This week's lesson delivered on the psychology of market cycles by professor @allbert has proven to be very timely and helpful in increasing my knowledge of the different emotions and feelings that surround cryptocurrency trading. In participating in the homework task given, I decided to answer all the questions.

Explain in your own words what FOMO is, wherein the cycle it occurs, and why

The Fear Of Missing Out (FOMO) is a term that is generally used to describe a sort of social anxiety that makes cryptocurrency speculators think or believe that others are already having a good time making gains by trading an up-trending cryptocurrency market without themselves being involved. This feeling is usually seen with people who may not have much knowledge skills on technical analysis but rely on news making the rounds on social media, top picks news outlets, stories of young millionaires who become rich overnight from cryptos suddenly shutting upwards in price. In some cases friends and neighbours who may have participated in the onset of the bullish run could be making mockery of those who may not have, thereby creating a sort of, "it's either now or never!" sensation.

screen from Binance

Usually, this particular feeling would occur at the cusp of a particular bullish season of a cryptocurrency asset. This refers to the place where the market cycle is inadvertently set to experience the usual downward reversal of price movement.

This fear of missing out in the buying pressure may often be caused by some basic human emotions:

Belief: In this scenario, some people who may have been following the asset or hearing about it or hearing that somebody like Elon Musk suddenly made a fortune from acquisition of cryptos would become interested. Now they see cryptocurrencies as a potentially huge investment that could rake in a lot of returns. This belief had been seen in the market when Elon Musk suddenly declared that Tesla had made over $100 million profit from Bitcoin.

Thrill:Immediately spectators get convinced that this is a worthwhile investment. Suddenly such people might decide to go out of their way to pull out hard-earned resources in order to participate in the bullish season. Interestingly, they spread the rumour equally and those around them may decide to join the rat race for glory. Haven been fully convinced of the credibility of the investment, some may not even put any limit on what they spend in expectation of suddenly becoming very rich. This cycle has been observed in the crypto-currency market in October, November and even middle of December 2020. People were all over social media with calling signs for crypto investments. The BTC thrill had continued even into January and February this year.

Euphoria: Due to buying pressure, the market experiences an increase in volumes and prices go up even higher as the whales come in with large buying activities. At this stage of euphoria the prices keep hitting the highs and even reach new higher levels. Following the BTC thrill, prices had gone even higher and hitting an all-time high of over $63, 500 on the 14th of April.

Complacency:As the prices hit near the highs, both the whales and such other traders who have an idea of technical analysis and who know what they are doing decide to start taking profits. The market begins to experience reduced volumes as a result of large sellout activities going on. In the BTC saga this stage had led to the retracement which resulted in prices hitting as low as $29,800 on the 21st of July. Unfortunately, the new inexperienced investors propelled by greed may hope and believe that the prices would make a recovery. So, they retain their positions, much to their peril. Uninformed people who see this as minor retracements may still buy in.

Explain in your own words what FUD is, wherein the cycle it occurs, and why

Fear Uncertainty and Doubt (FUD) is a term that is generally used to describe a kind of strategy that is meant to influence the perception of people over some cryptocurrencies or cryptocurrency markets by the spreading of misleading, negative or false information. Usually, it refers to the emotions that are experienced by the entire crypto community or, at least, a majority of the uninformed spectators or participants as crypto coins undergo the usual temporary bearish seasons. In some cases cryptocurrency enthusiasts would employ this term in describing any factor that opposes cryptocurrencies generally.

screen from Binance

Normally, these emotions set in on the part of the cryptocurrency market chart where very large sellouts begin to occur and prices begin to nosedive making people who had bought in at the peak of the fear of missing out, and wrongly anticipating that prices will continue upwards, begin to experience a lot of anxiety. This is mixed with denial of the reality, panic, capitulation, anger, depression and even disbelief as prices fail to recover from the bearish season. In some other cases, it can also be seen in a neutral case where some people do not just generally believe that cryptos are a good investment. This would be irrespective of whether prices are up or down.

There are some factors that have been identified to be the causes of FUD in cryptos, namely:

- Anxiety:The anxiety stage is where the people who may have been hoping that prices will recover from the minor retracements that were seen in the complacency stage are suddenly shocked by a further dip in the prices of the asset. They become anxious that the current deep is lasting longer than expected.

- Denial: Unfortunately, the prices go further down in this stage. There is so much uncertainty in the minds of the inexperienced crypto investors but they console themselves with the thinking that since their investments are with great companies, they would be a comeback. However, they are not very sure about this.

- Panic:Eventually, the prices go further down and even enter into a range - being unable to break above or below certain resistance and support levels. Out of more fear, some of the inexperienced investors begin to sell off some of their investments.

- Capitulation: Unfortunately, as the prices plunge deeper, even the little they may have decided to hodle are sold off entirely. Such investors would exit the market completely at this stage. This stage is almost closest to the bottom.

- Anger: All of a sudden the market hits the bottom. This stage of anger sets in. In the minds of the new investors they begin to play the blame game. They begin to ask who had caused the shorting of the market. Some may even begin to blame the government for allowing crypto to thrive!

- Depression: As the prices remain at rock bottom, people begin to regret their losses and regret having wasted so much in an uncertain market.

- Disbelief: Suddenly - as envisaged by the experienced traders - the market begins to make a recovery. Unfortunately, the inexperienced losers would not have any of it!

Generally, the above emotions describe the reason why fear, uncertainty and doubt are sometimes seen in cryptocurrency markets. Prices would usually go down because the whales decide to sell off and take profits. Out of fear the general public joins this selling trail and prices plunge further down much to the surprise of the new investors.

Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

XTZ/BTC PAIR

screen from Binance

In the case of this particular XTZ/BTC crypto pair it can be seen that the market is in the depression stage according to the psychology of the market cycle described by professor @allbert. In this stage the market has obviously gone into a range. Previously prices had gone from low trading volumes to higher volumes and eventually consolidated at a flat top. Much selling pressure set in probably as a result of whales shorting the market and the public joining. Prices didn't make any recovery but have gone further down and are now trading at rock bottom.

This current depression stage caused by large sellouts of the asset may see some inexperienced and new investors nagging and complaining. Some may have even gone into regrets as a result of having borrowed funds or deeping into their savings to buy the asset hoping for gains. Such people will be greatly disappointed now and will generally exhibit fear, uncertainty and doubt towards the crypto.

BNB/BTC PAIR

screen from Binance

The second asset I have chosen to examine is the BNB/BTC pair. Currently, it can be seen that the market is in the complacency stage. Prices had hit the highs at 0.012352 but rather than continue this upwards trajectory it made a retracement down below 0.007937. there was a momentary recovery which continued in what now looks like the onset of a downtrend but precisely in the stage where FOMO buyers may still be expecting that prices would make a huge comeback.

Actually, this stage of complacency may have been caused by a lot of selling pressure marked by reduced volumes in the market due to large sell-offs of the asset occurring near the highs. Momentarily the buyers set in hoping to push the price up but this buying pressure is unsustained as a result of being met with larger supply of the asset. This drives the price a little lower than the retracement and it is currently hovering around 0.007937.

Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.

In making this purchase and transaction I discovered that the NULS/BTC crypto pair is currently in the depression stage based on the psychology of market cycles studied. Prices have hit very low and I intend to purchase and hold for a long time to sell back near the highs.

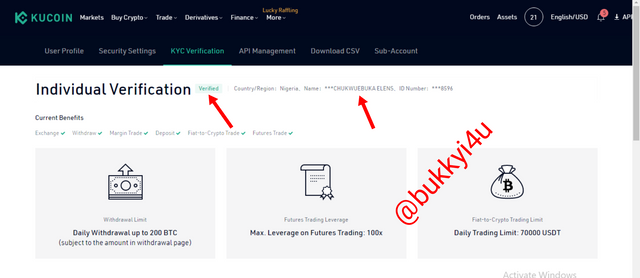

I am going to be making the purchase and investment with my Kucoin verified exchange account whose screenshot is displayed below.

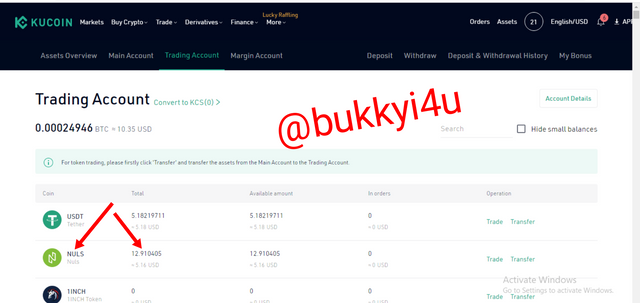

In the trading portal as shown below I open a limit buy order for 12.910405 NULS at the price of 0.00000965 BTC.

The order is filled and is displayed in my trading account as a held asset as shown below together with its $5.16 USD worth.

CONCLUSION

The psychology of a trader which involves all the feelings and emotions he is likely to encounter in trading is one which is very vast and broad. While some of them may be helpful, embraced and encouraged, others like nervousness, fear, doubt, uncertainty, complacency and anxiety should be controlled and contained.

For one to overcome and contain these different wrong emotions and feelings that could come with being in the market at the wrong time or not understanding what is happening behind the price action it is important to equip yourself with the necessary knowledge. Learning how to avoid the fear of missing out, the uncertainty and anxiety that may be inherent in the market would be dependent on how much of the psychology driving the market you are able to comprehend.

Hello, @bukkyi4u Thank you for participating in Steemit Crypto Academy season 3 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit