Trading asides the normal buying and selling is the speculation of price movement over a given period of time in other to make a profit. Often when the word trading is mentioned, it is often misunderstood for short-term buy and sell of securities but this is wrong. Tradings such as perpetual contracts can go indefinitely and not for a short period of time. before I continue to explaining Spot and Margin trading, there are a few types of trading that you should know which occur on these trading markets. On the spot market, we can have traders who swing trade, trend trade, and so on. Seeing trading as a short-time exchange of position is actually wrong.

Spot Trading Market

We can call this the immediate or fast delivery trading market where buys and sells are completed immediately or when they reach the price set to be sold. Calling it "Spot" gives it the name that implies that trades are done on the spot rather than on a fixed day in futures trading where the trade is made when the contract expires.

With the spot market, it is easy to trade fiat for any type of cryptocurrency as there are many immediate trading pairs such as the USDT/BTC, USDC/TRX, and so on. If coins are set to a predetermined price and the price reaches, Then the coin is swapped immediately releasing the exchanged assets to the individual traders.

Margin Trading

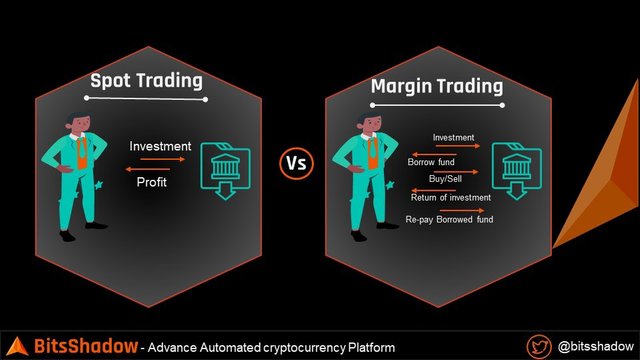

Margin trading is a type of trading but this time it is different from spot trading. It requires borrowing other peoples' funds to amplify or increase the stake used to trade. With Margin trading, the trader has access to more capital and more risk. It is like going to the bank to get a loan for a business that has a high possibility of liquidating. With margin trading, a trader can have $100 but trade with $1000 in his margin account as leverage is free to use in this type of trading.

In margin trading, the trader brings in their margin (their real funds), and then they use leverage (borrowed money) to make their trade bigger so as to increase profit. With margin, making extra profit by leveraging (eg. 2X, 4X, and so on) is possible. As profitable as it seems, liquidation is very easy to ome accross as it magnified upward movement is directly proportional to its magnified downward movement.

Spot Tading and Margin Trading

| Margin Trading | Spot Trading |

|---|---|

| Higher trading power with regards to leverage | Power to trade is limited to wallet funds |

| Increased Risk | Minimal risk |

| High Profit/High loss | Trading can be swing trading with normal profit and loss |

| Funds can be lost faster | Coins remain intact but may lose value. |

Conclusion

Trading is a way to make profit over the market flunctuation and while all trading market is good, some help traders make more profit than others at a higher risk of loss.

Hello @busted1,

Thank you for submitting homework task 3 ! You have discussed the topic well. I love the table you have presented to compare spot trading and margin trading. Keep up the good work ! [7]

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit