INTRODUCTION

Hello, dear Steemians, the Week 10 Steemit Cryptoacademy lecture delivered by professor @fendit on risk aversion, its strategies and high-risk products in cryptocurrency is quite strategic. This is based on the fact that a lot of people are now looking for ways to increase their coin holdings. Such ones if not properly informed may fall victims in an unguarded way to most of these high risk products. However, proper education and enlightenment is important so that one can make decisions in an analytical manner.

So, I feel honoured to participate in this week's assignment having learnt so much from the lecture, equally. I am going to cover focal points on risk aversion, the risk aversion strategy I would prefer, the risk aversion product which I find most appealing and why I do prefer it. Also, I will examine fixed savings, flexible savings, high-risk products, launch pools and provide informed and detailed explanations on how to set the investment I have chosen in Binance.

WHAT IS RISK AVERSION IN CRYPTOCURRENCY

To put it in the most simple terms, risk aversion in cryptocurrency simply refers to the inherent ability and the natural instinct of a crypto investor to rather settle for and prefer such investments as offer him more reliable and sure results than for such other investments which come with rather uncertain reward promises. This mindset and reasoning makes such an investor choose investments that have an uncertainty value that is low over such ones that come with uncertainties that are on the high side.

Usually, such a cryptocurrency investor would still prefer the investment with a low level of uncertainty even if it comes with lower monetary rewards. This means that even when the investments that have high levels of uncertainty promise a lot of monetary rewards that could be equivalent to those of low levels of uncertainty or even much higher, the investor will still settle for investments with lower risks or uncertainty. This makes him stick with his smaller amount of gains or profit while avoiding risky ventures that could make him lose all, eventually.

RISK AVERSION STRATEGIES AND THE ONE I WOULD PREFER

Usually, three very distinct strategies for risk aversion can be identified based on the stance of the crypto investor. It may be postulated that any of the three has been adopted. All the same, an investor can be said to have adopted any of these three strategies in risk aversion. Viz a viz:-

- Aggressive risk tolerance

- Moderate risk tolerance

- Conservative risk tolerance

Before deciding on the one I will personally adopt, let us, first of all, take them one after the other. Thus:-

1 AGGRESSIVE RISK TOLERANCE

Adopting an aggressive risk tolerance posture would mean that an investor pays little or no attention to the high risk involved in an investment. Usually, he goes for such investments as would give him higher returns even if it means undertaking higher risks. They are prone to high levels of uncertainty but would often reap higher rewards from their investment portfolio if the market is performing well. Most times, they are not in a haste to pull out their funds when the market is experiencing a lot of ebbs and flows. So, they patiently wait for when things will turn out better.

2. MODERATE RISK TOLERANCE

Usually, an investor who adopts a moderate risk tolerance strategy is not willing to undertake such aggressive risks as his aggressive risk tolerant counterpart; his investment portfolio is made up of a mix of low risk ventures with a few high-risk ones that would clearly define the amount of losses he may be able to manage. Adopting this strategy would mean that such an investor would earn less than his aggressive counterpart when the market is doing well. However, he would suffer smaller losses than his aggressive counterpart if the market should go bad.

3. CONSERVATIVE RISK TOLERANCE

The conservative risk-tolerant investors is very averse to risk. He prefers to settle for crypto investments that involve a lot of lower level of uncertainty even if it means very small or minimal monetary returns. This investor prefers the safety of his investments to very high returns from high risk ventures.

If I am to choose then I would personally prefer the MODERATE RISK AVERSION strategy. This is due to the fact that as much as I would want to earn high from my investments, I do not also want to lose my money unnecessarily. Be that as it may, I would choose a healthy mix of high risk ventures, which would clearly be based on my loss-bearing capacity, and the low-risk ventures. When the market is doing well I should expect to receive higher returns from my high-risk ventures. When the market is failing, I should also expect some reward from my low-risk ventures even if I am losing from my high-risk ventures.

THE PRODUCT I FIND MOST APPEALING

When considering such products as launch pools, staking (in the form of fixed and flexible savings) and high-risk products- like dual investments- I will definitely settle for staking as my most appealing and preferred product. Apart from the fact that I do not stand to lose my money unnecessarily from staking, the other two products mentioned- launch pools and high-risk products- come with a lot of inherent and underlying dangers that should make one to thread with a high level of caution when dealing with them.

My choice of fixed and flexible staking as forms of savings in the cryptocurrency market, especially on Binance is an informed one. This is due to the fact that they are not much different from the traditional fixed and savings account deposit we operate in such countries as Nigeria here in Africa. Flexible savings or staking functions just like the traditional savings account which would require you to stake or put up your coins to be locked for some time and expect some passive gains at the end of the time frame. However, in flexible staking or savings, you can always order the withdrawal of your coins. This makes the reward or passive income expected to be much lower. Unfortunately, an announcement on Binance on the 1st of October 2020 indicated that this form of staking may have been discontinued.

Also, I find the fixed option of staking or savings appealing. This works like the fixed deposit account we operate in Nigeria. You simply have to stake or lock up your coins for a specified period of time and expect passive gains. However, you do not have the option of pulling out your funds before their expiration time. I prefer this option because it will give me the opportunity of knowing that I can always lock up coins which I do not intend to use immediately. Again, it will help me to curtail or reduce miscellaneous or spontaneous expenditure and control my finances while equally saving up and even earning passive incomes on such funds which have been stored up as coins.

MY UNDERSTANDING OF KEY CONCEPTS THAT HAVE BEEN TAUGHT

FIXED SAVINGS

Fixed savings is one of the forms of staking that is available on the Binance exchange and a few other cryptocurrency exchanges. It refers to a situation whereby a crypto coin holder or investor reaches a sort of agreement with the exchange to receive a higher rate of passive income from his coins which he has locked up or staked. However, the coins which have been staked or locked up must necessarily stay or remain so for a period of time agreed upon by both the investor and the exchange.

FLEXIBLE SAVINGS

The flexible savings option which is also available on Binance is a form of passive income generating opportunity which allows users to lend out their coins and earn some interest from it. With this option you simply have to lend some of your crypto assets which are not immediately in use to the Binance margin option. All you need do is to indicate your Binance account as loanable and this option becomes activated. In this form of flexible savings you can always pull out your funds or coins whenever you like. This is unlike the fixed savings. So, the returns you will receive will be much lower in rate.

HIGH-RISK PRODUCTS

I once came across a Reddit user posting about making interest or gains above 115 per cent and 140 per cent per annum from Binance high risk products. I did not pick much interest anyway since I did not know what they were.

This form of investment is considered highly risky because it is prone to the high rate of volatility in the crypto market. Moreover, it is a 'dual investment' which involves the use of two different currencies and comes with an uncertain or floating interest at the end of the day. Although the annual yield rate at the end of the year will be fixed, the settlement you eventually receive will be based on the prevailing 'volatile' conditions of the two currencies.

LAUNCH POOLS

With the launch pool which is available on Binance you will use your already existing coins to earn new ones absolutely for free. Usually, in the launch pool section you would have to stake or own up for some time the coins you already have in order to earn or farm new tokens when they are released. So, you gather new tokens or coins before and after their listing. However, they are sure to be released as Binance will never list any token without a guaranteed release in its marketplace.

DETAILS ON HOW TO SET UP MY INVESTMENT OPTION ON BINANCE

The investment option most preferred by me and which I will now explain how to set it up on Binance is the fixed staking or saving investment option.

To set up a fixed or locked staking investment on Binance you should take the following steps:

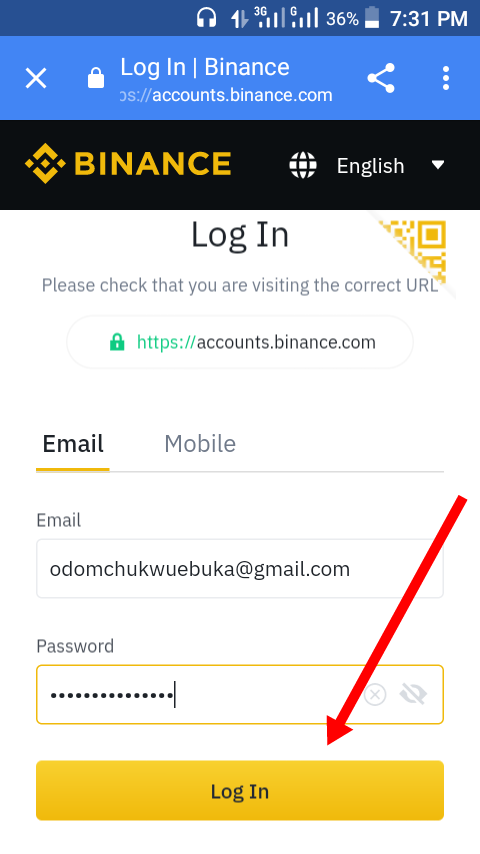

- First of all go to https://accounts.binance.com/en/login and login into your Binance account

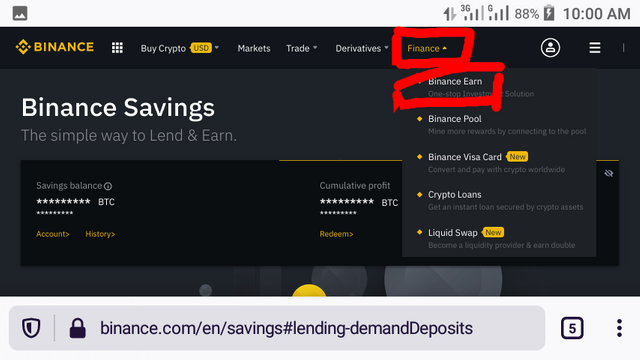

- Having gained access into your account through login click on 'Finance' and from the drop down menu click on the 'Binance Earn' option

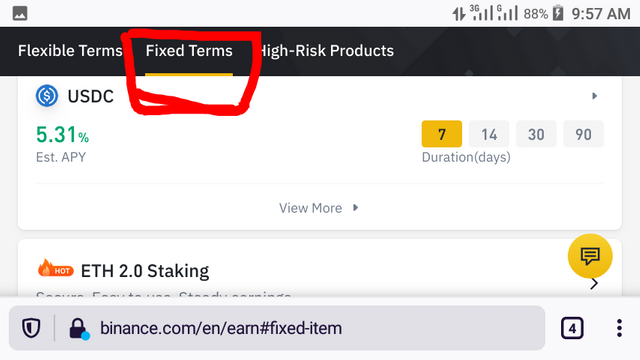

- Click 'Fixed Terms' which would then take you to the fixed savings area

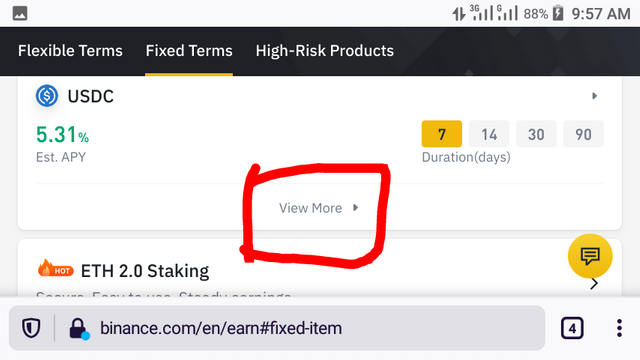

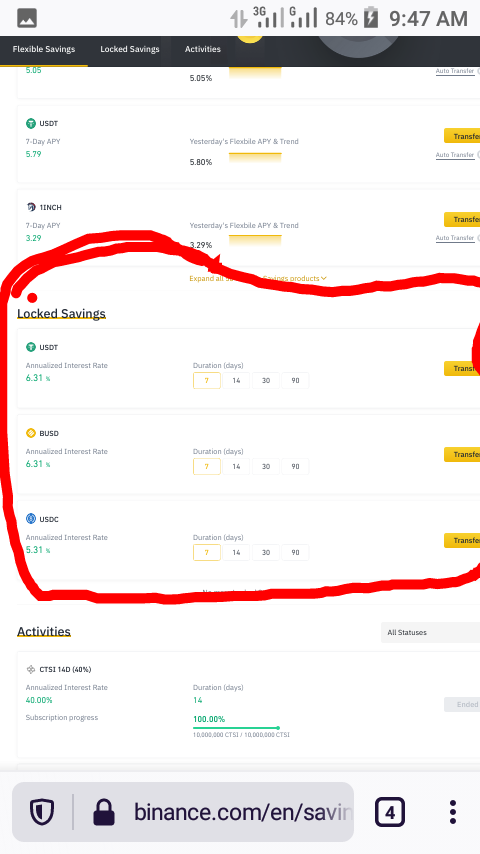

- On the fixed savings area click on 'View More' to open up the 'Locked Savings' assets

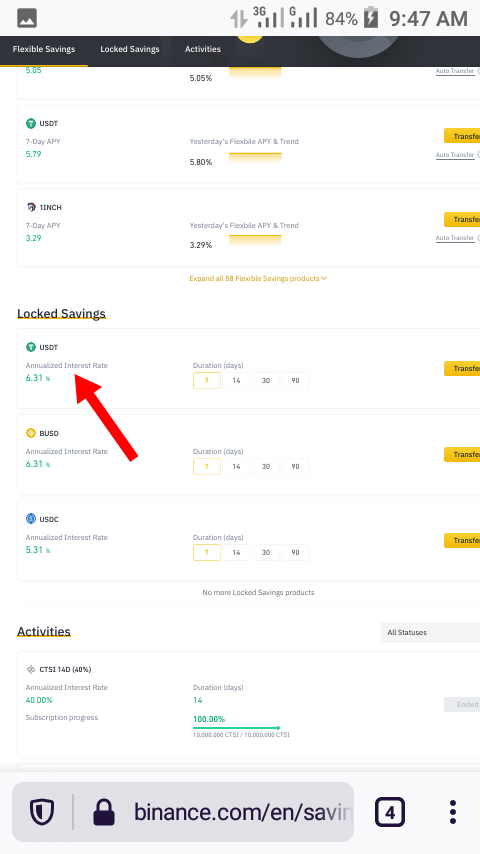

In this area you will see such information as the interest rate which is calculated per annum and other terms that come with the fixed savings.

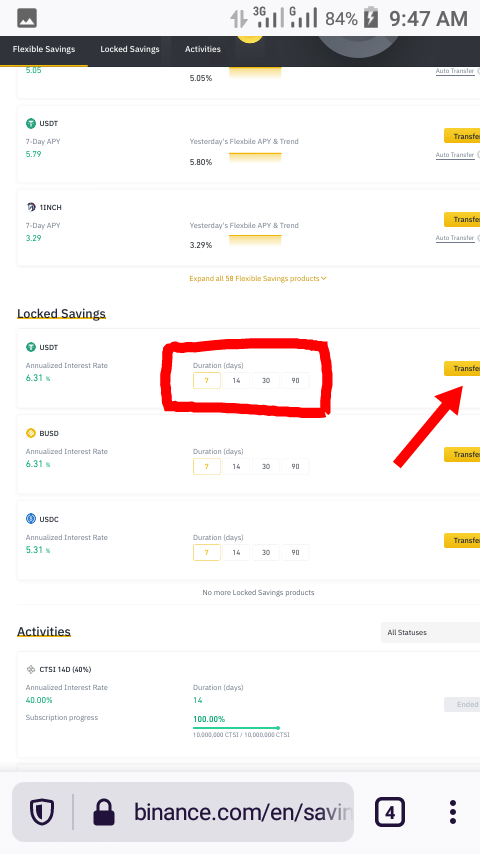

- Choose the duration you want for your assets (USDT in this case) and then click on 'Transfer' to proceed

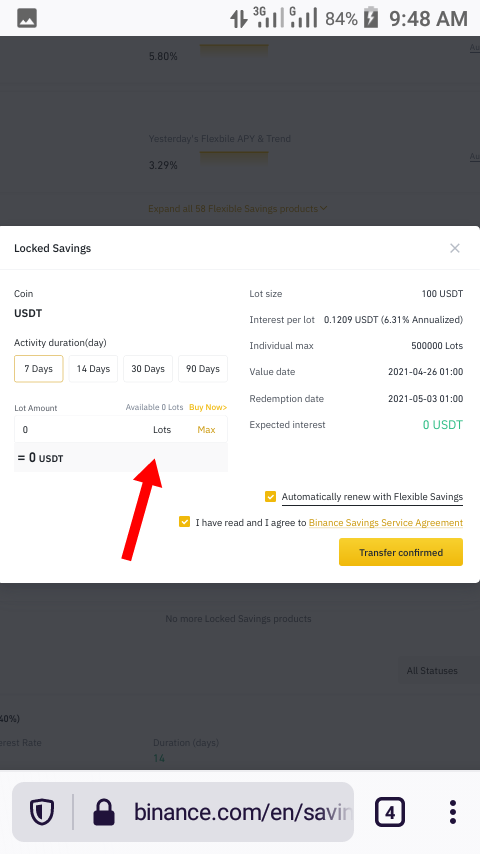

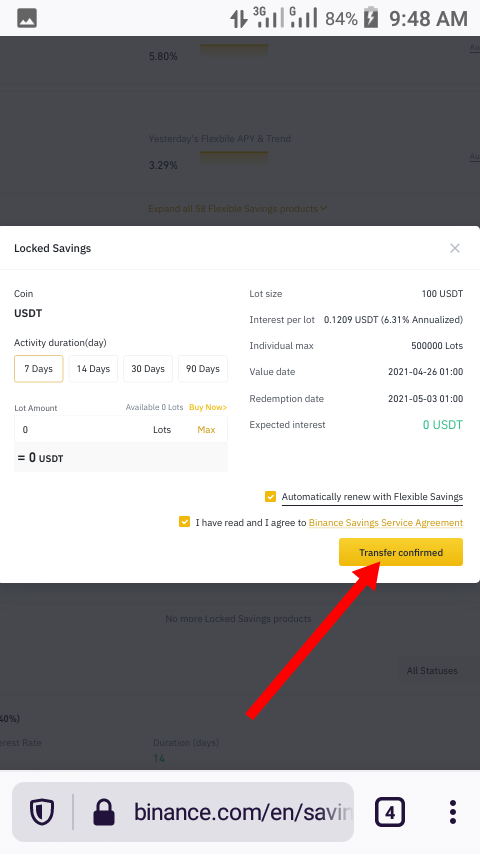

- A fresh page opens up on which you are required to input the 'Lot Amount' you want to stake, automatically your settlement price, which is the money you should expect at the end of the time frame selected, would be calculated at the prevailing interest rate.

- After this you will have to confirm the subscription you have chosen to continue

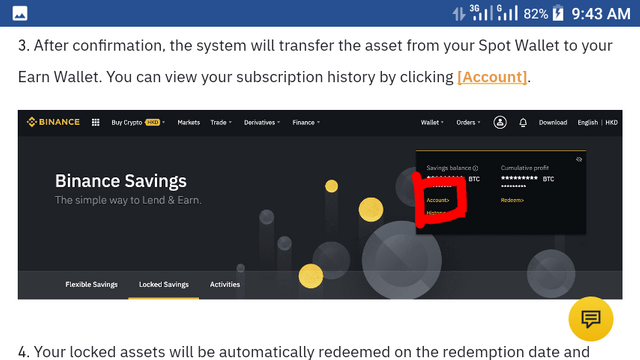

Once you click 'Transfer Confirmed' your funds will be automatically transferred to a section called 'Earn Wallet' from your 'Spot Wallet'.

- In order to view your subscription history you should go and click on the 'Account' section.

CONCLUSION

The importance of risk aversion strategies in the management of crypto assets and investments cannot be overemphasised. While a lot of people may not just be comfortable leaving their assets to appreciate in value over time and would definitely want to undertake ventures that would likely increase the value of their assets, even in the short-term or in the near future, it is important to carefully study whatever investments you decide to undertake before making a headway.

You can choose from the staking products to the high-risk products depending on the risk aversion strategy you decide to adopt and your target. Whichever way, it is necessary to be properly informed before investing.

(unless otherwise indicated, all screenshots are taken from Binance)

Thank you for being part of my lecture and completing the task!

My comments:

Nice work!

I really liked going through your post, as you seem to really understand what you're talking about and explained everything in a crystal clear way :)

Congrats on such good job!

Overall score:

7,5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit