--- Paxos Standard Token (PAX) is an ERC-20 token issued on Ethereum blockchain. As a regulated stablecoin collateralized by the U.S. dollar, it brings benefits of the blockchain technology and stability of fiat currencies together.

It results in a steady cryptocurrency which offers:

Instant worldwide transactions

Immutability

Decentralized accounting

24/7 transactions

On top of that, every PAX token is fully backed by the equivalent amount of U.S. dollars, meaning it can also be redeemed for USD at any time. However, according to U.S. Law, Paxos Standard isn’t a security.

PAX Standard was established in the light of the infamous Tether controversy, where the leading market stablecoin has come under scrutiny for printing Tethers out of thin air during the early 2018 crypto market bull run. Paxos team has noticed the opportunity and made an extra effort to be as transparent as possible. Paxos issues and burns its tokens using an audited smart contract, inspected by smart contract auditor Nomic Labs. Withum, one of the top U.S. auditing companies, regularly verifies the reserves.

[ ]

]

The Brian Behind Paxos is Charles Cascarilla and his team

Paxos team consists of seasoned professionals from diverse backgrounds, including former Wall Street and Silicon Valley employees.

Paxos Vision

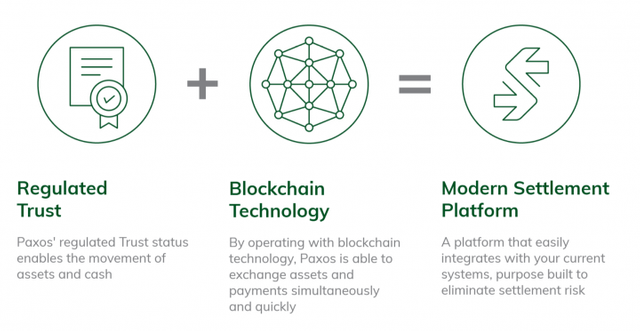

Paxos team sees a future in which blockchain isn’t a part of a major financial revolution, but an essential element of its evolution. In the big picture, the company wants to improve the economic ecosystem by developing a global frictionless network for simple, mobile and instant exchange of assets.

The way Paxos Standard Token Work

Paxos Standard is designed to have growing use cases. Today, it’s primary use case is to limit crypto asset volatility, remove friction from cross-border transactions, and become a reliable payment vehicle for crypto assets and other blockchain assets.

In the future, Paxos expects to be used for consumer payments and the stable store of value for people outside the U.S., especially in countries with unstable national currencies.

1). A user sends USD to the token issuer's bank account.

2). The issuer creates the equivalent amount of PAX using PAX smart contract.

3). The freshly minted PAX are delivered to the user while the USD is held in the bank account.

The same but reversed process is used to redeem PAX for USD. Every Paxos Standard token can be purchased and redeemed using Paxos.com. Upon PAX token redemption, the tokens are immediately burned and taken out of the circulation.

It’s worthy to note the company doesn’t charge any fees for both converting and redeeming PAX tokens. The minimal conversion amount starts at $100.

Paxos uses third-party auditors for proving they hold the corresponding amount of dollars. The monthly attestation reports can be found here.

What are the body Regulation paxos.

Paxos is regulated by the New York State Department of Financial Services.

Guaranteed cash deposits. Every collateralizing deposit is held at FDIC-insured U.S. banks.

Audited. Every Paxos Standard bank account is overseen by U.S. auditing firm Withum.

Security. Paxos employs additional transaction monitoring and surveillance partners for an extra layer of compliance.

Daily purchase and redemption windows. PAX tokenization and redemption requests are processed in regular windows that facilitate free and frequent fund movement. Every operation is usually done within one business day

No fees. Paxos Standard tokens are issued and redeemed without any extra charges.

These features make PAX like the other recently emerged stablecoins - USD Coin (USDC), TrueUSD (TUSD) and Gemini Dollar (GUSD). All of them are fully redeemable regulated ERC-20 tokens backed 1:1 which are backed by U.S. Dollars, uses Ethereum smart.

Paxos is making it possible “to move any assets anywhere, instantly.” Image via Paxos.com

After launching the itBit cryptocurrency exchange in Singapore soon after the creation of the company they were awarded a limited purpose trust charter by the New York State Department of Financial Services, making them the first company approved and regulated to offer crypto products and services. Soon after that they became regulated qualified custodians, enabling them to branch out from stablecoins to digital gold.

What is Paxos Gold (PAXG)?

Paxos Gold was created as an ERC-20 token on the Ethereum blockchain and with it Paxos is looking to solve the fundamental problems with physical gold and the traditional gold markets. Namely, that in the traditional market, investors have no access to a high-quality gold product that easy to purchase, transport, store, and trade.

.jpg)

In the traditional markets investors can certainly buy as much physical or allocated gold as they like, but along with the purchase comes the high risk of physical gold. This risk is due to the size and weight or larger gold bars, the expense of storing it safely, the inability to divide it into smaller units easily, and the fact that because it can be difficult to transport it can also be difficult to sell, trade, or use.

Pax Gold has many benefits vs alternatives. Image via Paxos.com

The alternative is to trade on unallocated gold futures, CFDs, or ETFs. These are just derivatives, without the backing of any physical gold at all. None of them involve actual ownership of gold. Rather it is little more than speculation of the changing price of gold without any physical gold to back up any of the assets. It makes trading easy, but there is no store of value involved.

How does Paxos Gold work

Paxos is using blockchain technology to improve the distribution, storage, and ownership of gold. Because PAXG is a blockchain asset it is decentralized, immutable, and highly resistant to malicious attacks or theft. Paxos Gold is as good as gold, but without the problems of storage, transportation, and the risk of theft.

The PAXG token is an ERC-20 token at the time of writing, but the whitepaper does not specify that this platform is necessary, and Paxos could reissue PAXG on a different platform in the future. [Steve Walters]

Market value and why you should invest

Paxos, is an infrastructure for the creation of regulated financial institutions to enable movement between physical and digital assets, has closed a dizzying investment round as Bitcoin continues its inexorable climb, setting new highs. We take stock of the situation by trying to deepen the signatures behind the investments in the Paxos company and how the services offered by PayPal are moving the prices of Bitcoin.

Paxos and the $ 142 million round C

The announcement made Thursday by Paxos, a company that offers services in the world of cryptocurrencies based in New York, is one that does not go unnoticed. The company closed a $142 million Series C investment round with funds from companies such as Declaration Partners, PayPal Ventures, RIT Capital and Ken Moelis. 2020 was a very busy year for Paxos that ends in the best way. The partnership with PayPal has brought a lot of visibility to the company that now has liquidity of around 240 million dollars to improve the API services and the Crypto Brokerage which has clients such as the Revolut digital bank.

The services offered by Paxos

The Paxos mould is undoubtedly very institutional, given that CEO Chad Cascarilla worked for Goldman Sachs and Bank of America, but with a focus on the tech world, as most of its founders come from Silicon Valley. The services offered by the company branch out into various areas. The first is a Stable coin pegged to the dollar value and sustained 1 to 1 in proprietary reserves. In addition to the world of cryptocurrencies, Paxos is building an infrastructure that can potentially revolutionize the stock market. In fact, the company is working in a process to improve the way shares are traded to increase their speed and efficiency. In addition, one of the most famous services provided by Paxos is the digital token linked to physical gold held in a London bank.

[ Gianmarco Guazzo]

PayPal and the price of Bitcoin

The partnership between PayPal and Paxos has given rise to an interesting development for the world of cryptocurrencies. The fact that a digital payments giant like PayPal has invested large sums in the sector has changed the mind of many sceptics who still considered it a niche field. Since Square announced its Bitcoin investment, the narrative for institutions has changed dramatically. From that moment there has been a real digital gold rush that has brought very important companies on board. PayPal’s announcement of services related to the crypto world has undoubtedly driven the already very high demand for Bitcoin, breaking new highs and prompting many investment funds to reassess their position regarding cryptocurrency.

Retail demand and digital services

The amount of new users who will have the possibility to buy BTC through PayPal is almost 3 times the current one. In addition to retail users, PayPal brings with it many merchants who will have the ability to receive payments with cryptocurrency. The service is not yet active but 2021 will certainly bring a large sum of people to take an interest in cryptocurrency. With the arrival of the pandemic, online services in the payments sector have exploded, leading many consumers to avoid the use of physical cash and prefer digital.

Conclusion :

Even though Bitcoin remains a project far from the crowd, investments and partnerships like the one between PayPal and Paxos try to simplify the world of cryptocurrencies by bringing it into the pockets of millions of people without much effort.

Thanks professor.