edited with canva

INTRODUCTION

The Tron network is a blockchain that has been described as market-leading and very well recognised for having a community which has been adjudged to be quite large and very active with a lot of developers and users from the global community who have put in so much interest into the development of an internet infrastructure that can be truly said to be decentralized. It is one of the largest recognisable operating systems in the world of blockchain and makes use of the Delegated Proof-Of-Stake consensus mechanism.

This is very energy efficient and works very well in the provision of high scalability, high-throughput and high availability for the Tron ecosystem, an interesting list of decentralized applications. The TRC-20 token standard of the network is recognised to have the largest circulating supply of stablecoin in the whole world which amounts to close to 36 billion USDT after going into deep partnerships with such brands as Opera, Poloniex, Samsung, Swisscom Blockchain and a lot of others. It has a native coin which is known as Tronix (TRX) and is useful as a currency for the purchase of in-game assets and as reward tokens for entertaining-content creators.

The TRON network was founded by Justin Sun, who is a very influential personality in the world of blockchain technology and has also served as the CEO of BitTorrent between 2018 to 2021. A very important feature of the network is an operational model borrowed from the proof-of-stake consensus where you can stake your Tron assets that are idle. Staking assets makes it possible for you to earn some passive income as well as be able to participate in the operations of the network that are important for validating blocks.

1- Who are Super Representatives, SR partners and SR candidates? (The Governance of the TRON Ecosystem)

For you to be able to nominate or elect someone who does the work of block validation on your behalf you need to stake your tokens in favour of such a person. Actually, all the accounts on the Tron network are eligible to vote for any super representative or super partner they may wish to support. However, for one to participate in the voting process you must possess some Tron Power and this is always allocated in proportion to the frozen TRX balance of a user.

Usually, you will not lose your TRX by staking. The throne which you stick will only be locked or fixed for a period of 72 hours or 3 days in which period you cannot unstake or trade such tokens. The smallest amount of tokens that can be staked for this function is 1 TRX. So, there is almost no minimum cap to it. Equally, transaction fees are not charged in the process of unstaking, thereby making the blockchain quite popular among users. You can claim your TRX rewards which can be up to 5.46% annual rewards (APY) once every 24 hours after staking and voting for your preferred candidate.

In the Tron ecosystem there are 27 nodes responsible for the production of blocks and these are collectively referred to as Super Representatives on the network. Interestingly, every account on the network is eligible to submit an application for the position. The people who submit applications to be considered for the positions of super representatives by the process of election are collectively called Super Representative Candidates. Once the votes have been cast, the top 27 candidates that were able to pull the highest number of votes become the Super Representatives(SRs).

The next token holders from the positions of 28 down to 127 gain the position of Super Partners(SP). That is to say that when one stands in for the election of super representative but does not succeed among the top 27 and eventually finds himself between 28 to 127 he automatically gains the reputation and position of a super partner. So, the network has 27 SRs and 100 SPs. The super representatives are responsible for the packing of transactions and the generation of new blocks.

For all their efforts they are rewarded with voting and block rewards. On the other hand, the super partners can only receive voting rewards since they do not participate in the performance of the already mentioned tasks of the SRs. The super representatives, super candidates and super partners all have the right to propose and vote for or against modifications to parameters on the network.

Source

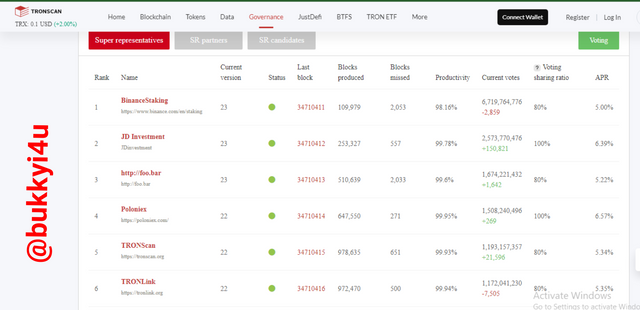

The screenshot above shows the list of the super representatives who have been elected. It showcases their current Status and this is marked with green dots. This most probably shows that they are active. Then, you would see the last block produced by each. Again, you would see the total number of blocks each has produced as well as the total number of blocks that have been missed; together with the productivity of each person followed by the current number of votes, the voting sharing ratio and the APR voters stand to gain from each SR.

Source

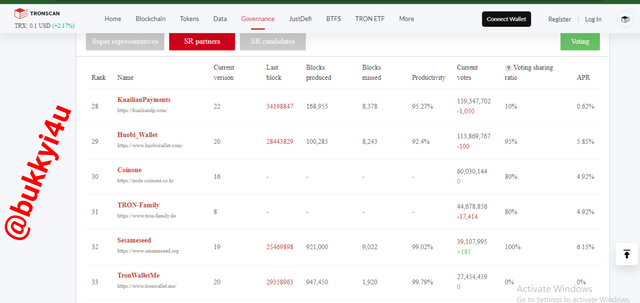

From the image above you can equally see the super representative partners as they are ranked from 28 downwards. Equally, you would see the current votes as well as other important parameters that are linked to them.

Source

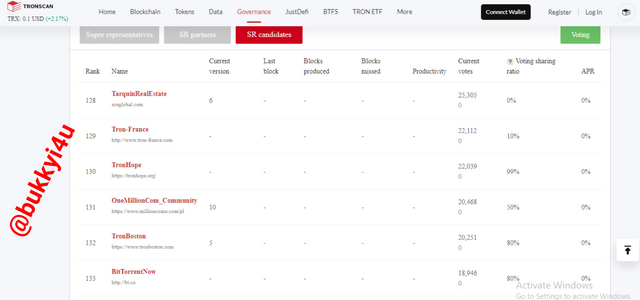

The next is the super representative candidates who are ranked from the positions of 128 downwards. The only parameters available for them include current version, current votes and the voting sharing ratio. Their APRs stand as 0%.

2- What’s the difference between DPOS and POS consensus mechanisms?

The Proof-Of-Stake Consensus Mechanism

Proof-of-stake was a concept that was first written in theory in July, 2011 on a Bitcointalk forum. The intention behind this consensus mechanism was to produce a methodology that could enable blocks to be verified without having to employ the use of the intensive energy as required in the proof-of-work consensus mechanism that was already in operation in the Bitcoin network. In the proof-of-work consensus mechanism, thousands of computers that compete against one another are made to spend a lot of energy trying to confirm the data. However, in the proof-of-stake mechanism, network nodes are made to do the verification.

These network nodes must have locked or staked the tokens in the network as collateral. The Beacon Chain which was launched in December 2020 as the first phase of the Ethereum 2.0 that is meant to replace the traditional Ethereum network comes with the proof-of-stake as its consensus layer where every single validator stakes a minimum of 32 ETH on the Beacon Chain. Different other versions of the POS have been adopted by Algorand, Cosmos, EOS, Tezos, the Synthetic Network and Cardano.

Since the use of mining that is energy intensive is not required, validators are chosen at random to validate data blocks. Consequently, the cost that would be involved in planning a malicious error in the network would be way greater than the reward that could come from such an attack on the network. This helps to improve security on the network. Interestingly, several methods are employed by the algorithm in selecting who gets to validate the next block. These include:

The size of the coins or tokens that have been staked as increasing the size of staked tokens equally increases the chances of being selected to validate the next block

The length of time that such tokens have been staked on the network as tokens that have been staked for a longer period of time have increased chances of being selected and once it verifies a block the age of the tokens it would be reset to zero

It could also be selected at random where the largest stake is combined with a lowest hash value produced by the hashing algorithm to determine which node gets to validate the next block

Advantages Of POS

There are a good number of advantages associated with the proof-of-stake consensus mechanism. Some of these include:

It eliminates the energy-intensive process of computational mining in blockchain

It offers incentives to users who are made to confirm data are on the network

It uses collateral staking which ensures optimal security on the network

Some of the most powerful and popular blockchains are adopting the proof-of-stake mechanism

Participation in the staking process does not actually require any form of technical or expert experience

It is actually accompanied by a reduction in the gas or transaction fees

Disadvantages Of POS

Equally, there are some disadvantages associated with POS consensus mechanism which include:

Relatively it is new and its reliability and security is not as proven as the earlier proof of work used in the Bitcoin network

Coins that have been staked must remain for the stipulated period of time before they can be sold

Actually, mining comes with a greater reward than staking

When users gain larger amount of holdings in the coin they could gain unnecessary privileged influence over the process of consensus in the network

A user who acquires up to 51% of all the currency in the system can actually attack it

Delegated Proof-Of-Stake

One of the ways that the proof-of-stake concept has evolved is the delegated proof of stake consensus mechanism. In the delegated proof of stake (DPOS) consensus mechanism, delegates are usually elected by the users of the network through voting to serve as block validators. Officially, they are either called block producers or witnesses. Usually, the users would have to pool their tokens into a pool. The tokens that are contributed to the staking pool would have to be linked to a particular delegate. This does not mean that it will be transferred into another wallet physically.

You only relinquish power to a staking service provider to actually stake the tokens on your behalf. In most protocols, the number of delegates are usually limited between 20 to 100 and randomly selected when a new block needs to be confirmed. Hence, each block may be verified by different delegates who now receive the transaction fees which would then be eventually distributed among the users that staked their tokens into the delegate that had succeeded in verifying a particular block in direct proportion to the value of their staking.

Some examples of blockchains that use DPoS and the respective number of witnesses they have include:-:

| Serial Number | Blockchain | Number Of Witnesses |

|---|---|---|

| 01 | Ark | 51 |

| 02 | Steemit | 21 |

| 03 | Lisk | 101 |

| 04 | EOS | 21 |

| 05 | BitShares | 101 |

Advantages Of DPOS

Some of the interesting advantages associated with this kind of consensus mechanism include:

It offers a democratic method in the validation of new blocks

This makes for wider participation and interest in the system

The system ensures that diverse groups are represented with their interests through the delegates that used to pool with

Consensus is actually reached in a faster way with the use of validator that are limited in number

The mechanism increases efficiency in blockchain technology

It is more friendly with the environment than the earlier proof of work

Equally, the mechanism increases the speed of transactions

The blockchain throughput is increased and this encourages more enterprises from the larger market to incorporate blockchain technology

It is possible to remove the delegates or block producers at any time so they are forced to maintain the best behaviour

Disadvantages Of DPOS

Some of the disadvantages associated with the delegated proof of stick consensus mechanism include:

The system could becomes less resistant to attacks and less decentralized as the few number of delegates could form cartels

Few persons make decisions for the larger crowd and this may not actually be the heart of all but they are forced to delegate since they themselves may not stand any chances of winning the voting process

Nonchalant behaviour from users would mean that this system can no longer function as a result of voter apathy

It imposes a system which enables the rich to get richer as those that have larger tokens get the voting strength and most of the reward

The few delegates good dangerously corporate to serve their own selfish interest

Differences Between POS And DPOS

| POS | DPOS |

|---|---|

| Users selected at random to carry out validation do not have any voters monitoring their reputation, though they could still lose the privilege | The elected delegate have a reputation to maintain as they could be voted out if they are viewed in a bad light |

| Nodes with the highest stakes are selected at random to validate blocks | Selection is made among the elected delegates only for block validation |

| Any user with staked tokens who wins the race gets the block reward | The delegate who wins the race gets the reward together with his voters |

| Witnesses are not elected as users simply have to stake their tokens to get a chance to validate blocks | Delegates and witnesses are elected for the purpose of block validation |

| Slower than in DPOS | Faster than in POS |

| Everyone competes to create the new block where selection for the purpose is done randomly | The delegates compete to create the new block |

| Validators must stake tokens that are higher than the transaction fees they expect and this can be lost in the case of malicious behaviour | Delegates can lose the chance of validating blocks again in the case of malicious behaviour and be voted out |

| The system is more decentralized as nodes are selected at random to validate blocks | The system seems to be more centralized in the hands of a few elected delegates |

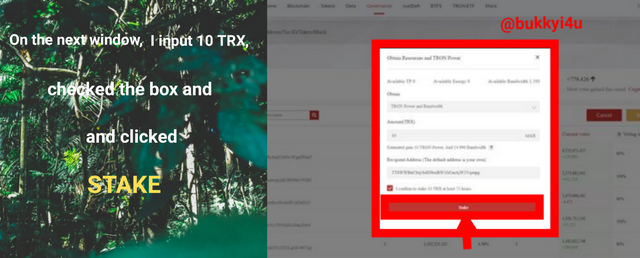

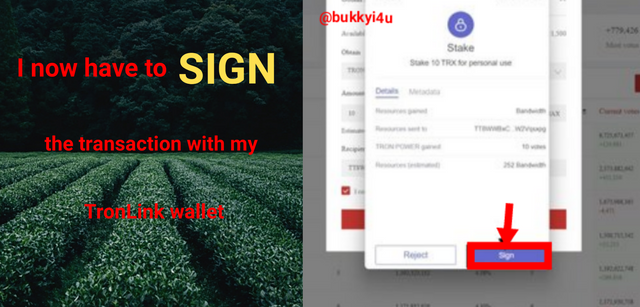

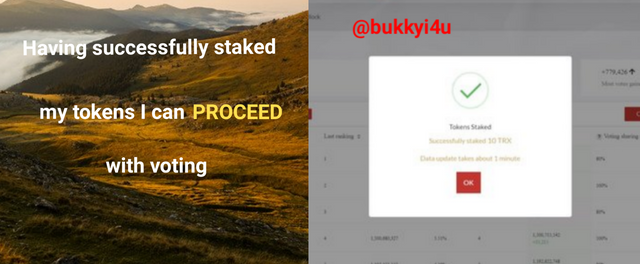

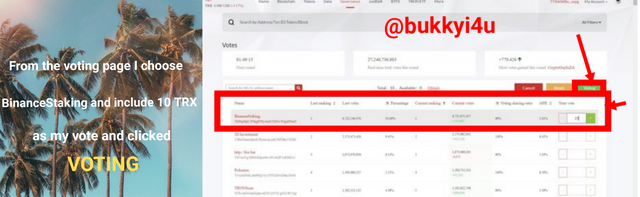

3- Write a Step by Step tutorial showcasing how to stake/freeze TRX and vote for SRs

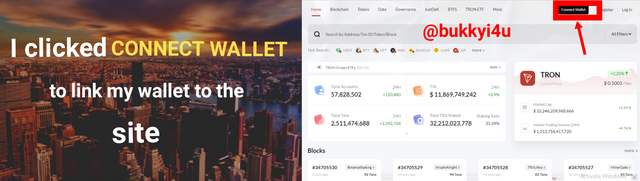

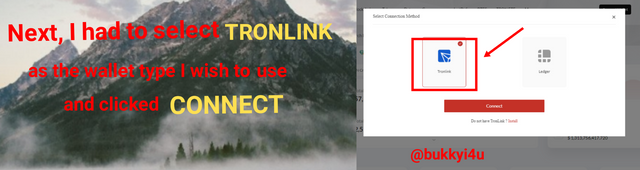

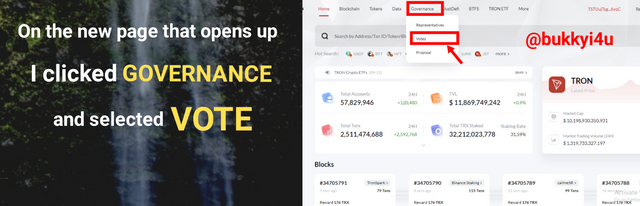

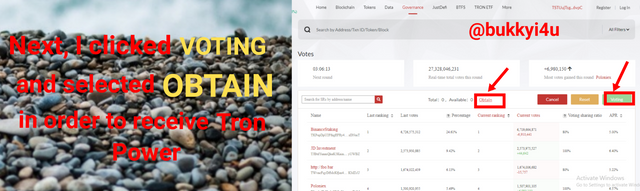

In order to vote for a super representative candidate I had to visit the official TRON website from https://tronscan.org. Once on the site:-

Step 01:-

edited with iMarkup

edited with iMarkup

edited with iMarkup

edited with iMarkup

edited with iMarkup

edited with iMarkup

edited with iMarkup

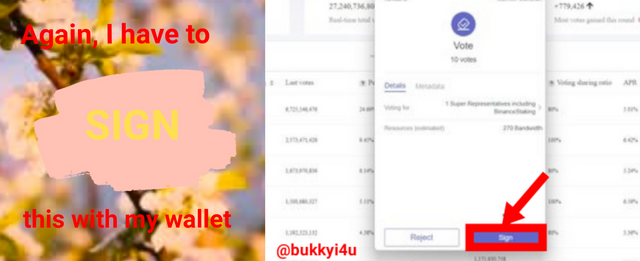

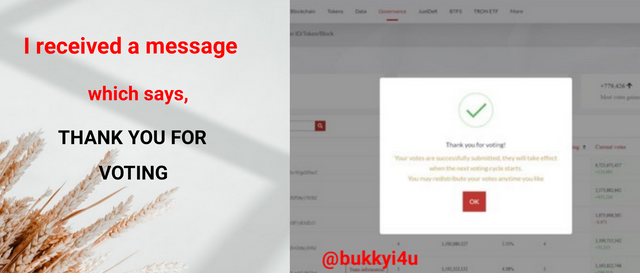

Step 02:-

edited with iMarkup

edited with iMarkup

edited with iMarkup

Note: the free templates in this section were obtained from Canva and the screenshots were taken from https://tronscan.org.

CONCLUSION

The Tron ecosystem as a blockchain has come with quite a number of good advantages especially with its implementation of the Delegated Proof-Of-Stake consensus mechanism. Equally, it has received widespread adoption and usage from the global community who benefit so much from its improved speed of transactions, higher throughput and reduced transaction fees. The staking of Tron assets on the network functions to earn users additional rewards and to enable them to elect their preferred candidate for the validation of blocks.

Usually, candidates can stand for the position of super representatives who are responsible for validating new blocks and proposing new changes to the system by going through the application process. A total of 27 super representatives are selected and the succeeding 28 to 127 positions automatically become the super partners of the network. The super representatives are rewarded with voting and block rewards while these super partners only receive 14 rewards.

It is interesting to note that this blockchain has gained a lot of crowns and I expect that it would gain more widespread adoption and usage in no distant time.

Cc:

@yohan2on

Hi @bukkyi4u

Thanks for participating in the Steemit Crypto Academy

Feedback

Total| 8/10

This is good work. Thanks for taking the time to learn about the governance of the Tron ecosystem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 22 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 4 SBD worth and should receive 43 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit