Hello everyone, this season 4 week 4 of the steemit crypto academy. This week’s lecture was delivered by professor @reddileep and it was centered on Cryptocurrency Triangular Arbitrage. After going through the lesson I decided to try my hands on the given task.

1- Define Arbitrage Trading in your own words.

Arbitrage trading is a short term investment strategy that is used based on the difference in prices of assets to make profit. The risk involved in arbitrage trading is very low. The traders buy assets at a lower price and sell them at a higher price in order to make profit. Arbitrage trading can be applied by buying assets on a particular exchange and selling them on another exchange. It can also be done within assets on the same exchange.

A trader needs to have the ability to be able to detect slight differences between the prices of the same asset on different exchanges and at the same time also have the ability to be able to detect the slight difference between different assets on the same exchange. This will help the trader to be able to make profit through this trading arbitrage. This however requires great trading experience to be able to detect these slight differences.

As said earlier, the arbitrage is a short term trading technique. For that matter the profit is accumulated in small bits to be able to get a good amount of profit at the end. Due to this the arbitrage trading requirements large amount of capital to start the process. Using small capital in this trading procedure is very risky and the trader could lose all assets.

2- Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

Triangular Arbitrage

This type of arbitrage requires 3 different crypto assets at the same time. Three steps are used to exchange these three assets simultaneously and difference in their price results in a profit. Traders take advantage of the price difference to make profit. The process starts with one asset and end at that same asset after going round. This idea is to help buy an asset at a very cheaper rate and profit is made from it.Fixed income arbitrage

This type of arbitrage is very popular in trading and other marketing activities at large. It is used to fix the shortcomings that are happening in a trade. The deficiencies that are present in trading are fixed using the fixed income arbitrage.Merger arbitrage

The buying of other companies or merging of one company to another happens as a result of merger arbitrage. When some companies are about to face liquidation or are not strong enough to operate alone, they are bought by other strong companies so that they can be merged to function together. This company is bought at a discount so that the newly merged business can generate profit through its operations.

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

Triangular arbitrage requires the use of 3 different assets. As discussed earlier, three steps are used to exchange these three assets simultaneously and difference in their price results in a profit. Traders take advantage of the price difference to make profit. The process starts with one asset and end at that same asset after going round. This idea is to help buy an asset at a very cheaper rate and profit is made from it. At the end of the process, it is expected that the value of the asset at the end of the trade will be more than the initial value.

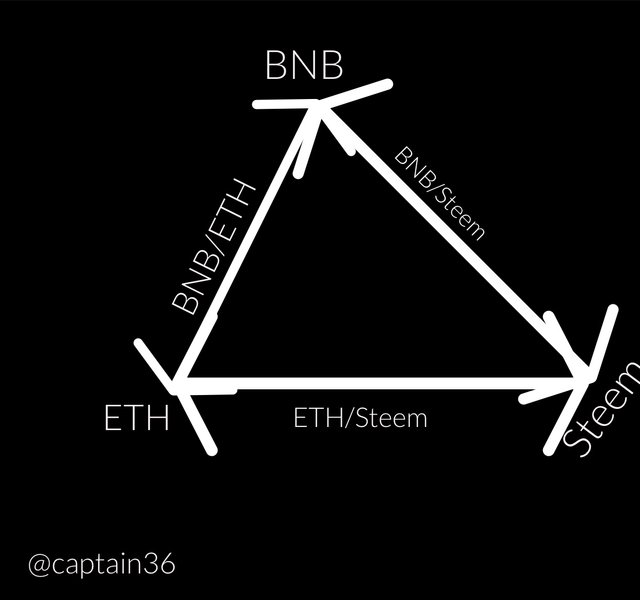

Below is a triangular representation of BNB, ETH and Steem.

Design from spark post

Let’s take for example that a particular trader has BNB worth of 16.70. Then he wants to do a triangular trade between BNB, Steem and ETH. Then the trader can decide to trade the 16.70 BNB to ETH in which he obtained 52.30 ETH. He then went on to trade the 52.30 ETH to Steem and then he had a total of 336,984 Steem. Looking at this the trader had a 3.3% profit from the 16.70 BNB he started with within this few minutes of trading.

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

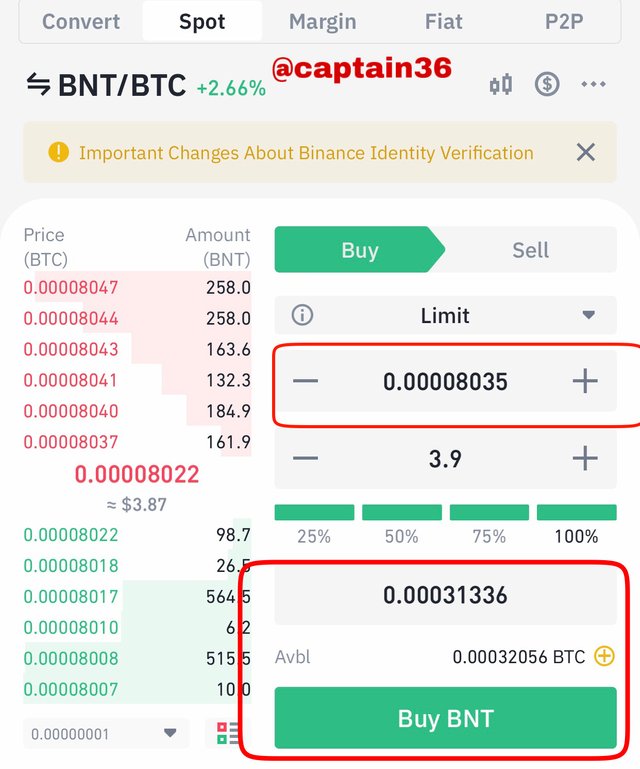

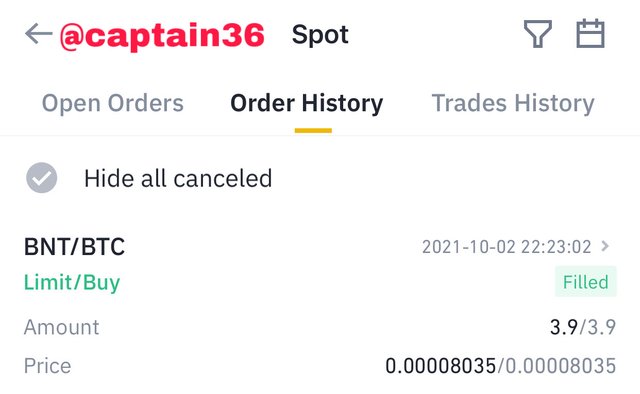

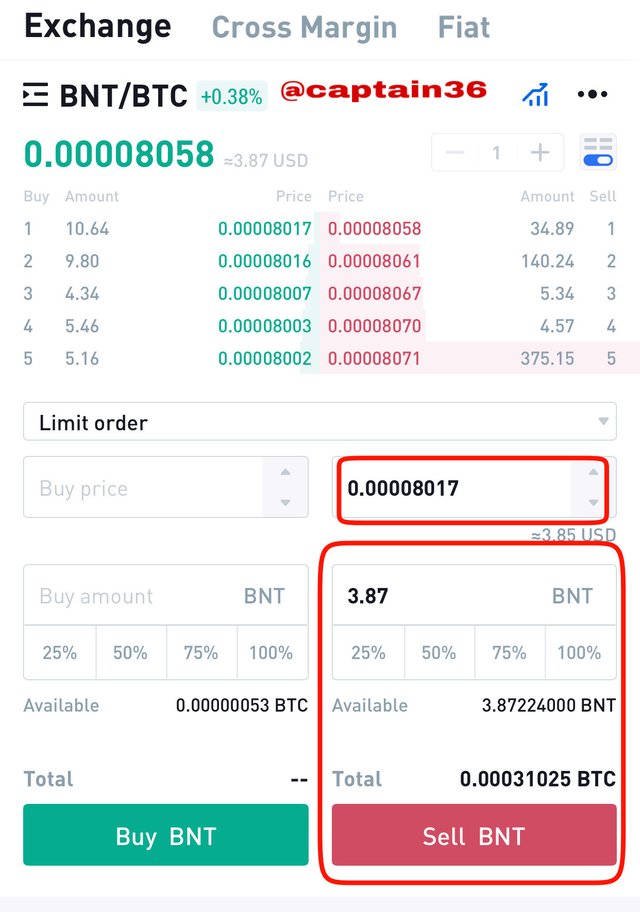

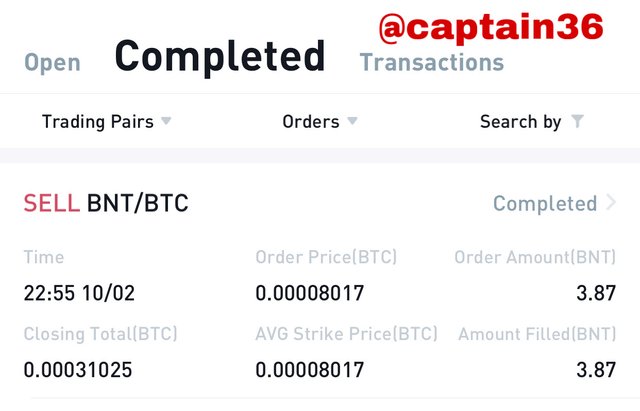

For this example I chose two different exchanges which are Binance exchange and Huobi pro exchange. I saw some arbitrage differences in the prices of BNT/BTC on these two exchanges. Huobi pro listed the price of BNT at a rate of $0.00008068 whilst Binance listed it at a rate of $0.00008035. At this rate in Binance I got 3.9 BNT with about 0.00031336 btc.

After this I withdraw the BNT from Binance to a different exchange called Huobi pro exchange.

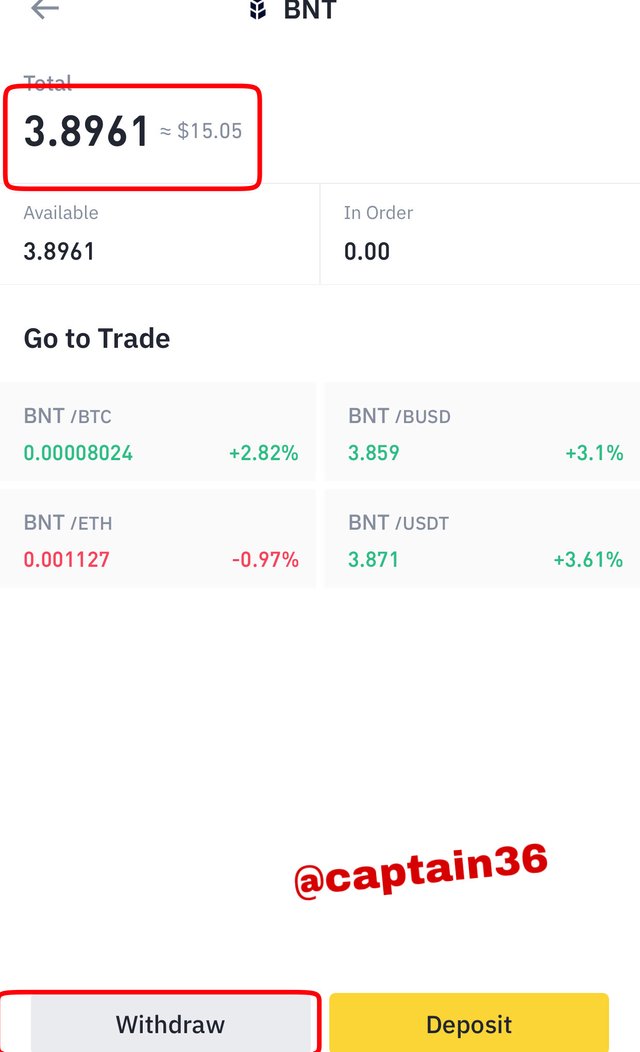

Now this is my BNT in the Huobi pro exchange.

At the end of all these I ended up with 3.87 BNT. This is a slight loss due to the transaction fees involved and the withdrawal fees as well.

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

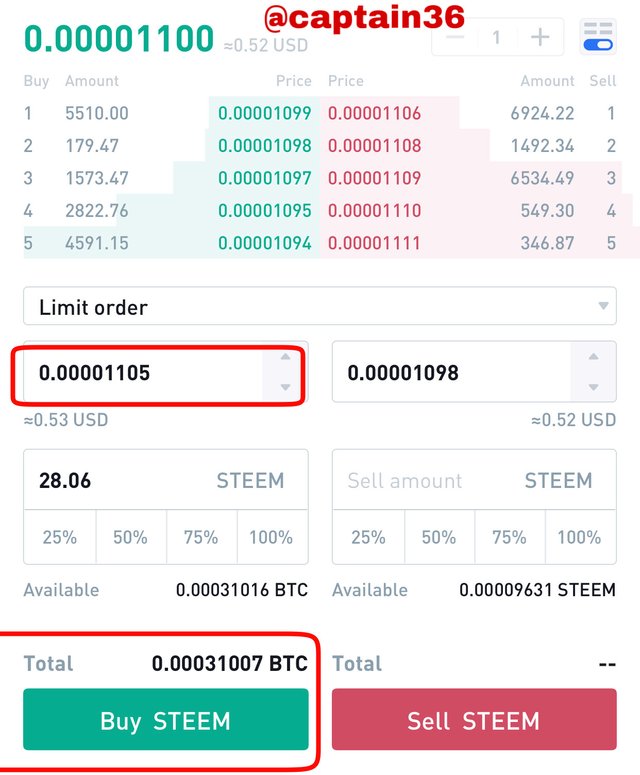

To be able to demonstrate the triangular Arbitrage, we have to chose three different coins within the same exchange. Here the three coins I choose are Steem, BTC and USDT.

Firstly I will buy Steem from BTC in my Huobi pro account. Here exchange rate is 0.00001105.

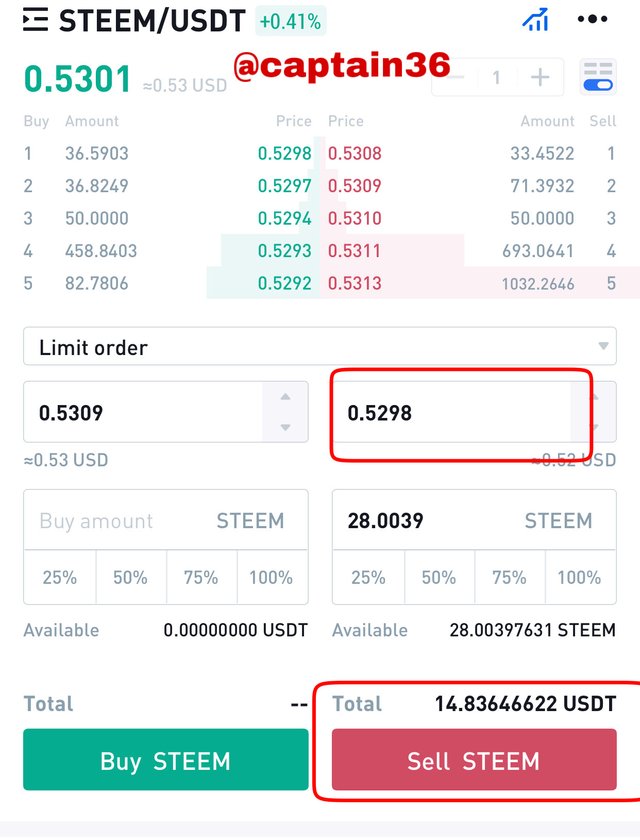

Now I will exchange these Steem into USDT at an exchange rate of 0.5298

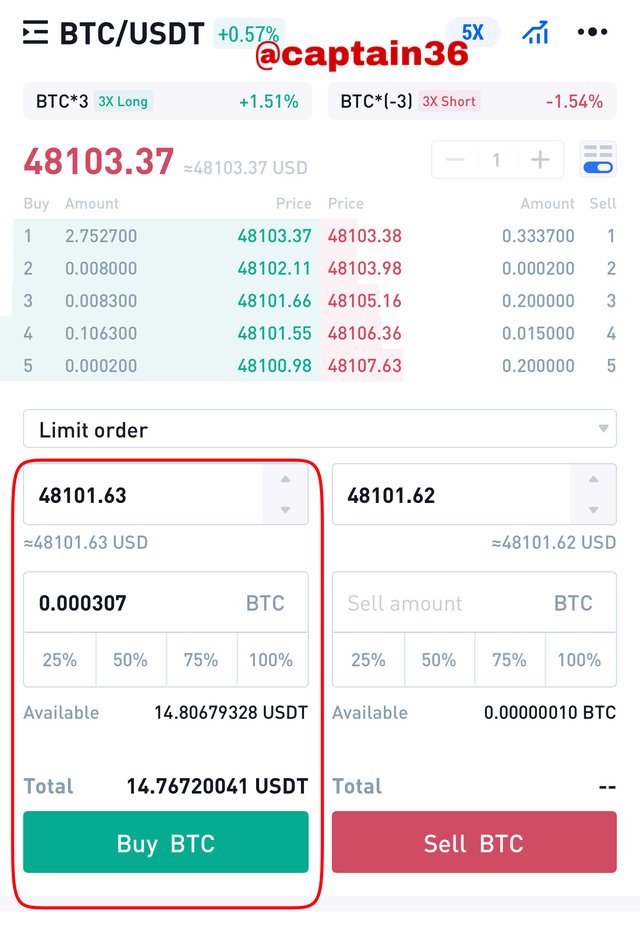

I’m order to be able to complete the three steps process we need to buy BTC from USDT.

6- Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Traders can make a lot of profit from this triangular arbitrage method if they understand it properly

Change of prices is unlikely to affect this process as the transactions are done simultaneously.

This strategy is very simple and straightforward so traders can use it without any complications

There can be instant change in price that will affect the trade negatively. This is because crypto assets are very volatile.

The profit gained from this arbitrage strategy is always very less. This is because it is just a short term process and it doesn’t give time for massive change in price

Sometimes it is difficult because some assets are difficult to trade quickly due to liquidity levels.

Conclusion

As discussed earlier, Arbitrage is a low risk process and the profit involved is very low as well. Arbitrage can be done within one exchange platform or among different exchange platforms.

Thank you once again professor @reddileep for this detailed lecture.