For quite some time now the P2P marketplace and P2P cryptocurrency exchanges have been gaining more strength and momentum . Obviously, they seem to be emerging as viable alternatives to the centralised exchanges. Moreso, this momentum is further strengthened by the stark realisation that the centralized exchanges are quite prone to attacks and hacks which have actually occurred in some cases even for very large exchanges like Binance. However, at the moment, P2P marketplaces do not have so much liquidity. Nevertheless, from the rate of acceptance they have enjoyed so far you can bet this situation could change anytime soon. One of the major advantages of these P2P marketplaces is that you have an opportunity to either buy or sell cryptocurrencies with fiat currencies at a much easier or faster rate. Furthermore, you may not even have to worry about KYC and verification processes.

One of these fast rising P2P marketplaces that has gained so much acceptance and popularity is LocalCryptos. Founded in Australia, based in Richmond and owned by LocalEthereum Pty Ltd, the platform avails people from all walks of life all around the world the opportunity to exchange their local fiat currencies to the currently listed assets (which include Ethereum, Bitcoin, Litecoin and DASH). On the platform users have the opportunity of posting ads which can either be buy or sell ads. While doing this there is an opportunity for the users to state some important trade variables and set some trade determinants. To make the trading experience much safer, secure and trustworthy there is the presence of an on-chain escrow service which would help gain the faith of users. The exchange is available in English, French, Russian and quite a good number of other international languages that is more than 10 in number. I am going to explore a few features of the local crafters exchange in each in the succeeding sections.

How do you set up an Exchange niche(non-custodial) in Localcryptos? (Complete process & Screenshots needed)

In setting up a non-custodial exchange niche on local tribals I followed a simple step

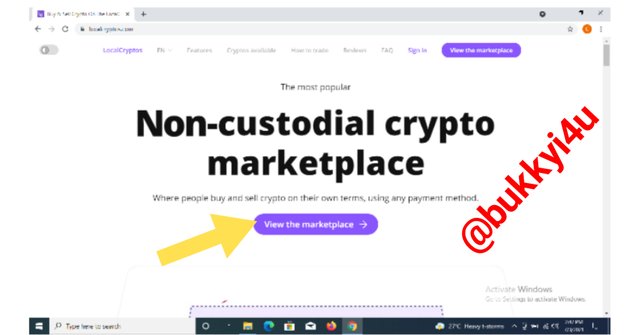

- First of all I went to the website https://localcryptos.com/ then I clicked on the view marketplace symbol

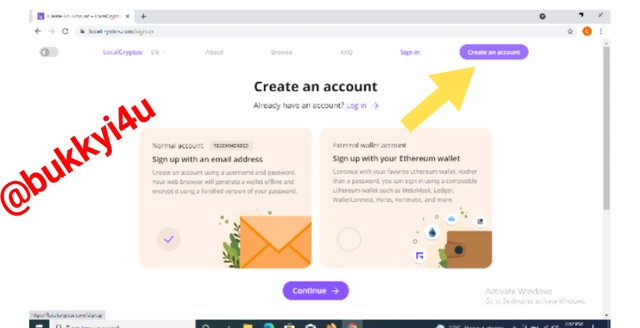

- Once I clicked on this symbol another symbol which says create an account appears on the top right corner

- I then clicked on the create an account symbol which appears.

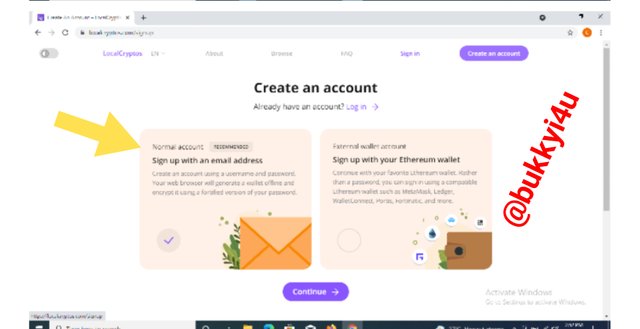

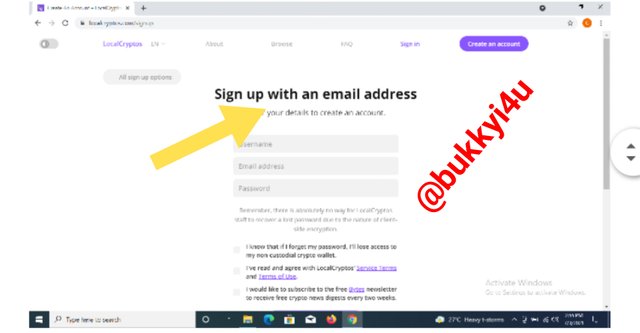

- This takes me to the page where I have to complete the account creation process as shown below and from the screenshot I discovered you can either choose to create the account with your email address or with your Ethereum wallet address. I decided to create the account with my email address

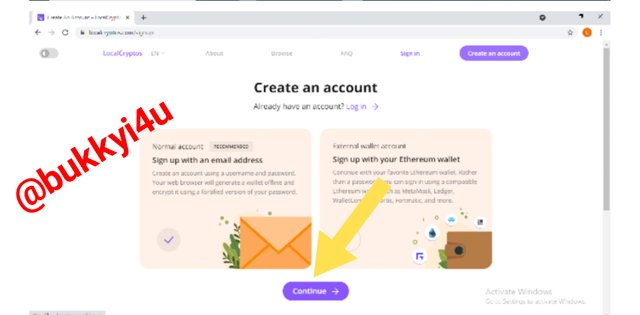

- Then I clicked on continue in continuation of the account creation process. This takes me to the page where I have to fill in some details like user name, email address and password.

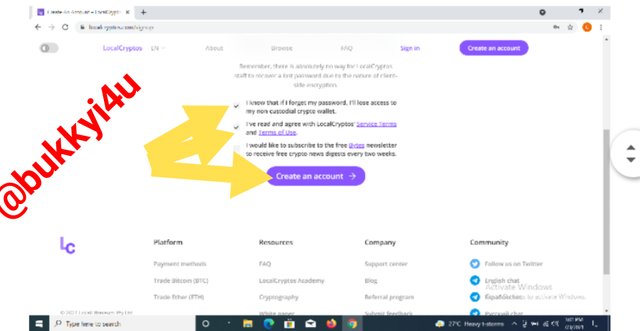

- After filling in the username, email and password I had to agree to the service terms and the terms of use and also check the box to agree that if I forget my password I would lose access to my non-custodial crypto wallet as shown below. Finally, I click on create account.

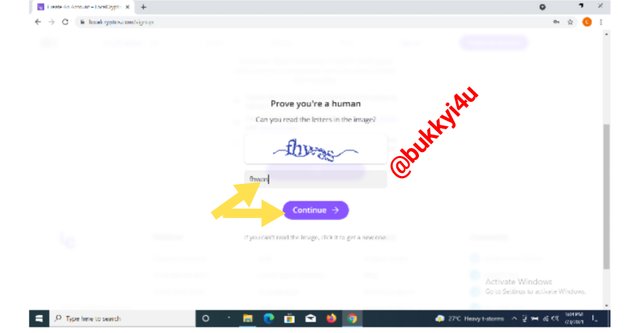

Haven done this, another page opens up where I have to go through a sort of test that requires me to retype some letters that are displayed on the screen and then click on continue.

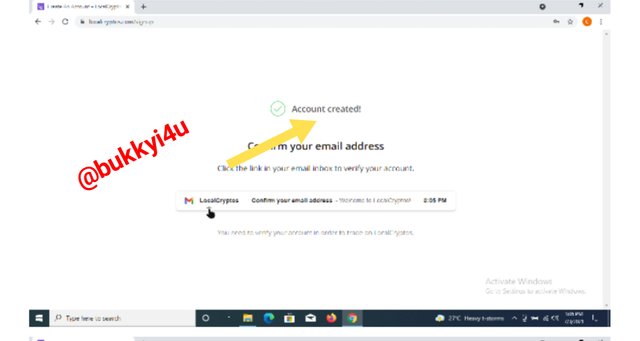

Once I clicked on continue another screen which displays account created shows up and then I am directed to go to my email inbox to verify my email account.

A message is sent to my email and I then click on the message to confirm my email

After doing this I received a message which confirms that my email has been successfully verified.

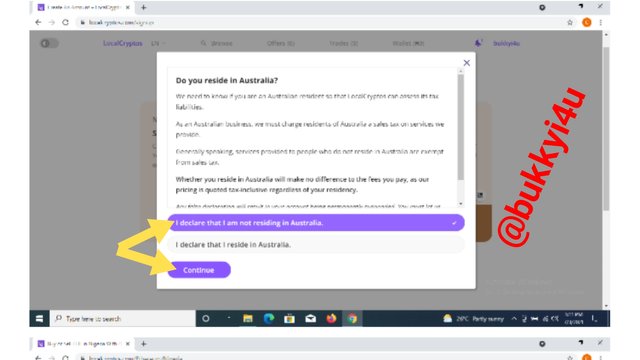

After confirming my email another message pops up on the screen and requires me to equally confirm whether or not I am an Australian citizen for the purpose of tax verification.

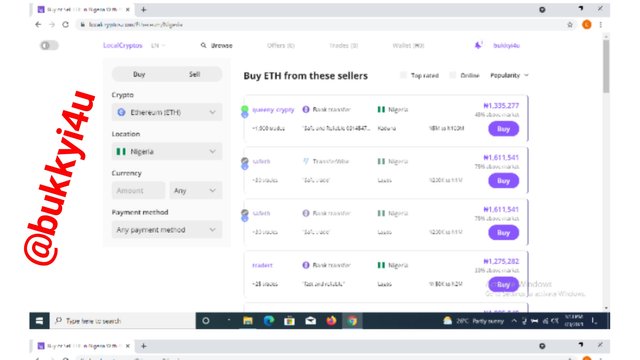

Once this last step is completed I was launched to the homepage of my exchange niche that has just been created on Localcryptos.

Indicate your non-custodial wallets (BTC, ETH. LTC, DASH) in Localcryptos? How do you secure the keys? Can you re-import the wallet of Localcryptos in other wallets(of different services) For example, Can you re-import your Locaclcryptos wallet in Trustwallet?

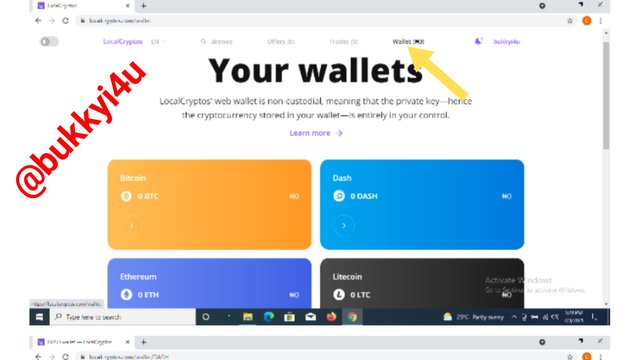

In indicating my non-custodial wallets which include the BTC, ETH, LTC and Dash wallets on Localcryptos I simply followed the steps below:

First, it requires logging in into my exchange niche on local crafters however since I am still logged in I simply had to click on the "Wallets" icon located at the top of the screen inside my exchange niche account.

This automatically displays my different wallets domiciled inside the exchange niche. As you can see my BTC, DASH, Ethereum and Litecoin wallets are displayed with their zero balances.

How do you secure the keys?

In answering this question it is worthy to note that all of these cryptocurrency wallets available on the exchange in each I just created do have private keys attached to them. With these private keys deposits can be made into the exchange niche wallets.

In order to reveal these private keys you have to click to gain access into the particular wallet you need to open.

In this case I have opened the DASH wallet. This reveals my DASH wallet with all its details. Inside the wallet to the right is displayed my private key for the particular digital asset that underpins the wallet.

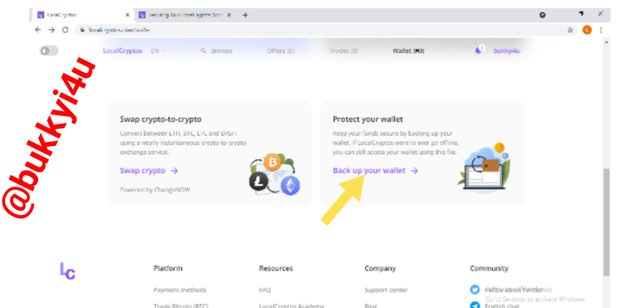

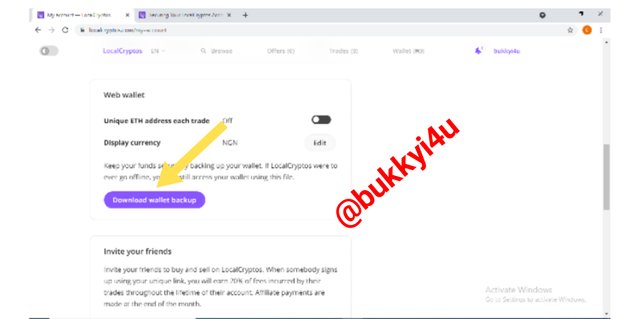

Now, down to the question of how I would secure my wallet's private key. Actually, in securing my wallet private key on the LocalCryptos exchange niche I would first of all make use of the recommended option which is to backup my wallet private key and then download the wallet backup. This should be the very first thing to do once you have signed up for this exchange niche. You should quickly back up your wallet keys and then download the backup file. This gives you the ability to view the private key of your wallet independently. You can always make reference to this file which can be stored offline such that in a case that the exchange itself should ever go offline you would still have access to your stored private key.

In order to download these wallet backup files I would go to the "Protect your wallet" section which is located to the bottom left-hand side on the wallet tab and follow the "Backup your wallet" prompt which appears as shown in the screenshot below.

In ensuring the safety of this quality backup file which I have downloaded I would decide not to store it on my computer system. It would be better for me to store it in a, let's say, USB flash drive which must be encrypted. If I ever for any reason decided to store it on my personal computer, then I would have ensured that the PC is completely free of malware. Again, I will save it in a folder which I would encrypt with a strong password.

In a more traditional way I could even just simply decide to copy out the private key and safely keep it where I can always access it, however this may be quite bulky.

Can you re-import the wallet of Localcryptos in other wallets(of different services) For example, Can you re-import your Locaclcryptos wallet in Trustwallet?

Actually I discovered that it is possible to re-import your wallet private key to an external device or wallet like the trust wallet. This is due to the fact that it is a non custodial exchange niche. This means that even if the company should also go into extinction, you can still import your wallet into another device and lay claim to your cryptocurrencies inside. Let me demonstrate how I succeeded in importing the Ethereum wallet private key from my LocalCryptos account to my Trust Wallet account.

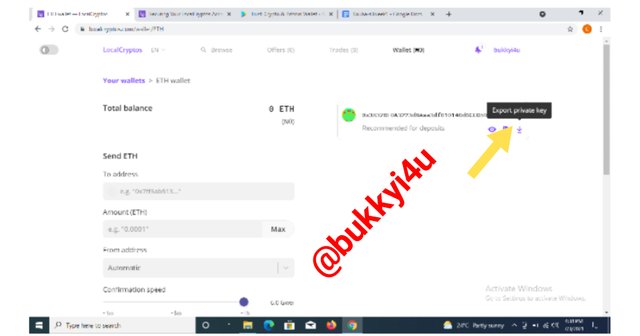

- On the ethereum wallet I clicked on the icon indicated below that says export private key.

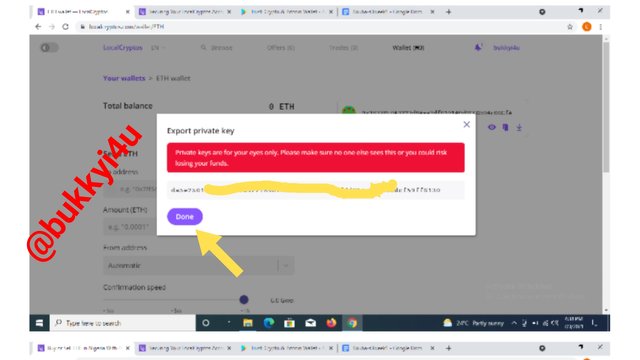

- A pop-up displays the private key to be exported from this Ethereum wallet. I then copy the private key and head over to my trust wallet.

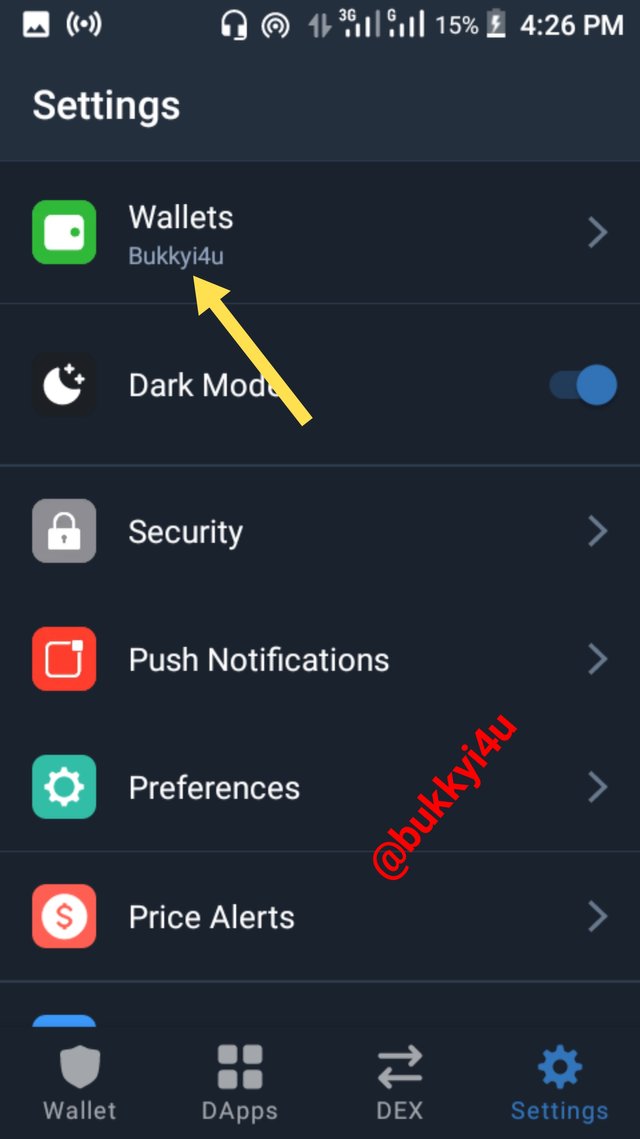

- Once on my Trust wallet homepage on the settings tab I click on wallets as shown below

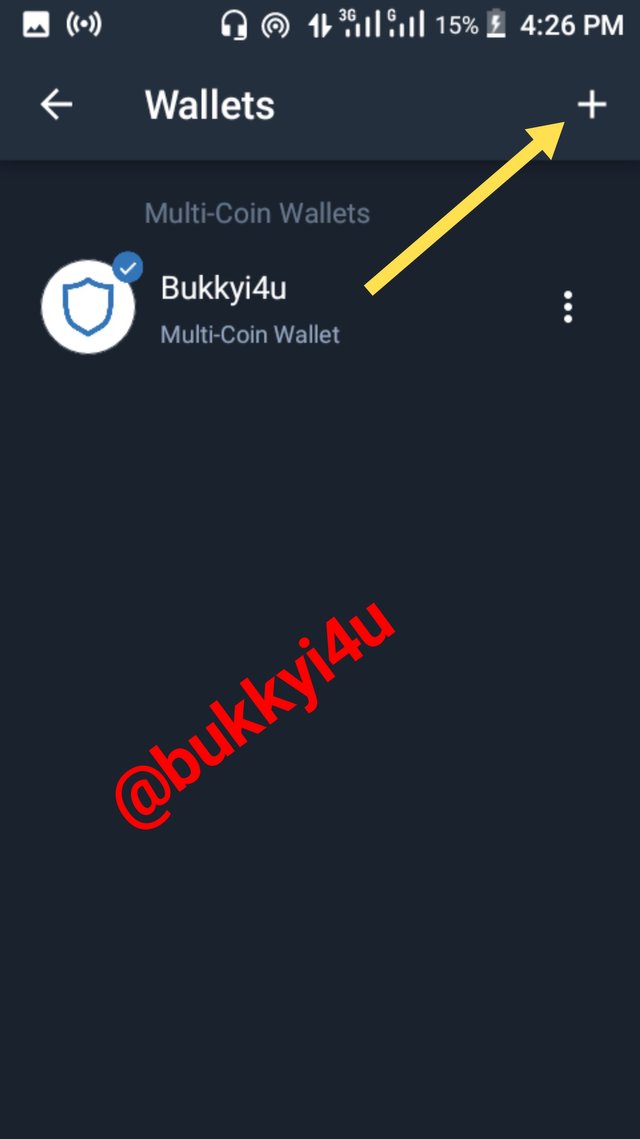

- This takes me to a new tab and I click on the "+" sign to start the process of importing the ethereum wallet from the LocalCryptos exchange niche account.

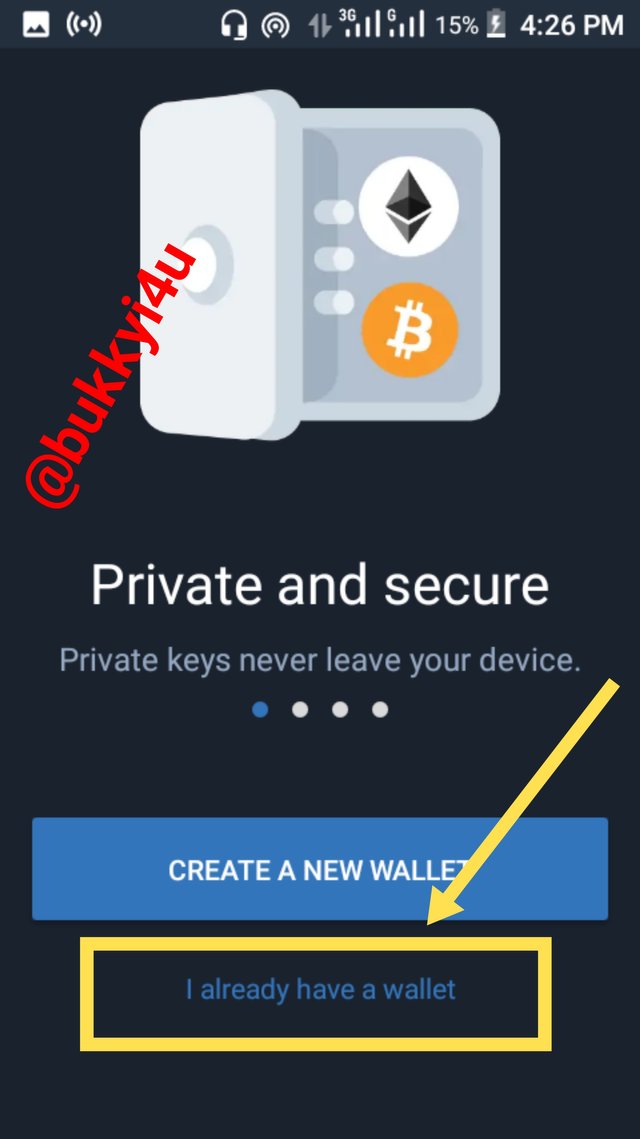

- On the new tab that opens when I click on this "+" icon I selected "I already have a wallet" as shown below.

- A new tab opens and I click on "Ethereum" as shown below:

- This takes me to a new tab where I have to input the private key of the wallet to be imported. However, this new tab does not support the taking of screenshots obviously for the sake of the sensitive private key that would be pasted on it.

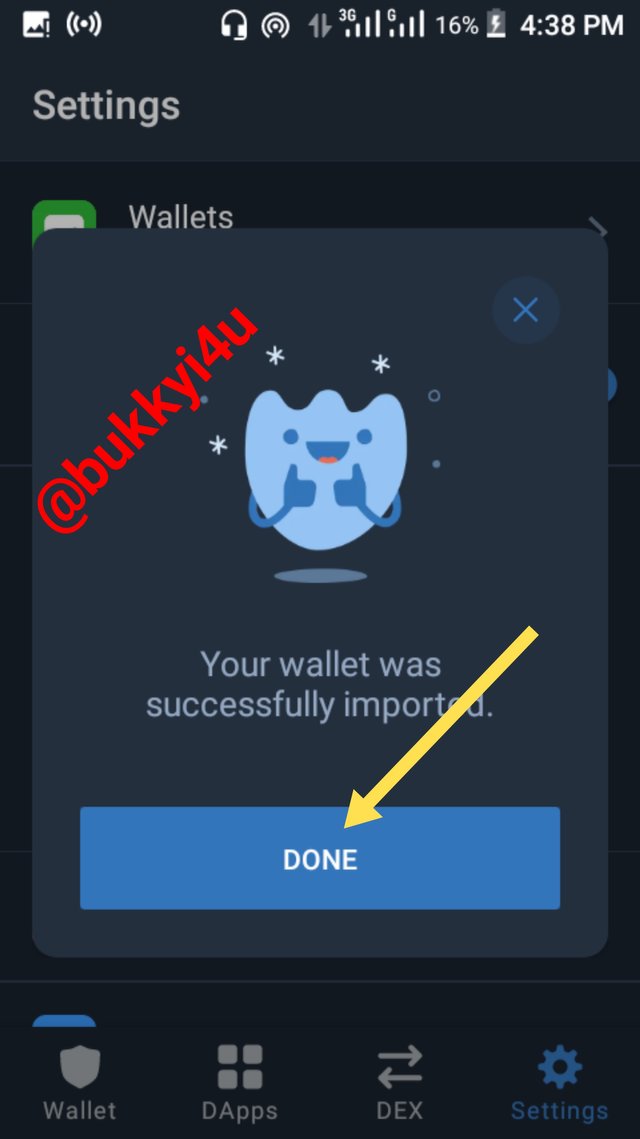

Once I had pasted the private key and given the wallet to be imported a name which reads "LocalCryptos Ethereum Wallet" I received a message which shows that the import process had been successfully completed.

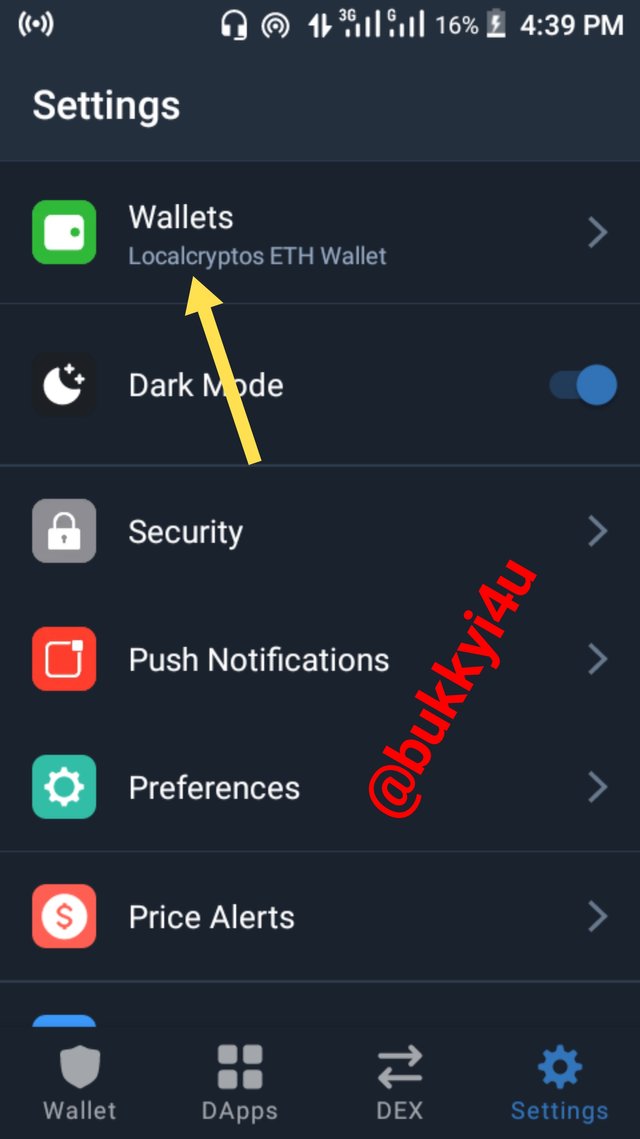

- On the image displayed above I clicked Done and this takes me to the settings tab with the imported wallet displayed as shown below:

How many different fiat options available in Localcryptos?

Wow! Knowing the exact number of different fiat options that are available and can be seen on the LocalCryptos exchange niche was quite an assignment. However, I was able to count out a total number of 166 different fiat currencies available on this platform!

How did I do this? From the screenshot below I simply clicked on the space below "Currency" from the dashboard as if I'm about to either buy or sell a crypto. Once this was done the different fiat options were displayed and I took my time counting all of them from the very first United States dollar to the very last Zimbabwean dollar.

How secure is Localcryptos as a non-custodial P2P Market? How does escrow protection safeguard both buyers and sellers?

From my observation LocalCryptos is a quite secure non-custodial P2P marketplace. This is due to the security measures that I have observed to have been put in place on the network. Some of these features are given below:

- Two-factor authentication:With the two-factor authentication in place you are required to authenticate your email for approval on every single login attempt. This would go a long way in preventing hacking or an unauthorised entity gaining access to your account.

- Escrow service:Whenever a user requests a trade to be made the digital assets are held on the escrow service provided by the LocalCryptos platform. Consequently, such assets will only be released when payments are confirmed.

- Conflict support and resolution:If a user should raise an alarm of foul play the system has a mechanism in place to quickly respond to customer complaints and render justice.

- Reputation system:Every user on the platform has a reputation rank which is publicly displayed. Furthermore, historical data on the trades each user has made is publicly displayed.

- End-to-end encryption: I also discovered that on the platform this service ensures that whatever messages that are shared between you and your trading partner would remain secret to the both of you and even the system is not aware of it.

How does escrow protection safeguard both buyers and sellers?

An escrow protection is a sort of financial agreement reached between the buyer and the seller in which assets to be transferred are held in custody by a third party who only releases such assets when all the terms regarding the transaction in view are properly met. Typically this is how the escrow service functions in centralised platforms or in the traditional world.

However, on a non-custodial P2P marketplace like LocalCryptos the buyer does not have to rely on any third party. Neither does the seller have to equally rely on any third party to safeguard the funds that are meant to be transferred in the fulfillment of the terms of the transaction. All the seller needs to do is to transfer the digital assets that are to be exchanged for fiat or another digital asset into a sort of smart contract.

Once the buyer has confirmed that the asset has been transferred into the smart contract he releases the funds required for the exchange of the transferred assets to the seller. In this way the escrow service has protected the assets of the seller which are to be transferred while equally protecting the funds of the buyer who wishes to make payment for the assets. In such a situation the escrow services are said to be on-chain and both the seller and buyer are interacting with the on-chain escrow service.

Some important things that should be noted about on-chain escrow services include:

- It gives full assurance to the buyer that the required assets to be exchanged would be transferred

- It gives the seller the opportunity to abort the transaction if the buyer fails to make the payment as agreed

- Once the seller puts the assets into the escrow he cannot cancel them

- The buyer is the one who has the power to cancel the escrow service

- If the buyer fails to meet the requirements within the time limit placed the escrow service automatically times out

- In the case of disputes, an arbitrator would step in to ensure that the funds or assets are released to the rightful party after reviewing evidence available.

Create an offer as Market Maker or Perform a real trade as Market Taker to demonstrate your real experience of non-custodial P2P trade(Crypto-Fiat)? (Hint- Trading DASH or LTC is cost-effective in terms of transaction and escrow fees)? How much fee in total did you incur in the entire process, if any? (Screenshots Needed)

I am going to demonstrate the process of market making on the LocalCryptos exchange niche.

I am going to create an offer to buy Litecoin. This is going to be done in three different steps, namely:

- Adding an offer category

- Adding payment details

- Creating ad details

Step 01

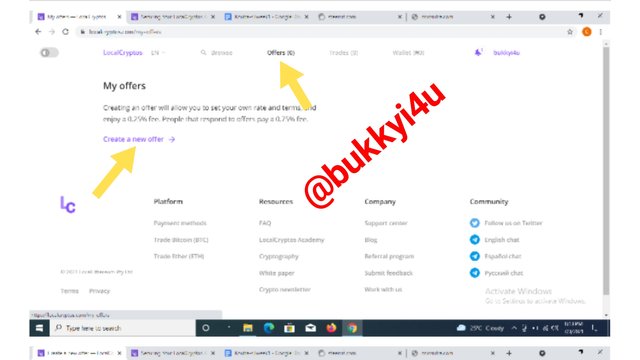

- To create an offer as a market maker who wants to buy a light coin I went to my exchange dashboard and clicked on offers. Then I clicked create a new offer as shown below.

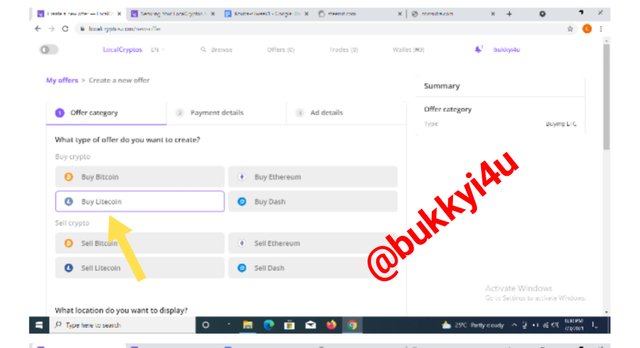

- A new tab under the offer category pops up and I select by Litecoin as shown below

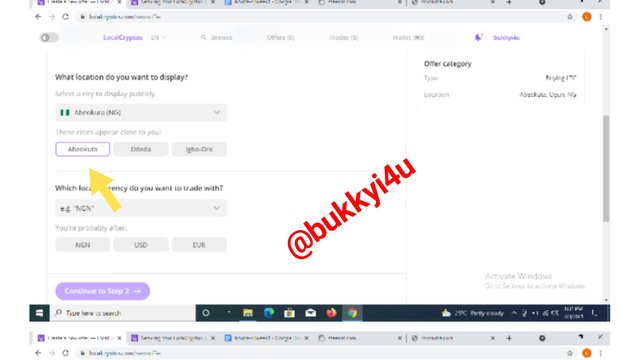

- I then filled in my location as Abeokuta

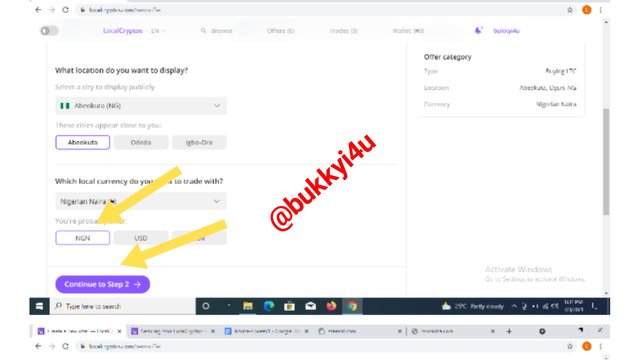

- Then I selected the fiat currency I want to trade with as Nigerian naira and then click continue to step 2

Step 02

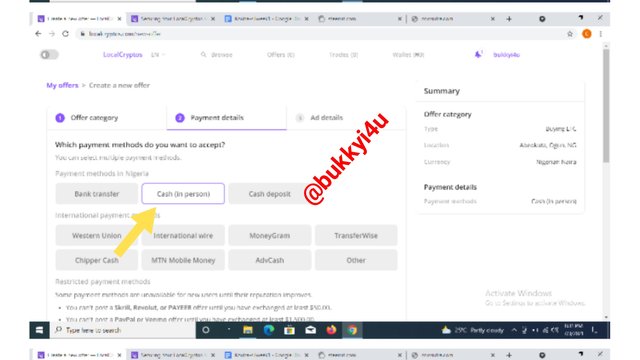

- On the step 2 which is the addition of payment details I had to first of all select the method of payment I preferred which is cash and person

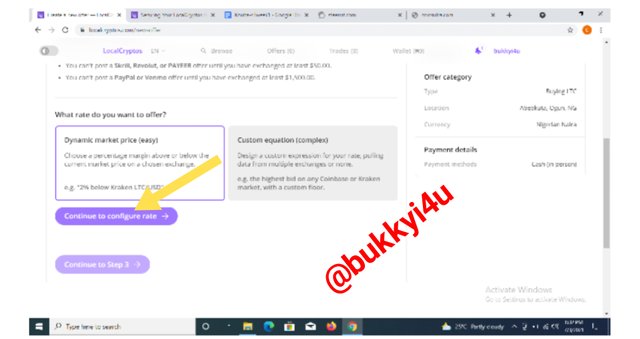

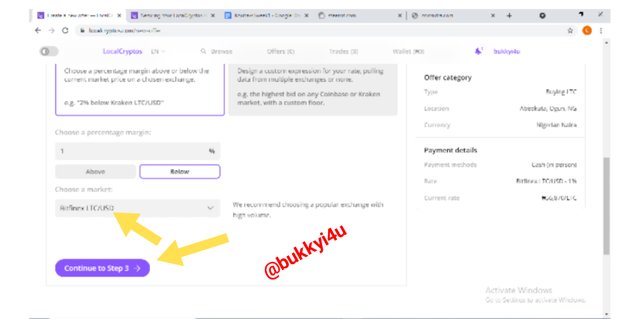

- Then I had to indicate the rate at which I would want to buy. I configured this to be at 1% below the current market price as seen on the exchange market which I would select subsequently

- Then I had to select my preferred exchange market and then click on continue to step 3

Step 03

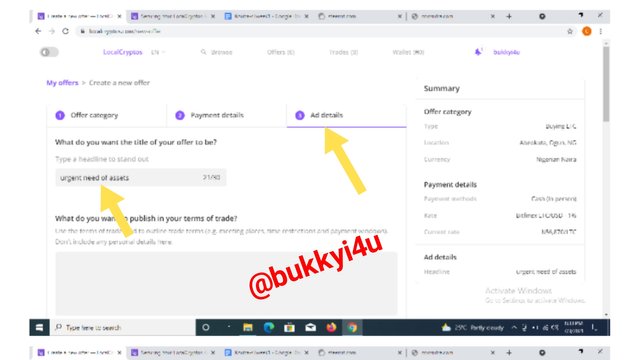

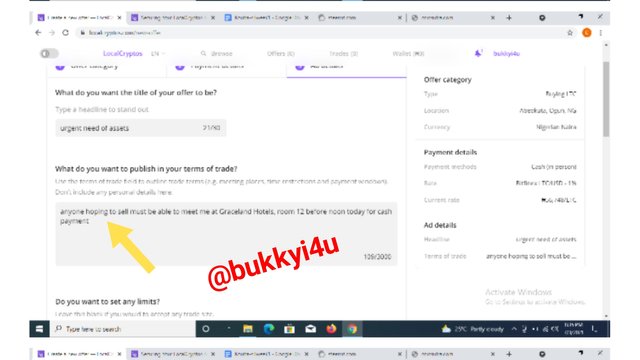

- In adding my Ad details on step 3. I had to choose how I would like the offer to be. In this case I they cleared it an urgent need of assets

- After that I had to publish a terms of trade and declared that anyone hoping to sell must be able to meet me at Graceland Hotels, room 12 before noon today for cash payment

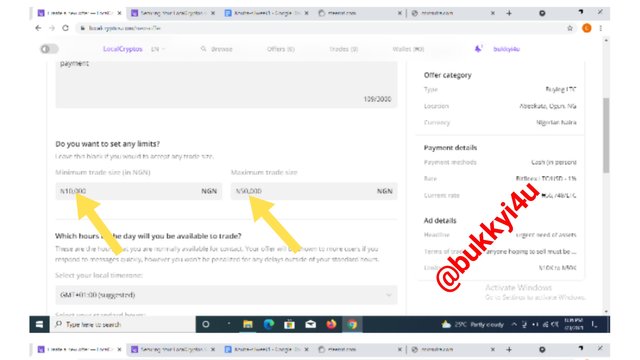

- The next option is to set a limit of the lowest and maximum amounts I would want to buy when converted to Nigerian naira. I set this to be at 10,000 naira lowest and 50,000 naira highest

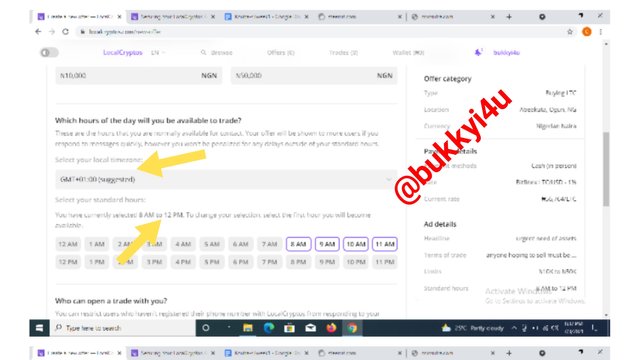

- After that I had to declare the hours of the day I would be open for business as 8 a.m. to 12 p.m.

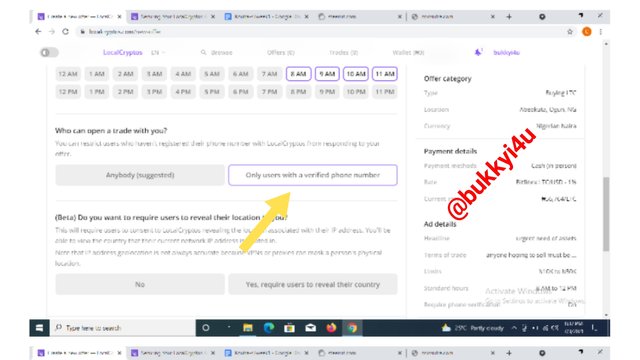

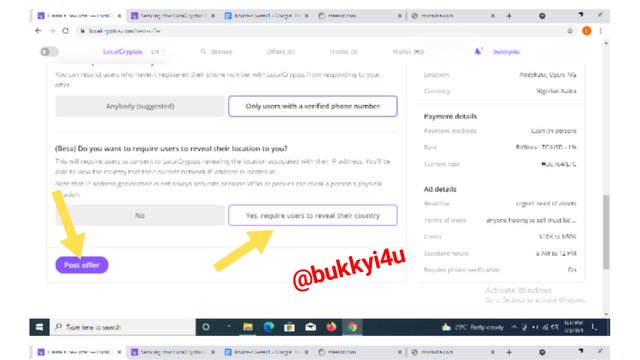

- Haven done this I have to choose the people that can open my trade as only users with a verified phone number

- After doing that I had to select that I needed potential sellers to reveal their locations to me and then I clicked post offer

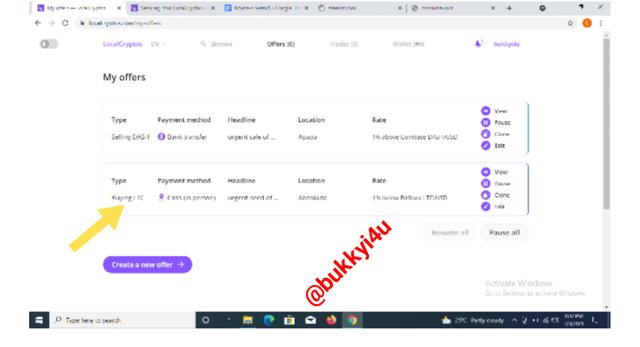

- Having clicked post offer, the offer is successfully added and displayed on my offers dashboard as buying LTC as indicated below.

CONCLUSION

In conclusion, I would like to say that from the look of things the P2P exchange marketplace has every possibility of becoming the future of trading digital assets of values especially when exchanging them with local fiat currencies. The P2P exchange marketplace has a great advantage in being globally available and people from all over the world can transact in a matter of seconds, even.

Equally, there are multiple payment methods that are enabled on P2P exchange markets. Furthermore, they can be accessed even in countries where exchanges are not allowed. Another important point is that P2P exchanges provide a lot of privacy and in some cases you just sign up with an email and verify your phone number. Moreso, they can be non-custodial and your assets do not necessarily have to be domiciled in them before you can make transactions. However, it is important to note that the two key issues of slower trading rates or speed and low liquidity should be amply handled in order for the P2P exchange marketplace to thrive more meaningfully.

Thanks to professor @sapwood for the interesting Steemit Crypto Academy season 3 week 1 lecture.