Hello to Steemians around the world! I'm glad to feature my entry for the steemit Crypto Academy, wk2 in the steemit engagement Challenge and as required today, I will be submitting my entry based on the centralized exchanges.

In this article, the following questions will see the light of the day.

- Discuss briefly Centralized exchanges and its Benefits to crypto users.

- What do you look out for when choosing an exchange to trade your crypto assest?

- Review your favorite centralized exchange and explain its unique features

- Is there anything about your favorite exchange you will like to be changed? Discuss.

Discuss briefly Centralized exchanges and its Benefits to crypto users

Let's start this discussion by defining what a centralized exchange is before then the benefits.

CENTRALIZED EXCHANGES can be explained as platforms that facilitate the services of buying and selling of Crypto assests, either for fiat currencies, for example the US dollar, or better still, between digital assets, such as BTC and STEEM. They act as trusted intermediaries in the Crypto world, and oftentimes, act as caretakers by storing and protecting your digital assets.

To furthermore reiterate on the definition, centralized exchange can be defined as a an exchange platform which is developed, controlled, owned and led/run by a company. It is made up of a central authority that controls and manages all the activities of users of the exchange. The thing is not much Independence in centralized exchange sequel that the users do not have full authority over their account because the exchange platform have access to all their user's keys and this doesn't guarantees 100% security.

Centralized Exchanges also has the features of having almost all the details of their users because of the required KYC feature that has to be undergone during registration or signup process so in view of this, anonymity is always not guaranteed. Few examples of centralized exchange platforms are Binance, Roqqu Coinbase, etc.

Majority of exchanges regulates and facilitate all aspect of digital asset trading experience ranging from security, market price, fair regulation compliance, customer protection, and authorization to different digital assets. It may interest you to know that as of September 2020 that 95% of Crypto asset trades have been executed with centralized exchanges, which estimately represents approximately $228 billion USD a month😊.

It is really important we even discuss the advantages and few Disadvantages of centralized exchanges before we move on.

ADVANTAGES

USER-FRIENDLY

Centralized exchanges provides a friendly user interface and offers new investors a familiar, friendly way of initiating and running trading activities as well as investing in cryptocurrencies. In contrast to using crypto wallets and peer-to-peer transactions, that can be very complex, the users of centralized exchanges can easily log into their accounts on the Exchange, ability to see their account balances, and to initiate transactions in the platform very easy.RELIABILITY

Centralized exchanges provides an extra layer of security and reliability to user's exchange when it comes to transactional activities and trading. By improving the transaction via a developed centralized platform, centralized exchanges provides higher levels of comfortability and usability.HIGHER TRADING VOLUME

Centralized exchanges are characterized with higher amount of trading volume compared to the decentralized Exchange.

DISADVANTAGES

HACKING RISK

Centralized exchanges are run by companies that are responsible for the storing and retrieving of their customers digital assets. Some users exchanges usually hold billions worth of dollars of bitcoin and other digital assets, this tends to make them a target for hackers and theft.

A clear example is the case of Mt.Gox, which was once initially one of the world’s largest cryptocurrency exchange company until it reported the theft of 850,000 bitcoins, and that led to its suspension.TRANSACTION CHARGES

In contrast to peer-to-peer transactions in the decentralized system, centralized exchanges considerable tends to charge high transaction fees for their services and convenience, this can be especially high when trading in huge or large amounts of Cryptocurrencies.BREAKDOWN RISK

Centralized Exchanges makes use a single/one server and as a result of this, a breakdown in the central server will affect the whole platform. So once the server responsible for controlling the entire process breaks down, the whole platform also goes down which makes it not trustable.

Having discussed that, Let's proceed to the next question..

What do you look out for when choosing an exchange to trade your crypto assest?

Before investing your dollars into crypto assets its highly recommend that one looks out for the best exchange (s) in other not to loose money. This is very important, so I would be outlining variables or features I look out for when choosing an exchange to trade with.

SECURITY

Security is my number one variable or feature I'm c concerned about! As we all know, Cryptocurrencies are not backed by any central institution, our digital assets are not really protected the same way as the money kept in the bank or the traditional investments. Some CEX such as Coinbase, Gemini do keep any fund in U.S. Dollars you keep with them in FDIC-insured bank accounts. Although the FDIC insurance doesn’t apply to cryptocurrency balances nevertheless, to protect your crypto, few exchanges have their insurance policies to endeavor to protect the digital assets users hold within the exchange fraud hacking or hacking. Let's take for an example, Coinbase which has an insurance policy that is worth $255 million. This means that paradventure, Coinbase’s reserves were to be compromised/hacked and any fund of crypto that amounts $255 million was to be stolen, account holders would still be protected and saved because of the reserves. But in contrast, like Kraken, they only rely solely on their own security practices to protect clients rather than the insurance policies of Coinbase.

FEES

Some Exchange fees can be a fixed price although they often like a percentage of your trade volume. We have some exchanges, like the Cash App that charges fluctuating fees which are solely based on price volatility. So I really take into consideration the fees charged before using an exchange.

COIN OFFERED

When choosing an exchange, I put the consideration of what type of digital assets are being offered by the exchange for example I can't used an exchange that doesn't support Steem for trading when steem is needed. So I put the types of coin offered by the exchange as a variable.

Review your favorite centralized exchange and explain its unique features

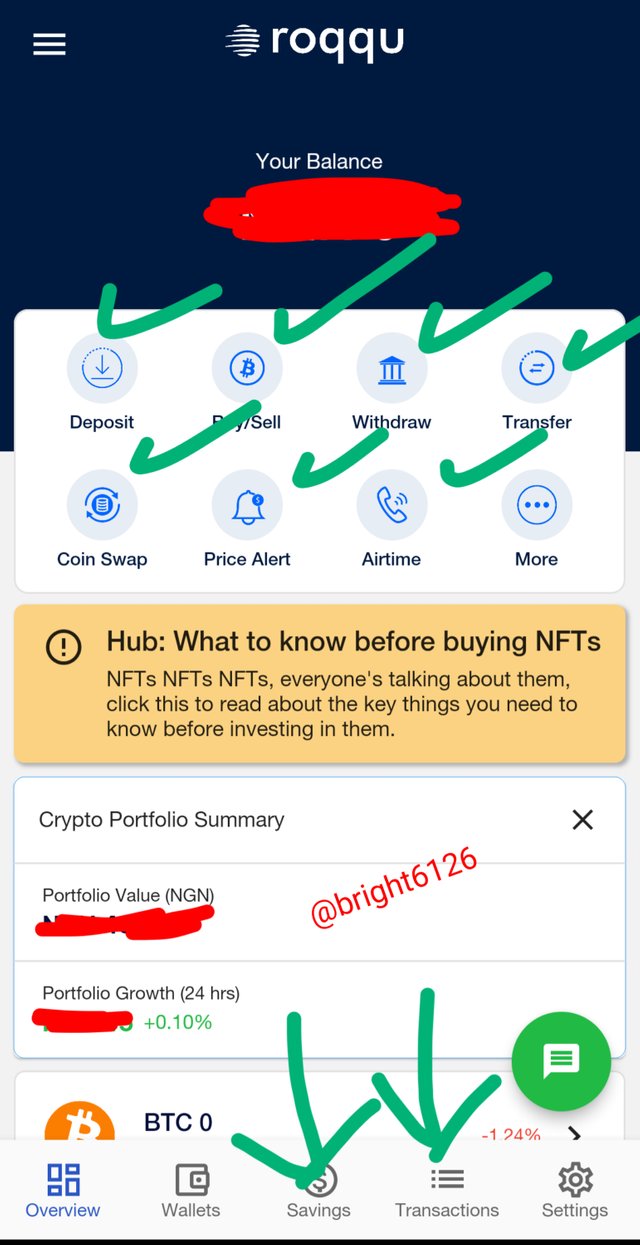

Screenshot from Roqqu app

My favourite CEX is the Roqqu (download HERE ) which is an exchange founded in Nigeria in 2019 which has gained more ground ever since. Their steemit username is @roqqulovesteem. I have found some unique features about them and I will be outlining them below 👇

Screenshot from Roqqu app

From the above we could see that it allows the Services to deposit, buy and sell, withraw, transfer, coin swap, price alert. I find this features very unique not to even talk about the UI/UX which is really an amazing part already. Users can deposit Fiat currencies and convert to crypto assets and vice versa. They also have the feature of saving too which can be found in the down part of the app as seen the pics above. The feature of transaction also is there to check previous transactions and history as shown below 👇

Screenshot from Roqqu app

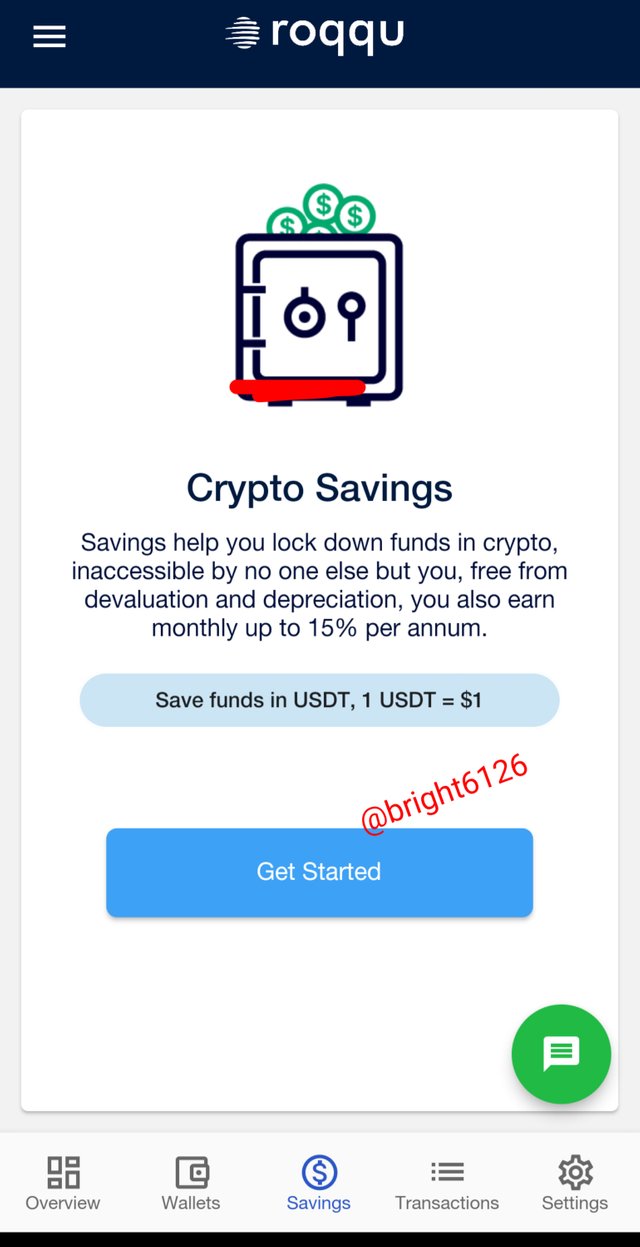

The feature of saving is totally outstanding and below is a screenshot of it too.

Screenshot from Roqqu app

Other features about the app won't be discussed as I don't find them unique but with the above unique features, I have found Crypto solace using the ROQQU CEX.

Is there anything about your favorite exchange you will like to be changed? Discuss

Yes, in as much as I give very good reviews about my favorite CEX, deep down I still want some certain things to be changed like the customer care service which has a very poor reputation and response time. I would recommend more experts are put in replacement for the current ones. I would also like Roqqu to list more coins too in future.

What shortcomings do you see on centralized exchanges

Well so far, I have seen some security lapses in the app, and also the sluggishness most times. The app maybe prone to infiltration by reverse app Engineers which put the CEX and the entire users at risk. Lastly, the unavailability of new coins makes the app not usable by most Crypto users.

CONCLUSION

We've discussed at length about centralized exchanges and probably may have learnt new things here. However, I want to appreciate the steemit team and the crypto Academy team for putting up this activity. Kindly drop your feedback after reading my piece and let's engage together.

I honorably mention my few friends to join the Challenge

@starrchris

@solar-star

@focusnow

@whitestallion

@anyiglobal

@liams1

@patjewell

@gentles

@ruthjoe

Special regards to my amiable prof.

@reminiscence01

Nice write up bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for dropping by 🙏😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like how you reviewed your favourite centralized exchange, Roqqu

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your acknowledgement

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're welcome

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have never used roqqu before. You have nicely explained everything about it. I think this is also a good exchange when studying its security and fees.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much for your opinion! I'm always available for help whenever you want to use it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit