Edited with canva

1. What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

Actually, cryptocurrency investment refers to a process whereby conscious efforts are taken to purchase crypto tokens at prices where they are either expected to go up or down. In most cases when cryptocurrency investments are made it is because the prices are expected to shoot upwards. This is the general notion for the crowd but a few more experienced investors equally learn how to short the market as a way of making investments in cryptocurrencies. Over the years cryptocurrency has come with very important and disruptive technologies like the blockchain and this has seen a lot of widespread adoption of this new phenomenon by the crowd who believe that a lot of gain is inherent in the project.

However, there are still some groups of people who believe that these may not be very good investments, after all. These are those who believe that better investments should be made into projects with more solid concepts as they generally believe that cryptos are just speculative just like every other currency that does not have the ability to generate any kind of cash flow. Instead, they rely on you buying them at lower prices and expecting another person to come and fill your sell orders at higher prices. This even makes some institutional traders manipulate the entire market at the risk of the retail traders; this makes this kind of investment a no-go area for some die-hard detractors of cryptocurrencies.

Nevertheless, there is a very strong case and effective argument in support of investments into cryptocurrencies. Looking at the trajectory of a lot of crypto coins one can argue that they do stand to be good sources of investment and even when the prices are going down it only requires a little more experience to learn how to profit from such downtrends.

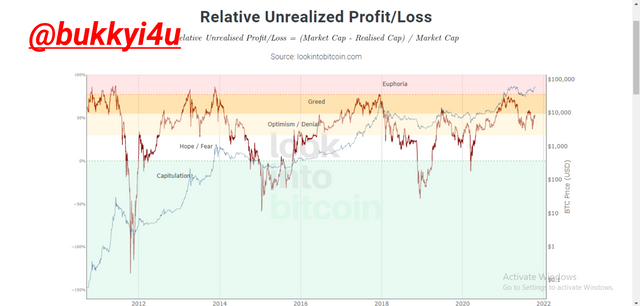

On-chain metrics

All the same, it all boils down to the strategy one adopts when going into cryptocurrency investments. To start with, it is expected that someone should only be making investments into things that he is well aware of. This means that when one steps out to make investment he should research on the underlying crypto-asset and the project behind it to ensure that they have a strong and operable use case that has the ability to draw crowds and push investments upwards.

This may further lead a wise investor to research on different ways to actually diversify his crypto investment as this has become the in thing. This is because it would not be good to put all your eggs inside one basket but choosing from different projects that have strong use cases could mean that even if one does not succeed, another could perform remarkably well and give you your expected gains in the longer run.

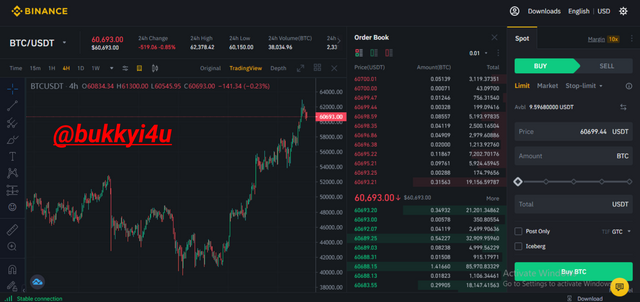

Again, this may require that someone researches on the different platforms and how they operate. This could require researching on different cryptocurrency exchanges and learning how coins are traded. You will then have to understand the basic functionalities and features of the platforms to ensure that you do not use them negatively against your investments. For instance, one who does not know how to use the OCO order may not understand that he can both plan to take profit from a trade while equally cutting down on his losses. So, a proper knowledge of the functionality of the Binance exchange would suffice in this regard.

Again, it is also necessary to understand that cryptocurrency wallets usually come with private and public keys. While a good understanding of these can help you to properly store your assets, if you do not understand that private keys should never be released to someone else then you could lose your investment as you can mistake this to be the bank account detail when it is actually your bank account password. So, a basic understanding of private and public keys and their functions will equally be necessary when making cryptocurrency investment.

Binance Exchange

Furthermore, when investments are made into cryptocurrencies, it is necessary to understand how to analyse important on chain metrics that can help in giving you a good idea of what the market is probably going to do next. In this regard, the realised cap, MVRV ratio, and some other important metrics could be great in helping you determine when the prices of assets are probably going to reverse to inform your trading positions as this is the core of cryptocurrency investment.

Still on this, it will become necessary to understand the concept of technical analysis with the use of some tools that could help you determine possible trading decisions and most of all I usually advise people to understand the concept of smart money as this could be revolutionary in changing their trading patterns and ensure that they do not become baits for the large institutional traders.

Moving further, one can also and should also learn how to use different charting tools, for instance, TradingView, to produce such important indicators as Fibonacci retracements and be able to mark out important levels when drawing price charts for analysis. There is so much to learn when it comes to making investments into cryptocurrency and it is always necessary to gain the required knowledge before putting in your funds to avoid being stopped out of the market entirely, especially by large institutional traders who are always looking to use the inexperienced ones.

2. Talk extensively about the following. Also, highlight the benefits and risks associated with each.

Private Sale in Cryptocurrency.

This is the very first stage in the ICO. Nevertheless, at this stage the founders are required to have completed every necessary detail and documentation which includes the white paper for the project. Here the founders begin to search for potential investors. However, it is mostly big investment companies, large funds or investors, venture capital investors or groups of wealthy individuals that are approached in this stage.

They are usually approached personally by the top management and the team behind the project who show them all the details. The team has to make a strong and effective case and answer every single question and make all necessary clarifications to the potential big investors. Some investors may simply go in because of the preferential treatment it gives them and the hope and assurance of always being able to meet the team behind the project at every instance of the project's development.

Generally, the founders may always put a limit on what they intend to receive as an investment from this level or stage. Once this amount is achieved this stage could just be closed in from abruptly. However, in most cases the private rounds may fail to bring in the required or anticipated maximum investment. This would usually make founders to go on with the succeeding stages.

Benefits:-

Some of the benefits associated with the private sales in cryptocurrency include:

- It helps to provide the needed funding for the fulfillment of the goals and completion of the underlying project or blockchain

- Founders could receive effective networking from powerful investors who may become incredibly drawn to the project

- When investors participate in the private sales, they stand to make a lot of gains as they usually buy the tokens at much cheaper prices

- The investors can also receive preferential treatment as they get to even know the people behind the project

Risks:-

Actually, there are some drawbacks or risks associated with private sale and they include:

- Usually, KYC of the investors is required by the founders and this offers no privacy

- If the private sale does not succeed then no rewards should be expected by the investors

- The investments could stay unprofitable for a long time before eventually going public on tradable platforms

Presale in Cryptocurrency.

This is the next stage after private sale. Most times it will just be the friends and families of the founding members of the project who get to participate here. At this stage the investors are not expected to be as wealthy as the private investors in the first round. However, a big investor who may have missed the first round can still come in here.

Usually, the discount and bonus at this stage may not be as that received in the first stage. However, it can still be better than the crowd sale or public sale. Investors who come into this round earlier may still benefit more than the later ones. In most cases word-of-mouth is just used but advertisements could also be shown on social media and on the project's website.

There isn't too much spending on marketing here and founders may come very close or actually achieve their maximum investment at this stage. So, this period constitutes the optimum round for people who do expect the project to succeed but may not be willing to invest in the private sale round.

Benefits:-

- Pre-sales equally bring in a lot of gain to the investors as the prices are still low

- If the pre-sell stage actually comes then the token is already probably gaining traction with its road map and this offers more security and assurance in investment

- The funds gotten from this stage can also be committed towards putting finishing touches to the project concept

Risks

There are some risks associated with this stage and they include:

- This stage could come with a higher minimum on the investment that should be made and this could cause investors to even spend more than the average investor in the crowd sale

- Even if the presale succeeds it is not a guarantee that the ICO would. So, there is the risk of loss of capital

Public Sale in Cryptocurrency.

This stage is the most common and is usually visualised once ICO is mentioned. Groups, individuals, large and small investors all have this round open to them. Investors probably just need to register online at the company's website to be able to participate. Usually, there is heavy advertisement at this level especially if the goals had not been achieved in the private and pre-sale stages.

Most times they may not be a lower limit on investment except for the minimum number of tokens that can be possessed. It offers the lowest risk but comes with lower bonuses and discounts. At this level the founders usually expect the investment base and reach to become larger. Once the concept behind the project is properly explained to the public, huge fundraising could come in at this stage.

Benefits:-

Some of the benefits of the public sale in cryptocurrency include:

- This stage offers investors more privacy as KYC may not be very much required

- This stage offers the lowest risk for investors as a large community may have been behind the crypto by now and you can even gauge the success or otherwise of it by yourself

- Participating at this stage equally offers more gains to the investor than those who would buy it on exchanges though it comes with less gain than those who bought it at the private and presale stages

- At this stage liquidity is increased as even investors can exchange trades while equally benefiting from possible referral programs

Risks:-

Some of the risk associated with this stage include:

- This stage normally involves prices that are higher than the first two stages

- This stage may not come through if the investor reaches his target ICO at the earlier stages

- This stage may still not be a guarantee of the success of a coin

- Investors could eventually lose their phones and some ico's have eventually proven to be rug pulls

3. What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

There are quite a number of mediums that can be used for private/pre and public sales. They include:

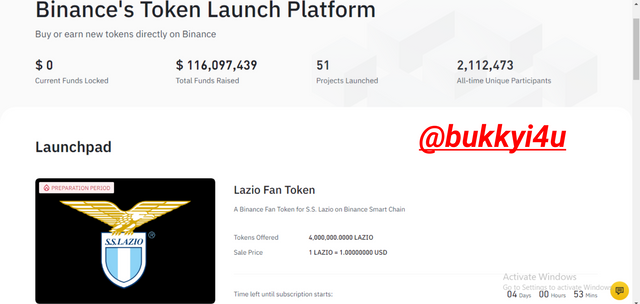

Crypto Launchpads

Crypto launchpads refer to different platforms that list crypto projects when they are at their infancy stage. Such launchpads are usually the first to introduce the relatively new projects into the world of investors who may wish to participate in the fundraising activities of the projects that could be in there initial coin offering initial exchange offering or initial decentralized exchange of rain stages.

In most cases, it is the crypto exchanges that use launchpads to hold IDOs, IEOs or ICOs. Some of the most popular crypto launch parts include the Binance Launchpad, Red Kite, TrustSwap, Polkastarter and the Unicrypt Launchpad. The Binance crypto Launchpad is particularly noteworthy. Most of the coins launched on this platform have often become very successful as it simply means that the coins would be exposed to the over 14 million users of the platform.

Binance Launchpad

The image above represents statistics from the Binance token Launchpad. Over 51 projects have been launched with an all-time $116,097,439 funds realised and with 2,112,473 unique participants of all time currently dealers your farm token is in its launching.

Websites Of Cryptocurrency Projects

Another popular resort for the sales of cryptocurrencies is usually the websites where such projects are domiciled. Usually when crypto projects want to be taken seriously they would take the pain of putting up websites where they can put important documentation including their white papers for public review of interested investors.

In many cases these websites can also act as points of exchange where we can simply either purchase or exchange our other crypto assets for the ones that are being launched.

4. Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded)

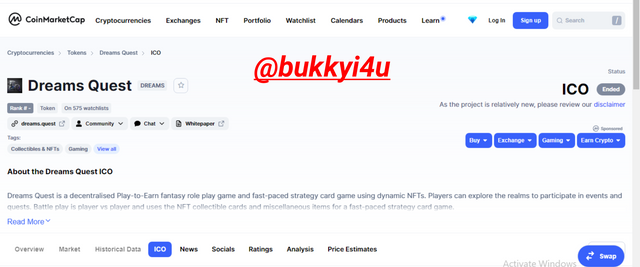

I would like to talk about the Dreams Quest ICO. Interestingly, this particular ICO is listed on coinmarketcap as one of the discontinued ICOs. The initial decentralized offering of this token was recorded to have been held between 14th and 15th of October 2021 and ended one day ago today.

It is a play-to-earn fantasy game that has a fast-paced strategy which involves the use of NFTs that are dynamic in nature. It is dynamic in nature and the players are usually expected to explore different kingdoms or realms by simply taking part in different quests and events being held. The mode of gameplay is between different players.

Source

The tokenomics of the game is designed in such a way that players can earn by participating in quests, tournaments, events and battles which are ultimately meant to test the skills of such players. Conquering or winning more of these adventures would earn you more loot and reward in the game.

In these quests players can discover new lands and even uncover new valuables which they can loot. These looted valuables can be traded, upgraded or even sold as a way of earning more. Card packs which are created by the users can equally be rented out.

Source

Within the game battle, you would encounter unknown conditions like storms, temperature, weather and other things that are meant to affect the character and the attribute of the player adversely. There are miscellaneous cards in the form of magic cards and weapons which can be used to affect the attribute of players positively and help them overcome their foes. Once each battle is completed the outcomes are recorded on chain after being converted to NFT.

Within the game, there are two realms or two sides. Each side consists of 3 nations that have a lot of races within them. In each realm, there is the Celestial side that captures our attention with wizardry and magic. Equally, there is the internal side that deals on strength, classic battle cards and dexterity in gameplay. When players select which sites they want to be on it would now enable them to choose which nation they hope to be fighting along with.

Important Dreams Quest Statistics

| Parameter | Dreams Quest Statistics |

|---|---|

| Tokens for Sale | 3,958,333.33 DREAMS |

| Tokens Sold | N/A |

| ICO Price | $0.012000 |

| Where to buy | DuckStarter |

| Soft Cap | $50,000 |

| % of Total Supply | 0.099% |

| Fundraising Goal | $50,000 |

| Accept | TBA |

| Personal Cap | 100USDT - 255USDT |

| Access | Public |

Source

TokenSuRance(TSR)

The coin I would wish to create is the TokenSuRance (TSR) coin. This would be a coin which I would anonymously develop on the Tron blockchain with the TRC-20 token standard. It has become a common and harrowing experience in our society today that most of the very productive and best of the workers and employees eventually end up incurring a lot of debt on retirement. Other times, they would lose every form of financial security they could ever boast of and in the worst-case scenario insurance companies may fail to give proper account of monies collected from these workers AS insurance premiums and the companies are not only held accountable because some of them may be linked to powerful government quarters.

Sometimes even lawsuits are unable to bring them to account and a lot of aged retirees eventually die in this tedious process. In such climes as Africa in general and Nigeria in particular, some workers do not even have any insurance to boast of because they may not even receive their salaries on a regular basis. The root problem behind the inadequacies and inefficiencies in the insurance world here in Africa is CENTRALIZATION.

In the backdrop of this reality, TSR is to be created. The idea behind this coin is that rather than salary earners going for unreliable insurance companies, they can begin to purchase the token and keep them for use in the future. To ensure that the coins are not tampered with or used before time it will take into account your current years in service and the number of years remaining and the coins which you possess will be fixed by a time period. This will ensure that the coins can only be released to you once you have attained the age of 67 which is 2 years after retirement or 37 years from the time you were employed into the service which is 2 years after the normal 35 years in service.

Interesting projects under this concept include:-

- TokSureLend: This would enable other users to borrow the tokens while interest accumulates for the employees whose tokens have been borrowed.

- TokSureSwap: Here swapping function will be enabled for the tokens where they can be exchanged for other tokens and transaction fees are generated to be used in maintaining the super nodes of the network and to accumulate interest for the employees.

- TokSureUtility: This would be a utility function which ensures that workers who are making use of this insurance platform can pay for the utilities like NEPA Bill and health bills from the transaction fees generated as interest.

For our goals to be achieved, we need financing to ensure stability in the project and to maintain the super nodes. To ensure the stability of the project by establishing stability for the tokens we would be pegging the TSR to gold. So, the money to be raised from the ICO would be to buy enough gold bars and store up as reserves to maintain the token as a stable coin.

An investment target of $150 million is estimated while the maximum cap is to be at $200 million. We have capped the total supply for the coin at 500 million.

First Private Sale:-

- The first private sale is timed for January to March 2022

- At this time the price of the token would be kept at $0.065

- For a start, 100 million tokens are to be allocated to 100 different countries

- Funds to be realised from this venture would be $6,500,000

Second Private Sale:-

- The second private sale is time for April to June 2022

- Now the price would be raised to $0.1

- An additional 150 million tokens would be allocated to the different 100 countries

- Funds estimated to be realised from this stage would be $15 million

Third Private Sale:-

- This stage would be timed from July to September 2022

- The price would remain at $0.1

- At this stage, another 100 million tokens would be allocated to the 100 different countries

- Funds estimated to be realised from this stage would be $10 million

Generally, in the first three stages of the private sale of the token:

- The total funds realised from the concluded private token sales was $31.5 million. This is a far cry from the estimated minimum of $150 million

- The total number of tokens distributed was 350 million

- At this stage 70% of the total or maximum supply has been achieved

Once we had concluded the private sales stage, in order to fully realise our required maximum capital to proceed with the project the remaining 30% of the maximum supply was put up for sale through a public ICO.

Public ICO Sale:-

- The public ICO is going to hold on the 7th of November 2022

- Now the price will be put at $1.2

- The remaining 150 million tokens will be allocated

- A total of 180 million in funds is estimated

Adding the $180 million realised from the public sale with the $31.5 million realised from the private sale, a total of $211.5 million would be realised and this will be greater than the estimated maximum target. Once this is made we would follow up with our planned project and take steps to be listed on exchanges and on coinmarketcap.

6. What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

If coinmarketcap must accept your request to list a coin then the request should pass the three tests underlisted:

- Credibility test: this checks whether the one who is making the request is able to substantiate that the coin is credible with verifiable evidence

- Verification test: this seeks to ascertain whether the source of the evidence backing the coin can be verified by coinmarketcap independently

- Methodology test: this seeks to ensure that the proper method of application is used

Criteria For The Review Of Listings

Because coinmarketcap receives so many requests to list coins on their platform they devised a criteria which recognises five distinct steps that are described below.

Tips For Application (Section A)

As a criteria, the application tips for coin listing must be followed and they include:

- You are advised to go from section A to E before making any submission

- Priority is given to request that are well structured with proper backup information

- Submissions must be made through correct options and coins must be submitted through coin option.

- Requests that are skeletal should never be submitted but properly enunciated before being submitted

- Should provide verifiable evidence and sources while equally maintaining truthfulness

Guidelines For Tracked Listings (Section B)

For Coins:-

- The coin must have a block explorer together with a website which must be working

- The coin must use cryptography and have a consensus algorithm as well as a peer-to-peer technology or smart contracts enabled

- The coin must be traded on a recognisable exchange publicly and actively

- There has to be a representative that can be interacted with

There are different kinds of listings for coins. These are tiers that may still favour a coin even if it does not meet the track listings criteria. They include:

- Inactive listings

- Unverified listings

- Untracked listings

Framework For Evaluation (Section c)

Usually, the exchange would still on its own conduct very thorough research into the coins and they base their conclusions on:

- The market pairs and trading volume of the coin

- Interest and engagement from the community

- The traction or progress of the coin

- The team behind it

- The product of the coin or its market fit

- Uniqueness and the innovation of the coin

House Rules (Section D)

- Requests can only be submitted with the use of the online form

- You should not bother trying to reach them through social media or emails

- Don't submit request more than once

- Avoid the use of angry comments

Delisting Policy (Section E)

When applying you should understand what could get your coin delisted even after being successfully listed. These include:

- Low trading liquidity or suspicious trading activities

- Lack of noticeable advancement with the project

- If information provided during application is later determined to be false

Centralized Exchange Listing Criteria

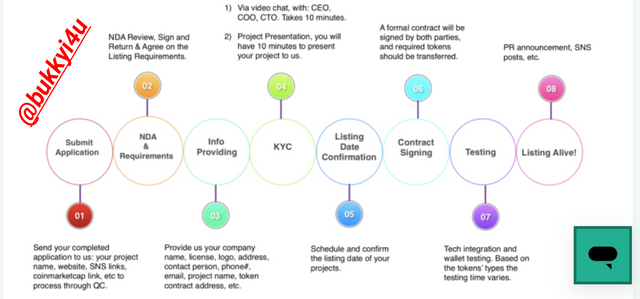

Different centralised exchanges follow different rules and criteria when listing coins. I will be describing the criteria for coins to be listed on KuCoin exchange. These criteria are in stages and you are expected to follow them through.

Source

Stage 1

- You must submit your application to them by providing the website name, coinmarketcap link, SNS link, etc of your coin

Stage 2

- This is the NDA and requirements stage where it is reviewed and feedbacks are sent to you

Stage 3

- This is the info providing stage where further information like contact person, license, project name, company logo, token contract address, etc are required from you

Stage 4

- This is the KYC stage where you take about 10 minutes as a CEO, CTO, COO with video call to explain more about yourself and a coin

Stage 5

- If you pass the requirements then you your coin will be scheduled and you will confirm the date for its release

Stage 6

- At this stage you sign a live contract and the tokens required will be transferred to the exchange.

Stage 7

- This is the testing stage where the wallet will be tested and the technology will be integrated based on the type of token

Stage 8

- This is the stage when the listing eventually goes live

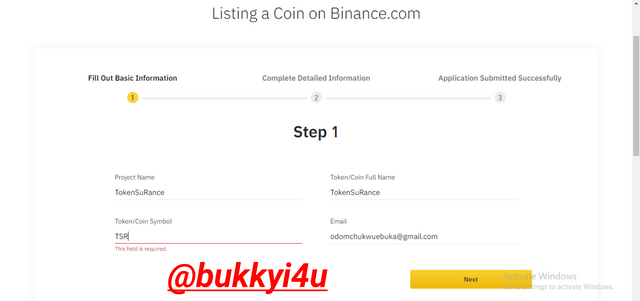

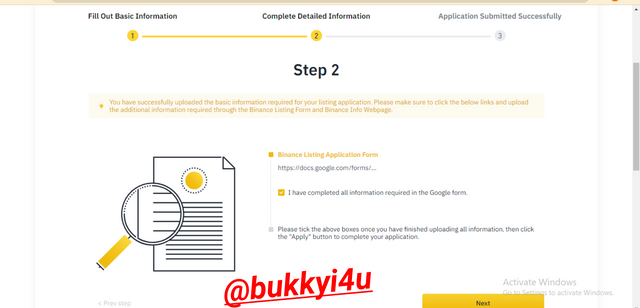

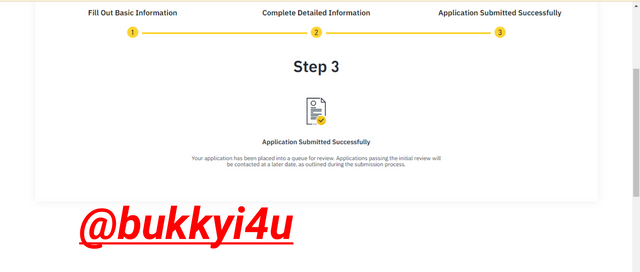

I will now show the procedure for listing a coin on Binance since this procedure on KuCoin involves a very tedious process that will actually use your real identity.

On Binance, this involves three simple steps that can be completed through binance.com/en-NG/my/coin-apply

- The first step requires that you provide all the information related to the coin which can include the name email address symbol and its project

- The second step requires that you submit the form after checking the boxes

- The third step is the actual submission of the application

CONCLUSION

The idea of investment into the world of cryptocurrency has come with mixed feelings in some quarters. While there are a few die-hard detractors who do not see this as being worthwhile, there are quite very strong and ardent believers in the potentials of cryptocurrencies especially as tradeable tokens that have high volatility.

Whatever the case maybe it is always advised that before 1 steps how to make any investment into cryptocurrencies he should undertake adequate Do Your Own Research (DYOR) measures and not just rely on me hearsay to inform his decisions. One of such interesting ways to make good crypto investment is to seek opportunities to participate in ICOs or IEOs so that when the coins eventually get listed on exchanges we would be on the winning side as has mostly been seen in other cases.

Cc:

@fredquantum