CONTRACTILE DIAGONAL

Contractile diagonal as discussed by professor @allbert is a type of pattern which can be used to analyse the cycles of financial market whereby it is observed that trends are created with extreme highs as a result of market psychology which are followed by lows in prices together with some other factors that result into a structure that creates a trend which eventually spirals into a reversal in the opposite direction.

This structure creates a pattern where 1,2,3,4,5 points are vividly identifiable and can be likened to the Elliott wave principle which was enunciated by Ralph Nelson Elliott in 1938. The contractile diagonal is subject to the rhythmic procedures that are evident in market psychology (including crypto markets) due to crowd mentality.

Consequently, it follows a procedure which alternates between impulses identifiable by motive phases which are followed by corrective phases displayed on a market trend timeframe. The impulses are subdivided such that the motive phases alternate with the corrective phases. It is such that the 1, 3 and 5 waves represent the impulsive motive moves while 2 and 3 represent respective pullbacks of 1 and 3. In a downtrend, there is usually a reversed system whereby waves 1, 3 and 5 are downwards with 2 and 4 atop.

Contractile Diagonal In Uptrend

bullish contractile diagonalTradingView

In an uptrend the first impulsive wave is created and labelled 1. It is followed by a retracement labelled 2. Another impulsive wave is labelled 3 and is followed by wave 4 which is its retracement. Eventually, impulsive wave 5 is created before the reversal.

Normally, wave 1 is always longer than wave 3. In turn, wave 3 is longer than wave 5. In the retracement or corrective waves 2 is usually longer and extends more than wave 4.

Contractile Diagonal In Downtrend

bearish contractile diagonalTradingView

In a downtrend the pattern is much the same in the opposite direction. In this case an impulsive wave 1 is created downwards with a corrective wave 2 following it; then, another impulsive wave 3 downwards with a corrective wave 4. Finally, an impulsive wave 5 downwards before the upward reversal.

WHAT EXACTLY IS HAPPENING?

Wave 1

Wave 1 is usually created with high volatility in the market due to the fact that there is an increase in the volume as a result of a new trend coming in place or renewed interest or vigor pushing the prices a little bit extensively in the direction of the current trend.

Wave 2

The corrective wave 2 occurs as a correction in a market that is still generally either bullish or bearish. It is normally the longer of the corrective moves. However, it will not go beyond where wave 1 started.

Usually, it occurs due to the fact that prices tend to retest the previous lows and it could come with corrective sentiments. However, impulsive motive reactions usually work in stopping them extending further.

Wave 3

Volume usually picks up as a result of renewed impulsive sentiments. Nevertheless, this never extends more than wave 1. Infact, it seems the impulsive waves are gradually reducing.

Wave 4

Other corrective wave 4 follows which is short-lived. This is smaller than wave 1 and generally the trend seems to be weakening. With the Fibonacci, it is usually less than 38.2% addressment of wave 3.

Wave 5

As wave 4 which lacks much interest in the current trend gives way, 5 takes up the final leg. It continues in the direction of the current trend. However, it comes with lower volumes and does not extend more than 3. Some indicators might show divergences which eventually result to reversals.

2- Give an example of a Contractile Diagonal that meets the criteria of operability and an example of a Contractile Diagonal that does NOT meet the criteria. (screenshot required / Bitcoin not allowed)

OPERABLE CONTRACTILE DIAGONAL SETUP

Actually, before a pattern can be clearly said to be a contractile diagonal, there are quite a number of criteria that must be met. Of course, patterns that look like the contractile diagonal may still create reversals without completing the setup. However, it does not qualify as an operable contractile diagonal except it follows the criteria below:

- Wave 1 should be more extensive than wave 3

- Wave 2 should not produce a retracement that is more than 100% of wave 1 and should be more extensive than wave 4

- Wave 3 should be more extensive than wave 5 and can never be the shortest among waves 1, 3 and 5

- It must be possible to produce a trace which must join points 1 and 3. Also, this trace can extend to point 5 (but not necessarily)

- Tracing the second diagonal must connect waves 2 and 4

- The two diagonals when extended must meet and cross each other at a point nearby

- The risk-reward ratio must be in favour of the reward

In view of the criteria enumerated above, the crypto-asset chart below is an operable contractile diagonal:-

operable contractile diagonalTradingView

From the chart:

- Wave 1 is more extensive than wave 3

- Wave 2 is more extensive than Wave 4 and is not more than 100% of Wave 1 in retracement

- Wave 3 is more extensive than wave 5 and is not the shortest among the three impulsive motive waves 1, 3 and 5

- The trace of the first diagonal correctly joins points 1 and 3

- Waves 2 and 4 are correctly joined by the trace of the second diagonal

- The two diagonals produce extensions that meet and cross somewhere nearby

- The risk to reward ratio tilts in favour of the reward

NON-OPERABLE CONTRACTILE DIAGONAL SETUP

In view of the aforementioned criteria the crypto-asset chart below is not an operable contractile diagonal setup:

non-operable contractile diagonalTradingView

The above scenario is an non-operable contractile diagonal setup. A potential contractile diagonal setup becomes non-operable or invalidated if one or more of the rules are breached and out of the limit of what could be permitted or acceptable. In the chart above:

- In the first scenario every other condition was in place except for Wave 5 which extended above Wave 3

- In the second scenario every other thing was in place except for Wave 4 with extended above Wave 2

- Eventually, the breach of the rules or criteria invalidates the two potential contractile diagonal setups

3- Through your Verified exchange account, perform one REAL buy operation (15 USD minimum), through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Your purchase data must match your analysis data: such as cryptocurrency and entry price.

REAL CONTRACTILE DIAGONAL BUY TRADE

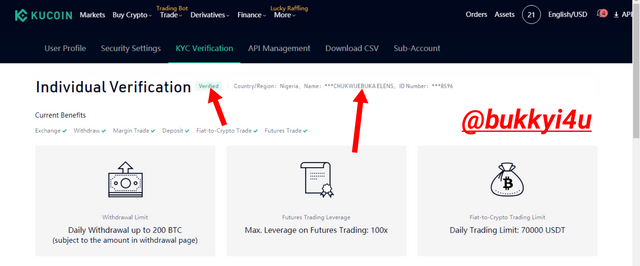

To demonstrate this part I am going to be making use of my Kucoin verified account.

screen from kucoin

Buy Entry Criteria:-

screen from kucoin

I entered a buy position with the ARX/USDT crypto pair in this order:

- Having observed that all the criteria for an operable contractile diagonal had been met I entered a position with the bullish candle that forms at the onset of the expected bullish reversal

- Consequently, my entry was at point 0.03896

- I set my take profit at 0.04203, the beginning of Wave 1 which is about 7.9% reward

- I set my stop loss at 0.03675, the end of Wave 2 which is about 5.67% risk

Buy Exit:-

screen from kucoin

- As at the time of writing this article the trade was going against me and I had to close it with a market order at 0.03812

screen from kucoin

4- Through a DEMO account, perform one sell operation, through the Contractile Diagonal method. Explain the process and demonstrate the results and graphical analysis through screenshots. Bitcoin is not allowed.

I will be demonstrating this section with my Binance account while taking screenshots from Kucoin

Sell Entry Criteria:-

screen from kucoin

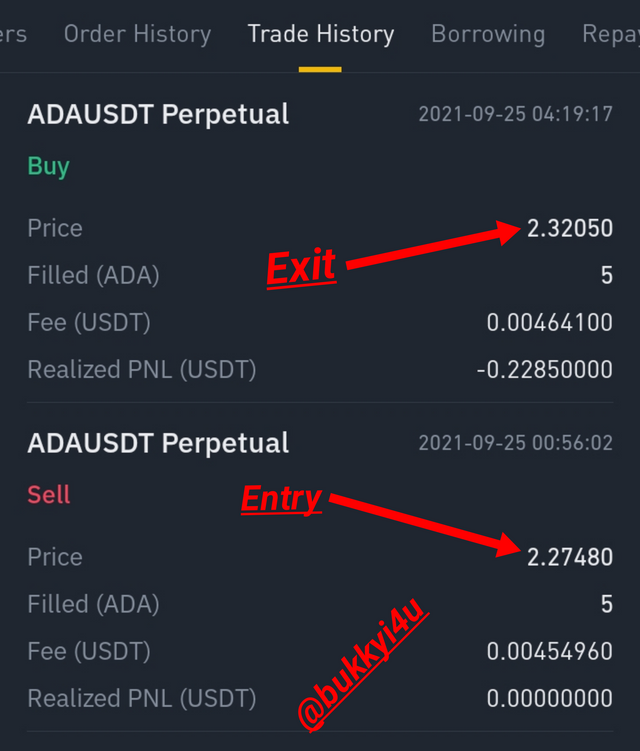

I entered a sell position with the ADA/USDT crypto pair in this order:

- Having observed that all the criteria for an operable contractile diagonal had been met for a sell position I entered a trade with the second or confirmatory bearish candle that forms at the onset of the expected bearish reversal

- So, my entry was at 2.27480

- I set my take profit at 2.132626, the beginning of Wave 1 which is about 6.25% reward

- I set my stop loss at 2.338109, targeting a previous swing high somewhere above Wave 2 which at about 2.79% risk

Sell Exit:-

- With the odds against me, I closed the trade at 2.32050 close to my stop loss

h6>

h6>

5- Explain and develop why not all contractile diagonals are operative from a practical point of view. (screenshot required / Bitcoin not allowed)

They could be quite a number of reasons while not all the contractile diagonals that seem to have been perfectly-formed could eventually be operative. This could be due to the fact that while most of the criteria could be in place, a few variables or even one could invalidate the setup.

Apart from when some criteria are breached I would like to discuss two scenarios where the criteria may have actually been met but trading the pattern would still not be advisable.

ABSENCE OF CONFIRMATORY BREAK-OUT CANDLE

The first scenario is a situation whereby the pattern is actually in place. However, a confirmatory break-out candle is not formed thereby making it risky to trade the setup.

screen from TradingView

In the crypto-asset chart above, Wave 1 had been perfectly formed

It connects to Wave 2 and 3 nicely. Also, Wave 4 comes in place but Wave 5 rather extends below Wave 3 with an unexpected downward break-out (with the expected bullish break-out occuring a little bit later)

ADVERSE RISK-REWARD RATIO

It is always advised when taking trading positions that you go for risk reward ratios that is in favour of the reward - that is to say the percentage you stand to gain by putting your take profit at a previous swing high or swing low should be higher than the percentage that would come with placing your stop loss with a previous swing low or swing high in view.

screen from kucoin

Trading the above crypto asset chart is not advisable because the potential reward ratio is smaller than the risk ratio.

CONCLUSIONS

The contractile diagonal is an interesting market structure which produces wave-like patterns that could be very instrumental in predicting possible reversals of current trends. Usually, it produces patterns that can be identified with numbers from 1, 2, 3, 4 and 5. However, there are a few rules that must be obeyed in the numbering system for a pattern to be seen as being operable with the contractile diagonal.

Quite a number of factors could make a pattern non-operable with the contractile diagonal structure. Apart from the cases where the structures are not produced completely - thereby validating it - an adverse risk-reward ratio and unconfirmed breakout are two red signals in trading this pattern.