THEORY

1. Explain and define in your own words what the Donchian Channels are?

The Donchian Channel was developed by a well famous individual known as Richard Donchian who was born in 1950. Mr. Richard Donchian was also known to be called the father of trend monitoring. He developed this technical indicator and gave it a name by using his name "Donchian".

The Donchian Channel indicator refers to an indicator used in measuring the price volatility of an asset in the crypto market. It is also used in measuring trend reversals of crypto assets in charts. It looks similar to the Bollinger bands indicator where it also possesses three lines namely, the upper band, middle band, and lower band.

These three bands are what helps in determining the price volatility of the assets in the market. There is a high expansion of the bands when the volatility of the price of the asset is high. Similarly, when the volatility of the price of an asset is low, there would be the contraction of the bands. Moreover, an overbought is signaled when the price of the asset touches or hits the upper band whilst an oversold is signaled when the price of the asset touches or hits the lower band of the Donchian channel. The Donchian channel is formed as a result of the formation of the highest-high and the lowest-low of the previous period which is either daily or weekly.

When the price of the asset touches the lower band of the indicator a trend reversal may happen due to the formation of an oversold in the market. Also, a reversal of trend leads to a downtrend when the price of the asset touches the upper band of the indicator.

2. Explain in detail how Donchian Channels are calculated (without copying and pasting from the internet)?

The three lines that are seen in the Donchian channels must be noted that they are calculated from moving averages (MA). It should also be noted that the upper band represents the highest price of an asset for a certain period, and the lower band also represents the lowest price of an asset for a particular period whilst the middle band represents the average price of the asset for a certain period.

The area of the channel is formed by the difference between the upper band and the lower band. In calculating for the upper band, the lower band is determined by selecting a particular period and similarly in calculating the lower band, the upper band which would form the highest channel is calculated by selecting a particular a period. After obtaining the values for both the upper and lower bands, the middle band which is the average price is calculated bu dividing the sum of the upper and lower bands by two (2). That is, by calculating the average of the two bands.

In calculating the Donchain channels, I would like to illustrate an example below here using ETHUSDT chart;

I would be using 25days as my period in this calculation, and this indicates that the highest and lowest bands would be calculated within this period.

From the above chart shown, the following data can be extracted;

The Upper Band channel = $4,596.80

The Lower Band channel = $3,957.82

Period (N) = 25 days

Now, to calculate the Middle Band channel, we sum up the the values for the two bands above and then divide by two to obtain the average.

Middle band channel = (Upper band channel + Lower band channel)/2

= ($4,596.80 + $3,957.82)/2

= $8,554.62/2

= $4,277.31

Therefore the middle band for the period 25 is $4,277.31.

3. Explain the different types of uses and interpretations of Donchian Channels (With examples of bullish and bearish trades)

In explaining the different types of uses and interpretations of the Donchian channels, I would be elaborating on the following ; volatility, overbought & oversold, trend & breakout. These are the uses of the Donchian channels indicator and I would explain and illustrate them crypto assets.

Volatility:-

Determination of the Volatility of an asset's price is one of the most importance of the use of the Donchian changes indicator. The Donchian channels is used in measuring the volatility of an asset to know whether the volatility price of the asset is high or low. When the Donchian channel's bands expands then this indicates a high volatility of price of the asset whilst when the Donchian channel's bands contracts then this indicates a low volatility of price of the asset. Investors or traders mostly reads these indications so as to cath pips out from the market. It also helps trader or investors to spot good entry and exit positions points in the market during trades. A good illustration is shown below;

Overbought and Oversold:-

Another significant use of the Donchian channels is the use in determination of overbought and oversold of asset's price in the market. When the price of the asset hits or touches the upper band channel then it's an indication of an overbought in the price of the asset in the market whilst when the price of the asset hits or touches the lower band channel then it's an indication of an oversold in the price of the asset in the market. During the period of overbought when the asset's price touches the upper band of the Donchian channels, it is noted to be as a result of the high accumulation of the assets by buyers in the market. On the contrary, during the period of oversold where the price of the asset touches or hits the lower band of the Donchian channels, seller are compelled out of the market and buyers enter trade because it's possible for a bullish trend to take over. A good illustration is shown below;

Strong Trend and Zone Breakout

Strong of trend can determine the continuous movement of the asset's price in a particular direction without a reversal in trend after the price touching either the upper band or lower band channel of the Donchain channels. When this occurs we say that the trend is a strong trend. For instance when the price of an asset is moving or trending with a strong momentum to the downside, the price would be seen to break the lower band of the Donchian channels and then stick to it whiles the asset's price is still moving downwards. Similarly, this can take place in a bullish trend as well, where the price of the asset would break the upper band channel of the Donchain channel and sticks to it whiles the asset price is moving up. A good illustrations seen in the chart below:

Also, for a bearish representation of a strong trend, the chart below describes it and shown:

PRACTICE

Make 1 entry using the "Donchian Channel Breakout Strategy" and make 1 entry using the "Reversal and Retracement Strategy" . You must explain the step by step of how you analyzed to take your entry and make them into a demo account so I can evaluate how the operation was taken.

I would be demonstraing two entries of trades using the Donchian channels breakout strategy and also reversal and retracement strategy in this question. Without much ado let's dive into business.

Entry Trade using the Donchian channels breakout Strategy:-

The breakout strategy is used during strong trends in the market. That is, when the price of an asset touche or hhits the either the upper or lower bands channels of the Donchian channels and sticks to the price whilst the asset's price still continues in the direction of movement. In placing a long entry using this strategy, the price of the asset must break the upper band channel and stick to it to indicate that the bearish momentum is over in the market. Similarly, in placing a short entry using this strategy, the price of the asset must break the lower band channel of the asset to indicate that the bullish momentum is also over.

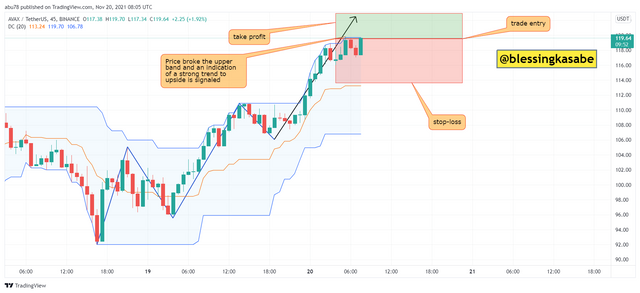

I would be illustrating a trade entry with an AVAXUSDT chart below here . I would be using a length of 20 for my indicator.

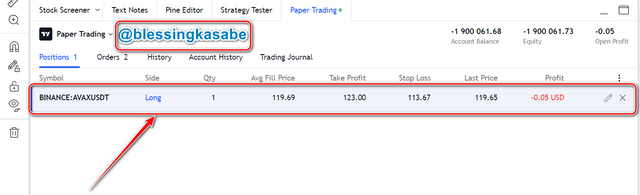

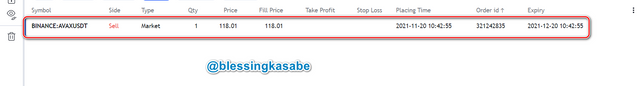

I placed a sell entry using tradingview paper trading as shown below. My stop-loss was set below the candle that broke the upper band and also take-profit was set above the candle that broke the upper band channel of the Donchian indicator. A risk to reward ratio of 1: 2 was set so that I can earn double rewards if trade goes in favor of my trade.

Trade entry using the Reversal and Retracement Strategy:-

The reversal and retracement strategy involves taking advantage of price reversal of an asset or taking advantage of the price retracement of an asset during a trending market. A retracement or reversal is formed when the price of an asset breaks the middle band downwards during a bullish trend in the market. Usually a short position is taken after the candle that breaks the middle band of the Donchian channels indicator.

On the contrary, when the price of an asset breaks the middle band upwards during a bearish trend then a long positions taken after the candle that breaks the middle band of the Donchian channels indicator.

I would be illustrating a typical example of the reversal or retracement strategy in taking entry position;

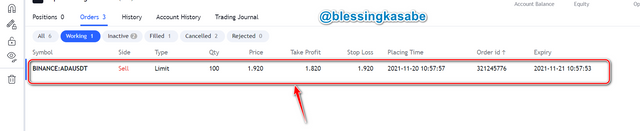

ADAUSDT Sell Entry

The current trend of ADAUSDT was in bullish and it started moving downwards until the price of the asset breaks the middle band of the Donchian channels which indicates a retracement or reversal in the market. Because this was a bullish trend so I take a short position. The chart below indicates the illustration of the explanation above.

After the price broke the middle band of the asset, I placed a sell order as indicated and also placed my stop-loss above the middle band and take-profit was set below the middle band. The risk to reward ratio of my trade was placed at 1: 1 indicating a equal rewards as my risk if trade goes in my favor.

This is my placed order I did.

Conclusion

To conclude, I would like to summarize what we have done so far in this article. First of all, we looked at the concept of the Donchian channels indicator and its component. Again,we also looked at the calculations involved in DOnchian Channels indicator and how it is being calculated.

Furthermore, we discussed the different types of uses of the Donchian Channels indicator including interpretations of them as well. We also looked at the uses by providing good examples using crypto assets on charts. Finally, we practical demonstrated how to trade using the Donchain Channel breakout strategy and also using the reversal or retracement strategy.

I would like to say a very big thank you to professor @lenonmc21 once again for this wonderful lecture. I have really understood the concept the Donchian Chhanels and its uses. Thank You.

CC: @steemcurator02

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit