpg)

It will then bring out a confirmation screen, click confirm, the OCO will then be opened.

![Screenshot_20210525-162834_Binance[1].jpg](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmcvdwk87e8cESetytDUtUDY1caassdAZApuvDKu9h6MDK/Screenshot_20210525-162834_Binance[1].jpg)

OCO sell order is done.

What this simply means is that once the price of the asset pair hits the limit price of the limit order of 380, this order will be consummated and the stop limit will automatically be cancelled. However, if the price goes the other way and touches the stop price first. 320, the order will be initiated and consummated at the limit price of the stop limit order, while the limit order will then be cancelled.

To set a buy order using an OCO ,

We will follow the same process as in the sell, but in this case we will select or click on buy, follow the same step to locate our OCO template and then fix in the price values.

So if the prices gets to the limit price first, the buy order will then be executed and the stop limit order will be cancelled, if it goes the other way, stop limit order will be initiated and executed at the limit price of the stop limit order. However, the limit order will be cancelled.

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

From the lecture and my writeup so far, we can see that the order book is an important part in an exchange platform which can help the trader to make wise and important decisions. With the various features that can be found in the order book, ranging from limit order, market order stop limit order to OCO order, a trader can actually do his trade maximizing profit and minimizing his losses.

The order book helps the trader to ascertain the trend of a particular asset pair just by checking on the volume traded in the buy and sell feature of the order book.

The provisions of the order book enables the trader to carefully study a trade and enter the trade at his own price for maximum returns just buying setting these orders at the expected price he wants to enter the market. This prevents him from sitting all day long waiting to enter the market.

The use of stop limit orders feature enables the trader to set his loss limits without extending it further. It truly serves as a protection to them while maximizing their profits.

As a trader, the order book can be used in conjunction with other indicators like the Macd. From the Rsi and EMA 200. When i trade with these indicator, pick up the volume of trade from the order book, it is much easier for me to find the support and the resistance of the asset pair that I want to trade.

For me , I do my trade analysis some hours before actually taking the trade, and wait patiently for the market to come to my desired entry point by making use of these limit order features.

Conclusion.

Knowledge of the order book and its intrinsic and advantageous feature is a must know for any trader. Once this knowledge is acquired, it spares the trader from unnecessary losses and helps him to maximize profits since he well knows these order placements, its application and how to go about them(entry and exit points).

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor, i will make further research on this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit