- Explain Spot Trading. Discuss the advantages and disadvantages of Spot Trading.

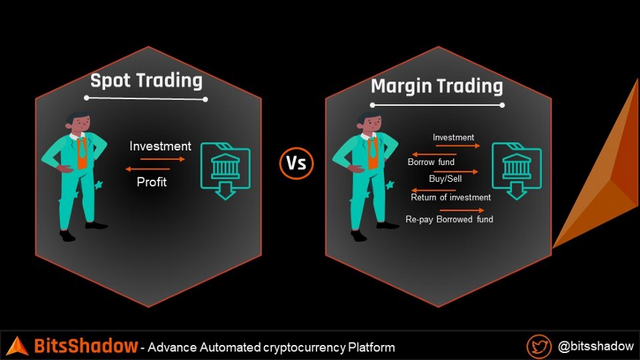

Spot trading takes place in the spot market. A spot market is a money-related market where financial instruments and things are traded for sure-fire movement. The movement suggests the real exchange of a financial instrument or product with a cash thought. The spot market is generally called the currency market since cash portions are dealt with instantly, and there is a genuine exchange of assets. The expense on the spot market is the going expense for a trade executed on the spot and is known as the spot cost or the spot rate. Cost is constrained by buyers and traders through monetary cooperation of the natural market. Rather than the forward cost – which is a component of the time assessment of money, yield twist, just as limit costs – the spot cost is generally an aftereffect of natural market work. Buyers and merchants need to agree to finish on and get the spot cost for the standard measure of assets on a proposition for a trade to occur.

Advantages:

- Represents a transparent environment.

- Trader can hold the asset and later find a better deal.

- No minimum capital is required.

- Traders complete trading on the spot.

Disadvantages:

- Significant risk for volatile assets.

- Lack of planning.

- Need to be up-to-date on current events and news.

- There is not time flexibility on the spot market.

- Explain Margin Trading. Discuss the advantages and disadvantages of Margin Trading.

Margin trading is a strategy for trading assets using holds given by a third party. When stood out from typical trading accounts, margin accounts grant merchants to get to more critical measures of capital, allowing them to utilize their positions. Fundamentally, margin trading upgrades trading results with the objective that sellers can comprehend greater advantages on productive trades. This ability to develop trading results makes edge trading especially popular in low-insecurity markets. For example, you think Bitcoin is going up in the following not many days and you have a great deal of confidence in it. You can purchase Bitcoin with USDT and trust that the cost will go up and when it arrives at your objective you sell Bitcoin and trade it back into USDT. This is a customary exchange. With edge exchanging, you increment the sum you exchange with by utilizing it. You can make the exchange to trade USDT to purchase Bitcoin on the grounds that you accept the cost goes up, you go long (when you figure the cost will go down you go short). Presently you can decide to add influence, the greatest you can add is 3x, so for example, on the off chance that you add 1x influence, you apply for a line of credit to guarantee that you can pay my influence if the exchange goes the incorrect way. The advance safeguards the cash trade can sell an exchange account. In the event that the exchange made a 100% benefit before it was shut, with the 1x influence it implies you get another 100% benefit. On the off chance that the exchange has a 100% misfortune, it implies the misfortune is likewise multiplied.

Advantages:

- It boosts purchasing power.

- Provides more investing options.

- Provide flexibility to account.

- Higher profits due to more capital.

Disadvantages:

- Higher risk of losing.

- Owe interest on your loan.

- Risk of meeting margin call.

Regards:

Cc:

@steemcurator01

@steemcurator02

Hello @boss75,

Thanks for submitting homework task 3 ! You have done a nice job ! Have explained both spot trading and margin trading with advantages and disadvantages. keep up the good work [7]

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are welcome.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://twitter.com/boss7514/status/1366048478149808130

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit