Its a great honour to participate in cryptoacademys week 2 lectures. Much thanks to prof.@pelon53 for this interesting lecture on tokens. Before i start my writings, i want to explain tokens in my own words and understanding.

What is tokens?

Tokens, in their most basic sense, are a substitute for or reflection of another form of trade, which can be digital/virtual, physical, or abstract. Having said that, unlike generally recognized legal tender (currency), tokens are restricted to their offering to the public, and are thus most often distributed by private companies rather than the government. It does not have a blockchain of its own. It can be created on a variety of blockchain networks, including Ethereum, Tron, and Eos. The network used for transferring and transferring addresses must be the same.

These tokens can be used to represent a stake in the cryptocurrency ecosystem, as well as voting rights. Developers create projects with Ethereum smart contracts, which enable them to create a native token that can be used in their apps. These tokens can be used for payment within the app ecosystem, as well as for governance and voting rights on community-driven platforms.

ERC-20 tokens are used on the Ethereum blockchain, while TRC-20 tokens are used on the Tron blockchain, BEP-20 tokens are used on the Binance smart chain, and NEP-5 tokens are used on the NEO blockchain.

Differences Between Token And Cryptocurrency

Tokens are built on an established blockchain, but cryptocurrency is a blockchain's natural asset.

Tokens often function in an environment to meet needs, while cryptocurrencies are only meant to be used as a means of exchange.

Tokens are programmed through smart contracts to achieve the goal for which they were created, while cryptocurrencies are not programmed through smart contracts.

Tokens are digital assets, while cryptocurrencies are digital currency.

After explaining tokens, i will like to move to next topic which i will be talking about the types of tokens. In the lecture, the prof. made mention that we have 3 types of tokens, which are, security, utility and equity tokens. I will start with Security tokens.

Security Token

A security token is a one-of-a-kind token that represents a stake in an external asset on a permissioned or permissionless blockchain. Security tokens are similar to stocks, shares, or other equities in that gains derived from the company's assets are distributed to security token holders. Government rules and oversight apply to security tokens. Securrency, swarm, polymath are examples of security tokens.

Advantages of security tokens

Fraud prevention: The property rights of investors are protected and registered using a smart contract that cannot be altered or withdrawn.

Transparency: Transactions and fund transfers are made public and permanent using blockchain technology. Transparency is created, and everybody can keep track of transactions.

Charges are reduced: With the aid of security tokens, several foreign organizations have hosted fundraising campaigns. It's been a burden to transfer money globally. Depending on the amount, there have been delays in international money transfers.

Disadvantages of security tokens

It's Expensive Compared to Utility Tokens

STOs, unlike ICOs, want to include a moderator from another organization in their crowdfunding campaign. Approved institutions are an excellent example of a value-added service for which STO participants must pay a fee. An STO is more difficult to manage than an ICO, and it is much more expensive to do so.

Among the examples stated initially, the most popular security tokens are Polymath, Securitize, and Harbor. I will highlight a bit on the POLYMATH

POLYMATH

Polymath is an example of a security token that would provide a way for universal investment assets to be tokenized and traded in a manner similar to other blockchain assets. They want to do so via a STO (Security Token Offering). The aim of a polymath is to create an environment and methods for verified investors to buy and sell tokenized securities that are comparable to other forms of trading.

Chris Housser and Trever Kovert founded the polymath system in 2017 with the aim of encouraging and assisting developers in launching their STOs. POLY is the company's own security token.

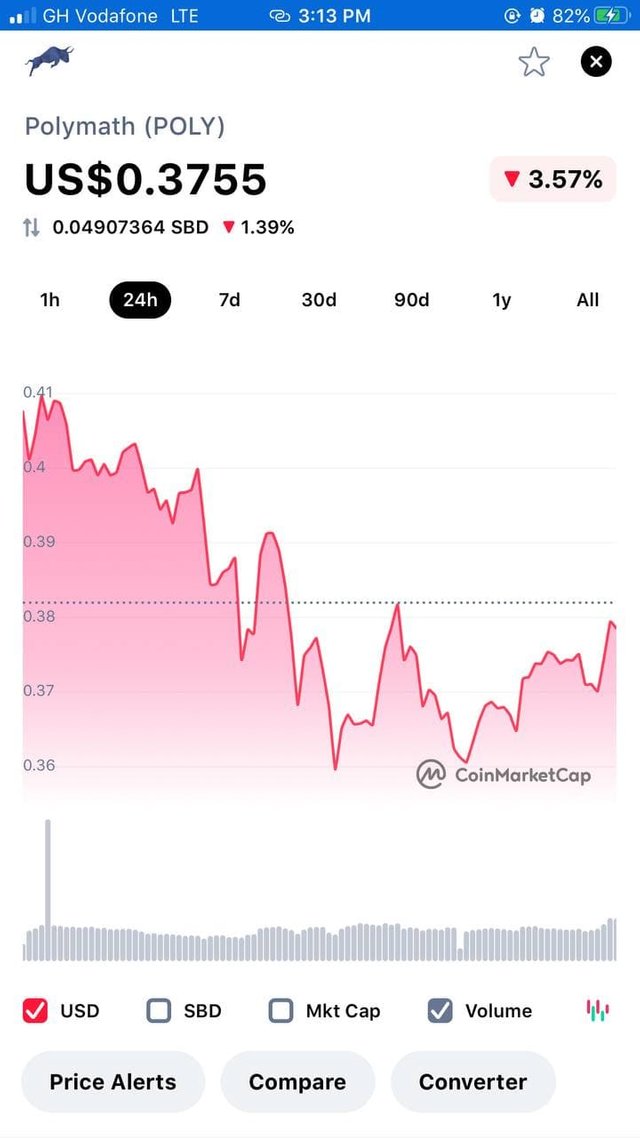

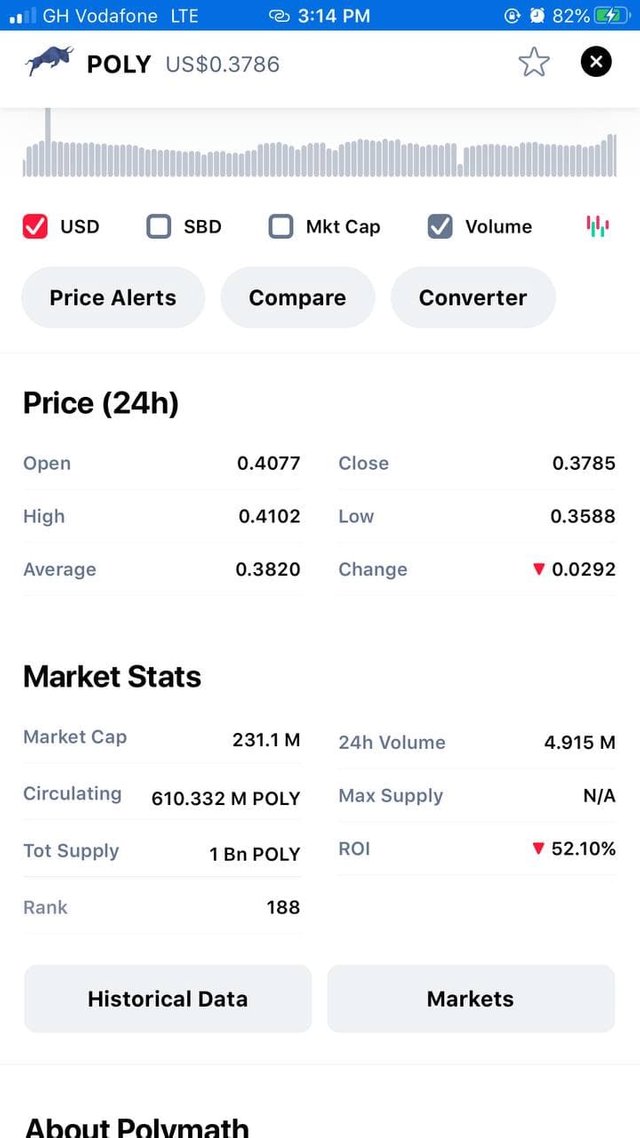

The current price of poly tokens is $ 0.3772

Coinmarketcap rank 188

Market cap $ 231.1M

Circulating Supply: 610,332M POLY

Total Supply: 1,000,000,000

The next type of token i will explain is the Utility token

What Is A Utility Token?

A utility token is a non-physical token created to support the cryptocurrency's creation which can later be used to purchase a good provided by the cryptocurrency. This basically implies that the purchaser of a utility token has charged the issuer for the token so that the company can create a product that the purchaser of the token can later exchange for products.

Utility tokens may provide value to investors in a variety of ways, including giving them access to future goods. They are arguably the world's most well-known tokens.

There are no regulations in place for utility tokens. Utility tokens are used by scammers to build fake ICOs and steal people's money.

Advantages of utility token

Start-up cryptocurrency companies may use utility tokens to collect funds to further grow their ventures.

If the underlying project succeeds, utility tokens will produce massive profits in the long run. This is because utility tokens are sold at a low price during an ICO.

There is no currency or equity for utility tokens.

Disadvantages Of Utility Tokens

They are unregulated, and the majority of them turn out to be a fraud after investors purchase the token during the ICO.

If the underlying project fails after the ICO, the tokens are worthless.

Since several ventures fail to achieve their full potential, utility tokens face liquidity issues. This will make it extremely difficult to buy or sell the token quickly.

GAL token, Brickblock, Timicoin ,Sirin Labs Token, Golem are some utility token platforms.

Lets take a utility token - Golem and give some highlights.

GOLEM

In April of this year, the Golem network was launched. Golem is a decentralized peer-to-peer computing platform that allows users to access processing and computing resources for tasks such as scientific computation and rendering. The Golem network's decentralized nature is one of its advantages. There is no central authority, and all users of the network have equal rights and control.

GLM is the network's native token, which is used to pay network fees. The Golem network is driven by this currency. The GLM token is used to carry out any transaction in the Golem network. On the Ethereum blockchain, there is an ERC-20 coin.

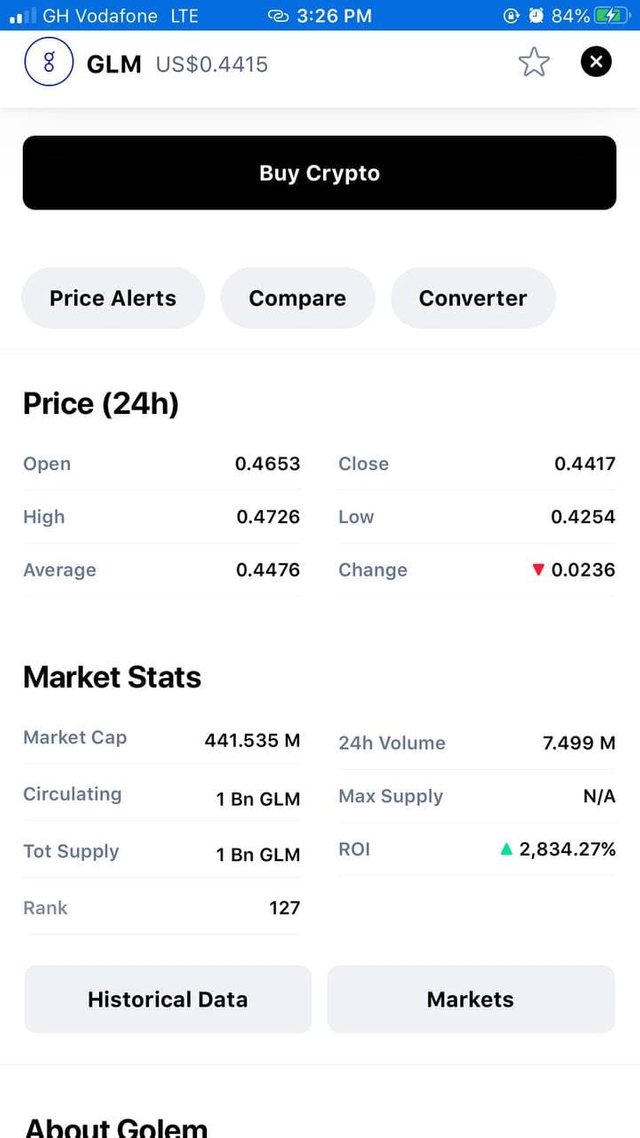

The current price of poly tokens is $ 0.4416

Coinmarketcap rank 127

Market cap $ 441.646M

Circulating Supply: 1Bn GLM

Total Supply: 1Bn GLM

exchanges listed: Binance, Huobi, Poloniex, Uniswap

Now lets finish up with the last type of token which is the Equity token

What Is An Equity Token

An equity token is a type of token that is commonly used to require asset ownership. Equity tokens, like other financial appliances and the universal way, have virtual records, while the universal way has tangible documents. Both types contain the same valid information, and since the equity token is decentralized, its data is stored in blocks and encrypted. When opposed to other assets, it has its own distinct characteristics, and it not only maintains a share of an asset, but also has voting rights over it.

Some benefits of the equity token

- It gives you the voting rights and power

- You assets are safe

- It gives you authority over your tokens

A few examples of equity token platforms are Dao Maker token, Media Show.

Lets take a look at the Dao Maker token

Dao Maker Token

It is the Dao Maker project's token, which runs on the Ethereum blockchain. Holders of Dao Creator Tokens participate in ecosystem governance. Its aim is to serve as a starting point for entrepreneurs interested in investing in the decentralized ecosystem's stocks and tokens.

One of the most interesting aspects of the project is that it has been able to self-fund since 2018. The slogan of investors reducing risks and building funding frameworks for beginners greets you as you join the Dao Maker website.

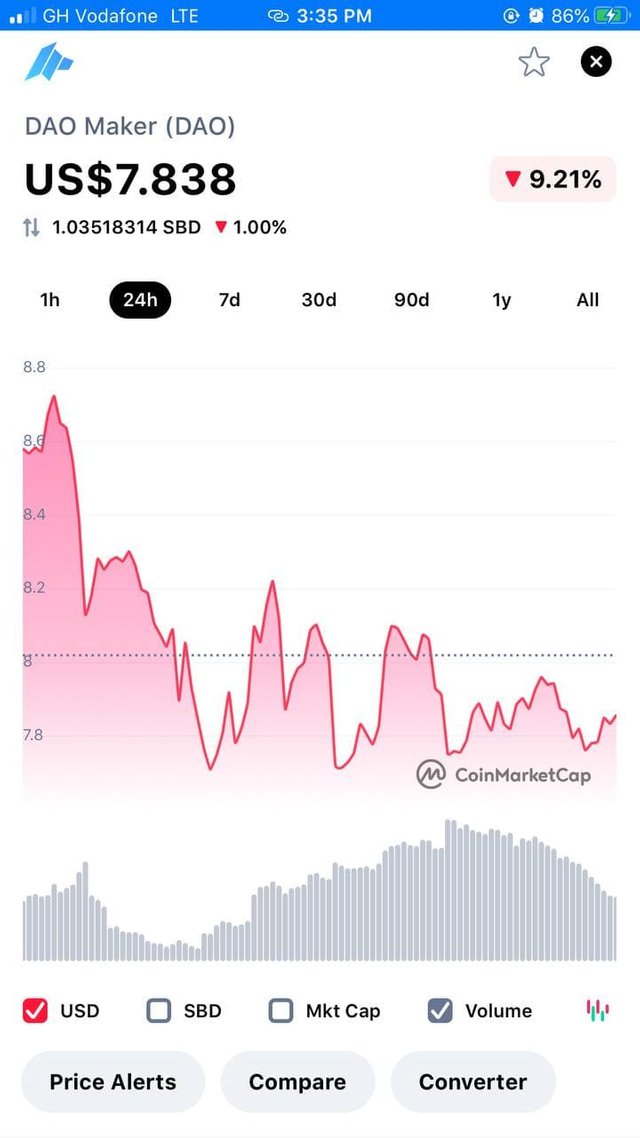

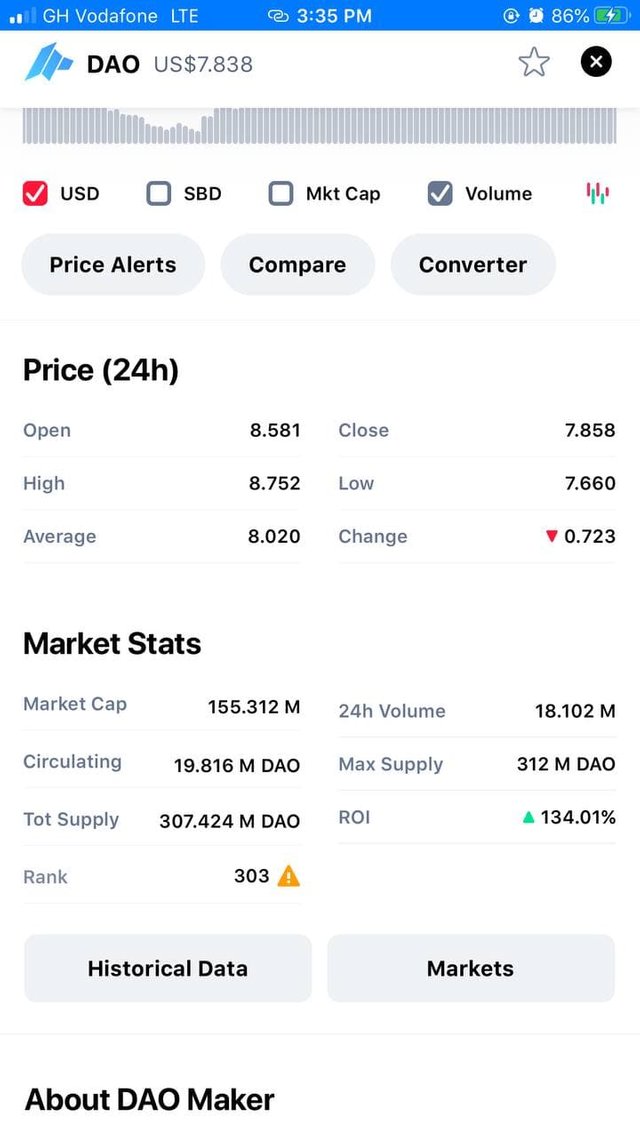

The current price of Dao Maker Token is $ 7.838

Coinmarketcap rank 303

Market cap $ 155.312M

Circulating Supply: 19.816 M DAO

Total Supply: 307.424 M DAO

exchanges listed: UniSwap

Conclusion

I would like to say a big thank you to prof. @pelon53 for this wonderful lecture on tokens and i cant wait to read his lecture on the part 2 of it. i must say that Investors can make better investment decisions and avoid risk by knowing the coins and projects. I hope you enjoyed reading my submission. Thank You

ALL SCREENSHOTS WERE TAKING FROM COINMARKETCAP

Gracias por participar en Steemit Crypto Academy.

Muy buen trabajo, felicitaciones

espero seguir corriendo tus atreas.

Calificación: 8.8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit