What is Cryptocurrency Trading?

Trading in common terms refers to the process of exchange of goods and services. It mostly involves the activity of buying and sell of items, goods and services.

Trading can be classified into two major categories which are; Domestic or internal trading and International trading.

Domestic trading takes place between individuals, companies and the like. This type of trading involves wholesalers and retailers.

International trading takes place between two or more countries, which involves importing and exporting of good and services to the country they are needed.

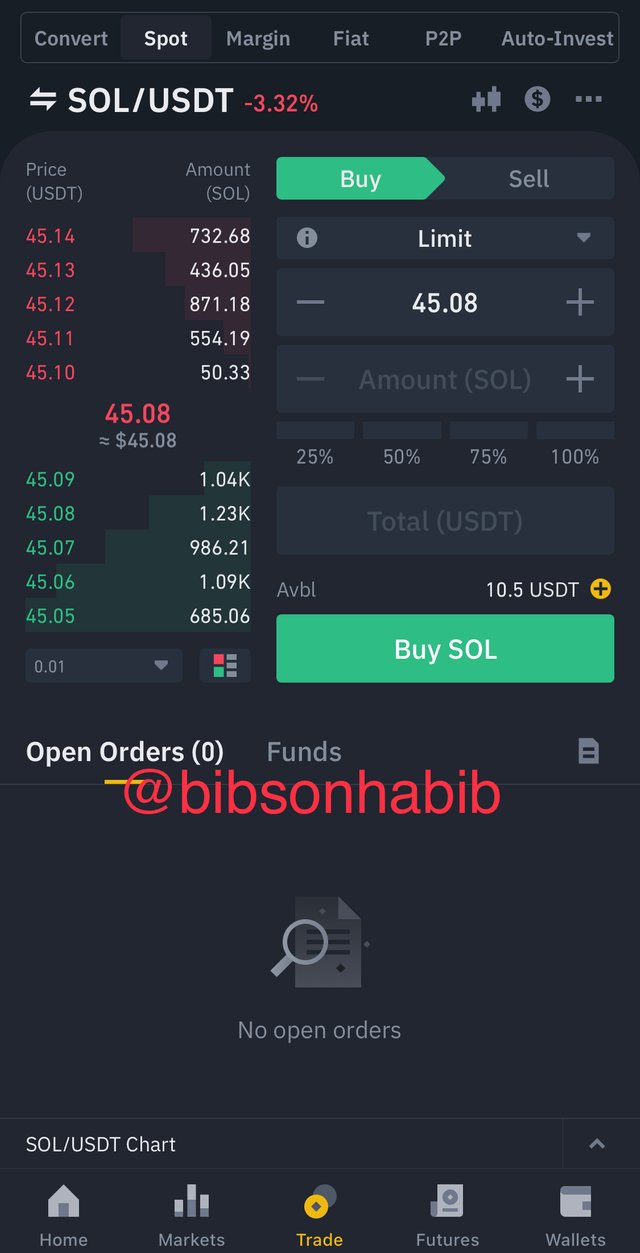

Trading on binance screenshot taken with my phone from the Binance app.

Hence cryptocurrency trading is the buying or exchange of crypto assets between users in the crypto market. For most cryptocurrency platforms I know, they have a P2P( Peer-to-Peer) interface where users can be able to sell their cryptocurrency to buyers.

In P2P trading, sellers are able to exchange their cryptocurrencies into his country’s currency equivalent. The P2P method for exchange of funds is very secure, as a moderator monitors the two parties to ensure there is no fraudulent behavior from any of them.

The moderator can also block a user from engaging in trading on the platform if he engages in fraudulent activities.

This trades are carried out on a very secure network called the blockchain. It consists of many blocks binded together by cryptography, hence making it almost impossible for hackers to penetrate.

All cryptocurrency transactions are recorded on the blockchain. For a crypto trade to be carried out successfully, the seller must have a wallet with contains the cryptocurrency he wants to trade, the buyer should also have a similar Wallet for the particular cryptocurrency.

For example if the seller wants to sell bitcoin(BTC), the buyer should have a bitcoin wallet so that the assets can be deposited there. The buyer should also provide the seller with a correct Wallet address to prevent wrong transfer/ loss of funds.

What type of traders do you see most effective.

Investors(HODLERS): this type of traders buy cryptocurrencies without intention of selling them, they seek to hold them for a long term as they believe the price of the cryptocurrency would Skyrocket one day.

This type of traders are well versed when it comes to performing fundamental and technical analysis in order to choose which cryptocurrency project is worth investing in for the long term.

Day traders: This type of traders also make good use of technical analysis indicators. In this type of trading, the trader buys crypto assets and also sells them on the same day.

Since cryptocurrencies are volatile, they use these price fluctuations to buy when prices are down and sell while prices have gone up, In order to make their profits.

Scalping: Scalp traders make good use of the price volatility of crypto assets. When they spot a trading window, they quickly enter and also quickly exit / close their positions on the market upon realizing a profit. Scalp traders do not keep their positions open for long.

Swing trading: In this type of trading, the trader takes into consideration the general performance of the cryptocurrency for a certain period of time. The trader then buys and holds the cryptocurrency with the intention that the price of the cryptocurrency would increase in order for him to make profits.

Swing trading positions are relatively longer than day trading and can be open for weeks.

My type of trading;

I see myself as a day trader, swing trader and investor.

As a day trader, I try to perform technical analysis everyday on a particular selected crypto asset, I would then enter the market. I am mostly comfortable with the one minute candle chart where I monitor them for an hour or more. Depending on the signals I get from the chart, I set my exit price. I mostly round up in profit rather than losses.

As a swing trader, I mostly check the performance of a selected cryptocurrency over a period of time. From months to as long as a year. This data would provide me with price insights of the cryptocurrency, I would then buy and hold and hope prices swing in my direction.

As an investor, I have invested and will invest in some particular cryptocurrency assets depending on how feasible the project and the potential it has. I also study the project whitepaper to be sure it’s worth investing in for the long term. Some cryptocurrencies I have invested in include Affyn (fyn) and Multivac(MTV).

So all in all I am a day trader; since I look for price fluctuations to enter and exit the market daily, a swing trader since I study past price data of cryptocurrencies in order to open a position.

I am also an investor since I HODL some cryptocurrency for a long term, because I believe their prices will skyrocket someday.

Have you tested several time units? What Timeframe and Crypto Asset Pairs Are Best for You? Why?

Yes I have tested different time units. I mostly make use of the 1 min , 5 min, 15 min and 1 day candle charts in order to get an insight of the maket and also study the price trend.

I use the 1 min chart when I want to study the price fluctuations of the cryptocurrency in order to enter a short sell position.

I use the 5 min chart to take note of trend formation and how fast they are changing in order to enter a day trading position without experiencing losses.

I use the 15 min chart to determine how strong trend formation is. That is whether prices are strongly in an uptrend or downtrend. This helps me exit my positions quickly to make profits or control my losses.

I use the 1-day chart to mark the opening and closing prices of an asset to determine which position would be suitable for me (whether buy/sell).

Of all the timeframes, the 1 min chart is the best for me, since it provides me with the vital information I need. It gives me crucial in-depth market information which makes my positions opened using information from the 1 min chart result in profits 99.5% of the time.

The cryptocurrency asset pair best for me is GALA/USDT since it’s prices are highly volatile and easily predictable. This supports my day trading strategy. Before this bearish crypto market, i profited a lot from this pair using the day trading strategy.

I also like the BTC/USDT pair. Since BTC has a 39% dominance on the crypto market, the BTC/USDT pair tell me what to do when I see it’s price chart. When the price chart signals price downtrend, it tells me to close/ enter a short sell position and when price is in an uptrend, it tells me to enter a short buying position.

My Trading Experience Over the Last Few Months.

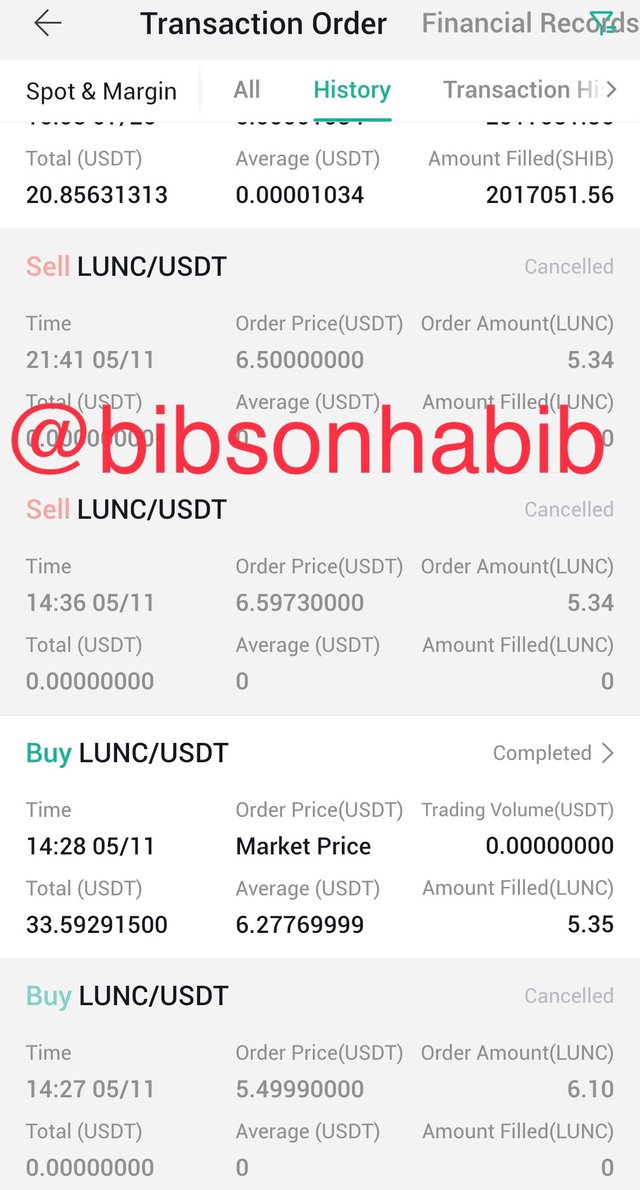

Over the last few months, I have been trading lately. This is because I lost almost all my funds to the recent LUNA crash.

The day the crash happened, the market was highly volatile and I thought I could enter a short buy and sell position. I entered the market at $6.5 for 1 LUNA. As soon as the order filled, the market went sideways.

Prices started to drop $2.2 and dipped even further. By the close of the day, the price of 1 LUNA dipped to $0.002. The $33 I invested in LUNA was worthless.

I entered a futures trade on the SOL/USDT pair the same night in order to recover from my losses but I ended up been liquidated in my positions. I couldn’t think straight.

Tell Us what you have learned from this experience eg: Over the long term do your, so your gains exceed your losses?

From the above experience, I have learnt that;

I should always have an entry and exit price when entering a trade.

I shouldn’t be greedy on the market. Regarding the futures trading of the SOL/USDT pair, after the order had filled, I was in profit of $5 but wanted to get more. I ended up loosing everything.

I need to learn when and where to use some technical indicators in order to see a clearer market picture.

FOMO was the main cause of my loss of funds in the LUNA crash. I should learn to assess a cryptocurrency and also take key notice of trend formation to prevent me from ever trading in a FOMO situation.

I should also have a specific trading plan which I would stick to. I shouldn’t just enter the market and just start trading without been prepared.

I should start taking weekly records of my trading on the crypto market to know how I am faring, Whether I am making profits or losses. Which this I can adjust my trading strategy to know which one best suits me.

Do you have a method of recording and reviewing your trades to improve your performance? refined your trading system after being dissatisfied with its results?)

No, not yet. I haven’t started taking records and review of my transactions on the market.

But as part of my fast track to bounce back from my losses, I have to put that system in place to see how best I am performing on the market and make any necessary changes if there is the need, In order to achieve my desired results on the market.

With regards to refining of my trading system, I have never refined my trading system. As I said earlier, the day trading has always worked well for me with a 99% success rate. Both times I failed; with is the LUNA crash and the SOL/USDT futures trade, it was due to my own negligence.

But I hope as I learn more, I will explore other trading options.

What Impact Does Artificial Intelligence Have On Crypto Trading In The Short And Long Term?

Artificial Intelligence (A.I) is the use of machines or robots to make life easier and simpler. AI seeks to create machines that can think and behave like humans with a high level level of skill in problem solving.

With regards to AI on crypto trading, there have been innovations in AI which has lead to the creation of trading bots that can create and complete orders and also enter and exit position in a trading window to make profits.

There are various types of bots used in crypto trading; each which what tasks it performs best.

These bots include: Arbitrage bots, coin lending bots, leverage and market maker bots. These trading bots are selected depending on the trader’s needs and specifications.

Some impact of bots on Crypto Trading

Trading bots facilitate easy trading.

Since most traders or investors don’t have time, bots can be put in place to trade on their behalf.

Bots respond quickly to price changes and

market signals. They execute orders faster than humans.Bots can trade round the clock with optimum trading capabilities to maximize profits, whiles normal traders get exhausted after trading for sometime.

Using trading bots can maximize profits. The arbitrage bot for example compares the price of cryptocurrencies across different exchanges in order to make good use of the price difference in order to enter at a relatively lower price and exit at the highest available price.

Conclusion.

Cryptocurrency trading is a very vital skill that needs to be learnt by any crypto trader or investor looking to make a fortune on the crypto market.

Regarding trading strategies, traders must be willing to change and adapt to a different trading style if there is the need since new trading methods are created all the time. One should also do correct research on trading Bots before using them.

This has been a very educative engagement contest from the SteemitCryptoAcademy. Looking forward to your next one.

Thank you all for your time.

Unfortunately, you are not eligible to participate in this contest. You have been inactive for several months after powering down. You need to remain active on the platform. Also, currently you do not belong to any club at the moment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Professor with regards to my club5050 status, l have not transferred any steem for the past month. I powered up 3 steem to activate a club status for me after my account had been hacked and powered down.

Please concerning my activity on this platform, I had made at least 5 posts before writing this engagement challenge post.

I would be very grateful if you could review my work again

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit