I feel very excited participating in the Week 3 of the Steemit Crypto Academy Season 3 lecture as presented by professor @cryptokraze. Going through the lectures presented, which serve as excellent materials to be deployed in the trading of cryptocurrencies in particular and the financial markets, in general, always present ample opportunities to not just learn and improve your knowledge but to even earn by participating in the homework tasks usually given. For this week I wish to make my entry in fulfillment of the assignment given over the Break Retest Break trading strategy.

What do you understand about the concept of break retest break strategy?

Anytime prices of cryptos make new moves beyond the defined or outlined resistance and support levels it could often occur with increased or larger volumes. Consequently, the volatility may increase remarkably as a result of prices having gone beyond a certain price barrier level. Sometimes, the price movement would continue in the direction of the new trend. Hence, the breakout could actually be the starting point of a larger future price trend or increase in volatility. Most times the breakouts that often become explosive are those that result from flax, channels, head-and-shoulders patterns and triangles.

Traders may often want to enter long positions whenever the price breaks beyond the defined resistance level and enter short positions whenever the prices break below the support level. However, the Break Retest Break (BRB) Strategy anticipates a negative possibility. This negative possibility could arise in the situation whereby such prices that have broken out suddenly comes rebouncing or rebounding - without continuing in the direction of the apparent new trend - to, sort of, check whether the resistance or support levels where the breakout had occurred would hold. Therefore, the BRB strategy works by allowing time for the price which has broken out and reached a new higher high or lower low to make a pullback towards the respective resistance or support levels from which it had earlier broken out; then it rebounces or rebounds and continues in the direction of the preceding breakout (this means that the support or resistance level has been retested).

The price action is allowed to continue in this direction to observe whether it will eventually break above the high higher or break below the lower low that was earlier created by the breakout which is being retested. If the price eventually breaks above or below these swings and continues in the direction of the breakout, then the BRB strategy or pattern would have been completed and can then be utilised by traders. The traders hoping to utilise this strategy would only enter new positions at the breakouts above or below these higher highs or lower lows. Examples of the BRB pattern from crypto assets chart patterns can occur in different market structures. It could, therefore, occur in an uptrend, a downtrend or a ranging market structure.

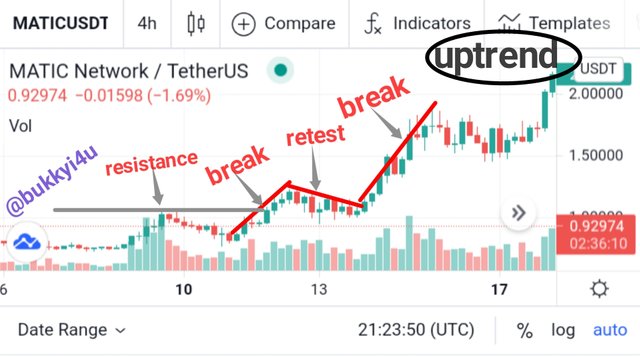

BRB Setup In An Uptrend(Resistance Level)

As has been indicated in the chart above BRB can be set up in a market that is bullish (that is, a market trend that is marked by price action making higher highs and higher lows as it journeys upwards). In this case a BRB pattern could be set up in a situation whereby a breakout occurs at the support level where the price action may have consolidated and makes its journey towards the upside creating a higher high. Unfortunately, the bears start coming in while some buyers begin selling. Consequently, the prices pushed lower as it aims to retest whether the support level would hold. As can be seen the buyers come in and this causes the price action to move back up in the direction of the original breakout. This renewed upward movement of the price action finally breaks above the initial higher high created by the original breakout. This completes the pattern for a BRB setup in an uptrend market.

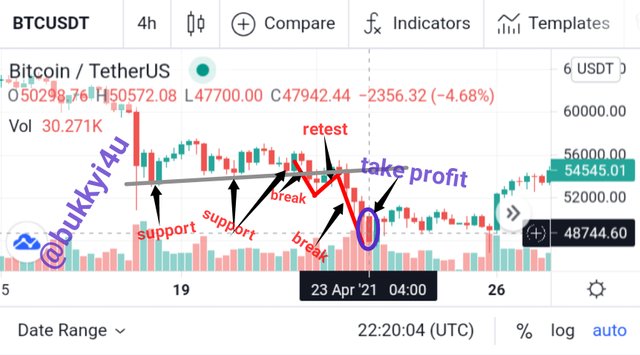

BRB Setup In A Downtrend

In a situation whereby the market is moving with a downwards price action creating lower lows and lower highs a breakout could occur below the consolidated resistance level. However, the bulls start coming in and some bears start exiting the market. This causes the price to pull back upwards in a bid to retest the resistance level. However, the bears come in again and this causes the price to reverse in the direction of the original breakout continuing in its downward trend. Eventually, the price breaks below the initial lower lower created by the original breakout. This completes the pattern for a BRB setup.

BRB Setup In A Ranging Market

In a ranging market, that is typically formed in a situation whereby the price action does not trade with a marked upward or downward movement but continues within a specified range of prices, a BRB pattern could still be set up. In such a situation, while still within the trading range, prices could still manage to make breakouts which result in higher highs or lower lows. However, these prices reverse in order to retest the support and resistance levels before turning back to continue in the direction of the original breakout. This sets up a BRB trading pattern as can be seen in the chart above.

Mark important levels on crypto charts to trade BRB strategy. Do it for both buy and sell scenarios.

In trading the BRB strategy in the cryptocurrency markets, there are some very important or crucial levels of market trend or price action that should be noted. These levels include essentially the resistance level, the support level, the stop-loss level and the take profit level. I will explain the resistance and support levels separately but the stop loss and take profit levels will be invariably explained in between.

Resistance Level In BRB Strategy(The Buy Scenario)

One of the important levels that should be taken into account while trading the BRB setup is the resistance level. In the cryptocurrency market, when the price of assets that are moving in the upward direction get to some certain levels they would normally pause and begin to move in the opposite direction. This is usually due to large selling interest which creates increased supply of the asset. Prices could break out from these areas of resistance due to increased buying interest. This area has been important in the BRB setup since. It is actually the basis of the breakout which could eventually create the BRB pattern. Traders make their buy entry when the BRB pattern is set up in the resistance level. The stop loss level or stop loss order should be placed immediately below the resistance level. Then, the take profit order should be placed in points or percentages that are equal in ratio to the stop loss order. This means that if the stop loss order is 1% below by entry point towards the resistance level then the tech profit should be 1% above the buy entry point in the direction of the desired trend.

Support Level In BRB Strategy(The Sell Scenario)

Another important level when trading the BRB strategy is the support level. Usually, as has been regularly observed in the financial markets, including cryptocurrency market, price action that is in the downward direction would normally reach some certain levels and pause as a result of large buying interest or concentrated demand for the asset. This increased demand forms what is known as a support line. Traders make their sell entry when the BRB is set up in the support level. In trading the BRB setup - which results in lower lows after breakout from support levels - one should be mindful to place the stop loss order immediately above the support line or support area. The take profit level should be placed in an equal ratio to stop loss order. That is to say if the stop loss order is placed 1% above the sell entry point then the take profit in the desired direction should equally be placed 1% below the sell entry point.

Criteria For Trading The BRB Strategy

For Buy Position

Trade Entry For Buy Position

Before entering a buy position with the BRB strategy there are some very important criteria that should be observed. These important criteria that should proceed an entry into a bullish market with the BRB strategy include:

- A resistance level must be in sight and you should ensure to carefully mark out where the resistance level would be

- Patiently wait for the price which has get to the resistance level, breakout above it and then get to a point of higher high or swing low

- You should wait for the price to reverse and start going back in the direction of the resistance level

- Wait for the price to turn back from the resistance level or to turn back in its approach to the resistance level and begin to move, again, in the direction of the original breakout

- Now you should watch out to ensure that the price breaks above the initial higher high or swing high created in the path of the original breakout

- The price breaking above the original higher high validates the BRB strategy and you should then make a buy entry immediately above this brake

Trade Exit (In Gain) For Buy Position

Exiting a buy position in gain means that your desired level for take profit is reached. Before exiting a buy position in gain the following criteria must have been met:

- First, the take profit level should be set in the desired direction of our trade

- You can take a look at a higher time frame to determine where a previous resistance level had been in the preceding bullish trend of this particular market

- If this resistance level looks reasonable in this current trade then you can set your take profit somewhere below this resistance level(you can use Fibonacci retracements to try to determine where these resistance levels where the price is likely to retest may be)

- You should set your take profit in a ratio of at least 1:1 RR (Risk:Reward). This means that whatever point you add to your entry level for take profit should be equal to the point you will add to your entry level for stop loss

When the price goes above your take profit level you can book the profits or exit in gain

Trade Exit (In Loss) For Buy Position

Exiting the trade in loss means that our take profit level wasn't reached. Instead the price turned back and the stop loss order was filed. Some criteria for exiting in loss with this strategy can include:

- First, a stop loss order should be put in place in the opposite direction of our desired trend

- With the BRB strategy the stop-loss order should usually be set somewhere below the resistance level from where price initially broke out

- The stop loss order should be set in a ratio of at least 1:1 RR(Risk:Reward) to the take profit level

- Price going below your stop loss means that the BRB setup has been invalidated

- If price eventually goes below your stop loss order you should exit in order not to incur further losses

For Sell Position

Trade Entry For Sell Position

Before making a sell entry with the BRB strategy you must ensure that the following criteria have been met in the market in view:

- Carefully mark out a support level which the market must be approaching

- Wait patiently for the price which would have gotten to the support level to now break below the support level and create a lower low point or swing low point

- Wait for the price which has broken below the support level to turn back after creating a swing low and begin to journey again in the direction of the support level

- Then watch and observe to ensure that the price reverses again from its move to the support level and begins to journey in the direction of the original break out towards the initial swing low point

- Wait for the price to finally break below this original point of swing low. This validates the BRB strategy

- Then immediately below this break of the initial swing low make a sell entry

Trade Exit (In Gain) For Sell Position

Exiting in gain for the sell position means that the desired level for take profit was reached. The following criteria should be observed for exiting a trade in gain for the sell position:

- First, take profit for the sell position should be set in the direction of the desired trend

- You can take a look at a higher time frame to determine where the lower preceding support level had been and set your take profit with that in view (if it is reasonable in this current trade).

- The take profit should be set in a ratio of 1:1 RR (Risk:Reward) to the stop loss

- Once your take profit is reached you can exit the trade or book your gains

Trade Exit (In Loss) For Sell Position

Exiting the sell position in loss means that price did not continue in your desired direction. Rather it got to a point and reversed in the opposite direction. A few criteria or guidelines can be followed when exiting in loss:

- First, you should set a stop loss order incase price does not continue in your desired direction

- With BRB strategy your sell stop loss should be set immediately above the support level from where the price broke out

- The stop loss order should be set in a ratio of 1:1 RR (Risk:Reward) to the take profit

- Price going above the stop loss order invalidates the BRB pattern for the sell entry

- You should exit if price goes above your stop loss order to prevent further losses

Examples Of BRB Demo Trades From Crypto Assets

I was able to use the BRB strategy in carrying out two real trades on the Binance exchange. One trade went in my desired direction while the other did the opposite.

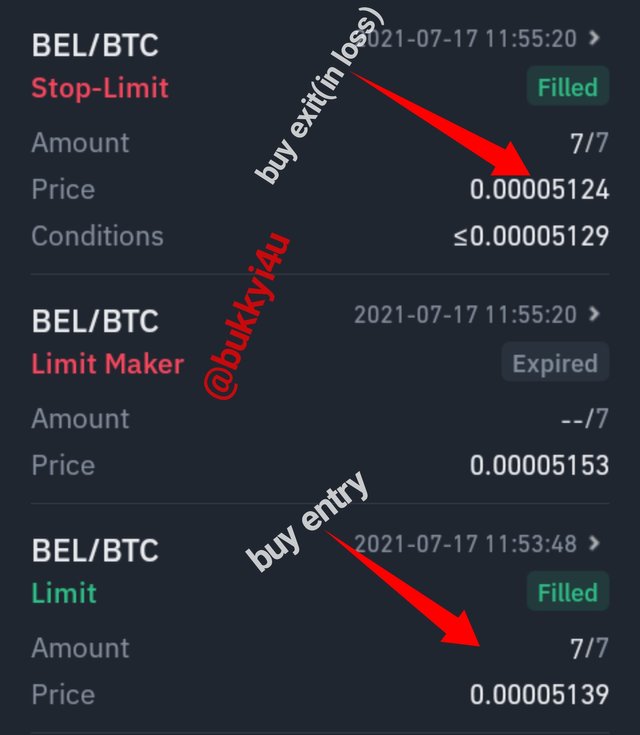

Bel/Bitcoin On 4 Hour Time Frame:

On the Bella/BTC 4 hour time frame I observed that price was currently trading at resistance level. The price obeyed the 20 period EMA. I kept my fingers crossed. Soon the price breaks above the resistance level which I have marked out in the chart above. I waited for it to make a swing high. Incidentally, it came lower down from its swing high to retest the resistance. I observed that it now moves away from the resistance level and continues in the original direction of the breakout.

I employed the use of Bollinger bands to discover that it was likely to go even higher. On its approach to the middle band of the Bollinger bands it breaks above the swing. Voila! I made a buy entry at 0.5139. I set my take profit at 0.5154 above it and my stop loss at 0.5124. Unfortunately, the price turns against me to fill the stop loss order at 0.5124.

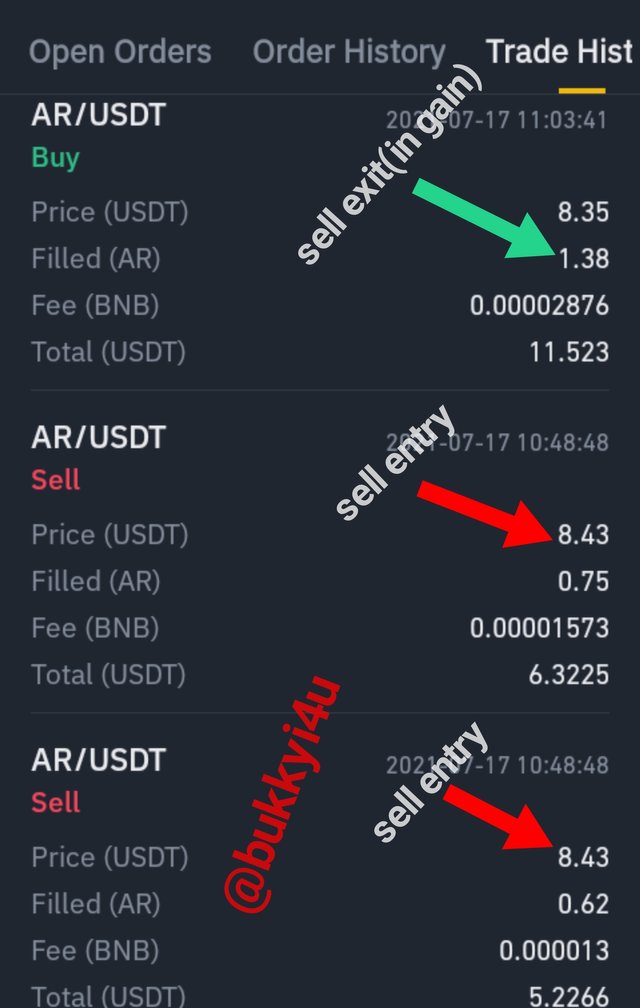

AR/USDT On 1 Hour Time Frame

I came right on time to discover that on the Arweave/USDT 1 hour time frame, price had broken out from the support level where it was trading. The price was now going further down after making a pullback in a bid to retest support. Obviously, the support didn't hold

Then I waited for the price to break below the initial swing low of the original breakout. Once price broke below the swing low I employed the use of the RSI Indicator which read 50. This means the asset was not yet entirely in the oversold region, hence, not likely to reverse. So, I made a sell entry at 8.43 and set my take profit at 8.35 with my stop loss at 8.51. Fortunately, my take profit order was filled this time around.

CONCLUSION

- When the intention is to trade in the direction of the trend then the BRB strategy could prove to be quite instrumental

- Interestingly, it is important to take note of the support and resistance levels which must be in place before the BRB strategy can work effectively

- After doing this you should take note of all the important points, metrics and criteria that should inform a dell entry or buy entry

- Importantly, you should also know where to put your stop loss and how to set up your take profit order

- Normally, the BRB strategy can be applied to any desired time frame. However, from my personal experience it is a lot easier to trade this strategy with shorter time frames.

- It is interesting to note that the strategy can be used in uptrends, downtrends and even in a ranging market.

- As a scalper I found this strategy very interesting and successful.