Edited with Canva

Hello everyone, I am glad to be participating in the homework task on Zethyr Finance for professor @fredquantum in this Week 8 of the Steemit Crypto Academy Season 4.

1. What is Zethyr Finance?

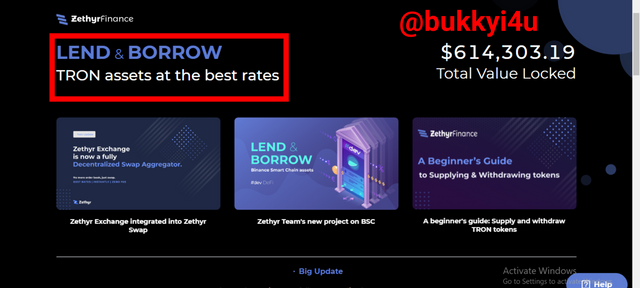

Zethyr Finance is a decentralized finance protocol which is developed on the TRON ecosystem which works by making use of both decentralized and centralised protocols from different markets to aggregate yields by leveraging on these different markets as a way of obtaining the best yields in their aggregation process. Consequently, the protocol makes it possible for lending and borrowing activities to be carried out by its users where these two important activities can be done with the WIN, USDT, BTT and TRX tokens.

While using the protocol people who wish to engage in lending can transfer assets from their TRON wallets and deposit such assets into smart contracts built on the Zethyr Finance. In like manner, people who wish to engage in borrowing can obtain such loans directly from smart contracts built on the Zethyr Finance protocol.

In the beginning, Zethyr Finance accepts different assets for collateral purposes. The assets accepted include TRX, USDT, BTT and WIN. Usually, users would simply have to toggle the switch that is located next to an asset in order to collateralize the asset which they intend to use for lending. In any case these assets must have first been deposited by the user.

| Tokens | Available For Borrowing | Accepted As Collateral | zTokens To Be Minted |

|---|---|---|---|

| BTT | Yes | Yes | zBTT |

| TRX | Yes | Yes | zTRX |

| USDT | Yes | Yes | zUSDT |

| WIN | Yes | Yes | zWIN |

The platform makes use of ztokens which are pegged in a ratio of 1 to 1 to the value of whichever underlying asset that the user has deposited into the Zethyr Finance Protocol. The ztokens can be stored freely by the user. Equally, they can be traded or even transferred. Usually, ztokens would be minted once deposits are made on the platform. On the other hand, they would have to be burned when they are redeemed out of the platform. Whenever a user has an asset in the protocol he would accrue interests whose equivalent ztokens would be minted and distributed to the wallet of the users directly.

The ztokens makes it possible for users to maximally benefit and enjoy the rewards that are usually distributed to users that do not withdraw tokens away from the Zethyr Finance platform. Another form of collateralization which the platform accepts from users is lending. Hence, assets can be borrowed against lent out tokens.

| Tokens Deposited | Tokens To Be Minted | zTokens Received By Users |

|---|---|---|

| WIN | zWIN | When they deposit WIN into the Zethyr lending pool |

| USDT | zUSDT | When they deposit USDT into the Zethyr lending pool |

| BTT | zBTT | When they deposit BTT into the Zethyr lending pool |

| TRX | zTRX | When they deposit TRX into the Zethyr lending pool |

2. What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

While on the platform https://zethyr.finance you are going to come across the different available functions and features offered by the Zethyr Finance. Some of the features include:

Lending And Borrowing

The platform has a lending and borrowing function or feature. Actually, this is its most prominent function. Through this feature you can simply collateralize your Tron-based assets in order to obtain or borrow other Tron-based assets or TRX. This can be done through the borrow function.

It equally comes with the lending feature. In this case it is possible to lend Tron-based assets or TRX to Zethyr Finance in order to earn more tokens. It is possible for your lent out assets to be used as collateral to borrow other Tron-based assets or TRX. Usually, this is done through the supply function.

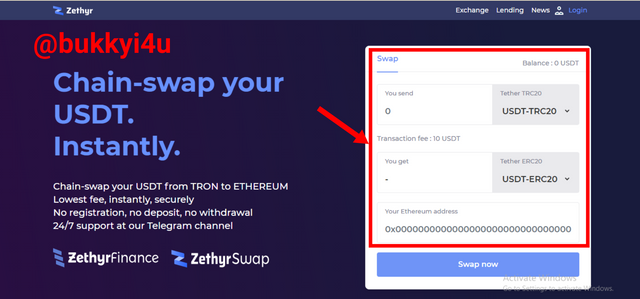

Swap feature

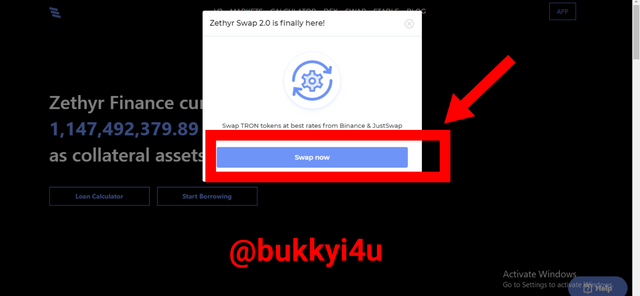

There is a swap feature on the platform. This enables users to easily exchange their tokens to other Tron assets or TRX at 0 fees and at an instant rate of time. This swap can be initiated with JustSwap and Binance platforms and the platform aggregates the best exchange rates from different swaps and exchanges in carrying out the instantaneous swaps on the platform.

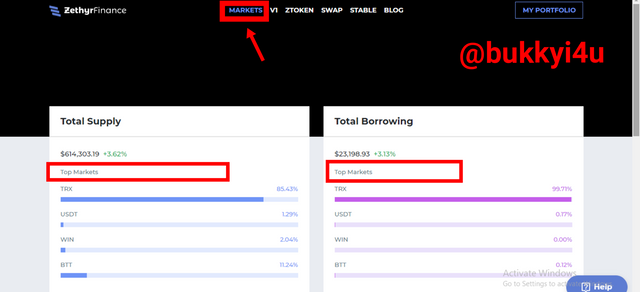

Markets feature

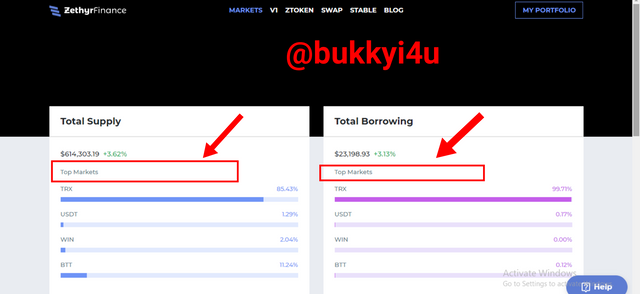

The markets feature which displays on the platform shows users the different markets where lending or supplying and borrowing functions can be carried out successfully. These markets reflect the different assets that can be efficiently borrowed or supplied. Some of the assets in the market include TRX, BTT, WIN and USDT. From this function you can also see the total supply which currently stands at $614303.19 and equally tells you the percentage of the supply contributed by each of the top markets in which case TRX is seen to have contributed 85.43%.

Also you will see that the total borrowing currently stands at $23,198.93 with TRX constituting 99.71% of the total borrowed assets followed by USDT at 0.17%.

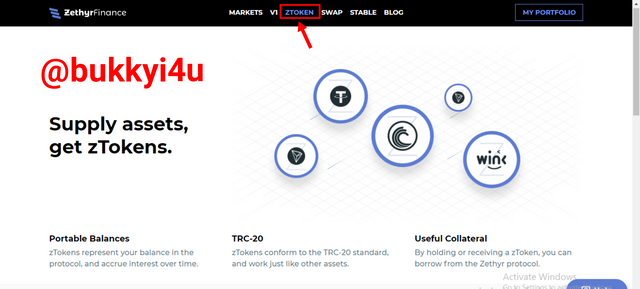

Ztokens feature

The tokens minted on the platform are carried out with the TRC-20 tokenization standard. Whenever assets are supplied to the platform for lending you would receive an equivalent amount of ztokens in your balance. Over time the tokens would accrue interest which would automatically be distributed or forwarded to your wallet.

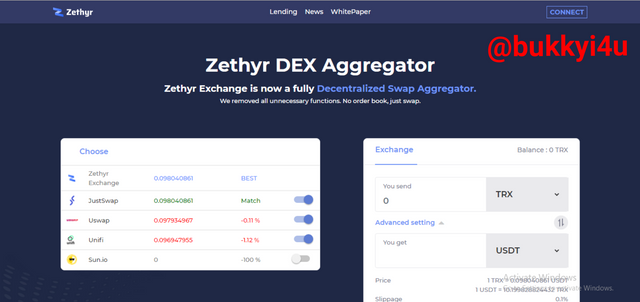

Zethyr Dex Aggregator

An upgrade was made in which the Zethyr Exchange was updated to ver 2.2.8. This upgrade came as a result of strong analysis that had been made on how users interact with Dapps and making use of recorded datas to evaluate the delivery of the Zethyr Exchange. Upon this research, it was discovered by the developers of the system that it was no longer suitable to continue using the old-fashioned order book model with the Dapps since it does not support the development of the Zethyr Exchange in a decentralized manner. This resulted in the decision to merge the Zethyr Swap and Zethyr Exchange as the Zethyr DEX Aggregator which functions as a swap aggregator which can be said to be fully decentralized.

In this master stroke, the order book model together with all its related functions have been eliminated. Consequently, you can now simply swap any assets of yours with the use of the DEX Aggregator whose user interface has been redesigned and updated to support quick and easy swap functions. This aggregator makes use of results obtained from the aggregated exchange rates from different swaps and exchanges to produce the best swap rates that come with zero fees and instant swap functions.

Recently, aggregated applications that have been developed on the Zethyr DEX Aggregator include:

- Justswap

- Uswap

- Sun.io(soon to be introduced)

This swap aggregator functions in the manner shown above. You simply have to include the amount of token you wish to swap and through the advanced setting you would be shown the total number of assets you would get. You can then click swap now to proceed with the swap function where you would be charged some network fee.

3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

While on the platform it is possible to explore the different markets on the Zethyr Finance protocol. To do this I had to visit the official site at https://zethyr.finance/#/ .

Once on the site I clicked the market icon displayed to the top and I was launched into the different Zethyr Finance market interface together with the details therein.

From the interface as at the time I visited, the total supply of assets to the platform had witnessed a 24-hour increase of 3.62% and currently stood at $614303.19. The top market in the platform for this supply of assets was TRX with 85.43%. This was followed by the BTT market with 11.24%. The WIN market followed with 2.04% and the USDT market brought the rear with 1.29%.

On the borrow side the total amount of borrowed assets was up by 3.13% in the last 24 hour and stood at $23198.93 currently. The highest percentage of borrowed assets was the TRX market with 99.71%. Next in line in terms of borrowed assets was the USDT market with 0.17%. This was followed by the BTT market at 0.12%. The worst in terms of borrowed assets was the WIN market which currently stood at 0.00%.

| Market | Total Supply | Supply APY |

|---|---|---|

| TRX | $524,771.87 | 3.92% |

| BTT | $69,043.60 | 4.80% |

| WIN | $12,555.22 | 5.87% |

| USDT | $7,932.48 | 21.49%. |

Generally, from the table above in terms of total supply and the supply APY, TRX had the total supply of $524,771.87 which was up by 3.13% in the last 24 hours and enjoys a 3.92% apy. BTT follows with the supply of $69,043.60 up 7.70% with a supply APY 4.80%. Next is WIN with $12,555.22 total supply of 4.64% with a supply APY of 5.87%. USDT brought up the rear with a total supply of $7,932.48 with the supply APY of 21.49%.

Obviously, USDT has the best supply APY of 21.49% and TRX has the lowest with 3.92%.

| Market | Total Borrow | Borrow APY |

|---|---|---|

| TRX | $23,131.41 | 10.80% |

| USDT | $39.99 up 2.56% | 8.00%. |

| WIN | No data | 23.00% |

| BTT | $27.51 | 20.00%. |

On the borrow side TRX has the highest number of total borrowed assets which was up 3.13% and now stood at $23,131.41 with a borrow APR of 10.80%. This was followed by USDT with a total number of borrowed assets which stood at $39.99 up 2.56% and with a borrow APY of 8.00%. There is no data for the total borrowed asset for the WIN market though it has a borrow APY of 23.00%. BTT market has a total borrowed assets which stood at $27.51 up 9.89% and a borrow APY of 20.00%.

Obviously, the WIN market has the highest borrow APY of 23.00%. So, it is the worst for borrowing while USDT has the best borrow APY at just 8.00%.

Clicking on any of the markets would reveal more. So, I clicked the TRX market and the price, total users, total supply, total borrowing, supply APY, borrow APY, borrow market liquidity and collateral to loan ratio were all revealed as additional details.

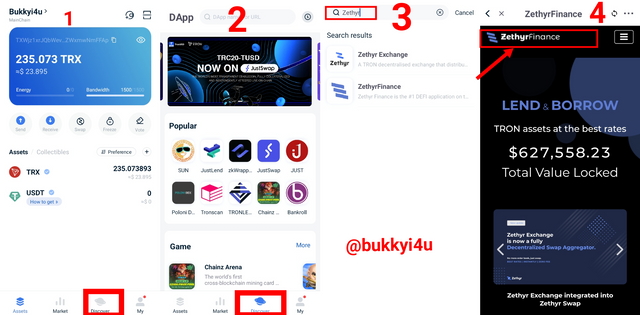

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

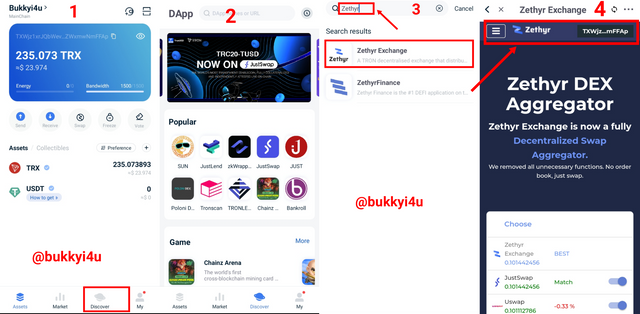

In order to demonstrate how to connect my TronLink wallet to the Zethyr Finance, I will be making use of the TronLink wallet app on my mobile phone.

- First, I launched the TronLink wallet app

- Next, I clicked on discover at the bottom of the page

- After that I had to launch the Zethyr Exchange Dapp by searching it on the search bar at the top of the page and then clicking on it

- This automatically connects the dapp to my TronLink mobile wallet as is shown at the top of the landing page

5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

ZTokens

Ztokens refers to the tokens that are issued to users when they deposit assets on Zethyr Finance platform for the purpose of lending or borrowing. Usually, they are pegged in a ratio of 1:1 to the exact value of the underlying assets which are deposited and for which they are minted.

Once these ztokens are minted they can be stored, transferred or even traded freely by the owners. Equally, when the user wants to redeem his underlying assets from the platform, the corresponding Ztokens minted would be burned.

Normally, users would supply tokens for lending purposes and interest can be accrued from such ventures. Whenever interests accrue on the underlying tokens which may have been used for lending purpose on the platform, such interests are accumulated and ztokens which are equivalent to the amount of the interest will be minted and directly sent to the wallets of users.

Another interesting feature is that the ztokens to retain the exact features and benefits of the underlying assets which have been minted on the Zethyr Finance platform even when they have not been withdrawn away from the Zethyr protocol.

Currently, there are some tokens that are accepted on the platform and for which their corresponding Ztokens can be minted upon deposit. Such accepted tokens include USDT, BTT, TRX and WIN. Respectively, zUSDT, zBTT, zTRX and zWIN would be minted once any of these tokens are deposited on the platform for any purpose.

JTokens

JTokens can be said to be the receipt that users would normally get whenever they supply a particular asset to the JustLend platform. Hence, for a supply of TRX, jTRX would be received, USDT receives jUSDT, BTC receives jBTC and a supply of SUN tokens receives jSUN. Equally, it is built after the TRC-20 tokenization standard.

So, JTokens are to JustLend what Ztokens are to Zethyr. On the JustLend platform, the jToken smart contract is normally used to integrate and pack the assets accepted by the platform in the DeFi protocol which mints the tokenized assets. Interest is generated on the assets provided and held by users. Interesting that they can always be redeemed back to their corresponding base tokens.

They can be transferred to other smart contracts since they share the same qualities as TRC-20. Once you transfer your JTokens to other institutions or users, it would be seen as a waiver of ownership of the tokens which you have supplied to the JustLend platform. The JTokens can be used to interact with the JustLend protocol. There is a token market for each jToken contract and the tokens can generally be used to interact with contracts that redeem, borrow, mint, repay, liquidate loans or simply transfer the underlying assets.

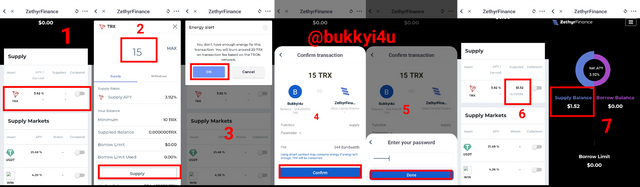

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

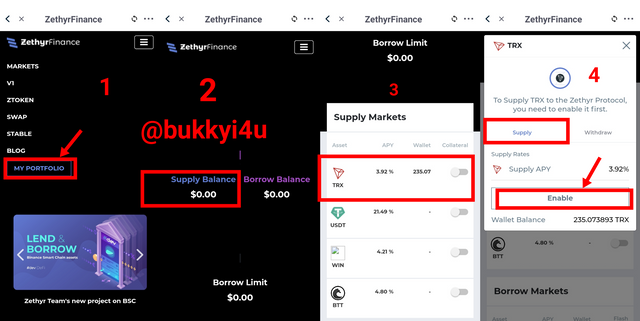

In order to perform a supply function on the platform I would first have to connect and enable their supply asset pool.

- First, I launched the TronLink app

- Next, I clicked on the discover icon

- After that I searched for Zethyr Finance in the search bar and this reveals that the Dapp is already connected to my TronLink wallet

- I now have to click on portfolio and then clicked supply

- I clicked on TRX which I wish to use for the supply

- Next, I have to click on the supply option and the enable button.

- I am required to burn 20 TRX and 307 bandwidth for this interaction. I clicked confirm.

- Next, I had to enter my password and signed the transaction.

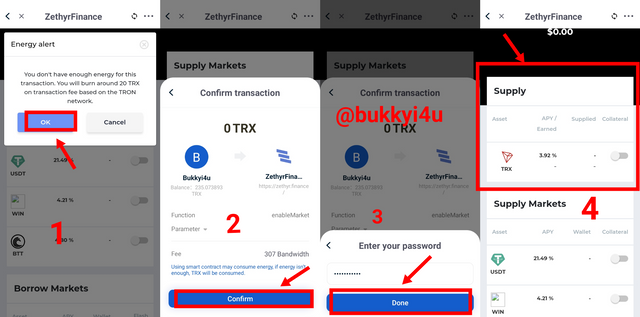

Having done this for the supply asset pool I will repeat the process for the borrow asset pool.

- I clicked on the USDT tokens

- After that I clicked on the enable button

- Now I clicked ok and a fee of 20 TRX is required

- I clicked confirm and entered my password to sign the transaction

Finally, I can now supply the TRX asset in the Zethyr Finance. To do this:

- I clicked on asset

- I now enter the value of TRX wish to supply

- Next, I clicked the supply button

- Again I am required to burn 20 TRX and I clicked comfirm

- I now have to enter my password to sign the transaction

- From the screenshot you can see that the supply has been successfully added

- The link to the transaction is also pasted for confirmation

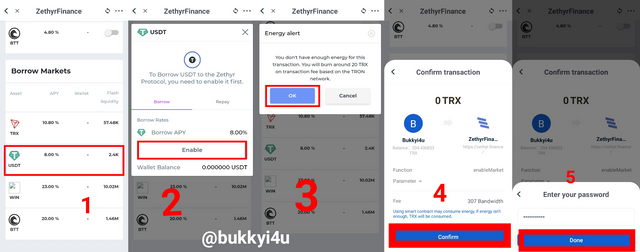

7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

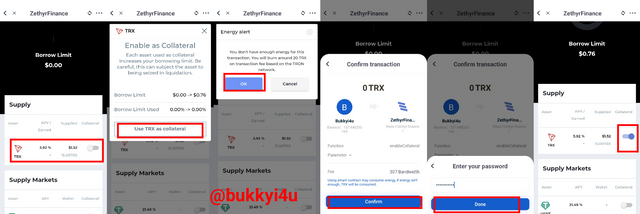

In order to collateralize my assets to borrow on the platform I follow the steps below.

- From the supply option I clicked on the asset which I have supplied by simply toggling the key to the right

- I received a pop-up message which requirement me to agree to use TRX as collateral

- 20 TRX and 307 bandwidth are required. I click ok.

- I have to enter my password to sign the transaction.

- The botton is immediately activated

8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

Actually, I think the Zethyr Finance is a great innovation and I believe it would receive greater adoption in the coming years. There are quite a good number of interesting benefits on the platform that would pave way for this greater adoption. I will enunciate some of them.

Using Deposited Tokens Which Are Idle

On the Zethyr Finance platform, whenever users leave assets unborrowed in the lending pools the platform automatically deposits these idle funds into different protocols that are meant to earn passive interest for the users. This would maximize the return that lenders benefit from the platform. For instance, an idle TRX can be staked by the Zethyr platform for a TRON super representative who has the highest distribution in the form of reward rate.

Providing Liquidity For Flash Withdrawals And Loans

Depositing idle tokens into other protocols that are meant to increase the return of lenders can be beneficial. However, it could result in a reduction in the available liquidity for borrowers who may desire instant credit lines or for lenders who may desire instant withdrawals from the Zethyr Finance platform. Unfortunately, too much idle funds cannot also be left on the platform as this would reduce the returns for lenders.

This situation requires that a trade-off should be made. Hence, Zethyr Finance would leave 5% of all the total assets that have been supplied into the platform idle. These idle funds are used for the facilitation of flash withdrawals and loans. Actually, this percentage could change with time as appropriate. All the same, this gives the platform a high credibility which makes it a great project that can be relied on.

Stable Interest Disbursement

Usually, when borrowers interact with the platform their interests would accrue and actually be compounded daily in the same underlying tokens which they have borrowed. That is to say, interest accrued on TRX borrowed would equally be paid out in TRX. Borrowers have the option of paying the interest anytime but daily repayment would prevent compounding. So, borrowers have the option of daily repayment to prevent compounding of interest on their borrowed assets and this is a great bonus to the platform.

The platform automatically mints Ztokens that are equivalent to the interest repayments they receive from borrowers and send this to the wallets of lenders directly. This ensures that lenders receive stable income or passive benefits from their investments. These underlying token interests of lenders can always be withdrawn at any time because of the availability of flash liquidity.

There are quite a number of other benefits including the rebalancing mechanism which is done once everyday to ensure the best yields, liquidity for flash withdrawals and loans, risk diversification and other factors are properly catered for to the benefit of the users. Equally, there is the use of maximum leverage for every digital token which is used as a collateral and this ensures that users can only borrow what they can repay.

With all these mechanisms put in place I think the project is a great one and has an interesting future to look out for.

CONCLUSION

The Zethyr Finance protocol is a decentralized system that is built on the TRON ecosystem and aggregates the best exchange rates from both centralised and decentralized swaps and exchanges to obtain the best yields in the aggregation of interests being paid out to lenders and users that carry out borrowing and lending functions on the platform. Usually, an equivalent amount of Ztokens which is pegged in a 1:1 ratio to the underlying asset would be minted when assets are deposited on the platform for the purpose of lending.

There are a lot of interesting features on the platform and it is very easy to interact with the system where supply and borrow functions can be easily carried out either on mobile or even desktop devices. The platform is quite a great one and has a lot of nice mechanisms that have been put in place including the rebalancing system and the liquidity for flash loans and withdrawals mechanism which give it a great potential for massive future adoption.

Do not use the #club5050 tag unless you have made power-ups in the last 7 days that are equal or greater than any amount you have cashed out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit