.png)

Introduction

In this section, I would be explaining the concept of median indicator and how it is being used. Without much ado, let's move straight to the median indicator definition.

The Median Indicator is a type of trend-based technical indicator that is used in identifying trends in the crypto market by identifying the directional bias of the price of an asset and its corresponding volatility in the market. The Median indicator is just similar to that of the Heikin Ashi indicator, moving averages indicator, etc as they are all trend-based indicators but there is a slight difference with the median indicator.

The median indicator uses the channel created by the ATR from the median line to measure the volatility of an asset in the market is this is what differentiates the median line indicator from the other types of trend-based indicators.

The volatility of the price of the asset is determined by the median indicator by drawing the ATR of the middle line above and below the median line after which EMA of similar length is being compared to that of the median lines. When the comparison is done, the differences that we obtain between the EMA of similar length and that of the median line provide a cloud formation and this indicates bullish and bearish trends in the market.

The color of cloud formation depends on the line with a higher value whereas the median indicator determines the current trend of the asset by producing possible trade signals in the market which makes it easy for traders to enter or exit the market.

In reading and identifying trends from the median indicator, when the green color cloud is formed or generated, then this means that the median value of the indicator is higher than the EMA value of the same length thus, indicating an uptrend in the market. When this happens, it shows that the buyers are now in control of the market price of the asset. Similarly, when a purple color cloud is formed or generated, then this means that the median value of the indicator is lower than the EMA value of the same length (EMA is higher than median value) thus, indicating a downtrend trend in the market. When this happens, it shows that the sellers are now in control of the market price of the asset. Let's now look at the calculation and parameters of the median indicator n the next section.

In this section, I would be throwing more light on the median indicator parameters as well as the calculation involved in using this indicator. In doing this, we would explore the TradingView platform and use that to show.

The Parameters of the Median Indicator

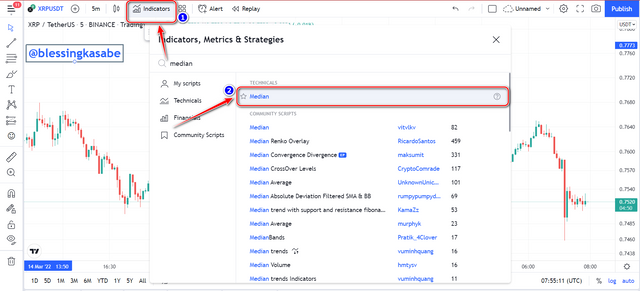

First of all, we would visit the TradingView platform and then click on the chart to direct us to the chart window as shown below.

I would then click on the indicators tab from the menu bar and then enter and search "median indicator" to add it to the chart.

Now, we can see that the median indicator has successfully been added to the chart as shown below.

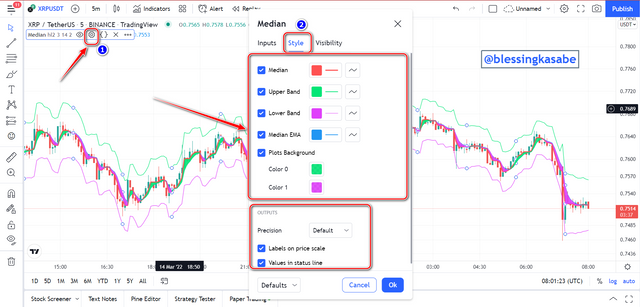

Now, to configure and explore the parameters of the median indicator, we would, first of all, click on the settings icon of the median indicator and a window would be displayed as shown below.

The above screenshot shown is the style parameter, and we can see the default settings from the above. The style indicates how the indicator's appearance looks on the chart and it can be changed or modified to suit one's preference. The median has a default color of red, the upper band is green, the lower band is purple, and the median EMA is blue. Let's look at the next parameter (Inputs).

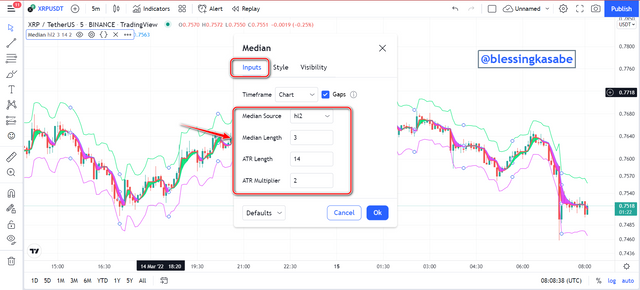

The above screenshot shows the default parameters for the Inputs settings and they include Timeframe, Median source, Median Length, ATR Length, and ATR Multiplier settings. The default settings for Median Source is hl2, Median Length is 3, ATR Length is 14, ATR Multiplier is 2. These settings can be altered to suit a trader depending on the type of trader and the style of trading strategy he/she uses.

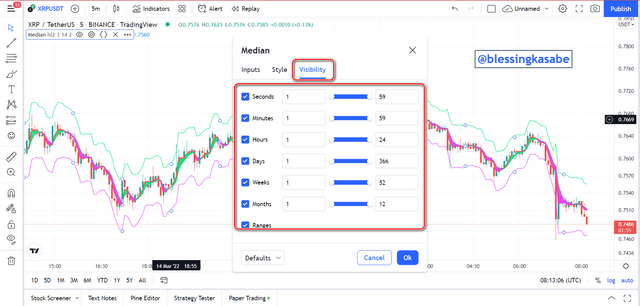

The Visibility Paramters for Median Indicator TradingView

The last parameter we have is the Visibility settings and it can be seen from the above chart indicated. These include seconds, Minutes, Hours, Days, Weeks, Months, etc and they can also be altered to suit a trader's choice. Let's now look at how to calculate the median indicator.

The Calculation involved in using the Median Indicator

In calculating the median indicator, the percentage difference between the EMA value within a specific interval and the median value is used in doing so. The specified interval of the EMA used makes the calculation to be accurate and logical. There is a formula used for the calculation of the median indicator and it is shown below.

The Median value = (highest price + lowest price) / 2

The EMA Value = (Closing price x multiplier) + [EMA (previous day) x (1-multiplier)]

Therefore;

The Median indicator = ATR %change (median value, EMA value)

If EMA %change >= the Median value, plot Purple

If Median %change >= the EMA value, plot Green

Other useful parameters used in the calculation include the following;

The Median length = the period of observation

The Upper band = the Median Length + 2ATR

The Lower band = the Median Length - 2ATR

From the equations/formulas provided above, we can clearly see that first of all, the percentage depth used helps in identifying a median value after which the difference between the median value and the EMA value is determined.

When the median value is observed to be higher than the EMA value, a green color is formed indicating the formation of a bullish signal and a new bullish trend formation. Similarly, when the median value is observed to be lower than the EMA value (EMA is higher than median value, purple color is formed indicating the formation of a bearish signal and a new bearish trend formation. Let's now deeply look at how to identify bullish and bearish trends in the market using the Median Indicator.

In this section, we would be looking at how to identify an uptrend using the median indicator on a crypto chart. We know that generally, traders or investors do follow trend signals in order to enter and exit the trade as a matter of that, we have to know how to use this indicator to determine trends of crypto assets. Generally, we found out that the color formation of the median indicator helps us to determine an uptrend formation is possible to occur in the market.

In the previous section, we found out that in identifying an uptrend, the median value is higher than the EMA value and as result produces a green color formation. When this happens, the market is said to be in a bullish trend indicating that buyers have taken control of the price of the asset in the market.

Traders and investors take buying opportunities when the green color formation starts to appear because it is an indication of a buy signal in the price of the asset. A good illustration is shown below in the chart;

From the chart shown above, we can clearly observe the green cloud color formation as well as the price movement of the asset crosses and closed above the green cloud formation. This indicates a bullish trend as well as a buy signal in the market. Traders then take buy positions in the market with take-profit aiming at the previous high point and stop-loss below the closest low point.

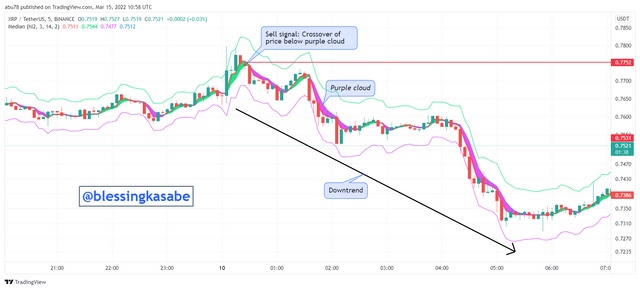

In this section, we would be looking at how to identify a downtrend using the median indicator on a crypto chart. We know that generally, traders or investors do follow trend signals in order to enter and exit the trade as a matter of that, we have to know how to use this indicator to determine trends of crypto assets. Similarly, the color formation of the median indicator helps us to determine a downtrend formation is possible to occur in the market.

In the previous section, we found out that in identifying a downtrend using the median indicator, the median value is lower than the EMA value (EMA value is higher than median value) and as result produces a purple color formation. When this happens, the market is said to be in a bearish trend indicating that sellers have taken control of the price of the asset in the market.

Traders and investors take selling opportunities when the purple color formation starts to appear because it is an indication of a sell signal in the price of the asset. A good illustration is shown below in the chart;

From the chart shown above, we can clearly observe the purple cloud color formation as well, as the price movement of the asset crosses and closed below the purple cloud formation. This indicates a bearish trend as well as a sell signal in the market. Traders then take sell positions in the market with take-profit aiming at the previous low point and stop-loss below the nearest high point.

In this section, I would be discussing how to identify false signals using the median indicator on crypto charts. We know that there is no indication that we can say it reads or predicts a 100% signal without any false signal. Every indicator produces false signals due to the high volatility and fluctuations in the market. In other to identify and fish out these false signals, we add other indicators in order to do so. As a matter of that, I would combine the RSI indicator with the Median Indicator to identify and filter false signals on crypto charts.

As we already said in our previous lessons, the RSI indicator is a type of volume-based indicator which helps in identifying the current market conditions of assets which is either overbought condition or oversold condition.

We learned from previous lessons in the Academy, that when the price of an asset crosses below the RSI 30 mark then it is an indication of an oversold condition, and a possible bullish reversal in the price of the asset can take place. Similarly, when the price of an asset crosses above the RSI 70 mark then it is an indication of an overbought condition, and a possible bearish reversal in the price of the asset can take place.

In identifying false signals when using the RSI indicator and the Median Indicator, the two indicators have to abide by the trend movement of the asset as well as the trend indication of these indicators when identifying trends movement. When there is a discrepancy between the two indicators, then it is an indication of a false signal in the market. A good illustration is shown below from the crypto chart;

From the chart indicated above, we can clearly see that the RSI indicator is trading below the RSI 30 mark, i.e. an oversold condition indicating that a possible bullish trend reversal is going to take place. On the contrary, from the Median Indicator, we saw that the purple color formation still continued forming an indication of a continuous bearish trend of the price movement of the asset, and also the price of the asset didn't also close above the cloud showing that the sellers in the market are still in strong position ad control of the market.

This shows a clear discrepancy between the two indicators (median indicator and RSI indicator) signals formed. In these situations, mostly it is through the influence of the huge investors to deceive traders or investors to enter the trade.

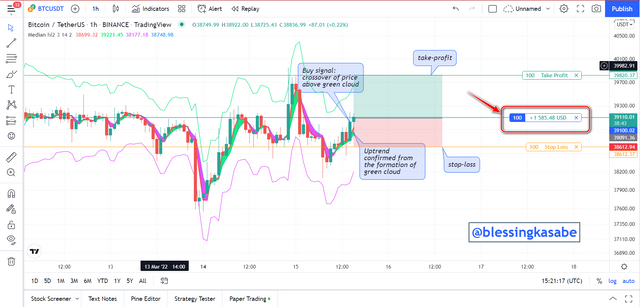

Trade 1:- Buy entry trade for BTCUSDT (1 Hour)

In this section, I would perform two demo trade (long and short) on crypto asset using the Median Inidicator. Without much ado, let's go straight to the first trade.

From the BTCUSDT Chart shown above, we can clearly see that the median indicator identified a bullish trend reversal in the price movement of the asset. This is indicated by the green color formation of the median indicator below the low point. Similarly, the price of the asset crossed over the green cloud indicating a buy signal and it also indicates the presence of buyers taking control of the market price of the asset.

After observing the above, I then waited for the formation of a bullish candlestick and then executed a buy order trade at the price of $39,100.02, with take-profit at $39,820.37 and stop-loss at $38,612.37. I set my risk to reward ratio at 1.52.

After leaving the trade for about an hour or more, I made a profit of over $14K. This indicates that, one can utilize the Median Indicator to trade and earn more profit if the strategic procedures are rightly implemented.

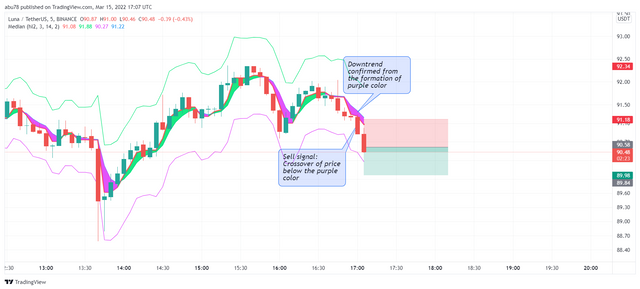

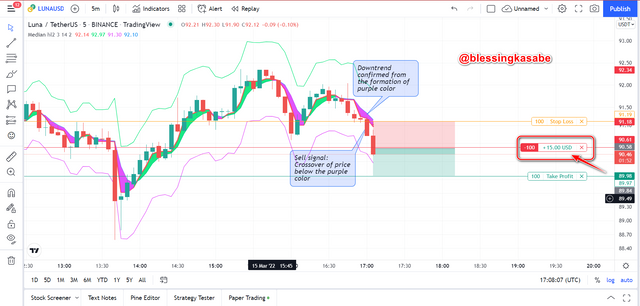

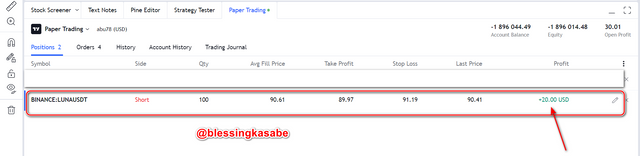

Trade 1:- Sell entry trade for LUNAUSDT (5 MINS)

From the LUNAUSDT Chart shown above, we can clearly see that the median indicator identified a bearish trend reversal in the price movement of the asset. This is indicated by the purple color formation of the median indicator at the high point. Similarly, the price of the asset crossed below the purple cloud indicating a sell signal and it also indicates the presence of sellers taking control of the market price of the asset.

After observing the above, I then waited for the formation of a bullish candlestick and then executed a buy order trade at the price of $90.6, with take-profit at $89.97 and stop-loss at $91.19. I set my risk to reward ratio at 1.

After leaving the trade for about 30 minutes, I made a profit of over $20. This indicates that, one can utilize the Median Indicator to trade and earn more profit if the strategic procedures are rightly implemented.

Conclusion

To conclude with, I would like to summarize what has been done so far in this article, first of all we looked at the concept of the Median Indicator including its uses. We again looked at the parameters of the median indicator and also its calculation involved whereby we discussed the formula needed to be used in the calculation.

Furthermore, we discussed how the median indicator can be used to identify uptrend and also downtrend on crypto charts by proving typical examples. Moreover, we went further to discuss how the median indicator can be used with teh RSI indicator to identify false signals in the trend of crypto assets.

Finally, we performed two demo trades, one for buy and the other for sell trade. I used the median indicator trading strategy to perform the trade and I earned over $14K profit for both trades executed.

would like to say a very big thank you to professor @abdu.navi03 for this wonderful lecture. I have really understood the concept of "CRYPTO TRADING STRATEGY WITH MEDIAN INDICATOR".

Thank You.