Designed by @bilaldar113 Using Post Maker

Hey Everyone!

I would like to welcome everyone to the 7th week of the Steemit Crypto Academy. I would like to thank the professors who are putting exceptional efforts into teaching the community about the crypto industry, especially @reminiscence01. The professor has come up with a lecture on the most important topic which is risk management. He has very well explained tools and their importance in the lecture and provided homework tasks that I have done with sheer interest. I hope this community likes my homework post.

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

Crypto trading has emerged as a great way to earn dollars but not everyone can make a fortune as the market is extremely volatile and those with great trading and management skills can pioneer in this career. The trading strategy is a great way to predict the price and trade accordingly. It can give you a hefty amount of profit but there’s only 1 thing that is capable of saving those profit and capital which is risk management.

The word itself gives a brief about the concept. It is referred to the management of the capital as a novice trader can easily turn thousands of dollars into zero. However, if the risk is managed from the beginning, then not only it can minimize the loss but it will be considering increasing the capital as the profit booked in each trader will be more than the loss.

Risk management includes the use of numerous tools that are must understand in order to make sure that capital remains in profit even if a few of the setups goes negative. It is simply the process of controlling the trades in which we minimize the loss through the stop-loss tool and increase profit through taking profit tool while the risk-reward ratio is an equally important tool to consider to ensure that the reward is more than the taken risk.

The bottom line is that it is the technique to leverage several tools to cut down the chances of loss to a great extent and make sure to gain as much profit as possible while sustaining it.

Importance of Risk Management in Crypto Trading

Importance of Risk Management in Crypto Trading

Speaking of the importance of risk management, it has numerous great benefits that can improve the journey of crypto traders. The most important advantage of proper risk management is that safeguards the capital. It doesn’t matter which trading strategy is being used, what truly matters is booking profit and closing the position without crucial loss, and that’s what risk management is all about.

Emotions like greed and fear are the core enemy of the trader as they can badly affect the mindset and lead to more loss. Most traders after a series of loss open more positions by forcing the chart which is called “Revenge trading” which can lead to more loss. Proper risk management is the only thing that can help a trader to control its emotion and embrace the loss as a person know that stop loss will save the capital from serious loss.

The top benefit of risk management is that a trader gets more profits while the loss is nothing in comparison. If you open trades with twice the risk, then it can simply cover 2 failed setups. So, it means that if you make 5 trades in a day with a risk-reward ratio of 2:2 and only 2 of them hits the TP, then you will still be in profit as the reward will be more than the loss that occurred from the 3 lost setups.

Explain the following Risk Management tools and give an illustrative example of each of them.

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

a) 1% Rule.

It is one of the best risk management tools which helps in saving capital from horrendous loss. You might have observed that those people who start crypto trading tend to invest all their capital into a single trade and if such setups hit the stop loss, then a huge loss can occur. However, the 1% rule is the only tool that can minimize the loss as a trader will only invest one percent of its portfolio.

Before starting trading, a trader should decide which percent of the capital he/she will be investing per trade so that the entire capital won’t be affected by the loss of a single trade. Countless successful traders that I know prefer to invest only 1% as the loss is barely nothing and can be easily covered in another trade. I have covered illustrative examples also for better understanding.

Illustrative Example

Illustrative Example

Suppose that you have a capital of $100,000 and you have decided that you will only adhere to the 1% rule on every trade. Let’s calculate the number of dollars you will be risking each trade.

Risk per Trade = $100,000 X 1 / 100

Risk per Trade = $100,000 / 100

Risk per Trade = $1000

The above calculation indicates that you will be risking $1000 per trade which gives you the margin of 100 failed trades to turn the capital to $0 which is actually impossible. So, if you open 5 trades a day with a risk-reward ratio of 2:2 and 3 hits the stop loss, then your actual capital will become $97000. However, if 2 trades hit TP, then you will get a profit of $4000. So. Overall your capital will be $101,000.

That’s the power of the 1% rule, even if 3 trades fail to hit the TP, then the loss won’t be much and that can be covered by the successful trades if the RR is more than the risk.

b) Risk-reward ratio.

b) Risk-reward ratio.

Even if you are applying the 1% rule in your trades, then it can safeguard your capital from sudden loss but the risk-reward ratio is the tool that can help you to recover the loss amount and gain profit. This tool will help you to decide what amount you will risk per trade and what reward you will get when the trade hits the TP. The beginners don’t pay attention to RR due to which they risk more amount than the reward and that makes a negative effect on the capital.

At the start, a trader has to decide risk-reward ratio and it should be always more than 1:1 because the risk equal to reward won’t be much beneficial. An average trader should opt for either 1:5 or 2:2 so that a single trade can cover the loss of more than a single failed trade.

Let’s take a look at the illustrative example for better insight into this tool.

Illustrative Example

Illustrative Example

Now consider that you open an account with the capital of $1000 and decide RR of 2:2 which means that the reward is twice the risk taken. So, that means you are risking $100 per trade and you can get $200 on the hit of TP. The risk is taking worth because reward is handsome amount but if you start trading with RR of 1:1, then it will be pretty much useless as there won’t be enough profit.

c) Stoploss and take profit.

c) Stoploss and take profit.

Stoploss and take profit is the act of exiting the setup either in loss or profit. Once we enter a trade and decide the RR price, then we have to place stop loss so that the setup can be closed once the price reaches the risked amount. It minimizes the loss as the trade will be instantly closed. The take profit is used to close the trade in profit when the asset reaches the predicted area. Both tools are very important in risk management because a trader won’t have to sit in front of the chart and they also give confidence that the loss will be minimal and the profit will be instantly booked. Every trade should make use of these tools to secure its capital. It minimizes the loss according to the risk a person is taking and helps in making the desired profit.

Let’s head to the illustrative example for a better understanding.

Illustrative Example

Illustrative Example

Let’s start with stop loss, it depends on the strategy but most traders prefer to place it according to support and resistance. The reason is that prices tend to bounce from that specific area which gives chance to hit the TP easily. When it’s about placing take profit, it can be also placed according to support and resistance but always remember that RR should be considered while doing so. That’s how you can make use of this trade and manage your risk.

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

The following are expected from the trade.

The following are expected from the trade.

- Explain the trade criteria.

- Explain how much you are risking on the $100 account using the 1% rule.

- Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

- Place your stop loss and take profit position using the exit criteria for market structure.

Trend Reversal using Market Structure.

Trend Reversal using Market Structure.

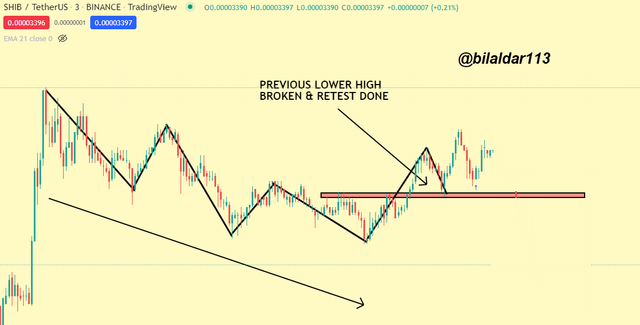

I’m taking a demo trade on SHIB/USDT in which I will take notice of trend reversal using market structure. I will not simply just open trade but also shows how the risk should be managed by the traders.

Entry Criteria

Entry Criteria

My analysis completely represents that the commodity was in a bearish trend and made lower low and lower high. Suddenly, the price surpassed the previous lower high and broke the major resistance, and retested the line which means that trend is changed from bearish to bullish. The successful retest was the strongest confluence of the trend reversal but we have to wait for engulfing candle which was also formed. It means that we can long the commodity because the entry criteria were fulfilled.

Exit Criteria

Exit Criteria

Stop-loss should be placed below the newly formed support which was retested by the price. The reason is that there’s less chance of price retracing to that region. I have used the tool from tradingview for illustration.

Calculating Stop Loss & Take Profit

Calculating Stop Loss & Take Profit

I always use tradingview.com for analysis and it has a great feature of a demo account where anyone can practice their skills. I opened a demo account with $100,000 so that I can open trades by risking 1% which is $1000. I have to calculate the stop loss and take profit.

My entry point was 0.03428 and I mostly use the risk-reward ratio of 2:2 which means that my take profit will be 0.03450 and stop loss will be 0.03417. I placed the orders by my calculations and waited for further price action.

The price failed to hit the take profit but the stop loss was placed so there was not enough loss but as calculated earlier, only the risked amount which was $1000 was lost.

Trend Continuation using Market Structure

Trend Continuation using Market Structure

I will demonstrate the second demo trade on the ROSE/USDT chart in which I will open a trade considering the trend continuation. Have a look at the entry & exit criteria along with other factors that were considered in this trade.

Entry Criteria

Entry Criteria

I opened the chart and had a look at the market structure which simply showed that the price was in a bearish trend. A few lower high and lower low was formed which means that the price was continuously in a downtrend and I can open a short position. I waited for the price to further touch the previous lower low and an engulfing candle to enter the trade. Once it was formed, I sold the commodity with the preferred risk-reward ratio of 1:5.

Exit Criteria

Exit Criteria

When I sold the asset, I used the risk-reward ratio of 1:5 and that’s how I placed the stop loss and take profit. The traders also prefer to book profit when the price reaches the support or resistance of the commodity.

Calculating Stop Loss & Take Profit

Calculating Stop Loss & Take Profit

My risk-reward ratio was 1:5 which means that I was risking a total of $500 while the TP will get me the profit of $1500. My entry point was 0.3380 and I placed take profit at 0.3300 and stop-loss at 0.3456.

The chart shows that the TP was hit and suddenly it retraced back to the stop loss and that’s the importance of proper risk management. If I would not have placed the TP, then the profit would not have been booked but I managed the risk and got the profit as shown in the below image.

Conclusion

Conclusion

Risk management is the basic step to successful trading in the crypto market. The market is volatile and if the capital is not managed, then the entire investment can be blown and that’s why 1% risk should be applied while some essential tools like stop loss, take profit, the risk-reward ratio should be used as well. I would like to appreciate the professor for teaching the community with this valuable knowledge and his remarkable lecture.

Thanks For Visiting My Post

Cc: @reminiscence01

Hello @bilaldar113, I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

Trading with 2:2 RR is same as using 1:1 which is not advisable.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit