Coin animation from Pinterest

Stablecoins are some cryptocurrencies that were created in order to decrease the volatility of a coin’s price. It may be relative to a stable asset or multiple assets.

Some stablecoins are pegged to currencies, while some are pegged to exchange-traded commodities/assets like Gold.

These stable cryptocurrencies are classified as a DeFi solution because they are decentralized alternatives to existing financial commodities like fiat, gold, other assets, or a combination of those things.

Logo Image from Equilibrium

An EOS-based project called EOSDT is a stablecoin that is transparently backed on the Equilibrium platform. It represents a robust store of dollar value that may be free of volatility.

The Equilibrium framework is an intuitive environment for developing Decentralized finance projects and creating DeFi-based stablecoins as well. Equilibrium-based products are able to make the community generate assets that are pegged to different currencies against cryptocurrency collaterals. These products also allow users to use DeFi-built Dapps.

This framework built a layer of core libraries just to achieve this feat, this framework runs on top of the EOS blockchain for developing end-user applications e.g gateways and voting dApps that can interact with the core logic/library.

Equilibrium is aiming to provide a simple but intuitive experience for its users. These people may or may not have relevant developer experiences. Some of them may even not be familiar with crypto in general. This project uses a full-stack approach in order to achieve this method, each layer of this stack has been designed with the end-user in mind.

Logo Image from EOSDT

EOSDT is a dollar-pegged currency that leverages underlying EOS and BTC collateral and adds extra liquidity to the market.

It is safe, stable, and transparent.

Safe

EOSDT has been insured by the Equilibrium Stability Fund of 4,209,376.24 EOS or equivalent to 17,222,662 USD (est.).

Stable

Stability mechanisms have been embedded in smart contracts to be able to maintain a 1:1 peg with the US Dollar.

Transparent

The only way to put EOSDT into circulation is by collateralizing other cryptocurrencies.

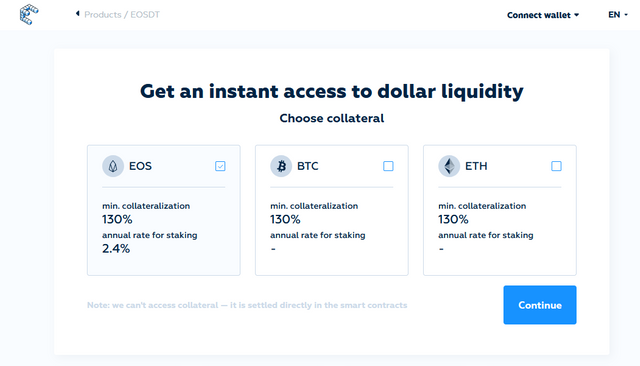

Screenshot from EOSDT

You can get EOSDT directly from their website (https://eosdt.com/en). You just have to look for the "Get EOSDT" button on the main page and click on it to be redirected to this page:

Screenshot from EOSDT

First, you will need to choose the collateral that you want to use in order to get your EOSDT tokens. The minimum collateralization percentage and annual rate for staking will be listed under your choices (if available). You have 3 options:

- EOS

- BTC

- ETH

Once you have decided which route to go through, just click on "Continue", and it will forward you to the deposit page (depending on which cryptocurrency you chose, we will use EOS as an example):

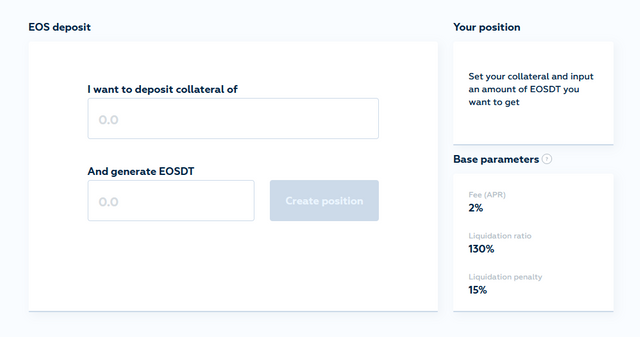

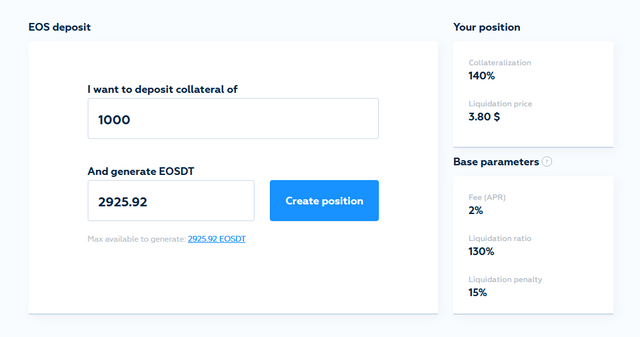

Screenshot from EOSDT

You can set your collateral and input the EOSDT amount you are wanting to get on the blank spaces provided. Once you enter values, you will be given more details about it like the percentage of collateralization and liquidation price. Base parameters will still be present on the side:

Screenshot from EOSDT

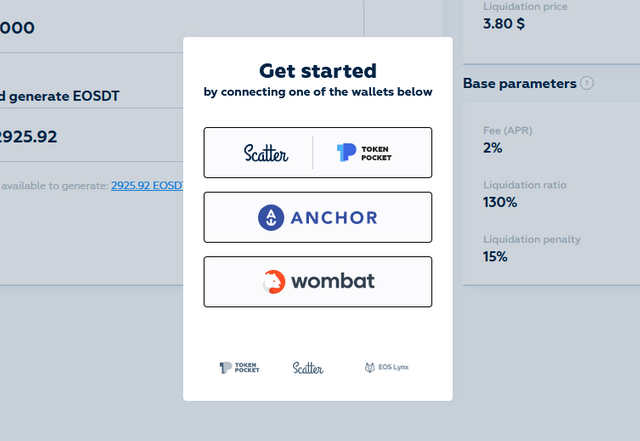

If you agree to the percentage and price, you can proceed to click on the "Create position" button, then you will be asked to connect your wallet. You simply go through the process of sending your collateral to them depending on which collateral/wallet you've chosen. Then wait for you to receive your EOSDT tokens.

Screenshot from EOSDT

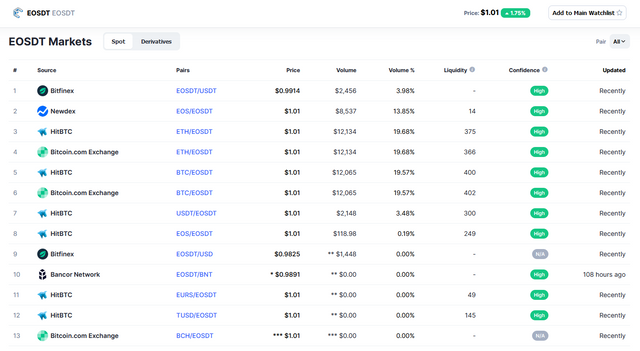

Alternatively, you can also acquire EOSDT by trading for it in an exchange. You can check coinmarketcap for an up-to-date list:

Screenshot from Coinmarketcap

Upon checking, EOSDT is currently trading with pairs like EOSDT/USDT, EOS/EOSDT, ETH/EOSDT, BTC/EOSDT, EURS/EOSDT, and many more in the following exchanges:

- HitBTC

- Bitfinex

- Newdex

- Bitcoin.com Exchange

The primary use case of EOSDT as a stablecoin cryptocurrency are lending and borrowing.

Lending

Traders who have long-term investments in EOS, as well as other tokens, can use Equilibrium market as a source of additional ROI. An example of this is when someone who owns EOS can send his tokens to a pool contract and earn EOS interest with no requirement to manage the asset, take speculative risks, or complete loan requests.

Borrowing

Someone who is looking to short a traded coin can borrow EOSDT, then send it to exchanges, and sell the token. This method may provide profits if they short an overpriced token and it goes bearish.

Dapps can also borrow EOSDT to use in the EOS ecosystem, e.g for governance functions like with NUT token, or for paying Dapp subscriptions.

That's on top of the usual reasons to get a stable like avoiding volatility by using it as a hedge.

I hope you learned a thing or two from this quick research of mine about a certain DeFi ecosystem (stablecoins) and a sample project that runs on DeFi. This research homework is brought to you by @steemitblog and @gbenga. Thanks for the support @steemcurator01 and @steemcurator02.

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Review

Thanks for writing on this topic, this is the first assignment that is looking into the EOS blockchain.

Rating 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot, professor. I noticed there are other blockchains DeFi can be run on so I decided to make it unique and choose one from the EOS blockchain.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi professor @gbenga and @steemcurator02, this post still doesn't have a vote, please check. Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi professor @gbenga, please review thanks! Have a wonderful day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit