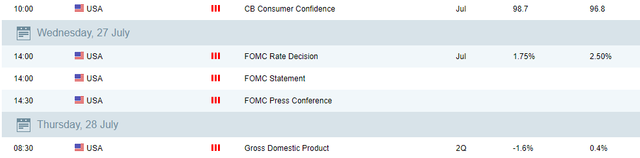

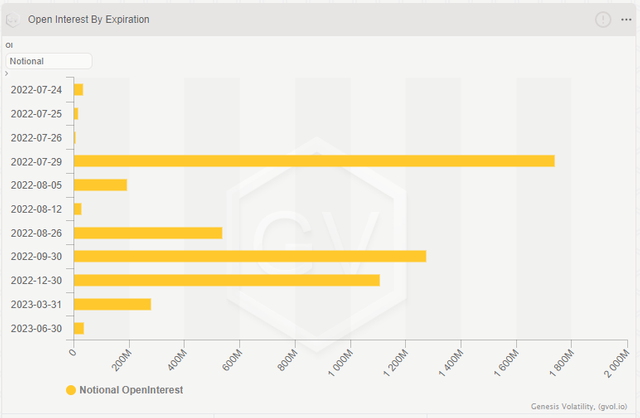

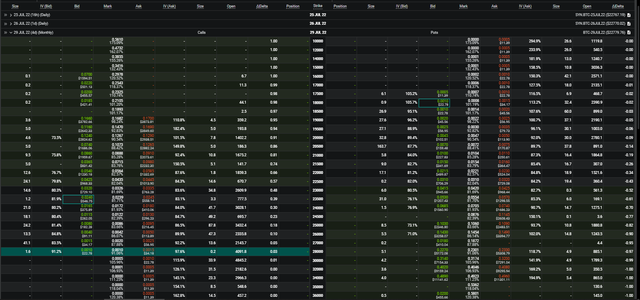

A large volume of BTC options will expire on 29 July, two days after the FOMC Rate Decision. All the BTC-29JUL22 open interest is worth about $1.8 Billion. I notice that the ATM IV of 29 July is higher than on other dates. IV on the call side is slightly higher and trading at a higher premium than the put side. This means options traders are bullish and think the price will go higher even after the rate decision. What do you guys think? Maybe someone with a better understanding of options can tell me more detail.

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit