Performing Staking On PancakeSwap

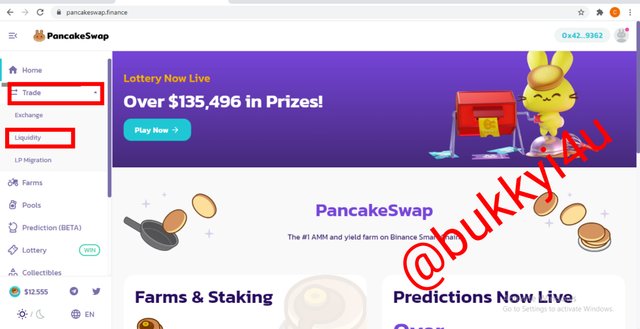

In performing the staking I am going to make use of the PancakeSwap decentralized exchange. Before you can perform staking on PancakeSwap platform you have to first of all add the coins you wish to stake to the liquidity pool. After that you can stake the coins which you must have added to the liquidity pool. So, I am going to add liquidity, first. To do this I visited https://pancakeswap.finance. I connected my Binance Chain Wallet (I will describe the steps later). I clicked on trade and selected liquidity under it.

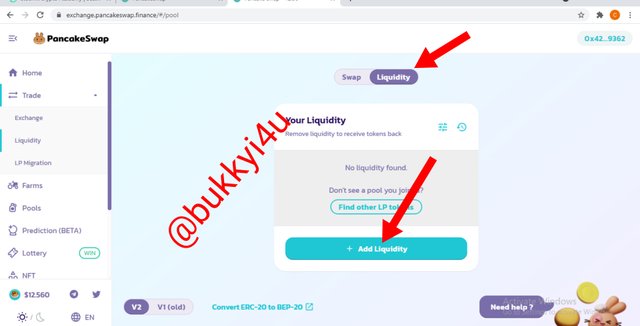

A new page displays and I switch to liquidity and then clicked add liquidity as indicated below:

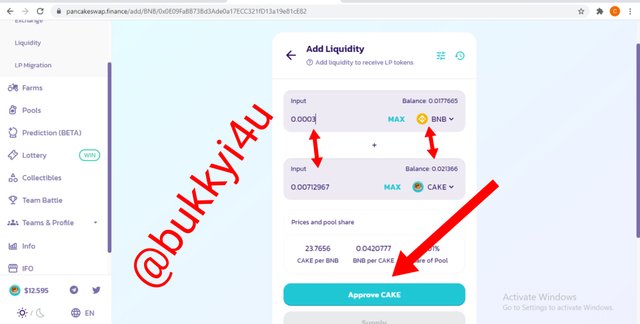

Then I select the coins I wish to add to the liquidity pool and the amount. In this case I wish to swap BNB and CAKE (which I already have in my wallet) and click approve CAKE

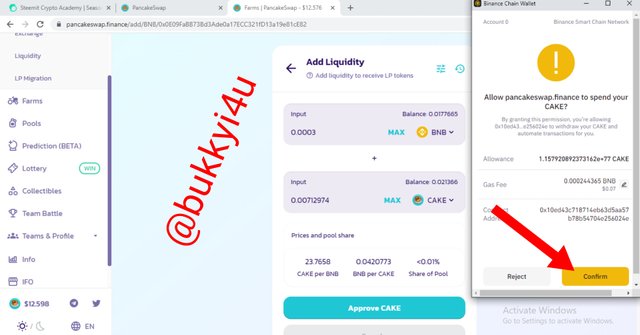

Then I have to authorise my wallet to make payment for the transaction by confirming it as shown below:

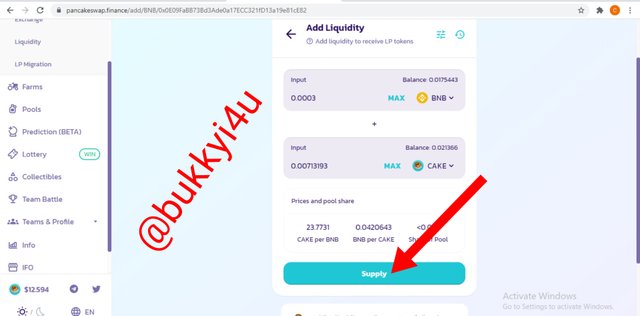

On the next page that opens up I click supply

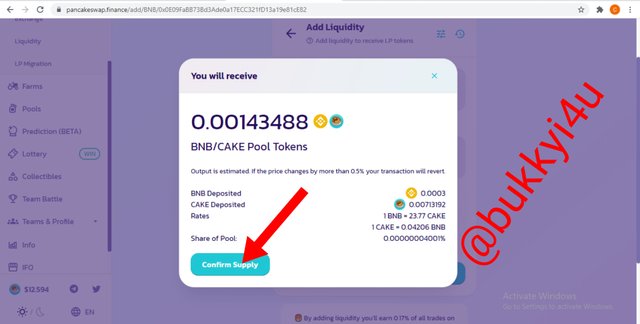

Then I confirm supply

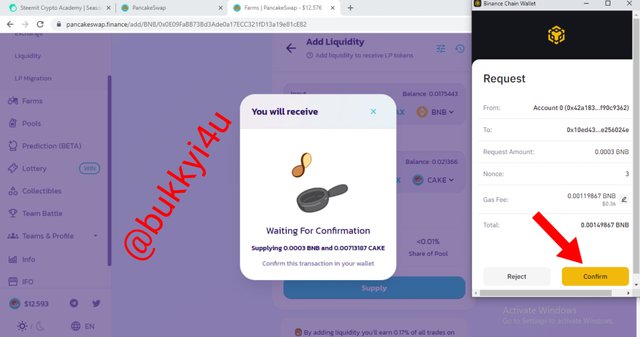

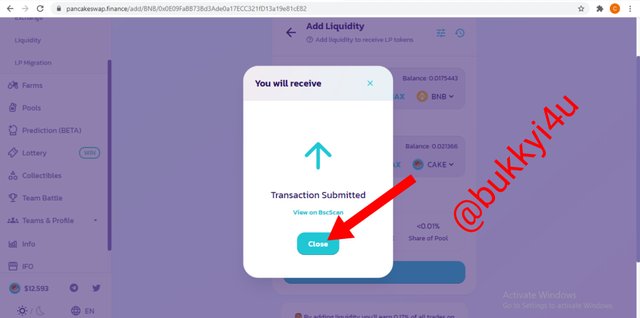

After this I have to sign the transaction with my wallet. So, I click confirm as shown below:

It then shows transaction submitted and I click close

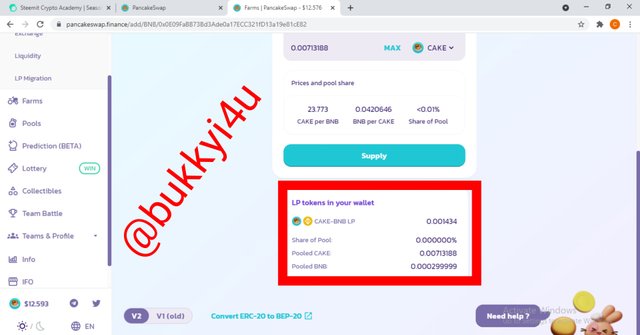

The image below displays the amount of liquidity and the coins I have provided to the liquidity pool thereby confirming that I have added liquidity

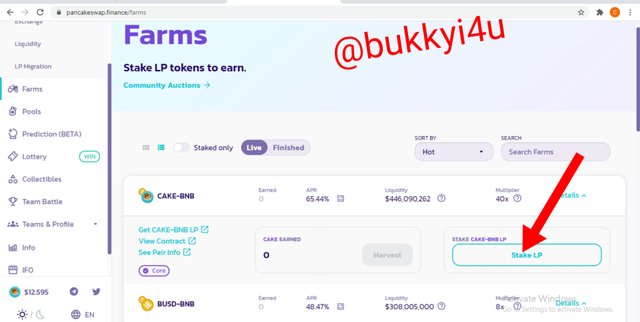

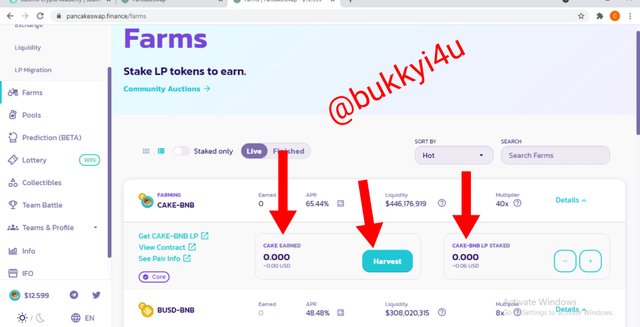

I can now proceed with the staking. So, I go back to the home page and click farms and select the CAKE-BNB pair which I wish to stake:

From the details that open up I click stake LP

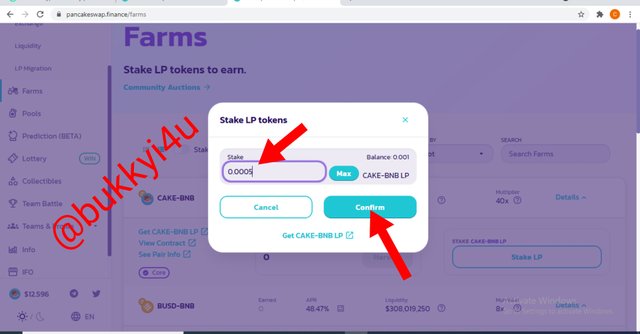

On the page that pops up I input the amount I wish to stake and click confirm

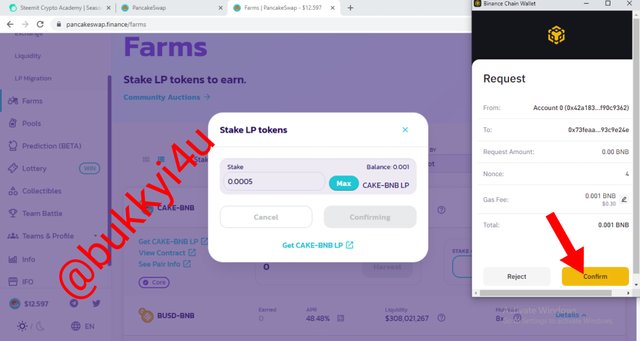

Then I signed the transaction with my wallet by clicking confirm on my wallet

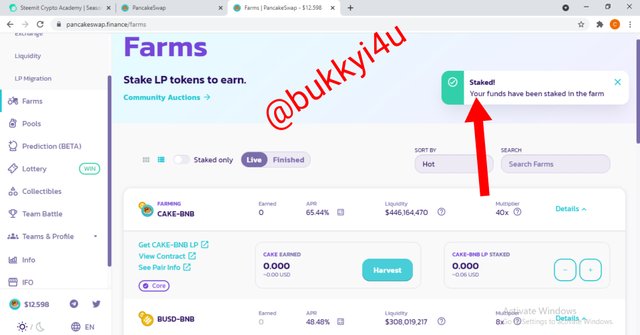

I then receive a message which says your funds have been staked in the farm

The details below show the amount of CAKE I staked and then the harvest command button through which I can reap the rewards.

That explains the process of performing staking on PancakeSwap decentralized exchange.

Which platform did you choose and why?

Actually, the platform I have chosen to perform the staking function is the PancakeSwap decentralized exchange. Personally, I prefer the pancake decentralized exchange for staking due to its high APR/APY. The APR/APY can even go as much as are above 200%! This is the most important factor I considered before choosing PancakeSwap for the staking function. However, there are a lot of other interesting features that make me prefer the exchange to the other exchanges. Some of these features include:

- PancakeSwap is quite secure as it is non-custodial and does not even require you to transfer or deposit your assets to the exchange before carrying out this staking function

- Again, the transaction fees are quite lower since it is connected to the Binance Smart Chain (as against the Ethereum Smart Chain which charges high gas fees)

- They have a wide use case due to the fact that although they are primarily meant to accept BEP-20 tokens, you can still transfer other forms of tokens and then I wrap them as BEP-20 tokens and still carry out staking

- It has a very large trading volume which can cater to my needs in staking and gives me a sense of security

- It enjoys a large community behind it and has been adopted widely making it quite reliable and popular

- On the platform I will earn from both trading fees and transaction fees by staking my coins

- Apart from the liquidity pools I can still decide to stake my coins into the Syrup pools that provide even greater rewards

- There are no interference from middlemen so ordinarily the fees that may have been charged by them go directly to me for staking

Which wallet did you use for the procedure?

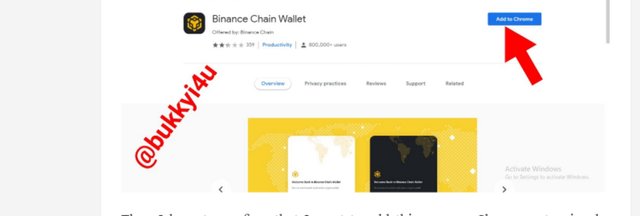

In performing this staking function I had to make use of the Binance Chain Wallet. This wallet is the one that has been officially created by the Binance cryptocurrency exchange. It can be used to access the Binance Chain,the Binance Smart Chain and even the Ethereum Chain. You can store your coins in the wallet very securely. Through it you can have access to thousands of different projects hosted on different blockchains.

Actually, the wallet looks quite similar to other wallets that can be added as browser extensions. You can add it to your Chrome extension or even to Firefox and Brave browsers. Also, you can directly link or connect it to your Binance account through the wallet Direct. As such you do not have to copy and paste address anytime you wish to make transfers and as such transfers can easily be done in a very easy way that looks like simply swapping coins from your Binance exchange to the wallet.

How can you link your wallet to the platform you chose?

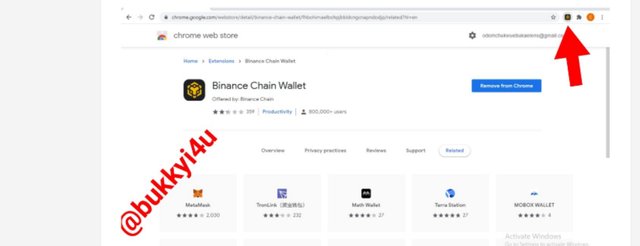

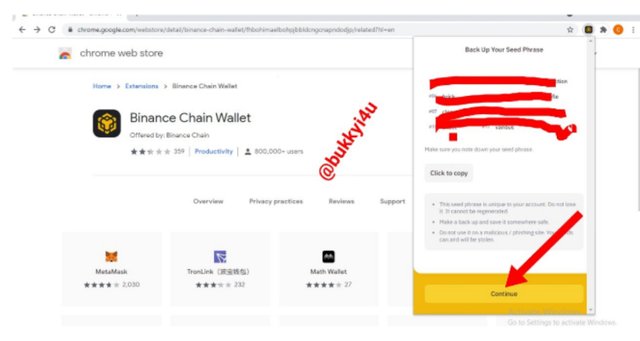

Linking the Binance Chain Wallet to the PancakeSwap decentralized exchange platform is quite simple. First, I have to add the wallet to my Chrome browser so I visit the website https://chrome.google.com/webstore/detail/binance-chain-wallet/fhbohimaelbohpjbbldcngcnapndodjp?hl=en. On the site I click, add to Chrome:

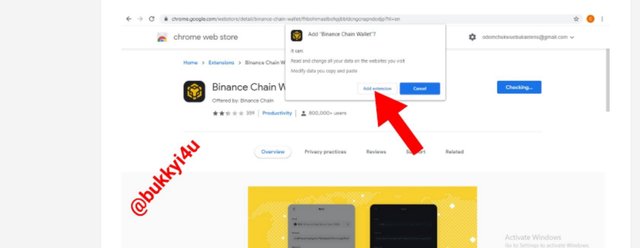

Then I click add extension

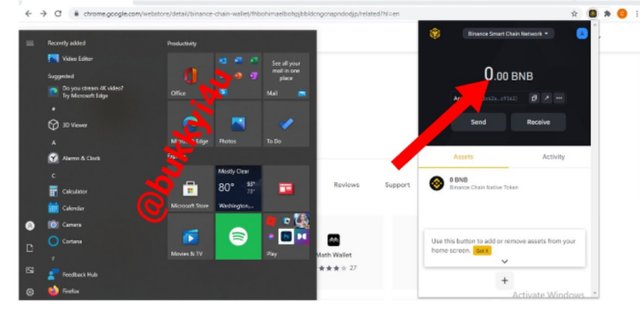

This automatically adds the Wallet as an extension to my Chrome browser as indicated below:

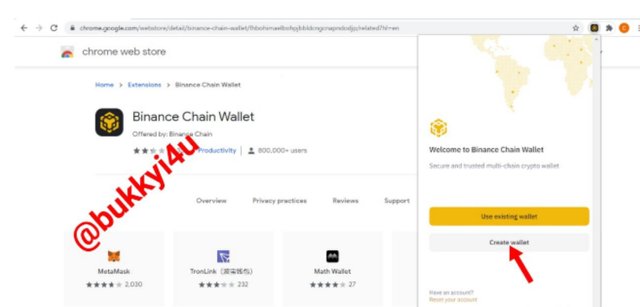

I have to create an account in the wallet. So, I click on it to reveal the pop up below from where I click create wallet

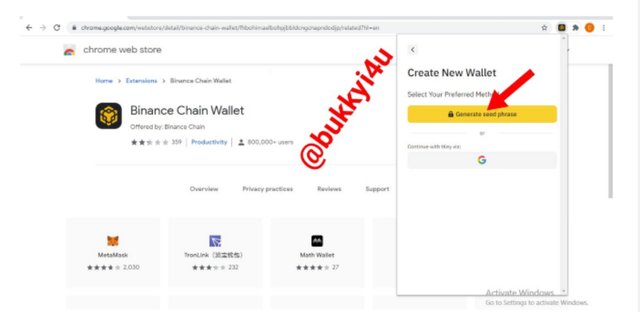

Then I click on generate seed phrase

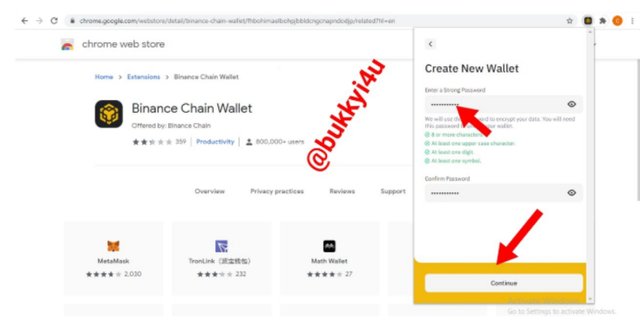

I then enter a new password and click continue

Then I have to enter the seed phrase generated after which I click continue

This automatically creates the wallet account as shown below:

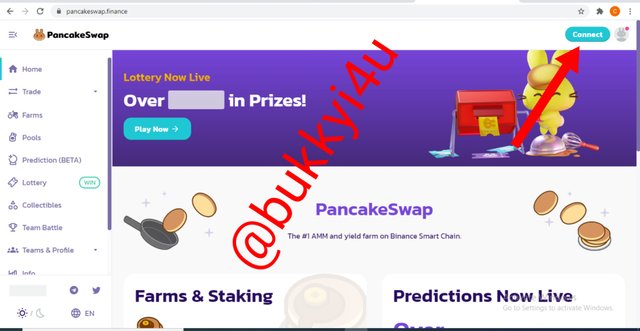

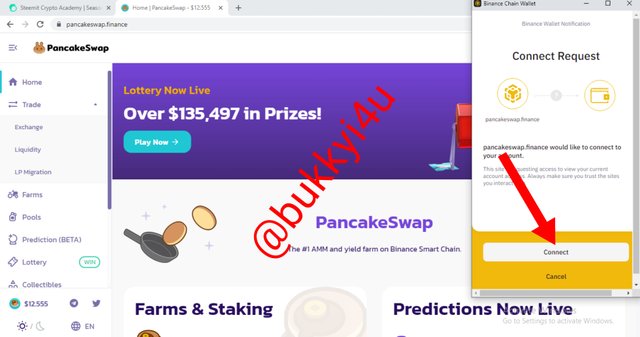

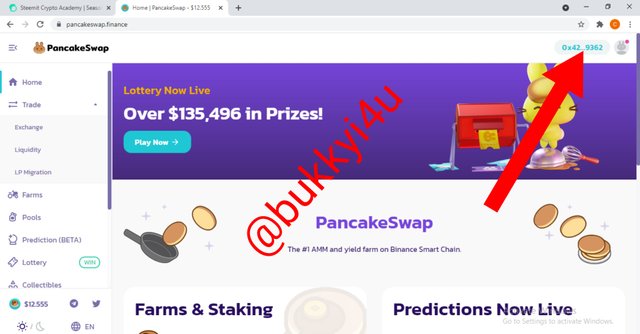

Then I visit the PancakeSwap site to connect the wallet. I click on connect

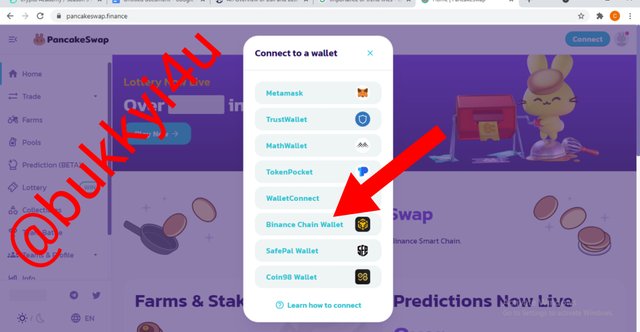

This displays the icons below and I select Binance Chain Wallet

On the pop-up that shows I click connect

This automatically adds the Binance Chain Wallet to the PancakeSwap decentralized exchange as indicated below:

Which coins will you staking with, what is the APY/APR

In performing the staking I used CAKE-BNB. It has an APR of 65.44% and promises made a lot of interest in the long run. Although I only staked just a little amount for the purposes of the assignment I think I might have to explore this option of investment later even as I have seen some coins that offer as much as 200% APR.

Assuming the APY or APR of the coins you chose for staking and the current market value of those coins remain stable, how many coins should you have in one year? In US dollars how much would that amount of coins equal?

Solving this can be quite simple anyway. It doesn't go beyond our little knowledge of simple interests. Obviously, it works in the manner that traditional banks issue out there simple interest on an annual basis.

Mathematically,

Simple Interest, SI = Principal X Rate X Time

In this case the principal is the amount of CAKE-BNB I staked which is 0.0005.

Rate is the Annual Percentage Rate (APR) which is 65.44% and

Time is 1 year

So, SI = 0.0005 X (65.44÷100) X 1

SI = 0.0005 X 0.6544 X 1

Therefore, SI = 0.0003272

The amount I will have by the end of the year can be calculated from:

Amount = Interest + Principal

Amount = 0.0003272 + 0.0005

Amount = 0.0008272 CAKE-BNB

So, I will have 0.0008272 CAKE-BNB coins by the end of the year.

To calculator what date will be in US dollar I followed the steps below:

From, the results of the staking, 0.0005 CAKE-BNB = 0.06 USD

So, 0.0008272 CAKE-BNB = (0.0008272 X 0.06) ÷ 0.0005 (that is, cross-multiplying)

Therefore, US dollar = $0.099264.

So, by the end of the year I will have 0.0008272 CAKE-BNB worth $0.099264 assuming the current prices do not change.

Technical Analysis On BNB/BTC

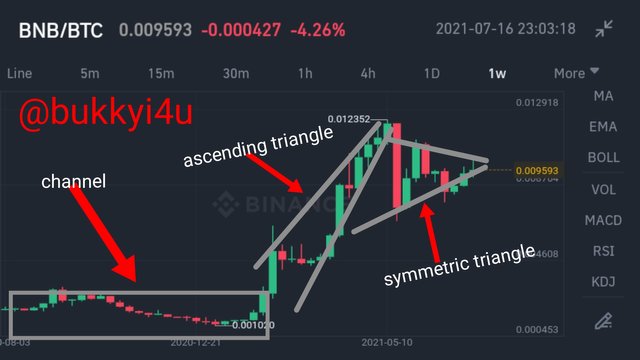

7 day (1 Week) Analysis:

BNB/BTC price chart on a one week or 7 days time frame, first shows a channel, then an ascending triangle followed by a symmetrical triangle. A price channel is usually seen in a situation whereby the price of the cryptocurrency asset becomes bounded within some sort of two parallel lines as shown in the chart above. The asset starts with a horizontal price channel in which case the market was finding it difficult to break above or below the visionary two parallel lines. This is often followed by a price breakout. In this case the price breaks to the upside with an ascending triangle which represents a bullish continuation in an uptrend pattern. This is followed by a symmetrical triangle which signals that neither the sellers or buyers are pushing the prices far enough to make a clear trend.

30-day (1 Month) Analysis:

BNB/BTC chart on the one month or 30 days time frame shows a pennant chart pattern. The Pennant Chart pattern usually signals a continuation pattern. They have converging lines in the periods of their consolidation. This Pennant chart pattern as seen in the chart above is formed by a large bearish movement - first - which is followed by a consolidation in prices. This is closely followed by a dip which suddenly breaks out into an uptrend followed by consolidation before another slight symmetrical triangle move that is followed by a slight fall in prices.

Technical Analysis On BAT/USDT

7 day (1 Week) Analysis:

The BAT/USDT 7 day or 1 week price chart starts with a channel followed by a Double Top. This price chart starts with prices trading in a channel. The prices are having a hard time breaking either above or below the two visionary trend lines. Eventually, this is followed by a bullish breakout which results in a double tops pattern. In the double tops pattern, the market makes two distinct unsuccessful attempts to break above a resistance or support level: a bullish push up followed by a downfall, then prices go into a bullish trend again and an eventual fall.

30-day (1 Month) Analysis:

The BAT/USDT price chart for one month or 30 days shows a head and shoulders price chart. The price chart starts with a head and shoulders chart pattern. First, there is a smaller move in the price of the asset which creates the first or left shoulder. A major move follows and is eventually swallowed up in another smaller move. This gives way to a slight fall in prices. There is a breakout resulting in an ascending triangle which is a quite bullish signal.

Technical Analysis On IOTA/BTC

7 day (1 Week) Analysis:

The IOTA/BTC one week or 7 days price chart shows a bearish season followed by a head and shoulders pattern. In the bearish season prices are making quick successive downward motions. Coincidentally, the bulls come in with so much buying pressure and there is a breakout to the upside. This results in a head and shoulders pattern that is marked by two smaller price moves of the crypto asset surrounding a much larger move of the price action. In the smaller move on the left side the prices make some attempt to break a sort of resistance or support level. There is a slight decline in prices which go up again. These prices come down to enter the second smaller move.

30-day (1 Month) Analysis:

The IOTA/BTC 1 month or 30 days price chart shows a Double Top followed by a channel. In the double tops, prices as usual attempt to break above resistance or support lines as a result of buying pressure or much supply. Eventually, the supply goes down. The high buying pressure is followed by so much demand which signals a downfall. There is an uptrend which tries to break above the resistance or support levels a second time but fails. This s results in a downtrend and prices eventually trade in a channel.

How can we differentiate a bearish season from a bullish season in the market?

A bearish season refers to a period in the observed trend of a cryptocurrency price chart where there is a marked recession and the prices of crypto assets or coins are generally experiencing decline in their values. Usually, the fact that financial markets and cryptocurrency markets particularly are known to be very much influenced by the attitude of investors. The term bearish season can also be used to refer to how investors usually feel about cryptocurrency markets and the trends that are likely to follow. As such investors that have bearish mindsets are referred to as bears. Generally, this period can be seen as a period of demand. It is marked by reduced volumes of trades and there is no buying pressure, rather there is much selling pressure

On the other hand, bullish season refers to a period in the price chart of cryptocurrency assets that is marked by a rise or increase in the prices of crypto assets in which case the conditions of the economy and the market are generally considered to be favourable and fruitful to bullish traders. Typically, in a bullish season the market experiences increasing prices which are sustained for quite some time. A bullish season can also be used to refer to a period where the assets of crypto hodlers who do not even engage in trading activities experience remarkable increase. This season is usually marked by an increase in volumes of prices and there is so much buying pressure in the market. Generally, it can be seen as a period where supply is high.

CONCLUSION

The cryptocurrency space is evolving at a much faster rate than anybody had envisaged at the start. Actually, this is due to the fact that there are so many interesting and often very important and crucial use cases of cryptocurrencies that are now making them an indispensable part of world history. Some of these use cases can be seen in staking of coins to earn higher profits. Although this functions like the traditional fixed deposit banking, it is way more profitable in most cases. This is due to the fact that in places like Nigeria, for example, where you would be lucky to come across fixed deposits that offer as much as 16% per annum, in the cryptocurrency space there are some coin staking(fixing) opportunities that offer even as much as a 200% annual percentage rate.

The trend pattern of cryptocurrency price charts are very important in the cryptocurrency space. This is not just because traders who are actively engaged in the trading of cryptocurrencies would always be very eager to skim off some profit from the trades they may have entered, rather it is also important in that, generally, it affects how cryptocurrency is seen by the onlookers. Some onlookers and potential investors or potential adopters of cryptocurrencies are always very particular about the price trends. For them this, in a way, tells them the viability of crypto assets.

Thank you for participating in the Third Season of the Steemit Crypto Academy.

Congratulations, you did a great work.

Continue to strive, I look forward to continuing to correct your next assignments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit