WHAT ARE DECENTRALIZED AND CENTRALISED EXCHANGES

DECENTRALIZED EXCHANGE

A decentralised exchange is a form of cryptocurrency platform where coins or tokens can be bought or sold on a peer-to-peer (P2P) basis without having to involve the services of a third party or an intermediary. In this form of payment these intermediaries are replaced with the distributed ledger or blockchain technology which makes use of order book relaying and such other methods like smart contracts or other decentralized forms of payment whose level of decentralization may differ.

CENTRALISED EXCHANGE

A centralised exchange, on the other hand, is a platform that makes it possible for buyers and sellers of digital assets to engage in a trade while their transactions are closely monitored by a third party. However the deals of the two parties and not actually cracked but only secured and monitored by the intermediary. In such exchanges as these they would have to provide some information and even documents for personal or company verification.

DIFFERENCES BETWEEN DECENTRALIZED AND CENTRALISED EXCHANGES

There are a lot of differences between decentralized and centralised exchanges. The most important of them all are going to be summarised here.

| S/N | FACTOR | DECENTRALISED | CENTRALISED |

|---|---|---|---|

| 1 | Liquidity | rather low | High |

| 2 | Security | No chances of hacking | Chances of hacking |

| 3 | Regulation | No need for license; hard to regulate | Need for license; easier to regulate |

| 4 | Fees | Minimal or no charges for using | A lot of charges apply |

| 5 | Control | Greater user control | Majorly control by the exchange |

| 6 | Popularity | Not very much popular | Highly popular |

| 7 | Speed | Orders could be executed in minutes | Orders are executed in milliseconds |

| 8 | Features | Limited features and usability | A lot of features and usability |

| 9 | Verification | not hard | can be rigorous |

LIQUIDITY

Actually, centralised exchanges boast of more liquidity than the decentralized ones; this is based on the fact that there is a higher volume of trading activities going on in the centralised exchanges.

SECURITY

Centralised exchanges are more prone to security linkages because they use just one server while the decentralized ones have millions of servers that make it difficult to be hacked.

REGULATION

Centralised exchanges can more easily be regulated and licensed under the regions where they are domiciled than the decentralized ones with distributed ledgers.

FEES

In matching orders, centralised exchanges charge more fees; unlike the decentralized ones where the fees are either zero or very minimal.

CONTROL

In centralised exchanges the platform has greater control of the entire system while in decentralized ones the users have more control over their ledgers.

POPULARITY

Although the decentralised exchanges may have more comparative advantage in terms of security and account holdership, they are less popular than centralised ones with greater liquidity.

SPEED

Decentralized exchanges are known to take more time or even up to one minute in executive orders; centralised ones can take 10 milliseconds, even.

FEATURES

Centralised exchanges have more usability and such additional features as margin trading, advanced types of orders and tools for portfolio management.

VERIFICATION

I am still finding it difficult to be verified on the centralised Binance exchange after uploading my documents; however, decentralized exchanges will not require rigorous verification processes.

MY TWO BEST EXCHANGE OPTIONS FOR 2021

The two exchanges I consider to be the best in the cryptocurrency market in 2021 is Binance and Coinbase.

Why?

BINANCE

Obviously in terms of trading volume it has been observed that the binance exchange is the largest online cryptocurrency exchange in the world. However, there are lots of other interesting features that make it my best preferred choice.

Earning opportunities

A few features like staking, launch pools and even high risk products give users the opportunity to earn extra rewards. Borrowing is also possible.

Variety of listed cryptos

As far as the crypto exchange world is concerned, Binance has the largest listing of coins globally.

Various kinds of trade

Binance supports different kinds of trades including margin trading, trading on futures and of course spot trading.

Strong security

The platform offers additional security features like two Factor authentication and ID card verification with different anti-phishing technologies.

TradingView Charts

The use of TradingView supported charts gives users a lot of tools and indicators to aid technical analysis.

COINBASE

Coinbase is a licensed crypto exchange which has become the largest generally accepted exchange in the United States. It comes with such interesting features as 'hot' wallet, custodial accounts, advanced trading and investing options.

Key Features

Offers various crypto options

The fact that Binance is not supported in the US makes coinbase the next available option. With a total of 32 coins for US users and 36 on the coinbase pro, it offers more coins than many other exchanges.

Friendly trading platform

Traders can use any of the two trading platforms: original coinbase with dollar-crypto payment or coinbase pro with advanced functions like crypto-to-crypto.

Insurance and security

Coinbase claims to hold only 2% of funds belonging to customers in their online wallets. The rest are said to be deposited in US custodial accounts, US treasuries and money market funds. This ensures that you can get your funds back should their online security be breached.

A new way to earn

With the coinbase earn users can gain rewards by covering video classes.

While coinbase is considered the best exchange in the US it is necessary to use the pro version to minimise charges.

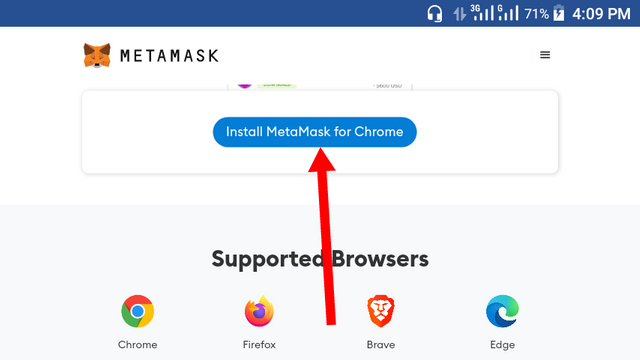

How to install metamask on Chrome extension

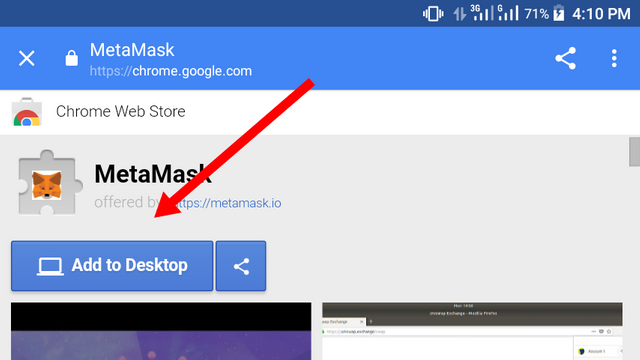

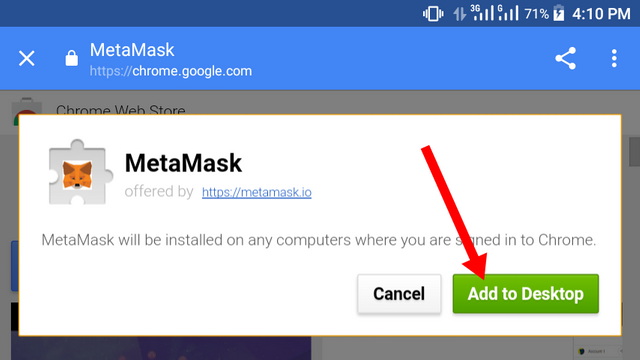

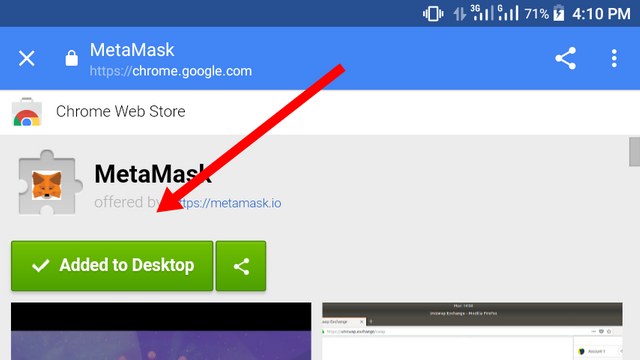

To install metamask on Chrome extension:

- Visit metamask.io and click on 'Install metamask for chrome'

- On the next page that opens up click 'Add to desktop'

- Confirm that you want to 'Add to desktop'

- It will then be added to your desktop as a Chrome extension

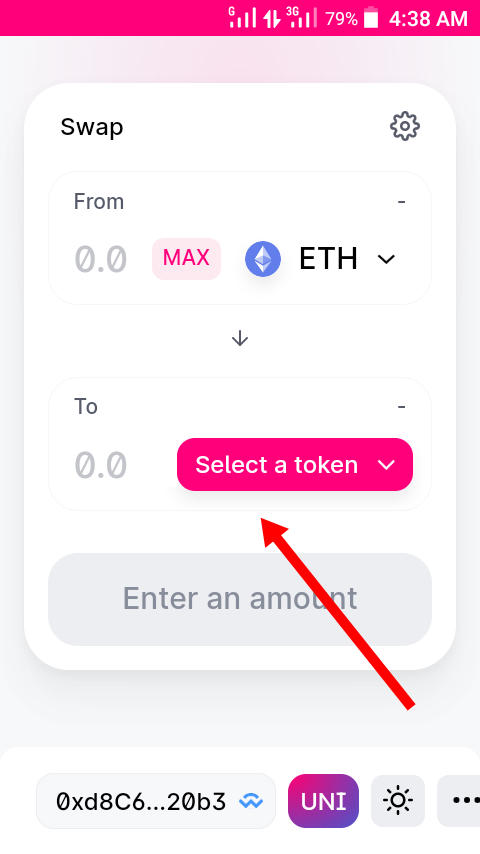

How to use uniswap v2 to swap/buy another coin

Using the uniswap version to require some preliminary steps.

- First step would be to fund the account to purchase some ether

- The second and final step would be to perform the actual swapping of ether token to any token from app.uniswap.org

Step 01

To fund the account by purchasing ether:

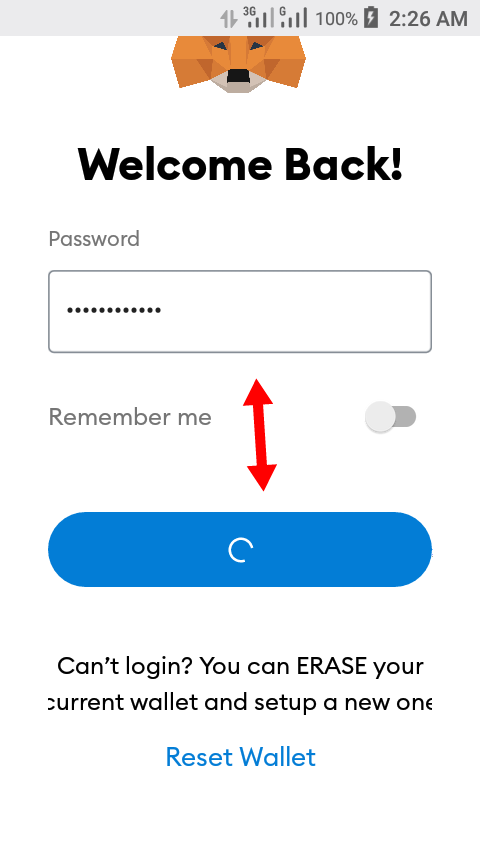

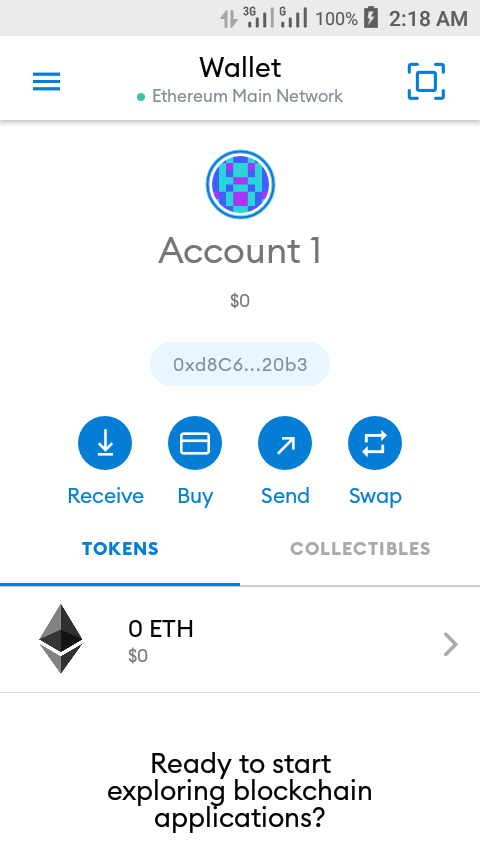

- Login to your metamask wallet

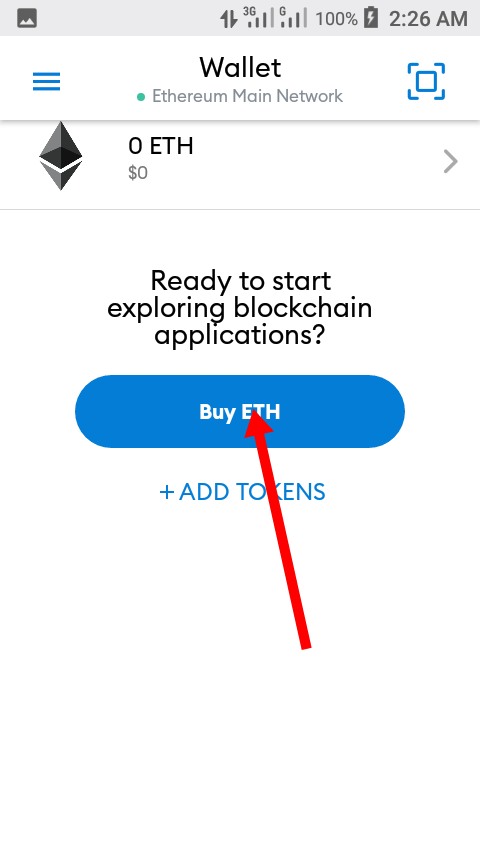

- Click on 'buy ether'

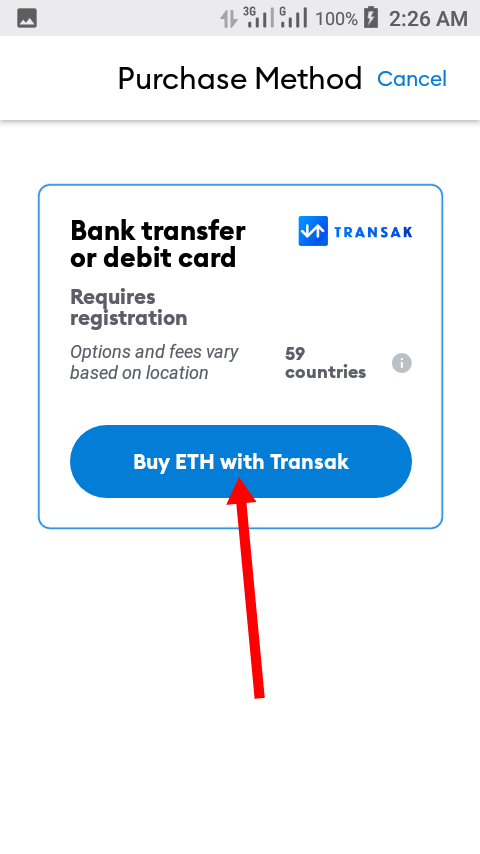

- Click on 'buy ether with Transak'

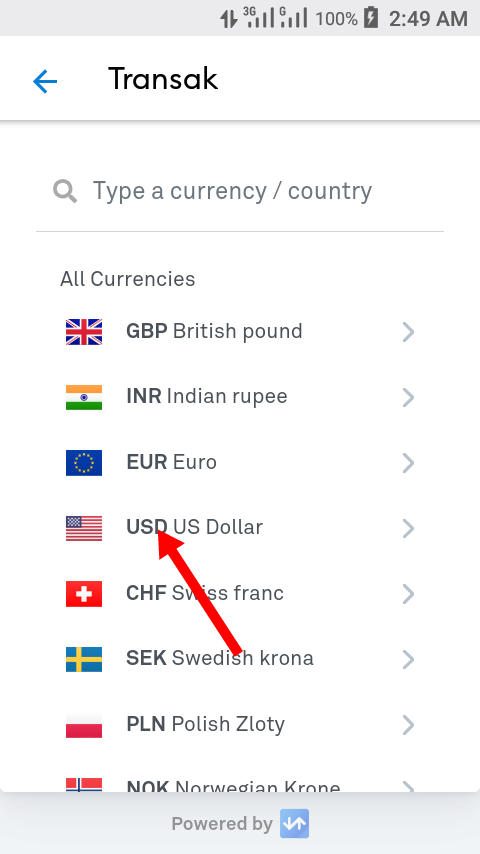

- Select USD u.s. dollar

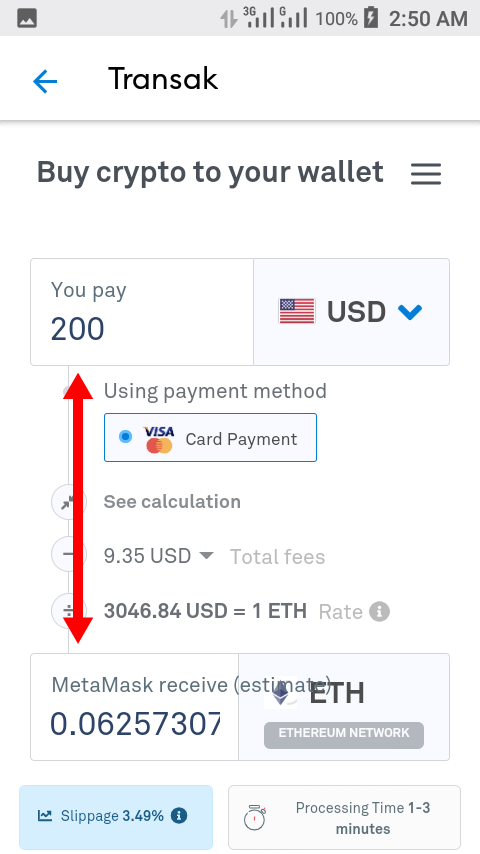

- Input the amount of USD you wish to pay to reveal the total number of ether that would be purchased

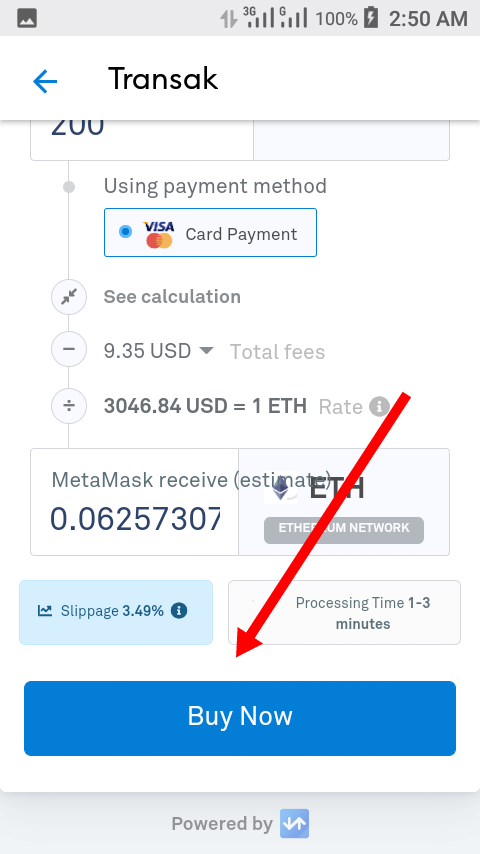

- Click on 'buy now'

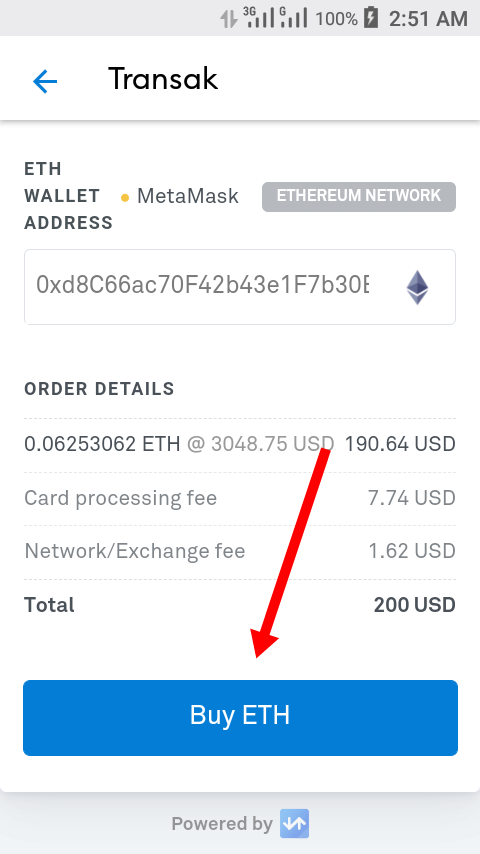

- Click on 'buy ether' to confirm your transaction

Step 02

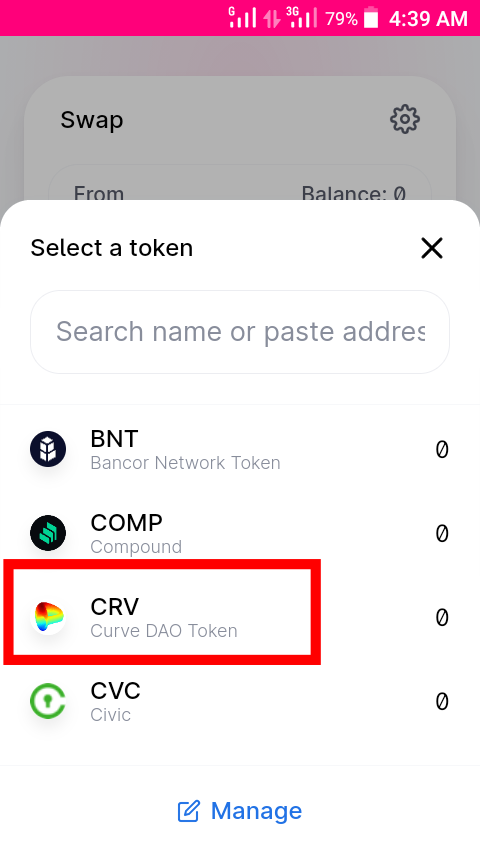

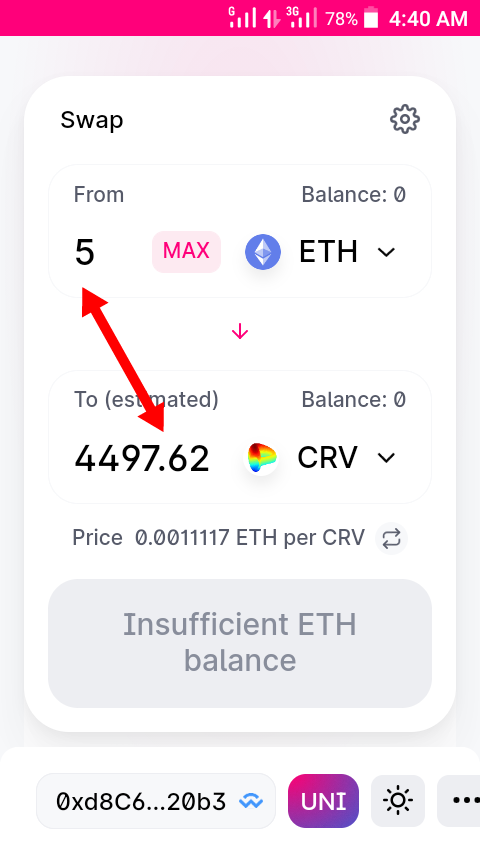

To perform the actual swapping:

- Visit app.uniswap.org and click on 'use uniswap'

- Select the token you would want to be swapping your ether to

- Enter the total amount of ether you wish to spend to reveal its equivalent in the new token

First respected student Thank you very much for taking participate in Steemit Crypto Academy Season 2, Week 3 course class..

i could not see your swap of any coin after connecting with uniswap

i did not see your cex profile and last 24 hours trade history from your real account

you used copyright images in the homework , that are not allowed in task

thank you very much for taking interest in this class

Grade : 4

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit