Hello professor @lenonmc21, it is of great pleasure to be part of your lecture which has considerably improved my knowledge about trading and cryptocurrencies at large. I, therefore, submit my homework post as follows below.

Define in your own words what trading is, what its function is, and how it relates to the cryptocurrency market.

Trading is a general term used to describe the exchange of one item for another. It is also the buying and selling of different financial instruments. Today as we use money, we trade by exchanging money for items. Trading in the financial market is the same, for instance, buying shares of a company.

When you buy shares you buy a part of the company and if the company grows, makes a large profit, or brings out a new product, its shares become more valuable. The person who bought these shares can now sell them to someone else for a higher price and make profits from the initial investment. The price of these shares goes up in relation to the concept of supply and demand thus demand refers to the desire consumers have for a good or service while supply is the total amount of a good or service available for consumption. These have a big impact on the prices of products and services.

Cryptocurrency market refers to an online or virtual market where cryptocurrency assets are traded also well known as exchanges which include Huobi Global, Binance, Coinbase, Kraken, among others. Cryptocurrency trading in this case is defined as the buying and selling of the different cryptocurrency assets from the cryptocurrency markets for example Bitcoin, Ethereum, Binance coin, Steem, among others. There are lots of profits that are made from cryptocurrency trading because the prices of the different assets are very volatile.

Define and explain what are the tools used for trading (Technical Analysis and Fundamental Analysis) and at least one example of each. ( A screenshot is required).

The volatility of the cryptocurrency prices makes it very difficult to predict the prices of a specific crypto asset from the market. With this said, there are tools that to the traders’ advantage if used perfectly, make it easier to predict the prices of the different cryptos so as to make profits from buying and selling cryptocurrency assets. These tools include;

Fundamental Analysis:

Fundamental analysis is simply a method of measuring an asset’s fair or intrinsic value. It is the framework of any crypto investment strategy. Unlike technical analysis, fundamental analysis takes under the hood of a company to study anything that can affect the asset’s value which can be generally broken down into two groups, that is, qualitative and quantitative.

Qualitative refers to generally understanding the economic environment the asset is in, for instance, business model, competitive advantage, the management team behind the asset, the stage of development, and regulations in the company whereas quantitative refers to things in the asset you can measure with numbers, for instance, cash flow, balance sheets, earnings per share and market share. The main idea is to combine this analysis to help you find the true value of an asset. This number is then compared with the current price of an asset to see whether it is overvalued or undervalued.

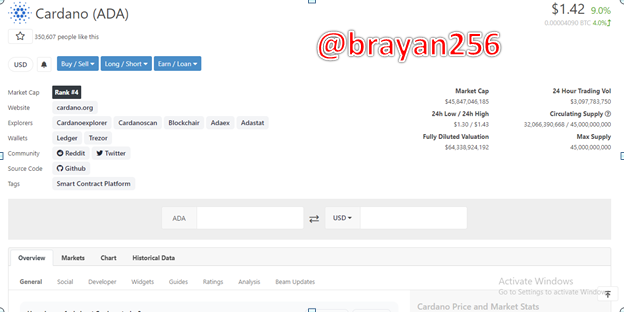

There are different platforms that lay grounds to do fundamental analysis about a specific crypto asset. In this case, I chose Coingecko which gives detailed information about cryptocurrency assets as shown below.

Screenshot source

Technical Analysis:

Technical analysis simply refers to the study of the price movements on a financial chart. We can think of technical analysis as a sort of framework that traders use to study and make use of the price movement of a market. It focuses entirely on the study of price charts and trading history to determine the upcoming price movements of an asset. It enables traders to determine where an asset might be going, where it is coming from, and whether it is trending up or down and where a trader should get in or out of a market which is majorly based on past price movements.

An example of technical analysis about Cardano (ADA).

As you can see over the past few days it has been performing quite well after the massive deep that had occurred from the 17th to 19th June 2021 which went all the way down to $1.04. If you look down below (shown in A above) the volume on that drop wasn’t actually that large so it is not like it was a massive dump but there wasn’t just enough buying pressure to counter the selling that was going on. Currently, the price has started to go on an uptrend with a large buy volume (shown in B above).

Name at least 3 trading platforms with the highest trading volume where we can buy our first cryptocurrencies and explain in your own words the ways to buy cryptocurrencies on that platform (Do not use Binance).

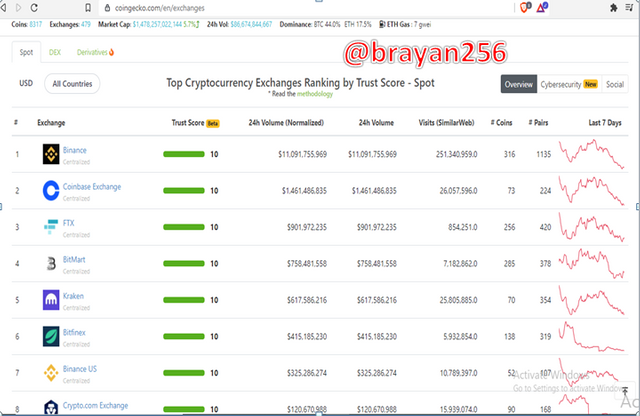

There are numerous trading platforms where cryptocurrency traders buy and sell different cryptocurrency assets. It is advisable to trade cryptocurrencies from trading platforms that have a high volume of both buying and selling cryptos which makes it easier for a cryptocurrency trader to execute trades. Coingecko is one of the sites where a trader can find a favorable cryptocurrency trading platform as shown below.

screenshot source

In this case, the 3 cryptocurrency trading platforms with the highest trading volume according to coingecko are as follows below;

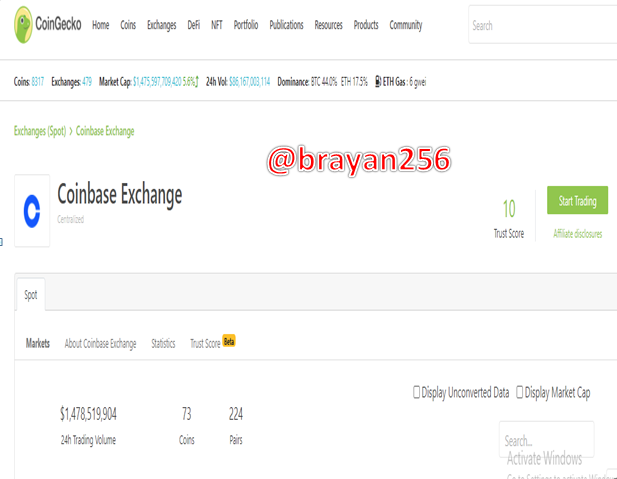

Coinbase Exchange.

Coinbase Exchange was founded in July 2011by Brian Armstrong, an ex-airbnb employee who wanted the world to have a global financial system that drove innovation and freedom. Currently, coinbase has over 35 million accounts generating approximately a billion dollars per year. According to coingecko, it is the second-largest cryptocurrency market in volume with about $1,461,486,835 and 224 pairs of cryptocurrency assets.

screenshot source

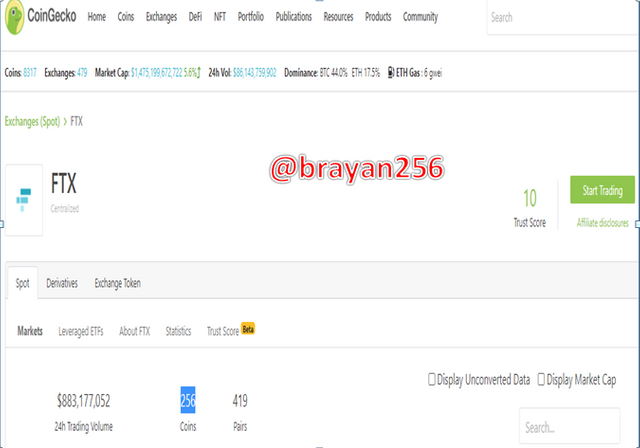

FTX Exchange:

Launched back in May 2019 by its CEO and founder Sam Bankman-Fried. FTX exchange has already commanded a significant presence in the crypto space with its FTT token comfortably in the top 50 by market cap. According to Coingecko, FTX exchange is the third-largest cryptocurrency market with a 24-hour trading volume of $872,397,441, consisting of 256 coins and 419 trading pairs.

screenshot source

P2PB2B Exchange:

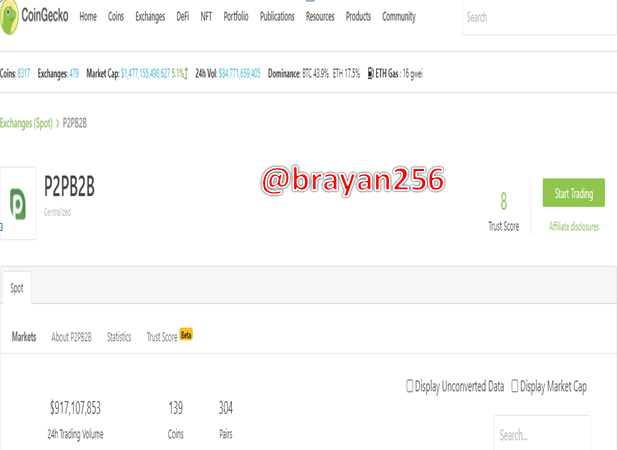

P2PB2B exchange is an advanced cryptocurrency exchange that was founded in 2018. It is ranked 33 by coingecko with a 24 hrs volume of $917,107,853, 139 coins and 304 trading pairs.

screenshot source

How to buy cryptocurrencies from P2PB2B exchange.

STEP 1.

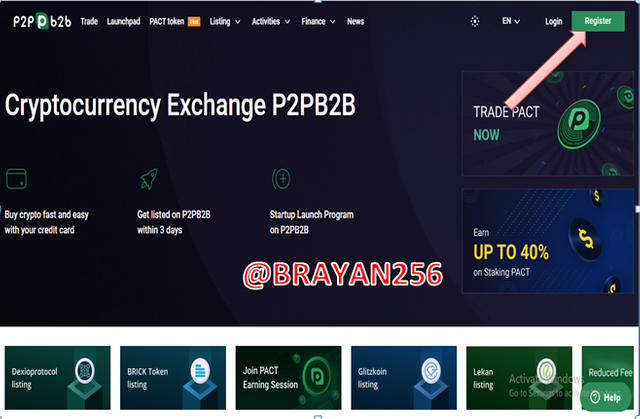

If it’s your first time buying cryptocurrency from P2PB2B exchange, first you will need to visit the website and create an account from here.

screenshot source

STEP 2.

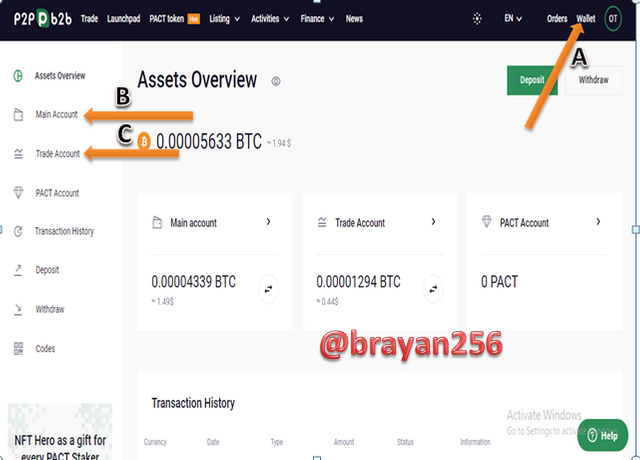

After we login to the account, we will then have to click on the wallet (shown in A) to display the different account types which in the sense are the main (shown in B) and trade accounts (shown in C).

screenshot source

STEP 3.

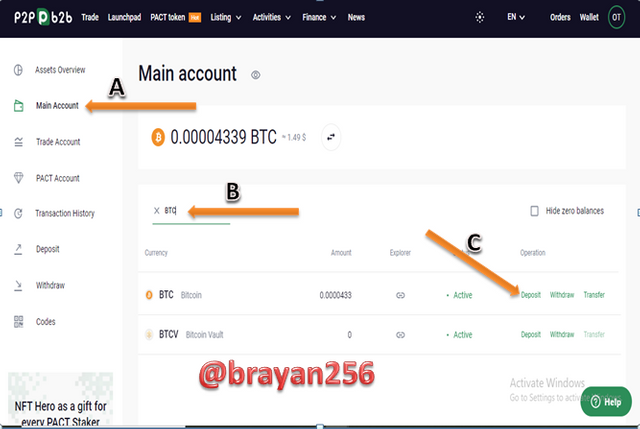

So since we want to deposit some crypto into the account on the exchange for trade, we shall choose the main account (shown in A) and search for the particular asset that we want to deposit (shown in B). Thereafter, click on deposit (shown in C) and the wallet address of the asset that you want to trade.

screenshot source

STEP 4.

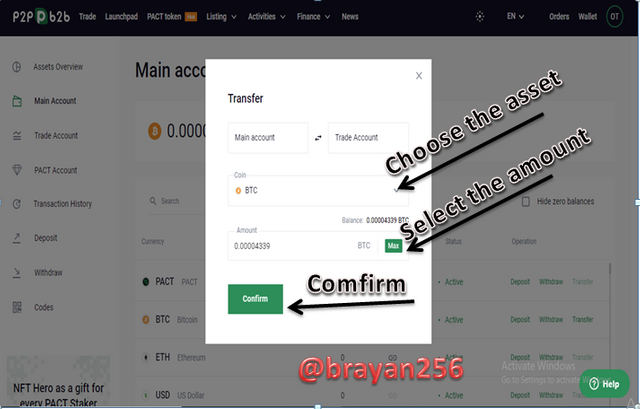

After we have deposited the particular crypto asset, we will then click on transfer to send the asset from the main account to the trading account so as to be able to execute a trade.

screenshot source

STEP 5.

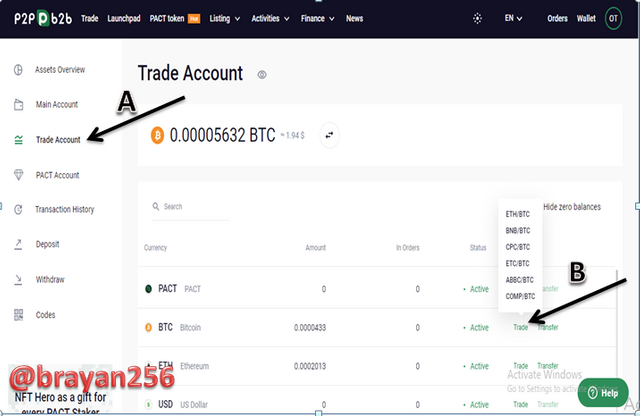

Thereafter click the trading account (shown in A) then click on trade (shown in B) where you will see the different pairs of the asset that you want to trade.

screenshot source

STEP 6.

After you have clicked on the particular pair you want to trade, you will be directed to the market where you will be able to view the charts and the activities taking place as shown in the screenshot below

screenshot source

In conclusion

There is massive adoption of cryptocurrencies and trading cryptos all over the world the fact that there are several opportunities in the crypto space. Cryptocurrency trading can act as a source of passive income to an individual since there is a lot of profits to be made. This can only be achieved if a trader puts the right tools into use while executing the trades so as to avoid making huge losses.

Therefore I would like to thank professor @lenonmc21 for making this effort of coming up with this amazing lecture which has really broadened my knowledge about cryptocurrency trading.

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much @yohan2on for the great work you’re doing for the steem Uganda community. Stay blessed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit