Hello professor @imagen, I present to you my assignment task about the introduction to technical analysis of price patterns that you provided to the steemians.

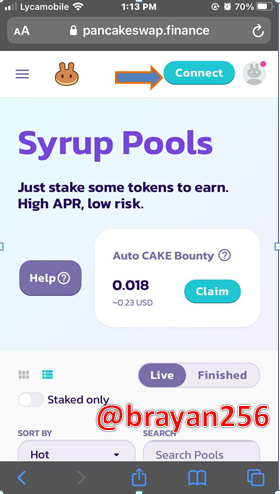

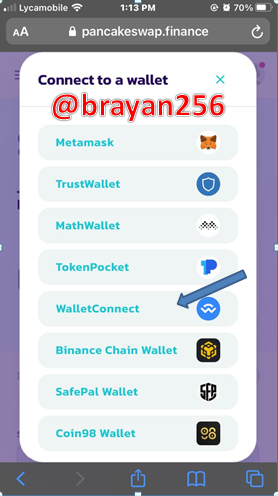

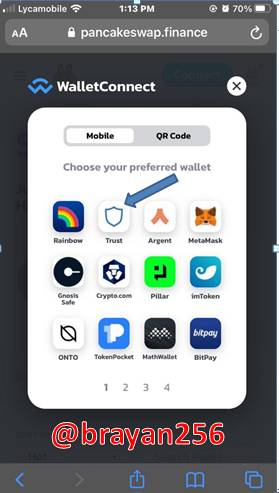

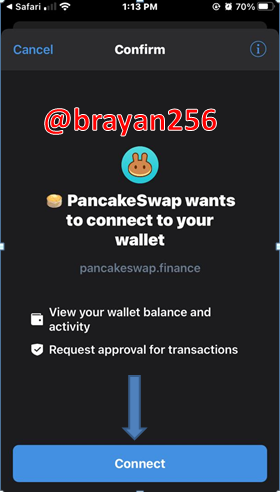

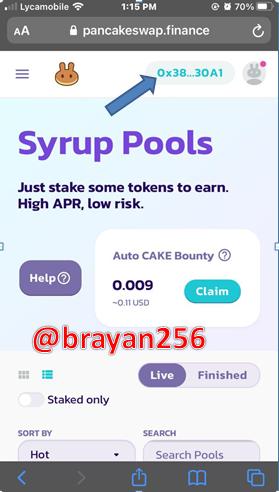

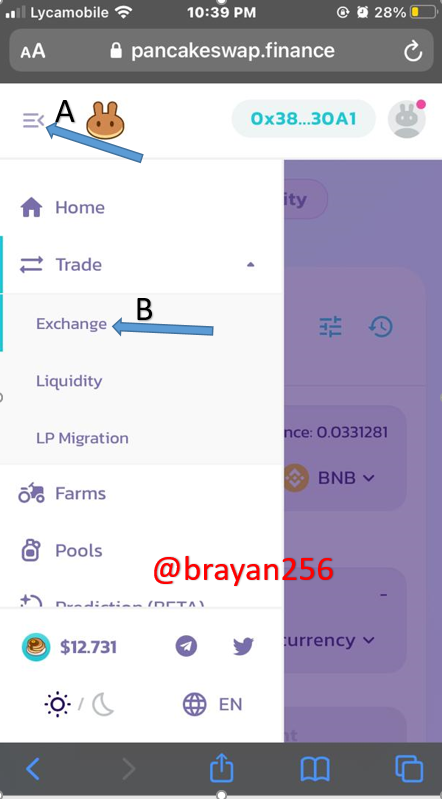

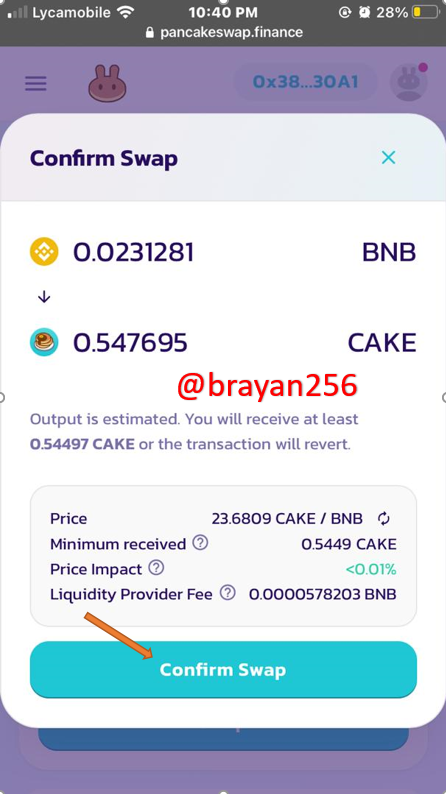

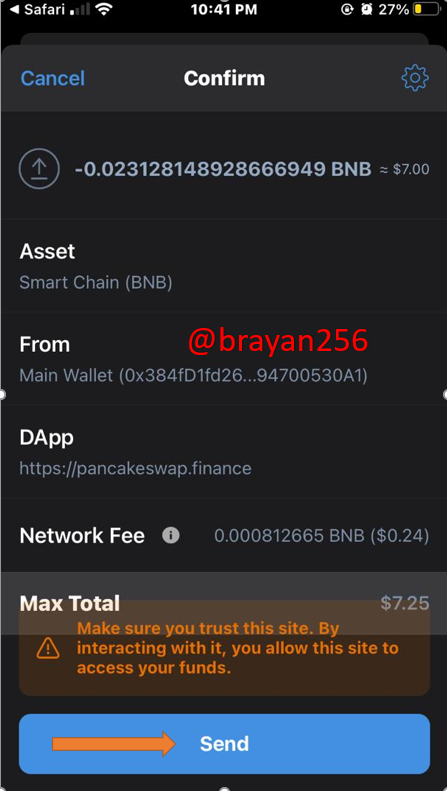

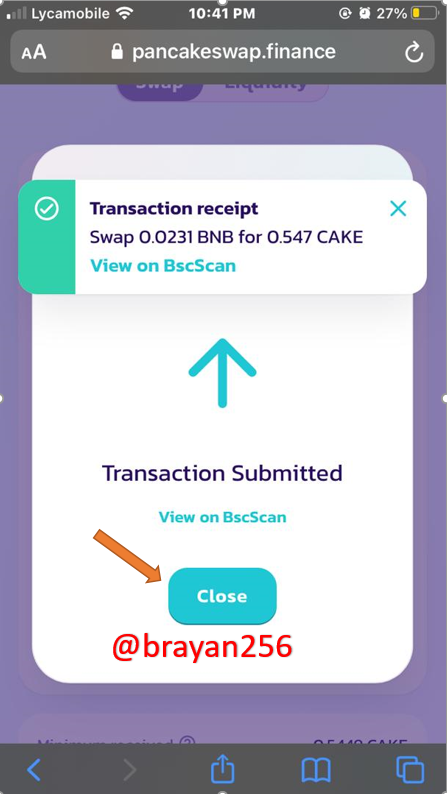

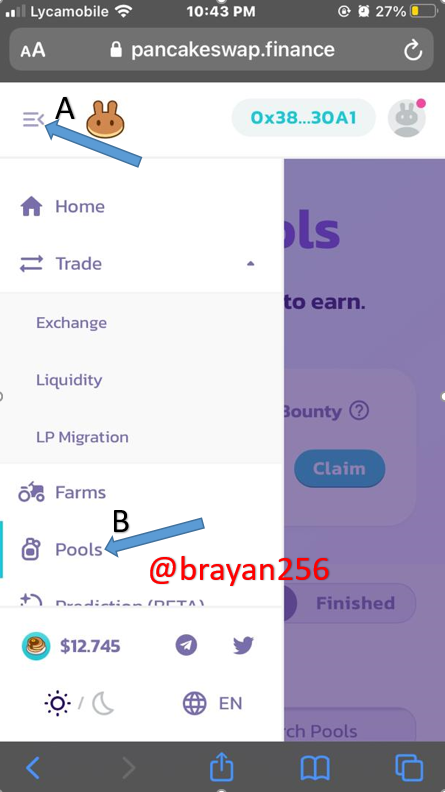

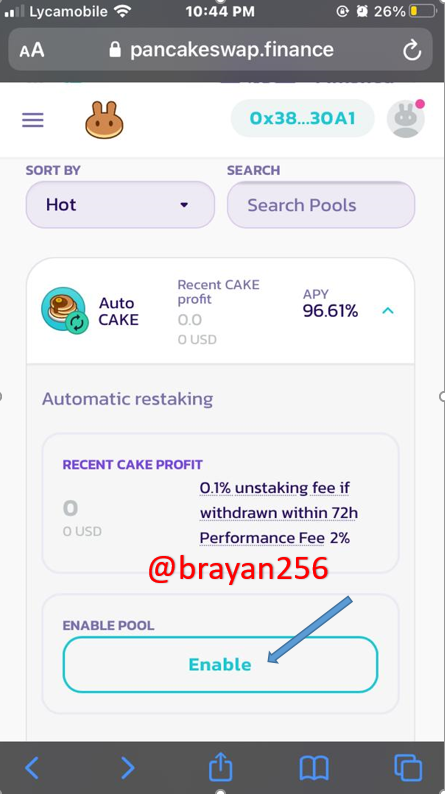

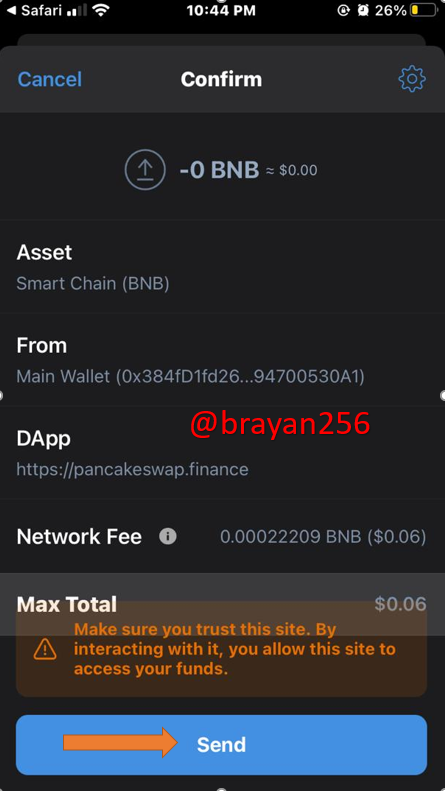

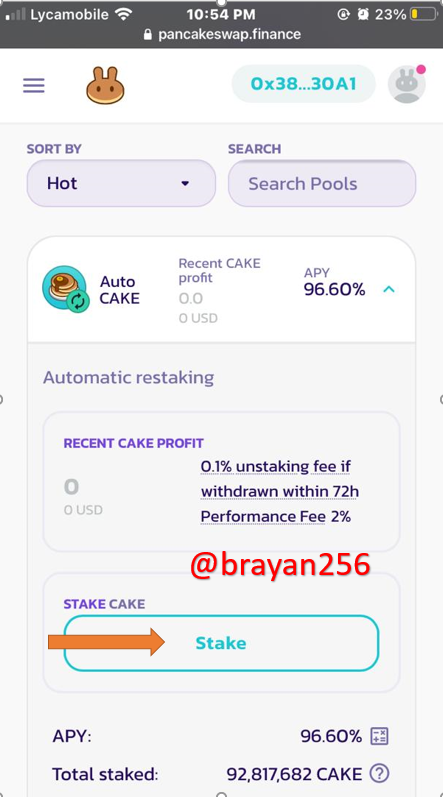

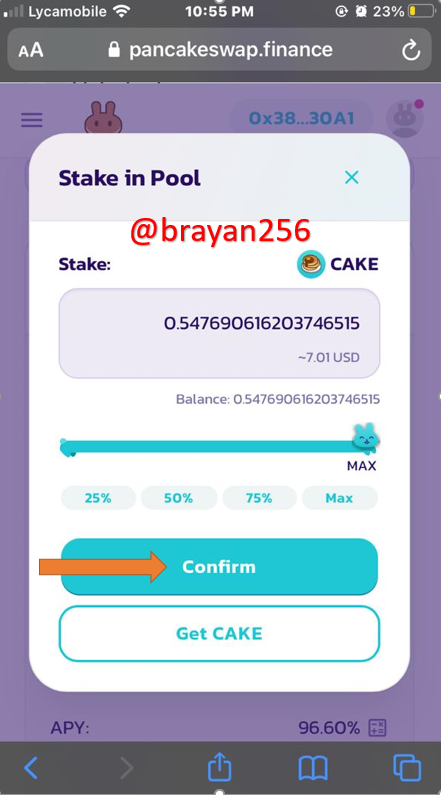

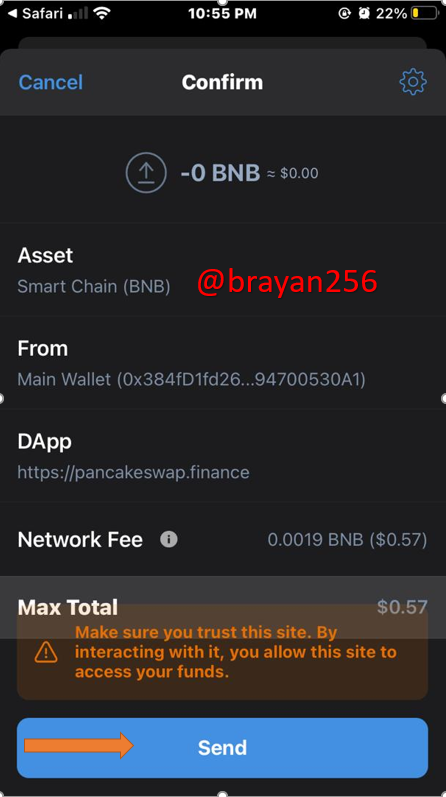

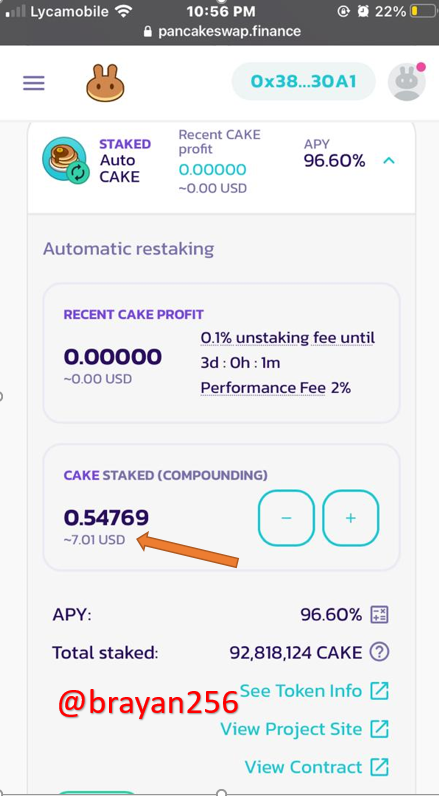

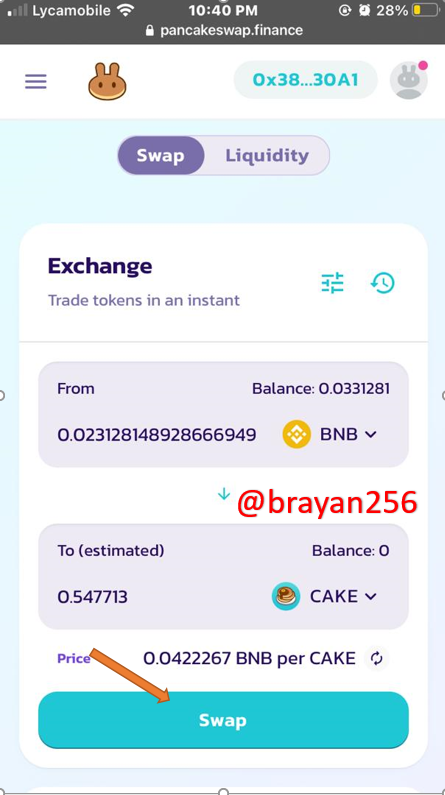

Staking CAKE token on Pancakeswap.

I will be elaborating step by step the staking of CAKE on Pancakeswap using an IOS device. The Dapp browser was removed from the trust wallet for IOS devices, so I connect my wallet manually from my safari browser.

I chose Pancakeswap to do the staking of CAKE coins because;

The amount of CAKE staked was 0.547

The APR was 96.60%

Using the APR formula I will get 1.075 CAKE tokens in a years time .

Pick 3 cryptocurrencies and perform a 7-day and 30-day technical analysis. Draw trend lines and describe whether the coins are in a continuation or reversal pattern. Take screenshots.

Cardano:

Cardano is right now at a significant point on the chart. As you can see on the daily time frame, it is on the up-sloping blue line which is one of the many levels. It has created a sort of trendline that sets the medium trend for Cardano. One sort of level that looks very key in my opinion is that at around $1 as you can see buyers coming in multiple times. If we look at the trend, it is very possible that Cardano has basically just gotten a pullback.

If we look back keenly, we can see that buyers started coming in on February 15th, April 23rd and another time on May 19th and right now Cardano is testing the support level. In my opinion, this is what has been a medium trend for Cardano, so if a candle closes below the blue line then it would be the first bearish sign.

Polygon:

The entire market is on a bear trend and Polygon is moving down as well. Polygon is ranked 20 on coinmarketcap with approximately $473M in trading volume for the last 24 hrs being up with about 22%. This means that people have more interest during this sell-off which is why there is a trend reversal at least short term.

How can we differentiate a bearish season from a bullish season in the market?

A bearish season:

This is a general term used to describe a period of time when the value of assets declines by a significant amount. As it might sound scary, a bearish season is a normal part of the investing process in the financial market. A bear season is usually associated with investors pessimism towards the future of the economy, corporate profits and stock prices in general.

Therefore I would like to thank professors @imagen for such an amazing lecture which has greatly improved my knowledge about Technical Analysis of Price Patterns.

Hola @brayan256, lo siento mucho pero el tiempo de la tarea expiró, debes verificar las reglas en donde dice la fecha límite, publicaste varias horas tardes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor @imagen, this is so unfortunate. I made a mistake by creating my post in the wrong community which was before the time had elapsed. I realized this after the closing time so I reposted in the right community. I will be glad if this is looked into otherwise thank you for your feedback.

Below is a screenshot of my deleted post that I posted before the deadline.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit