.png)

Introduction

The Triple Exponential Moving Average Indicator was created by Patrick Mulloy. The triple exponential moving average consists of a single oscillating line calculated from the combination of three exponential moving averages of the same period. Patrick Mulloy developed the triple exponential moving average indicator in order to reduce or eliminate the laggings that the other moving averages produce.

It has been used in the market for a while without it being popular in the crypto market but now it is known and used by most traders in the technical analysis of crypto assets. The triple exponential moving average has a smoothing modifier in its calculation which helps it to prevent laggings and also unexpected fluctuations in the price of the asset.

The TEMA indicator helps to produce a smoothened chart or data of information of the price movement of an asset in the market. The TEMA indicator is used in identifying trend structures, support, resistance, and also identifying trends of crypto assets on charts. When calculating the TEMA indicator line, it takes into consideration the most current data price changes in the price of an asset.

The TEMA indicator also reacts faster to the price movement of an asset and also small trend changes which are also taken into account when calculating the TEMA indicator line. The oscillating line's angled slope of the TEMA indicator is used to indicate the trend direction of an asset. A bullish trend is indicated by an upward angle slope of the TEMA indicator line whilst the price of the asset continues to move above the TEMA indicator line. Similarly, a bearish trend is indicated by a downward angle slope of the TEMA indicator line whilst the price of the asset continues to move below the indicator line. The TEMA indicator also helps traders to identify pullbacks in the price of an asset. In using the TEMA indicator, when the price of the asset moves or trends above the TEMA indicator line, then an uptrend signal is indicated. Likewise, when the price of an asset moves or trends below the TEMA indicator line then a downtrend signal is indicated.

In this, I would be showing how we can calculate the triple exponential moving average indicator and also show how to configure and explain its parameters on a crypto chart. The TEMA indicator has a general formula that is used in its calculation and it is stated as shown below;

TEMA = (3 × EMA1) - (3 × EMA2) + EMA3

Where,

EMA1 = the exponential moving average

EMA2 = the EMA of EMA1

EMA3 = the EMA of EMA2

From the formula stated above, we can see that in calculating the TEMA indicator, we need three exponential moving averages of the same periods so as to provide unique data. There is also a smoothening multiplier of 3 with the EMA1 and EMA2 as shown in the formula above. Now let's look at how to add the exponential moving average indicator on the crypto chart. The following steps should be followed to add TEMA to a crypto chart.

How to calculate the Triple Exponential Moving Average Indicator line

From the above formula, the following steps must be followed in order to calculate the TEMA indicator.

- Search and select a lookback period that is how many periods will be factored into EMA1

- You then calculate the lookback period for EMA1

- Using the same lookback period, calculate the EMA of EMA1. For example, if using period 20 for the calculation of EMA1 then use the same 20 periods for this step too and that would be EMA2

- Similarly, calculate the EMA of EMA2 with the same lookback period as used earlier

- Lastly, you then enter the EMA1, EMA2, and EMA3 you find into the TEMA general formula and calculate the TEMA.

How to Add Triple Exponential Moving Average Indicator (TEMA) on a crypto chart).

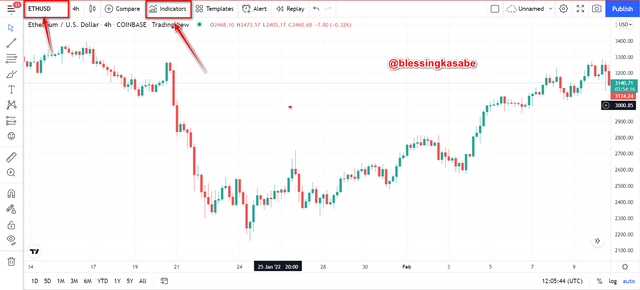

Step1:-

First of all, visit the TraadingView website and then selects any crypto asset (ETHUSD).

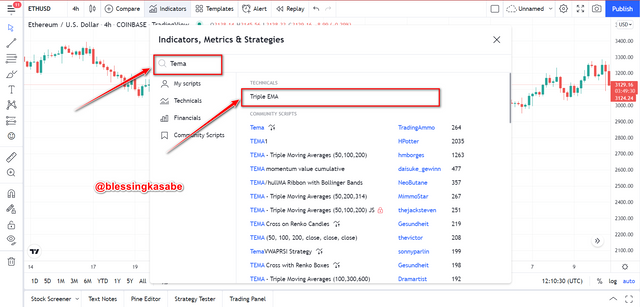

Step 2:-

Click on the Indicators icon and then Search for exponential triple moving average (TEMA) to add the indicator to the chart.

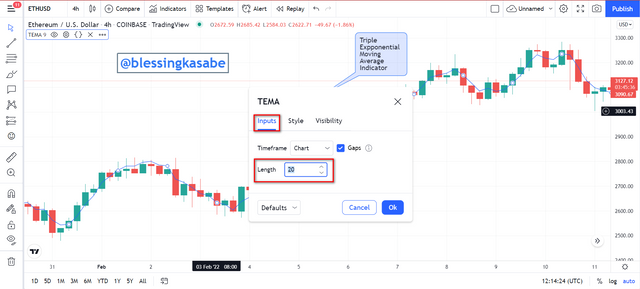

Step 3:-

Right after clicking on the chart, we can see that the TEMA was added to the crypto chart as shown below.

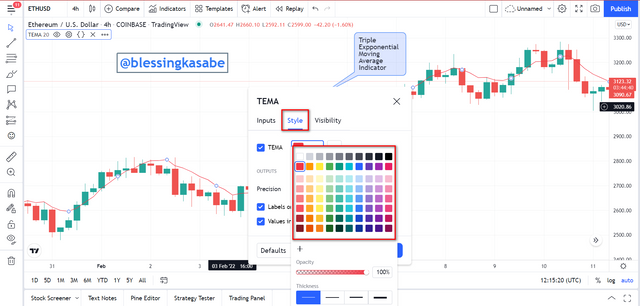

Configuring the TEMA indicator's Parameters

- To do this, we first click on the Settings Icon of the TEMA indicator as shown below

- Once it is opened, we can see that the default settings for the periods is 9 and it is good for scalpers or scalping trading. I will configure the period settings to 20 because a little higher periods are more suitable to be used by the TEMA indicator. Also, I would enter the style settings and change the color of the indicator line to red so that it becomes visible for me to use.

- After configuring the settings, we can see the new changes that were observed as indicated below.

In this section, I would be enumerating some of the differences between the triple exponential moving averages and the other types of moving averages we have. I would be comparing the TEMA with SMA and EMA indicators.

| TEMA | SMA | EMA |

|---|---|---|

| The TEMA indicator uses a complex formula in its calculation which helps in smoothing and reducing lags by reacting faster to the price movement of an asset. | The SMA uses a simple general formula in its calculation and it is easier to use and understand. | EMA, on the other hand, uses a general formula in its calculation that is built to improve upon the SMA indicator. |

| The TEMA indicator is a suitable tool for scalp traders because it reacts faster to the price action or price changes of an asset | The SMA is also a suitable tool for long-term traders because it aids in identifying trend reversals of an asset and also it moves a bit ahead of the price change of an asset | The EMA, on the other hand, is suitable for short-term traders because when identifying trends the EMA takes into account the current price of the asset. |

| The TEMA indicator reacts very quickly and faster to any small change in the price movement of an asset | The SMA moves behind or lags behind the recent price of the asset | The EMA, on the other hand, reacts faster to the recent price movement of an asset. |

| During downtrends, the TEMA indicator serves as dynamic support at the asset price | During downtrends, the SMA serves as dynamic resistance at the price of the asset. | Similarly, during downtrends, the EMA also serves dynamic resistance, unlike the TEMA. |

| Reliable signal results are produced when a little bit higher values of periods such as 20, 21, 222, ... 25 are used with the TEMA indicator because better indication of price movement of the asset is shown | Reliable signals results are produced when higher values of periods are used with the SMA indicator because longer days price data points are calculated for in order to depict false signals | Reliable signal results are produced when lower values of periods are used with the EMA because it takes into account the current price movement of the asset. |

| The TEMA indicator line is seen to be very closer to the price movement of the asset because of how fast it reacts to the price changes of the asset | The SMA indicator line is far away from the price movement of the asset | The EMA, on the other hand, is somehow closer to the price movement of the asset than the SMA indicator line. |

I would add these three indicators on a chart so that we can obviously see the difference between them on crypto charts.

From the chart shown above, we can obviously see that the TEMA (red line) is very closer to the price movement of ETHUSD because it reacts faster to price changes. In addition, we can see that the SMA(green line) is far away from the price movement of ETH as compared to the EMA (blue line) indicating that the SMA has more laggings as compared to that of the EMA. This is an indication the TEMA was created to actually reduce the laggings of the other moving averages.

In this section, I would be indicating how to identify or confirm bearish and bullish trends using the TEMA indicator on crypto charts. It should be noted the TEMA indicator uses the angle of its line to identify the current trend of an asset as well as possible trend reversals. It identifies trend direction with respect to the direction of the angle of the indicator line.

Identifying Bullish Trend using the TEMA Indicator

In order to identify a bullish trend using the TEMA indicator, the angle of the indicator line must be moving upwards in the same direction as that of the price movement of the asset (uptrend). In order to confirm and identify the uptrend, the price of the asset must be moving or trending above the TEMA indicator line in the bullish trend of the asset. A good illustration is shown below from the chart below.

From the ETHUSD Chart shown above, we can clearly see that the TEMA indicator line was trending or moving with the current trend of the asset (uptrend) price. Further bullish trend confirmation is seen when the price movement of ETH is trending above the TEMA indicator line on the chart.

Identifying Bearish Trend using the TEMA Indicator

In order to identify a bearish trend using the TEMA indicator, the angle of the indicator line must be moving downwards in the same direction as that of the price movement of the asset (downtrend). In order to confirm and identify the downtrend, the price of the asset must be moving or trending below the TEMA indicator line in the bearish trend of the asset. A good illustration is shown below from the chart below.

From the ETHUSD Chart shown above, we can clearly see that the TEMA indicator line was trending or moving with the current trend of the asset (downtrend) price. Further bearish trend confirmation is seen when the price movement of ETH is trading below the TEMA indicator line on the chart.

Now let's quickly look at how to identify Support and Resistance using the TEMA indicator.

Identifying Support levels Using TEMA indicator

As I mentioned earlier, the TEMA indicator serves as dynamic support in a downtrend of an asset's price. It should be noted that other types of moving average serve as dynamic resistance instead in a downtrend of an asset's price. When the price of the asset moves towards the dynamic support and it is being rejected then it signals a trend reversal in the price of the asset from a bearish trend to a bullish trend. A sell order opportunity can be taken advantage of immediately after the price of the asset is being rejected by the TEMA indicator line. A good illustration is shown below in the chart.

From the ETHUSD Chart shown above, we can see that the TEMA indicator line is playing the role of dynamic support to the price movement of ETH on the chart. We can again see that the price of ETH was rejected at the dynamic support level a pullback was observed before a continuation of the trend of the asset bearishly. The support level observed here can be properly utilized by traders in order to make a good exit position of trade or a selling opportunity.

Identifying Resistance levels Using TEMA indicator

As I mentioned earlier, the TEMA indicator serves as dynamic resistance in an uptrend of an asset's price. It should be noted that other types of moving average serve as dynamic support instead in an uptrend of an asset's price. When the price of the asset moves towards the dynamic resistance and it is being rejected then it signals a trend reversal in the price of the asset from a bullish trend to a bearish trend. A buy order opportunity can be taken advantage of immediately after the price of the asset is being rejected by the TEMA indicator line. A good illustration is shown below in the chart.

From the ETHUSD Chart shown above, we can see that the TEMA indicator line is playing the role of dynamic resistance to the price movement of ETH on the chart. We can again see that the price of ETH was rejected at the dynamic resistance level and a pullback was observed before a continuation of the trend of the asset bullishly. The resistance level observed here can be properly utilized by traders in order to take a good entry position of trade or a buying opportunity.

Combination of two TEMAs of different periods (20 and 50 periods)

In this section, I would be using TEMAs of different periods to identify possible signals on crypto charts. For the purpose of this assignment, I would be using TEMAs of periods 20 and 50 which is totally different from what professor @fredquantum used in his lecture. The combination of two TEMAs indicators must include a small period and a longer period setting. The shorter period being 20 helps in reacting faster to the price movement of the asset whereas the longer period 50 reacts slower.

When these two periods of TEMAs are used, they help traders to identify buy and sell trades opportunities in the market. I would, first of all, indicate how to use these two combinations to identify a buy order position on a crypto chart.

How to Identify Buy Opportunity using 20-period TEMA and 50-period TEMA.

For a buy opportunity to be determined, the price of the asset must be in an uptrend. When the smaller period of the TEMA indicator (20) crosses above the longer period of the TEMA indicator line (50), then this indicates a possible bullish signal in the price of the asset indicating that buyers are taking over the market whereas sellers are leaving. A buy order trade is then executed immediately after the crossing over of the smaller period(20) above the longer period(50) and also when the price of the asset rejects the dynamic support. A good illustration is shown below from the chart indicated.

From the ETHUSD Chart shown above, we can clearly see that the 20 periods of TEMA crossed above the longer TEMA period (50) after which a buy trade order was executed after the cross-over. We can obviously see that there was a continuous formation of higher highs and higher lows indicating a continuation of the uptrend.

How to Identify Sell Opportunity using 20-period TEMA and 50-period TEMA.

Similarly, for a sell opportunity to be determined, the price of the asset must be in a downtrend. When the smaller period of the TEMA indicator (20) crosses below the longer period of the TEMA indicator line (50), then this indicates a possible bearish signal in the price of the asset indicating that sellers are taking over the market whereas buyers are leaving. A sell order trade is then executed immediately after the crossing over of the smaller period(20) below the longer period(50) and also when the price of the asset rejects the dynamic resistance level. A good illustration is shown below from the chart indicated.

From the ETHUSD Chart shown above, we can clearly see that the 20 periods of TEMA crossed below the longer TEMA period (50) after which a sell trade order was executed after the cross-over. We can obviously see that there was a continuous formation of lower highs and lower lows indicating a continuation of the downtrend.

In this section, I would be discussing trade entry and exit points criteria using the TEMA indicator on crypto charts. Trade entry and exit criteria refer to the necessary conditions that must be met or followed in order for entry or an exit position to be considered. First of all, let's look at the buy entry and exit criteria.

The Buy Trade entry and exit criteria Using TEMA Indicator

The following conditions must be satisfied by an asset on a crypto chart before a buy entry or exit is considered;

First, two TEMA indicators of different periods must be added to the price chart of the asset

After identifying a downtrend in the price of the asset, you wait for the smaller period of the TEMA indicator line to cross above the higher period of the TEMA indicator line. When this happens, it is an indication that buyers are taking charge of the market.

After the occurrence of the crossing over, you then wait for the price of the asset to trade above the TEMA indicator and two candlesticks must be considered at least for the bullish trend confirmation.

Once the buy trade is entered, you wait until the price of the asset trades closer to a resistance level along the TEMA indicator line. You then set the stop-loss and take-profit ratio at 2:1 so as to obtain profit and avoid loss.

An illustration is shown below in the chart indicated.

From the ETHUSD Chart shown above, we can clearly see that after the bearish trend of the asset was observed, the smaller TEMA period crossed above the higher TEMA period which indicates a buy signal or a confirmation of a bullish trend. A buy order trade can be executed after considering at least two bullish candlesticks in the price movement of the asset. The take-profit is set targeting the closest resistance whilst the stop-loss was set below the previous low of the asset's price.

The Sell Trade entry and exit criteria Using TEMA Indicator

The following conditions must be satisfied by an asset on a crypto chart before a sell entry or exit is considered;

First, two TEMA indicators of different periods must be added to the price chart of the asset

After identifying an uptrend in the price of the asset, you wait for the smaller period of the TEMA indicator line to cross below the higher period of the TEMA indicator line. When this happens, it is an indication that sellers are taking charge of the market.

After the occurrence of the crossing over, you then wait for the price of the asset to trade below the TEMA indicator and two bearish candlesticks must be considered at least for the bearish trend confirmation.

Once the sell trade is entered, you wait until the price of the asset trades closer to a support level along the TEMA indicator line. You then set the stop-loss and take-profit ratio at 2:1 so as to obtain profit and avoid loss.

An illustration is shown below in the chart indicated.

From the ETHUSD Chart shown above, we can clearly see that after the bullish trend of the asset was observed, the smaller TEMA period crossed below the higher TEMA period which indicates a sell signal or a confirmation of a bearish trend. A buy order trade can be executed after considering at least two bearish candlesticks in the price movement of the asset. The take-profit is set targeting the closest support level whilst the stop-loss was set below the previous high of the asset's price.

In this section, I would be combining the TEMA Indicator with that of the RSI indicator. The RSI indicator as we all displays market conditions in the oversold, overbought, or balanced market of an asset. The RSI indicator has two levels that are RSI 30 and RSI 70. When the price of an asset is seen to be trading above the RSI 70 mark, then it is an indication of an overbought condition in the market of that asset and an indication of a possible bearish trend reversal signal in the price of the asset.

When combining the TEMA indicator with the RSI indicator, the crossover condition must be satisfied in order to enter or exit a trade in a market. I would be performing a demo sell trade for GALAUSDT.

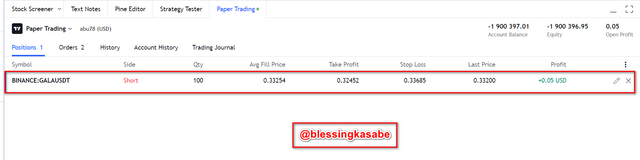

1. A Demo Sell trade for GALAUSDT using 5 MINS Chart

From the screenshot taken above, we can see that the 20 TEMA indicator line crossed below the 50 TEMA indicator line which indicates that sellers are taking over the market of GALA. Similarly, looking at the RSI indicator as well, we saw that the RSI indicator line was trending below the mid-point mark (50) indicating a confirmation of a possible bearish trend signal. I then executed a sell trade at the price of $0.33254 with a take-profit set at $0.32452 and stop-loss at $0.33685. The risk to reward ratio was set at 1:2 as shown above.

Sell Order trade Executed

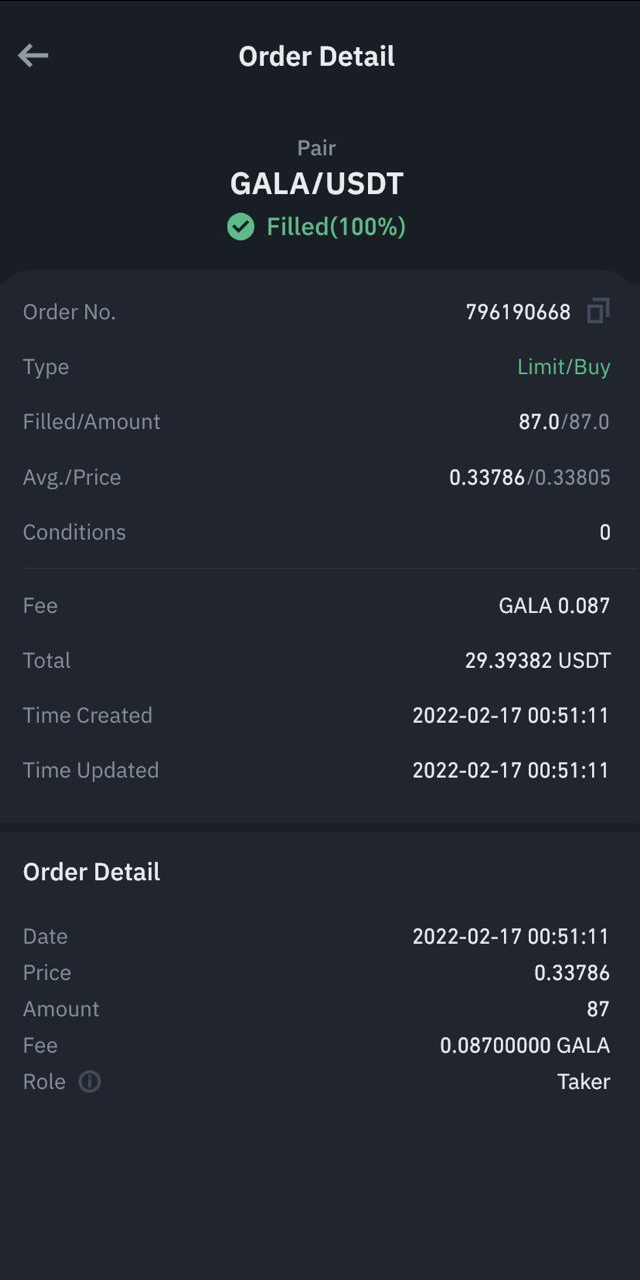

2. Real Buy Trade for the same GALAUSDT using margin trade on a 5MINS Chart

From the screenshot taken above, we can see that the 20 TEMA indicator line crossed above the 50 TEMA indicator line which indicates that buyers are taking over the market of GALA. Similarly, looking at the RSI indicator as well, we saw that the RSI indicator line was trending above the mid-point mark (50) indicating a confirmation of a possible bullish trend signal. I then executed a buy trade at the price of $0.3386 with a take-profit set at $0.34269 and stop-loss at $0.33437. The risk to reward ratio was set at 1:2 as shown above.

In this section, I would be enumerating some of the advantages and disadvantages of the Triple Exponential Moving Average indicator. We would first begin with the advantages.

Advantages of the Triple Exponential Moving Average Indicator

The TEMA indicator helps traders to identify dynamic support and resistance points of an asset which tends to aid them in spotting entry and exit levels on charts when trading crypto assets in the market.

The TEMA indicator help reduce lagging involved in its calculation because it reacts faster to the price movement or changes of an asset.

The TEMA indicator utilizes the crossover technique to help traders find buying and selling opportunities on crypto charts in the market.

The TEMA indicator is easier to use in identifying trends of crypto assets in the market.

Disadvantages of the Triple Exponential Moving Average indicator

The triple exponential moving average indicator is easily swapped or changed the dynamic support and resistance levels of the price of an asset because of how closely it reacts to the price movement of the asset.

The triple exponential moving average indicator is sometimes not reliable in a volatile market because the reduced lags of an asset can sometimes produce invisible or unidentifying signals due to how fast the indicator reacts to the price movement of assets in the market.

The TEMA indicator is a trending-market indicator and when assets are not in trending market structure it produces wrong or false trading signals.

Conclusion

To conclude, I would like to briefly summarize what has been done so far in this article. First of all, we discussed the concept of the triple exponential moving average indicator including its uses and importance to a trader. In addition, we looked at how the TEMA indicator is calculated and also how to configure the default settings of the TEMA indicator on the crypto chart.

Furthermore, we did a comparison between the TEMA indicator and two other moving average indicators (SMA and EMA). We further discussed how to identify bullish and bearish trends using the TEMA indicator with examples on crypto charts. We also explained support and resistance levels with the TEMA indicator on crypto charts.

Moreover, we looked at the situation of combining two TEMAs of different periods to identify buy and sell opportunities on crypto charts. We again discussed the trade entry and exit criteria using the TEMA indicator by showing examples on crypto charts. Last but not the least, we performed a demo trade and a real margin trade on a 5 min chart for both buy and sell positions.

Finally, we looked at some of the advantages and disadvantages of the triple exponential moving average indicator. I would like to say a very big thank you to professor @fredquantum for this wonderful lecture. I have really understood the concept of "Crypto Trading Strategy with Triple Exponential Moving Average (TEMA) indicator".

Thank You.