Hello to everyone. I am happy to be in Season 4 of Crypto Academy. Let's continue to work together to improve this community.

In this assignment, I will talk about The Order Book and how it works. In addition, I will make the subject easier to understand by making examples on the Binance exchange. I wish you pleasant reading.

Define the Order Book and explain its components with Screenshots from Binance.

Who are Market Makers and Market Takers?

What is a Market Order and a Limit order?

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

The Order Book is an electronic list in which the buy and sell orders of an asset are arranged according to supply and demand and are transferred to the user without delay. It works with the same logic in all wealths. Orders are sorted by price and allocated in the supply-demand balance. In this way, the trader gets to know about the asset by following the orders on the board. In the order book, buy orders are shown in green and sell orders are shown in red.

The order book is a tradition from the old stock market times. Back then, buy and sell orders were written on a blackboard. In some places, this need was met by using receipt. I say need because people enter transactions by comparing supply and demand. An entity that has no demand does not attract attention. That's why the importance of knowing the demand is the reason the order book exists. You wouldn't invest your money in something you didn't know, would you?

Some data can be obtained by monitoring the order book. For example, regions where bid and ask are high can be seen as support and resistance. As a result of a good technical analysis, the trend direction can be determined by following the orders in the order book. Now let's talk about the information on the order book.

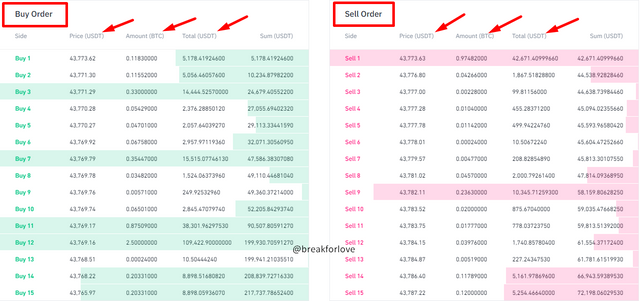

We see two sides in the above order book. One side buy orders, one side sell orders. Bid orders are shown in green and ask orders in red.

On the order board, we see the Price in the first column. This is the price at which the buy order will be executed, and the highest bid price is always at the top. But on the ask side, the lowest ask price is at the top.

Both sides have the Amount section in the second column. Unlike the price, in the bid and ask quantity shown in black, the highest quantity is not at the top. You will only see the amount entered for the asset pair. The important thing here is how much money will be spend for the bid or ask.

Another column contains one of the two elements of the asset pair to be traded. For example, this pair we are looking at is Bitcoin and USDT. If you want to buy Bitcoin with USDT in your balance, you will see the current USDT orders. This also applies to other fiat coins and assets.

Picture has created by me from Canva

Picture has created by me from CanvaIn all markets, there are buyers on one side and sellers on the other, and the whole process is based on this. The balance between buyers and sellers is created by liquidity. But for this liquidity to be created, someone must take on the task of making and others must handle the taking. That is the subject of our present question. Makers and Takers.

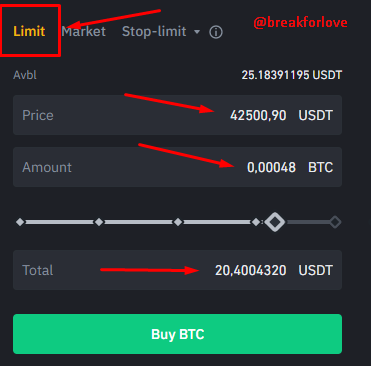

Market Makers are people who create orders in an asset pair's order book. These people form the market in the direction of buying or selling. They place an order at a certain price and create a liquidity in the market. Thanks to these limit orders, they “build” the market. Example; A market maker who places a 1 BTC buy order at $45,000 matches a buyer when the price gets there, and the order is fulfilled. The liquidity created in this way ensures the movement of the market. The market maker uses limit orders. It places an order to buy or sell, and this order remains in the order book until it is filled by the buyers. An asset has a dense order book is an asset with high liquidity and mobility. That's why market maker orders are very important for an asset. I will now assume the role of a market maker and present you a small example of limit orders.

At the time I was doing this homework, the price of Bitcoin was around 43,500. As a market maker, I enter a Bitcoin buy order of 20 USDT if Bitcoin drops to $42,500. The Limit Order I created is placed in the order book and is waiting for its buyer.

Market Takers are people who take the liquidity of an asset without question. They take the orders entered by the market makers from the order book and enable the price to move. Unlike market makers, they do not use limit orders and use market orders. Therefore, they do not have a chance to bargain. They use bid and ask prices created by market makers. They buy at the bid price and sell the asset at the ask price.

The bids and asks created by the market makers in the order book create liquidity and transactions are realized thanks to the takers who take this asset with market orders. In other words, executing another maker's order makes you a market taker.

There are two types of buy and sell orders in the markets. These orders are created by market makers and market takers. Let's talk about Limit Order first.

Limit orders are orders created by market makers. Market makers place orders on the order book so that an asset pair has liquidity. If you want to place a buy limit order, you must place an order below the current price of the asset. On the contrary, if you want to place a limit order in the direction of selling, you should place an order above the current price.

Limit Order has some benefits. By analyzing the buyer orders in the order book, you can identify the places where the asset can react as support. By watching the sell orders, you can see the points where the asset can react as resistance. Reading these orders well gives you an idea of the market.

Market Order is created by takers who take orders entered by market makers at their current price. The price cannot be negotiated. Since they are executed at the current price, they do not appear in the order book. They simply realize the liquidity formed and complete the bargain between the buyers and makers.

Also some fees is paid in these two types of orders. For example, if you enter a buy order below the current price, your order will be entered in the order book and you will pay a "maker fee". However, if you switch to the buyer role with a market order at the current price, you will pay a "taker fee" this time.

The first thing an asset needs to have liquidity is a market maker. Market makers create limit orders on the asset and provide liquidity. These limit orders wait for their buyers above and below the market price. The excess of orders thus increases the liquidity. These created orders are waiting to be received by market buyers. According to the direction of the market, the market orders to be made by the buyers also execute the orders entered by the makers, thus liquidity is realized. The gist of the matter is that market makers provide liquidity, market takers get that liquidity from them. In this way, the price of the asset moves.

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

- Now I will place orders using SBD on the Steemit Market.

- First, click on the Wallet section in your profile and select Market from the column where your Steem Dollar appears.

- When you enter the Steemit Market, a screen like this will appear and we will perform our transactions here.

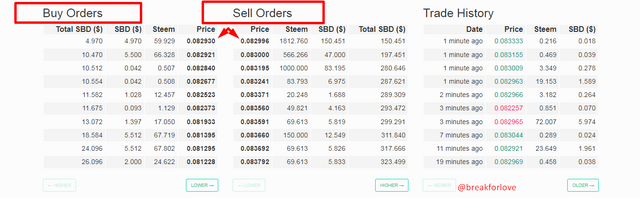

- When we lower the screen, we encounter the order book. The bids and asks are lined up.

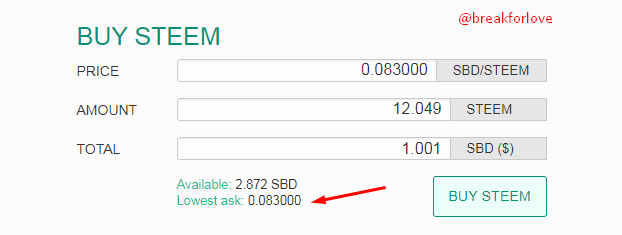

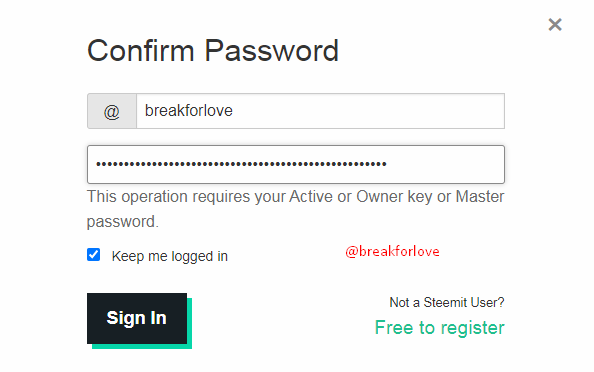

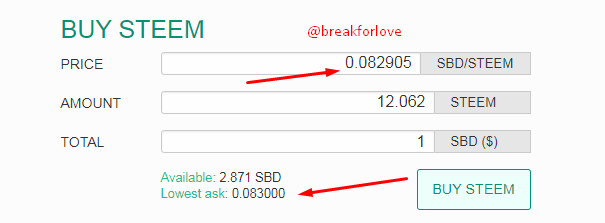

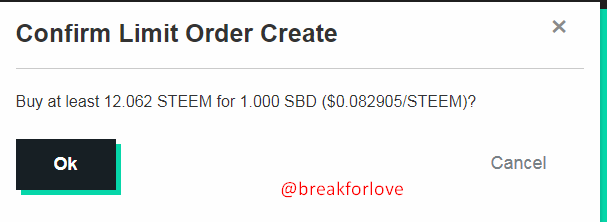

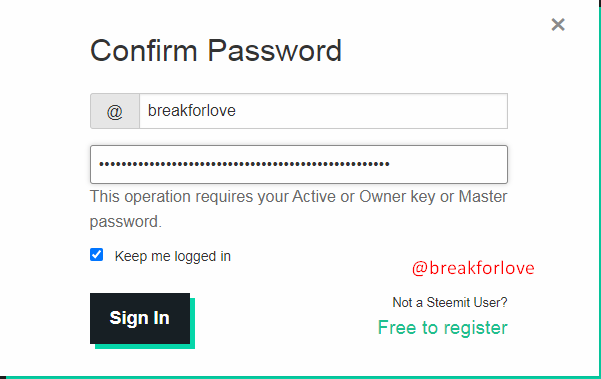

- Now I get Steem for 1 SBD at the current price. Lowest Ask price: 0.083000. After entering my password, I confirm the order.

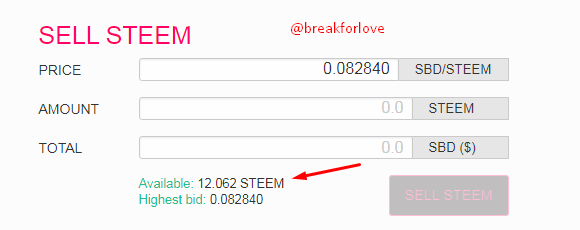

- My transaction is done. My role here was Market Taker. Because I made a purchase order without questioning the current price. I got the liquidity.

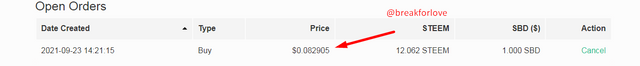

- Now, I place a limit order below the price and take the role of market maker.

Lowest Ask: 0.083000. My order is 0.082905.

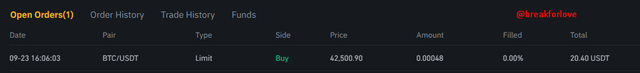

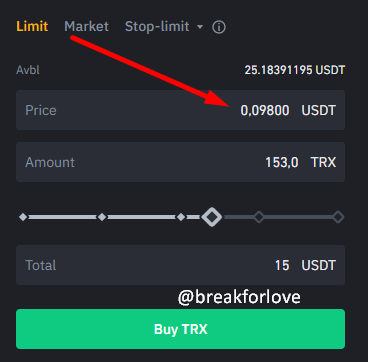

- I logged into the stock market to open a trade on the TRX/USDT pair on the Binance exchange. I then went through the order book and looked at the sell order on the top.

- As a market maker, I wrote my buy order at this level because I thought the price would drop to 0.9800 levels and it would make sense to trade from there.

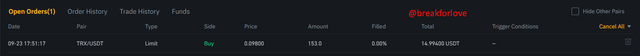

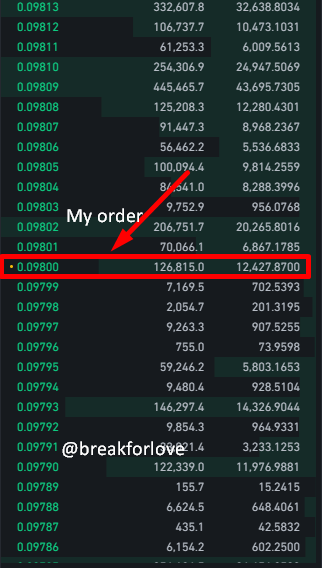

- My limit order waiting for being filled. I will now wait for a market taker to receive the liquidity I have created. When I look at the buy order book, my order appears here.

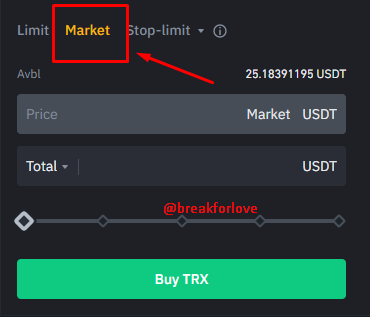

- This time I am in the role of Market Taker. Again, I choose TRX/USDT pair. But this time, instead of Limit, I select Market.

- I'm watching the order book. The liquidity which created by market makers is high. I executed my market order of 15 USDT and received the liquidity created by the market maker. My enter location is 0.09759.

I executed market orders at the price requested by the market maker and assumed the role of market taker. The fact that the price was volatile indicated that the liquidity was high. But the price dropped from the point I bought it and it tried to find new takers below. Since I took the liquidity of a market maker, I helped reduce the liquidity in the order book. With my and other market takers' market orders, the price moved.

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

The mid-market price is the average of the buying and selling rates of an asset. It can also be called the average of the current offers. The difference between the highest price a buyer is willing to pay for an asset and the lowest price at which a seller is willing to sell the asset is calculated and the mid-market price is found. Now let's find the mid price between bid and demand in the ADA/USDT pair.

When we look at the order book;

- Highest Bid: 2,229

- Lowest Ask: 2.206

The formula given to calculate the Mid-Market Price is;

Mid-Market Price = (Bid Price +Ask Price) /2. So according to this account;

Mid-Market Price = (2.229 + 2.206) /2

Mid-Market Price = (4.435) /2

Mid-Market Price = 2.2175

The order book is one of the old stock market traditions and continues to exist digitally today. Most of successful traders trade by following their order books. Others augment their analysis by interpreting the order book. Order books are simple to analyze and understand. You can even find support and resistance levels by reading these boards well. Because you can easily see the places where buyers and sellers are concentrated. Exchanges such as Binance, Huobi, Coinbase, FTX have their own order books. There may be some changes in the books according to the market's own volume. You just decide which side you will be on. Will you be a market maker or market taker?

Thank you for reading.

CC: @awesononso

Hello @breakforlove,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit