Thanks to professor @yousafharoonkhan for a wonderful Week 15 lecture on Order Book.

What is meant by order book and how crypto order book differs from our local market. explain with examples

An order book in the world of cryptocurrency refers to an electronic listing of the prices which buyers are bidding or asking and are willing to pay or the prices which sellers are willing to accept for the purchase or sales of a particular financial instrument which in this case refers to a particular cryptocurrency, coin or token. Usually, in cryptocurrency the order book is listed electronically and organised in levels according to the prices. Normally, they are listed from the highest prices to the lowest prices. Furthermore, it lists and showcases the number of shares or quantity of a particular asset that is needed at or which is being provided for a particular price which is known as market depth. Actually, this list is important in helping traders in their trading decisions by providing transparency in the market. Just as has been said already, cryptocurrency order books are usually electronically listed. Again, either to the right or left - depending on the exchange - other buying and selling information or related details, like technical analysis price charts, for the asset in question can be displayed, especially when viewing the web version of the site.

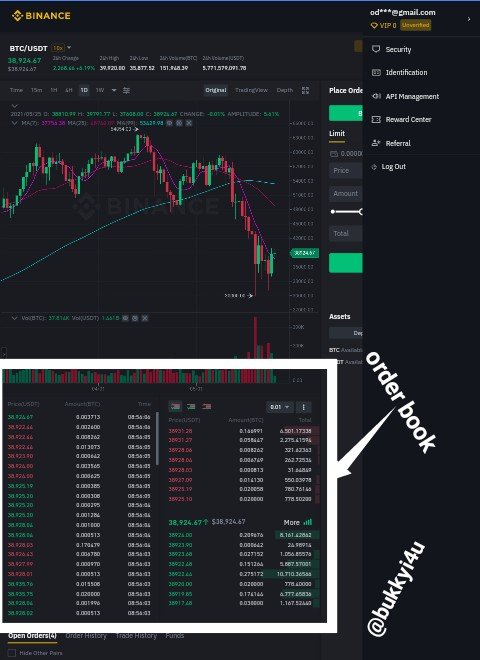

The crypto order book can be seen as displayed from the binance exchange below. The order book indicates a lot of important information and features which would be examined later in this article.

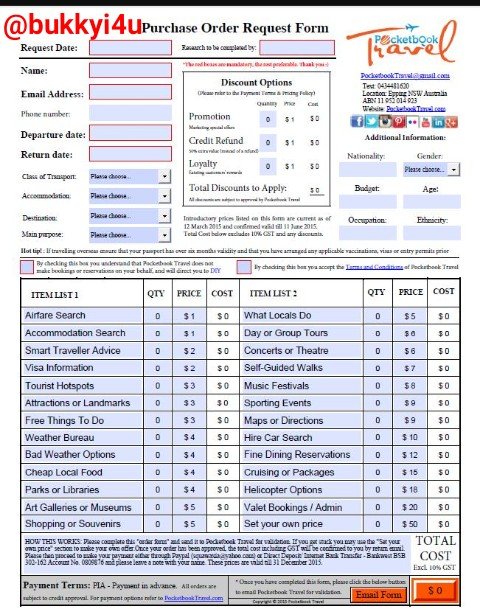

On the other hand, in the local market order books are usually in the form of customer order books which can either be a purchase order or a sales order. The purchase order in the local market refers to a form of a commercial document which is usually the first order being officially sent from the buyer to the seller pointing out the quantity and type of a particular asset which year the buyer is willing to buy at a particular bidding price. In the same vein, the sales order refers to a commercial document which is generated, recorded and stored by the seller when he receives a purchase order from a potential buyer. Normally, the sales order indicates the same details in the purchase order and works for the purpose of record keeping. The duo of the purchase and sales orders constitute the order book in the sense of the local market.

The local market order book is displayed below. The purchase order book comes from the potential buyer. The sales order book is generated by the seller himself after receiving a purchase order.

Purchase or buy order book screen source

Actually, there are quite a number of differences between the cryptocurrency order book and the local market customer order book. I have examined some of these differences in the table below.

| VARIABLE | CRYPTOCURRENCY ORDER BOOK | LOCAL MARKET ORDER BOOK |

|---|---|---|

| Mode of preparation | They are usually listed electronically and normally displays many buy or sell orders at a time | They can either be prepared electronically or manually and may only contain one other at a time |

| Nature | Cryptocurrency order books are dynamic in nature and continuously change and are updated in real time | They are not dynamic in the science of real-time updating of data but may remain opened irrelevant for as long as the order has not been fulfilled |

| Trading | They can be used to aid trading decisions since they are prepared and presented in real time to crypto traders especially scalpers | They may only be relevant to either a particular buyer or seller in question who have either sent or received them and may not be used to aid trading decisions by other traders since it may not be open to them. |

| Effect on prices | They can affect the prices of securities by either pushing them up when a particular buy amount has been exceeded or lowering them if the sellers are winning | Normally, they may not always affect a seller's decision on prices since this decision will be purely subjective or based on cost of production |

| Support and resistance | The order book can help to identify the price where buyers and sellers are pushing the support and resistance levels to by telling of the momentum possessed by each side | May not necessarily identify any particular preferred level of pricing since it may not come from a sufficient number of large buyers or large quantity of orders at a particular time |

| Short term prediction | It can be helpful in the prediction of short-term direction of price action since the momentum in buyers and sellers decisions can determine where the price goes | It may not been helpful in the prediction of the direction in which the prices of a commodity could go even in the short term |

| Appearance | May only contain additional buying and selling info related to the particular pair either to the left or right depending on the exchange | Usually contains a lot of other information like company's name, address and users signatures |

How To Find Order Book In Binance Exchange

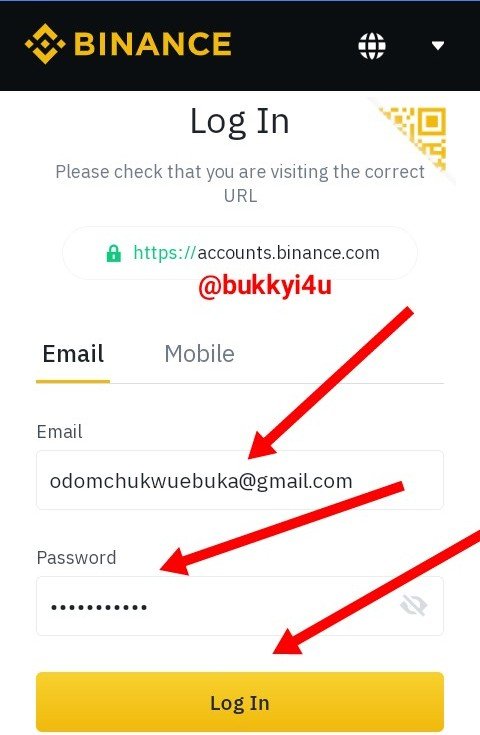

To find the order book in Binance exchange you have to, first, gain entrance into the exchange platform. To do this you can either login from the web or use the app. I am going to log in from the web.

So, I visit https://accounts.binance.com/en-IN/login from where I will log in to the platform.

The page requests my email and password. I provide both my email and password and then click 'login'.

This email represents the email I used in creating my account and then the password I had generated when creating the account.

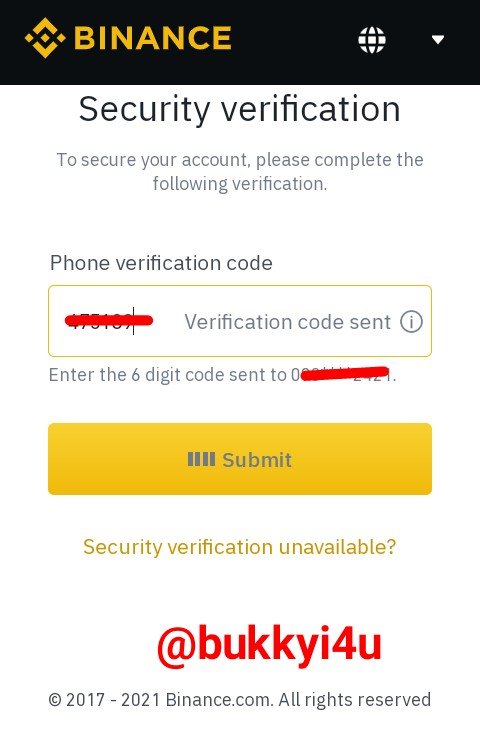

After this, I undergo some preliminary phone verification process by clicking on 'send code' and providing the code sent to my mobile phone to complete the verification process before gaining access to the platform.

The phone number verification is necessary to authenticate my identity. I had provided this phone number when creating the account and in order to verify that it is the original owner of the account that is trying to gain access I have to verify my phone number. If I don't have my phone on me I cannot gain access to the platform for security purposes

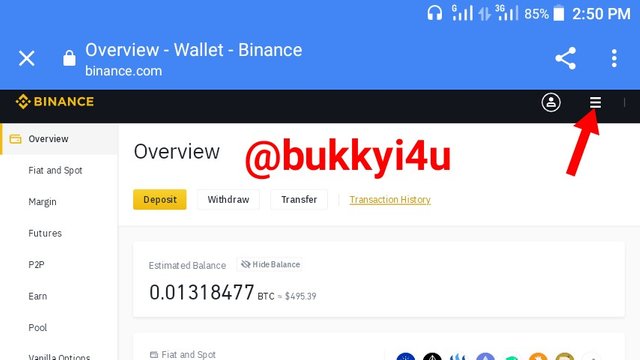

Haven gained access to the platform on the overview page, I click on the three tiny horizontal lines located to the top right-hand corner.

The overview page is the very first page that opens up when you have logged into your account. On this page you see a lot of other options to proceed with whatever action you wish to perform on Binance.

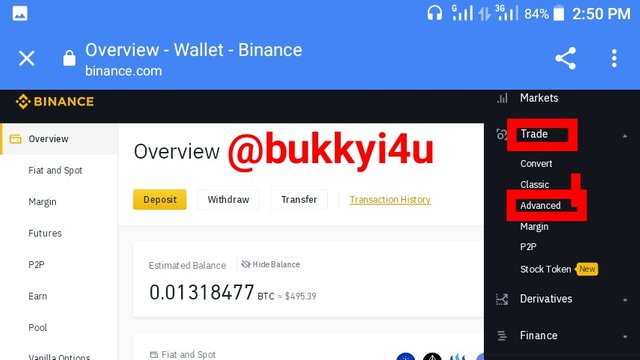

From the underlying page revealed I select 'Trade' and then click 'Advanced' (Note that you can also click 'Classic' if you like).

This trading option is the place from where you can carry out real-time trading actions of either buying or selling cryptocurrencies or simply exchanging from one crypto to another with the use of cryptocurrency pairs.

You can either choose to trade with the 'Classic' or the 'Advanced' option both of which will take you to the same trading page.

Clicking through would open up the trading view of cryptocurrency pairs.

On the page above, the place indicated with a red box represent the order book and are located to the lower part of the page on the right side.

That is how to find the order book in the Binance Exchange.

Explanation Of The Given Words

Cryptocurrency Pairs

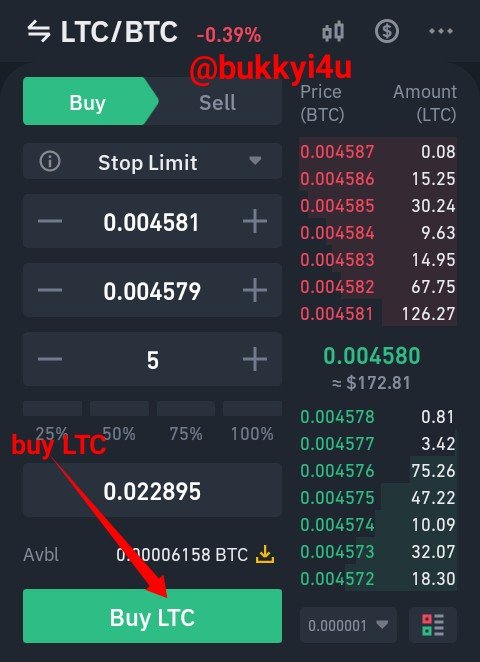

Cryptocurrency pairs as indicated below in exchanges represent the two cryptocurrencies between which trading actions are to be performed. This means that the two pairs I decide to select on an exchange represent the two cryptocurrencies I would like to purchase one with the other or sell one for the other.

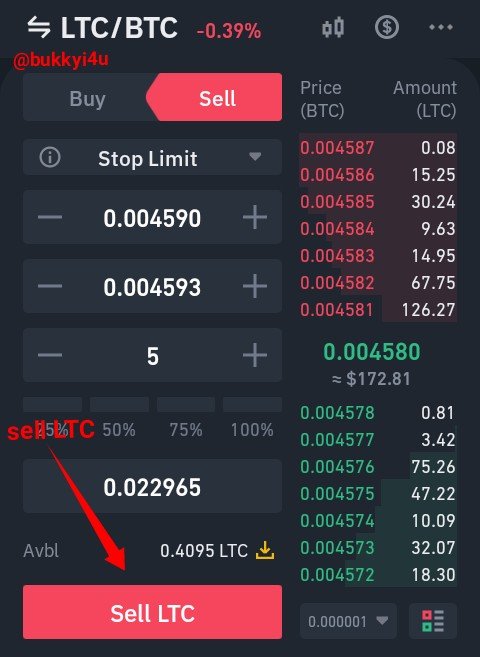

For instance, in the LTC/BTC pair below, I intend to purchase some LTC with BTC because I already have BTC in my exchange balance.

On the other hand, I might decide to sell LTC to get BTC.

This is the simple meaning of cryptocurrency pair where it is the two coins between which buy or sell transactions are going to be made.

Support and Resistance

Support and resistance levels refer to some point or certain price levels or areas in the trading of cryptocurrencies where prices of assets encounter a lot of difficulty in trying to break through them.

In bearish or downward markets, you talk of a support level which can be visualised as a sort of 'floor' where the price is very likely not to get below. This forms an area of demand and constitutes the major prices at which buyers are willing to transact in the meantime.

In the case of a bullish or upward trending market you talk of resistance level as the point or 'ceiling' where the prices are likely not to pass through and get higher. This forms an area of supply and represents the prices at which sellers are willing to settle.

The support and resistance points represent places where trend reversals are expected since prices may encounter difficulty in breaking through them. However, there is no hard and fast rule to that. Meanwhile, these levels should not be visualised as single lines of prices but as a range of possible prices. Therefore, there should not be seen as lines but as areas since that can cover different prices that are close to one another.

Limit Order

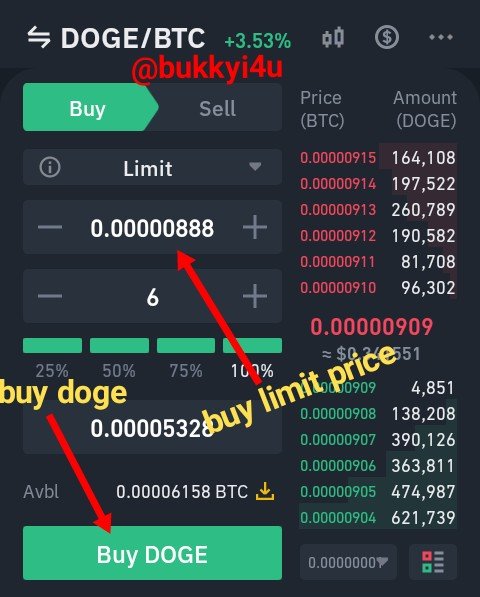

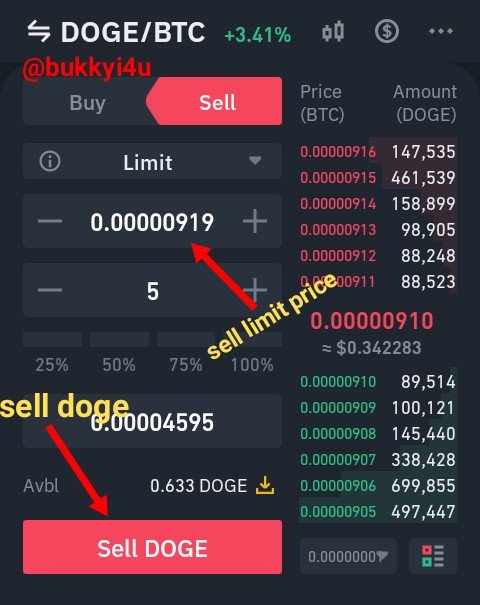

A limit order is a particular type of trading position which you enter by placing or selecting a particular limit or specific price at which your market choice of either buy or sell should be executed or at a higher or lower price, as the case may be. In the case of buy order, the limit buy price is the price at which your market must be bought or a price below which the market can be bought but not above it. In a sell order, the limit sell price is the price at which your market should be sold or above which the market can still be executed but not below it.

In the buy limit order below I intend to buy doge at a particular limit price above which the market cannot be executed. I simply set the price and select the amount of doge I wish to buy. The market cannot be executed above the selected price.

In the sell limit order below I intend to sell doge at a particular price below which the market must not be executed. I set the price and select the amount of doge I wish to sell. The market will be executed at the selected price or a higher price.

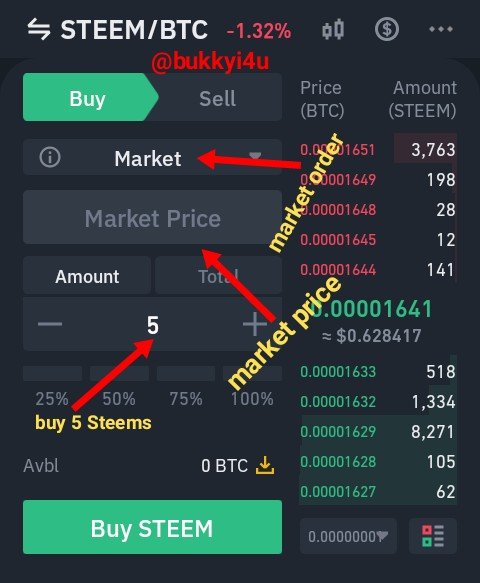

Market order

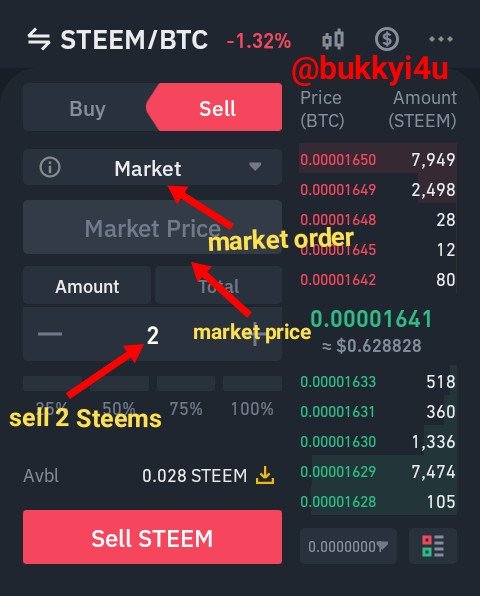

A market order in cryptocurrency refers to a buy or sell position which a trader enters by opting for his market to either be bought or sold at the lowest available market price.

In the sell market order below I intend to sell 2 Steems with the market order. I select the number of Steems I intend to sell. Using the market order means you don't have to input any price at which it has to be sold. Therefore, it will simply be sold at the lowest possible price in the market. However, this can only happen when there is liquidity to execute your market, that is to say that all outstanding limit orders must first be fulfilled before your market order will be met.

In the buy market order below I intend to buy 5 Steems at the market price. I simply select market order, input 5 Steems and then enter this position. The order will immediately be fulfilled based on the current market price when there is liquidity.

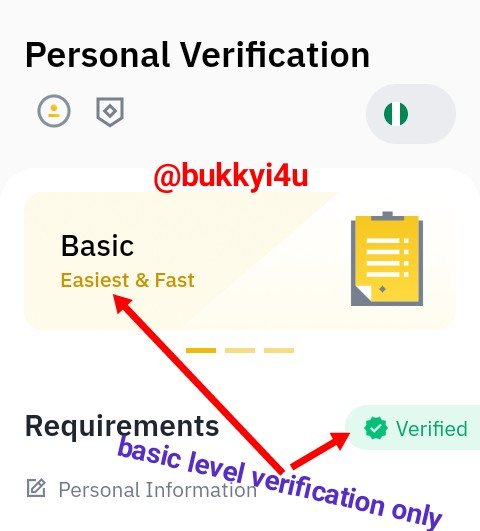

Explain the important features of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear

To illustrate all my answers to this homework task I would be using screenshots from my binance exchange account. However, my Binance exchange account which indicates my email address [email protected] has only been verified on the basic level.

I'm still having issues of 'blurred document' with my government issued document for the intermediate level verification). Nevertheless, this basic level verification allows me to trade on the exchange as is indicated by my four currently open orders on the exchange (evidence below):

Some of the important features of the Binance order book which I will be explaining include:

- Amount

- Price

- Total quantity

- Time

- Order history

- Last traded price

Amount

Amount as indicated in the cryptocurrency order book refers to the particular number of coins or particular quantity of coins which an entity places an order for at the given instant of time.

As indicated above the amount shows that the entities place buy orders at the particular time the screenshot was taken and would want to buy specified number of coins at that time. This is a real time value and can change even instantly once it is fulfilled.

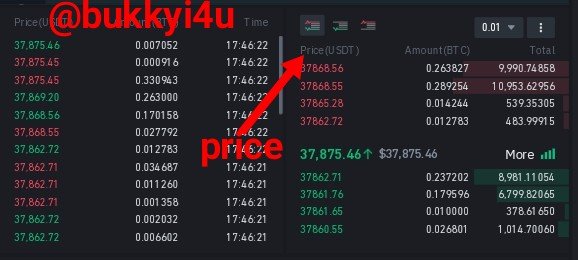

Price

Price refers to the amount of asset which an entity who places an order is willing to either pay for his order to be executed or amount of assets which the entity is ready to collect in exchange for his own asset which he is willing to sell.

In the sell order above the entities are willing to sell different amounts of coins at the price of BTC (satoshis) specified.

Total Quantity

Total quantity refers to the summation of all the amounts of a particular asset which all entities who have opened a particular order at a particular price willing to either pay for another asset or at which they are ready to sell their own asset in exchange for another asset.

As indicated above it is the total sum of all amounts from all entities. While amount is from one entity, total quantity considers all the entities that have opted for a particular total quantity of an asset in exchange for another or at a particular price. This total quantity reflects outstanding orders that are yet to be fulfilled. Fulfilling them would be a function of the liquidity available based on the total current supply of the particular cryptocurrency that is needed.

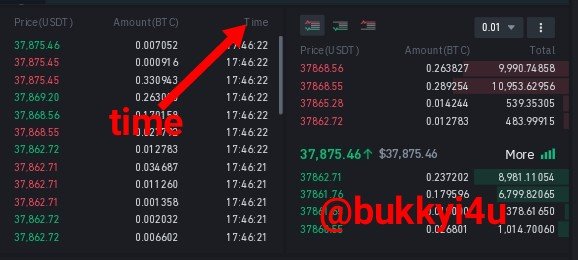

Time

Time in the order book is a representation of the particular instant of time at which orders are opened. In the screenshot below, it can be seen that at exact instance of time, a orders of various amounts are put up in the order book.

The significance of time in the order book is to show that trades are taking place in real time. Since it is happening in real time and not a presentation of past trade events, the timing that appears on the order book when the screenshots are taken correspond to the actual time of the day that the screenshots are taken.

Order History

Order history for a specified period of time as represented in the screenshot below is a pictorial display which shows the relative number of either sell orders to buy orders or relative number of buy orders to sell orders. It gives an idea of which side the price is being pushed to with greater momentum. If there are more predominant buy orders in the timeframe under review, it means that the buyers are winning and pushing the price higher and vice versa.

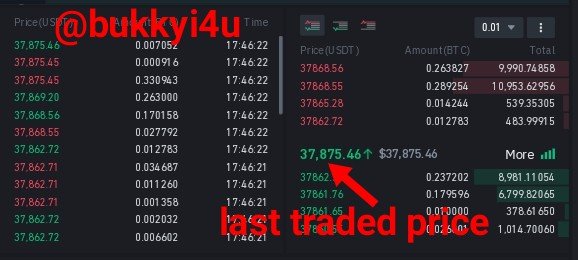

Last traded price

The last traded price refers to the particular price at which the last successful trade event occurred when a seller was successfully matched to a corresponding buyer. Its significance is that it tells you the actual price at which you are most likely to either successfully sell or buy - at the given liquidity - irrespective of what traders are bidding for on either the sell or buy side.

In Binance, when it is red in colour it indicates the last traded price in a downward direction. On the other hand, when it is green in colour it indicates the last traded price in an upward direction. It gives an idea of the current liquidity in the market. It is instrumental to take note of this price before deciding on where to place your own bid when entering a position.

How to place Buy and Sell orders in Stop-limit trade and OCO.

HOW TO SET BUY AND SELL ORDERS IN STOP-LIMIT TRADE

A stop-limit trade is a type of trade that uses two prices: the stop price and the limit price. In this type of trade you set a stop price at which your market will be triggered and executed at the limit price. That is to say, the limit price is the actual price you would want to sell or buy but you set a stop price which signifies the price at which the market would get to before your order to either buy or sell at the limit price will be placed. This type of market is usually done in expectation of either an increase in current market price - in the case of a sell order - or decrease in current market price - in the case of a buy order.

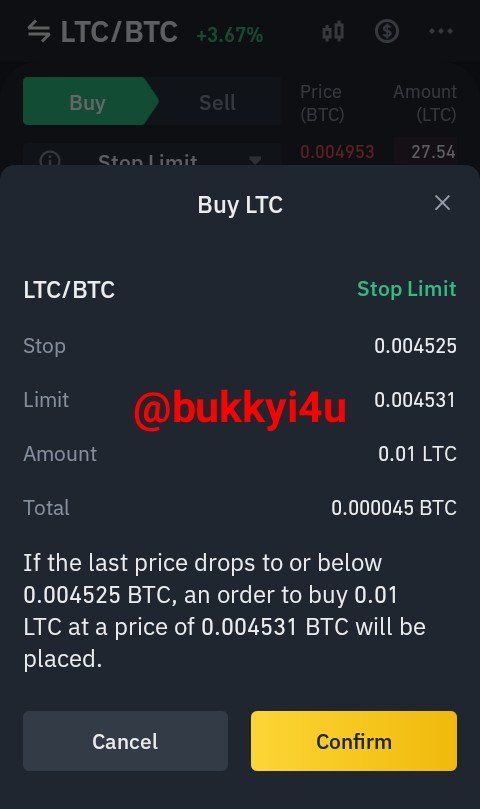

Stop-limit Buy Order

The above screenshot signifies my stop-limit buy order. In the LTC/BTC pair stop limit buy order above, I have set the stop price at 0.004525BTC and the limit order at 0.004531 to buy a 0.01 amount of LTC. As the current market price of LTC is 0.004937BTC, I intend to buy at a lower price and decided to set my stop limit at the previous 24-hour low which forms a sort of support level for the day. If the market should get back to the 24-hour low of 0.004525 BTC then an order to buy 0.01 amount of LTC at a price of 0.004531 should be opened in the order book.

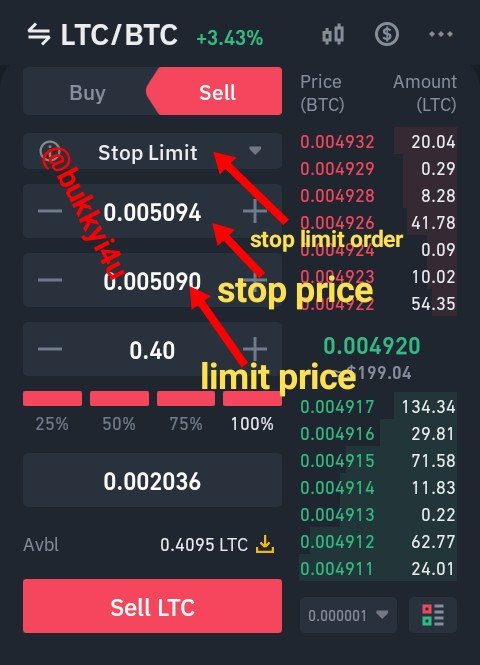

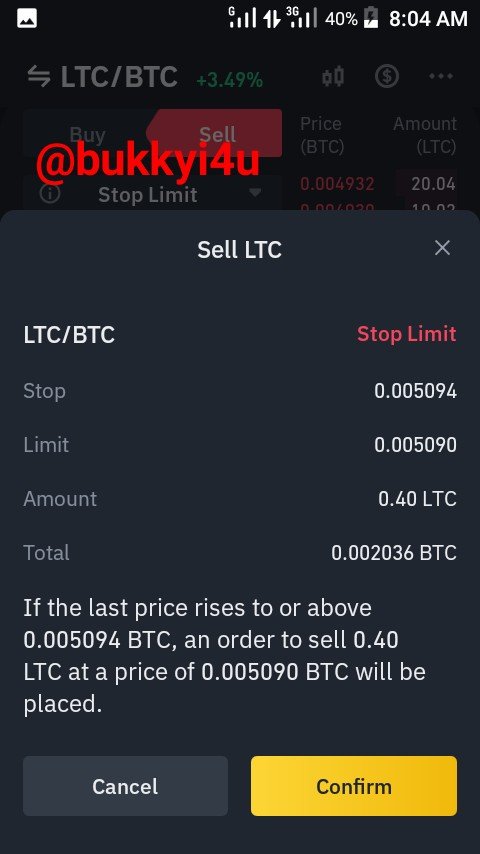

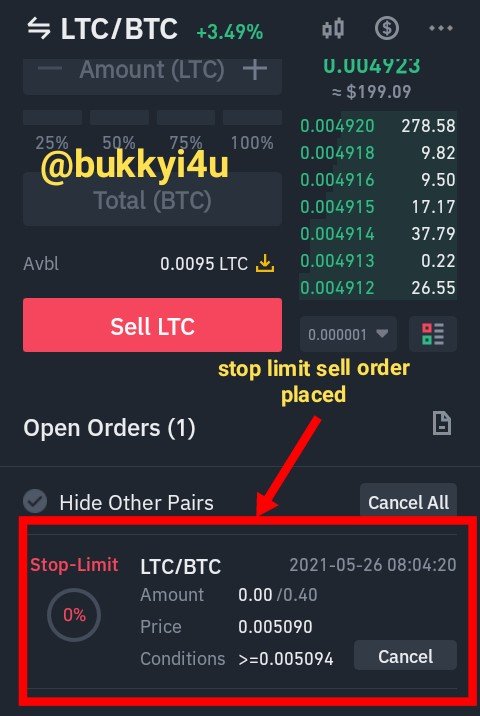

Stop-limit Sell Order

The above screenshot signifies my stop limit sell order for LTC. I have set the stop price at 0.005094 BTC and the limit price at 0.005090 to sell a 0.04 amount of LTC. This is because I expect the market price to rise from its current value of 0.004820 BTC to the previous 24-hour high or sort of 24 hour resistance level of 0.005094 BTC. If the price should rise to this expected swing high then that would trigger my order to buy at 0.005090 BTC to be opened in the order book.

HOW TO SET BUY AND SELL ORDERS IN OCO TRADE

OCO is an acronym for 'One Cancels The Other'. It is a type of trade order that gives you the opportunity to set two different trades in one order. In this type of trade you can set a limit order together with a stop-limit order. The limit order represents the actual price you would want your market to be executed at. However, if your prediction does not go in the direction of your limit order then the stop limit order should be executed. A stop-limit order is usually in the opposite direction of the limit order. The moment one of the orders is fulfilled, the other would be cancelled.

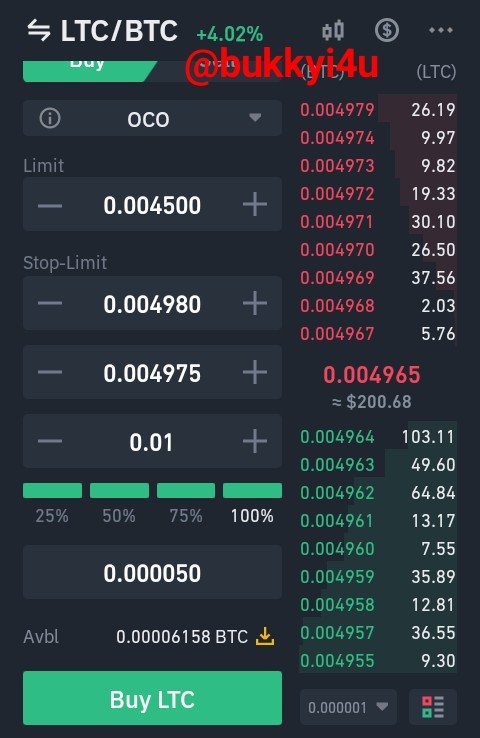

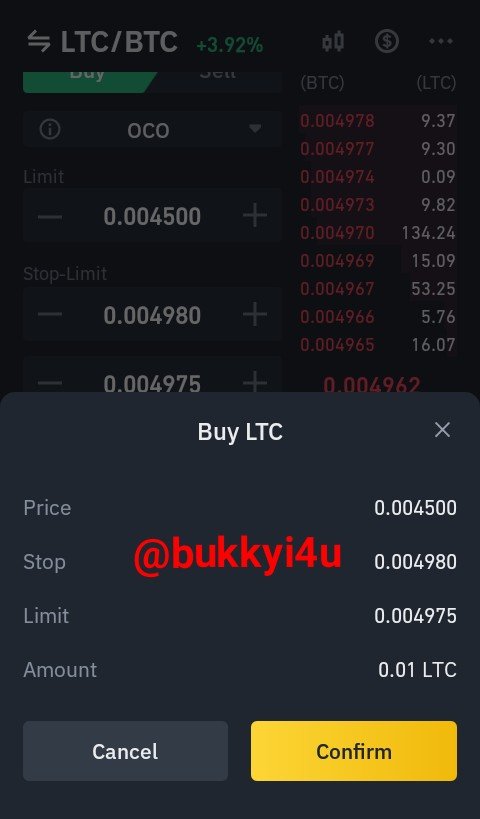

OCO Buy Order

In the OCO buy order above I have set the limit price at 0.004500 BTC, the stop price at 0.004980 BTC, and then the stop-limit price at 0.004975 BTC to buy a 0.01 amount of LTC. The current market price of LTC is 0.004965 BTC. However, before now under the same day the rice had hit a 24-hour low in the region of 0.004500 BTC. The interpretation of the OCO buy order above is that if the market price should go down to its previous 24 hour sort of resistance level of 0.004500 BTC, then my market should be bought. On the other hand, if the market should rather increase above the current market price then if it reaches 0.004980 BTC the market should be triggered and bought at 0.004975 BTC.

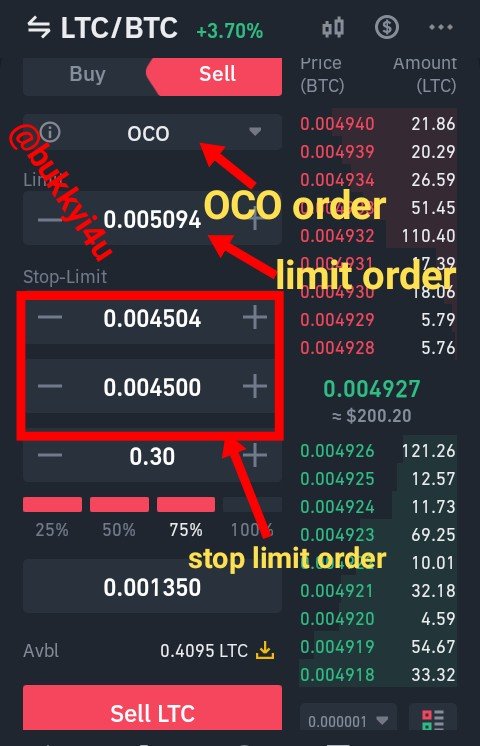

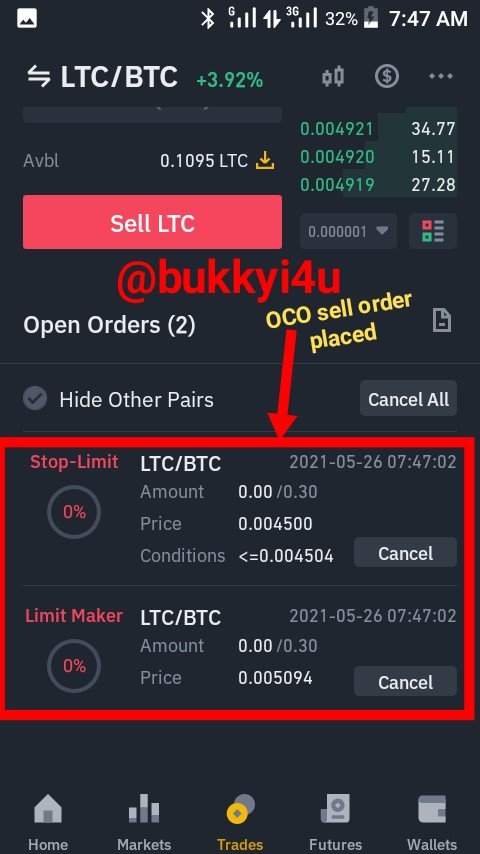

OCO Sell Order

In the OCO sell order above, I have set the limit price at 0.005094 BTC, the stop price at 0.004504 BTC and a stop-limit price at 0.004500 to sell a 0.30 amount of LTC. What this means is that as much as the current market price is 0.004927 BTC, I expect that it will rise from there to reach the previously hit 24-hour high of 0.005094 BTC.

If the price should go in my direction and reach this level then this limit order should be sold there. However, if the price should fall below the current market price and head towards the previous 24 hour low of 0.004500, then the market reaching 0.004504 should trigger my order to be placed in the order book to be sold at a stop limit price of 0.004500 BTC.

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

I would be looking at what I call order walls and how the order history can help in trading decisions based on the order book.

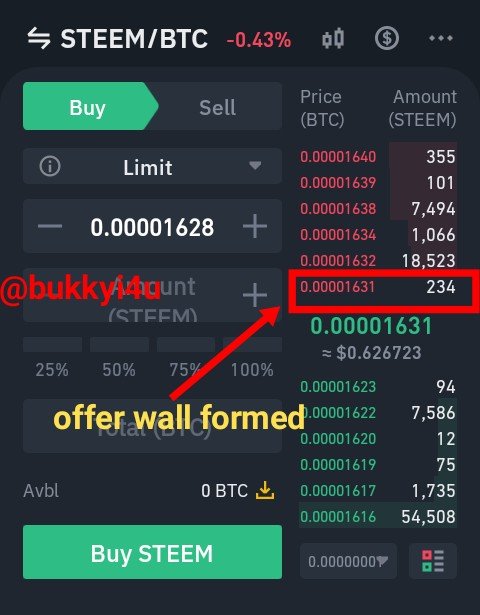

Based on the order book, bids refer to when traders want to buy at a price that is below the current market trading price. Offers or sell orders refer to when sellers want to drive the price of a security above the current trading market price. I am particularly interested in the lowest sell offer and the highest bid offer when I am hoping to initiate a trade from the order book. If there are more sell offers at the lowest sell price than bid offers at the highest bid price it means that the market is going to experience a downtrend because the sellers are trying to push prices lower based on the fact that there are a lesser number of highest bidders than lowest sellers.

This means that there isn't enough liquidity to fill the current lowest sell price. In this case, an offer wall or a sell wall has been created and this will drive the price of the security downwards. If I had earlier entered a position then this point signifies the place where I have to take profit in order not to incur losses. However, for this offer wall to fully count and push down the price it must be respected by the market forces. This means that it must be sustained at the same price for a long time.

If, on the other hand, the offer wall created is not respected and does not remain at the lowest sell price and rather moves up to a higher offer price, then the price of the security would chase it up along and the price will equally go up. So, when entering a trade I'm looking at whether the sell wall has been created and whether it is respected.

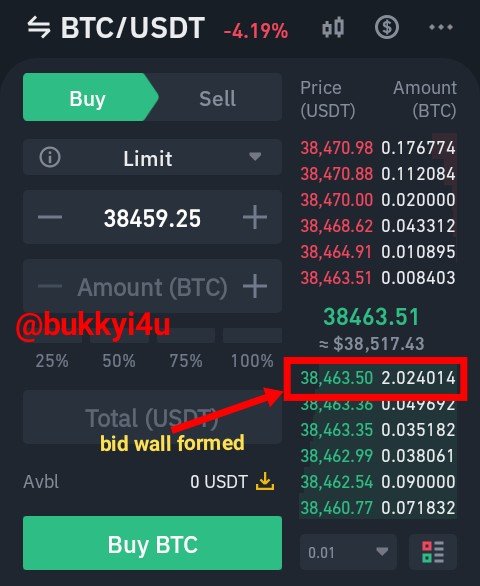

Conversely, if a bid wall is created in a situation whereby the highest bid price has more quantity than the lowest sell price, then the buyers would be pushing the price of the security upwards. The point where I discover that a bid wall has been created should be a good entry point for me since I'm expecting that the price would go up from there.

However, I must take note to carefully observe whether the bid wall is respected by market forces. That is to say that I must carefully observe to ensure that this largest quantity of bid price is sustained at that highest price for a long time. If the largest quantity of bid offers reduces from its highest price to a lower price then the bid wall is not respected and will not push price upwards, rather the price will come down.

Again, I can look at the order history to determine whether I should be making an entry or an exit. However, as a scalper this must be done in a very short time frame, preferably the one minute basis, since a lot of things could change within a short time.

Initiating the trade on the short time frame based on the order history at the resistance level, I would have to look at the order history to determine the side of the market that was the strongest or that may have formed a consolidation at that point of resistance. If at the resistance level the sellers formed the predominant market determinants then prices would be pushed lower and a downward reversal is imminent. The point where sellers are trying to push prices down at the resistance level is the place where I am supposed to take profit.

On the other hand, if at the resistance level I check the order history in the short time and discover that the buyers are forming stronger market determining force then prices are likely to go up and I should enter a trade there.

Also, in the case of support level I would check what prices the support has come down to in the short time frame under consideration and then check the order wall at the same price level. I would check the order book history to determine whether at that point sellers are ready to accept a lower price thereby ready to push the price lower in the support level to cause a downward trend. This is seen when there is a higher number of sell offers at that price level.

Conversely, if at the support level I discover that buyers have formed a stronger consolidation and are ready to push up the price higher then it forms a point of entry for me since I am expecting that prices would go up.

CONCLUSION

In conclusion, the order book can be important in crypto trading because it can give you a real time pictorial display of what the price action is currently in the market of a particular security.

Interestingly, it can also inform your trade decisions on entry and exit points since there are a lot of factors in it that can guide your trading decisions like sell walls or bid walls that may have been formed.

(Unless otherwise indicated, all screenshots are taken from Binance)

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit