1. Explain Head and Shoulder and Inverse Head and Shoulders patterns in detail with the help of real examples. What is the importance of volume in these patterns(Screenshot needed and try to explain in detail)

Traders and investors as we all know before they make any decision in trades, they have to examine and study the trend or patterns of the asset on charts before taking any decision. Traders and investors do study these trends/patterns in order to make profits always from their trades. Trends and patterns are generally classified into reversal patterns and continuation patterns. Reversal patterns are patterns that show a change of movement of the price of an asset in the opposite direction. This means that, if a trend was initially moving upwards and a reversal trend occurs then the trend/pattern would now be moving downwards. On the contrary, continuation patterns or trends refer to patterns/trends that indicate a continuous movement of the price of an asset in the initial or current direction.

A good example of the reversal patterns is what has been taught by professor @utsavsaxena11 this week, that is Head and Shoulder pattern, and the inverse head and shoulder pattern which I would elaborate more about them in this article. Without wasting much time, let's commence with the head and shoulder pattern.

Head and Shoulder Pattern:-

The Head and Shoulder Pattern refers to the pattern of a chart that indicates a trending asset's endpoint in an upward direction or it is formed or occurred when a bullish trend is about ending and a bearish trend/pattern is just about to commence. The head and shoulder pattern comprised three main components and they include; the right shoulder, the left shoulder, and the head. The head and shoulder pattern is also termed as bullish-bearish trend reversal because of how it is being formed. A good example is shown in the chart below:

The left shoulder for this type of pattern or trend is formed when an upwards spike in the price of an asset occurs and it's followed by a quick decline immediately. When this occurs, the first peak is established or created which is termed as the left shoulder. The next peak (head) which is higher than the left shoulder is formed or created by the high and low created by the left shoulder. The head's peak is the highest peak formed and after which the right shoulder is also formed. The high of the right should is always lower than the head and it is almost the same high as that of the left shoulder. Although they might differ a bit but not that much.

Now let's look at the second pattern termed the Inverse head and shoulder pattern.

Inverse Head and Shoulder Pattern:-

The inverse head and shoulder pattern is also a type of reversal pattern and it's just opposite to that of the head and shoulder pattern. It is formed when a bearish trend is about ending and a bullish trend/pattern is just about to commence. This indicates that the head and shoulder pattern indicates the exhaustion of a bullish trend of an asset whilst the inverse head and shoulder pattern indicates the exhaustion of a bearish trend of an asset in the market. During the period of formation of the inverse head and shoulder pattern, sellers are seen to leave the market whilst buyers start to enter the market. It is also termed as bearish-bullish trend reversal.

Similarly, the inverse head and shoulder pattern also comprise three main components namely, the inverse right shoulder, the inverse left shoulder, and the inverse head. A good example is shown in the chart below:

From the chart shown above, the inverse left shoulder for this type of pattern or trend is formed when a downwards movement in the price of an asset occurs and it's followed by a quick rise in price immediately. When this occurs, the first low is established or created which is termed as the inverse left shoulder. The next low (inverse head) which is lower than the inverse left shoulder is formed by the low and high created by the inverse left shoulder. The inverse head must be lower than both the left inverse shoulder and inverse right shoulder. After the formation of the inverse head is the formation of the inverse right shoulder. The low of the inverse right shoulder is always higher than the inverse head and it is almost the same low as that of the inverse left shoulder. Although they might differ a bit but not a higher difference.

The Importance of Volume in Head and Shoulder and Inverse Head and Shoulder Patterns:-

The volume in head and shoulder and inverse head and shoulder pattern helps to determine the path or trend of an asset's price in the market. During the formation of the left shoulder in head and shoulder pattern, a greater volume is observed which indicates that buyers are still in the market and they still have an influence on the price of the asset as well. Again, we start to observe a decrease in the volume of the asset during the formation of the "head" and this indicates that buyers are leaving the market and withdrawing all their assets as well.

Similarly, this situation occurs in the inverse head and shoulder pattern whereby we observe a greater volume during the formation of the inverse left shoulder and a decrease in volume during the formation of the inverse head. To make good profits from trades, investors or traders must understand this situation technically, and know when the volume is increasing and decreasing in the market.

From the 45 minutes ETHUSD chart shown below, we observed that there was a greater volume formed during the formation of the left shoulder indicating that buyers are still in the market and have influence or control of the market. Subsequently, during the formation of the head, the volume reduced indicating that buyers are now leaving the market by withdrawing their assets. It was also observed that after the formation of the right shoulder the volume started to increase again in the market.

2. What is the psychology of market in Head and Shoulder pattern and in Inverse Head and Shoulder pattern (Screenshot needed)

The Psychology of market in the Head and Shoulder Pattern:-

Previously I said the head and shoulder pattern is considered to be a bullish-bearish reversal trend due to its way of formation, which is a bullish trend exhausting and a bearish trend about to begin.

From the 15 minutes, SHIBUSDT chart shown above, we saw that the price of the asset was in an uptrend before the left shoulder was formed. Sellers entered the market at the left shoulder and influenced the price of the asset greatly such that it moves down to create the first point of the neckline as shown above. After the creation of the first neckline points, buyers then entered the market and greatly influenced the market such that the price of the asset spiked so high above the previous high thereby forming the head. Again, sellers took over the market once again and depreciated the price of SHIBUSDT such that the second point of the neckline is formed as indicated.

Buyers again also entered the market and again the price of SHIBUSDT raised again but this time around it couldn't spike above the previous high (head) thereby creating the right shoulder as indicated. Subsequently, with time there was high supply than demand in the market and as a matter of that, the price of SIBUSDT continuously moved downwards until the price broke the neckline and the price of the asset then moved in the bearish direction as we can see from the chart.

The Psychology of market in the Inverse Head and Shoulder Pattern:-

The psychology here is just the opposite of what we saw in the head and shoulder pattern's psychology market. In this pattern, I would be using a 30 minutes ADAUSDT chart.

From the 30 minutes, ADAUSDT chart shown above, we saw that the price of the asset was in a downtrend before the inverse left shoulder was formed. Buyers entered the market at the inverse left shoulder and influenced the price of the asset greatly such that it moves up to create the first point of the neckline as shown above. After the creation of the first neckline points, sellers then entered the market and greatly influenced the market such that the price of the asset moved so lower below the previous low thereby forming the inverse head. Again, buyers took over the market once again and increased the price of ADAUSDT such that the second point of the neckline is formed as indicated.

Sellers again also entered the market and again the price of ADAUSDT fell again but this time around it couldn't fall below the previous low (inverse head) thereby creating the inverse right shoulder as indicated. Subsequently, with time there was high demand than supply in the market and as a matter of that, the price of ADAUSDT spiked upwards until the price broke the neckline, and the price of the asset then continuously moved in the bullish direction as we can see from the chart.

3. Explain 1 demo trade for Head and Shoulder and 1 demo trade for Inverse Head and shoulder pattern. Explain proper trading strategy in both patterns separately. Explain how you identified different levels in the trades in each pattern(Screenshot needed and you can use previous price charts in this question)

Explanation of a Demo trade for Head and Shoulder Pattern

The following points or procedures briefly explains how to trade using the head and shoulder pattern strategy;

First of all, search and find a head and shoulder pattern on a chart.

From the 15 minutes SHIBUSDT chart below we would demonstrate a demo trade for head and shoulder patterns.

From the chart below, we can see that the left shoulder is formed which is followed by the head and then the right shoulder as well.

The neckline was also indicated by drawing a line joining the low of the left shoulder to the low of the head as shown below.

We then wait for the price of the SHIBUSDT to break the neckline downwards.

Right after the neckline was broken by the asset's price, a sell entry was taken as indicated in the chart above. Stop-loss was set just above the right shoulder as indicated above in the chart. In setting my take-profit level or target level, I calculated the difference between the head and the low of the left shoulder from the chart after which the difference we had was then minus from the price of the neckline as indicated above.

Explanation of a Demo trade for Inverse Head and Shoulder Pattern

The following points or procedures briefly explains how to trade using the head and shoulder pattern strategy;

First of all, search and find an inverse head and shoulder pattern on a chart.

From the 15 minutes ADAUSDT chart below we would demonstrate a demo trade for inverse head and shoulder patterns.

From the chart below, we can see that the inverse left shoulder is formed which is followed by the inverse head and then the inverse right shoulder as well.

The neckline was also shown by drawing a line joining the low of the inverse left shoulder to the low of the inverse head as shown below.

We then wait for the price of the ADAUSDT to break the neckline upwards.

Right after the neckline was broken by the ADAUSDT's price, a buy entry was taken as shown in the chart above. Stop-loss was set just below the inverse right shoulder as indicated above in the chart. In setting my take-profit level or target level, I calculated the difference between the inverse head and the low of the inverse left shoulder from the chart after which the difference we had was then added to the price of the neckline as indicated above.

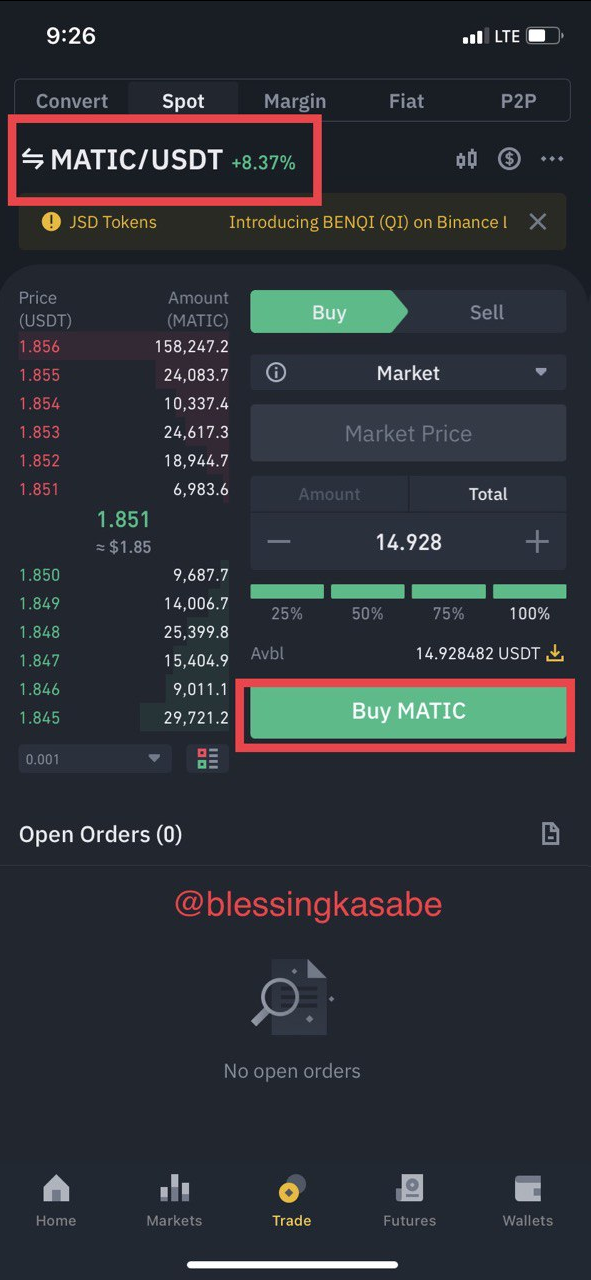

I have performed a real trade of MATICUSDT worth 14.808 USDT using the inverse head and shoulder pattern strategy. The chart indicated below is a 1minute MATICUSDT chart from which I analyzed before trading.

From the chart, we observed and spotted the formation of the inverse head and shoulder pattern as seen below. My neckline was then drawn so as to wait for the break of the neckline and then execute my trade.

Immediately when the price of the asset broke the neckline drawn, I executed an entry order with a price of $14.808. Also, I placed my stop-loss just below the inverse right shoulder as shown in the second chart. The stop-loss was placed at $1.850 and the take-profit was calculated to be $1.861 after adding the difference between the inverse head and the low of the inverse left shoulder.

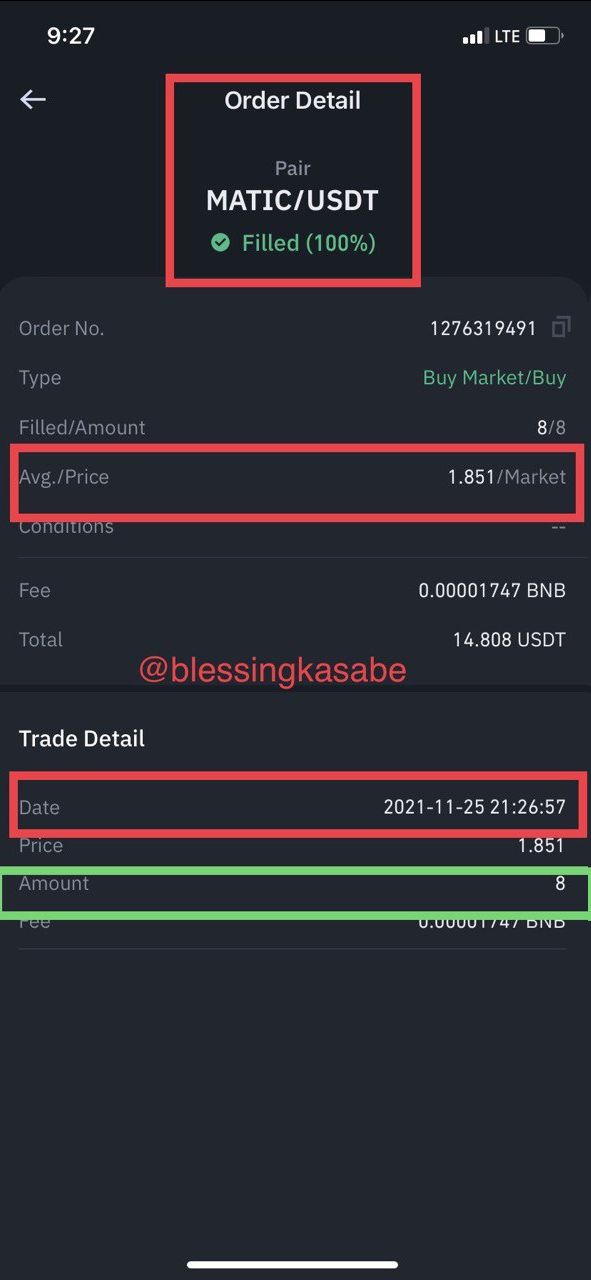

- A buy order was placed using my mobile phone in the Binance app. I placed the order for MATIC/USDT at the current market price which allowed my order to be executed immediately. The current price of MATIC/USDT as of then was $1.851.

- The details of my order after a successful trade are shown below in the screenshot taken. From my Binance order history, the trade was executed or filled at 25-11- 2021 at 21:26:57 pm. The order was also filled at a price of $1.851 as shown below.

- The chart below was taken after some time of trading. It can be observed from the chart that after I executed my entry trade the price of the asset after breaking the neckline upwards later came back and broke the neckline again downwards and started moving bearishly. With time it can be seen again that the price of the asset came back and has started to trade bullishly. This can be seen from the chart shown below.

To conclude I would like to briefly summarize what we have done so far in this work. Firstly, we looked at the concept of head and shoulder patterns and also inverse head and shoulder patterns where we explained it in detail by including crypto charts to support our work. Again, we looked at the importance of volume in these two patterns.

In addition, we discussed the psychology of the market in the head and shoulder pattern as well as in the inverse head and shoulder pattern. Over here, we discussed and explain how these patterns are formed and we included crypto charts to support our answers.

Moreover, we demonstrated a demo trade for head and shoulder patterns with a detailed explanation of all the steps required. Similarly, we demonstrated a demo trade for the inverse head and shoulder patterns with a detailed explanation by including crypto charts. We also discussed how all the different levels are obtained in the trade.

Finally, we discussed how to perform a real trade for the inverse head and shoulder patterns where I traded MATICUSDT worth $14.808. Detailed information about the trade was provided as well including the trade history and the time the trade was executed.

I would like to say a very big thank you to professor @utsavsaxena11 once again for this wonderful lecture. I have really understood the concept of the head and shoulders and inverted head and shoulders pattern. Thank You.