Tether graphic art from Coindesk

The stablecoin called Tether is one of the most popular in the crypto space today.

It is a stablecoin that is pegged to US Dollar and has the symbol USDT. The issuing company behind this is also called Tether. This stablecoin allows traders to transact on a fixed (or almost) 1 USD value between different places like exchanges with no hassles of fiat regulations.

Stablecoins are crypto assets that are pegged to real-world assets like fiat currencies or gold. They are issued by companies who maintain the peg through collaterals or contracts/algorithms that maintain supply vs demand. Stablecoins allow people to trade in fiat without using actual fiat, removing or minimizing fiat regulatory needs.

Tether = 1 USD graphic art from Coingecko

The Tether cryptocurrency that is pegged to the USD has the ticker: USDT. It is supposedly: 1 USDT = 1 USD. There are also other stablecoins issued by Tether based on other currencies like Euro (EURT), an ounce of Gold (AUXT). This currency is designed to keep traders away from the volatility of the cryptocurrency market since it mimics the value of a real-world USD.

The first platform Tether was one was the Omni Platform which is used for different assets anchored to the BTC blockchain. Afterwards, ETH-based Tether was also launched. They continued utilizing other blockchains that currently there are more than 8 blockchains where Tether is based on.

The value of Tether exists because of collateral, whereas 1 USDT is qual to 1 real USD in reserves. This is called a collateralized stablecoin. If you have USDTs in your wallet, you can directly exchange it through some exchanges for its USD value, you can also use Tether's own platform, although I heard that the minimum and fees are a bit on the high side.

The advantage of using Tether is because it's a stable alternative for fiat currencies for people who do trades. Some of the actual reasons are based on transaction times, fees, on top of stability.

Fiat deposits and withdrawals are a time-consuming process that could take up to 1 to 4 business days to finish. If the weekends and Holidays are there, it can be more than that too. Whereas, transferring Tether would take minutes only, which is very useful because as we know the cryptocurrency world changes fast and is active 24/7.

The cost to transfer fiat is very high, which can be more than 20USD. There are also conversion fees that can be charged extra if the exchange or bank does not support a certain currency/market.

Using Tether to transfer value has no cost, just the standard blockchain fees.

The extra risk of passing in between different volatile cryptocurrencies can be steep. If you have a stablecoin where you can keep the same stable value in between trades, that would be very much useful. Tracking the rising-falling movements of multiple currencies is also hard and you might experience losses on one currency while transferring to another currency.

Using Tether or stablecoins as a store of value helps you maintain a good position when executing your trades.

Tether wallet graphic art from BLockonomi

The top 6 Tether Wallets in 2021according to some websites are:

- MyEtherWallet

- OmniWallet

- Tether Wallet

- Coinomi

- Exodus

- Ledger Nano S

Graphics from MEW

MyEtherWallet or MEW is one of the most compatible & best wallets for Tether. MyEtherWallet is a web-based browser wallet that allows extensions for ease of use. A great thing about MEW is that hardware wallets like Trezor and Ledger have integrated it into their wallets making it one of the most popular choices among hardware wallet owners.

The main option to buy USDT Tether is through trading for it in an exchange. This will depend on the trading pair in that exchange.

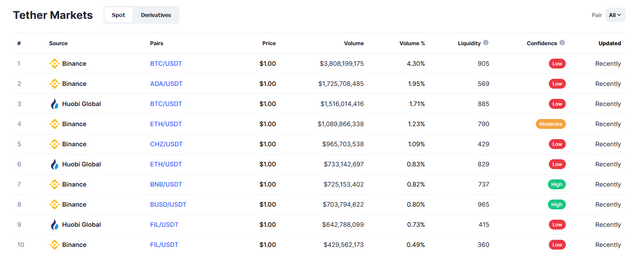

There are exchanges that list pairs for Tether with cryptocurrencies, but there are some exchanges that have a trading pair between USDT and USD. For a complete list of listed markets, it will be best to head over to sites like Coinmarketcap or Coingecko and check them there.

List of markets where Tether is listed, more from Coinmarketcap

I hope you learned a thing or two from this quick research of mine about Tether/USDT. This research homework is brought to you by @steemitblog and @yohan2on. Thanks for the support @steemcurator01 and @steemcurator02.

Hi @blessednami

Thanks for attending the 6th -Crypto course and for your effort in doing the given homework task.

Feedback

This is excellent work. Well done with your research on Tether. It's an interesting article. Keep creating such valuable content on steemit.

Homework task

10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot Professor!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great work on getting featured here. Congrats!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Kuya!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit