Hello to everyone. I am happy to be in Season 4 of Crypto Academy. Let's continue to work together to improve this community.

In this assignment, I will talk about the types of trading in the cryptocurrency market which are Spot Trading, Margin Trading and Futures Trading. I will also trade on Binance and explain my trade step by step. I wish you pleasant reading.

- Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading - a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed). - a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

- Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

1. Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading

First, let's talk about the dynamics of the cryptocurrency market. Many traders trades using their technical and fundamental analysis knowledge. And of course there are indicators which they uses as an aid. The trader tries to make a profit by bringing together all his knowledge and research. While this planning is sometimes successful, it can sometimes result in huge losses because it is quite a lot in the dynamics of this market. While you have the chance to double your money in an instant, you also have a high chance of losing your savings within 1 hour. Therefore, the trader should determine a suitable trading method for himself. Now let's talk about these trading methods and see their advantages and disadvantages.

Picture has created by me on Canva

Picture has created by me on CanvaSpot Trading is the simplest type of trading in the cryptocurrency market. It is simple to understand and apply. The basic principle of spot trading; is to buy an asset at a low price and sell it at a high price. Therefore, it is recommended that novice users who have stepped into the cryptocurrency market trade with this method. Let's make this clearer with an example.

Suppose you entered a buy order of $1000 from an area that worked as a support before, and you closed your trade when it came to an area that worked as a resistance. Your $1,000 is up 39% to $1399. When you make such a transaction, you are using the spot trading method.

| Pros of Spot Trading | Cons of Spot Trading |

|---|---|

| When using the Spot Trading method, you buy assets, not contracts. Therefore, if the asset bought falls below the price at which it was bought, the owner can keep the asset in his wallet until he makes a profit. | The Spot Trading method is suitable for one-sided trading. In other words, you can only open trades in the buy direction. This means that we will not be able to take advantage of opportunities in a bearish market. |

| In Spot Trading, since you will only invest as much as the money you have, the risk and psychology method is more easily managed than other types of trading. | When you buy at inflated prices, the price of the asset may go lower. This causes you to either close your trade with a loss or wait for it to rise again. |

| You can invest with a small capital while doing Spot Trading, there is no limit. |

Margin Trading is a type of trade that allows the trader to open a trade with more money than he has. Traders can borrow from third-party providers and increase the transaction size by 5, 10, 50, 100 times their own money. Example; A trader with $500 gets the right to open a $2500 trade by adjusting the leverage size to 5x.

Important! Margin Trading is riskier than spot trading. In spot trading you buy the asset itself, but in margin trading you buy a contract. You also have a liquidation level based on the balance and leverage you are trading. If the price drops to your liquidation level and you don't have a margin to collateralize, you risk losing all your money.

| Pros of Margin Trading | Cons of Margin Trading |

|---|---|

| Margin Trading allows low-capital users to increase their trading size by giving them leverage. | When inexperienced traders use high leverage, huge losses are inevitable if the trade fails. |

| If the transaction is successful, the trader can make huge profits thanks to the leverage. | Margin Trading requires experience. When trading in this style, it is necessary to look at the market from two sides. In this case, the error rate of novice traders is high. |

| Margin Trading provides the opportunity to open two-way trades. In other words, instead of opening a buy trade as in spot trading, you can also open a sell trade according to the course of the market. I think this is the biggest advantage. | While using leverage often seems profitable, it is extremely risky and stressful if the trader has no balance to show as margin. |

Similar to Margin Trading, Futures Trading is a type of trading that should be used by more experienced traders. The trader follows the price action according to his forecasts and analysis and can trade either in the buy or sell direction. Instead of buying the asset as in spot trading, traders buy contracts equivalent to the asset. Again, as in margin trading, leverage can be used by borrowing from stock markets, but in this case, the loss will increase as well as the gain. Traders using the Futures Trading method can easily open trades in both bear and bull markets. Futures Trading receives bidirectional funding fee payment. Margin Trading has a borrowing fee payment. Also, on exchanges like Binance, Margin Trading leverage is 5x, while Futures Trading leverage can be set up to 125x.

| Pros of Futures Trading | Cons of Futures Trading |

|---|---|

| Traders can open trades both during the bullish period and the bearish period. Because the futures trading method is suitable for opening two-way transactions. | Using high leverage carries great risks. You can see your balance melt away in seconds. |

| If traders manage to adjust the leverage to their own risk, they can very comfortably increase their balance by trading correctly. | Unlike Spot Trading, you buy contracts in Futures Trading. Therefore, there is no question of owning an asset. |

| A trader who uses leverage correctly can open trades in other coins with his remaining balance. |

2.a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

2a)

To open a transaction in the cryptocurrency market, it is necessary to use some types of orders. Now let's explain these order types and talk about their functions.

Market Order is an order type that is used to instantly receive orders created by market makers in the order book and realize liquidation. The transaction is executed at the current price and is fast. You may not make any inquiries in such orders. You take the orders created by the market makers and take on the role of market taker. Most traders use this method frequently.

Unlike Market Order, Pending Order is executed with orders created in the order book. To open this type of trade, you make certain estimates and create orders in the buy-sell direction. There are types such as Limit Order, OCO and Stop-Limit Order. Traders who trade in this type are called market makers, and the more orders an asset has in its order book, the more liquidation it has.

In addition, the trader waits to close his trade with profit by using the take profit and stop loss orders.

Now let's talk about the types of orders in the Pending Order.

1. Limit Order

Limit Order is a type of order that allows the trader to act as a market maker. The trader places an order in the area he predicted and when the price gets there, his order is fulfilled when the market is received by the buyers. In this method, the order is triggered and the transaction is confirmed.

Example; A trader waiting for Bitcoin to fall to the support level writes a buy order at certain points and starts waiting instead of trading with a market order. If the price reaches the level set by the trader, the buy order is executed.

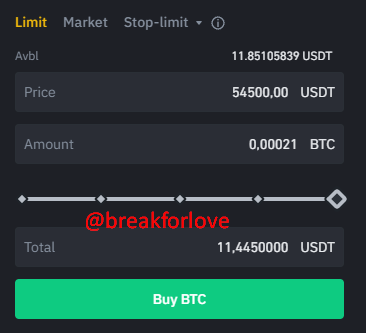

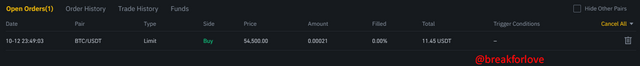

I performed an example of a limit order transaction above. Bitcoin price is currently at 55,400 levels. If it drops to 54.500 levels, my order will be triggered and opened.

2. Stop-Limit Order

As the name suggests, this order consists of both the stop price and the limit price. In this order type, there is a price determined as a trigger. A buy order is executed when the lowest selling price exceeds the estimated and determined price. In this way, a limit order is executed for an asset that has reached a stop price.

Example; The current price of an asset is $200. You enter an order as a Stop-Limit Order. You set the stop price as 190 and the limit order price as 185. After the price is triggered when it reaches the stop price, your order will be executed in the region you entered as a limit order. This order type can be used in both buy and sell directions. The suggested method is that the distance between the stop price and the limit price is not too close. You know that the crypto money market is a market that can rise and fall instantly and security should not be neglected.

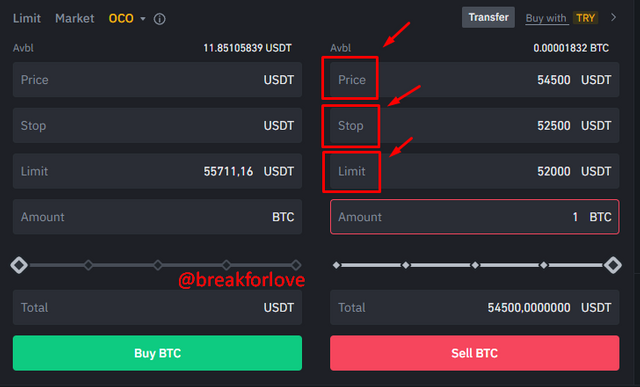

3. OCO Order

OCO, which stands for One Cancels the Other, is an order type that allows traders to open two trades at the same time, canceling the other if one occurs. It can bring success if used when the direction of the market is difficult to predict. It is also an advantageous order type in terms of risk management. In such orders, both limit order and stop-limit order methods are used, and orders can be placed in both directions.

Example; Let's take the price of an asset as $50. There is a resistance area at $55 that must cross, but the price has tested it before and fell back. Thanks to the OCO, a limit sell order that you enter for $55 will allow you to make a profitable trade if the price drops from there, and the other trade will be cancelled. But if the price drops before it gets there and your stop-limit buy order at $45 is fulfilled, your limit sell order will be canceled this time too. Thus, you will make a more guaranteed trade.

Next to these orders are the so-called Exit Orders. These orders are usually entered if you have a trade.

a) Stop-Loss Order

A trade is not always results positive and no trader has a 100% success rate. This is an order that allows you to accept that you can make a mistake. If there is a market movement in the opposite direction of your trade, you will prevent your loss from increasing with the stop-loss method. It is an order type that every trader should use. It is recommended to enter 3% - 5% stop-loss as margin of error.

b) Take Profit Order

This order type is an order type that allows you not to spend your hours watching the screen and is used to prevent your profits from melting during possible market turns. The order is triggered and executed when the price reaches the region determined as take profit. Take profit order has the features of closing the entire position or closing the specified amount.

2b)

As I mentioned in the explanations above, OCO orders are an important order type in terms of risk management. If it is used when the direction of the market cannot be predicted exactly, both less loss will be incurred and a guaranteed profit return will occur if the forecast is realized. It is very useful as when one order is fulfilled, the other order will be cancelled.

In the screenshot I sampled on Binance, you see an OCO order. In the sales section, a Bitcoin sell order was entered from 54,500. I entered the stop price at 52,500 and the limit price at 52,000 dollars. In this way, I have minimized the risk and damage that may occur. When one of my orders is triggered, the other will be canceled, so I will follow it more easily.

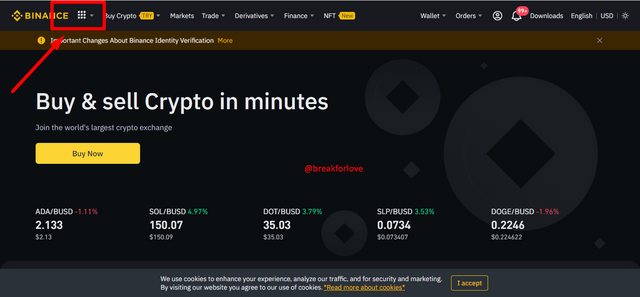

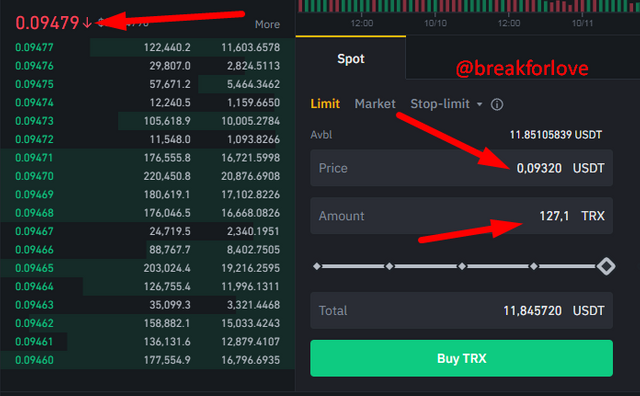

I will use the Binance exchange to perform this transaction.

- First, I log into the Binance exchange.

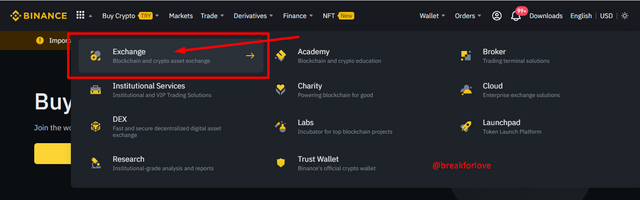

- Then I click on the box at the top left and then click on the Exchange option.

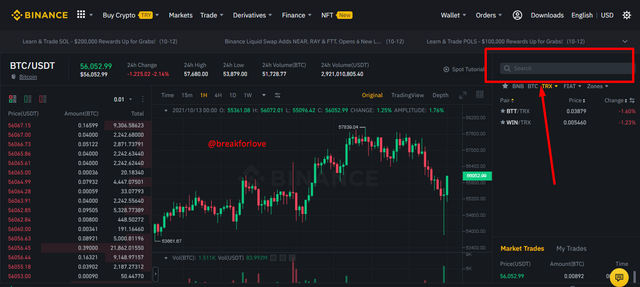

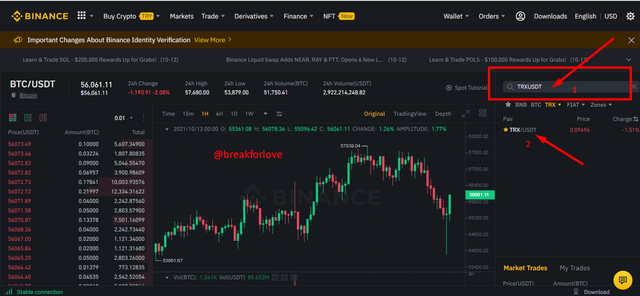

- After typing and clicking the pair I will trade in the search section on the right of the screen, a new screen appears. I will create an order in TRX/USDT pair.

Because we will be entering orders from Spot, first click Spot.

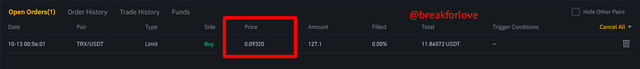

Currently, the TRX price in USDT basis is 0.09479. I entered a limit buy order at 0.09320 levels because I will enter a limit order in the buying direction and when I look at the order book, I see a lot buy orders around 0.09300.

- My order is waiting in the order book. In case the price wants to test these levels, my order will be fulfilled.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

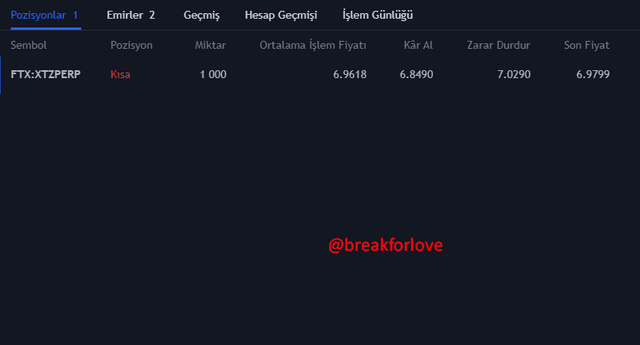

Now I will show an example of trading on my demo account on Tradingview. For this example, I choose the XTZ/USDT (Perpetual Futures) pair. The reason I chose this pair is because I think there may be selling pressure due to today's Bitcoin drop and the rise of Bitcoin Dominance.

As you can see, BTC.D continues to rise and therefore altcoins are facing selling pressure. Now that I've told you why I chose this pair, let's get into the trade.

The indicator I will be using is MA Cross 50 & 200. I like using this indicator because it makes it easy for me to predict future price movements based on past price averages. The red stripe shows the 50-day average, and the white stripe shows the 200-day average. When we look at the chart for 1h, we see that the price is below the 50-day average, and I am trading in the direction of selling, taking into account the selling pressure. Including the fact that the market may move in the opposite direction of my prediction, I put my stop loss level above the 50-day average. My take profit zone is between 6.85 and 6.84 which is the support zone. My exit zone from the position will be 6.65 levels, where it received an upward reaction today. Because this region has been tested 3 times and an upward price movement has occurred each time. I'm aiming to close my position completely here in case it happens again. My Stop Loss, Take Profit and Exit orders related to my position are also displayed here.

In this assignment, I talked to you about the types of orders in the cryptocurrency market. I have also reinforced my own knowledge by talking about Spot Trading, which is recommended for new users, and Margin and Futures Trading, which is recommended for experienced users. If we want to exist in this market, we must research the most suitable trading method for us and put it into practice. In addition to all these, we should learn the types of orders we mentioned in the homework well and aim to make a profit by using these orders at the right place at the right time. As in the last example, I showed a small trading example using the knowledge I gained, albeit with a demo account. I hope it was a useful writing.

Thank you for reading.

CC: @reminiscence01

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @breakforlove , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @reminiscence01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit